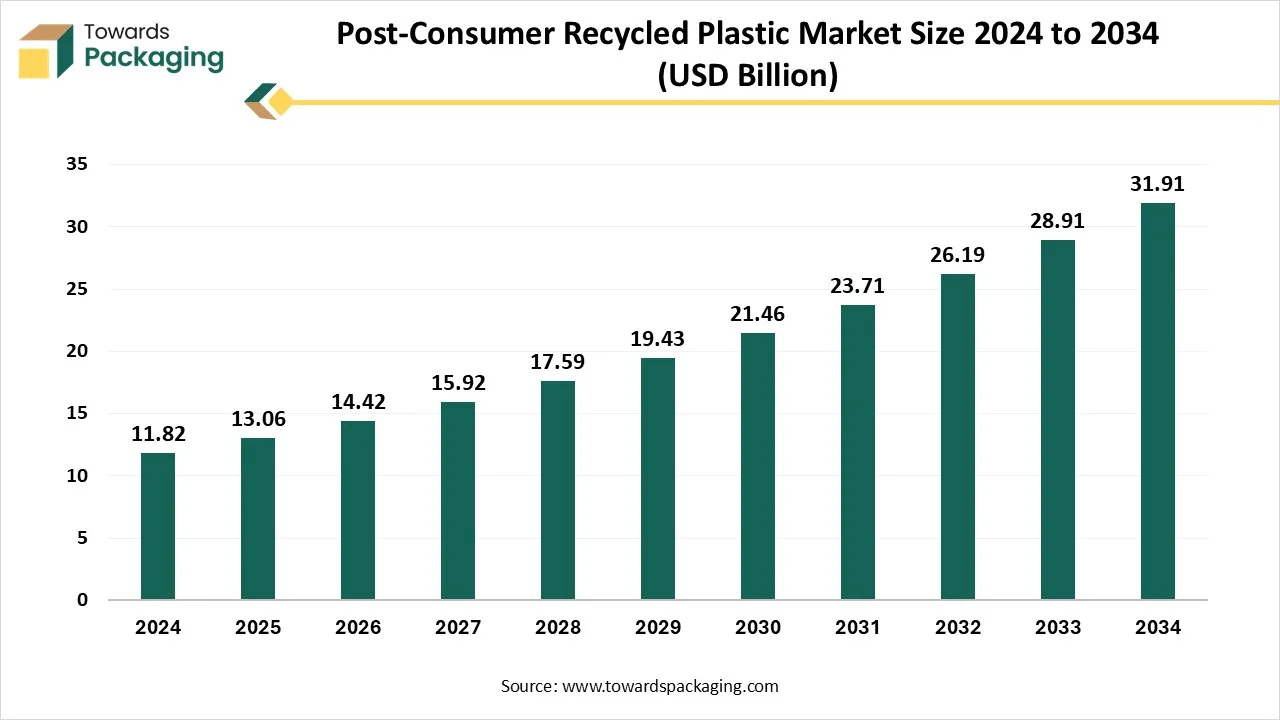

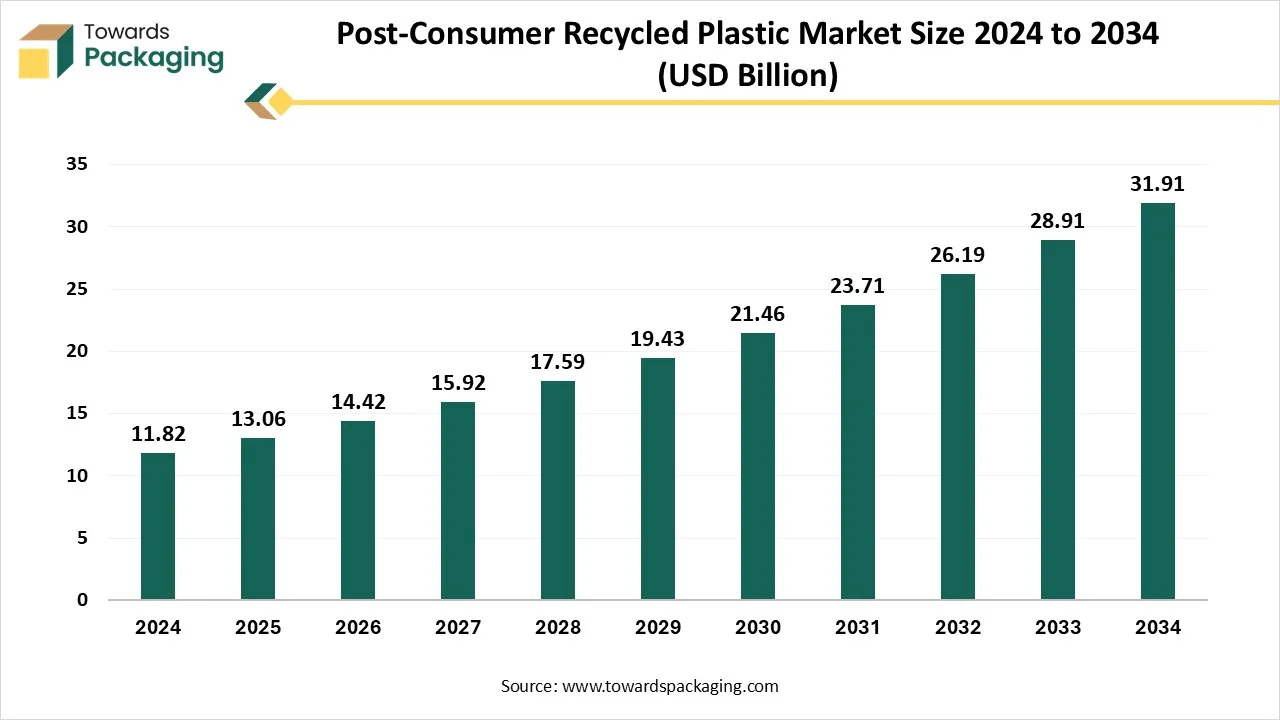

The post-consumer recycled plastic market is forecasted to expand from USD 14.42 billion in 2026 to USD 35.24 billion by 2035, growing at a CAGR of 10.44% from 2026 to 2035. This report covers market segments by source, including bottles and non-bottle plastics, and by type, such as polyethylene, polystyrene, polypropylene, and PET. Regional analysis includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, while key players like SABIC, BASF SE, Sumitomo Chemical, and Evonik Industries AG are profiled with their products, market presence, and competitive strategies. The study also provides value chain insights, trade flows, and detailed manufacturer and supplier data.

Post-consumer recycled plastic (PCR) is created from plastic material that has been discarded by consumers. It specifically comes from plastic bottles, plastic wraps, and other kinds of thrown-away plastic items. After being collected, cleaned, and processed, it is changed into usable plastic resin for producing new plastic products. Waste plastic material can be household product containers, water bottles, soft drink bottles, post-industrial waste, and many more.

These types of materials are prevalently in our current life and are the main plastic pollution. It is a kind of material that can be hugely recycled and reprocessed into a reason for use in new packaging. By reusing packaging, this procedure lessens the quantity of plastic waste generated. A circular economy is a systematic transformation from a "take-make-dispose" model to one that lowers waste and grows resource effectiveness. Post-consumer recycled materials are important to achieve this aim by serving as an alternative to virgin plastic and assisting manufacturers in closing the loop in manufacturing cycles. (Source: IFC advances economic development)

| Metric | Details |

| Market Size in 2025 | USD 13.05 Billion |

| Projected Market Size in 2035 | USD 35.24 Billion |

| CAGR (2025 - 2035) | 10.44% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Source, By Type and By Region |

| Top Key Players | SABIC, BASF SE, Sumitomo Chemical Co Ltd, Evonik Industries AG, Arkema, LyondellBasell Industries N.V. |

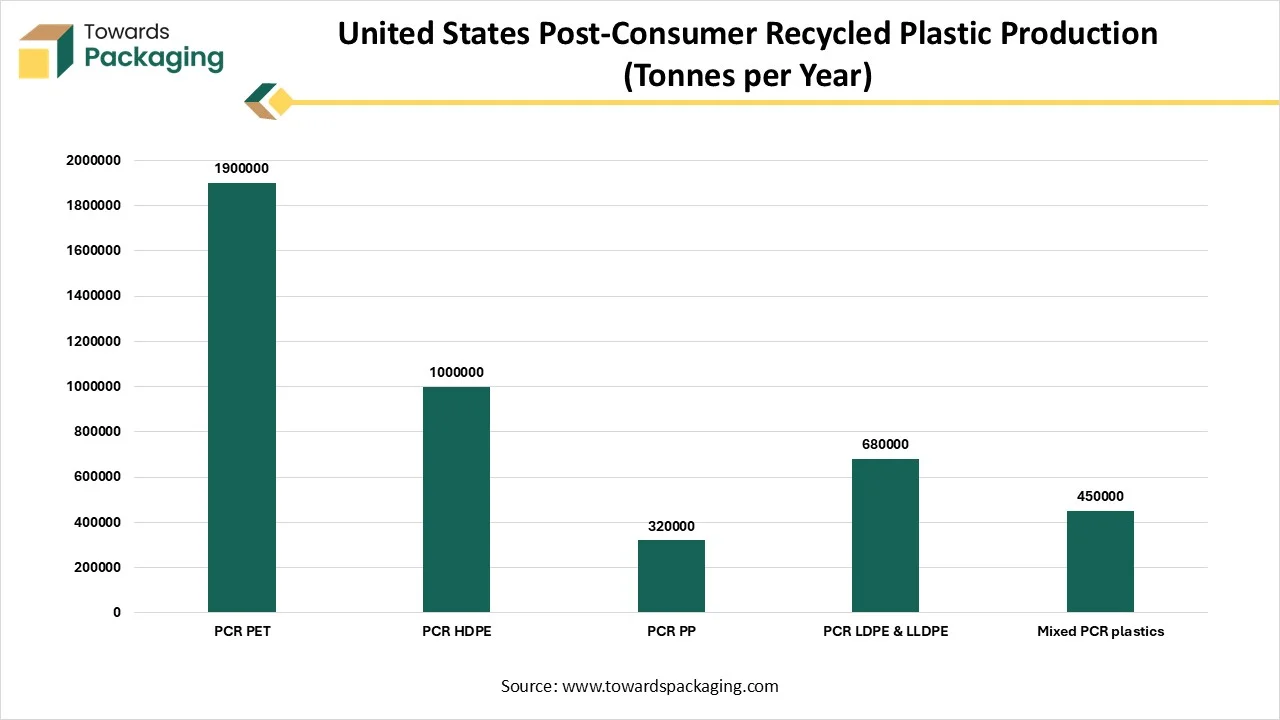

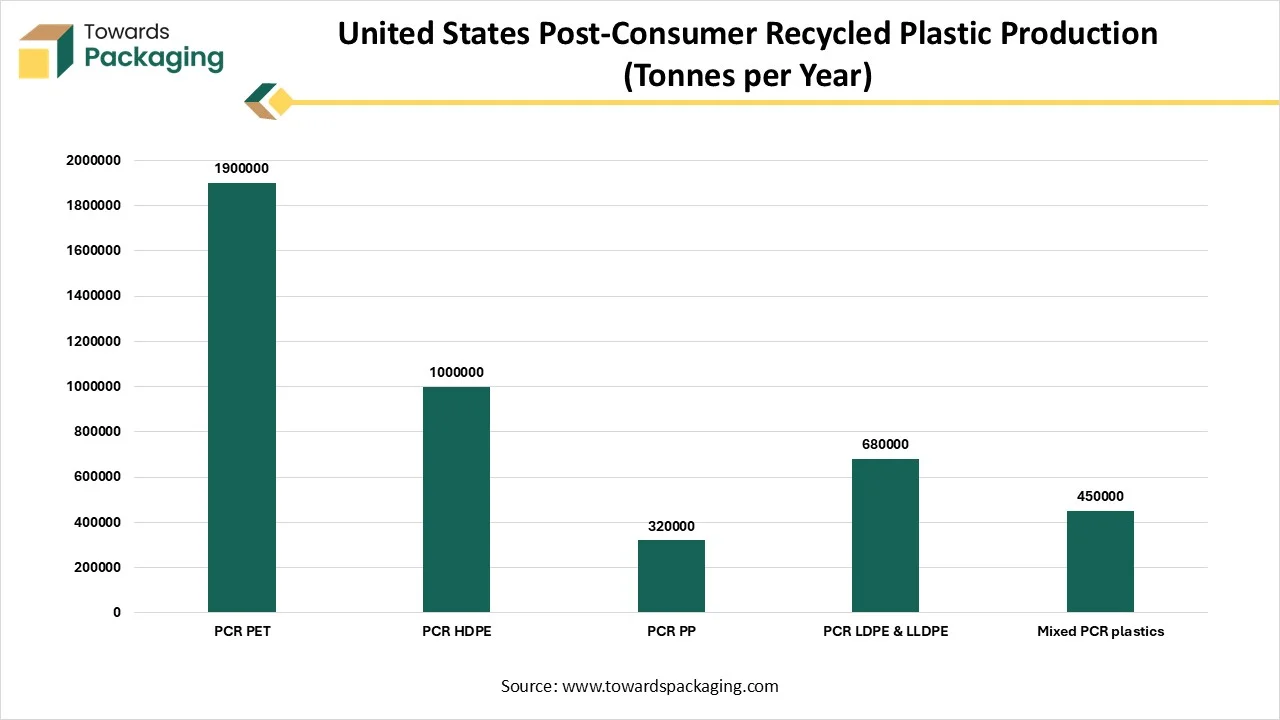

| PCR Plastic Type | Production |

| PCR PET | 1900000 |

| PCR HDPE | 1000000 |

| PCR PP | 320000 |

| PCR LDPE & LLDPE | 680000 |

| Mixed PCR plastics | 450000 |

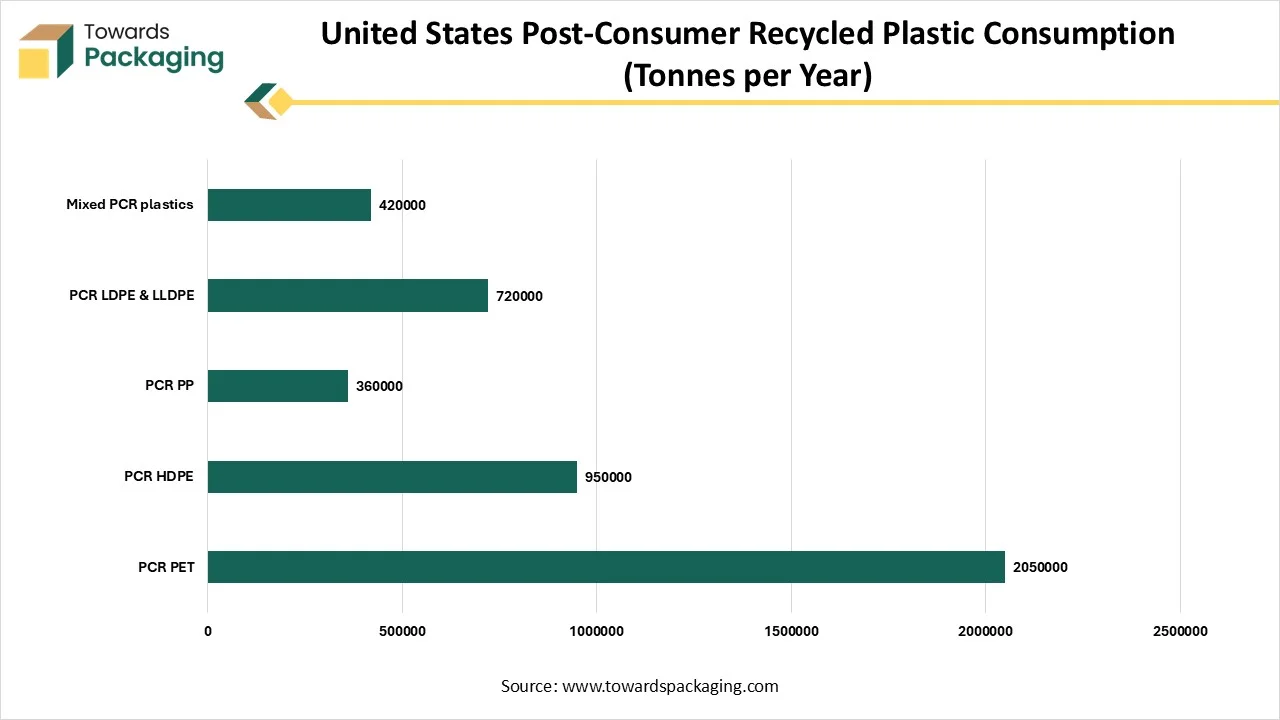

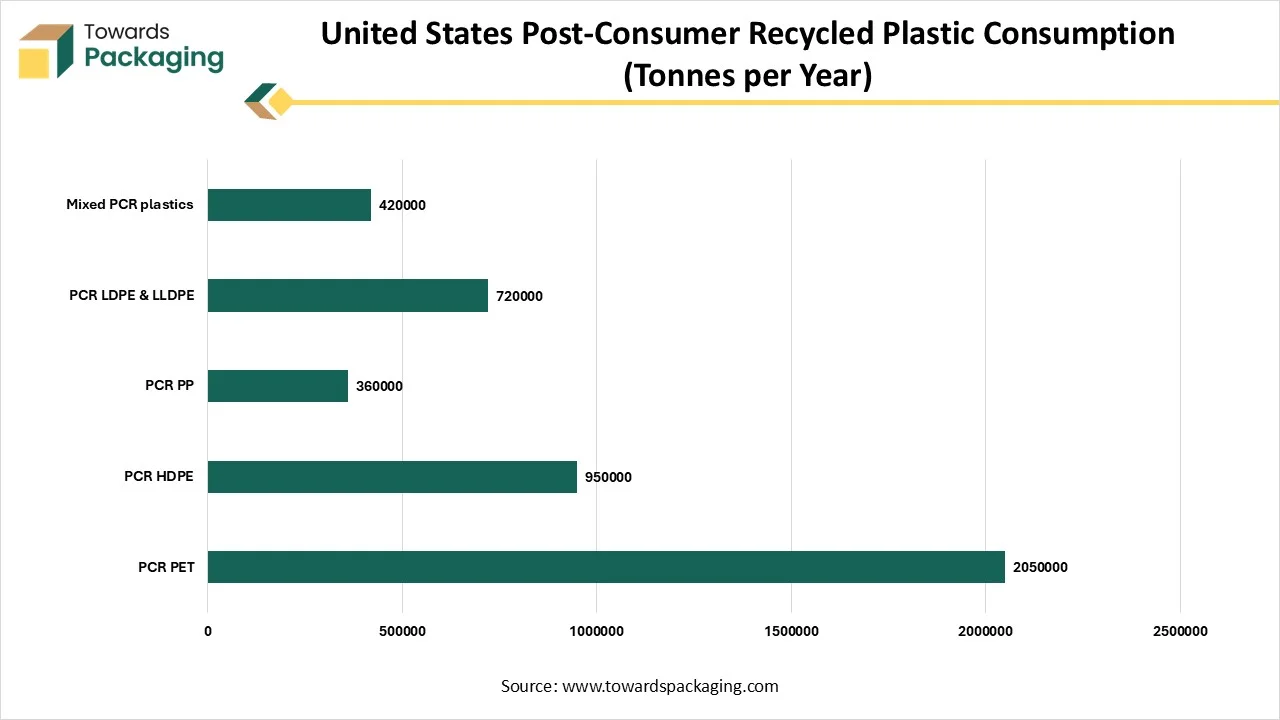

| PCR Plastic Type | Consumption |

| PCR PET | 2050000 |

| PCR HDPE | 950000 |

| PCR PP | 360000 |

| PCR LDPE & LLDPE | 720000 |

| Mixed PCR plastics | 420000 |

Regular recycling procedures depend heavily on manual labor and basic mechanical sorting systems, which frequently produce errors. AI-powered robotic sorting systems improve effectiveness by utilizing machine vision and deep learning algorithms to identify and classify plastics with unprecedented precision. Pollution in recycling systems is a main problem that often renders plastics non-recyclable. AI systems filled with hyperspectral imaging and high-level sensors can analyze contaminants and separate them effectively. It also improves the operational side of recycling facilities by ensuring predictive maintenance and procedure automation.

On the other hand, AI-driven analytics serve insights into recycling trends, processing capacity, and waste generation. These insights enable facilities to allocate resources more effectively by ensuring maximum output. AI isn't just changing industrial recycling; it's also partnering with consumers to recycle better. Apps powered by AI educate users on accurate recycling practices and serve location-specific guidelines.

Powering Sustainability with PCR Plastics

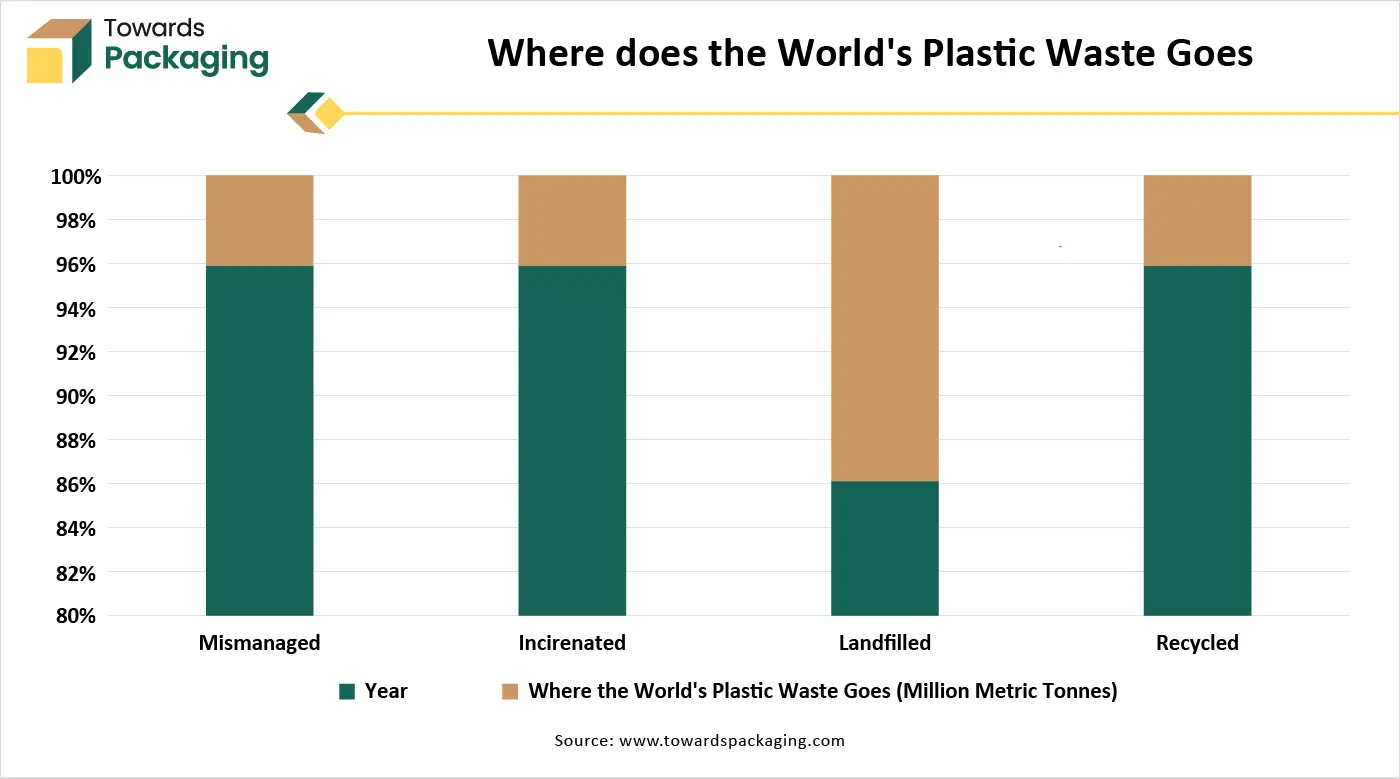

Post-consumer recycled plastic assists in lowering energy usage and emissions by reducing dependency on virgin plastic production, an energy-intensive procedure reliant on fossil fuels. Virgin plastics are created from natural gas or crude oil. In contrast to that, PCR plastics help divert waste from landfills and oceans, connecting used materials into a constant recycling loop. Governments everywhere are implementing Extended Producer Responsibility (EPR) policies to make PCR Content in terms of packaging. Plastic recycling is important in managing waste and making a more sustainable future.

Overcoming Challenges in PCR Plastics

Post-consumer plastic is often more costly than virgin plastic because of the processing and collection involved. It may have less clarity than virgin plastics. Even so, modern recycling technology, such as VACUNITE, now receives intrinsic viscosity values up to 0.80 dl/g, aligning with the clarity of virgin plastics. To make sure of constant quality, which can be more challenging with PCR plastic because of variations in recycled materials. One such challenge is color consistency. Hence, high-level optical sorting with TOMRA'S AUTOSORT and FLYING BEAM technology now receives 99% color separation purity, which improves color consistency. The supply of high-quality PCR plastic can be regulated by recycling rates and infrastructure. In the United States, post-consumer recycled resin is created by 9.4% of plastic packaging.

Global Push for Recyclability

Consumer trends and worldwide policy are driving this transformation towards improving the recyclability of complicated products like cars, and the rising expectation for more PCR materials utilized in those products. Automotive brands and original equipment producers are paying attention and giving feedback to unfolding regulatory policies around the world that require a higher percentage of recycled materials in vehicles. Other consumer brands are shifting to implement more recycled materials into product packaging. Apart from this, current shredding machines are crafted to process more plastic types, which reduces wear and tear while serving constant particle sizes. This growth improves overall procedure effectiveness, generating finer and good-quality recycled material with fewer contaminants.

| Material | Minimum Price | Maximum Price |

| PCR PET (food grade) | 1200 | 1600 |

| PCR PET (non-food) | 900 | 1200 |

| PCR HDPE (natural) | 1000 | 1400 |

| PCR HDPE (colored) | 650 | 900 |

| PCR PP | 900 | 1300 |

| PCR LDPE | 750 | 1100 |

Bottles Dominated the Market in 2024

Making post-consumer recycled products begins with collecting and sorting recycled PET and HDPE items from residential and commercial recycling programs, like milk jugs and bottles. The plastic is then cleaned and filtered, and any scraped materials are removed. The items are then broken down, melted, and reformed into a resin material. This resin can be integrated with other plastics to make PCR plastic packaging, jars, bottles, and closures with a changing content percentage of up to 100%.

Plastic beverage container means a product or material that has completed its intended end-use and product life cycle, from households or by industrial, commercial, and institutional facilities, and that has been distinguished from the solid waste stream for the purpose of collecting and recycling. "Recycled content " should not include pre-consumer or "post-industrial secondary waste material or materials and by-products created from, or prevalently used within, an original production and fabrication procedure.

Polyethylene Leads the Market

Polyethylene is created by polymerizing ethylene, also known as ethane. Polymerization is the procedure by which several identical small molecules are joined together to make larger molecules. Polymerization is achieved through the application of pressure, heat, and/or a catalyst to generate the formation of long chains of molecules that make up a polymer. The procedure of creating polyethylene starts with either natural gas, such as ethane or methane, or a blending of gases that includes propane. It may also be made from by-products of the procedure which is used to make gasoline from crude oil. The gas is polymerized using three key methods, depending on the type of product the polyethylene will be used to maket.

Polystyrene recycling and reuse technologies are now well-developed. The recycling procedure particularly includes stages like pelletizing, compaction, and resume. Due to lower density and large volumes of grown polystyrene, it must first be processed using a polystyrene densifier to improve transport effectiveness and increase profit margins. The compressed foam blocks are then transmitted to downstream recyclers for pelletizing, shifting into clean PS pellets utilized as raw material for different recycled products. For post-consumer polystyrene with heavy contamination, utilizing a specialized foam recycling machine for washing is important to ensure the quality and purity of the pellets. Polystyrene recycling is an industrial chain that needs a global partnership. Among its platforms, compaction is the one with the lowest investment and quick return.

Economic feasibility is the main thing in terms of recycling. While Asia has huge plastic waste (along with China, estimated at 25 million metric tons of single-use plastic waste. It does not mean the same availability of feedstock that is perfect for recycling procedures, either chemical or mechanical. Waste that is perfect for mechanical recycling, such as PET (polyethylene terephthalate) bottles or PP (polypropylene) packaging, has a market value. Lesser recyclable materials, like LDPE (Low-Density Polyethylene) bags, have the capacity to become raw materials for the rising chemical recycling industry, but are less economically viable for mechanical recycling.

The Japanese government has revealed the first industry-government-Academia Consortium for Developing a Market for Recycled Plastics in Automotive Applications. This initiative's goal is to meet the EC's updated ELV directive, giving Japan a competitive edge in making a strategic action plan. The consortium brings together 10 companies from different sectors across the supply chain, including plastic waste management, recycled material production, and automotive manufacturing. To market the usage of recycled plastics in vehicle manufacturing, the group is examining challenges throughout the supply chain, giving importance to industry-wide partnerships and assisting measures to facilitate the transition.

EPR in India has been disclosed under Plastic Waste Management, which makes it compulsory for importers, producers, and brand owners to take full responsibility for tracking the plastic pollution that is generated by their products. Particularly, it requires them to ensure accurate collection, plastic recycling, and disposal, thereby making a shared responsibility for a cleaner environment. India's informal sector plays a crucial role in terms of waste management. EPR policies, hence, push the collaboration of waste collectors and ragpickers into formal systems, to ensure fair consumption and developed working conditions. This strategy is mainly to reduce waste through more organized waste collection.

The application of North American PCR in packaging means more buyers and more constant buyers of PCR resin. This, in turn, creates a rigid, current demand for post-consumer recycled plastic commodity bales created by recycling programs and processed to make PCR resins. When PCR usage is required across the packaging industry, every brand and package converter has the same mandate to buy and implement PCR, which reduces any competitive benefit or disadvantage in the industry. Grown market breadth, depth, and consistency for recycled commodities and resins disturbed the boom-and-bust business cycle, constructing confidence and reducing risk for innovators and investors. Several and multiple buyers for post-consumer recycled commodities send rigid signals back to municipalities, which can continue to collect materials and contribute to consumer recycling education.

The Government of Canada is developing a Federal Plastic Registry (TRegistry) as a part of its overall plan to receive zero plastic waste by the year 2030. This initiative's goal is to improve plastic waste management through transparency, data collection, and harmonization of expanded extended producer responsibility (EPR) policies worldwide. The Registry will need companies mixed in the life cycle of plastics that report annually on different aspects of their plastic products, from manufacturing to end-of-life management, and will affect a huge swathe of businesses across the country.

By Source

By Type

By Region

February 2026

February 2026

January 2026

January 2026