Polyolefin Shrink Sleeve Labels Market Analysis, Demand and Growth Rate Forecast

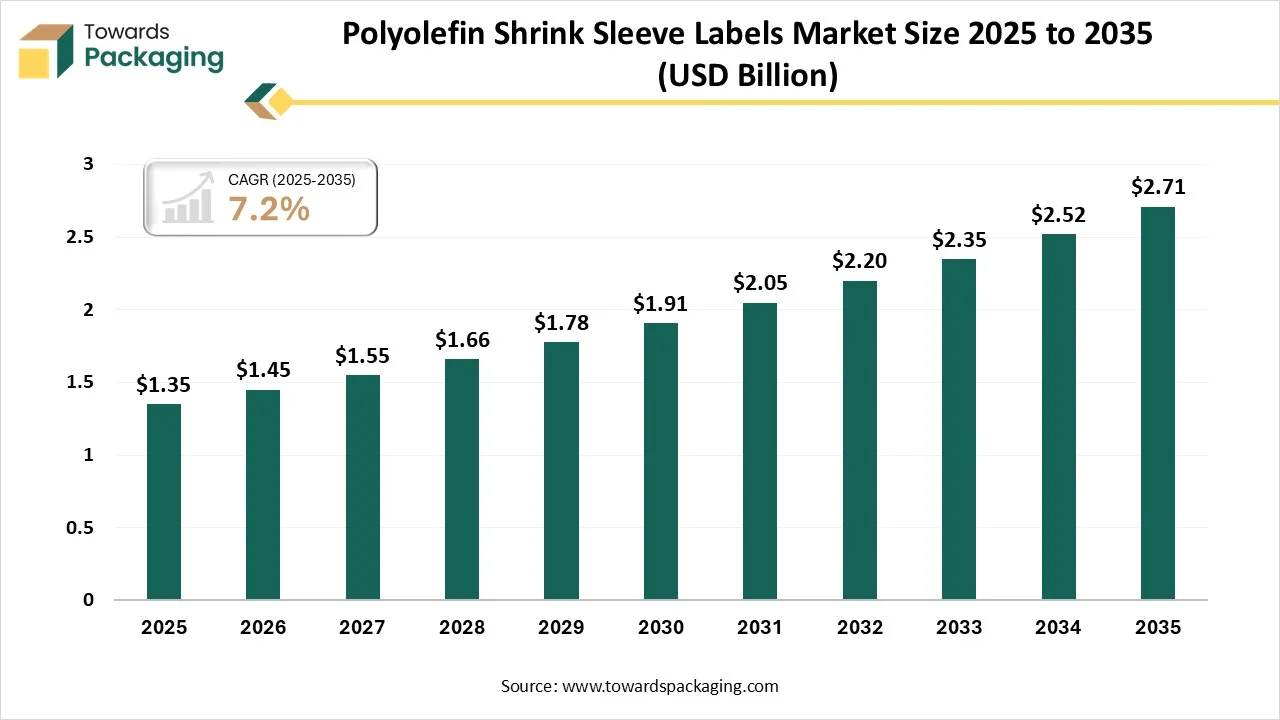

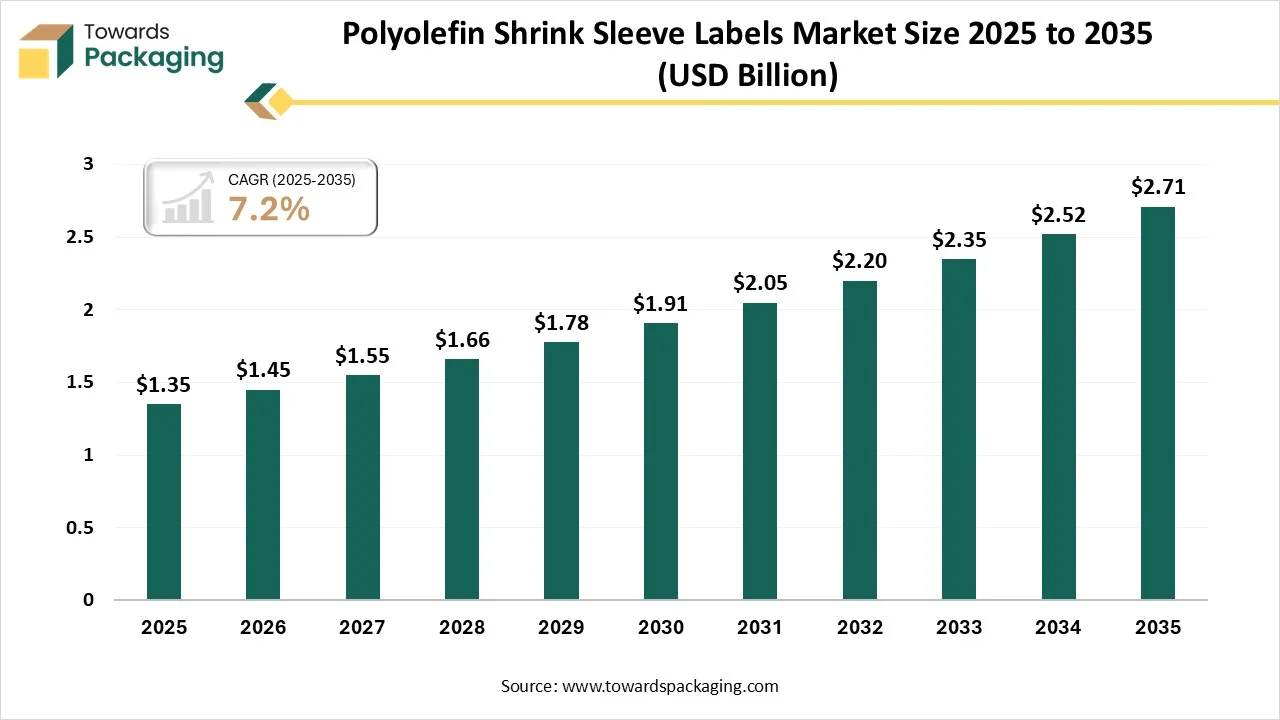

The polyolefin shrink sleeve labels market is forecasted to expand from USD 1.45 billion in 2026 to USD 2.71 billion by 2035, growing at a CAGR of 7.2% from 2026 to 2035. The brand shifts away from regular plastics like PVC to align with sustainability compulsions and develop product visibility.

Major Key Insights of the Polyolefin Shrink Sleeve Labels Market

- In terms of revenue, the market is valued at USD 1.35 billion in 2025.

- The market is projected to reach USD 2.71 billion by 2035.

- Rapid growth at a CAGR of 7.2% will be observed in the period between 2026 and 2035.

- By region, Asia Pacific has dominated the global market by holding the highest market share in 2025.

- By region, North America is expected to grow at the fastest CAGR from 2026 to 2035.

- By material type, the polyvinyl chloride segment dominated the market in 2025.

- By material type, the polyolefin segment will be growing at a significant CAGR between 2026 and 2035.

- By sleeve type, the full-body shrink sleeve segment dominated the market in 2025.

- By sleeve type, the partial-body shrinks sleeve segment will be developing at a main CAGR between 2026 and 2035.

- By container type, the bottles segment has overall dominated the market in 2025.

- By container type, the pouches and flexible containers segment will be growing at a significant CAGR between 2026 and 2035.

- By end-use industry, the food and beverage segment dominated the market in 2025.

- By end-use industry, the personal care and cosmetics segment will be developing at a main CAGR between 2026 and 2025.

What does the Polyolefin Shrink Sleeve Labels Market?

The polyolefin shrink sleeve labels market is rapidly growing sector, driven by strong demand for high-impact, full-body product decoration and increasing emphasis on sustainability. Shrink sleeve labels are flexible plastic films that, when heated, conform tightly around containers, offering 360° branding, tamper-evidence, and excellent print quality across complex shapes advantages that are especially valued in personal care, food & beverage, pharmaceuticals, and domestic products packaging.

Polyolefin Shrink Sleeve Labels Market Trends:

- Market Growth Overview: The market is gaining attention because of its flexible nature, which presents complicated products of different shapes and sizes. It is used across different sectors due to its unusual power that serves as protective packaging for the product.

- Global Expansion: The global expansion of the polyolefin shrink sleeve industry is constant and strong, driven by a growing urge in electronics, food and beverage, and the pharmaceutical sector, fueled by e-commerce development and automation.

- Major Market Players: The main market players are Macfarlane Group, Constantia Flexibles, Taghleef Industries, and the WestRock Company, too.

- Startup Ecosystem: The polyolefin (PO) shrink sleeve startup and the invention ecosystem are experiencing a fast update, which moves from an alternative to an initial solution for sustainable packaging. It is being driven by the overregulation’s like Extended Producer Responsibility (EPR) and the plastic taxes in the European region.

Technological Developments in the Polyolefin Shrink Sleeve Labels Market

The sleeve label enables security characteristics to be mixed directly into the packaging without the demand for further elements or added industrial complexity. Either through NFC Chips or an RFID, invisible inks, or different serialized codes, such elements develop product traceability at each stage of its lifecycle -from manufacturing to an end-user. They match with relevant needs in a fragile sector like cosmetics, pharmaceuticals, and nutrition, which also ensures product integrity through characteristics like tamper evidence. By integrating protection with invisibility, this sleeve becomes a smooth shield against counterfeiting, all while mixing seamlessly into manufacturing lines.

Trade Analysis of Polyolefin Shrink Sleeve Labels Market: Import & Export Statistics

- As per the global data, the globe has imported 2 shipments of the polyolefin shrink sleeve labels during the period February 2024 to January 2025. Such imports were being supplied by 2 exporters to a total of 2 worldwide buyers.

- The globe has imported most of the polyolefin shrink sleeve labels from the United States.

- Worldwide, the leading two importers of the polyolefin shrink labels are Colombia and Indonesia. Indonesia has topped the globe with 2 shipments, which is being followed by Colombia with 1 shipment.

Polyolefin Shrink Sleeve Labels Market - Value Chain Analysis

Package Design and Prototyping: Shrink sleeve classified at the corner of design flexibility, durability, and functionality, which is unaligned and acceptable across the container types and has perfect opposition to the surrounding challenges, polyolefin shrink sleeve labels are transforming how sectors use product packaging and branding.

Recycling and Waste Management: Consumers are excessively urging sustainable packaging selections, and businesses are giving feedback with passionate sustainability goals and loyalty to lower their eco-friendly footprint. Governments are also implementing strict regulations on the packaging waste and recyclability. Plastic waste, in particular, has become a major concern, with huge quantities that end up in oceans and landfills.

Logistics and Distribution: One of the main challenges associated with storing and shipping shrink sleeves is that such labels are very fragile in the surrounding environments. If the shrink sleeves get too cold, hot, dry, wet, or apart from these conditions. It can lead to material that gives feedback on the labels and makes them completely unusable. It’s crucial to make any shipping and storage areas as climate-managed as possible to keep your funding safe.

Segmental Insights

Material Type Insights

How Will The PVC (Polyvinyl Chloride) Segment Dominate The Polyolefin Shrink Sleeve Labels Market In 2025?

The PVC (Polyvinyl Chloride) segment has dominated the polyolefin shrink sleeve labels market in 2025 as they are the most common type of shrink labels that serve complete tailored solutions, enabling product details, brand logos, and marketing messages to be hugely displayed through high-quality multi-color printing and developing the brand recognition. Apart from perfect product prevention, these labels deliver as a smooth marketing tool that ensures distortion-free and bright printing through high-level processing techniques.

The polyolefin segment is predicted to witness the fastest CAGR during the forecast period. Polyolefin shrink film is a kind of luxury and multi-layer shrink film that has an integration of materials such as polyethylene (PE) and polypropylene (PP). Such materials can be co-processed in different multi-layer co-extruded procedures to make a premium shrink film that has flexibility, strength, clarity, and the shrinkage that tightly wraps around the products when heat is used. They are free of any toxic plasticizers and or chlorine -dependent elements, which are compliant with EU and FDA regulations for food contact. Furthermore, its film serves as a highlighted barrier to oxygen and moisture, hence it allows for a stretched shelf life and the product flavor.

Sleeve Type Insights

How Will The Full Body Shrink Sleeve Segment Dominated Polyolefin Shrink Sleeve Labels Market In 2025?

The full body shrink sleeve segment has dominated the market in 2025 as they cover the complete container, from top to bottom, by serving a 360-degree solution for overall graphics and a huge area for branding. Such an option serves the biggest printable space, which enables intricate design, complete product information, and vibrant colors, too. Also, they are perfect for differently shaped or outline containers, as the film shrinks to perfectly accommodate a product’s design.

The partial body shrink sleeve segment is predicted to witness the fastest CAGR during the forecast period. These sleeves cover only a specific portion of the container, such as the middle area or the shoulder area, leaving such areas uncovered. Such sleeves are a more economical selection, as they are full-body sleeves and utilise less material without sacrificing effect. Also, it enables displaying the container’s actual texture or color while it still serves a huge amount for the main branding factors. And the necessary information too, for nutritional facts.

Container Type Insights

How Bottles Segment Dominated Polyolefin Shrink Sleeve Labels Market In 2025?

The bottles segment has dominated the polyolefin shrink sleeve labels market in 2025, as this bottle, which uses recycled materials to lower its own greenhouse gas emissions at the time of both procurement and product disposal, such as incineration. By accepting multi-layer molding, which sandwiches a recycled material, the bottle can be used for a huge variety of non-food uses, which include daily products.

The pouches and flexible containers segment is expected to witness the fastest CAGR during the forecast period. One of the advantages is cost-effectiveness as compared to strong packaging like bottles, cans, or jars. Pouches use less material, which results in lower manufacturing costs as well as reduced travelling costs. Their advanced level product-to-package ratio also lessens material waste. The shape flexibility enables inventive structural designs that stand out on the retail shelves.

End-Use Insights

How The Food And Beverage Segment Dominated The Polyolefin Shrink Sleeve Labels Market In 2025?

The food and beverage segment has dominated the market in 2025 as container types are applicable to a shrink sleeve packaging, which includes cans, jars, bottles, and tubs too. The containers are cylindrical and tall, and even short too, which are shrink sleeve labels and are different in their potential to conform to the curves, uneven geometrics for an regular labels which struggle to cover. Glass, plastic, and metal containers are all compatible with the shrink sleeve as a labelling procedure. The main thing is to utilize a container strongly enough to firmly withstand the shrink forces of the sleeve while also managing the heat of the shrink tunnel.

The personal care and cosmetics sectors are predicted to witness the fastest CAGR during the forecast period. This industry uses shrink sleeves for products such as lotions, shampoos, and creams that serve a well-polished and attention-grabbing look. Pharmaceutical organizations also use the shrink sleeves for medical bottles and containers, which serve clear labeling and prevention against tampering. While delivering a luxury look which is frequently linked with costly packaging, the polyolefin shrink sleeve can develop a solution, particularly when compared to custom-printed containers.

Regional Insights

How Has Asia Pacific Dominated the Polyolefin Shrink Sleeve Labels Market?

Asia Pacific dominated the market in 2025 as it is being driven by encouragement from technological, economic, and regulatory factors. As economic moves continue to encourage the production hubs across developing markets, several countries with strong industrial design are developing rapidly as their export capabilities and manufacturing transformation to develop the quality standards and efficiency.

India Polyolefin Shrink Sleeve Labels Market Trends

Producers in India are heavily accepting full-body shrink sleeve to develop the “shelf appeal” and serve more space for compulsory and regulatory information, and lastly for brand storytelling. There is a huge demand for a tamper-evident characteristic to protect against adulteration, specifically in the pharmaceutical and beverage industries. The “Make in India “ campaign continues to attract investments for packaging companies in order to invest in new manufacturing technologies.

North America expects the fastest growth in the market during the forecast period, which is being driven by the developing user choice, developing demand, and innovative packaging solutions for a brand classification across sectors such as personal care, beverages, and food products. Furthermore, the industry is classified by a demand for eco-friendly and sustainable label options, along with technological developments that allow deeper designs and perfect product protection.

Canada Polyolefin Shrink Sleeve Labels Market Trends

The versatile nature of these labels has increased the demand in Canada, which enhances product visibility and appearance, too. There is growing acceptance in the food and beverage sector, particularly for the luxury and easy products, which further fulfills industry growth. Furthermore, developments in printing technologies allow tailored designs, high -quality products that attract producers who find differentiation.

Europe expects the notable growth in the market. The acceptance of high-level labelling technologies develops the brand differentiation, product visibility, and user engagement, too. There is growing importance on eco-friendly and sustainable packaging options, which further have market development as producers find eco-friendly conscious materials. Furthermore, the rising e-commerce industry in Europe makes a compulsion for tamper-proof and shrink labelling solutions, which boosts the acceptance of stretch sleeve labels and shrink too.

Germany Polyolefin Shrink Sleeve Labels Market Trends

The urge for the excessively pushed by the Packaging and Packaging Waste Regulation and Germany's Verpack G has led to a main shift towards PET-G, which commands a high regional share and cPET materials, which are being favoured for their suitability and clarity for Germany's mature deposit-return scheme (DRS). Also, the urge for 360-degree graphics is to develop on-shelf requests, which is an initial driver, specifically in terms of markets such as Germany.

Recent Developments

- In February 2025, CCL Label disclosed the launch of the future shrink sleeve, which is created by recycling-friendly polyolefin material in Southeast Asia. Such low-density PO material was perfect for the flotation classification in a sink. float step at the PET recyclers.

- In May 2025, Taghleef Industries has revealed its current inventions named as SHAPE360® TDSW, which is specifically a high-performance floatable white polyolefin TD shrink sleeve label film. Such a film serves an optimal opacity by tracking the important low-density elements which are necessary for mirroring, recyclability for its clear counterpart, named as SHAPE360 TDS.

Top Companies in Polyolefin Shrink Sleeve Labels Market

- Berry Global Inc.

- CCL Industries Inc.

- Fuji Seal International, Inc.

- Avery Dennison Corporation

- Amcor Plc

- Huhtamaki Oyj

- Klöckner Pentaplast

- Multi-Color Corporation

- Taghleef Industries

- C-P Flexible Packaging

- Resource Label Group

- Fortis Solutions Group

- Consolidated Label Company

- Multipack Labels

- Akar Shrink Packs

Polyolefin Shrink Sleeve Labels Market Segments Covered

By Material / Polymer Type

- PVC (Polyvinyl Chloride)

- Polyolefin (POF / POE-based)

- PETG (Polyethylene Terephthalate Glycol)

- OPS (Oriented Polystyrene)

- PLA (Bio-based / biodegradable)

- Others (recycled & specialty blends)

By Sleeve Type

- Full Body Shrink Sleeves

- Partial Body Shrink Sleeves

- Tamper-Evident Shrink Bands

- Multi-Pack & Specialty Sleeves

By Container Type

- Bottles

- Cans

- Jars

- Pouches & Flexible Containers

- Others (tubes, custom shapes)

By End-Use Industry

- Food & Beverage

- Beverages (Alcoholic & Non-Alcoholic)

- Personal Care & Cosmetics

- Pharmaceuticals & Healthcare

- Household & Home Care Products

- Industrial & Chemical Products

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Tags

FAQ's

Select User License to Buy

Figures (1)