Europe Food Packaging Market Size, Share, Trends and Forecast Analysis

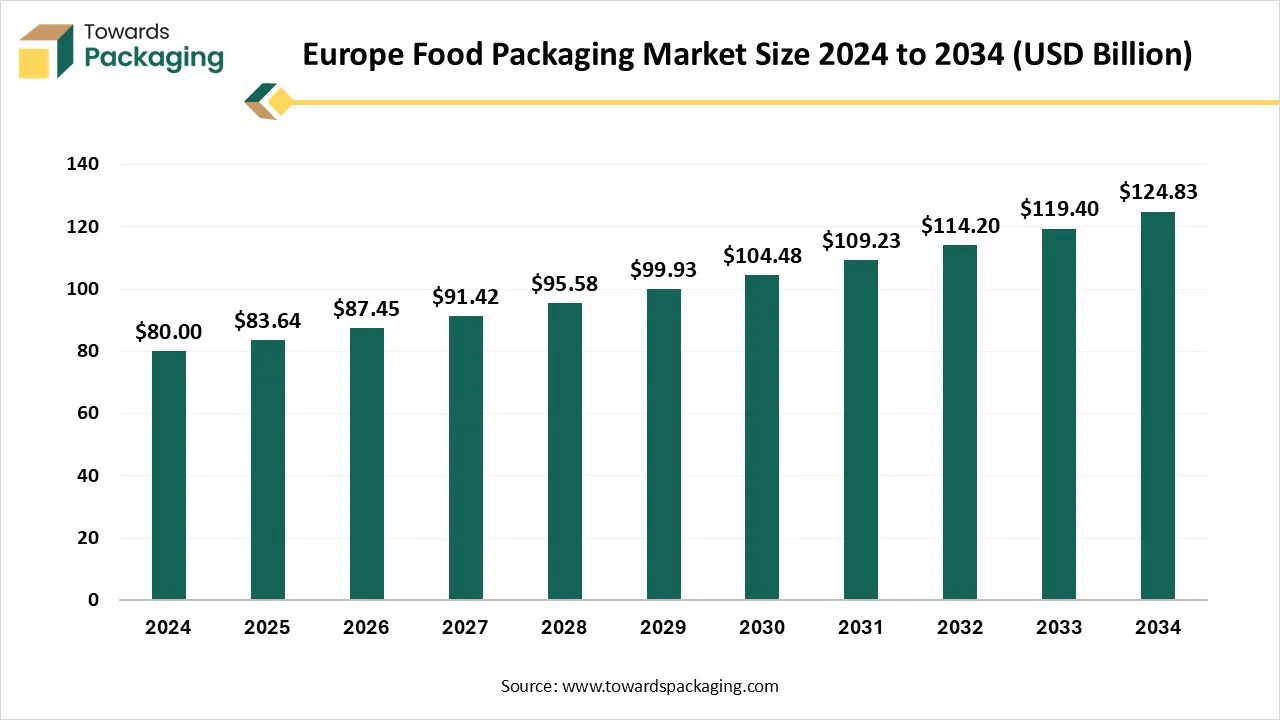

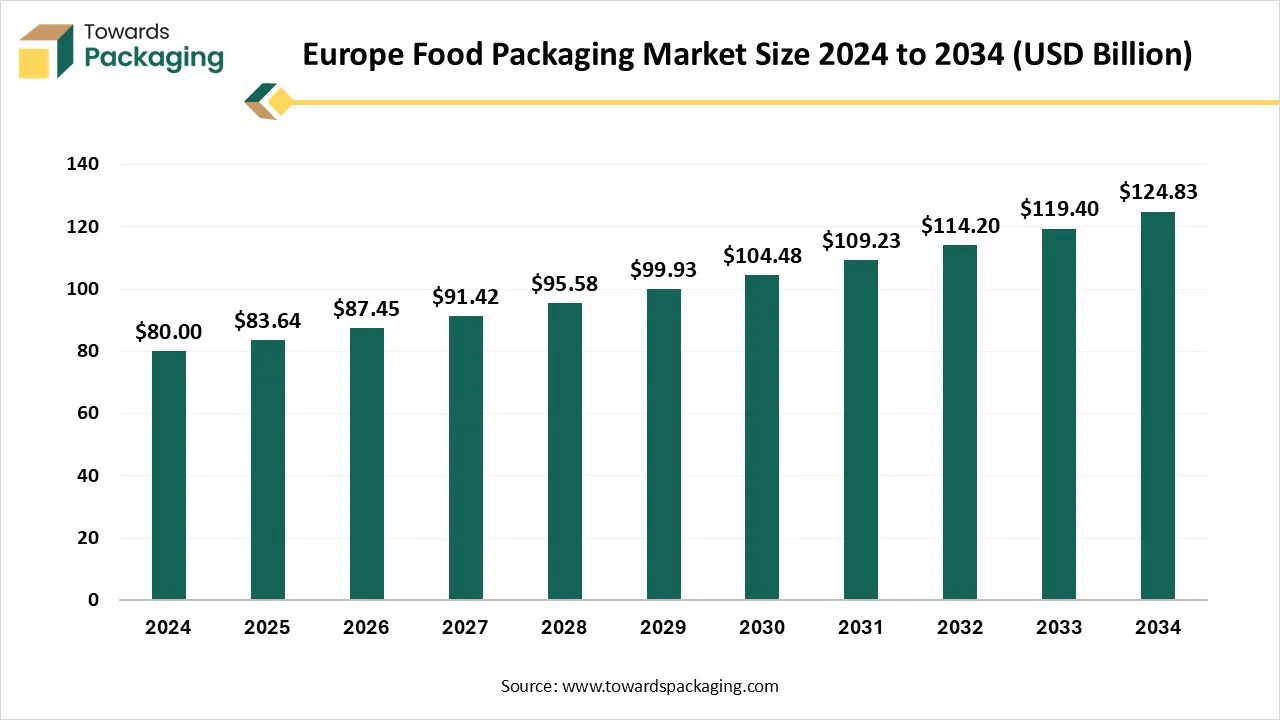

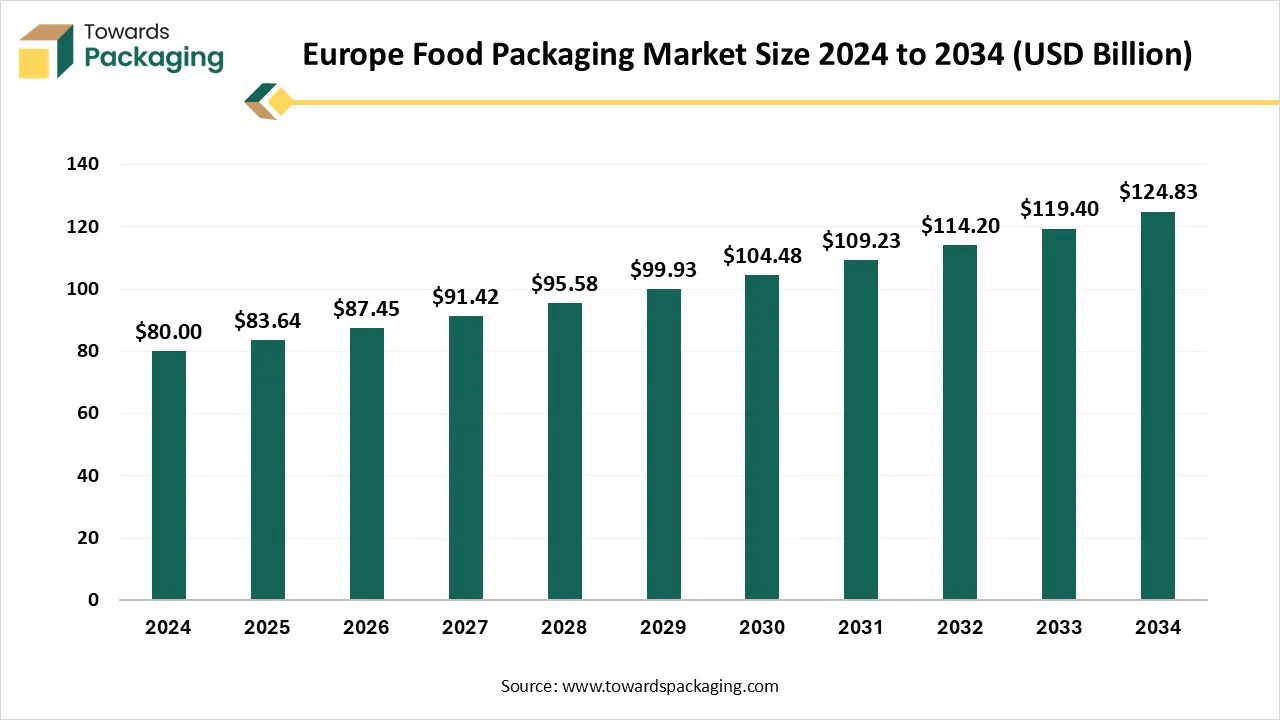

The Europe food packaging market is forecasted to expand from USD 86.69 billion in 2026 to USD 124.47 billion by 2035, growing at a CAGR of 4.1% from 2026 to 2035. The market is segmented by material type (paper-based and film-based), coating type (silicone-coated and non-silicone), and application (pressure-sensitive labels, medical, and industrial). In 2024, the paper-based segment dominated the market, while film-based liners are expected to experience the highest growth during the forecast period. Regionally, Asia Pacific leads the market, with North America expected to witness significant growth. The market is driven by the rise in self-adhesive products and innovations in coating technologies.

Major Key Insights of the Europe Food Packaging Market

- In terms of revenue, the market is valued at USD 83.64 billion in 2025.

- The market is projected to reach USD 124.47 billion by 2035.

- Rapid growth at a CAGR of 4.55% will be observed in the period between 2025 and 2034.

- By material type, the plastic segment contributed the biggest market share in 2024.

- By material type, the PLA / bio-based plastics segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By application/ food type, the bakery & confectionery segment contributed the biggest market share in 2024.

- By application/ food type, the ready-to-eat & convenience foods segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By packaging functionality, the protective packaging segment contributed the biggest market share in 2024.

- By packaging functionality, the active & intelligent packaging segment is expanding at a significant CAGR in between 2025 and 2034.

What is Europe Food Packaging Market?

The Europe food packaging refers to the production and commercialization of materials and solutions used to protect, preserve, transport, and display food products across the supply chain in Europe. These solutions include flexible packaging, rigid packaging, paper & board, glass, metal, and innovative bio-based materials. Market growth is driven by consumer preference for convenience and sustainable packaging, stringent food safety regulations, and innovations in active and intelligent packaging.

Europe Food Packaging Market Outlook

- Rising Digital Watermarking: There is a rapid growth in advanced technology for marking of the labels to improve the recycling process and storage of the products.

- Sustainability Focus: Sustainable packaging of the food products is the primary focus of the companies which comprises usage of bio-based, recyclable, and reusable materials.

- Enhancing Personalized Packaging Technology: Enhancing demand for personalized packaging of food due to diet restrictions and portion control requirement. It has enhanced the demand of the market by rising the adoption of such packaged food.

- Startup Ecosystem: Continuous innovation for biodegradable alternatives with enhanced recyclability, compostable solution, and software solution has promoted startup culture.

How Can AI Improve the Europe Food Packaging Market?

The incorporation of AI technology in the Europe food packaging market plays an important role in enhancing safety and sustainability. It is widely used in the optimization of materials for eco-friendly packaging development. It promotes unique packaging pattern with the help of generative AI which utilize less materials. It enhances the quality of the packaging and safety of the products. The real-time traceability and tracking process is the major role of AI in this packaging industry.

Trade Analysis of Europe Food Packaging Market: Import & Export Statistics

- France has food processing segment includes around 19,000 companies with whole annual sales surpassing $176.7 billion.

- UK has reported the value of goods & services exports was around £873.5 billion in 2024 which is up 0.7% on 2023. This shows a 7.5% reduction of goods exports and a 7.7% upsurge of services exports.

- Italy in 2024, imported consumer-oriented goods of approximately $38.3 billion, of which 84% initiating from several other EU member states.

Europe Food Packaging Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are metal, glass, plastic, paper & paperboard.

- Key Players: Mondi Group, Smurfit Kappa

Component Manufacturing

The major components used in this market are ethylene regulator, oxygen and moisture scavengers, and antimicrobial packaging.

- Key Players: Berry Global, Huhtamaki

Logistics and Distribution

This segment plays a crucial role in enhancing the safety, sustainability, and convenience.

- Key Players: DSV, DB Schenker

Market Dynamics

Market Driver

Increasing Demand for Convenience

The increasing demand for convenience has influenced the demand for the Europe food packaging market. Convenient packaging of foods is extensively utilized as they are transportable, have a longer shelf-life, and are ready-to-eat food products. These comprise a wide variety of goods like desserts, snacks, frozen foods, and beverages. These products usually need less training and are helped hot in ready-to-eat vessels. Growing demand for prepared snacks because of sitting lifestyles is anticipated to enhance the demand for cooked food products, resulting in the development of the industry. In totaling, the upsurge in throwaway pay per capita and the rise in the quantity of workers augmented economic development. Currently, the demand for fast-food is growing because of the lifestyle of customers. This huge demand has manufactured it easier for food producers to generate products that have enhanced nutritional charges.

Market Challenges and Restraints

High Quality Maintenance

High quality maintenance of the packages to enhance the protection of the food products has hindered the development of the market. The demand for enhancing shelf life of the food products required improved formulation of the packages which costs high and has become the major factor behind restricted enhancement of the market.

Market Opportunity

Busy Lifestyle of People

Busy lifestyle of people has raised several opportunities for growth of the market. The rising number of working individuals has raised the demand for packaged ready-to-eat food with longer shelf life which has raised the opportunities to grow for this market. Huge adoption for eco-friendly packaging has enhanced the demand for such packaging which can be easily recycled and biodegradable. There is a huge demand for processed food products with convenient packaging to consume while travelling has enhanced packaging industry with innovation and wide range of choices.

Material Type Insights

Why Plastic Segment Dominated the Europe Food Packaging Market In 2024?

The plastic segment dominated the Europe food packaging market share in 2024 due to its breakage resistance, flexibility, cost-effectiveness, and light weight. It also offers products protection against spoilage of food. Maximum plastic resins utilized in packing and it can be recycled. Both rigid and flexible packaging provide innovative chances. For instance, modified air packaging (MAP) supports in preserving the freshness of food products and enhance the shelf-life of food products by reducing spoilage. Enhancing water feeding has resulted in amplified demand for plastic packages, which can be useful to the develop economy.

The PLA / bio-based plastics segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to increasing demand of the customers for eco-friendly packaging. Strict regulation of the European countries towards packaging of food products has pushed this segment to grow significantly. Advancement in the production of PLA/ bio-based plastics formulation has influenced the demand for this segment. These are majorly used for their flexibility and rigidity as well.

Application Type Insights

Why Bakery & Confectionery Segment Dominated the Europe Food Packaging Market In 2024?

The bakery & confectionery segment held the largest share of the market share in 2024 due to rising demand for dessert. This segment is majorly utilized for confectionery and sweets, comprising savoury pastries, chewing gum, croissants, chocolates, savoury pastries, and candies. Consumption of more food products will result in economic development. Moreover, growing demand for gluten-free substitutes has activated the development of this segment.

The ready-to-eat & convenience foods segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to increasing demand for portable packaging. Evolving lifestyle of the consumers and rising urbanization has fuelled the demand for this packaging sector. A rising emphasis on ecological concern is influencing the acceptance for such packaging.

Packaging Functionality Type Insights

Why Protective Packaging Segment Dominated the Europe Food Packaging Market In 2024?

The protective packaging segment held the largest share of the market in 2024 due to increasing concern towards food safety. The increasing online ordering trend required enhanced material packaging of the fragile products. Continuous innovation in this sector has raised the demand for this segment. Presence of online delivery platforms has enhanced the accessibility of the consumers has pushed major market players towards this segment. The major driver for this segment is the increasing concern of the consumers.

The active & intelligent packaging segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to sustainability, increasing food safety, and convenience. Increasing awareness towards quality of fuels adoption has evolved the demand for this segment. The continuous innovation in this sector with sensor to observe the quality of the food products has raised the demand for such packaging.

Country Insights

Strong Ecological Guidelines in Germany Promote Dominance

Germany held the largest share of the market in 2024, due to the presence of strict ecological guidelines. Ecological regulations such as the Packaging Act influence the investment in sustainable packaging. The rapid growth in food & beverage sector of this region has raised the demand for this market. Consumers are strongly aware about sustainable packaging, generating robust demand for biodegradable and eco-friendly packaging choices. Advancement in packaging technology has influence the extension of shelf life of the food products and encourage the adoption of such packaging.

Robust Focus on Sustainable Packaging in France Boost the Europe Food Packaging Market

France has well-established market players focusing towards the development of innovative packaging sector with sustainability of food packages. The rising consumption of fresh food has raised the pressure of developing packages that maintain the integrity of the food products. Due to the increasing awareness towards adverse effect of the packages on the environment has enhanced the demand for biodegradable packaging. The presence of major market players helps to introduce innovative packaging and meet huge demand of the consumers.

Eastern Europe’s Increasing Industrialization Enhance Market Demand

Eastern Europe expects the significant growth in the market during the forecast period. This market is growing due to increasing industrialization has enhanced innovation process in this market. Rising online food ordering trend has also influenced the adoption of superior quality packaging of food products. High consumption of cooked food products has evolved the demand for this packaging market.

Recent Developments

- In June 2025, Clariant announced the launch of advanced PFAS-free polymer giving out helps for more sustainable polyolefin extrusion. Its new AddWorks PPA creation mark, a new creation of PFAS-free polymer giving out helps intended precisely for polyolefin extrusion usages.

- In April 2025, UFlex announced the launch of strategies to grow a new engineering facility in Mexico emphasis on manufacturing woven polypropylene (WPP) bags for the pet food segment.

Top Companies in the Europe Food Packaging Market

- Amcor plc: It offers a huge variety of packaging solution comprising rigid as well as flexible packaging.

- Berry Global, Inc.: It collaborate with several market players to introduce innovation in the food packaging sector.

- Sealed Air Corporation: It provides a huge variety of protective packing solution which is majorly centered for food freshness, safety, and protection.

- Mondi Group: It has huge digital alteration efforts which is executing principles of smart factories.

- Huhtamaki Oyj: It is modernizing the flexible packaging services with enhanced digital technologies.

Europe Food Packaging Market Key Players

Tier 1

- Stora Enso Oyj

- Smurfit Kappa Group

- Tetra Pak International S.A.

- Ball Corporation

- Crown Holdings, Inc.

- Amcor PLC

- Mondi Group

- Sealed Air Corporation

- Graphic Packaging International

- Packaging Corporation of America

Tier 2

Tier 3

- Sidel Group

- Flextrus AB

- Yupo Corporation

- Ritrama S.p.A.

- Winpak Ltd.

Europe Food Packaging Market Segments Covered

By Material Type

- Plastic (PET, PE, PP, PVC, PS, PLA)

- Paper & Paperboard

- Metal (Aluminum, Tinplate, Steel)

- Glass

- Composite / Laminates

By Application / Food Type

- Bakery & Confectionery

- Dairy Products

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Beverages (Non-Alcoholic & Alcoholic)

- Frozen & Processed Foods

- Other Food Products (Snacks, Sauces, Condiments, Nutraceuticals)

By Packaging Functionality

- Protective Packaging

- Active & Intelligent Packaging (Modified Atmosphere, Oxygen Scavengers, Smart Labels)

- Convenience & Ready-to-Use Packaging