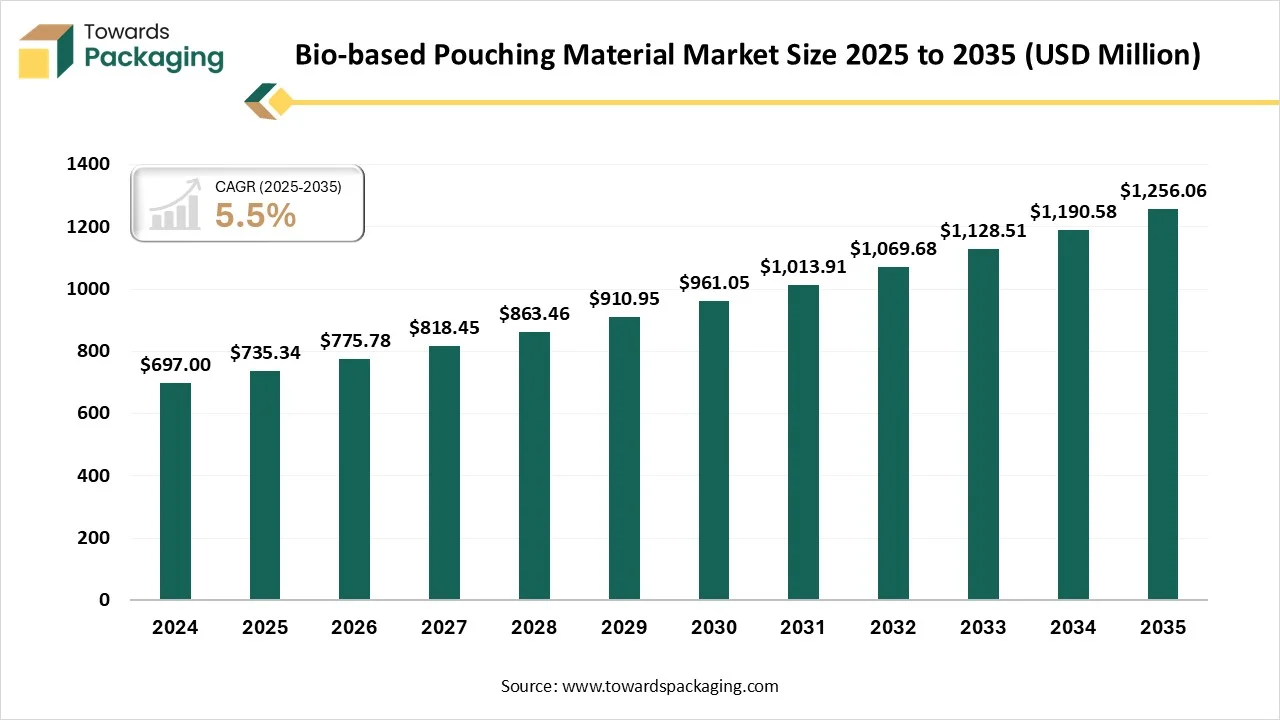

The bio-based pouching material market is forecasted to expand from USD 775.78 million in 2026 to USD 1256.06 million by 2035, growing at a CAGR of 5.5% from 2026 to 2035. The market growth is driven by environmental concerns and consumer demand, rising e-commerce, food and beverages, and pharmaceutical sectors create a massive demand for sustainable packaging material.

The bio-based pouching material market comprises flexible packaging films and laminates manufactured wholly or partly from renewable biological sources (PLA, bio-PE, PHA, starch blends, cellulose, etc.) used to produce pouches for food, pharmaceuticals, personal care, and industrial products. These materials aim to reduce fossil-feedstock content and improve end-of-life outcomes (compostability, recyclability). Adoption is driven by sustainability mandates, brand ESG commitments, and advances in barrier and sealing technologies that enable wider replacement of conventional petrochemical-based pouches.

The integration of advanced technologies such as advanced materials and nanotechnology, smart and active packaging, digital integration, and novel production and design significantly allows for 3D printing customized, complex packaging designs with specific functions. The advanced materials and nanocomposites create biodegradable films, adding nanoparticles to boost strength, thermal stability, and extended shelf life of the materials.

This initial stage involves the sustainable procurement of biomass, which can range from agricultural residues (like corn stover or sugarcane bagasse) to dedicated energy crops and forestry byproducts.

Major Players: Corbion, a producer of lactic acid used for PLA, and Stora Enso and WestRock.

In this stage, the raw biomass feedstocks are processed and converted into usable intermediate materials or finished biopolymers through various technologies such as fermentation, extraction, and polymerization.

Major Players: BASF SE, NatureWorks LLC, Novamont S.p.A., and Braskem.

The manufactured biopolymers and additives are then formulated and processed into flexible packaging materials, films, and ultimately, pouches.

Major Players: Amcor Plc., Mondi Plc., and UFlex

The finished bio-based pouches are distributed through various channels to consumer goods companies and retailers, and strategies are implemented to promote their sustainable attributes to the market.

Major Players: Tetra Pak Group

| Country/Region | Key Regulations |

| United States (U.S.) | The U.S. regulatory frameworks, like California’s AB 1201, now mandate rigorous third-party certification to prevent misleading "biodegradable" labeling. The USDA BioPreferred Program utilizes ASTM D6866 standards to verify bio-based content for federal purchasing and consumer labeling. |

| European Union (EU) | The EU region has banned single-use plastics, and the packaging and packaging waste regulation aims to reduce packaging waste, promote reuse/refill, and increase recycled content. |

| Japan | Japan has implemented stringent regulations to control plastic pollution and promote sustainable replacements. |

The bio-PE / bio-PET (drop-in bio-based polymers) segment dominated the market with 34.4% share in 2025. The dominance of the segment can be attributed to growing consumer preference for sustainable products and corporate environmental, social, and governance goals, which boosted demand for these eco-friendly materials. Its performance in flexible packaging, cost effectiveness, and drop in functionality.

The PHA & PLA blends segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the improved barrier properties and durability, as well as superior biodegradability. Rising environmental awareness drives brands to adopt sustainable, plant-based packaging for food, beverage, and e-commerce. Innovation in technology and rising consumer demand fuel the market growth.

The stand-up pouches segment dominated the market with 31.4% share in 2025. The dominance of the segment can be linked to the growing environmental awareness and strict laws forced the adoption of bio-based, recyclable, enhanced product appeal, and cost and logistics efficiency.

The spout pouches segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by resealable spouts that offer portion control, spill prevention, and freshness, ideal for beverages, baby food, sauces, and cleaners. The e-commerce and retailer favors technology innovation, and the sustainability shift fuels the market growth.

The high-barrier laminated films segment dominated the market with 53.8% share in 2025. The dominance of the segment can be boosted by consumer brand demand for packaging that protects products but is also eco-friendly, high barrier lamination, regulatory support, and the increasing need in the food sector and pharmaceutical sectors. Innovation in technology and smart packaging drives the market growth.

The medium-barrier co-extruded films segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by it represent a crucial evaluation in sustainable packaging by balancing shelf-life protection with high-speed manufacturing compatibility. These advancements directly support the e-commerce sector’s need for lightweight, durable pouches that reduce shipping costs and material waste.

The food & beverage segment dominated the market with 35.8% share in 2025. The dominance of the segment can be linked to the aggressive brand adoption and material innovations is replacing fossil-fuel plastics with high-barrier, sustainable alternatives. The booming e-commerce, providing the lightweight and resealable convenience modern consumers demand for on-the-go lifestyles.

The pharmaceuticals & nutraceuticals segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the shift toward proactive healthcare and a booming nutraceutical market are driving an urgent need for sustainable packaging that protects sensitive, immunity-boosting ingredients. Advanced bio-based pouches, enhanced by nanocomposites and polymer innovation, now match the barrier performance of conventional plastics to ensure the stability and efficacy of bioactive compounds.

The ambient shelf pouches segment dominated with 37.8% share in 2025. The dominance of the segment can be driven by the convergence of urban convenience and environmental responsibility, which has made bio-based ambient pouches a preferred choice for portable, shelf-stable meals that eliminate the need for refrigeration. Enhanced by material science breakthroughs, these pouches now provide barrier protection comparable to traditional plastics while significantly lowering logistics costs and carbon emissions due to their lightweight design.

The retort / sterilized food pouches segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the urban lifestyle shift towards ready-to-eat meals are accelerating the demand for sustainable report packaging that matches the high heat resistance and barrier performance of traditional plastics. It can reduce material use and invest in PFAS-free, mono-material designs and new biocomposites, showing strong market confidence.

Europe dominated the market with the 42.5% share in 2025. The dominance and growth of the region can be attributed to the strategic alignment with EU circular economy directives and single-use plastic mandates, has transformed bio-based materials from niche alternatives into essential regulatory requirements for European market participation. Rising consumer awareness and demand, innovation and infrastructure products, and increasing adoption of the industry in the region.

Germany Bio-based Pouching Material Market Trends

In Europe, Germany dominated the market owing to a high emphasis on using post-consumer recycled content and design for recyclability. The rising demand in food service, e-commerce, cosmetics, and the nutraceutical industry, the circular economy in the region, and innovation in the material fuel the market growth.

Asia Pacific is expected to grow at a fastest CAGR over the forecast period. The growth of the region can be driven by the region's urbanization, smaller households, and a desire for convenience, single-serve, resalable increase demand for flexible packaging. Rising consumers' disposable income, rising e-commerce demand, rising industry investment, and rising market growth.

China Bio-based Pouching Material Market Trends

In the Asia Pacific, China. led the market due to growing environmental awareness, which fuels consumers' preference for sustainable packaging, especially in the region’s massive e-commerce and retail stores. The increasing use of premium, sustainable pouches, consumer goods, and food and beverages.

North America held a significant market share in 2025. The growth of the region can be credited to the rising e-commerce and increased demand for processed foods, which fuel the need for innovative, sustainable, flexible packaging solutions. Increasing growth in the flexible packaging and rising investment in innovation drive the region's growth.

U.S. Bio-based Pouching Material Market Trends

The growth of the market in the U.S. can be driven by rising eco-consciousness and brand commitment to carbon neutrality fuel demand for alternatives to fossil-based plastics. Rising material innovation and regulatory strict rules on plastic waste encourage the shift towards biodegradable and compostable options.

South America held a major market share in 2025. The growth of the region can be fuelled by the rapid adoption of Bio-PE and PCR content is being propelled by the food and pharmaceutical sectors' increasing requirements for high-barrier, modified-atmosphere packaging. Market leaders like Amcor and Berry Global are capitalizing on this shift, reporting resilient growth as they integrate sustainable materials into the region’s dominant flexible pouch segment.

Brazil Bio-based Pouching Material Market Trends

The growth of the market in the country can be propelled by the innovation in biopolymer technology, which has closed the performance gap with conventional plastics, enabling bio-based materials to meet the rigorous flexibility and heat-resistance standards required across the pharmaceutical and e-commerce sectors.

Middle east and Africa seen a significant growth in the market. The growth of the market is owing to the rapid urbanization and a young growing population that increasingly favors convenient, single-serve, and ready-to-eat products. This demand is further amplified by a booming e-commerce sector and the expansion of modern retail chains in Saudi Arabia and the UAE.

Saudi Arabia Bio-based Pouching Material Market Trends

Saudi Arabia held a significant market share in 2025. The growth of the country can be driven by the Green Initiative and Vision 2030. Aggressive regulatory restrictions on single-use plastics are catalyzing a nationwide shift toward high-performance, biodegradable packaging in the retail and food delivery sectors.

Other Companies in the Market

Material Type

Pouch Type

Barrier Performance

End-use Industry

Application / Use-case

By Region

February 2026

January 2026

January 2026

January 2026