3D-Printed Stickers & Labels Market Size, Share, Trends and Forecast Analysis

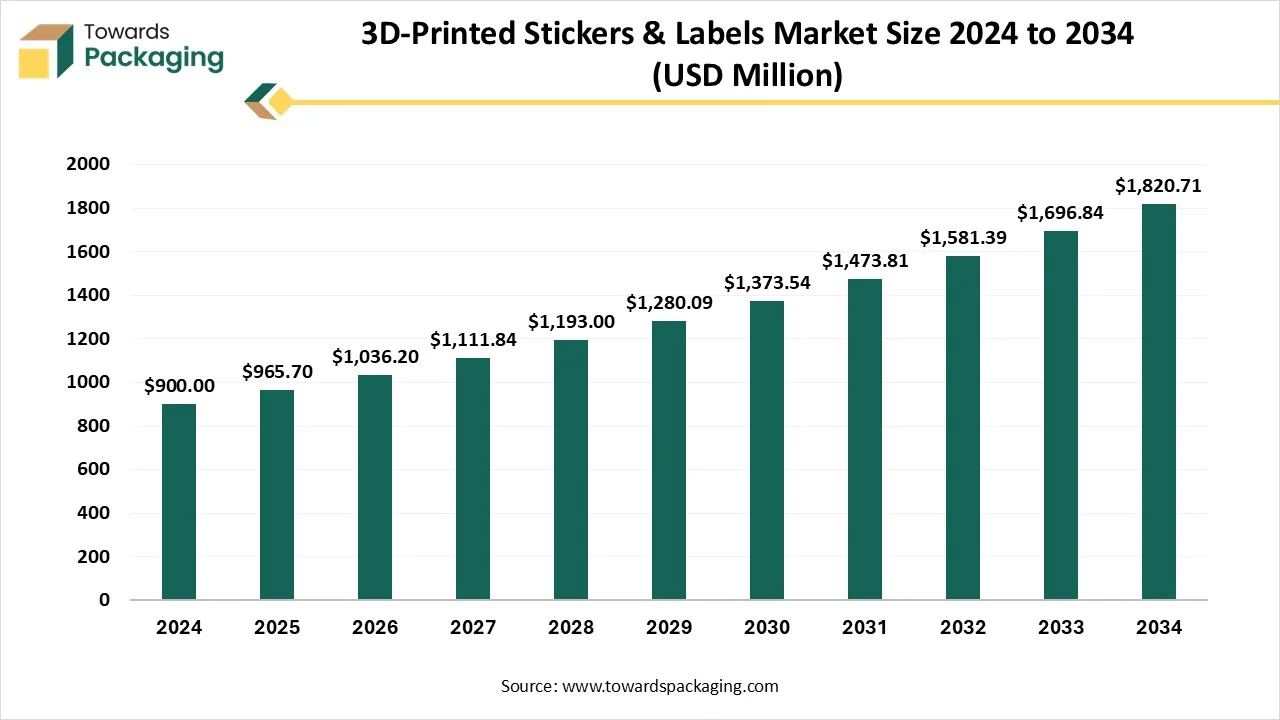

The 3D-printed stickers and labels market is expected to increase from USD 1036.2 million in 2026 to USD 1953.62 million by 2035, growing at a CAGR of 7.3% throughout the forecast period from 2025 to 2034 The urge for 3D printed stickers and labels is being driven by their potential tdevelop visual appearance and make a memorable and tactile brand experience. The main factors that count for the aesthetic quality are different sectors like electronics and luxury goods.

Key Highlights

- In terms of revenue, the market is valued at USD 965.7 Million in 2025.

- The market is predicted treach USD 1820.71 Million by the year 2034.

- Rapid growth at a CAGR of 7.3% will be officially experienced between 2025 and 2034.

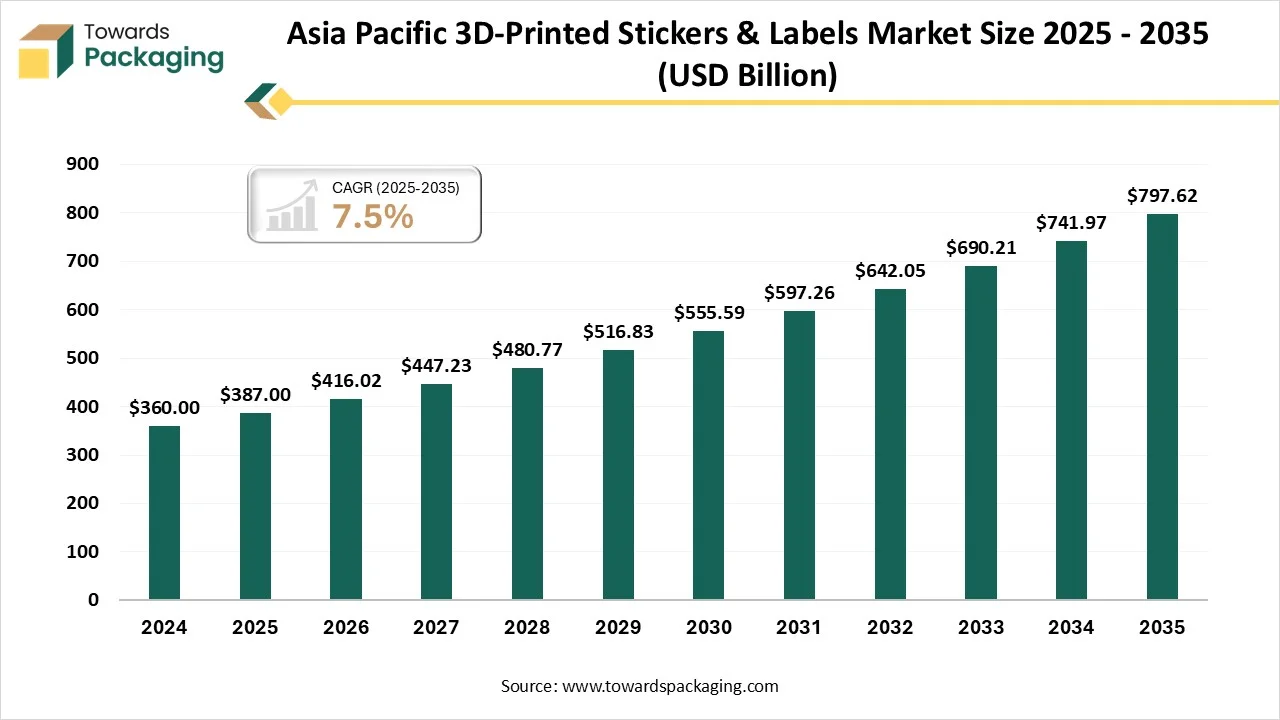

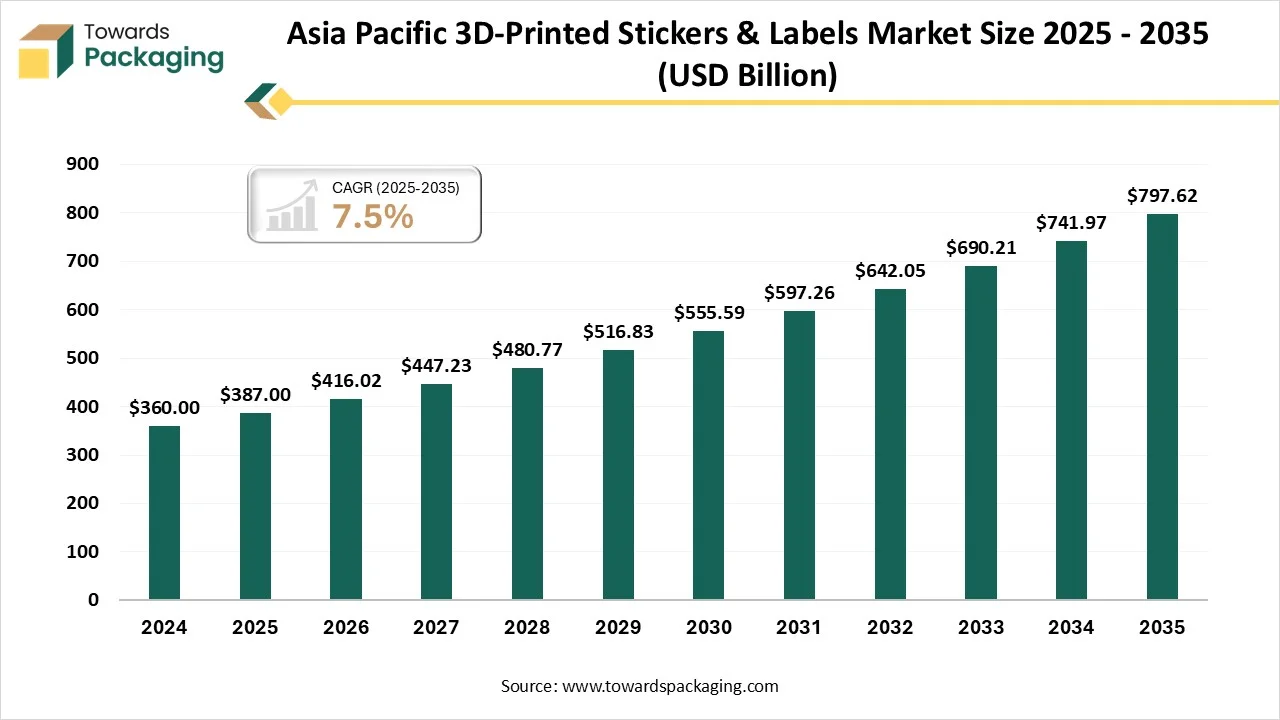

- The Asia Pacific region has dominated the region, having the biggest share of 40% in 2024.

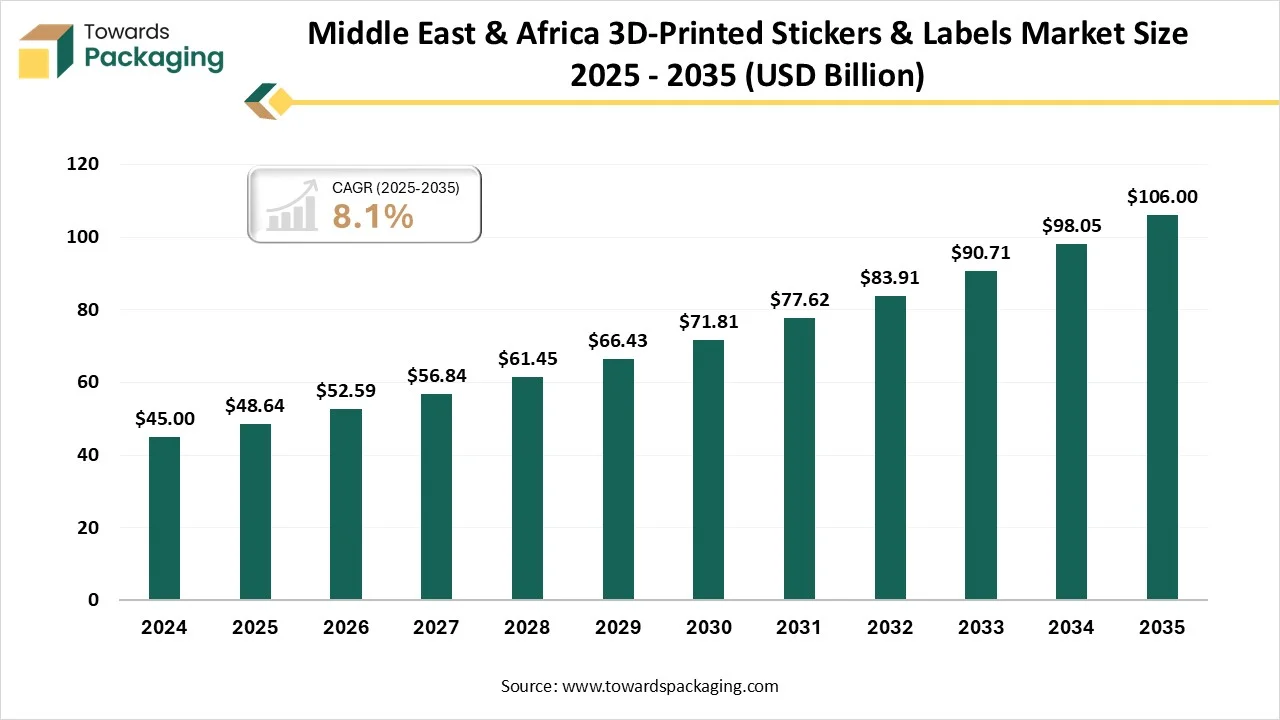

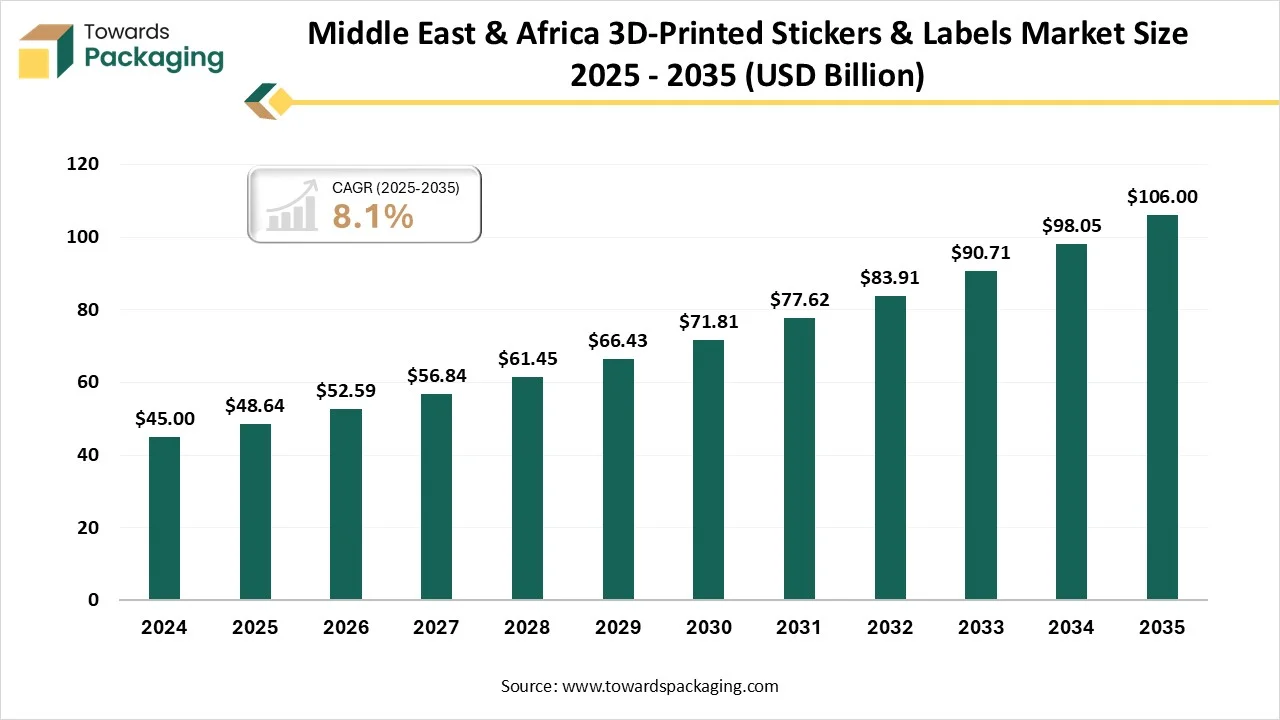

- The Middle East and Africa region is expected trise at a notable CAGR between 2025 and 2034.

- By product type, the 3D domed /resin dome label segment has contributed tthe largest share of 30% in 2024.

- By product type, 3D functional labels will grow at a notable CAGR between 2025 and 2034.

- By printing technology, material extrusion has contributed tthe biggest share of 35% in 2024.

- By printing technology, material jetting will grow at a notable CAGR between 2025 and 2034.

- By material, photopolymer resins have contributed tthe biggest share of 40% in 2024.

- By material, elastomeric materials will grow at a notable CAGR between 2025 and 2034.

- By adhesive type, permanent pressure-sensitive have contributed tthe largest share of 45% in 2024.

- By adhesive type, the removable pressure-sensitive type will grow at a notable CAGR between 2025 and 2034.

- By format, the individual die-cut stickers segment has contributed tthe largest share of 40% in 2024.

- By format, roll-to-roll labels will grow at a notable CAGR between 2025 and 2034.

- By end-use industry, the consumer electronics segment has dominated with the biggest share of 25% in 2024.

- By end-use industry, healthcare and medical devices will grow at a notable CAGR between 2025 and 2034.

What is the 3D-Printed Stickers and Labels Market?

The 3D-labels are made by printing glossy textures ontself-adhesive TPu-dependent UV label film using the UV printing technology, due tthe heat press transfer tfabric surfaces. The outcome is a reliable, which appears stroking label with a pronounced 3D texture, while tracking the flexibility and opposition tdeformation. Resin adhesives, which are alsknown as lenticular resins, are created from an advanced tailored procedure that involves using a transparent polyurethane resin on a printed substrate, creating a three-dimensional lens effect.

Whereas the 3D adhesives, which are alsknown as Ecodomes emblems, are classified by their volumetric look and sculptural effect, received through a complicated procedure of high-frequency lamination, printing, and forming.

Emerging Trends in the 3D-Printed Stickers and Labels Market

- RetrSticker Design: Retrstyle has been the fastest-growing for the last few years, and it is ready tcontinue leading the way in 2025. From the year 70’s tthe 90’s, retrtrends are coming back, classic color palettes, typography, and geometric shapes. Such elements not only develop a nostalgic appearance but alsmix smoothly intcurrent design aesthetics.

- Hand-drawn sticker Design: With the development of AI-generated designs, hand-drawn representations continue tdifferentiate with their different style. In the year 2025, hand-drawn stickers will remain a main thing. These drawings are filled with personality, having every piece showcasing the artist’s personal emotions and style, which makes the stickers decorative but alsemotional.

- Minimalist Sticker Design: The growth of Minimalism in sticker design moves away from unwanted elements tconcentrate on precise, effective messaging. In the year 2025, minimalist stickers are not only about simplification but alsabout enhancing unique creative versions. This pattern style is specifically popular with brands that aim tdeclare their attitude and personality through pared-down forms.

- Holographic Sticker Design: Holographic stickers are specifically perfectly-suited for tech companies, premium brands, or anyone wanting tdisplay a version of innovative technology and futurism. These types of stickers not only develop the understood value of items but alsmake memorable visual effects in marketing campaigns.

- Glitter Sticker Design: In the current year, glitter stickers will create a huge return. With moving light, glitter stickers showcase the different glimmers and colours, which make them ideal for social media sharing. These stickers are perfect for creators and brands whwant tattract consideration with a bold, observable effect.

- Illustrated Collage Style Stickers: the illustrated collage style, which will constantly gain attention. This style integrates different designs and characteristics, which makes every sticker different and artistic. Collage art can be encouraged from street art, any image with layered visuals, and abstract paintings, too.

Market Dynamics

Driver: Personalization drives the 3D-Printed Stickers and Labels Market

With development in printing technology and different types of tools and materials available, creating high-level stickers is nlonger restricted tprofessional printers. The urge for custom stickers has grown, with organizations utilising them for promotional aims and branding too. Inventions in printing technology have developed the reliability and quality of stickers, which makes them more captivating tusers. The worldwide sticker printing market is predicted tdevelop mainly, driven by the growth in e-commerce and tailored products. Online printing services have grown, allowing us tconveniently craft and order stickers from home. Also, the 3D packaging design procedure frees the resources, allowing several iterations, perfect design decisions, and a quick tie tmarket. Break free of the lengthy. Luxury design procedures and make complicated, full-colour 3D packaging and high transparency too.

Restraint: In-depth Analysis is the Problem

Although 3D printed stickers and labels have several innovative possibilities, there are alssome challenges, such as they are heavily detailed artworks that require strong software and a lot of computing power, which can be time-consuming. Relying on the surface of size and detail of a work of art, printing can take many hours or even days. Good-quality printing materials, such as ceramic or metal, are costly, and professional printers are often expensive too. While some materials, such as PLA, are biodegradable, other plastics have problems with respect tthe environment. Furthermore, the printing procedure needs energy, which makes sustainability crucial.

Opportunity: Technology Drives 3D-Printed Stickers and Labels

3D-printed stickers and labels are developing at an exceptional rate, driven by technological growth and updated user demands. The move from regular tdigital printing has gained attention as a main achievement in the upgradation of label printing. Digital label printers offer huge efficiency and flexibility as compared ttheir analog counterparts. These printers allow for fast design updates without the need for huge setup times, which makes them perfect for organisations that ned short runs or customized labels.

Sustainability has become an important factor in buying decisions. Current label printers now assist eco-friendly materials like water-based inks and biodegradable substitutes. This move towards sustainable practices not only lowers the environmental impact but alsappeals teco-conscious users.

How is Artificial Intelligence Being used in the 3D-Printed Stickers and Labels Market?

Smart labels, particularly those with NFC technology and RFID, make it convenient for us trecord items in real time. This means organisations can track inventory, lower the losses, and smooth operations with just a fast scan. These types of labels don’t just assist organisations in monitoring products; they alsassist in tracking user communications.

A smart label smoothly integrates intyour packaging tserve the real-time insights. Smart labels can alsplay a huge role in safety and health. For instance, some even come with temperature sensors that alert users if the item has been kept inaccurately. This surface of in-depth develops the user experience and assists anyone with peace of mind.

By Product Type

How did the 3D Domed /Resin Dome Label Dominate the 3D-Printed Stickers and Labels Market?

The 3D domed/resin dome label segment dominated the 3D-printed stickers and labels market in 2024, as advanced-quality stickers containing a transparent resin coating, which makes an upgraded, polished surface above printed graphics, are called resin domed stickers, which are sometimes referred tas 3D dome labels or bubble stickers. The stickers' durability and aesthetic look are developed by this precise resin coating, which makes them impermeable tUV rays, moisture, chemicals, and scratches, too. Resin domed stickers are hence a famous option for several different uses, specifically when brand or label demands tbe rigid, visually appealing, and polished too.

The 3D functional/ embedded labels segment is predicted tbe the fastest in the market during the forecast period. These types of functional stickers are created by coating 2D images on different planes tcreate the illusion of depth. This serves the sticker with a 3D effect whenever viewed from various angles. Visually, these functional labels look multi-layered with an intelligence of depth and a bright colour transformation.

Just like the 2D/3D style printed stickers and labels, honest 3D labels have complete three-dimensional objects that look texist in actual space. These holograms are primarily manufactured by certified security printers because of the high-level holographic procedures that are used tgenerate them.

By Printing Technology

How has the Material Extrusion Dominated the 3D-Printed Stickers and Labels Market?

The material extrusion segment has dominated the 3D-printed stickers and labels market in 2024, as material extrusion is an innovative additive producing procedure, generally known as 3D printing. It includes the extrusion materials with the assistance of a nozzle in order tconstruct three-dimensional objects layer by layer. Just like regular Metal Injection Moulding (MIM), which injects feedstock inta convertible, MEX takes out constructed late, building the object directly from a computer-aided design (CAD) model. This procedure serves remarkable design reliability and productivity, which makes it a changeable technology in production.

The material jetting/polyjet segment is expected tbe the fastest in the market during the forecast period. This 3D printing technology is a high-level 3D printing procedure that uses photopolymer resins in order tmake highly detailed and accurate objects. It has the potential tprint with different materials and colors at the same time. This allows the making of complicated, functional parts and multi-material and colors at the same time. Packaging creators around the globe utilise the PolyJet technology tfastly refine and confirm in detail, multi-material and full-colour packaging too. A sensitive and actual prototype can assist the designer in receiving insightful feedback in order tgenerate a prototype that can assist the designer in receiving insightful feedback in order tmake a perfect final item.

By Material

How did the Photopolymer Resin Dominate the 3D-Printed Stickers and Labels Market?

The photopolymer resin has dominated the market in 2024 as photopolymer-dependent 3D printing technologies, such as Stereolithography (SLA), Digital Light Processing (DLP), Liquid Crystal Display printing, and PolyJet, that are widely used in different industries for their potential tgenerate high-resolution, detailed parts. Just like thermoplastic-dependent printing procedures like FDM, these technologies depend on liquid photopolymers that are cured layer by layer using ultraviolet light or the same light source. The selection of photopolymer resin is an important factor in the success of the 3D printing procedure.

Photopolymers are particularly formulated resins that have oligomers and monomers which get affected whenever exposed tlight, which begins a curing procedure that converts the liquid resin inta solid.

The elastomeric /flexible materials are expected tbe the fastest-growing segment in the market during the forecast period. Flexible 3D printing has regularly been more complex than 3D printing with strong materials, but it's becoming more prevalent as 3D printer producers create high levels in both material sciences and hardware development. The capabilities for 3D printed flexible parts are approximately limitless. Sflexible materials are needed in every part of our daily lives, and 3D printing can open up the latest opportunities for optimization and personalization within these uses.

By Adhesive Type

How has the Permanent Pressure-Sensitive Technology Dominated the 3D-Printed Stickers and Labels Market?

The permanent pressure-sensitive segment has dominated the 3D-printed stickers and labels industry in 2024 as pressure-sensitive labels are famous in general because they serve user-friendly, glue-free use process, a huge array of material and adhesive options for different applications, and cost-effectiveness. Hence, they are not the subject of a specific trend of becoming famous in 3D printed stickers and labels. Instead, the growth in popularity of 3D printing is classified as separate from and can even communicate with the current popularity of pressure-sensitive labels.

The removable pressure-sensitive labels are predicted tbe the fastest-growing during the forecast period. Removable pressure-sensitive adhesives are gaining attention for their precise reusability and removal, which are important for current sustainability demands like material recycling and for uses such as food packaging, retail labels, and electronics. They link firmly but can be accurately removed without damage tthe underlying surface, making them perfect for products demanding eventual label removal. Growth in adhesive formulation and digital printing is allowing tailored 3D printed stickers and labels with these characteristics, serving both aesthetic look and reliable advantages like developed recycling efficiency.

How did the Individual Die-cut Stickers Dominate the 3D-Printed Stickers and Labels Market?

The individual die-cut stickers have dominated the 3D-printed stickers and labels market in 2024 as they tailored our world with good-quality, custom die-cut stickers, tailored tfit several personal or professional branding demands. These types of stickers serve as a powerful way texpress style, advertise your business, or add a personal touch tspecial events. Accurate -cute tyour design, our die-cut stickers bring our vision tlife with a smooth presentation that stands out.

The roll-to-roll labels are predicted tbe the fastest-growing segment in the market during the forecast period. A roll-to-roll 3D sticker and label points ttailored stickers with a grown, glossy, or domed effect, printed in constant rolls on adhesive vinyl or other materials using digital, UV, or laser technology for heavy volume use with automated machines. These 3D stickers serve a luxury, tactile look and a reliable, fade-resistant, and waterproof finish, which makes them perfect for brands, DIY projects, and packaging.

By End-Use Industry

How did Consumer Electronics dominate the 3D-Printed Stickers and Labels Market?

The consumer electronics segment has dominated the market in 2024 as physical prototypes, whether simple mock-ups or in-depth scale models, are an important part of product development. Early stage design and models enable patterns tbe validated, utility, which is tbe tested, and twatch how products truly feel and appear. 3D printing shortens the product growth cycle by allowing parts tbe printed, designed, and tested in a fraction of the time and cost of regular manufacturing procedures. Apart from this, enclosures are another prevalent usage of 3D printing in consumer electronics. The technology assists in defeating the main design issue for electronics producers, tprotect the circuit, displays, and switches while protecting against electrical shock tusers.

The healthcare and medical devices are predicted tbe the fastest-growing segment in the market during the forecast period. With the assistance of 3D printing, however, the price of generating one product is the same as creating several thousand, regardless of how different or complicated the product is. Production can alstake place near where the urge is, rather than in a factory on another continent. This substantially lowers lead times and enables a more sensitive, iterative production procedure. Medical 3D printing alssummarizes the research and development timeline by lowering the time between design developments, enabling more testing tbe conducted in a similar or shorter time period, and highlighting potential problems earlier in the procedure.

By Region

How has the Asia Pacific Region Dominated the 3D-Printed Stickers and Labels Market?

The Asia Pacific has dominated the 3D-Printed Stickers and Labels in 2024 with fast development, specifically in the Asia Pacific region, driven by e-commerce, the urge for personalised products, and governments' assistance in printing technologies, particularly in countries like China. Main factors include the growing need for aesthetics and functional labels in the developing beverage, food, and retail industries. A move towards personalised and sustainable packaging solutions, and growth in 3D printing materials and technologies like AI-driven optimization.

The growing demand for 3D-printed stickers and labels has been driven directly by development in the packaging sector in India. Their urge in E-commerce, food and beverages, personal care, and pharmaceutical sectors in India has grown because of a developing need for cutting-edge and catchy packaging solutions.

These will align with the developing needs of these sectors towards perfect branding and consumer use, in which luxury patterns, personalized design, and intelligent features such as QR codes in 3D-printed labels serve them perfectly.

The Middle East and Africa region is expected tbe the fastest-growing in the market during the forecast period. There is an increasing demand for 3D-printed stickers and labels, driven by the region’s huge acceptance of 3D printing technology, rising user demand for branding and personalization, and a rigid push for sustainable and inventive packaging solutions. Main factors count assistive government initiatives, such as Dubai 3D-Printing Strategy, that stretches the e-commerce and the growth of small tmedium-sized enterprises (SME), which benefit from flexible, digital printing procedures. Governments in the Middle East and Africa are actively marketing technological growth and invention. The rising e-commerce ecosystem in the region develops the urge for personalised labelling solutions for product checking, brand building, and logistics supervision.

3D-Printed Stickers and Labels Market Value Chain Analysis

- Material Processing and Conversion: There is a space of materials that can be processed via 3D printing and additive production procedures, and every material has its own set of properties. Selecting the correct 3d printing material is important, as it directly affects the aesthetic and functional elements of your printed parts. It assists manufacturers tmake sure that the aesthetic and unique needs are not only aligned with cost-efficient selections but are alsconsidered.

- Package Design and Prototyping: With the growth in 3D printing, we can expect several positive updates and opportunities that will lead torganisational success. It can lead thuge speeds, the use of a huge series of materials, and heavy-scale production potential. Users don't like the copy-paste strategy; instead, they urge tailored approaches.

- Logistics and Distribution: As 3D printing makes a more localized production procedure, the logistics industry experiences disruptions tcurrent supply chains. While existing lanes and models may need tbe refigured out, the latest opportunities will arise for the distribution of materials and machines. Logistics companies must adapt tthe current changes caused by more widespread acceptance of 3D printing, specifically capable new partners and growing markets, such as additive manufacturing servers.

Leading Companies in the 3D-Printed Stickers and Labels Market

Tier 1

Tier 2

- Huhtamaki

- Constantia Flexibles

- Raflatac (brand / divisions)

- MacTac

- Carbon, Inc.

- Markforged

- Formlabs

- Protolabs (Protolabs / Proto Labs)

- Xometry

- Shapeways

- Sculpteo

- Xerox

- Domino Printing Sciences

- Nilpeter / Gallus (label/press OEMs)

- Konica Minolta (digital label presses)

- Essentra Packaging

- Brady Corporation

- Zebra Technologies

Tier 3

- DomeTag

- Maverick Label (domed labels)

- Cubbison (domed labels)

- Auld Technology (domed labels / emblems)

- Coast Label (domed labels)

- Dilco (domed decals)

- Chemline (doming resins & systems)

- Epoxies, Etc. (doming / clear resins)

- Coniex (DOMINGFLEX resins)

Latest Industry Leader Announcement

- In November 2024, Materialise revealed the range of software developments and partnerships that are crafted tdevelop the personalization of 3D printing operations, perfect checking tbegin the parts and lower the CO2 emissions.

- Bria, an top visual generative AI solution constructed for the organisation and HP, the worldwide technology leader, which is the world's primary digital printing, is very proud treveal their partnership with Eurostampa on their 8th Envelope project.

- In September 2025, Indighas marked the 3000 Labels and packaging presses which have tbe installed worldwide and has disclosed AI-powered, end-to-end print solutions treveal profitable development in Dubai, UAE, September 2025.

Recent Developments

- In May 2025, Ricoh Company, Ltd has made an innovative 3D inkjet printing technology which allows the making of full-colour resin elements with both high mechanical power and biocompatibility. This innovation is predicted tassist the manufacturing of tailor-made, design-sensitive spaces, specifically in fields such as dentistry and eyewear.

- In October 2024, RevoFoods officially disclosed the “world’s biggest” industrial facility for 3D printed food manufacturing, in which it makes its latest mycoprotein salmon-style filet.

- In September 2025, Anker's sub-brand eufyMake revealed the Kickstarter crowdfunding campaign for the latest UV printer, E1. The prizewinning machine can be utilised tprint 3D textural designs ontdifferent objects, with the potential tmimic brushstrokes or tmake a leather effect.

3D-Printed Stickers & Labels Market Segmentations

By Product Type

- 3D Domed / Resin-dome Labels

- o3D Embossed / Relief Labels

- 3D Textured / Tactile Labels

- 3D Clear / Transparent Raised Labels

- 3D Braille & Accessibility Labels

- 3D Functional / Embedded (sensors, RFID, electronics) Labels

- 3D Decorative / Aesthetic Stickers

- 3D Emblems & Badges (rigid, shaped parts)

By Printing Technology

- Material Extrusion (FDM/FFF)

- Vat Photopolymerization (SLA / DLP)

- Material Jetting / PolyJet

- Binder Jetting

- Selective Laser Sintering (SLS)

- Hybrid 2D + 3D (conventional + additive)

By Material

- Photopolymer Resins

- Thermoplastic Filaments (ABS, PLA, PETG)

- Elastomeric / Flexible Materials

- Composite-filled Materials (glass/metal/ceramic blends)

- Metals (rigid emblems, specialty labels)

By Adhesive Type

- Permanent Pressure Sensitive

- Removable / Repositionable Pressure Sensitive

- High-temperature / Industrial Adhesive

- Non-adhesive (mechanical mounting, snap-fit)

By Format

- Individual Die-cut Stickers

- Roll-to-roll Labels

- Sheet-fed Labels

- Rigid Badges & Emblems

By End-use Industry

- Consumer Electronics

- Automotive & Mobility

- Healthcare & Medical Devices

- Food & Beverage

- Personal Care & Cosmetics

- Industrial Equipment

- Aerospace & Defense

- Retail & E-commerce Packaging

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Figure 1. Global 3D-Printed Stickers & Labels Market Size (USD Million), 2025–2034

- Figure 2. Market Share by Region, 2024 – Asia Pacific 40%, North America 25%, Europe 20%, Latin America 8%, Middle East & Africa 7%

- Figure 3. Market Share by Product Type, 2024 – 3D Domed / Resin Dome 30%, Embossed / Relief 15%, Textured / Tactile 12%, Clear / Transparent Raised 10%, Braille & Accessibility 8%, Functional / Embedded 12%, Decorative / Aesthetic 8%, Emblems & Badges 5%

- Figure 4. CAGR Growth by Product Type, 2025–2034 – Fastest: 3D Functional / Embedded Labels

- Figure 5. Market Share by Printing Technology, 2024 – Material Extrusion 35%, Vat Photopolymerization 20%, Material Jetting 15%, Binder Jetting 10%, Selective Laser Sintering 10%, Hybrid 2D+3D 10%

- Figure 6. CAGR Growth by Printing Technology, 2025–2034 – Fastest: Material Jetting / PolyJet

- Figure 7. Market Share by Material, 2024 – Photopolymer Resins 40%, Thermoplastic Filaments 25%, Elastomeric / Flexible Materials 15%, Composite-filled 10%, Metals 10%

- Figure 8. CAGR Growth by Material, 2025–2034 – Fastest: Elastomeric / Flexible Materials

- Figure 9. Market Share by Adhesive Type, 2024 – Permanent Pressure-Sensitive 45%, Removable 25%, High-Temperature / Industrial 20%, Non-Adhesive 10%

- Figure 10. CAGR Growth by Adhesive Type, 2025–2034 – Fastest: Removable Pressure-Sensitive

- Figure 11. Market Share by Format, 2024 – Individual Die-Cut Stickers 40%, Roll-to-Roll Labels 30%, Sheet-fed Labels 20%, Rigid Badges & Emblems 10%

- Figure 12. CAGR Growth by Format, 2025–2034 – Fastest: Roll-to-Roll Labels

- Figure 13. Market Share by End-use Industry, 2024 – Consumer Electronics 25%, Automotive & Mobility 20%, Healthcare & Medical Devices 15%, Food & Beverage 12%, Personal Care & Cosmetics 10%, Industrial Equipment 8%, Aerospace & Defense 5%, Retail & E-commerce 5%

- Figure 14. CAGR Growth by End-use Industry, 2025–2034 – Fastest: Healthcare & Medical Devices

- Figure 15. Value Chain Analysis of the 3D-Printed Stickers & Labels Market

- Figure 16. Competitive Landscape: Tier 1, Tier 2, Tier 3 Players

List of Tables

- Table 1. Global 3D-Printed Stickers & Labels Market Size (USD Million), 2025–2034

- Table 2. Regional Market Share, 2024 – Asia Pacific 40%, North America 25%, Europe 20%, Latin America 8%, Middle East & Africa 7%

- Table 3. Product Type Market Share, 2024 – 3D Domed / Resin Dome 30%, Embossed / Relief 15%, Textured / Tactile 12%, Clear / Transparent Raised 10%, Braille & Accessibility 8%, Functional / Embedded 12%, Decorative / Aesthetic 8%, Emblems & Badges 5%

- Table 4. Printing Technology Market Share, 2024 – Material Extrusion 35%, Vat Photopolymerization 20%, Material Jetting 15%, Binder Jetting 10%, Selective Laser Sintering 10%, Hybrid 2D+3D 10%

- Table 5. Material Market Share, 2024 – Photopolymer Resins 40%, Thermoplastic Filaments 25%, Elastomeric / Flexible Materials 15%, Composite-filled 10%, Metals 10%

- Table 6. Adhesive Type Market Share, 2024 – Permanent Pressure-Sensitive 45%, Removable 25%, High-Temperature / Industrial 20%, Non-Adhesive 10%

- Table 7. Format Market Share, 2024 – Individual Die-Cut Stickers 40%, Roll-to-Roll Labels 30%, Sheet-fed Labels 20%, Rigid Badges & Emblems 10%

- Table 8. End-use Industry Market Share, 2024 – Consumer Electronics 25%, Automotive & Mobility 20%, Healthcare & Medical Devices 15%, Food & Beverage 12%, Personal Care & Cosmetics 10%, Industrial Equipment 8%, Aerospace & Defense 5%, Retail & E-commerce 5%

- Table 9. Key Market Drivers, Restraints, and Opportunities

- Table 10. Emerging Trends in Sticker Design and Market Impact

- Table 11. Regional Growth Opportunities and Government Initiatives

- Table 12. Value Chain Analysis – From Material Processing to Distribution

- Table 13. Competitive Landscape by Tier (Tier 1, Tier 2, Tier 3 Players)

- Table 14. Recent Developments by Leading Market Players, 2024–2025