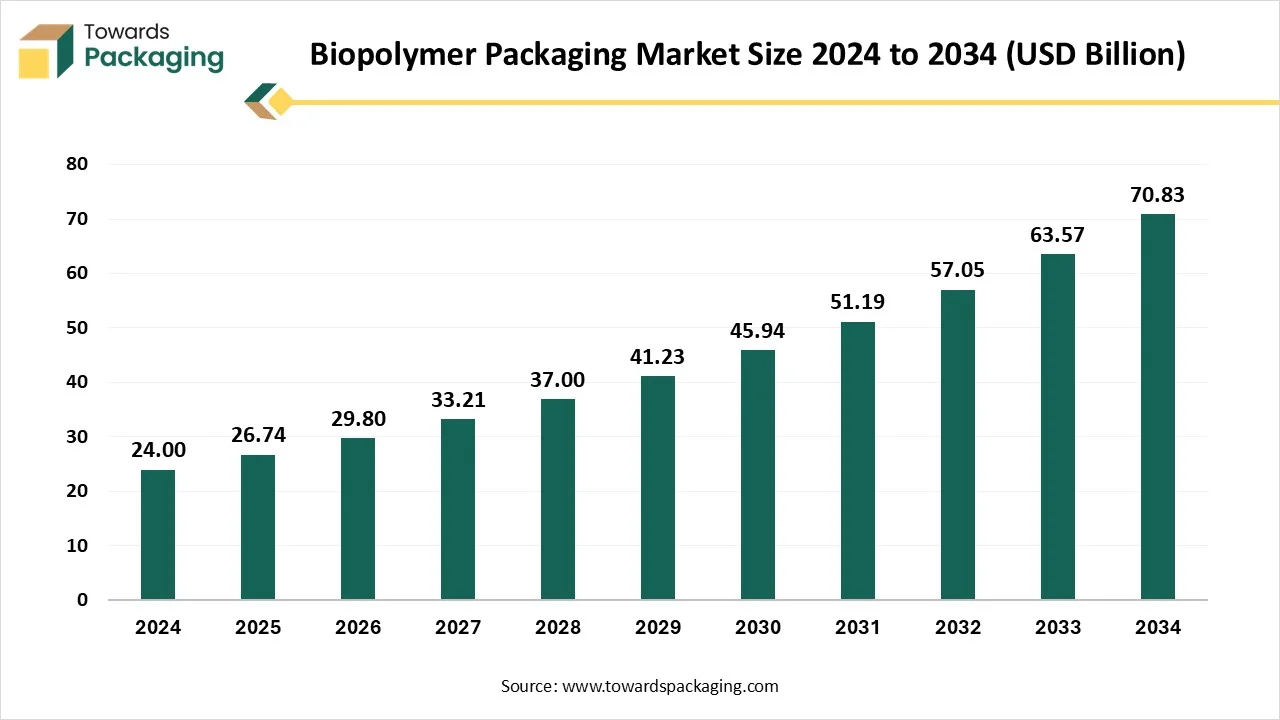

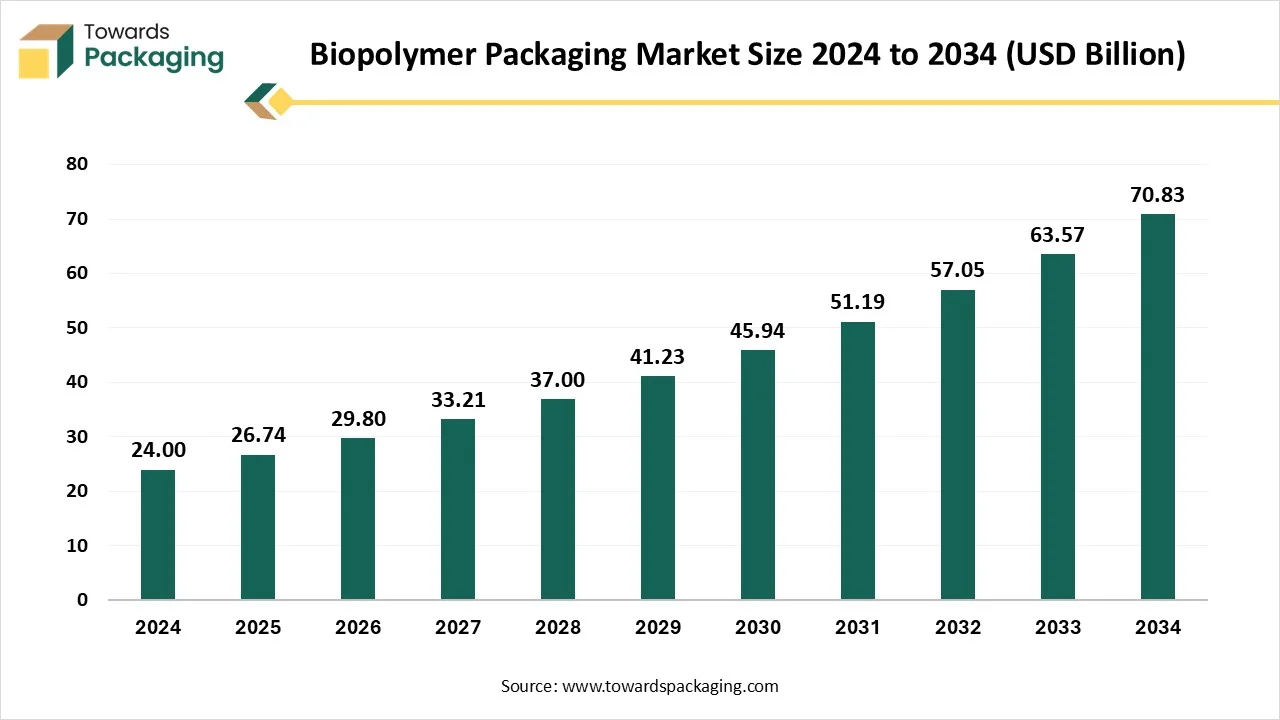

The biopolymer packaging market is forecasted to expand from USD 29.80 billion in 2026 to USD 78.93 billion by 2035, growing at a CAGR of 11.43% from 2026 to 2035. This comprehensive report covers market size, segment-wise performance (PLA, PHA, starch blends, bio-PE, bio-PET, cellulose), packaging formats (rigid & flexible), end-user adoption, and provides detailed regional insights for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

It also includes trade statistics, production capacity trends, cost structure analysis, value chain mapping, key manufacturer profiles, and competitive benchmarking of companies like NatureWorks, BASF, Novamont, TIPA, Danimer Scientific, and others.

Biopolymer packaging refers to the use of natural, biodegradable polymers derived from renewable biological sources such as plants, starch, cellulose, and proteins for the creation of packaging materials. Unlike conventional plastic packaging made from petroleum-based polymers, biopolymer packaging is eco-friendly, compostable, and designed to reduce environmental pollution. Common types of biopolymers used include polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch blends, and cellulose-based films. These materials can be used for various applications such as food packaging, cosmetics, pharmaceuticals, and consumer goods.

Biopolymer packaging not only decomposes naturally under specific conditions but also helps reduce carbon emissions during production. With growing awareness of sustainability and increasing regulations on single-use plastics, industries are adopting biopolymer packaging as a viable alternative to traditional packaging. While challenges like cost, performance limitations, and lack of industrial composting infrastructure exist, ongoing innovation and government support are helping the market grow rapidly across global supply chains.

| Company Name | Biopolymer Packaging Products |

| NatureWorks LLC | Ingeo PLA-based (polylactic acid) biopolymer for films, containers, and flexible packaging. |

| BASF SE | EcoVio compostable polymer made from PLA and PBAT, used in bags, food packaging, and films. |

| Novamont S.p.A. | Mater-Bi– starch-based biopolymer used in bags, wrappers, and trays |

| TIPA Corp Ltd. | TIPA compostable films and laminates for food and fashion packaging |

| Biome Bioplastics | BiomeHT, BiomeEP – biodegradable plastics for rigid and flexible packaging |

| Danimer Scientific | Nodax PHA – used for straws, cutlery, films, and flexible packaging |

| FKuR Kunststoff GmbH | Bio-Flex, Terralene - PLA, PHA, and starch blends for food trays, wraps, and blister packs |

| TotalEnergies Corbion | Luminy PLA – used in thermoformed trays, cups, and flexible packaging |

| Rodenburg Biopolymers | Solanyl – starch-based biodegradable polymers for industrial and consumer packaging |

| Plantic Technologies Ltd | Plantic – high-barrier starch-based biopolymer packaging for perishable foods |

| Earthpack | Compostable and biodegradable retail packaging (bags, mailers, boxes) made from PLA and recycled content. |

| Cortec Corporation | EcoOcean, Eco-Corr– biodegradable films and anti-corrosion packaging using biopolymers |

| Green Dot Bioplastics | Terratek BD (biodegradable) and Terratek Flex – for film and molded packaging applications |

AI integration can significantly enhance the biopolymer packaging industry by optimizing processes, improving material innovation, and accelerating sustainability goals. Through machine learning and predictive analytics, AI can analyze vast datasets to identify optimal biopolymer formulations with enhanced durability, flexibility, and biodegradability. This accelerates R&D efforts and reduces the time-to-market for innovative materials. AI-driven quality control systems, such as computer vision, ensure consistent product standards during manufacturing by detecting defects or irregularities in real time.

AI supports supply chain optimization by forecasting demand, managing raw material sourcing, and reducing production waste. In product design, AI can simulate packaging performance under various conditions, helping companies create lightweight and effective packaging with minimal material use. It also enables smart packaging solutions, such as incorporating sensors and digital tracking, that enhance traceability and consumer engagement. AI aligns production with market trends and sustainability rules, promoting adaptable, eco-efficient biopolymer packaging operations, boosting competitiveness and compliance.

In September 2025, Biomaterials organisation Erthos is collaborating with Colgate-Palmolive to merge with Erthos’s AI-powered stage, Zya, which aims to use sustainable materials. Zya will assist the user packaged goods company to align with their performance particulars and sustainability inspirations.

In May 2025, Chief Minister of Maharashtra Devendra Fadnavis revealed India’s first Poly Lactic Acid (PLA named “Balrampur Bioyu”, which is to be revealed by Balrampur Chini Mills Limited, marking a major achievement in the nation’s journey towards sustainable invention.

Increased focus on zero-waste supply chains and circular production models is promoting the use of compostable and renewable packaging materials.

Companies aligning with Environmental, Social, and Governance (ESG) targets are investing in green packaging to meet sustainability benchmarks. Strict bans and restrictions on single-use plastics, especially in Europe, North America, and parts of Asia, are encouraging the adoption of biopolymer packaging.

In May 2025, PepsiCo declared that it had revised its sustainable packaging goals in addition to other company-wide sustainability objectives. Among other adjustments, the business chose to revoke its reuse goals. The business unveiled its sustainability plan, PepsiCo Positive (pep+). The corporation claims the redesign takes into consideration "external realities" that impede success, but it also notes progress toward the targets since adoption.

Biopolymers are a variety of classes that come from renewable biopolymers sources, such as cellulose, starch, proteins, and polylactic acid 9PLA). They count both the biodegradable and renewable occurring and bio-based synthetic polymers, as several of them serve biodegradable or compostable alternatives to regular plastics under particular conditions. These materials can be crafted to align with the performance of regular plastics, making them ideal for packaging applications such as flexible films, food trays, beverage cups, and shopping bags. By adding the biopolymers, sectors can shift towards a circular economy in which materials are sustainably sourced, disposed of, and used, particularly lowering the environmental impact.

Limited Industrial Composting Infrastructure & Performance Limitations

The key players operating in the market are facing issues due to limited industrial composting infrastructure & performance limitations, which are estimated to restrict the growth of the biopolymer packaging market in the near future. Biopolymers are generally more expensive to produce than conventional plastics due to raw material sourcing, complex processing, and limited economies of scale. Many biopolymer products require industrial composting facilities for proper degradation, which are not widely available in many regions.

Some biopolymers lack the same durability, barrier properties, and heat resistance as traditional plastic, limiting their use in certain packaging applications. Dependence on agricultural sources like corn, sugarcane, or starch can create competition with food supply chains and lead to inconsistent availability. A lack of understanding about biopolymer packaging and how to properly dispose of it can hinder its widespread adoption. Biopolymers are often incompatible with traditional recycling streams, leading to contamination and reduced recyclability.

The growth of protein-based biopolymers marks a major innovation in sustainable materials. These materials serve as a perfect gas barrier and have mechanical characteristics compared to regular polysaccharide-dependent alteration. Their different communication with bioactive molecules makes them specifically valuable in medical uses, such as tissue engineering and tablet covering. The packaging sector is also experiencing these materials for their advanced nutritional elements and food preservation properties.

Also, starch biopolymers, which come from different plant sources like rice, potato, corn, wheat, and barley, are gaining attention in usual applications. Current developments have allowed the growth of anti-microbial films that protect against microbial growth in food products. The adaptability of starch-based materials expands from medicine to cosmetics to agriculture, making them an important player in the sustainable materials invention.

Government policies and regulations banning or restricting single-use plastics across several countries further open the market for biopolymer packaging. These regulatory frameworks encourage both public and private sectors to invest in biodegradable, compostable, and recyclable packaging solutions.

Advancements in material science also offer promising opportunities. New formulations of biopolymers, such as enhanced PLA, PHA, and cellulose-based materials, now offer better strength, flexibility, and barrier properties, making them suitable for a broader range of applications, including food, beverages, cosmetics, and healthcare.

Polylactic acid (PLA) is dominant in the biopolymer packaging market due to its excellent biodegradability, renewability, and compatibility with existing plastic processing equipment. Derived from renewable resources like corn starch or sugarcane, PLA offers a lower carbon footprint compared to petroleum-based plastics. Its versatility allows it to be used in various packaging formats such as films, trays, and containers. Additionally, PLA exhibits good mechanical strength, transparency, and compostability, making it ideal for both food and non-food applications. Growing consumer demand for sustainable packaging and favourable regulatory support further contribute to PLA’s leadership in the biopolymer segment.

Polyhydroxyalkanoates (PHAs) are the fastest-growing biopolymer in packaging due to their environmental advantages, technological improvements, and expanding demand. PHAs are fully biodegradable across diverse conditions, soil, marine, and compost, offering superior eco credentials over conventional plastics. Advances in microbial fermentation, engineered feedstocks (like agricultural waste and industrial by‑products), and genetically optimized strains have significantly lowered production costs and boosted scalability. Meanwhile, escalating regulatory pressure, such as single-use plastic bans in Europe and North America, and rising consumer preference for sustainable packaging have accelerated PHA adoption in food, medical, and consumer-goods sectors. These factors collectively position PHAs for rapid market growth.

Rigid packaging leads the biopolymer packaging market because of its superior durability, strength, and protective qualities ideal for food, beverage, cosmetic, and pharmaceutical products. Its rigid structure preserves shelf life, resists moisture and temperature changes, and ensures safe transport and portion control. Additionally, it offers premium visual appeal and branding opportunities through customization. The rise in single‑serve, convenience‑oriented products and growing consumer awareness of sustainability further reinforces rigid biopolymer packaging’s dominant position.

The flexible packaging segment is the fastest-growing in the biopolymer packaging market due to several key factors. Flexible packs like films, pouches, and bags are lightweight and use significantly less material than rigid alternatives, cutting costs and reducing environmental impact. Technological breakthroughs in barrier coatings and biodegradable biopolymers (PLA, PHA, starch blends) now offer the same protection and shelf-life performance as traditional plastics. Additionally, increasing regulatory pressure against single-use plastics, rising consumer demand for convenience and sustainability, and digital printing for product customization all contribute to accelerating the adoption of flexible bio-based packaging.

The food and beverage segment dominates the biopolymer packaging market because it combines stringent functional demands with strong sustainability drivers. Biopolymers such as PLA, PHA, and starch blends deliver excellent barrier properties against moisture, oxygen, and microbial protection essential for preserving perishables and extending shelf life. Growing consumer environmental awareness, coupled with regulatory bans on single-use plastics and ESG targets, pushes food producers toward compostable, plant-based packaging. Moreover, the food sector's sheer scale as the largest global packaging user makes it the key driver of biopolymer adoption, with foodservice, ready-to-eat, and beverage products leading the shift.

The cosmetics and personal care segment is the fastest-growing in biopolymer packaging due to converging trends of sustainability, premium aesthetics, and functional innovation. Consumers increasingly favour "clean beauty," driving brands to shift from fossil-based plastics to biodegradable and plant-based biopolymers like bio‑PET, PLA, and PHA for tubes, jars, and refillables. These materials support high-barrier, visually appealing packaging that aligns with luxury branding while meeting eco-friendly standards. Moreover, regulatory bans on microplastics in rinse-off cosmetics and growing investments in biopolymer R&D help bio-based packaging overcome cost and performance gaps.

The retail and consumer goods segment dominates the biopolymer packaging market due to its vast scale, consumer-driven sustainability focus, and cost-effective material suitability. Major retailers and fast-moving consumer goods (FMCG) brands demand eco-friendly packaging to meet increasing environmental regulations, reduce plastic waste, and strengthen green branding. Biopolymers like PLA, PHA, and starch blends offer excellent properties lightweight, compostability, and functional durability that fit FMCG needs in household items, electronics, and personal goods. Additionally, rapid inventory turnover in retail encourages packaging that reduces transport and shelf costs while maintaining shelf appeal. Combined with strong consumer willingness to pay more for sustainable products (82%), these factors make retail and consumer goods the market's dominant end-user segment.

The e-commerce segment is the fastest-growing end-user segment in the biopolymer packaging market due to a powerful convergence of consumer expectations, regulatory pressures, and technological advancements. E-commerce relies heavily on mailers, pouches, and void-fill that must be lightweight yet robust, making biopolymers like PLA and PHA ideal for reducing shipping costs and environmental impact. A boom in B2C online retail spurred by digitization and convenience has escalated demand for sustainable packaging tailored to direct-to-consumer models. Advanced digital printing enables brand differentiation through customization, enhancing customer experience. Additionally, stringent regulations targeting single-use plastics and heightened eco-consciousness are compelling e-commerce players to integrate compostable and biodegradable materials, fuelling rapid adoption of biopolymer-based packaging.

Europe is the dominating region in the biopolymer packaging market due to a combination of strong regulatory, technological, and consumer-driven factors. The European Union has implemented some of the world’s most stringent environmental regulations, including bans on single-use plastics and mandates for compostable and recyclable packaging, which drive the demand for biopolymers. Additionally, government incentives and funding for sustainable packaging innovations support research and industrial adoption of biopolymer materials.

Europe also has a well-developed infrastructure for industrial composting and recycling, making the implementation of biopolymer packaging more feasible compared to other regions. The region’s high consumer awareness and eco-conscious behaviour further fuel demand, as European consumers increasingly prefer sustainable and biodegradable packaging options. Furthermore, Europe is home to leading packaging and biopolymer manufacturers and research institutions that invest heavily in technological advancements and product innovation. Major food, beverage, and cosmetic brands with strong ESG commitments in the region accelerate the shift to sustainable packaging.

German Market Trends

Germany leads the region with its strong industrial base, cutting-edge R&D capabilities, and firm government support for sustainability. Home to major packaging and chemical companies, Germany sets high environmental standards and is a hub for technological innovation in biodegradable materials.

France Market Trends

France is advancing rapidly due to strict bans on single-use plastics and an eco-conscious population. The French government’s support for compostable packaging and sustainable alternatives makes the country a strong adopter, especially in the retail and food sectors.

U.K. Market Trends

The United Kingdom, following Brexit, is implementing independent environmental policies, with retail giants and e-commerce platforms driving demand for biodegradable packaging to meet corporate sustainability goals. Italy stands out for its innovation in starch-based and PLA biopolymers, utilizing agricultural waste to support eco-friendly material development, especially in the produce and cosmetics sectors. The Netherlands is fostering circular economy practices and supporting startups through government initiatives, focusing on smart packaging solutions for food and logistics.

Spain Market Trends

Spain is witnessing growth driven by its expanding food export sector and increasing EU-backed investments in green technologies. The country is focusing on biodegradable packaging solutions for fruits, vegetables, and seafood. Together, these nations form the foundation of Europe’s leadership in the global biopolymer packaging market, driven by regulation, innovation, and strong demand across sectors.

Asia-Pacific is the fastest-growing region in the biopolymer packaging market due to a combination of economic expansion, environmental regulations, and rising sustainability awareness. Rapid industrialization and urbanization across countries such as China, India, Japan, and South Korea are driving increased consumption of packaged goods, creating strong demand for eco-friendly packaging alternatives. Government initiatives and regulations aimed at reducing plastic pollution such as India’s ban on single-use plastics and China’s Green Packaging Guidelines are accelerating the shift toward biopolymer packaging.

The region also benefits from abundant agricultural resources, which serve as raw materials for biopolymer production, reducing costs and supporting local manufacturing. Moreover, increasing foreign investment and strategic partnerships in sustainable packaging ventures are boosting technological advancement and scalability. The booming e-commerce and food delivery sectors further amplify the demand for sustainable, lightweight, and disposable packaging formats, positioning Asia-Pacific as a dynamic growth engine in the global biopolymer packaging market.

China Market Trends

China plays a dominant role due to its massive manufacturing capacity, strict government regulations on plastic usage, and emphasis on green development. The country’s "Plastic Ban 2025" and Green Packaging Guidelines are pushing industries toward biopolymer alternatives, especially in e-commerce and food delivery sectors. Investments in domestic biopolymer production and R&D are further strengthening its position.

India Market Trends

India is emerging as a key growth driver, supported by government policies banning single-use plastics and the availability of abundant agricultural raw materials like starch and sugarcane. Startups and local manufacturers are increasingly investing in compostable packaging, especially in the food and retail industries. Rising public awareness and urban demand are also boosting market momentum.

Japan Market Trends

Japan contributes significantly through innovation and high-tech solutions. With strong corporate sustainability goals and government support, Japan focuses on high-performance biopolymer materials, particularly for electronics, food, and cosmetics packaging.

South Korea Market Trends

South Korea emphasizes smart and eco-friendly packaging under its national green growth strategy. The government provides incentives for sustainable packaging R&D, and major Korean brands are adopting biopolymer packaging to meet ESG standards.

North America is experiencing notable growth in the biopolymer packaging market due to rising environmental awareness, regulatory pressures, and strong corporate sustainability commitments. Consumers in the U.S. and Canada are increasingly demanding eco-friendly packaging solutions, prompting companies to invest in biodegradable and compostable materials. Government policies at both the federal and state levels, such as plastic bans, tax incentives, and green procurement programs, are supporting the shift away from traditional plastics.

Major food, beverage, and personal care brands are incorporating biopolymer packaging to align with ESG goals and respond to growing climate concerns. The region also benefits from robust R&D capabilities and the presence of key biopolymer producers and packaging innovators. Additionally, the expanding e-commerce and food delivery sectors require sustainable, lightweight, and single-use packaging solutions, which biopolymers can effectively provide. These factors, along with more investments in green tech and consumer education, drive North America’s steady growth in the global biopolymer packaging market.

Latin America’s biopolymer packaging market concentrates on the distribution, production, and application of biodegradable and biobased packaging material. With growing environmental issues, consumer demand, and government regulations for sustainable solutions, bioplastic packaging is growing as an important alternative to regular petroleum-based plastics. As users and companies move toward greener alternatives, bioplastics packaging is becoming a preferred choice. Policies restricting single-use plastics and marketing biodegradable alternatives are accelerating bioplastic acceptance. Inventions in bioplastic formulation are developing durability, cost-effectiveness, and flexibility. Mixing bio-based and conventional polymers is making a cost-effective and durable packaging initiative.

By Type of Biopolymer

By Packaging Type

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026