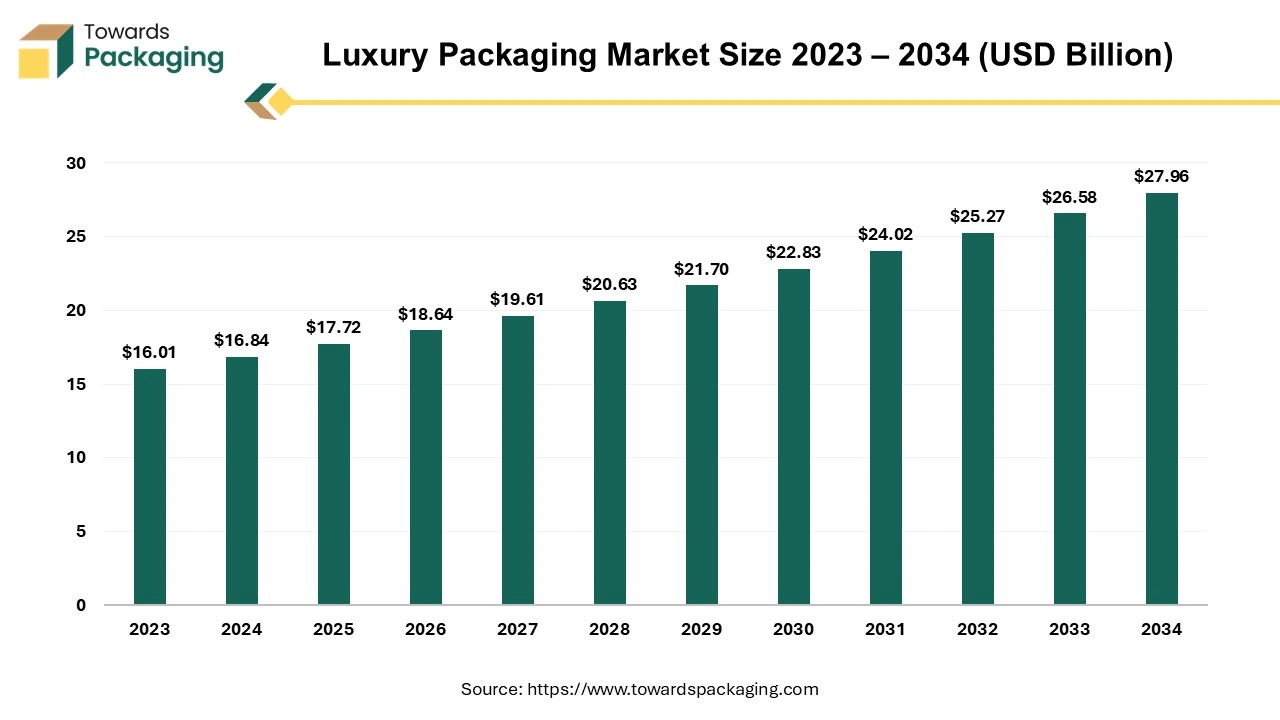

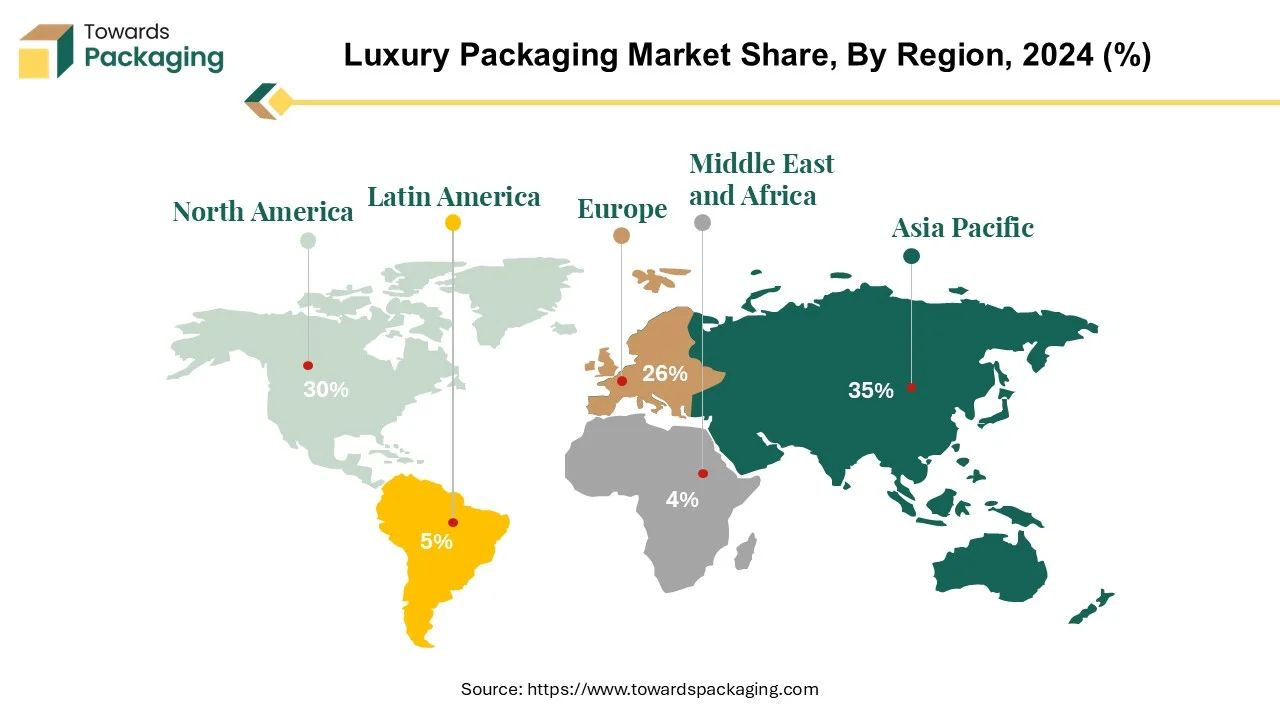

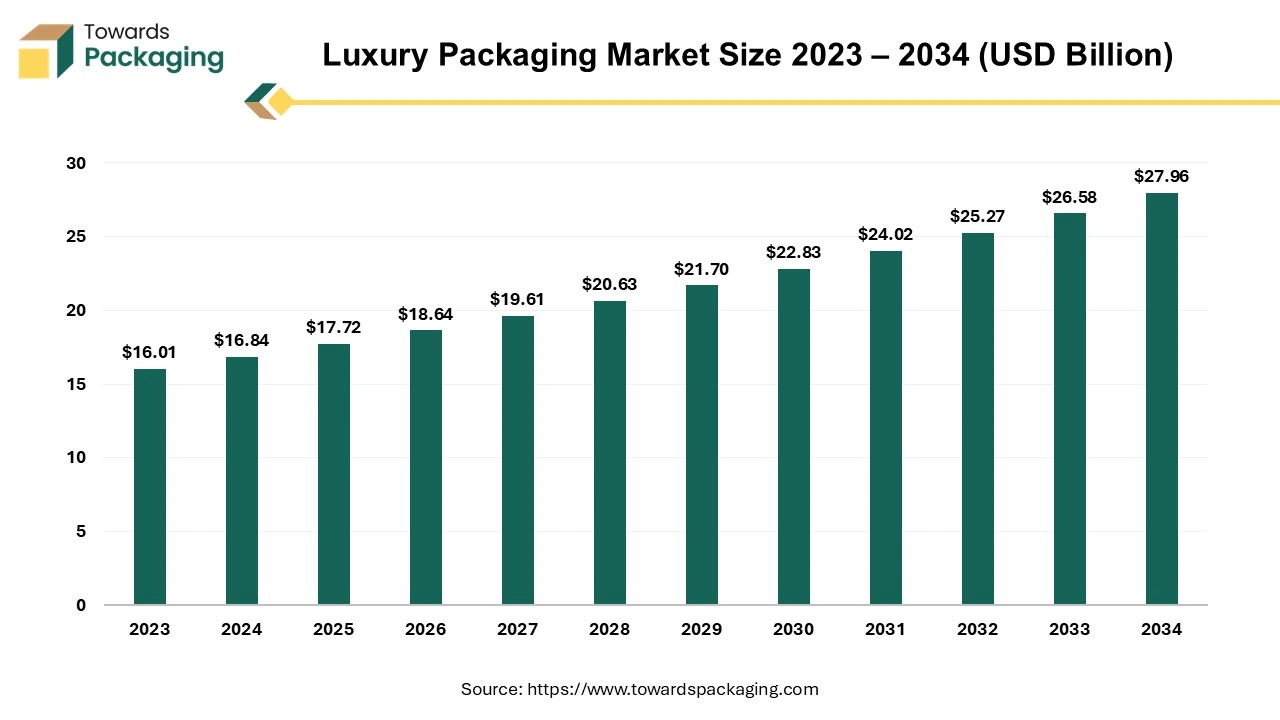

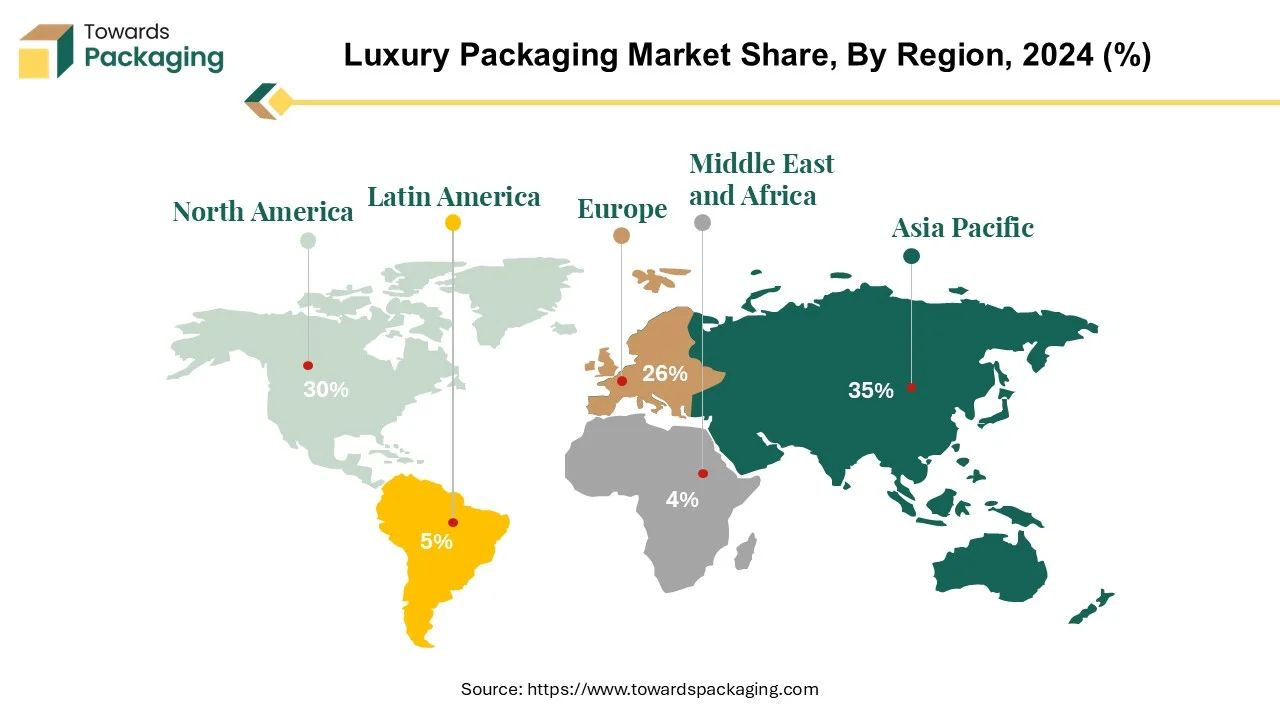

The luxury packaging market is forecasted to expand from USD 18.64 billion in 2026 to USD 29.41 billion by 2035, growing at a CAGR of 5.2% from 2026 to 2035. The market is deeply segmented by material (paperboard, plastic, glass, and metal), product type (bags, bottles, pouches, boxes), and end-use (cosmetics & fragrance, food & beverage, consumer goods). The analysis covers the regional market shares across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Key players in the market include Delta Global, WestRock Company, and DS Smith, among others.

Report Highlights: Important Revelations

- The Asia-Pacific region emerges as the focal point of growth in the luxury packaging sector.

- A shift in the luxury packaging landscape is evident in North America.

- Paper and board are gaining prominence in luxury packaging trends.

- Bags take the lead in the luxury packaging market.

- Premiumization is reshaping the packaging of luxury cosmetics and fragrances.

- Luxury brands are adopting sustainable packaging solutions.

The luxury packaging is a section of the packaging business focusing on luxury goods. This market is focused on developing packaging solutions that match and improve the premium nature of high-end products such as cosmetics, perfumes, jewellery, watches, and designer clothing. The luxury goods sector is changing significantly, with sustainability and digitalization emerging as crucial change drivers. What was once the domain of a small group of environmentally concerned innovators is becoming more common, with luxury brands embracing changes in customer tastes and regulatory needs.

Luxury brands are shifting their approach, including sustainability principles into long-term goals and leveraging digital technologies to improve consumer engagement and create immersive luxury shopping experiences. Luxury goods sales have skyrocketed, exceeding pre-pandemic levels and setting new records. In fiscal year 2022, the Top 100 luxury goods businesses reached composite sales of US$347 billion, a significant rise from the previous record of US$305 billion. Luxury goods sales of more than $5 billion accounted for roughly 70% of overall sales within this exclusive category.

The overall revenue for James Copper in the global luxury packaging business is expected to be £129.7 million by 2023. This amount comprises a capital expenditure of £5.8 million, which represents the company's investment in operations and expansion projects. Furthermore, James Copper has a 34% share of the luxury packaging market, indicating its enormous presence and influence in the business.

Prominent packaging providers can enhance the overall customer experience because they have access to various superior materials and distinctive designs. As a result, there is an increase in demand for luxury packaging solutions as firms focus more on design, production techniques, and overall product development. The market for luxury packaging is hugely competitive and highly fragmented, and we are seeing a rise in the number of new businesses entering quickly expanding sectors.

Packaging for products under luxury brands is considered luxury packaging. Packaging that is biodegradable and sustainable is a recent trend that is propelling the industry. By 2025, the luxury packaging market in Asia Pacific is expected to reach a valuation of over seven billion US dollars.

Leading suppliers are invading the global luxury packaging market, fuelled by the middle class's increasing income levels and the expansion of regional infrastructure. Due to this migration, there is more competition among regional and multinational businesses as they compete for market share. Because of this, there is intense competition across firms in the sector, forcing them to innovate and set themselves apart to win over customers' interest and loyalty.

For Instance,

- In August 2023, Robinson, the producer of value-added bespoke packaging, was selected to design the opulent packaging for the Aveda Parti Pris and More boxes.

Growth Factors

- Sustainability: The Worldwide push for net-zero emissions by the year 2050 is lobbying companies to rethink packaging goals. In several countries, strict government policies and carbon fees aimed at high-emission companies are paving the path for more sustainable inventions.

- PR Influence: Social media has transformed the aim of packaging. In which packaging needs to stand out in large crowds, unboxing videos on Instagram feeds or YouTube are gaining attention.

- Localization: Political and economic transformations are driving brands in which their packaging is manufactured. The United States can watch the growth in domestic production as the organization's goal is to impose tariffs on imports or redirect disruptions in worldwide supply chains.

Luxury Packaging Market Trends

- Personalized packaging experiences are gaining momentum in the luxury market because of their brand identity and appeal to their target consumer.

- Sustainability has become a popular trend in luxury packaging. Brands are progressively using recyclable materials.

- Luxury packaging is defined by its unique designs and high-grade materials.

- Luxury packaging is being enhanced with digital technology to increase consumer involvement and brand narrative.

Asia-Pacific Markets as the Epicentre of Growth in Luxury Packaging Market

Asia Pacific dominated the luxury packaging market in 2024. The market growth in the region is attributed to the increasing demand for sustainable packaging solution, increasing demand for premium products, increasing disposable incomes and increasing demand for premium products. China and India are dominating countries driving the market growth. The government has implemented various policies to inspire luxury packaging in India.

- For instance, The Confederation of Indian Industry (CII) - Paper Division Green Paper Initiative: To promote the use of recycled paper products used in luxury packaging, this initiative is a collaboration between various paper manufacturers and CII.

The Asia-Pacific region emerges as the global leader in luxury packaging, driven by rising disposable income and increased consumer expenditure on luxury goods. The high population expansion and widespread urbanization throughout the region justify this trend. These demographic transitions have promoted an urban lifestyle, resulting in changes in consumer preferences and increased demand for luxury products. Growth prospects for the region remain positive, albeit with more significant pressure and disruptive changes.

Even if the luxury packaging industry's growth in China and other Asian markets may be slowing down, these markets are still expected to remain the main drivers of the expansion. The fashion and cosmetics industries have witnessed a significant increase in product releases, driving market expansion. Environmental concerns have also made sustainable packaging solutions more popular. Notably, major worldwide brands are focusing increasingly on emerging economies, including China, realizing that the country is becoming the world's largest purchaser of luxury goods.

Asia-Pacific area is a dominant force in the luxury packaging market, emphasizing how important it is to meet discriminating customers' changing needs and tastes. Luxury brands in the region need to modify their approaches to effectively seize market prospects as the economy and urbanization continue to rise. Using the growing demand for luxury goods in emerging nations, in addition to adopting sustainable packaging techniques, is necessary to achieve this. By conforming to these patterns, businesses may set themselves up for long-term success and take advantage of the luxury packaging market's explosive growth in the Asia-Pacific region.

For Instance,

- In August 2023, Ferrero India launched a new bag packaging option to provide consumers with "premium yet affordable gifting" choices.

North America Luxury Packaging Market Trends

North America is expected to grow fastest during the forecast period. The market growth in the region is driven by the increasing use of sustainable packaging practices and materials, growing personal care and cosmetics industries and increasing demand for customized and premium packaging solutions. The U.S. is the fastest growing country contributed to propel the market growth.

North America is the second top region in the luxury packaging market, with around 54% of American customers aware of environmental programs such as the Sustainable Forestry Initiative. This expanding consumer awareness highlights the growing importance of sustainability in the luxury packaging industry. Top luxury companies in North America, including market titans like LVMH and Hermès, have released striking financial results for the year's first half. Revenue for LVMH increased by an astounding 15% to $46.5 billion, and revenue for Hermès increased by a significant 25% to $7.4 billion.

- In January 2021, The world's largest luxury products business, LVMH Moët Hennessy Louis Vuitton SE, declared that it had successfully acquired Tiffany & Co., a leading international luxury jeweler.

Similarly, Richemont saw a 19% increase in revenue during its first fiscal quarter, reaching $5.9 billion after accounting for constant exchange rates. These remarkable topline increases indicate the region's robust consumer demand and market need for premium goods.

For Instance,

The luxury packaging sector is transitioning significantly towards sustainability, consistent with broader consumer preferences and corporate social responsibility endeavors. Luxury firms prioritize sustainable packaging solutions to suit changing consumer needs as they become more aware of environmental issues. This emphasis on sustainability not only meets consumer expectations but also offers significant opportunities for expansion for the packaging industry overall. Leading luxury brands in the region have strong financial performances, highlighting North America's role as a significant participant in the luxury packaging market. Consumer awareness of sustainability is also vital. Sustainability is expected to stay at the forefront of industry evolution, spurring growth and innovation in the luxury packaging market.

For Instance,

- In June 2023, North America's Mondi, a global sustainable packaging and paper firm, announced the extension of its luxury packaging collection.

Luxury Packaging Market, DRO

Demand:

- Customers with high standards desire packaging that reflects the product's exclusivity and superior quality. Unique and complex designs and high-quality materials and finishes are in high demand for creating a unique unboxing experience.

Restrain:

- Luxury packaging frequently entails significant prices due to premium materials and elaborate design techniques.

Opportunity:

- Strategic collaborations can also help firms enter new markets, broaden their product offerings, and improve their brand positioning in the luxury segment.

Rise of Paper and Board in Luxury Packaging Trends

Paper and board have become popular in luxury packaging, providing a diverse canvas for elaborate graphics and intriguing ornamentation. These materials have unique qualities ideal for luxury products' premium nature. Laminations, one-of-a-kind coatings, and sophisticated embossing and debossing processes increase the visual appeal of luxury packaging, attracting discerning customers. Furthermore, paper and board packaging have incredible strength and a luxury tactile sensation, which improves the whole product experience. Paper and board are still the favored choices for luxury firms looking for packaging strategies prioritizing sustainability and innovation because of their adaptability, visual attractiveness, and green credentials.

Paper and board stand out for their capacity to give buyers the impression that the product is of higher quality, even though cardboard is one of the materials used in packaging more frequently than metal, glass, plastic, and wood. The European Paper Recycling Council (EPRC) reports that 2019 the percentage of paper recycled in Europe remained high at 72%. This accomplishment is attributable to the European paper industry's consistent use of paper for recycling (PfR).

For Instance,

- In June 2023, Global sustainable paper and packaging manufacturer Mondi disclosed its upscale "IQ GRASS+PACKAGING" line growth.

Paper has long been a common packaging material in the premium wine and spirits industry. Craft beer businesses also use paper labels to convey the exceptional quality or craftsmanship of their products. Brands may satisfy the changing needs of environmentally concerned consumers and raise the perceived worth of their products by using these materials in the packaging of luxury goods. The combination of strength, visual attractiveness, and environmental sustainability that paper and board provide is essential to luxury packaging. Premium companies may use these materials to develop packaging solutions that improve the product experience and meet customer expectations and sustainability targets as consumer preferences change.

For Instance,

- In February 2023, An American packaging company called Mill Rock Packaging purchased Keystone Paper & Box Company, a provider of upscale paperboard packaging.

Reign of Bags Leading the Luxury Packaging Market

Bags have recently gained popularity, with both men and women spotted carrying them practically everywhere, including schools, malls, businesses, and grocery stores. The fashion industry can be credited for some of this spike in popularity. Paper bags are a popular accessory since prominent clothing companies frequently design them with their emblem or brand name. Individuals who carry these bags gain recognition since they symbolize ownership of high-quality goods and add a touch of sophistication to their look. Printing a company's name or emblem on paper bags is a practical marketing approach that promotes brand awareness wherever the bag is handled. Furthermore, many individuals favour paper bags for their ease, cleanliness, and ability to hold many things.

Paper bags' positive effects on the environment are another reason for their rising popularity. Paper bags are 100% recyclable, biodegradable, and reusable, making them a more environmentally responsible option than plastic bags. Customers concerned about sustainability and lessening environmental impact are drawn to this environmentally-minded feature. Paper bags are also less harmful to animals than plastic bags, which makes them even more appealing to people who care about the environment.

Bags link with designer labels, convenience, and environmental benefits have contributed to their soaring popularity. Paper bags will continue to be a popular alternative for carrying goods and helping the environment as long as people prioritize sustainability and eco-friendly options.

For Instance,

- In January 2024, Louis Vuitton, a French brand, launched a sandwich-type bag made of cowhide leather.

Premiumization Reshaping Luxury Cosmetics and Fragrance Packaging

The cosmetics and fragrance sectors of the luxury packaging market have seen a significant transition, with a fundamental move towards premiumization. This trend, known as the "new lipstick effect," is powerful in the premium fragrance market. Premiumization highlights the growing demand for items that convey sophistication, luxury, and intricacy, as evidenced by the intricate and opulent packaging designs throughout the sector. The "new lipstick effect" trend has considerably impacted the global luxury business, with packaging impacting customer views and brand image. Brands are investing extensively in developing packaging that protects and maintains the product while serving as a tangible reflection of luxury and elegance. This emphasis on premium packaging reflects consumers' desire to have a wealthy and aspirational experience when purchasing luxury cosmetics and fragrances.

Luxury packaging in the cosmetics and fragrance industries has grown to include novel materials, complex details, and distinctive design aspects to engage consumers and differentiate businesses in a competitive market. Packaging has evolved from expensive glass bottles covered with ornate embellishments to sleek, minimalist designs expressing subtle luxury, serving as a significant differentiator and essential component of brand storytelling.

Richemont, Chow Tai Fook, and PVH, the three businesses whose fiscal years finish in Q1, experienced the largest increases in revenues in FY2022 (by 50%, 41%, and 33%, respectively), as the pandemic's effects subsided. Between 9% and 29% more sales were made by other Top 10 companies.

For Instance,

- In June 2022, Chanel launched N°1 de Chanel, a new line of eco-friendly cosmetic products made with up to 97% naturally sourced materials, including 76% from the camellia flower.

Between January 1 2022, and September 1 2023, the top luxury goods companies displayed heightened strategic activity compared to usual. This included significant acquisitions, product launches, and divestitures in sectors such as luxury beauty, watches, and retail, as well as the internalization of licensee operations. The table below summarizes the major deals during this period. Additionally, Tapestry is included as it has the potential to enter the Top 10 list in the fiscal year 2023/2024, pending approval of a relevant deal.

| Company |

Activity |

Deal Value |

Date Announced |

| Kering |

Launched Kering Beauté

Acquired Maui Jim eyewear

Acquired Creed luxury fragrance

Acquired Valentino (30% with 100% option)

|

Est €1.5 billion

Est €3.5 billion

€1.7 billion

|

Feb-23

Mar-22

Jun-23

Jul-23

|

| Richemont |

Sale of controlling interest in online luxury retailer YOOX NET-A-PORTER (Y).

Acquired Gianvito Rossi.

|

Est €3.4 billion

n/a

|

Aug-22

Jul-23

|

| Estee Launder |

Wound down Designer Fragrance Licensing Division.

Acquired TOM FORD brand.

|

n/a

US$2.8 billion

|

Jul-22

Nov-22

|

| L'Oreal |

Acquired AÄ“sop brand from Natura & Co. |

US$2.525 billion |

Apr-23 |

| PVH |

Will bring Calvin Klein and Tommy Hilfiger women’s North America wholesale business back in house by 2025-2027. |

n/a |

Nov-22 |

LVMH expanded its lead among the world's luxury goods corporations in FY2022, with personal luxury goods sales of approximately US$60 billion, up 22.6% yearly. Kering's net luxury goods sales surpassed €20 billion for the first time in fiscal year 2022, up 15.3%. Revenue. Richemont, situated in Switzerland, had the highest increase among the Top 10 firms in FY2022, with luxury goods brand sales increasing by 50.1%. The Estée Lauder Companies (ELC), a US-based cosmetics behemoth, increased its luxury goods sales by 9% in FY2022, with double-digit growth in the Americas and EMEA. Chanel Limited reported net sales growth of 10.1% in FY2022 (17.0% at constant currency exchange rates), with increasing sales volumes accounting for about half.

The shift towards premiumization in the cosmetics and fragrance sectors underscores the importance of packaging as a strategic tool for luxury brands to convey exclusivity, sophistication, and desirability to discerning consumers. As the demand for luxury experiences grows, packaging will remain critical in shaping brand identity and driving consumer engagement in these dynamic and evolving market segments.

For Instance,

- In January 2024, Constellium, an aluminium goods producer, offered a new sustainable packaging solution for Chanel's 'Le Volume' mascara range. Depending on the model, the container contains 10% to 20% PCR aluminium.

Luxury Brands Embrace Sustainable Packaging Solutions

Sustainable and biodegradable packaging has emerged as a key market driver in response to rising consumer awareness of environmental issues and a demand for more eco-friendly lifestyles. As a result, many organizations are increasingly prioritizing sustainability in their operations.

For instance,

- In July 2021, Giorgio Armani's creation of a sustainable makeup set attempts to raise consumer environmental awareness.

Consumers choose paper and cardboard packaging because of their ecological features, especially home compostability. Furthermore, these materials are viewed as the most recyclable, with 41% of consumers believing that the recycling rate in the United States is greater than 50%. Recycling rates for paper packaging are 73%, while cardboard packaging is 88%. This strategic commitment to sustainability is consistent with Estée Lauder's goals for sustainable packaging. By 2025, the company hopes to have 50% of its packaging made of post-consumer recycled (PCR) materials. Furthermore, Estée Lauder's collaboration with Origins highlights efforts to ensure that at least 80% of the brand's packaging, by weight, is recyclable, refillable, reused, recycled, or recoverable by 2023.

The transition to sustainable packaging is a more significant movement towards environmental awareness and responsibility in the consumer products industry. Companies understand the need to implement sustainable practices to meet consumer expectations while contributing positively to environmental conservation efforts.

For instance,

- In May 2023, La Bouche Rouge, a premium cosmetics brand that is plastic-free and refillable, introduced a line of five natural and upcycled perfumes aimed at the perfume market.

Competitive Landscape

The competitive landscape of the luxury packaging market is characterized by established industry leaders such as Delta Global, WestRock Company, DS Smith plc, Design Packaging Inc., Lucas Luxury Packaging, Prestige Packaging Industries, Luxpac Ltd., Keenpac, GPA Global, Ardagh Group, McLaren Packaging and Fleet Luxury Packaging. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences.

- Delta Global has also developed an inventive and eco-friendly packaging solution. Collaboration, which puts sustainability and innovation front and center, intends to uphold the businesses' shared commitment to ethical business practices and lessen the luxury industry's carbon footprint.

- In February 2023, a growing international luxury retail e-commerce sector drove Delta Global's aspirations to continue expanding in Asia-Pacific. Delta Global is the trusted leader in sustainable luxury packaging solutions.

- WestRock designs sophisticated and visually appealing packaging to increase the perceived value of premium products. The company's creative strategy combines aesthetic appeal with utility.

- DS Smith's unique packaging options include a variety of forms, colors, and materials that provide a premium feel and individual character to your products, ensuring they stand out. They capture the eye. We offer a variety of high-end printing and finishing processes.

The Global Reach of Luxury Brands

The market for luxury goods has expanded worldwide, with top brands increasing their presence in many countries. Most luxury goods come from major European brands, which make up about 70% of global sales. This shows their long history and strong influence.

Sales of luxury goods have grown in non-Western regions due to more wealthy urban consumers and a younger, Western-oriented population. Much of the global luxury goods market's growth is driven by China. Recent analysis suggests that without Chinese consumers, global luxury sales would have dropped by about 2% on average between 2012 and 2015.

Shopping for luxury items while traveling is becoming more popular, especially among the emerging middle class in China and other countries. Airport malls are a key location for this type of shopping. In 2016, shoppers at airport malls made up 6% of total worldwide luxury goods spending, up from 4% in 2015.

Recent Developments

- On 15 May 2025, Coat’s Footwear Lifestyle Solutions' profile served handbag brands and producers with limitless creativity and functionality when it comes to materials. It includes precisely engineered structural components, luxury and lifestyle filler materials, yarns, and threads, as this series includes inventive products that accurately fuse fashion, sustainability, and performance. (Source: Fibre2Fashion.)

- On 3 June 2025, Perfume Christian Dior officially collaborated with Axilone, which is a top production manufacturer in the luxury and prestige cosmetics industry, to reveal magnets created from 100% post-consumer recycled rare earths into its fragrance packaging. (Source: Premium Beauty News)

- On 27 May 2025, Bagzone Lifestyles Pvt Ltd disclosed the launch of Akiki London, the latest contemporary luxury handbag brand whose goal is current, prudent, and style-conscious women. This newest venture marks an important step for the company as it moves into the luxury segment. (Source: Franchiseindia.com Ltd)

- In May 2025, in partnership with Coty, Fashion brand Jil Sander launched its first luxury fragrance collection. The refillable bottle packaging in the collection is designed by Formafantasma Design Studio.

- In January 2025, a global leader in materials science and packaging solutions, Avery Dennison announced the launch of its Premium Labels range for luxury brands. The aim behind this announcement was to elevate consumer experiences through unique surface textures and patterns.

- In July 2024, Germaine de Capuccini, a luxury skincare brand launched refill and renew packaging. Product lines now feature a recyclable eco refill that can be placed inside the original product jar, to be replaced time and time again.

Luxury Packaging Market Top Players

Luxury Packaging Market Segments

By Material

- Paperboard

- Plastic

- Glass

- Metal

- Others

By Product Type

- Bags

- Bottle

- Pouches

- Boxes

- Others

By End Use

- Cosmetics & Fragrance

- Food & Beverage

- Consumer Goods

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA