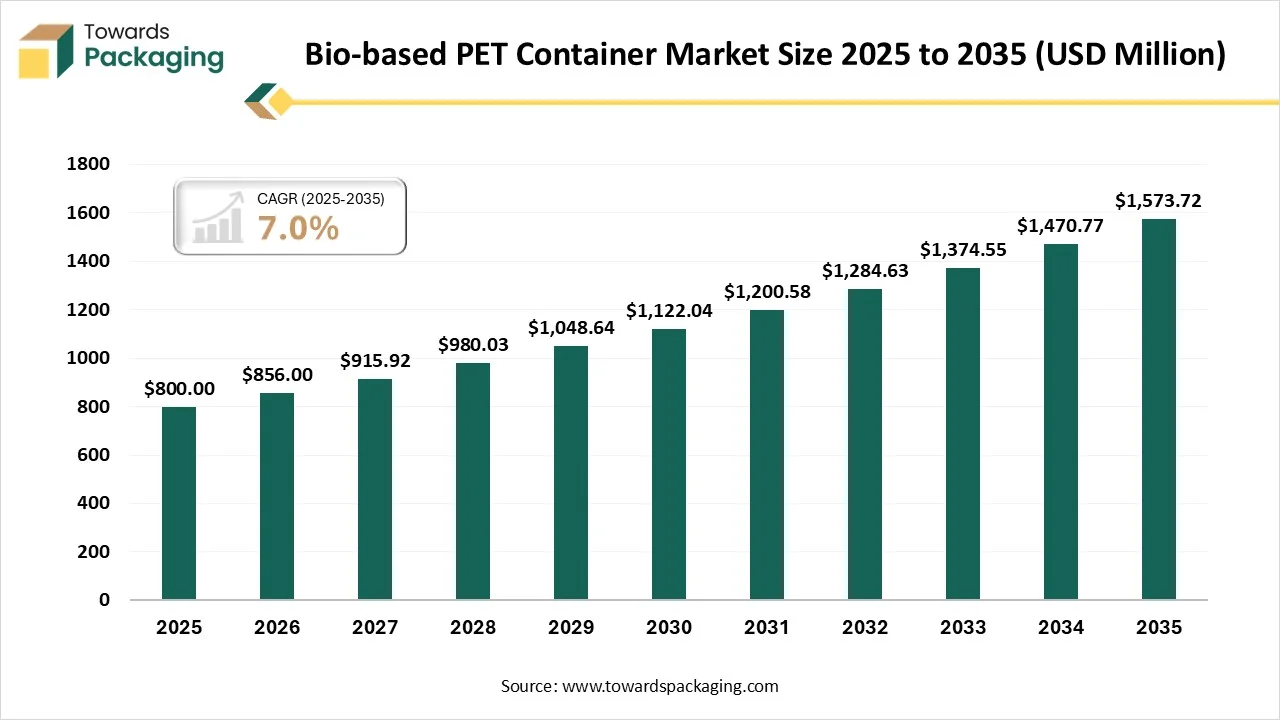

The bio-based PET container market is forecasted to expand from USD 856 million in 2026 to USD 1573.72 million by 2035, growing at a CAGR of 7.0% from 2026 to 2035. Increasing demand for sustainable and eco-friendly packaging has strongly boosted innovation in the market.

Bio-based PET (Polyethylene Terephthalate) containers are sustainable packaging solutions derived from renewable biological feedstocks such as sugarcane, corn, and molasses. These materials replace petroleum-based components with bio-MEG (Monoethylene Glycol), offering a lower carbon footprint while maintaining identical chemical properties, recyclability, and performance to conventional PET plastics.

Technological transformation in the bio-based PET container market plays a significant role by manufacturing 100% renewable packaging material. Increasing commercialization of bio-paraxylene has boost this market to develop such packaging. Incorporation of artificial intelligence in the manufacturing process of the bio-based PET containers. These advanced technology help in maintaining the structural integrity of the packaging.

The major raw materials utilized in this market are sugarcane and bagasse, molasses, and monoethylene glycol.

The component manufacturing in this market comprises injection-stretch blow molding. It help in production of enhanced quality containers that can be recycled completely into new shape and size.

This segment comprises from manufacturing, distribution, to recycling infrastructures. It support expansion of this market by enhanced distribution process.

The sugar segment dominated the market with approximately 75% share in 2025 due to its high efficiency of these containers. These are considered as most scalable and reliable packaging used in several industries. Such properties with higher strength enhance the demand of this segment. Utilization of advanced technology to ferment sugar has fuelled the demand for this segment. It provide high-strength and safety to the products throughout transportation which raise the demand for such material to manufacture containers.

The corn segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its affordability and high availability which meet the huge demand for packaging. Rapid progression in biotechnology enhanced corn-based conversion efficacy. These allow cost-effective solution for packaging with enhanced agricultural practices. Increasing agricultural sector which raise the production of corn and make innovation and bulk production process easy.

The bottles & jars segment dominated the market with approximately 72% share in 2025. This segment provides high clarity, safety, and inertness. There is a huge demand for transparent PET packaging among consumers as it allows product visibility. Its non-reactive and non-toxic properties boost the adoption of these containers.

The trays & clamshells segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing significantly due to rising food services and fresh produce sector. Increasing versatile packaging technique in food service sector has raised the utilization of such containers. Rising demand for ready-to-eat food products has fuelled packaging designs sector. Increasing demand for packaging to enhance consumer convenience, excellent product protection, and thermal retention has boosted the demand for these containers.

The beverages segment dominated the market with approximately 58% share in 2025 due to increasing online foodservice platforms. Rising eco-consciousness among consumers has also influenced the growth of this segment. Increasing brand strategy to enhance its image is the major factor behind the growth of this segment. These packaging are highly recyclable which enhance its demand in beverages industry. These are highly utilized for packaging of soft drinks, water, and other functional beverages.

The consumer goods segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing significantly due to strict ecological guidelines. These are lightweight and highly recyclable which help to build strong brand image. These containers provide high-performance and enhanced-barrier properties has boosted the demand for this market. The utilization of agricultural waste for manufacturing packaging containers has enhanced its demand rapidly.

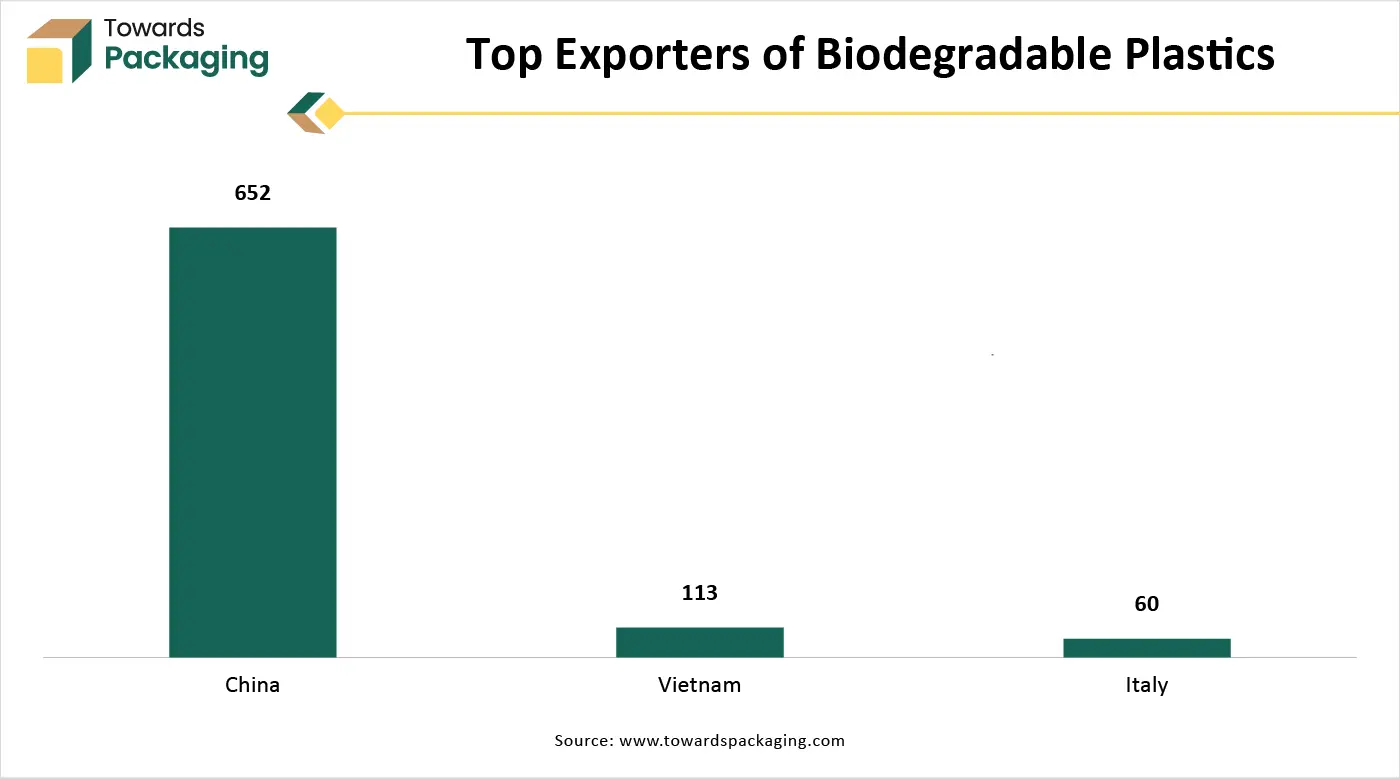

Asia Pacific dominated the global market by holding 45% share in 2025, due to rapid industrialization and strict ecological guidelines. Rapid shift towards sustainable packaging solution and its efficiency has pushed the development of this market. These are the alternatives of traditional plastic containers which has raised the usage of this sector. High awareness towards ecological issues has increase the demand for PET containers. Building of enhanced facilities to reduce plastic wastes has pushed packaging sector to utilize these containers.

China Bio-based PET Container Market Trends

Strong manufacturing capabilities has raised the demand for market in China. It allows high-scale production of the containers which fulfil the demand of the consumers. Rising awareness towards sustainable packaging and strict ecological guidelines has promoted the growth of this market. Expansion of food & beverages industry boost the demand for such packaging as these are leak-proof and enhance the shelf life of the products.

South America Bio-based PET Container Market Trends

South America expects the fastest growth in the market during the forecast period. Increasing commitment to reduce plastic waste have influenced the demand for the market. Rising focus towards reduction of carbon-emission has fuelled the demand for high production of bio-based containers. Rapid collaboration among major market players has introduced innovation in this market which boost the adoption of these containers. Promotion of utilizing bio-based products has pushed this market to grow significantly.

Brazil Bio-based PET Container Market Trends

Abundance of raw materials such as sugarcane have driven the demand of the market in Brazil. Huge investment of market players for innovation in the bio-based PET packaging has fuelled the demand for this market. High production and innovation capacity of such containers to meet high-volume packaging demand has boosted the adoption of such packaging. Enhanced recyclability, manufacturing efficacy, and strength has pushed this market to grow significantly.

The major factors influencing the growth of market are sustainability & regulatory push, technological advancement, and huge consumer demand. Strong commitment among major market players towards reduction of carbon-emission has pushed the adoption of this market. High scalability and strength have pushed this market to grow rapidly and enhanced its production demand. Increasing awareness towards adoption of green packaging has boosted the market to introduce innovation.

Germany Bio-based PET Container Market Trends

Strong demand for recyclable and plant-based packaging has influenced the development of the market. Rising focus to enhance the recyclability capacity and strength of the bio-based packaging has pushed this market to grow rapidly. Presence of major cosmetic brands has raised the adoption for these packaging to enhance brand image. Strict net-zero target among corporates has also increased the usage of PET containers made up of renewable source.

The North America bio-based PET container market is experiencing steady growth driven by increasing sustainability commitments from brands and consumers, strong regulatory support, and expanding industrial applications. Bio-based PET (polyethylene terephthalate derived partly or wholly from renewable sources such as plant sugars) is increasingly used in packaging, especially for containers and bottles in the food & beverage, personal care and consumer goods sectors due to its lower carbon footprint and compatibility with existing PET infrastructure.

In the United States, the bio-based PET container market is expanding rapidly as major consumer brands, particularly in the beverage and household goods sectors, shift toward more sustainable packaging solutions that minimize dependencies on fossil fuels and lower carbon emissions. Bio-based PET, often derived from renewable feedstocks such as corn, sugarcane and biomass, is increasingly integrated into bottles and containers because it offers equivalent performance to conventional PET while supporting corporate ESG (environmental, social and governance) goals and consumer demand for greener products.

By Raw Material Source

By Container Type

By Application

By Region

January 2026

January 2026

January 2026

January 2026