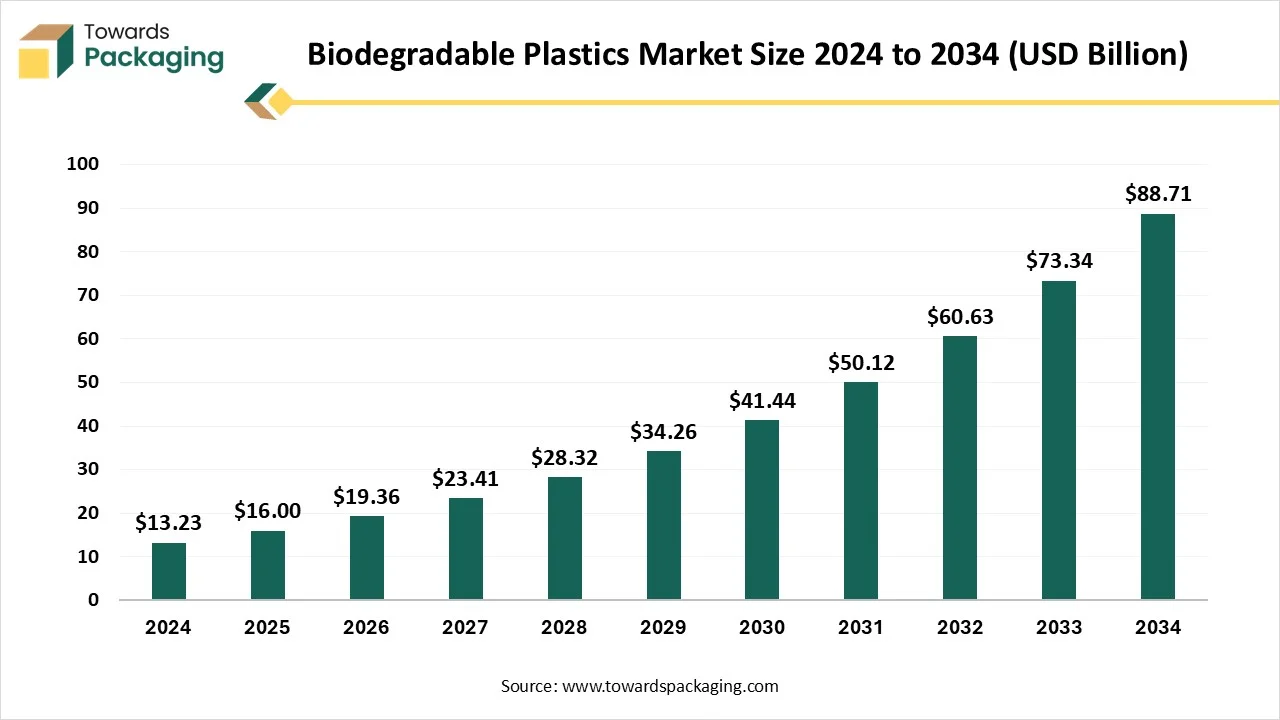

The biodegradable plastics market is set to grow from USD 19.36 billion in 2026 to USD 107.3 billion by 2035, with an expected CAGR of 20.96% over the forecast period from 2026 to 2035. The growing concern towards ecological issues has influenced the demand for the biodegradable plastics market. The rising aim of companies the production plastic with a smaller carbon footprint increases the demand for this industry. There is a huge upsurge in the packaging of agricultural products, which has contributed significantly to this market. This market is dominating in the North America region due to the rising demand for sustainable packaging among consumers.

Biodegradable plastics are derived from renewable sources such as plants, starch, or microbes, designed to break down naturally through the action of bacteria and other microorganisms. These plastics are seen as a solution to the environmental problem posed by conventional plastics, offering a more sustainable alternative with a reduced environmental impact.

The incorporation of AI in the biodegradable plastics market plays an important role by enhancing the technology of manufacturing. It enhances the production speed and design of the packages, and also enhances the optimization process. It improves the recycling process of such packages. With the incorporation of AI, the optimization of resources becomes easy, which helps to manufacture packaging that degrades easily. It makes products cost-effective by reducing the labour required during the production process.

| Rank | Manufacturer | Estimated Share (%) | Main Biodegradable Polymer(s) | Anchor Asset / Brand |

| 1 | Kingfa Sci. & Tech. | ≈23.0 | PBAT | ~320 kt PBAT base (Zhuhai, China) |

| 2 | Novamont | ≈10.8 | PBAT/starch blends (Mater-Bi), biopolyesters | ~150 kt Mater-Bi & Origo-Bi (Italy) |

| 3 | NatureWorks | ≈10.8 | PLA | 150 kt Ingeo® (Nebraska, USA) |

| 4 | TotalEnergies Corbion | ≈5.4 | PLA | 75 kt Luminy® (Thailand) |

| 5 | BASF | ≈5.3 | PBAT (ecoflex® / ecovio®) | Ludwigshafen PBAT facility |

| 6 | PTT MCC Biochem (GC × Mitsubishi Chemical) | ≈1.4 | PBS (BioPBS™) | 20 kt BioPBS™ (Thailand) |

| 7 | Danimer Scientific | ≈0.7 | PHA (Nodax®) | ~9 kt capacity (USA) |

| 8 | CJ Biomaterials (CJ CheilJedang) | ≈0.4 | PHA (PHACT™) | ~5 kt a-PHA line (Indonesia) |

The strong guidelines of the government have influenced the demand for the biodegradable plastics market. The rising awareness of the ecological impact of the packages has driven innovation in the biodegradable plastics industry. Consumers are listing sustainability and looking for environment-friendly substitutes to conventional goods. Discriminating consciousness of plastic pollution, boosted by media coverage and popular activities, has driven acquiring behaviours and brand insights. As a consequence, industries are under pressure to accept sustainable performs during their supply chains, including the use of biodegradable packaging resources. Companies that accept ecologically accountable plans stand to gain a competitive advantage and improve their brand status among customers.

Continuous fluctuation in the charges of the raw materials has hindered the growth of the biodegradable plastics market. It results in reducing the profit margin of the manufacturers and restricts the expansion of this business. As the charges of the raw materials fluctuate, this increases the operational charges and limits the growth of the market.

Rapid growth in the automotive sector has raised the development opportunities in the biodegradable plastics market. The continuous collaboration of major market players such as BASF, Biome Bioplastics Inc., BioSphere Plastic, Total Corbion PLA, Mitsubishi Chemical, and many others has enhanced the opportunities in this sector. Biodegradable plastics packaging can serve several applications, including shopping bags, electronic devices, food packaging, and beverage containers. Opportunities in the worldwide market exist as producers are devoted to the advancement of bioplastics that can substitute traditional plastics in several applications, extending from packing to textiles.

Biodegradable Plastics Market Size, By Type of Biodegradable Plastics (USD Billion)

| Year | Starch-based Plastics | PLA (Polylactic Acid) | PHA (Polyhydroxyalkanoates) | PBAT (Polybutylene Adipate Terephthalate) | Polycaprolactone (PCL) | Other Biodegradable Plastics |

| 2024 | 4.343 | 0.332 | 0.963 | 0.668 | 6.258 | 0.666 |

| 2025 | 4.082 | 0.866 | 1.634 | 0.173 | 7.675 | 1.574 |

| 2026 | 5.439 | 0.224 | 2.511 | 0.254 | 10.001 | 0.929 |

| 2027 | 6.246 | 0.628 | 2.129 | 1.265 | 12.170 | 0.976 |

| 2028 | 7.476 | 1.390 | 3.666 | 2.472 | 12.471 | 0.848 |

| 2029 | 9.726 | 1.088 | 4.329 | 0.969 | 17.599 | 0.548 |

| 2030 | 11.095 | 1.317 | 5.194 | 0.412 | 22.689 | 0.733 |

| 2031 | 15.881 | 0.493 | 6.305 | 0.871 | 23.943 | 2.631 |

| 2032 | 16.372 | 2.150 | 7.322 | 3.945 | 26.963 | 3.879 |

| 2033 | 21.217 | 2.432 | 9.191 | 1.228 | 35.497 | 3.775 |

| 2034 | 23.995 | 5.949 | 13.488 | 0.858 | 41.215 | 3.207 |

The PLA (Polylactic Acid) segment contributed a considerable share of the biodegradable plastics market in 2024 due to its easy processing and versatility. It is made from renewable resources and is receiving traction from several industries. Technological progressions have enhanced the properties and presentation of PLA, making it more competitive with outdated plastics in terms of cost-effectiveness, durability, and versatility. Inventions in processing techniques and polymer chemistry have resulted in the development of PLA preparations with improved strength, processing characteristics, and heat resistance, intensifying its applicability in several industries.

The PHA (Polyhydroxyalkanoates) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing notable growth due to its ability to decompose and biodegradability. In the marine region, it is developing as an important option for ecologically aware applications.

Biodegradable Plastics Market Size, By End-Use Industry, (USD Billion)

| Year | Packaging | Agriculture | Textiles | Consumer Goods | Medical | Automotive | Others |

| 2024 | 4.472 | 1.425 | 0.505 | 5.361 | 0.155 | 0.757 | 0.556 |

| 2025 | 3.413 | 1.218 | 0.732 | 6.178 | 0.315 | 2.772 | 1.375 |

| 2026 | 5.407 | 0.187 | 1.125 | 7.291 | 0.800 | 2.652 | 1.895 |

| 2027 | 6.900 | 0.684 | 2.220 | 10.650 | 0.291 | 1.217 | 1.453 |

| 2028 | 5.811 | 1.595 | 0.650 | 11.274 | 0.275 | 4.864 | 3.853 |

| 2029 | 7.162 | 2.649 | 0.741 | 15.265 | 0.488 | 6.315 | 1.639 |

| 2030 | 9.979 | 1.474 | 2.355 | 16.270 | 0.537 | 5.999 | 4.826 |

| 2031 | 11.676 | 2.828 | 1.601 | 21.937 | 0.521 | 7.162 | 4.399 |

| 2032 | 13.898 | 2.964 | 3.273 | 22.753 | 0.564 | 9.372 | 7.807 |

| 2033 | 16.334 | 6.822 | 2.902 | 26.717 | 4.966 | 10.988 | 4.610 |

| 2034 | 25.562 | 5.722 | 3.667 | 35.725 | 0.953 | 11.909 | 5.173 |

The packaging segment held a considerable share of the biodegradable plastics market in 2024 due to increasing preference for eco-friendly packaging. The requirement for product safety while transporting, along with biodegradability, has influenced the growth of this market. Supervisory pressures generate a favorable market ecology for biodegradable plastic packing and influence demand from industries looking for obedience with guidelines. Additionally, many firms are setting determined sustainability goals and incorporating ecological thoughts into their packaging plans.

The medical segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to strict regulations and rising ecological concerns. The medical sector is adopting biodegradable products, which has raised innovation in this market.

Biodegradable Plastics Market Size, By Processing Technology, (USD Billion)

| Year | Extrusion | Injection Molding | Blow Molding | Thermoforming | Casting | Compounding |

| 2024 | 0.693 | 1.212 | 2.272 | 3.685 | 2.230 | 3.137 |

| 2025 | 0.158 | 2.508 | 2.603 | 4.658 | 2.560 | 3.517 |

| 2026 | 0.176 | 2.574 | 3.529 | 5.515 | 3.097 | 4.467 |

| 2027 | 0.220 | 4.821 | 4.403 | 5.606 | 3.409 | 4.954 |

| 2028 | 0.281 | 3.482 | 5.539 | 8.021 | 4.385 | 6.615 |

| 2029 | 0.766 | 4.660 | 5.710 | 9.885 | 5.756 | 7.482 |

| 2030 | 1.683 | 6.350 | 7.038 | 11.167 | 7.034 | 8.167 |

| 2031 | 1.315 | 8.273 | 6.555 | 13.086 | 7.921 | 12.975 |

| 2032 | 0.615 | 10.125 | 13.556 | 13.687 | 10.559 | 12.089 |

| 2033 | 1.685 | 11.840 | 13.741 | 20.285 | 12.297 | 13.492 |

| 2034 | 0.980 | 17.998 | 11.947 | 21.606 | 14.020 | 22.160 |

The extrusion segment held a considerable share of the biodegradable plastics market in 2024 due to the rising adoption of biodegradable packaging in several sectors, such as food & beverages. The increasing awareness about plastic pollution has raised the demand for biodegradable plastics. Businesses are accepting biodegradability in packaging as it helps to gain consumers' attention and enhance reliability. Extrusion is a major processing method for obtaining biodegradable packages.

The injection molding segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its efficacy and capacity to generate shapes. It allows to create of intricate designs and provides safety to the packaged products.

Biodegradable Plastics Market Size, By Form, (USD Billion)

| Year | Films | Sheets | Pipes | Molded Plastics | Fibers | Foams |

| 2024 | 2.680 | 5.106 | 0.152 | 0.594 | 2.833 | 1.864 |

| 2025 | 3.388 | 5.443 | 0.671 | 0.817 | 3.221 | 2.463 |

| 2026 | 3.997 | 6.471 | 0.199 | 1.231 | 3.610 | 3.848 |

| 2027 | 5.776 | 7.903 | 0.878 | 1.226 | 5.137 | 2.495 |

| 2028 | 6.378 | 9.877 | 0.689 | 1.409 | 6.100 | 3.869 |

| 2029 | 8.178 | 11.159 | 0.332 | 4.159 | 5.461 | 4.969 |

| 2030 | 9.619 | 12.880 | 0.428 | 2.319 | 7.956 | 8.238 |

| 2031 | 8.865 | 18.905 | 3.039 | 2.349 | 9.270 | 7.697 |

| 2032 | 14.908 | 20.868 | 0.542 | 3.499 | 11.524 | 9.289 |

| 2033 | 12.343 | 23.245 | 0.727 | 6.492 | 18.248 | 12.284 |

| 2034 | 21.755 | 30.568 | 1.066 | 3.320 | 16.960 | 15.042 |

The film segment held a dominating share in the biodegradable plastics market in 2024 due to its clarity and versatility. This segment has gained prominent growth in this market due to its transparency, which keeps things visible and protects integrity. It enhances the reliability of consumers in the brands. These are widely used in the agricultural sector and the food & beverage industry.

The molded plastics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing rapid growth due to the rising adoption of customized packaging. This segment is accepted by various industries such as cosmetics, personal care, food & beverages, and many others.

Biodegradable Plastics Market Size, By Source of Raw Material, (USD Billion)

| Year | Plant-based Raw Materials | Microbial-based Raw Materials | Waste-based Raw Materials |

| 2024 | 5.674 | 0.244 | 7.313 |

| 2025 | 7.312 | 1.583 | 7.108 |

| 2026 | 7.853 | 1.458 | 10.046 |

| 2027 | 9.640 | 2.248 | 11.527 |

| 2028 | 11.498 | 1.859 | 14.965 |

| 2029 | 15.818 | 2.031 | 16.409 |

| 2030 | 18.126 | 3.002 | 20.311 |

| 2031 | 19.221 | 5.723 | 25.181 |

| 2032 | 26.104 | 2.996 | 31.531 |

| 2033 | 29.859 | 5.098 | 38.383 |

| 2034 | 36.711 | 7.469 | 44.531 |

The plant-based raw materials (Corn, Potato) segment held the largest share of the biodegradable plastics market in 2024 due to biodegradability and recyclability. There is a huge demand for packaging that is recyclable and reusable. Such packages attract a huge customer base towards brands with reusable packages. These are considered highly durable and provide enhanced safety for transporting products to customers.

The microbial-based raw materials segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to rising demand for enhanced packaging in the pharmaceutical sector, which requires high protection of products. These are considerably low in cost, which makes it highly accessible to various businesses and tends to grow this segment prominently.

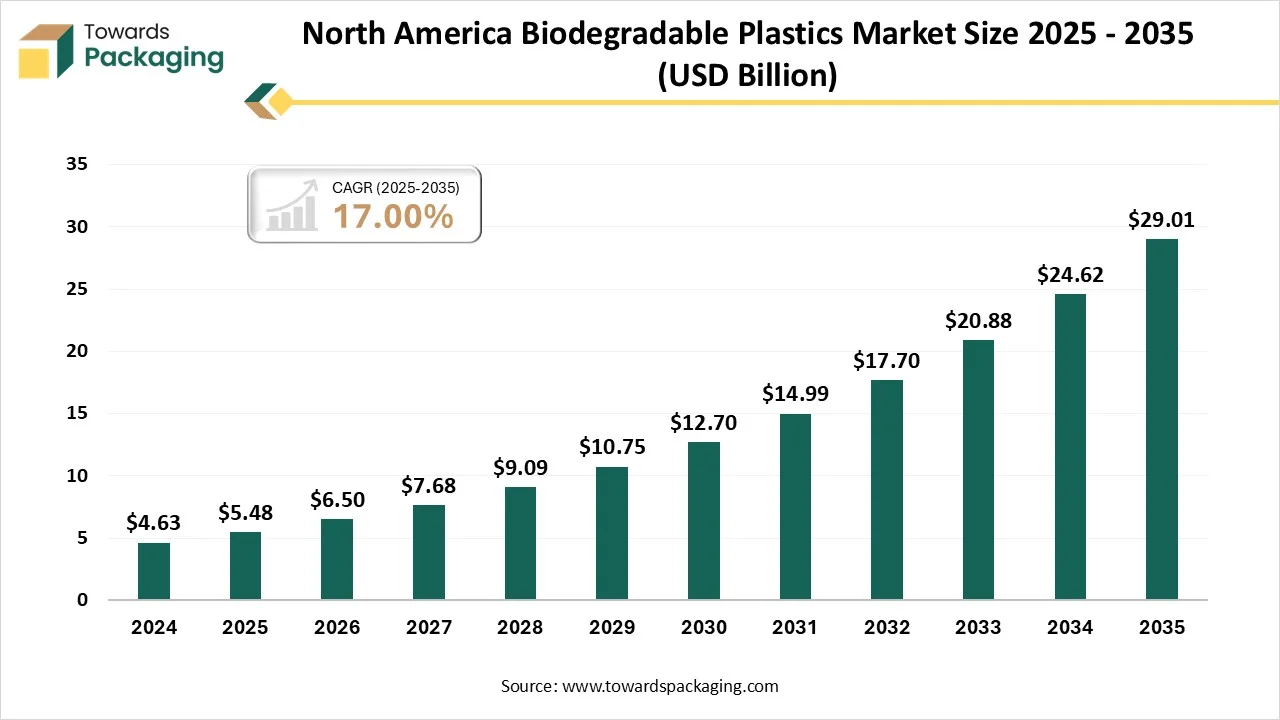

The North America region held the largest share of the biodegradable plastics market in 2024, due to the presence of advanced manufacturing infrastructures. The continuous innovation in this market and the introduction of superior quality packaging have influenced the development of this market. The rising practice for usage of eco-friendly packaging in countries like the U.S. and Canada has raised the market demand. Rising governmental efforts to promote the advantages of such eco-friendly packaging have also boosted the development of this industry.

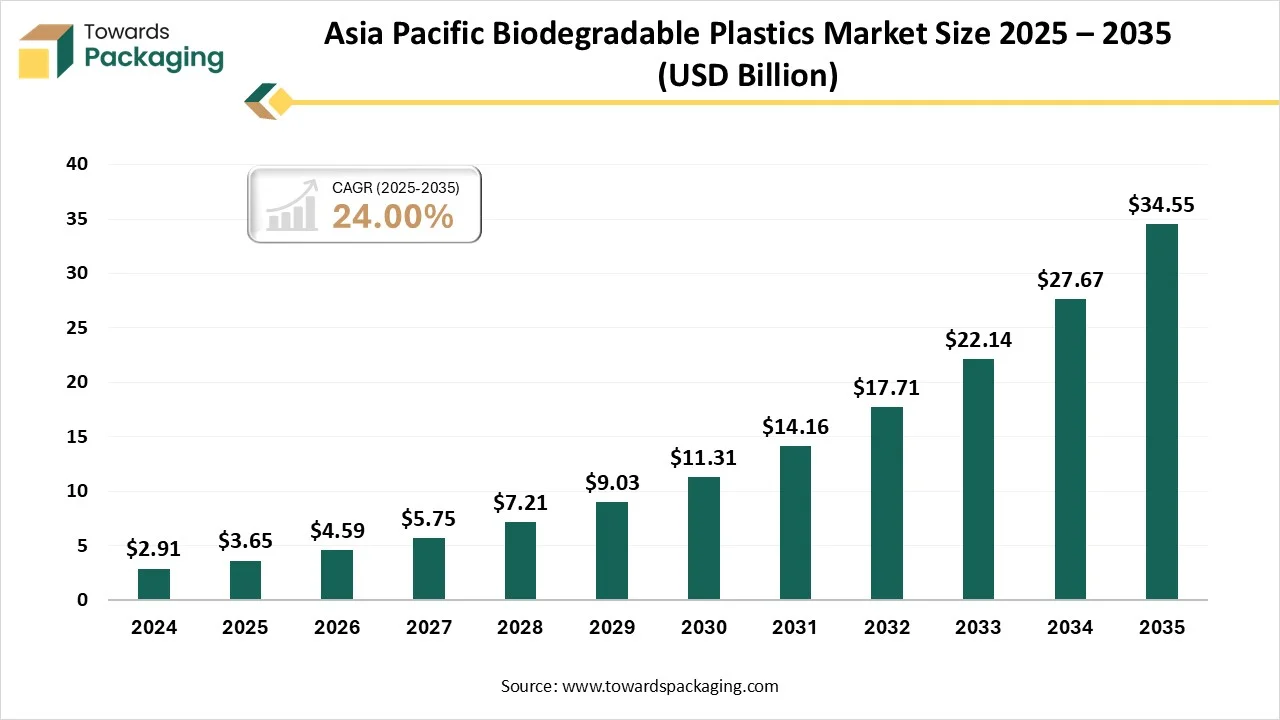

The Asia Pacific region is estimated to grow at the fastest rate in the biodegradable plastics market during the forecast period. The growing industrialization with sustainable packaging has raised the demand for this market in countries such as India, China, Japan, South Korea, and many others. The rising e-commerce sector has influenced the demand for such packaging due to its durability, which has the capacity to protect packaged products from damage.

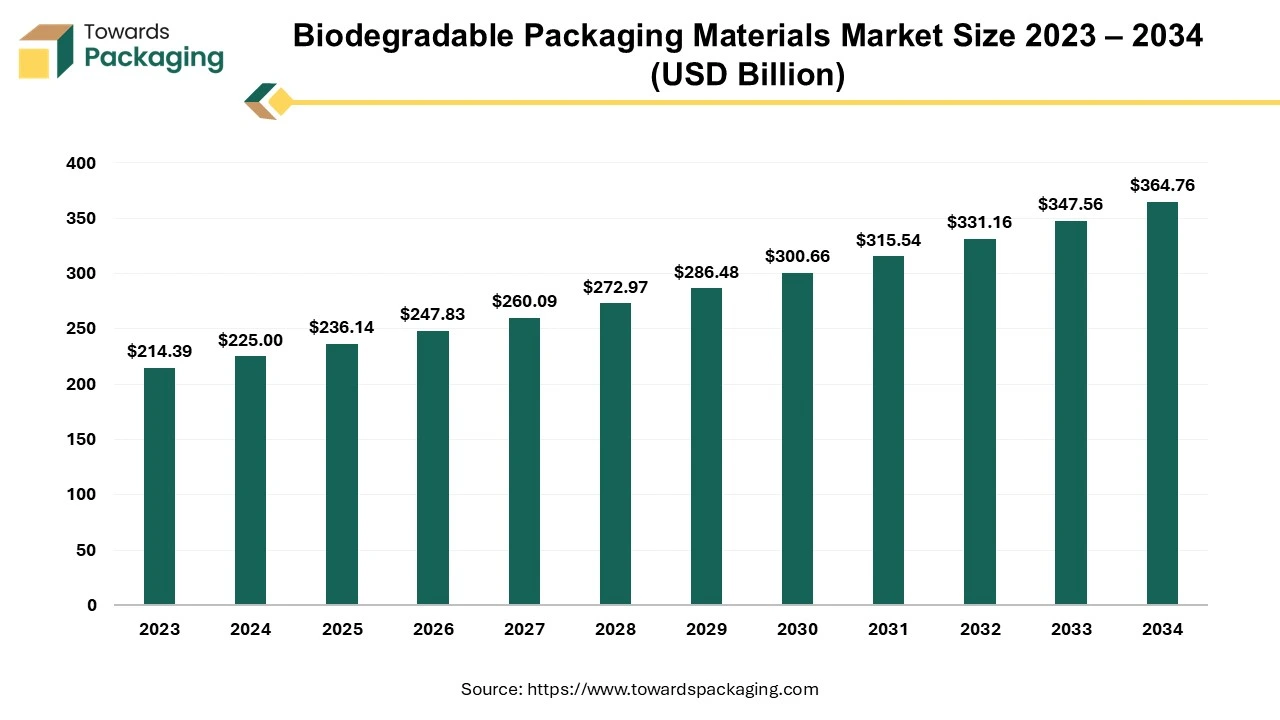

The biodegradable packaging materials market is projected to expand from USD 236.14 billion in 2025 to USD 364.76 billion by 2034, growing at a CAGR of 4.95% during the forecast period.

The packaging material made from natural resources benefits the environment. The market for biodegradable packaging materials centers around producing and distributing packaging materials made from renewable sources such as plants and microorganisms. Utilization of these materials reduces plastic waste, polluting the ocean and landfills since it decomposes naturally. Along with this, reducing carbon emissions and recycling and repurposing features of sustainable packaging are the leading objectives of the market.

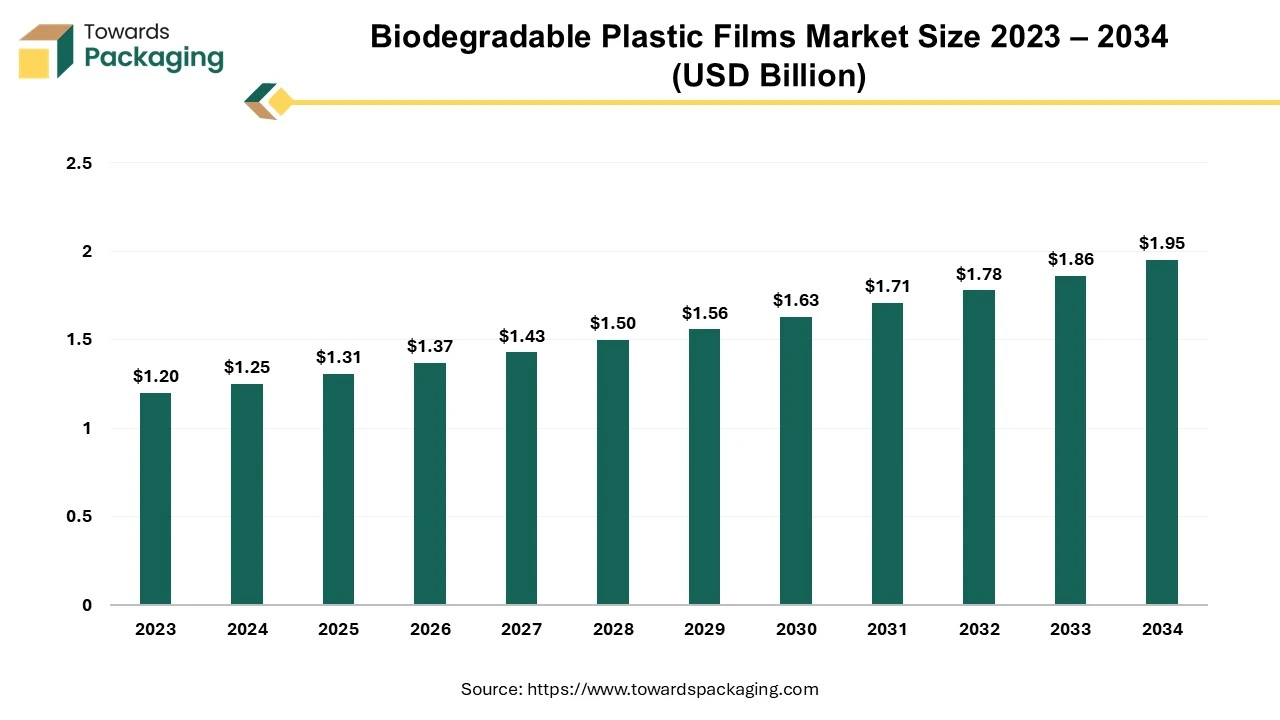

The biodegradable plastic films market is predicted to expand from USD 1.31 billion in 2025 to USD 1.95 billion by 2034, growing at a CAGR of 4.50% during the forecast period from 2025 to 2034. The biodegradable plastic films market continues to grow owing to the demand of harmless packaging materials, especially from the food and beverages sector. The end result of biodegradable films is less harmful to the environment than regular plastic bags.

The biodegradable plastic film market is growing rapidly as it offers the material that caters the demand that required products that cause less carbon emission. The materials used to make biodegradable films are plant-based, and the carbon footprint of the composting process is very low. Plastics are widely used in the production of packaging products due to their quality and ease of production. Biodegradable plastics use natural products; therefore, using bioplastics can reduce environmental damage by reducing petroleum use.

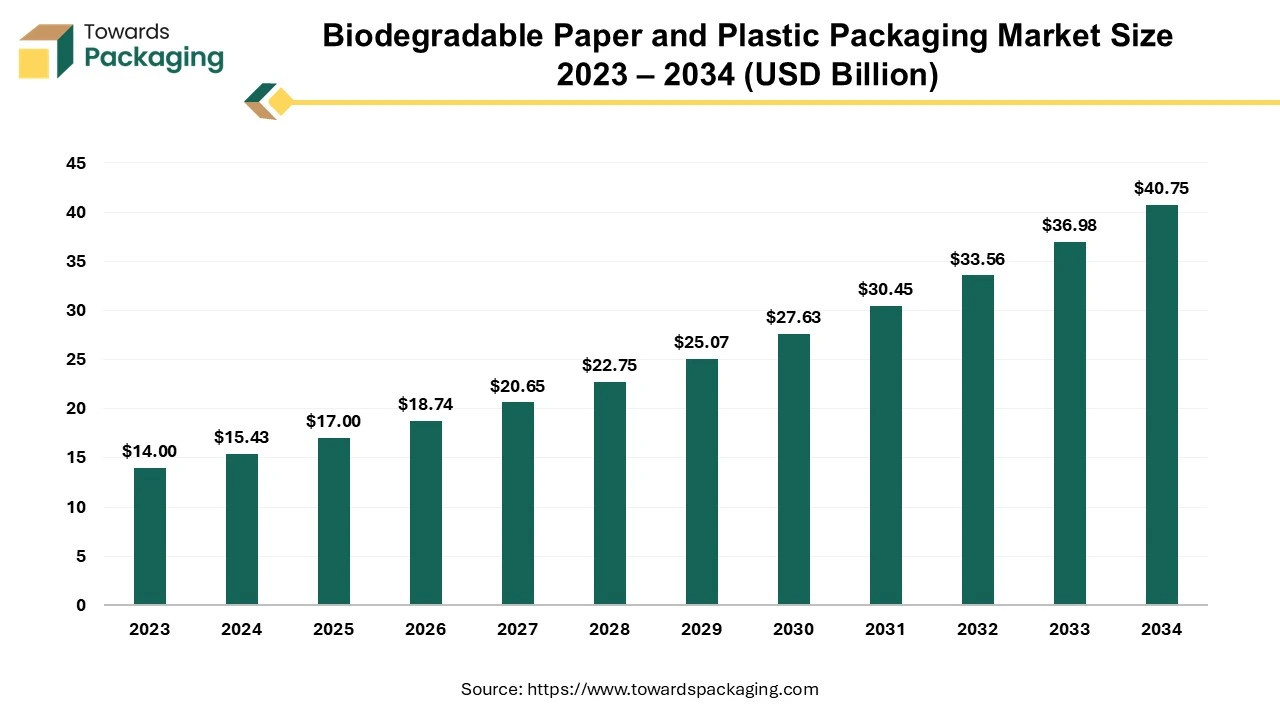

The global biodegradable paper and plastic packaging market size reached US$ 15.43 billion in 2024 and is projected to hit around US$ 40.75 billion by 2034, expanding at a CAGR of 10.20% during the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing fiber based packaging which is estimated to drive the global biodegradable paper and plastic packaging market over the forecast period.

Type of Biodegradable Plastics

End-Use Industry

Processing Technology

Form

Source of Raw Material

Regions (Geographical Segmentation)

February 2026

February 2026

February 2026

January 2026