Release Liners Market Size, Trends, Share and Innovations

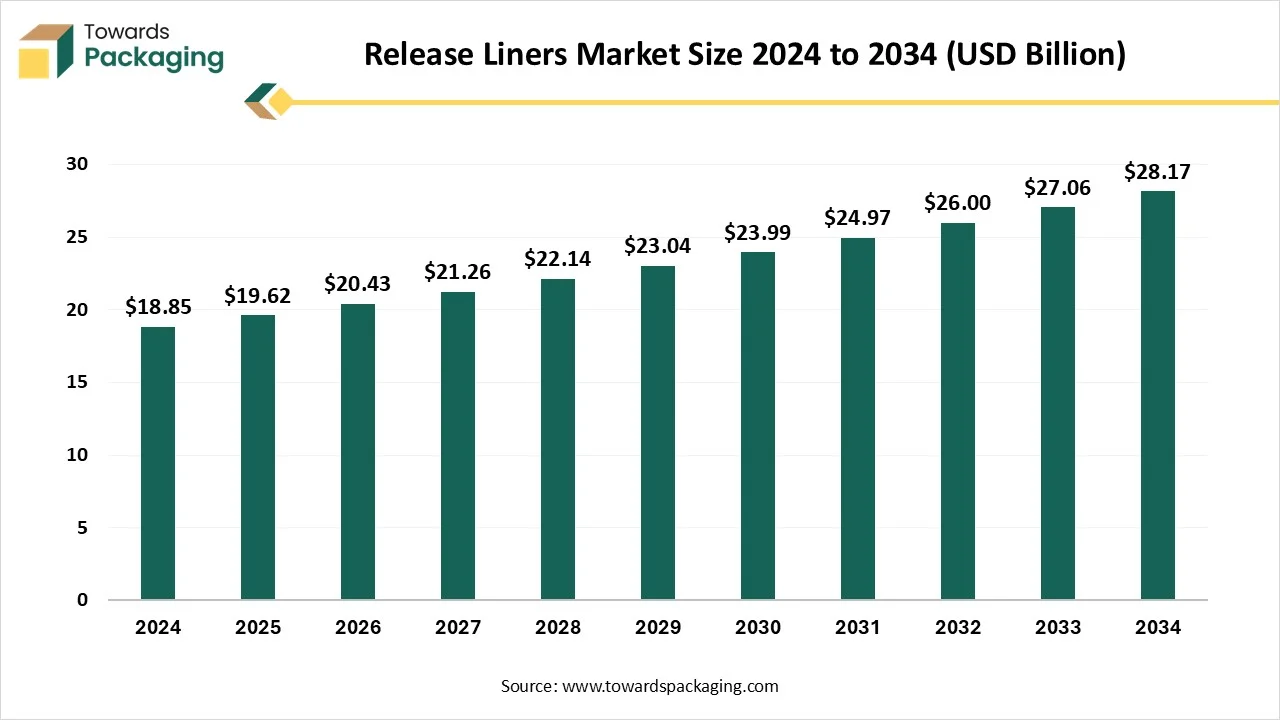

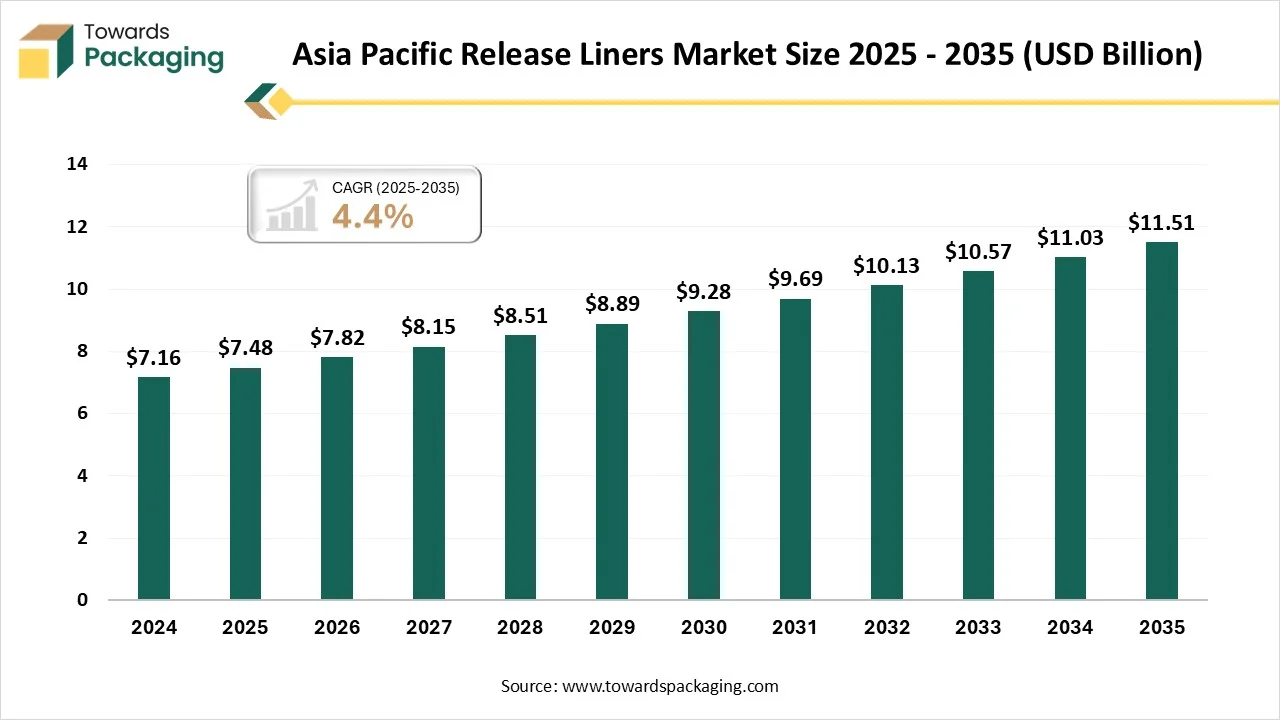

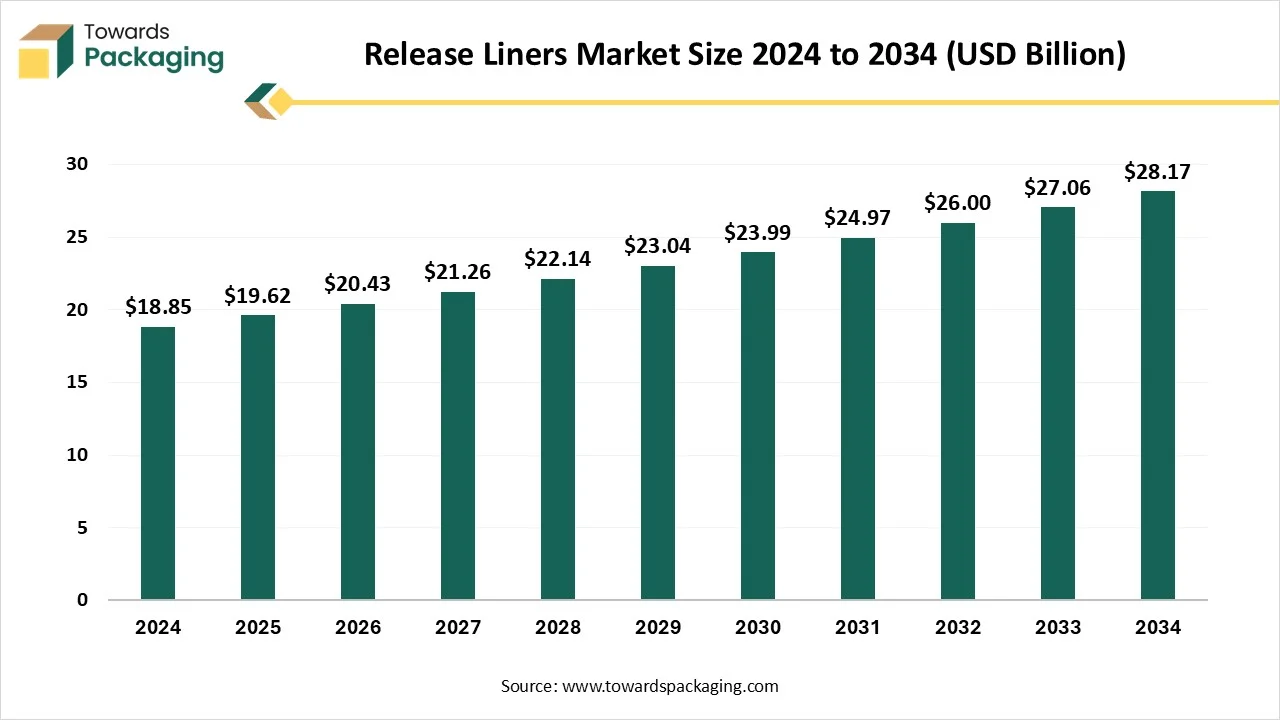

The release liners market is projected to grow from USD 19.62 billion in 2025 to USD 29.32 billion by 2035, at a CAGR of 4.1%. This growth is driven by rising demand for self-adhesive products, particularly in the packaging, labeling, and medical industries. The paper-based segment led the market in 2024, while the film-based segment is expected to grow at the fastest rate. Asia Pacific held the largest market share in 2024, with North America expected to witness notable growth during the forecast period. Innovations in silicone and non-silicone coatings are driving further advancements in the market.

Key Highlights

- In terms of revenue, the market is valued at USD 19.62 Billion in 2025.

- The market is predicted to reach USD 29.32 Billion by the year 2035.

- Rapid growth at a CAGR of 4.1% will be officially experienced between 2025 and 2034.

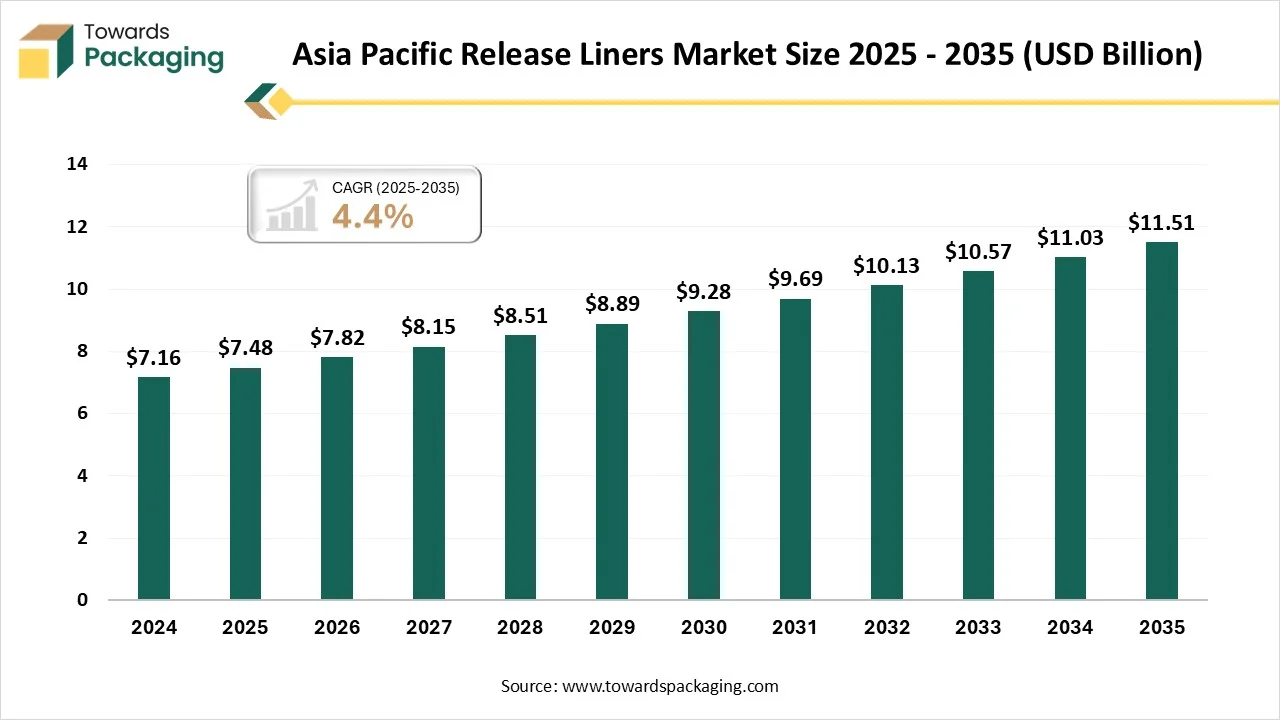

- By region, Asia Pacific dominated the market with the biggest share in 2024.

- By region, North America is expected to rise at a notable CAGR between 2025 and 2034.

- By material type, the paper-based release liner segment has contributed the biggest share in 2024.

- By material type, the film-based release liner segment is predicted to grow at a notable CAGR between 2025 and 2034.

- By coating type, the silicone-coated segment has contributed to the largest share in 2024.

- By coating type, the non-silicone segment is expected to rise at a notable CAGR between 2025 and 2034.

- By application, pressure-sensitive labels and tapes segment are dominated the market in 2024.

- By application, medical and hygiene applications are predicted to grow at a notable CAGR between 2025 and 2034.

- By end-use industry, labelling and packaging segment dominated the market in 2024.

- By end-use industry, the medical and healthcare sector segment is expected to rise at a notable CAGR between 2025 and 2034.

- By revenue model, direct product sales segment contributed to the biggest share in 2024.

- By revenue model, customised solutions and services segment are predicted to grow at a notable CAGR between 2025 and 2034.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 19.62 Billion |

| Projected Market Size in 2035 |

USD 29.32 Billion |

| CAGR (2026 - 2035) |

4.1% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material Type / Substrate, By Coating Type, By Application, By End-User Industry, By Revenue Model and By Region |

| Top Key Players |

Sappi Limited, Nitto Denko Corporation, Stora Enso Oyj, Ritrama S.p.A., Flexcon Company, Inc., Yupo Corporation, Molymer (India) Pvt. Ltd., Lintec Corporation. |

What Do You Mean By Release Liners?

The release liners market refers to the production and commercialization of sheets or films coated with a release agent that enables easy separation of pressure-sensitive adhesives (PSA) from the liner. These liners are widely used in pressure-sensitive labels, tapes, adhesive products, flexible packaging, graphics, and medical applications.

They can be paper-based, film-based, polycoated-paper-based, or even have different substrates. We can seek them in everyday uses by serving as a barrier between the pressure-sensitive adhesive and its surroundings, which protects the adhesive from sticking to surfaces before its actual usage. Without the release liner, an adhesive can become a pollutant and lose its smoothness, which then makes it challenging or impossible to use.

Release Liners Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the main reason behind the growth of the release liner industry is that it has underlined its main role in promoting high-level packaging solutions and tailored industrial applications.

- Sustainability Trends: Mechanical recycling is a developed procedure and is importantly utilised in the case of good-quality mono-material streams. The technique is fragile to pollutants, the presence of which affects the quality of the recycled material. A crucial step is the classification of the different parts: core, tape, packaging, and release liners.

- Global Expansion: The worldwide industry for release liners is stretching because of growth in packaging, e-commerce, and high-growth industries like automotive, medical, and electronics, too. While the Asia Pacific region is currently carrying the biggest market share, North America is experiencing fast growth, and Europe is driven by powerful sustainability initiatives.

- Major Investors: The major investors included in the release liners are balanced and consolidated, with the high five players that managed most of the worldwide income. These organizations are counted as main investors because of their huge product offerings, strategic investments, technological advancements, and rigid market presence.

Key Technological Shifts in the Release Liners Market

A procedure that integrates the usage of artificial intelligence technologies and a limited element method is constructed to track the manufacturing of a liner, specifically, the metallic shell of current high-pressure metal-composite cylinders. Costly physical experiments have been substituted by computer simulation, which made it possible to receive a big data array (BDA) in the design of tables counting the crucial technological parameters for swaging the liner neck and information about the metal flow at the time of deformation, and to disclose a tendency towards defect creation.

In the current packaging sector, release liners and release paper are rapidly driving a technological update. From regular carton labels and heat-sealed packaging to biodegradable electronic materials and composite film products, the use of release materials is constantly stretching, as kt becomes a main factor in developing packaging quality, environmental performance, and manufacturing efficiency too.

Trade Analysis of Release Liners Market: Import & Export Statistics

- India has imported 35 shipments of Release liners from October 2023 to September 2024. Such imports were being applied by 15 foreign exporters to 8 Indian buyers, which marks a growth rate of 250% as compared to the starting twelve months.

- During this duration, in Sep 2024 specifically, Globe has imported 5 Release liner shipments. This has officially marked a year-on-year development of 150% as compared to September 2023, and a 400% sequential growth increase from August 2024.

- India has imported many of the Release Liners from Taiwan, China, and the United States. Worldwide, the top three importers of Release Liner are Peru, Chile, and the United States. Chile led in terms of Release Liner imports, with 781 Shipments, followed by Peru having 376 shipments, and the United States that takes the third spot with 327 shipments.

Value Chain Analysis of the Release Liners Market

- Material Processing and Conversion: There are several procedures directed, which depend on the desired elements and uses. The release coating can be used through different techniques, such as solvent-based, UV curing, and hot melt. Every method has its benefits and is selected depending on factors like performance requirements, cost, and environmental considerations.

- Package Design and Prototyping: While prototyping and designing for release liners, the key is to make a system that protects the adhesive, enables convenient dispensing, and stays stable through the manufacturing process and end-use, too. The particular material and design rely on the final application, such as medical products, labels, or industrial tapes, too.

- Logistics and Distribution: The logistics and distribution of release liners are heavily complicated, which includes a tailored supply chain in order to handle fragile, high-performance materials. The procedure expands from the producer to transformers who use adhesives, and finally to end-users across various sectors like medical, packaging, and automotive.

Rising Trends in the Release Liners Market

- Nano-coatings for developed release Properties: Nano-coatings are included in release liners to develop release properties that reduce adhesive residue and develop overall performance. These coatings serve a smooth surface that protects the adhesive from becoming too rigid. For example, producers are experimenting with Nano-coatings created from carbon nanotubes or graphene in order to make release liners with unique durability and release properties.

- Laser Cutting and Die-cutting: Laser cutting and die-cutting technologies are more accurate and intricate in releasing liners. These procedures allow manufacturers to generate custom-shaped liners to align with particular uses and requirements. Furthermore, laser cutting can be utilised to make micro-perforations or other designs in the release liner, which can improve its results in particular applications.

- Silicone-based release liners: Silicone-based release liners are well-known for their perfect release characteristics, chemical durability, and opposition to heat, which makes them perfect for applications such as automotive components and medical tapes. Silicone -release liners can be tailored with additives or hand surfaces for perfect performance.

- Smart Release Liners: Smart release liners are being made with qualities such as temperature-sensitive release characteristics or indicators that show direction to adhesives, making them perfect for usage. These inventions serve perfect efficiency and ease in different sectors.

- Energy-Efficient Production: Producers are accepting energy-efficient technologies and practices in order to lower their carbon footprint. This contributes to renewable energy sources and updating manufacturing processes. By using energy-efficient measures, release liner producers can invest in a more sustainable future.

- Reduced Adhesive Residue: Efforts are being made to lower the release liners to minimize pollution and waste. High-level release coatings and production procedures are assisting in achieving this goal. By decreasing adhesive residue, producers can develop the recyclability of release liners and lessen the environmental impact of waste disposal.

- Compostable Release Liners: There is a rising importance on making compostable and recyclable release liners to minimize environmental impact. Producers are discovering materials like bio-based polymers and recycled paper to make more sustainable options.

Release Liner Applications In Drug Delivery, Medical Device And Pharmaceutical Packaging

| Medical and Pharmaceutical Applications |

Product Examples |

| Diagnostic & Point of Care |

Diagnostic Test Strips (blood glucose, cholesterol, urinary tract infections)

Point of Care / Diagnostic Devices |

| Fixation, Surgical & Wound Care |

Advanced Wound Dressing (extended wear, burn treatment, MVTR, etc.)

Catheter Placement

Incise / Ophthalmic Incise Films

IV Holders

Medical Fixation Tapes

Ostomy Pouches / Components

Surgical & Isolation Drapery |

| Drug Delivery & Pharmaceutical Packaging |

Transdermal Drug Delivery System (TDDS)

Drug-Loaded Monolithic Matrix

Reservoir with Rate Controlling Membrane

Transdermal / Medicinal Patch

Transmucosal Drug Delivery System (TMDS)

Buccal Mucosal System

Oral Thin Films (OTF) / Oral Strips

Pharmaceutical Packaging Tapes |

| Medical Sensors & Electrodes |

Disposable Electrodes

ECG, EKG and TENS Pads / Electrodes

Grounding Pads

Oxygen Sensors |

| Process Carrier Liner |

Enables Handling, Conversion & Assembly of Pharmaceutical & Medical Products |

| OTC / Consumer Healthcare |

Cosmetic Patches (Face strips, acne pads, etc.) Eye Patches

First Aid Bandages & Tape

Hygiene Products (diapers, sanitary napkins, incontinence pads)

OTC Therapeutic Patches |

Market Opportunity

Sustainable Release Liners Are At The Frontline

Sustainability is a rising trend in the release liner sector. Organisations are increasingly discovering environmentally friendly options such as recyclable film materials and biodegradable paper substrates to align with environmental goals. These sustainable selections lower the waste and appeal to environmentally conscious consumers. Expertise organisations and industry initiatives are generating programs in order to recycle and collect used release liners. This can allow closed-loop recycling, in which high-quality fibers from paper liners are reprocessed into the latest release base papers. Producers are creating liners from recycled and alternative sources that count bio-based polymers (like corn or sugarcane) and post-consumer recycled (PCr) and plastic both.

Apart from this, the latest coatings are being made to reduce waste and develop recyclability. For instance, UV LED curable silicones are more nerdy-filled and secure to generate than regular alternatives.

Market Restraint

Challenges In The Release Liners Industry

The restrictions of release liners are that they are frequently discarded immediately after every use, which contributes to a large volume of waste. Due to this, they are not widely or easily recycled and end up in landfills or incineration. Standard silicone-coated release liners, which consist of a base material (paper or film) and a silicone coating, are further challenging to recycle. The silicone must be removed from the substrate in a procedure called deinking, and not every recycling facility has the compulsory machine.

Material Type Insights

How Did The Paper-Based Release Liner Segment Dominate The Release Liners Market?

The paper-based release liner segment dominated the market in 2024, as they are greatly utilised in sectors where versatility and smoothness are the main factors. These liners are perfect for uses such as taps, labels, and graphic art. One of the benefits of paper release liners is their convenience of personalization, which enables producers to personalize them to needs. Furthermore, they have accurate moisture resistance characteristics, which ensure the integrity of the adhesive material even in humid surroundings.

Also, paper release liners provide perfect printability that enables high-quality graphics and vibrant colors. Their versatility expands to the tape sector, in which they serve as a reliable backing for different adhesive tapes, which ensure easy use and removal.

The film-based release liners segment is predicted to be the fastest in the market during the forecast period. These liners utilise polyester (PET), polyethylene (PE), and other films that are made of plastic material as the main material. The usage of films facilitates developed flexibility, strength, and opposition to surrounding factors such as moisture and heat. Film-based release liners are necessary in high-performance environments like automotive and electronics production, in which stability and accuracy are main. They also enable tighter tolerances with respect to performance and thickness, which is often complicated in big industries.

Coating Type Insights

How Did The Silicone-Coated Segment Dominate The Release Liners Market?

The silicon-coated segment dominated the release liners market in 2024, as silicone-release liners are necessary materials in the manufacturing and industrial sectors. These are particularly crafted sheets that protect the product from attaching collectively, which enables soft operations and improved product quality. It is made from silicone, which is well-known for its non-stick characteristics, durability, and heat resistance, as these liners play a crucial role in different production procedures.

Their personalised release characteristics enable manufacturers to choose the right release liner for applications, which adds to their versatility.

The non-silicone segment is expected to be the fastest-growing in the market during the forecast period. Non-silicone release liners serve as an alternative to regular silicone-coated liners. They search uses in situations in which silicone residues may interfere with downstream procedures in which particular adhesive characteristics need a non-silicone surface. Sectors such as medical devices and electronics often need non-silicone release liners to block pollutants or obstructions with sensitive elements. These liners serve a residue-free surface and are clean, which ensures the accurate functioning of the devices.

Application Insights

How Did The Pressure-Sensitive Labels And Tapes Segment Dominate The Release Liners Market?

The pressure-sensitive labels and tapes segment dominated the market in 2024, as release liners are crucial to pressure-sensitive adhesive uses such as graphics, tapes, and medical products. Release liners are also utilised in industrial composite applications and construction uses in which sticky chemicals are being managed by the release liner till they are ready for usage. These chemicals and adhesives need protection during transport and storage.

Usually, pressure-sensitive adhesive labels and tape include three parts: the carrier, release liner, and adhesive.

The carrier is a stiffer material that assists the tape in tracking its structure and stability. The adhesive layer assists the tape in making bonds.

The medical and hygiene segment is predicted to be the fastest in the market during the forecast period. Consumer goods are a complete set of products, including release liners. These include electrodes, wound care dressings, baby care products, transdermal patches, tapes, personal hygiene, wearable devices, and feminine care, too. Release liners seek huge applications in the medical field, specifically in hygiene uses. These types of liners ensure reliable and sterile use of medical adhesives while tracking the convenience of use and product integrity.

Furthermore, release liners make it convenient for healthcare professionals to use dressings or bandages precisely and securely, which provides optimal wound care.

End-Use Industry Insights

How Did The Labelling And Packaging Segment Dominate The Release Liners Market?

The labelling and packaging segment dominated the market in 2024, as labels and release liners deliver as dependable carriers of the facestock and adhesive during converting, printing, and application too. The release liners will serve as a hard surface for the die-cutting intricate shapes without enabling the die to break through the silicon layer and disturb the release performance at the time of usage. They provide a temporary carrier for the label unit till it is ready to be used on the needed substrate.

Release liner materials in film liners, paper liners, and specialty liners, too. They even make sure of ideal label performance.

The medical and healthcare segment is expected to be the fastest in the market during the forecast period. PET release liners are prevalent for wound dressings, medical tapes, and other medical adhesive products. Their reliability is to track dimensional security and oppose pollutants and moisture, which makes them perfect for sterile surroundings and complicated healthcare settings. Uses such as transdermal patches, advanced wound care, electrode fixation, and wearable devices are advantageous from PET liners as they serve a dependable and constant release, which assists in the accurate placement of medical products.

Revenue Model Insights

How Did The Direct Product Sales Segment Dominate The Release Liners Market?

The direct product sales segment dominated the release liners market in 2024, as it is completely possible to buy release liners directly from manufacturers and their official distributors, as well as from wholesale retailers and suppliers. The accessibility depends on the volume that is demanded and the uses for the liner. For a minute, businesses or those who do not demand custom runs, distributors and wholesalers serve a more usable way to buy release liners. These organisations have stocked items from different manufacturers and sell them in minute quantities. Online marketplaces are a famous way to seek these suppliers.

The customized solutions and services segment is predicted to be the fastest in the market during the forecast period. One can easily customize various colors and release force of release liners as per the customer's demands. This is a grid release paper that we tailor for users, which mainly solves the bubbles created by users during the die-cutting procedure of electronic tape. The surface of the product has the anti-sticking of grease liners, and it also has the reliability of the exhaust, anti-slip, and is not convenient to make bubbles when the product is being linked to it. It is perfect for waste discharge and punching pads for round knife die-cutting and flat knife die-cutting.

Regional Insights

How Did The Asia Pacific Region Dominate The Release Liners Market?

Asia Pacific dominated the release liners market in 2024 as the release liner industry is being driven by the fast industrialization, a rigid push towards sustainability, and the e-commerce sector too. The market is also finding ground demand from the main end-use industries like medical, packaging, and electronics. A growth in the packaging of consumer goods, pharmaceuticals, food, and beverages is fulfilling the urge for pressure-sensitive labels and tapes, which totally depend on release liners. Developed health consciousness and the usage of wound dressings, medical devices, and hygiene products like sanitary pads and diapers are driving the urge for high-performance release liners. The stretching of online retail has made a demand for reliable packaging materials and smoothness, mainly driving the demand for release liners for protective tapes and tables.

India Release Liners Market

Release liners demand in India is due to sustainability, as rigid development on main technological advancements and end-user industries to develop performance. The Indian market is a dominant force in the huge Asia-Pacific region, which is due to growing urbanization, industrialization, and a rising consumer base. India is one of the fastest-developing regions for release liners, which is a trend that is predicted to continue. The industry will continue to be strengthened by its huge population and growing disposable incomes that drive the usage of packaged goods.

North America is expected to be the fastest growth during the forecast period. The North American market is rigid, with the United States being an initial driver because of high-level production capability and big healthcare, consumer goods, and automotive sectors. The rising demand for packaging across different industries, including food and beverage, is also boosting the market. The developing e-commerce industry is fulfilling the urge for reliable packaging solutions. Release liners are necessary for pressure-sensitive tapes and labels in shipping and logistics, which ensure that the product integrity is maintained.

Canada Release Liners Market

The release liners market in Canada is driven by the worldwide move towards performance, developed sustainability, and efficiency. The Canadian industry is due to the rising e-commerce industry, with high demand from the packaging and medical industries, and a rigid importance on eco-friendly solutions. User demand and strict environmental solutions. This technology, which avoids the liner completely, is gaining attention as a waste reduction and cost-saving measure that is specifically for high-volume uses in retail and food packaging, too.

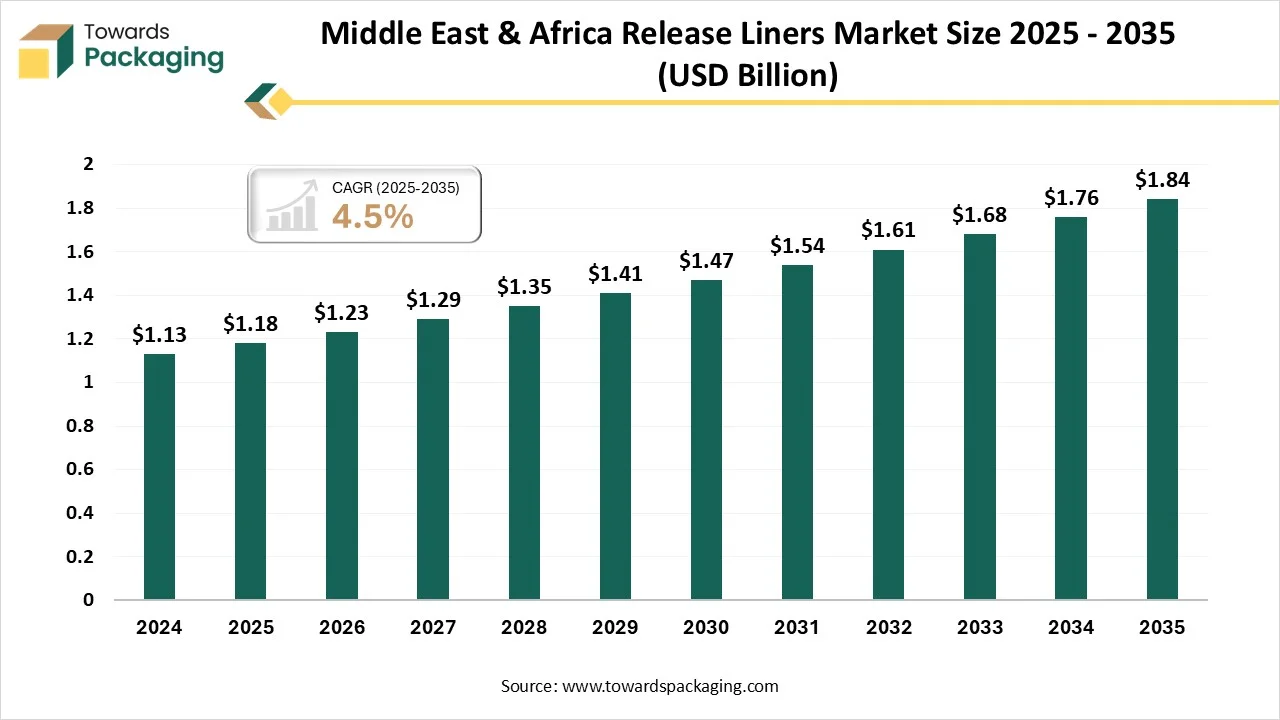

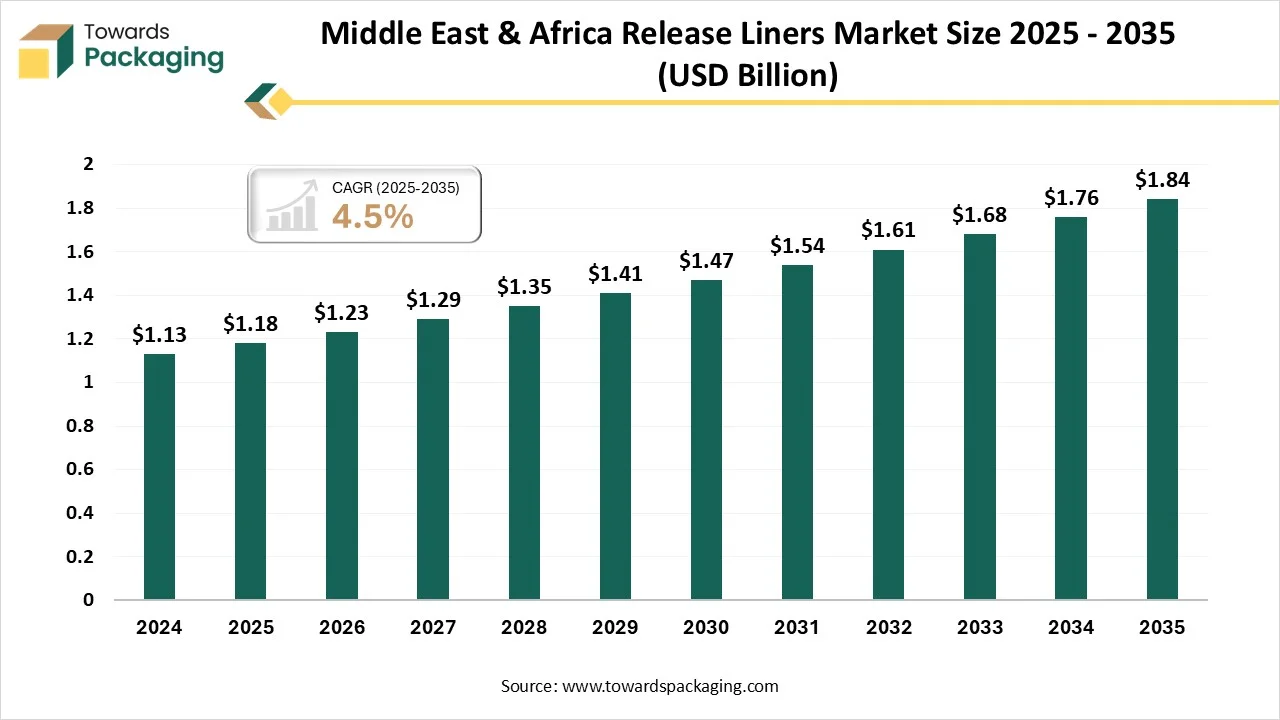

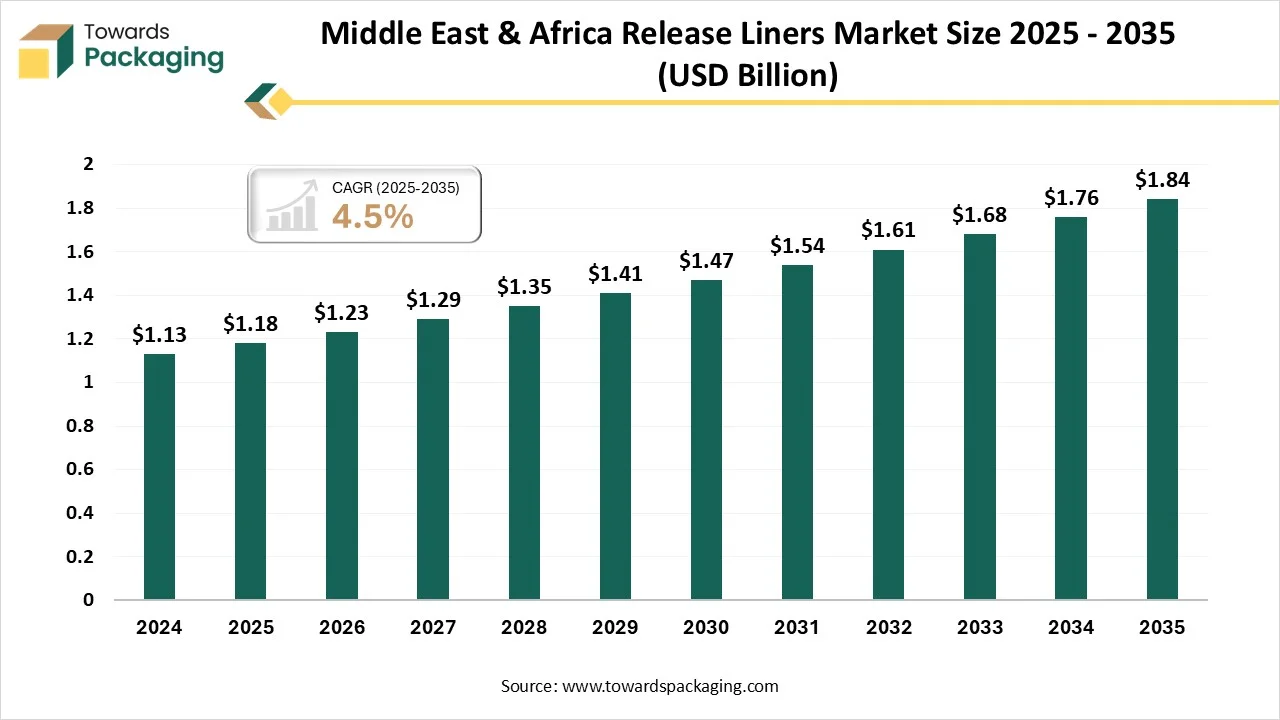

Middle East & Africa Release Liners Market Size 2025 - 2035 (USD Billion)

Country-Level Investments & Funding Trends For Release Liners Market

- A main sector trend includes substantial investment in terms of research and development in order to make recyclable products. Organizations are concentrating on developing inventive solutions to form strategic mergers and collaborations, which allow their release liner services.

- Market development is being driven by the growing demand from the medical, hygiene, and industrial markets, specifically in growing and developing economies like India and China. Developing economies in Asia, like India, Malaysia, and Indonesia, are predicted to witness extra-digital development in their packaging sectors, which in turn drives the urge for release liners.

- The rising retail, pharmaceutical, cosmetics, and household segments in the Asia-Pacific region are experiencing a packaging sector that leads to growing demand for release liners for label uses. Producers are investing in energy-efficient technologies to lower their carbon footprint, count on renewable energy sources, and update manufacturing procedures.

Recent Developments

- In April 2025, Elkem ASA’s Silicones division has currently revoked its two additions to its SILCOLEASE series for release liners, which reinforces its loyalty to invention and circularity. These innovative items serve perfect carbon profiles and serve the same technical performance as their non-recycled counterparts.

- In October 2024, Solventum revealed its Double-Coated Medical Tape, having a Hi-tack Silicone and Acrylate Adhesives on Liner (2487 Hi-Tack Silicone Tape), a high-level adhesive solution that is being crafted for sensitive skin, enabling medical wearable producers to stretch their devices to a huge patient population.

- In January 2025, Zeus, a top leader in high-level polymer solutions and catheter production, revealed its plans to reveal StreamLiner NG, its latest addition to the organisation's StreamLiner range of ultra-thin-walled catheter liners.

- In October 2024, Solventim revealed the launch of its Double-Coated Medical Tape that has Hi-Tack Silicone and Acrylate Adhesives on Liner for a high-level adhesive solution for the purpose of fragile skin that enables medical wearable producers to stretch the usage of their machine to a huge patient population.

Top Vendors in the Release Liners Market and their Offerings

- UPM Raflatac: UPM Raflatac is a part of UPM Adhesive Materials, as it is one of the top suppliers of self-adhesive labels that stock worldwide. They deliver consistently good-quality label materials that bring together sustainability and performance.

- Cascades Inc.: Cascades is a Canadian organisation that converts, produces, and promotes packaging and tissue products composed mainly of recycled fibres.

- Avery Dennison Corporation: Avery Dennison is a top materials science and digital identification solution organisation that serves a huge range of information solutions and branding, which updates supply chain efficiency and labor, too.

- LINTEC Corporation: LINTEC is a top producer of adhesive-related products. The organisation was established in 1934. The products include several items, including adhesive films and papers for labels and seals, adhesive sheets for outdoor signs, and shatter-proof window films.

- Mondi Group: Mondi is a top global paper and packaging group that concentrates on being sustainable by design. We are investing in a perfect world by making inventive solutions using paper, which are plastic and purposeful too.

Release Liners Market Players

Tier 1

Tier 2

Tier 3

Release Liners Market Segmentation of the Release Liners Market

By Material Type / Substrate

- Paper-based Release Liners

- Film-based Release Liners (Polyester, Polypropylene, PET, PVC)

- Non-woven / Specialty Substrates

By Coating Type

- Silicone-coated

- Non-silicone / Eco-friendly Coatings

By Application

- Pressure-Sensitive Labels & Tapes

- Flexible Packaging

- Graphics & Decorative Films

- Medical & Hygiene Products

- Industrial Applications (Electronics, Automotive, Protective Films)

- Other Applications (Specialty Adhesives, Functional Films)

By End-User Industry

- Labeling & Packaging Industry

- Medical & Healthcare

- Industrial & Electronics

- Consumer Goods & Retail

- Other End-Users (Automotive, Specialty Films, Printing)

By Revenue Model

- Direct Product Sales (Sheets, Films, Coated Liners)

- Licensing / Technology Royalties

- Customized Solutions & Services

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait