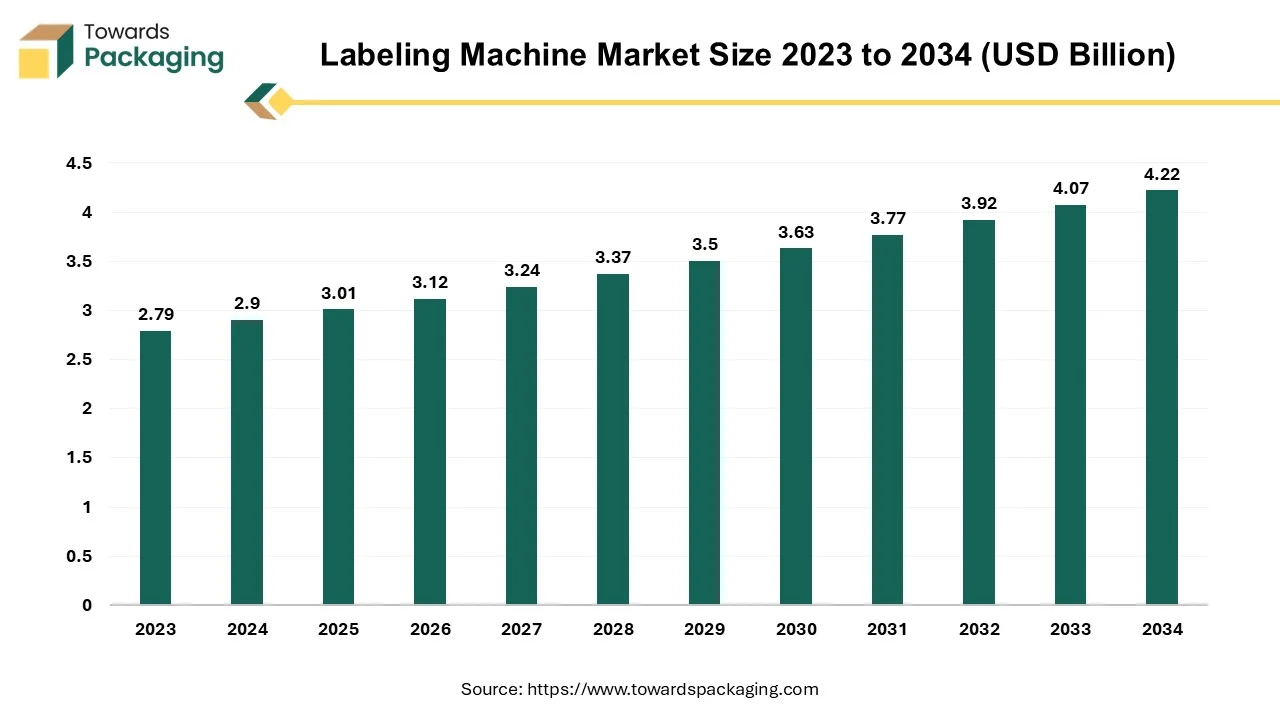

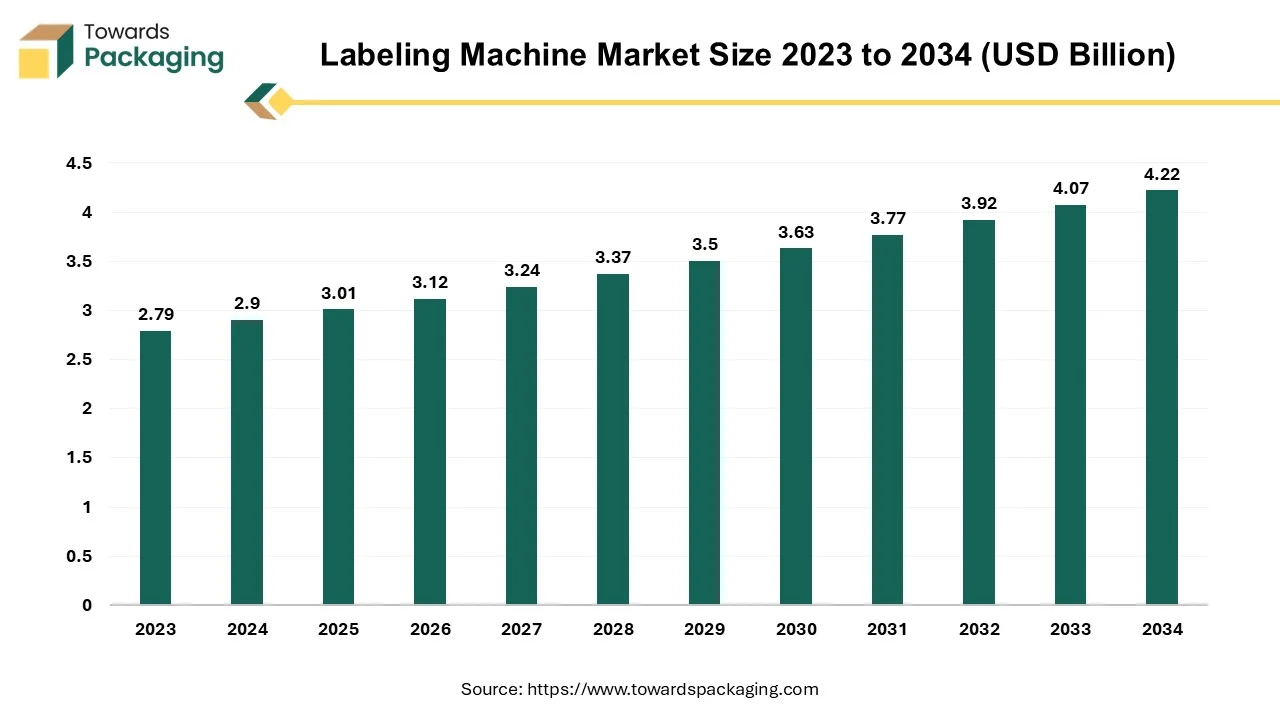

Market Forecast for the Labeling Machine Industry

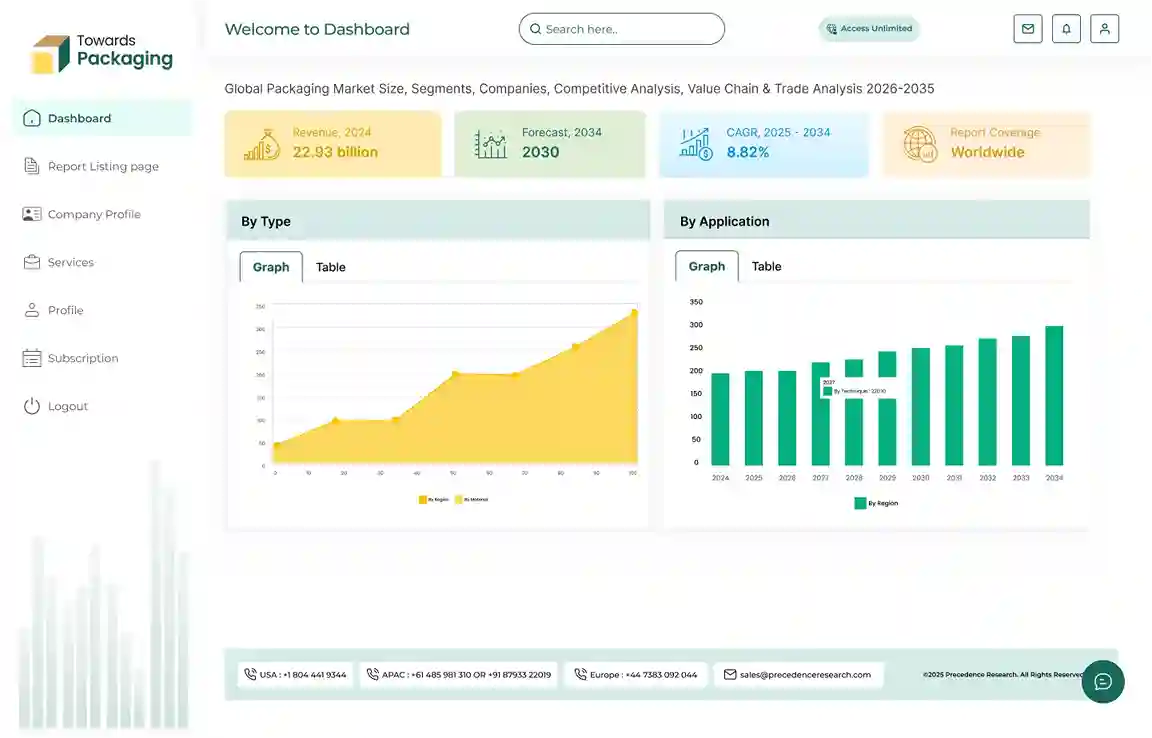

The labeling machine market is forecasted to expand from USD 3.13 billion in 2026 to USD 4.39 billion by 2035, growing at a CAGR of 3.84% from 2026 to 2035.

Labels are applied to products or packaging using a labeling machine. Some labeling machines can also produce labels in addition to applying them. The market is filled with a variety of labeling machines, from high-production machines that enable total automation to the manual tools that only allow for basic label dispensing. These machines are high in demand from various industry verticals.

The increasing demand from consumers for product diversity coupled with the growing stringent regulations for serialization and labeling is expected to contribute to the growth of the market during the forecast period. Additionally, the increasing automation in manufacturing processes across various industries like food and beverage, pharmaceuticals and consumer goods also expected to drive the growth of the market in the near future. Moreover, the growing e-commerce sector as well as the need for accurate logistics is also anticipated to contribute to the growth of the market in the years to come.

Key Trends and Findings Growth Drivers, Technological Advancements, and Regional Dynamics

- Labels printed in color allow businesses to market their brands to consumers more successfully. Due to this, a number of vendors regularly use color printing labels, which helps them concentrate on the selling points of their goods and strengthens their ability to retain the branding message.

- As the demand for ultra-cold cryogenic storage rises, cryo labeling is expected to continue growing. Cryogenic labels are designed to operate and work well at temperatures below freezing.

- There is an increase in adoption of expanded content label design. The ideal multipage solution that has room for extra information is the extended content label. Market leaders like Star Label Products, CCL Industries, Label Impressions Inc., Consolidated Label Co. and other competitors have adopted this new method of expanded content labeling.

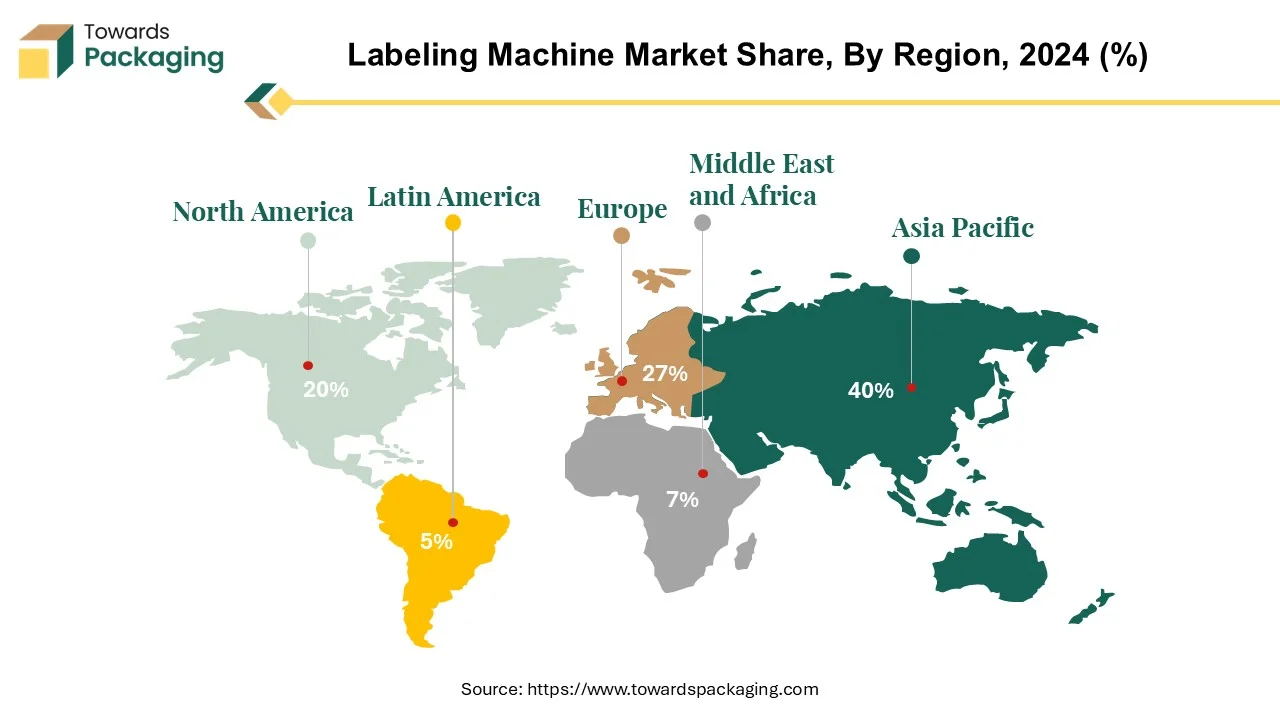

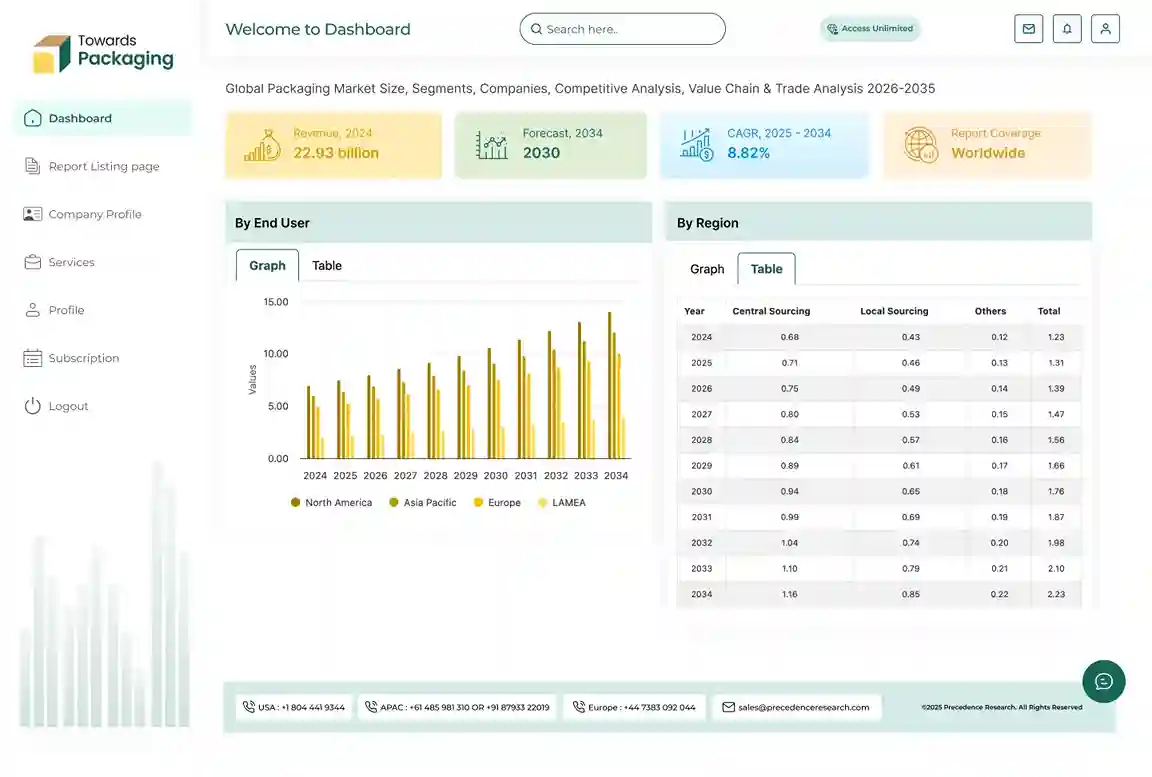

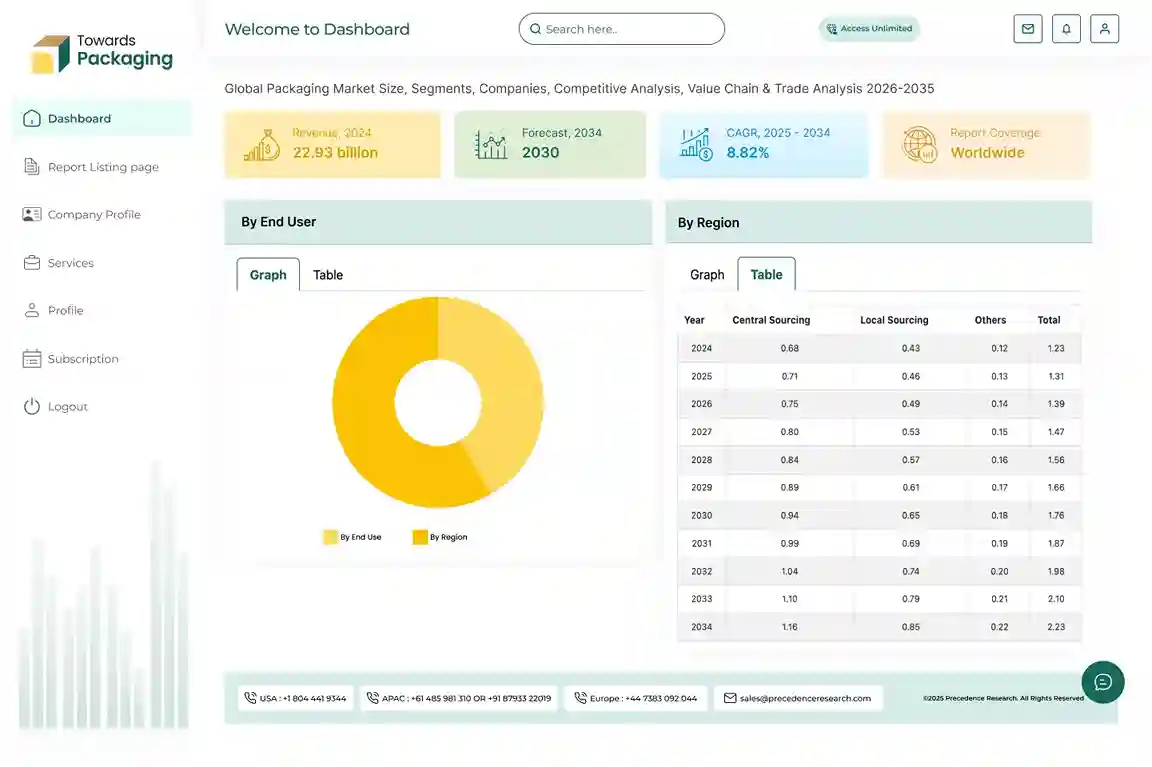

- North America is expected to grow by considerable CAGR of 2.42% owing to the high industrial automation, stringent regulatory standards as well as presence of a well-established manufacturing sector.

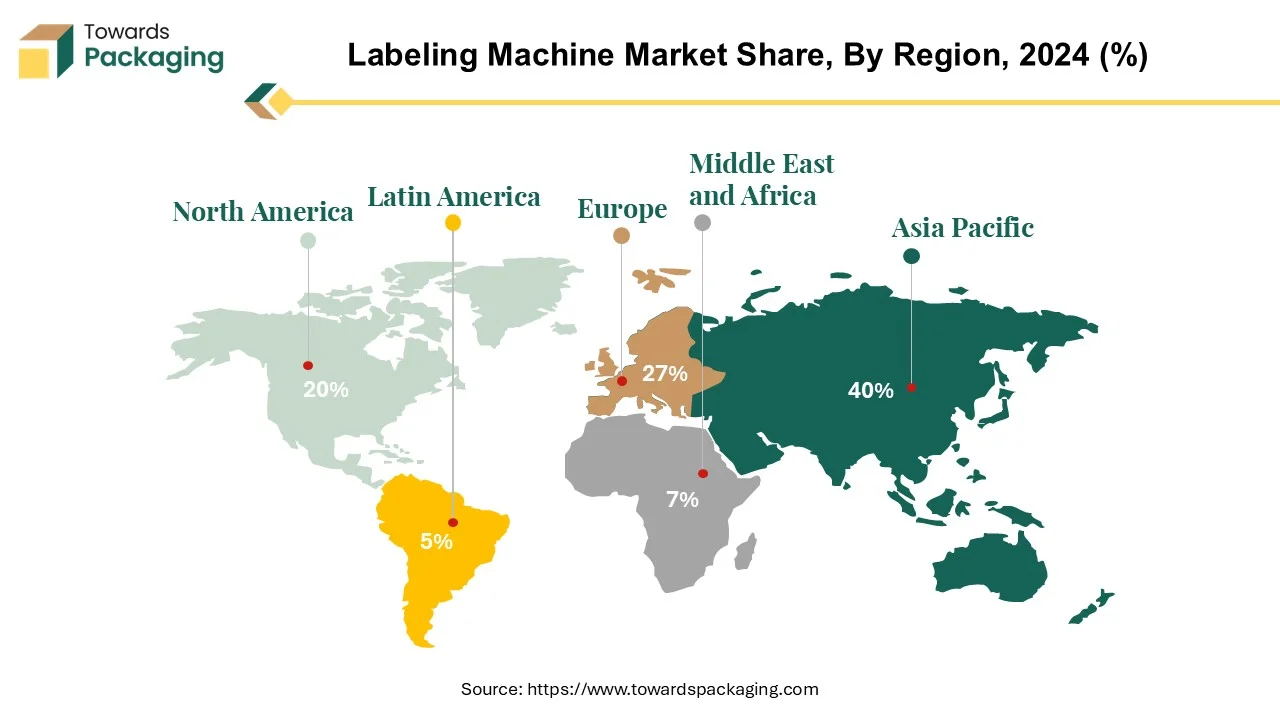

- Asia Pacific held substantial share of 40.24% in the global labeling machine market. This is due to the growing middle-class population coupled with the increasing consumer demand for packaged goods.

What are the Major Trends in the Labeling Machine Market?

AI-Driven Operational Intelligence

- As manufacturers increasingly focus on automation and data-driven decision-making, AI integration in labeling machines shifts from predictive maintenance to adaptive labeling accuracy. Over 80% of packaging facilities are expected to improve AI-based inspection and control systems, allowing for quicker changeovers, better defect detection, and more efficient energy use. Vendors need to adjust strategies to harness AI’s transformative potential in smart packaging lines.

Sustainability Trend

- Tightening environmental regulations and brand commitments to eco-conscious packaging are accelerating demand for energy-efficient, recyclable-material-compatible, and low-waste labeling systems. As over 70% of FMCG and pharma companies emphasize carbon reporting, machine manufacturers need to offer data-backed sustainability metrics to remain competitive.

Hybrid Automation and Cloud Connectivity

- The adoption of Industrial IoT (IIoT) and cloud-based line monitoring unifies previously siloed labeling operations. Real-time analytics, digital twins, and remote diagnostics will improve workflows across multi-facility enterprises, requiring that labeling OEMs deliver scalable, interoperable, and connected solutions.

Market Drivers

Presence of Regulations for Labeling

Regulations governing labeling are important in assuring that items are utilized by everyone properly and safely. However, regional criteria for regulatory labeling compliance might vary and new regulations are frequently adopted to update the labeling documentation.

- In March 2024, to determine the overall performance of the grid-connected solar inverters with no storage, the Bureau of Energy Efficiency (BEE) introduced the Standards and Labeling Program. Significant advantages are expected to result from the introduction of the approval label for grid-connected solar inverters, with a projected 21.1 billion kWh in energy savings from the fiscal year 2024–25 to 2033–34.

- In June 2022, to assist Canadians in making smart food decisions, the Minister of Health introduced new nutrition labeling standards for packaged foods. According to these regulations, packaged foods that are rich in sugar, sodium, or saturated fat must have a new symbol on the front.

- In June 2021, the new Food Safety and Standards (Labelling and Display) Regulations were introduced by the Food Safety and Standards Authority of India (FSSAI). Numerous questions that had emerged since the standards' origin have been resolved with a thorough revision.

The goal of the new legislation is to empower customers to make knowledgeable decisions about the food they buy, not just from packaged food goods but also from restaurants and online retailers.

Due to these regulations, there is a greater need for labeling machines that can apply labels precisely and accurately to stop the tampering, protect the consumer safety as well as preserve the product integrity. Also, the need for creative and trustworthy labeling solutions is growing as the companies work towards meeting these strict regulatory requirements which is further fueling the growth of the market.

Market Restraints

Inconsistent Labeling Practices

Numerous supply chain participants are involved in the complex labeling procedure. It's a process that also has to deal with constant changes in laws, rebranding, mergers, downsizing, scaling up or down, and economic ups and downs. It takes no effort for the labeling process to get complicated with so many factors that must be taken into account. Redundancies and errors are common when labeling procedures become segregated and supply chain visibility is restricted. This may result in higher expenses since errors and inferior procedures may result in relabeling.

Suppose a medical equipment company is expanding into a new international market. As they strive to satisfy the requirements of localization and legislation for that particular place throughout their supply chain, this company may encounter difficulties with global labeling. This inadequate visibility increases the likelihood of mistakes and misunderstandings and this in turn is likely to limit the market growth during the forecast period.

Market Opportunities

Rise of Automation

The future of the labeling machine industry is being reshaped by the convergence of smart automation, adaptive technologies, and sustainability imperatives. As manufacturers in pharmaceuticals, food & beverage, cosmetics, and logistics accelerate digital transformation, labeling equipment is evolving from conventional mechanical systems into intelligent, data-driven automation hubs.

AI-enabled vision systems are enhancing labeling precision, detecting print defects, misalignments, and inconsistencies in real time, while machine learning algorithms optimize placement accuracy and predict maintenance needs, minimizing downtime. The integration of collaborative and high-speed robotic systems allows labeling lines to manage complex packaging formats with greater speed, precision, and repeatability, particularly in high-volume production environments.

Transition to Eco-Friendly Solutions

Any label on a product that points its attention to environmental safety relative to others is considered a sustainable label. Recyclable labels reuse materials rather than adding to the need for additional resources for producing new labels. Since so many consumers prefer environmentally friendly products, sustainability has become a top priority for many businesses. Customers who buy eco-friendly products are informed that they are choosing a more sustainable and environmentally mindful product. Certain customers only purchase products knowing that they are protecting the environment through utilizing products with eco-friendly labels and packaging. Customers may choose to buy these goods over those of a rival if the label tells them of the product's lower environmental impact.

Furthermore, gen Z and millennials are well known for supporting firms that engage in the ethical company procedures like environmental sustainability with their purchases. Within this influential purchasing group, enhancing the brand with the use of sustainable product labels might help in building client loyalty. Companies who fully adopt the eco-friendly aspect not only attract environmentally conscious clients, but also strengthen their brand and support in the healing of the earth.

AI Enhancing Precision and Efficiency in the Labeling Machine Market

Artificial Intelligence (AI) is revolutionizing the labeling machine market by driving precision, efficiency, and innovation. AI's role in labeling machinery includes advanced image recognition and machine learning algorithms that significantly improve labeling accuracy and speed. AI systems can detect and correct errors in real-time, ensuring that labels are correctly aligned and applied, thereby reducing waste and minimizing human error.

Moreover, AI enhances the adaptability of labeling machines to handle diverse packaging formats and sizes. This flexibility is crucial in meeting the demands of various industries, from food and beverages to pharmaceuticals. AI-driven predictive maintenance also plays a pivotal role by analyzing equipment performance and predicting potential failures before they occur, which helps in minimizing downtime and maintenance costs.

AI-powered analytics provide valuable insights into labeling processes, allowing companies to optimize operations, streamline workflows, and improve overall efficiency. Additionally, the integration of AI with IoT technology enables remote monitoring and control of labeling systems, facilitating real-time adjustments and data collection.

Key Segment Analysis

Technology Segment Analysis Preview

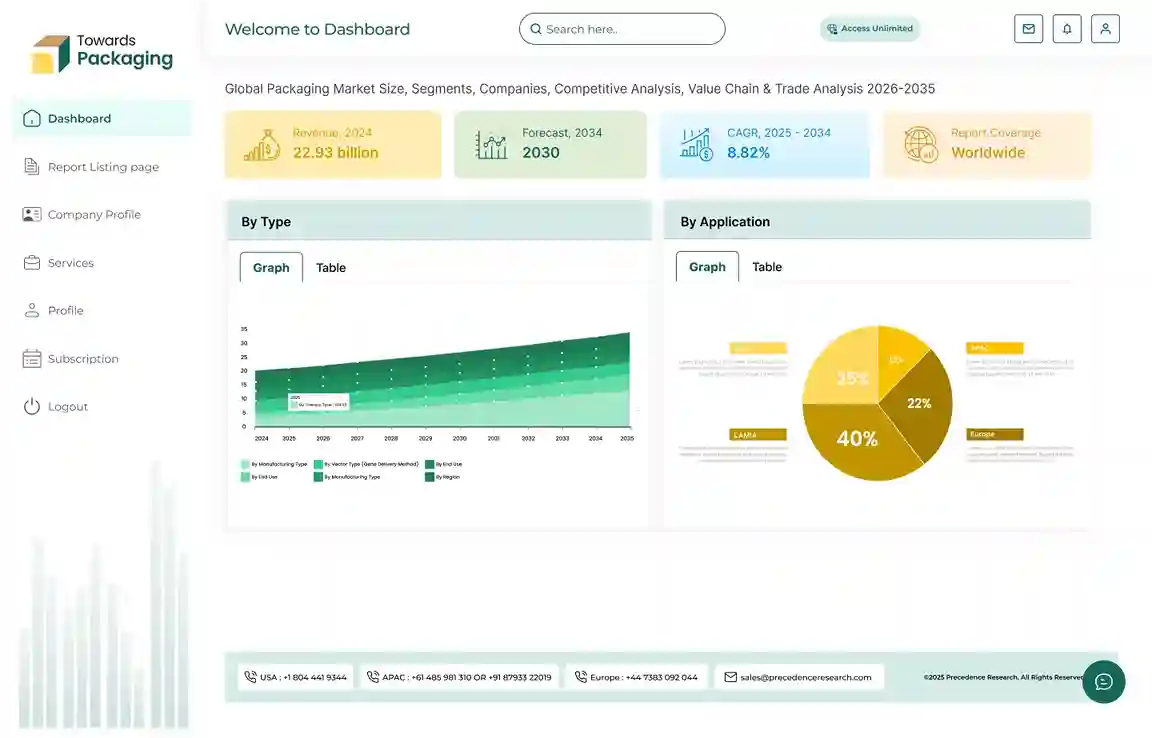

The pressure sensitive/self-adhesive labelers segment dominated the market with share of 39.27% in 2024 and is likely to grow at a CAGR of 3.84% during the forecast period. Pressure-sensitive labels are self-adhesive labels with a permanent or removable application option that can be applied without the need for water, solvents, or heat. These labels work well with practically any product, regardless of price range. These are widely adopted by various industries including foods beverages, consumer product, beauty and personal care, chemicals and even durable industrial applications. Furthermore, most of the companies are focusing on offering these labels with more advancement along with sustainability which is also expected to support growth of the segment in near future.

- In August 2023, Avery Dennison unveiled its most recent advancement in linked packaging along with two new decorative linerless options for pressure-sensitive labels that include patented micro-perforation technology. The goals of the AD LinrSave and AD LinrConvert are to reduce label waste, reduce CO2 and water footprints as well as improve the value and shelf appeal of pressure-sensitive labels.

- In March 2023, Avery Dennison Corporation expanded its Sustainable ADvantage solutions in Asia Pacific with the introduction of AD XeroLinr DTTM, its direct thermal (DT) linerless label portfolio. The goal of AD XeroLinr DTTM is to lower the total logistics time and cost while boosting productivity and sustainability.

End-use Segment Analysis Preview

The food & beverage segment held largest market share of 42.35% in 2024. The primary driver of the food and beverage segment is the growing regulatory compliance and safety standards to guarantee the product safety as well as the consumer protection. Furthermore, the increasing consumer demand for transparency is also expected to contribute to the growth of the segment in the global market. One way that consumers can learn more about the food they are considering to purchase is through the food labels. Consumers are likely to reduce the risk of foodborne disease and allergic responses by correctly adhering to the information on food labels, which includes handling directions, expiration dates and allergy warnings.

Regional Insights

Asia Pacific dominated the global labeling machine market with 40.24% of the share of the total market in 2024. The growing production capacities across various industry sectors such as food and beverage, pharmaceuticals and consumer goods is anticipated to support the regional growth of the market. Furthermore, the growing middle-class population along with the increased demand for packaged food & beverages is also expected to contribute to the regional growth in the global market. Moreover, the increasing volume of online shopping across the region is also likely to contribute to the growth of the market in the region.

China Labeling Machine Market Trends

China is the major contributor to the Asia-Pacific labeling machine market, driven by its vast manufacturing base, expanding packaging industry, and rapid adoption of automation technologies. The country’s strong presence across key sectors, including food & beverage, pharmaceuticals, and consumer goods, fuels consistent demand for high-speed, efficient labeling systems. Government initiatives promoting smart manufacturing and Industry 4.0 adoption further accelerate market growth. Additionally, China’s cost-efficient production capabilities and growing export of packaging equipment strengthen its leadership position in the region.

North America is expected to grow at a considerable CAGR of 2.42% in the labeling machine market during the forecast period. This is owing to the strict regulatory frameworks governing the labeling requirements in the US and Canada. Furthermore, the growing demand for customized labeling to differentiate products to meet specific consumer preferences is also expected to augment the growth of the market in the region within the estimated timeframe. Europe is also likely to grow at a substantial CAGR in the coming years owing to the changes in customer demands along with increased need from the food, pharmaceutical and personal care industries.

U.S. Labeling Machine Market Trends

The U.S. is the major contributor to the North America labeling machine market, owing to its large and diversified manufacturing base across food & beverage, pharmaceuticals, and consumer goods. High demand for advanced automation, smart packaging, and regulatory-compliant labeling solutions drives investment in modern labeling technologies. Strong R&D capabilities, early adoption of Industry 4.0 practices, and a focus on sustainability and eco-friendly packaging further reinforce the U.S.’s dominant position in the region.

Latin America

The labeling market in Latin America is growing steadily as automated packaging becomes more and more popular among manufacturers in an effort to increase productivity, accuracy, and cost effectiveness. Particularly in export-oriented industries, the increasing production of packaged foods beverages, and consumer goods is pushing businesses to switch from manual labeling to semi-automatic and fully automatic machines.

Brazil

Brazil represents the greatest demand for labeling machines in the region because of its robust pharmaceutical, food and beverage, and personal care manufacturing industries. To comply with regulations, improve shelf appeal, and enable increased production volumes fueled by both domestic and export demand, local producers are investing in cutting-edge labeling equipment.

MEA

The MEA labelling machine market is witnessing gradual growth, bolstered by growing industrial, pharmaceutical, and FMCG operations. To increase operational efficiency and product traceability, governments and private entities throughout the region are concentrating on manufacturing development and automation, which has led to a rise in the use of contemporary labeling solutions.

UAE

The UAE labeling machine market benefits from the country's position as a hub for trade and logistics in the region. Demand from the food processing, cosmetics, and consumer goods sectors, where automated labelling systems are being utilized more frequently to guarantee superior packaging quality, regulatory compliance, and quicker turnaround for both domestic and international markets, is what propels growth.

The Supply Chain Dynamics of the Labeling Machine Market

In the labeling machine market, the supply chain is ensuring that machines meet industry standards and customer requirements. The process begins with raw material procurement, where manufacturers source high-quality components and materials needed for machine assembly. This phase involves coordinating with reliable suppliers to secure materials like metals, plastics, and electronic components.

Once materials are obtained, they are delivered to manufacturing facilities where advanced labeling machines are assembled. These facilities are equipped with sophisticated technology to ensure precision in the production of machines that can handle various labeling requirements, from simple to complex.

After assembly, the machines undergo rigorous quality testing to ensure they meet performance standards and are free of defects. Following successful testing, the machines are distributed through a network of logistics providers. Efficient logistics are crucial to ensure timely delivery and installation of the machines at customer sites.

End-users, including packaging companies and manufacturers, then utilize these machines in their production lines. The supply chain also includes ongoing maintenance and support services to ensure the machines continue to operate effectively throughout their lifecycle. This comprehensive supply chain ensures that labeling machines are delivered, installed, and maintained to meet the diverse needs of various industries.

Major Components and Industry Contributions in the Labeling Machine Market

The labeling machine market is characterized by its diverse array of technologies and the significant contributions of various companies. Core components in this market include labeling machines, applicators, and printers, each playing a crucial role in product identification and packaging efficiency. Labeling machines are responsible for applying labels to products, while applicators ensure precise placement, and printers create labels with variable information such as barcodes and expiration dates.

Key players drive the market by offering innovative solutions tailored to different industries. For instance, companies like ProMach and Krones AG provide advanced labeling machinery that supports high-speed and high-precision labeling for consumer goods and pharmaceuticals. Labeling solutions from Accraply and Tadbik focus on flexibility and customization, catering to varied packaging requirements across sectors.

The firms such as Sidel and Bosch Packaging Technology offer integrated systems that combine labeling with other packaging processes, enhancing overall efficiency. With ongoing advancements, these companies contribute to the development of smart labeling systems featuring automation and data connectivity, improving traceability and operational efficiency. Collectively, these components and industry leaders are instrumental in advancing labeling technology and meeting evolving market demands.

Recent Developments by Key Market Players

-

In January 2024, Domino launched its new Mx-Series print and apply labeling machines with integrated, automated, GS1-compliant coding for products and pallets, addressing increased traceability needs.

-

In September 2025, Avery Dennison launched AD CleanGlass and AD CleanFiber labeling solutions at Label Expo 2025 to improve recyclability for glass and paper-based packaging. These technologies feature specialized adhesives that allow for clean label removal during washing or screening, supporting global circularity targes

Labeling Machine Market Companies

- Quadrel Labeling Systems

- PRIMERA TECHNOLOGY, INC.

- Krones

- Domino

- Sacmi

- Sidel

- Brother International Corporation

- Herma

- Brady Worldwide, Inc.

- DYMO, Inc.

Labeling Machine Market Segments

By Technology

- Pressure Sensitive / Self-Adhesive Labelers

-

- Wrap-Around Labeling Machines

- Front & Back Labeling Machines

- Top Labeling Machines

- Bottom Labeling Machines

- Multi-Side Labeling Machines

- Glue-Based Labelers

-

- Hot-Melt Glue Labeling Machines

- Cold-Glue Labeling Machines

- Roll-Fed Glue Labelers

- Cut-and-Stack Labeling Machines

- Sleeve Labelers

-

- Shrink Sleeve Labeling Machines

- Stretch Sleeve Labeling Machines

- Full-Body Sleeve Labelers

- Tamper-Evident Sleeve Labelers

- Others

-

- In-Mold Labeling Machines

- RFID Labeling Machines

- Print-and-Apply Labeling Machines

By End-Use

- Food & Beverages

- Bottled Water & Soft Drinks

- Alcoholic Beverages

- Dairy Products

- Packaged & Processed Foods

- Sauces, Oils & Condiments

- Pharmaceuticals

- Solid Dosage (Tablets & Capsules)

- Liquid & Injectable Medicines

- Medical Devices & Equipment

- OTC & Prescription Drugs

- Personal Care

- Cosmetics & Makeup Products

- Hair Care Products

- Skin Care Products

- Oral Care Products

- Chemicals

- Industrial Chemicals

- Household Cleaning Products

- Agrochemicals

- Lubricants & Oils

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countrie

- South Africa

- Rest of Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (3)