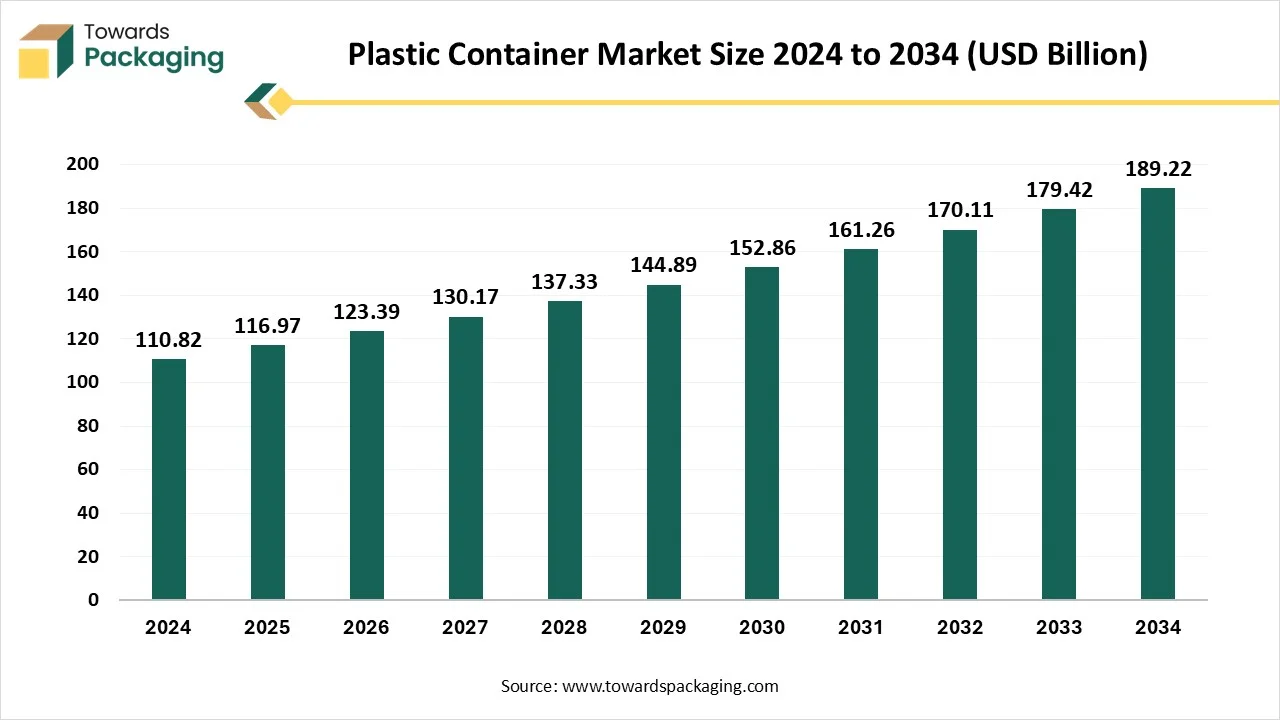

The plastic container market is forecasted to expand from USD 123.44 billion in 2026 to USD 200.54 billion by 2035, growing at a CAGR of 5.54% from 2026 to 2035. This report provides insights into material trends, including the dominance of PET in 2024 and the rising adoption of HDPE. We explore applications across beverages, cosmetics, and food, and present regional analysis covering North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The report also highlights competitive analysis, key players like Berry Global, AMCOR PLC, and Plastipak, and value chain dynamics shaping the industry.

Plastic containers are storage units that are created by using different types of polymers that come from crude oil or natural gas. These kinds of polymers are made from a range of complicated chemical procedures that transform raw petroleum into thermoplastics. Such materials are particularly engineered to be shaped, molded, and created into rigid, long-lasting transport, greatly durable, and storage boxes. Due to their growth during the Industrial Revolution, plastic containers have become essential components for industrial uses and logistics operations.

The manufacturing of plastic containers can change based on the essential specifications. Smaller-sized containers are generally made through the injection molding procedure, whereas larger, regular containers are usually produced by using rotational molding techniques. These high-level manufacturing methods enable the creation of a different array of plastic products, ranging from drink bottles to huge shipping containers. The invention of plastics was drawn late back to the late 1840s when Eduard Simon, a German scientist, first discovered polystyrene.

| Metric | Details |

| Market Size in 2025 | USD 116.96 Billion |

| Projected Market Size in 2035 | USD 200.54 Billion |

| CAGR (2025 - 2035) | 5.54% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Application and By Region |

| Top Key Players | Berry Global, AMCOR PLC, Plastipak, Time Technoplast Limited, ALPLA Group, Altium Packaging PLC. |

A complicated challenge in plastic recycling is the precision sorting of various plastic types. Regular methods are labor-intensive and frequently lead to adulterants, which reduces the quality of recycled plastics. Hence, AI-powered technologies have changed this procedure. Machine learning algorithms and high-level robotic systems can now examine and classify plastics depending on texture, colour, and even brand logos. As the ocean often gets highlighted, much of the plastic results in the water that comes from land-based sources.

AI is being utilized in projects that concentrate on removing plastics from terrestrial environments. It also reorganizes supply chains in the plastic industry, from forecasting the demand for recycled materials to updating transportation routes. AI makes sure that recycling operations are as effective and sustainable as possible. Also, it develops transparency in the supply chain, and it serves real-time data that assists companies in making updated decisions about their plastic use and waste management.

Smart, Strong, and Stackable: Strength of Plastic Containers in Modern Logistics

Plastic containers serve as responsible protection of products from mechanical damage and external elements, as they are opposed to UV and chemicals, moisture, lowering the risk of damage during transportation. Because of their stability and strength, plastic containers can be utilized to transport different types of cargo and food products. Large plastic containers and pallets are perfect for transporting goods in heavy volumes. Compact storage of plastic containers accelerates the procedure of return logistics. Plastic containers can tumble, as they can be molded or nested into one another, which specifically saves limited storage space or area in transport.

Global Threat of Plastic Pollution from Oceans to Urban Spaces

Plastic rubble pollutes the environment, posing a specific threat to life on land and in the oceans. From blocking the stomachs of marine animals to effects on air pollution and chemical contamination, the effects of plastic pollution are everywhere. Marine ecosystems are mostly linked to plastic pollution. Plastic debris is fastly accepted in oceans, meaning that plastic from worldwide is devastated coastal areas, which includes pillars of remote islands. As ocean plastic breaks down into microplastics, it penetrates food chains, poses further risks to marine life, and enters the human food chain. Around the globe, plastic is filling susceptible natural habitats in wetlands and forests, as well as causing health risks linked with urban spaces and neighborhoods living close to and working in unregulated dumpsites and landfills.

IML Technology Shaping the Future of Durable and Visually Appealing Plastic Packaging

In-mold labeling (IML) technology is changing the plastic packaging industry. It serves a range of advantages that make it a perfect choice for visually appealing and durable containers. As injection molding equipment becomes more automated, IML is gaining attention both internationally and residentially for its benefits. IML technology is not just about developing the look and feel of plastic IML containers; it's also aligning with the rising demand of consumers and producers. The visual look and sturdy elements of IML Containers make them ideal for a huge range of products, from food and beverage to cosmetics and household items. As the request for sustainable and high-quality packaging develops, IML is set to become the sector standard.

Polyethylene terephthalate (PET) is a kind of plastic material primarily used for producing food containers, beverage bottles, and other packaging materials. Because of its high mechanical power, process transparency, and potential to oppose impacts, PET is accurately one of the most commonly utilized packaging materials with a position in packaging liquids such as soft drinks, water, juice, and household cleaners. It is famous due to its lightweight durability and relatively low cost of production. It can be conveniently processed by injection molding and projection. It is usually extruded to generate films and sheets, which can be later thermoformed. Blow molding is usually used to generate transparent bottles.

It is the term being utilized to specify the petroleum-based thermoplastic polymer. It is influential as compared to its density and looks almost direct with small branching on the microscopic level. Further to this, deeply packed chains are created; therefore, it is one of the sturdiest polyethylenes without compromising height. Its characteristics, like the lightweight and strong properties of HDPE plastic, create its future value in eco-friendly patterns that can be easily recycled and reused for different uses. High-density polyethylene's high melting point and defective resistance make it future valued, for materials must resist physical tension and temperature variation. It will become even more utilized in adding opposition against chemicals and moisture as the polymer does not absorb these materials and reduces in aggressive environments.

The beverage market claims packaging that balances convenience, functionality, and sustainability as consumers find on-the-go, health-focused, and luxury drinking experiences. The growth of functional beverages, from gut-friendly kombuchas to protein shakes, requires high-level plastic packaging that protects active ingredients while making sure of modular elements. The demand for plastic bottles in the beverage industry remains rigid due to their convenience, cost-effectiveness, and reliability. The sustainability aim has paved the way towards more eco-friendly packaging solutions. Companies are heavily accepting recycled materials, such as rPET, and exploring alternative packaging options to reduce their environmental footprint.

High-density polyethylene (HDPE) is specifically famous because it is used for lotion bottles, shampoos, and even for bottling HDPE products. It serves perfect resistance and a good moisture barrier that makes it perfect for storing liquids like lotion and shampoo. Cosmetic jars, which are an important part of the industry, are also made of plastic. Cream jars, which are usually created to keep face creams, body creams, and other thick-consistent products, are made from plastic jars. Deodorant containers are also included. The regular deodorant stick containers are now being replaced by refillable deodorant containers, which are more environmentally friendly. These latest containers reduce waste and offer consumers more sustainable options.

Asia Pacific is a main worldwide producer and consumer of plastic packaging, specifically in the food industry. The fast economic growth and urbanization in Asian countries have led to a growing demand for packaged food products. Several Asian countries struggle with a lack of waste management structure, which results in heavy quantities of plastic waste that end up in landfills or leak into water bottles. Coastal groups in Asia are specifically sensitive to the effects of ocean pollution, as they totally depend on marine resources for livelihood and subsistence. Industries, Governments, and users should collaborate to lessen single-use plastics in food packaging. Inspire the usage of eco-friendly alternatives like biodegradable materials.

Quicker volume gains are expected for other plastic container classifications, such as cups, bowls, and tubs. Demand will be due to famous trends like ease, portion control benefits, and portability advantages of single-serving cup packaging, as well as favorable options for certain foods like hummus, yogurt, and single-cup coffee specifically packaged in cups and tubs. A response is expected for plastic bails based on new construction activity from lesser levels, which will grow demands in terms of adhesives, paints, driveway sealers, and other goods specifically packaged in pails.

Canada is growing as a complicated player in this growing landscape. With its huge natural resources, commitment to sustainable practices, and advanced level infrastructure, Canada is perfectly positioned to assist the rising global demand for plastic resin. It is well-positioned to highlight this growth. Alberta is specifically becoming a hub for plastic resin manufacturing, attracting investments because of its natural gas reserves and propane. These resources gave Canadian manufacturers a competitive edge in aligning with the worldwide demand for plastic resin. Canadian plastic resin manufacturers are implementing circular economy principles -concentrating on minimizing waste and growing resource efficiency to meet environmental standards and market demands.

Europe's plastic container growth is encouraged by the current trend in convenience packaging, the urge for lightweight and durable materials, and the constant acceptance of plastic packaging in different end-use industries, including food and beverages, personal care products, and pharmaceuticals. Various factors are investing in this upward sector growth. Primarily, the growing demand for plastic packaging for food and beverages, led by busy lifestyles and the demand for long shelf life products, is the main contributor. Furthermore, the cost-effectiveness of plastic materials, linked to their evergreen moulding opportunities.

Middle East and Africa demand for plastic containers is growing as users increasingly choose a path towards health-consciousness and sustainable products, and with growing regulations in the Middle East and Africa, professionals in Plastic packaging are sentiment to update. They are tracking materials, technologies, and patterns to meet the growing demands. Oxo-degradable plastics are on the rise. Countries in the Middle East and Africa, such as the UAE, Yemen, Saudi Arabia, Ghana and South Africa, and Togo, are not only marketing oxo-degradable plastics but some have even made their usage compulsory.

The Latin American plastic container industry has experienced constant development over the last years, fueled by growing user demand for durable, lightweight, and cost-effective packaging solutions across different industries. Plastic containers are evergreen packaging solutions utilised in industries like healthcare, food and beverage, personal care and cosmetics, as well as industrial uses. Their potential to protect product quality, with integrated inventions in terms of design and materials, has made them a select choice for users and producers alike.

It is being driven by elements such as the increasing importance of sustainability, development in plastic production technologies, and the growing popularity of easy packaging. The Latin America plastic container market is expected to experience significant development.

By Material

By Application

By Region

January 2026

January 2026

January 2026

January 2026