Tetrahedron Carton Market Size, Share, Trends and Forecast Analysis

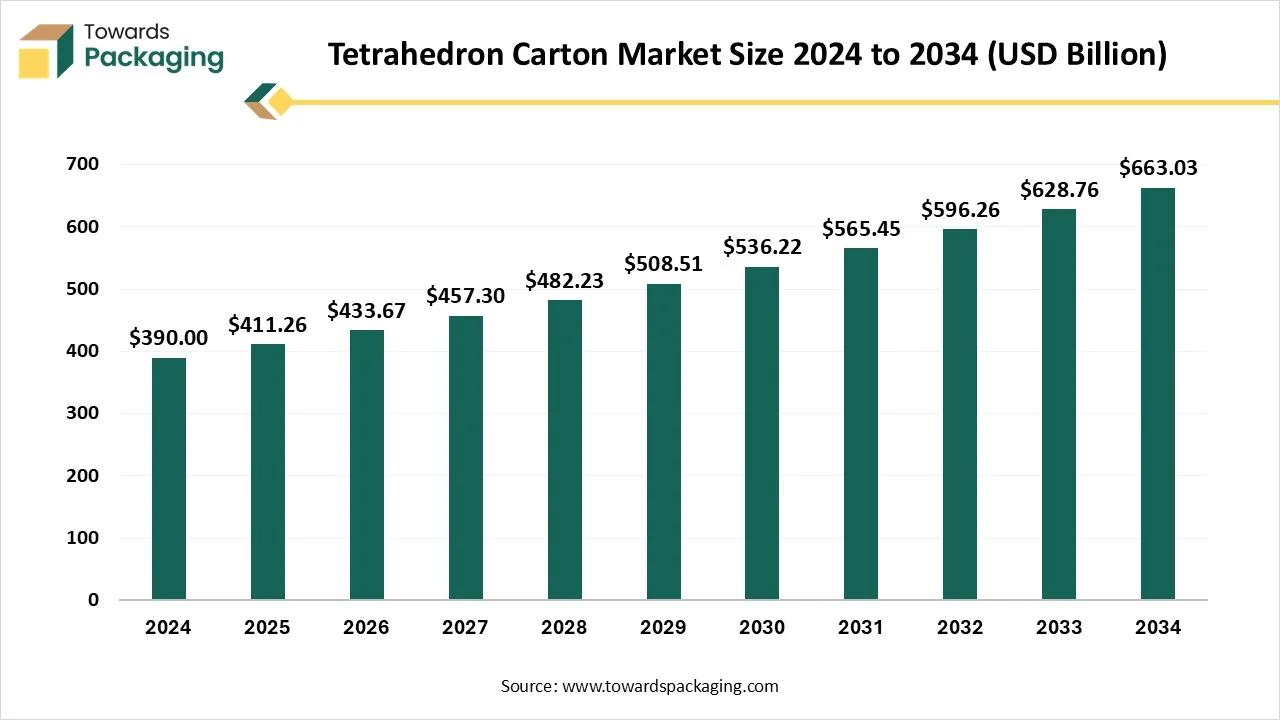

The tetrahedron carton market is projected to grow from USD 411.26 billion in 2026 to USD 699.17 billion by 2035, expanding at a CAGR of 5.45%. The market is segmented by material type, packaging volume, product type, end-user industry, and distribution channel. The paperboard segment holds the largest share (50%), while the 200-500 ml packaging volume segment leads with a 40% share. Asia Pacific holds the largest market share of 45%, while North America is expected to experience significant growth. Key players include Tetra Pak International S.A., SIG Group AG, and Elopak ASA.

Key Takeaways

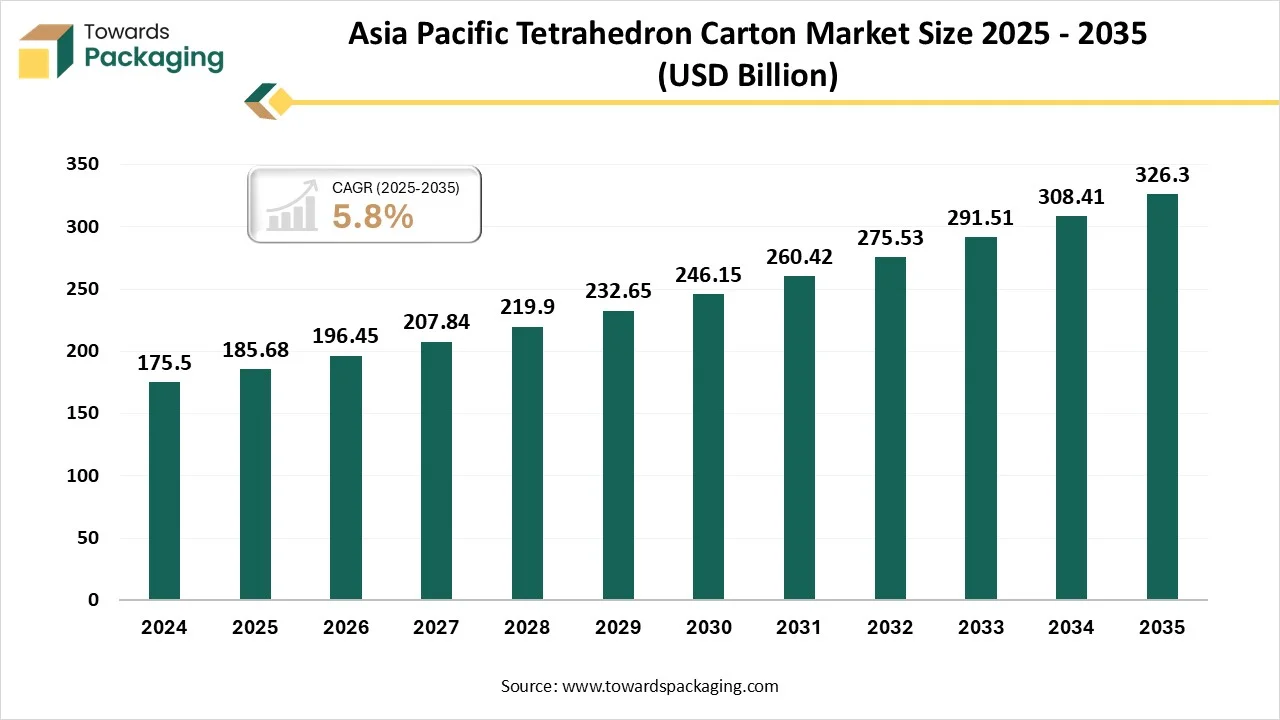

- Asia Pacific held the biggest share of approximately 45% in 2024.

- North America will grow at a notable CAGR between 2025 and 2034.

- By material type, the paperboard segment has contributed to the biggest share of approximately 50% in 2024.

- By material type, the laminated materials segment will grow at a notable CAGR between 2025 and 2034.

- By packaging volume, the 200-500 ml segment is predicted to have the biggest share of approximately 40% in 2024.

- By packaging volume, the above 1000ml segment will grow at a notable CAGR between 2025 and 2034.

- By product type, the milk and dairy products segment has contributed to the largest share of approximately 55% in 2024.

- By product type, juices and beverages will rise at a notable CAGR between 2025 and 2034.

- By end user, the food & beverages segment is predicted to have the biggest share of approximately 60% in 2024.

- By end user, the pharmaceuticals & nutraceuticals segment will grow at a notable CAGR between 2025 and 2034.

- By distribution channel, the supermarkets & hypermarkets segment has contributed to the largest share of approximately 50% in 2024.

- By distribution channel, online retail will rise at a notable CAGR between 2025 and 2034.

What Do You Mean by Tetrahedron Carton Market?

The tetrahedron carton market is witnessing steady growth due to the food and beverage industry's becoming increasingly interested in innovative and sustainable packaging options. Brand initiatives to improve product shelf appeal and growing consumer awareness of eco-friendly materials are propelling adoption. Market expansion is further aided by regulatory support for packaging materials that are recyclable and renewable.

Market Outlook

- Industry Growth Overview: The global tetrahedron carton market is experiencing steady growth, driven by an increase in the demand for ready-to-drink foods, liquid dairy products, and packaged beverages. Market growth is also being fueled by a growing emphasis on recyclable, eco-friendly, and sustainable packaging options.

- Global Expansion: The market is growing globally as businesses expand into both developed and emerging regions. North America, Europe, Asia Pacific, and Latin America are all seeing new opportunities because of growing urbanization, rising disposable incomes, and changing consumer preferences for convenient packaging.

- Startup Ecosystem: Global startups are driving innovation in tetrahedron cartons by introducing sustainable materials, smart packaging features, and user-friendly designs. These innovations enhance product safety, shelf life, and consumer engagement while supporting eco-friendly and efficient packaging solutions.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2024 | USD 390 Billion |

| Projected Market Size in 2035 | USD 663.03 Billion |

| CAGR (2026 - 2035) | 5.45% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material Type, By Packaging Volume, By Product Type, By End-User Industry, By Distribution Channel and By Region |

| Top Key Players | Tetra Pak International S.A., SIG Group AG, Elopak ASA, Amcor Limited,Evergreen Packaging Inc., Ecolean AB,Parksons Packaging Ltd., Uflex Ltd., Lamican Oy |

Key Technological Shifts in the Tetrahedron Carton Market

Adoption of Renewable and Recyclable Materials: To lower their carbon footprints, manufacturers are turning to plant-derived coatings FSC FSC-certified paperboard, and bio-based polymers. This action supports the objectives of the circular economy and complies with international sustainability standards.

Integration of Smart Packaging Technologies: Consumer interaction, authenticity verification, and product traceability are made possible by the use of digital watermarks, NFC tags, and OQ codes. Additionally, smart packaging assists brands in gathering up-to-date data on supply chain performance and consumer behavior.

Future Demands

| Future Demand Trend | What it Mean | Why it Matters |

| Higher demand for lightweight packs | Brands shifting to thinner, lighter boards | Reduces material cost and improves sustainability |

| Growth in aseptic packaging | Increased use for dairy, juices, and nutraceutical drinks | Longer shelf life and reduced cold-chain dependency |

| Digital printing adoption | Brands prefer short-run, customized packaging | Supports premium branding and market differentiation |

| Recyclable & bio-based materials | Rising preference for eco-friendly board coatings | Meets regulatory pressure and eco-conscious consumer demand |

| Smart packaging integration | QR codes, traceability, anti-counterfeit tags | Enhances consumer engagement and supply chain transparency |

| Small & single-serve formats | Busy lifestyles drive on-the-go consumption | Boosts SKU proliferation and retail shelf visibility |

Emerging Technologies

Digital & High-Speed Inkjet Printing: Enables rapid customization variable data and premium graphics for short production runs. It assist companies in carrying out time bound localized promotions with the least amount of waste because cartons can be printed on demand rather than pre stocked inventory pressure is lessened.

Bio Based Barrier Coatings: Improves recyclability and lower carbon footprint by substituting plant-based polymers for aluminum/PE layers. This helps businesses comply with sustainable packaging and carbon neutrality regulations. Additionally it aids in brands eligibility for green product listings and eco label certifications.

Smart Packaging Tech (QR, NFC, Blockchain): Supports product traceability authenticity checks and consumer engagement through mobile scanning. It enbles brands to collect consumer data and improve marketing analytics. Additionally smart identifiers lessen counterfeiting of expensive beverage brands.

Lightweight Fiber Engineering: Cutting edge pulping techniques lighten boards without sacrificing their strength or durability. This increases the effectiveness of logistics and reduces transportation expenses. Manufacturers gain from using fewer raw materials and using less energy during production.

Value Chain Analysis

- Material Processing and Conversion: To make multi-layer cartons, raw materials such as paperboard, aluminum, and plastic films are processed and laminated. The safety, freshness, and shelf life of products are guaranteed by sophisticated coatings and barrier layers.

- Package Design and Prototyping: Packaging is made with consumer convenience, longevity, and functionality in mind. Prototyping includes features like ergonomic shapes, evident seals, and easy pour spouts. Digital tools and 3D printing are used to optimize performance prior to mass production.

- Logistics and Distribution: Finished tetrahedron cartons are transported through secure supply chains, often with temperature control for sensitive beverages. Efficient logistics, serialization, and tracking ensure timely delivery to retailer's supermarkets and e-commerce channels worldwide.

Market Opportunity

Sustainable Packaging Demand

Tetrahedron carton adoption is increasing as a result of consumers growing preference for recyclable, renewable, and environmentally friendly packaging options. Businesses are spending money on eco-friendly materials in order to meet the objectives of global sustainability. Tetrahedron cartons are positioned as a preferred option for both manufacturers and consumers due to the emphasis on minimizing plastic waste.

Market Restraint

High Production Costs

Tetrahedron carton manufacturing necessitates sophisticated equipment and specialized materials, which raises production costs overall, particularly when multi-layer laminates and aseptic features are used. This might be a problem for smaller producers. The complex machinery required for filling and sealing tetrahedron cartons contributes to the high capital investment needed for production, further limiting market entry of new companies.

By Material Type

Why did the Paperboard Segment Dominate the Tetrahedron Carton Market?

The paperboard segment dominated the tetrahedron carton market with approximately 50% share in 2024 because of its low cost, wide availability, and environmentally beneficial qualities. Paperboard is the material of choice for packaging liquid food products and beverages worldwide because it is strong and long-lasting and readily recyclable.

The laminated materials segment is predicted to be the fastest growing in the market during the forecast period because it provides excellent protection from light oxygen and moisture. These multi-layer laminates are becoming increasingly popular for sensitive beverages and nutraceutical products because they prolong shelf life and help maintain product freshness.

By Packaging Volume

What made the 200-500 ml Segment Dominate the Tetrahedron Carton Market?

The 200-500ml segment dominated the market with a 40% share in 2024, because it is widely used for milk juices and other beverages, and satisfies consumers daily consumption needs. Its small size guarantees cost-effectiveness, ease of handling, and convenience for both producers and retailers.

Above 1000 ml segments are expected to be the fastest growing in the market during the forecast period, driven by the need for bulk or family-sized products because of their greater value, lower packaging waste per unit, and multipurpose use. Larger cartons are becoming increasingly popular in homes and the foodservice industry.

By Product Type

What made the Milk and Dairy Products Segment Dominate the Market in 2024?

Milk and dairy products dominated the market with a 55% share in 2024 because these goods need sturdy packaging to keep them hygienic and fresh. Tetrahedron cartons offer the best barrier protection, are simple to pour, and are frequently used by customers. Additionally, innovations in dairy products like probiotic-enriched yogurts and fortified milks met the growing consumer demand for healthy food options.

Juices and beverages are expected to be the fastest-growing segment in the market during the forecast period due to the rising demand for products that are portable and ready to drink. Beverage producers are being encouraged to use tetrahedron cartons with enhanced barrier and design features due to the rise in convenience-driven and health-conscious consumer trends.

By End User Industry

What made the Food and Beverages Segment dominate the Market in 2024?

The food and beverages segment dominated the tetrahedron carton market with approximately 60% share in 2024 due to the large quantity of packaged milk juices and other consumable liquids. Tetrahedron cartons well-established distribution networks and familiarity with consumers support their dominant position in this market.

The pharmaceuticals & nutraceuticals segment is expected to be the fastest growing in the market during the forecast period, as companies increasingly use tetrahedron cartons for liquid supplements, fortified drinks, and nutraceutical formulations. The packaging ensures product stability, safety, and convenience for consumers, and its unique and attractive shape is appealing to manufacturers and customers.

By Distribution Channel

What made the Supermarkets & Hypermarket Segment Dominate the Market in 2024?

The supermarkets & hypermarket segment dominated the market with approximately 50% share in 2024 since they act as important retail centers for dairy and packaged drinks. Customers buy in bulk tetrahedron-packed products like milk juices and liquid foods because of their extensive product line, eye-catching shelf displays, and high level of customer trust. Multiple brands available under one roof and convenient in-store promotions reinforce this channel's dominance.

The online retail segment is expected to be the fastest-growing in the market during the forecast period, because direct-to-consumer brands and e-commerce platforms are becoming increasingly popular. Customers are choosing subscription-based services and doorstep delivery for milk, juices, and health drinks because they are more convenient. Incorporating environmentally friendly tetrahedron cartons into online grocery and beverage delivery services promotes sustainability objectives while guaranteeing secure and effective transportation.

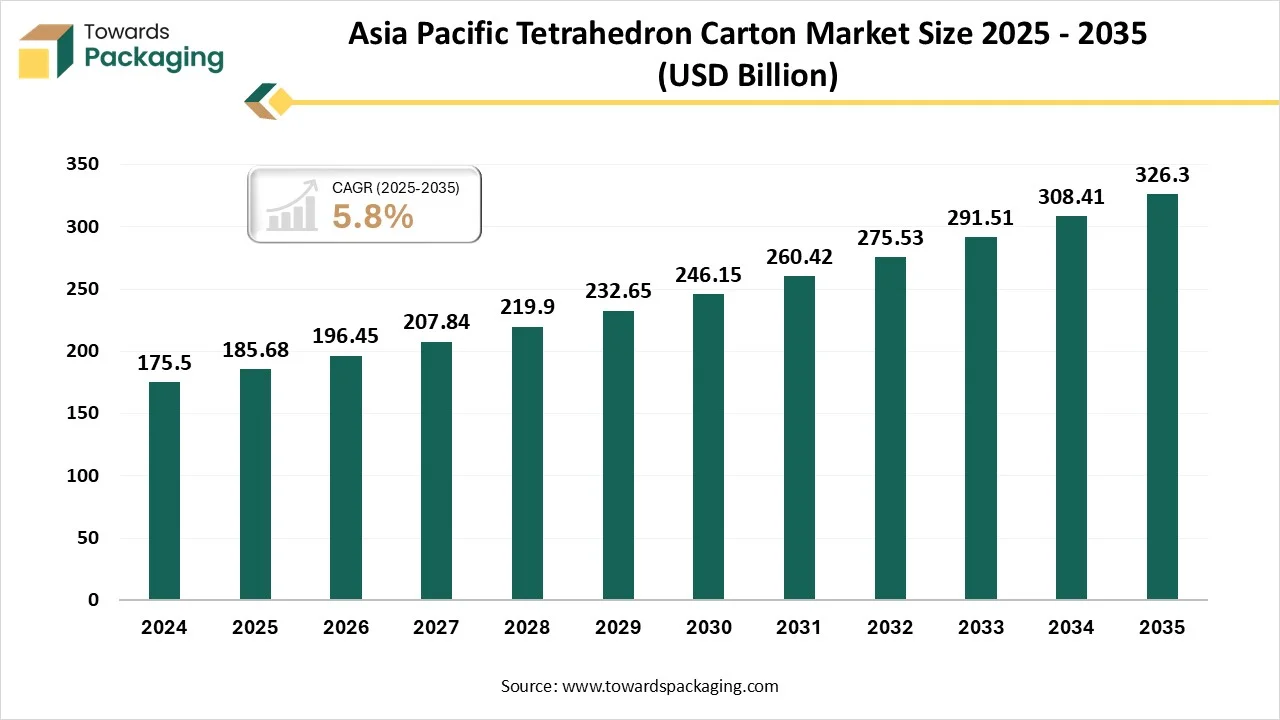

Regional Insights

Asia Pacific dominated the market with approximately 45% share in 2024, because of the existence of sizable dairy and beverage industries, the speed at which cities are becoming more populated, and the rising awareness of packaged goods among consumers. The region's dominant position is a result of its robust manufacturing base and high rates of consumption.

India Tetrahedron Carton Market Trends

The tetrahedron carton market in India is expanding due to risinf packaged beverage consumption urbanization and increasing focus on hygienic lightweight packaging. Particularly for juices and dairy drinks brands are using these cartons to target consumers who are always on the go. Government initiatives promoting sustainability market adoption. Overall steady growth is being driven by robust demand from dairy and FMCG processors

North America is expected to be the fastest growing market during the forecast period, driven by growing consumer demand for ready-to-drink beverages and eco-friendly packaging, and creative packaging ideas. The demand from consumers for convenient and environmentally friendly packaging options is driving market expansion in this area.

U.S. Tetrahedron Carton Market Trends

The U.S. tetrahedron carton market is driven by consumer preference for sustainable pack formats strong retail visibility and premiumization in beverage packaging leading beverage companies are using tetrahedron cartons to differentiate products and reduce plastic dependency. Advanced filling technologies and stricter environmental standards are accelerating adoption. The market is expanding due to consistent demand from producers of plant based milk and ready to drink beverages.

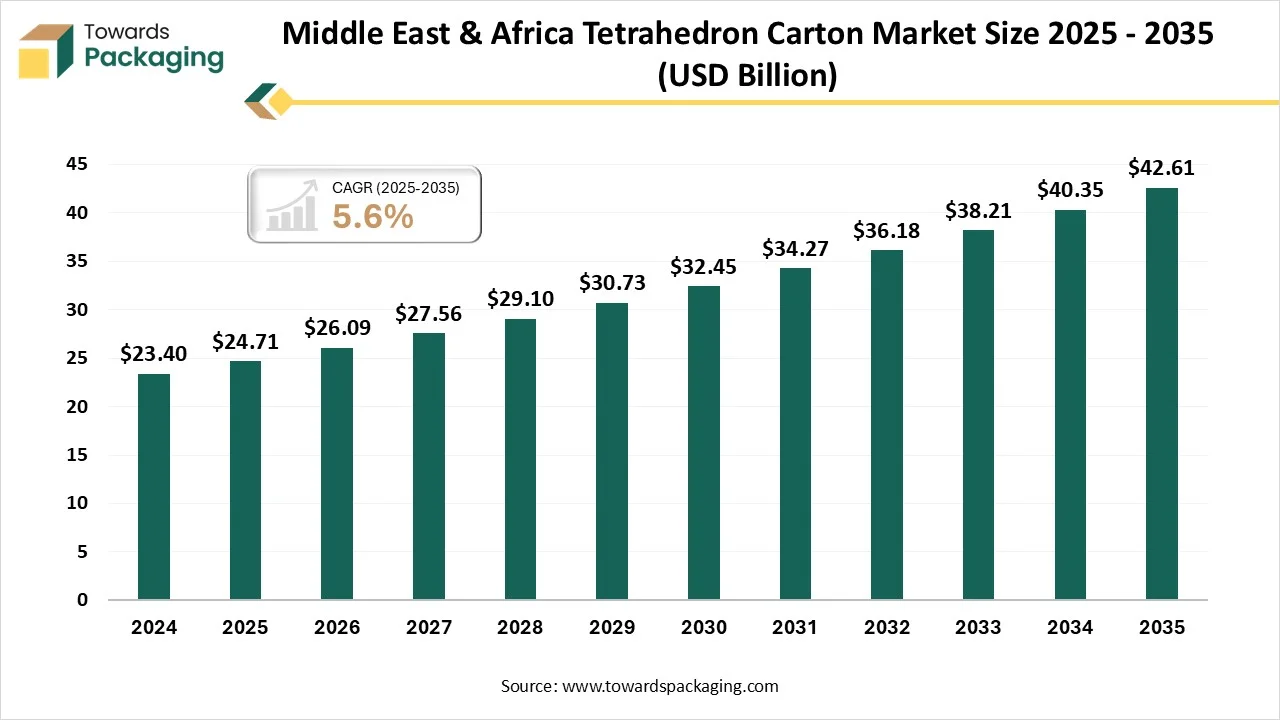

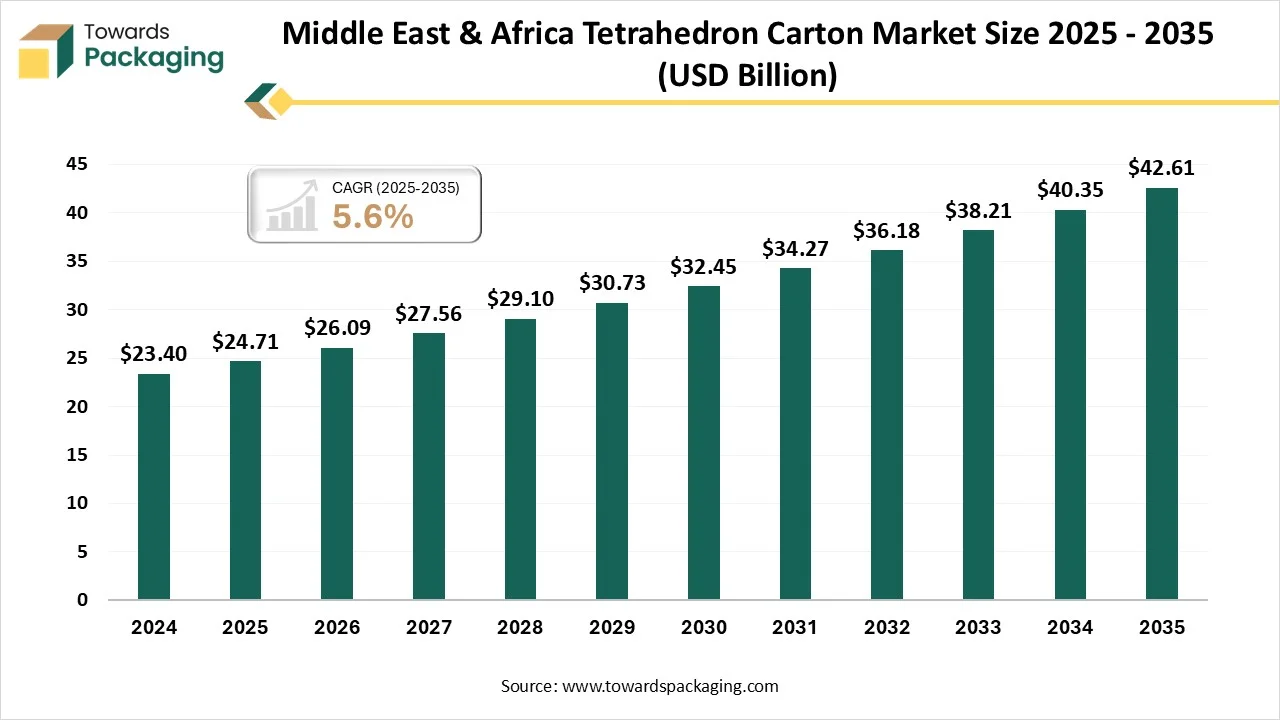

Middle East & Africa

The tetrahedron carton market is the Middle East & Africa is growing due to rising consumption of packaged dairy and juice products demand for lightweight and shelf stable packaging and gradual shift away from plastics. Africa is growing steadily as local beverage producers increase capacity and look for affordable sustainable solutions while the Middle East exhibits faster adoption due to higher purchasing power and modern retail.

Middle East & Africa Tetrahedron Carton Market Size 2025 - 2035 (USD Billion)

Recent Developments

- In February 2025, TetraPak announced the introduction of carton packaging in India that integrates certified recycled polymers under ISCC PLUS certification, making it the first company in India’s food & beverage packaging industry to do so.

- In September 2025, Tetra Pak began rolling out tethered CP solutions on carton packages in several European countries in partnership with leading beverage brands to comply with design for recycling requirements.

Top Vendors in the Tetrahedron Carton Market

- Tetra Pak International S.A.: A Swiss multinational company and the largest provider of carton packaging and processing solutions for the liquid food industry.

- SIG Combibloc Group Ltd.: A Swiss aseptic carton packaging company that is a major competitor to Tetra Pak, offering both packaging systems and materials.

- Elopak AS: A Norwegian supplier of carton packaging, specializing in sustainable, fiber-based solutions like its Pure-Pak gable-top cartons.

- Greatview Aseptic Packaging Co., Ltd.: A multinational provider of aseptic carton solutions headquartered in China that offers cost-effective packaging materials compatible with industry-standard filling machines.

- UFlex Ltd.: An India-based, diversified multinational flexible packaging company that also produces aseptic liquid packaging.

Top Players in the Tetrahedron Carton Market

Tier 1

- Tetra Pak International S.A.

- SIG Group AG (formerly SIG Combibloc Group AG)

- Elopak ASA

- Amcor Limited

- Smurfit Kappa Group

- WestRock Company

- Mondi Group

- Ball Corporation

- Huhtamaki Oyj

Tier 2

- Evergreen Packaging Inc. (Pactiv Evergreen Inc.)

- Ecolean AB

- Greatview Aseptic Packaging Co., Ltd.

- Refresco Group

- Rexam Plc

- Stora Enso Oyj

- Tetra Classic Aseptic Licensees (Regional Converters)

- Paper Excellence Group (Cascades Sonoco Joint Venture)

- AR Packaging (Now Part of Graphic Packaging International)

- Sonoco Products Company

Tier 3

- Parksons Packaging Ltd.

- Uflex Ltd.

- Paper Mart Sdn Bhd

- Shenzhen Youngsun Paper Packaging Co., Ltd.

- SIG Combibloc Obeikan (Middle East JV)

- Lamican Oy

- Allied Packaging Group

- Asia Pulp & Paper (APP) Sinar Mas Group

Segmentation of the Tetrahedron Carton Market

By Material Type

- Paperboard

- Plastic (Polyethylene, Polypropylene)

- Aluminum Foil

- Laminated Materials

By Packaging Volume

- Less than 200 ml

- 200–500 ml

- 500–1000 ml

- Above 1000 ml

By Product Type

- Milk and Dairy Products

- Juices and Beverages

- Liquid Food Products (Soup, Sauces)

- Others (Nutritional Drinks, Energy Drinks)

By End-User Industry

- Food & Beverage

- Pharmaceuticals & Nutraceuticals

- Cosmetics & Personal Care

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Foodservice & HORECA (Hotels, Restaurants, Cafes)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (3)