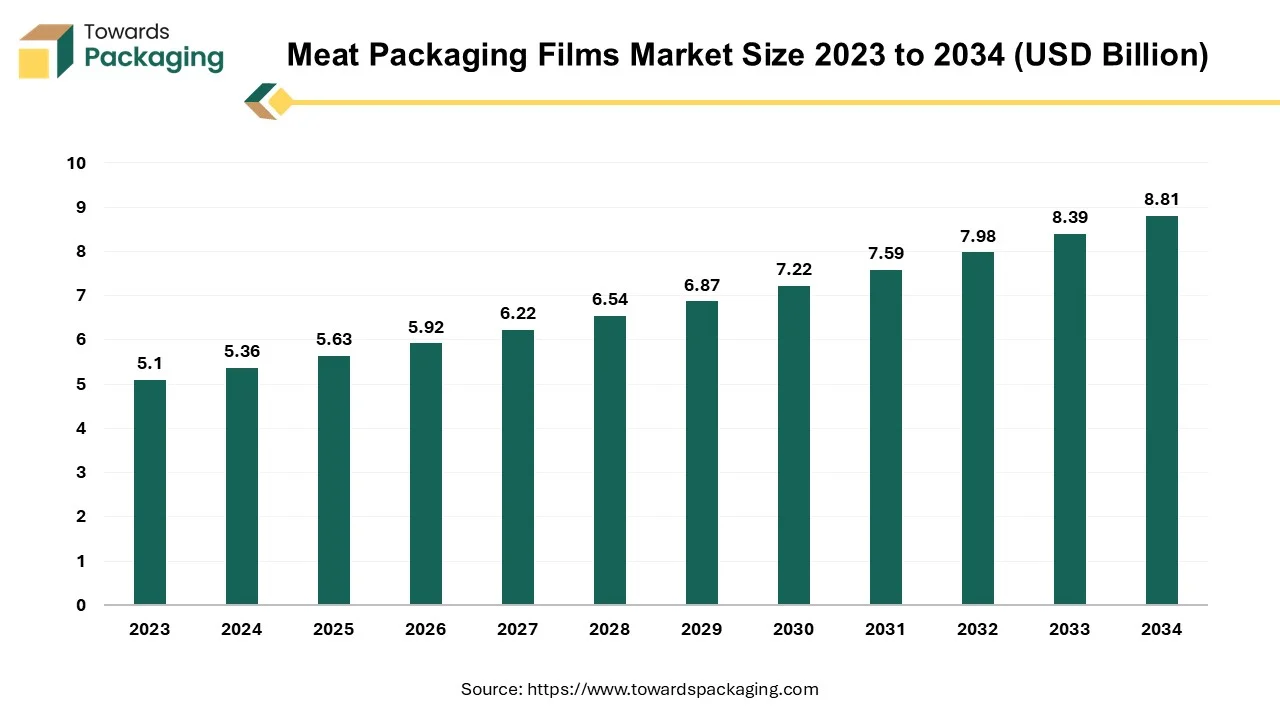

The meat packaging films market is forecasted to expand from USD 5.92 billion in 2026 to USD 9.26 billion by 2035, growing at a CAGR of 5.1% from 2026 to 2035. This comprehensive study covers segment data by material (PE, PP, BOPP, EVOP, others), meat type (beef, poultry, pork, seafood, etc.), and packaging technology (MAP, vacuum, thermoforming).

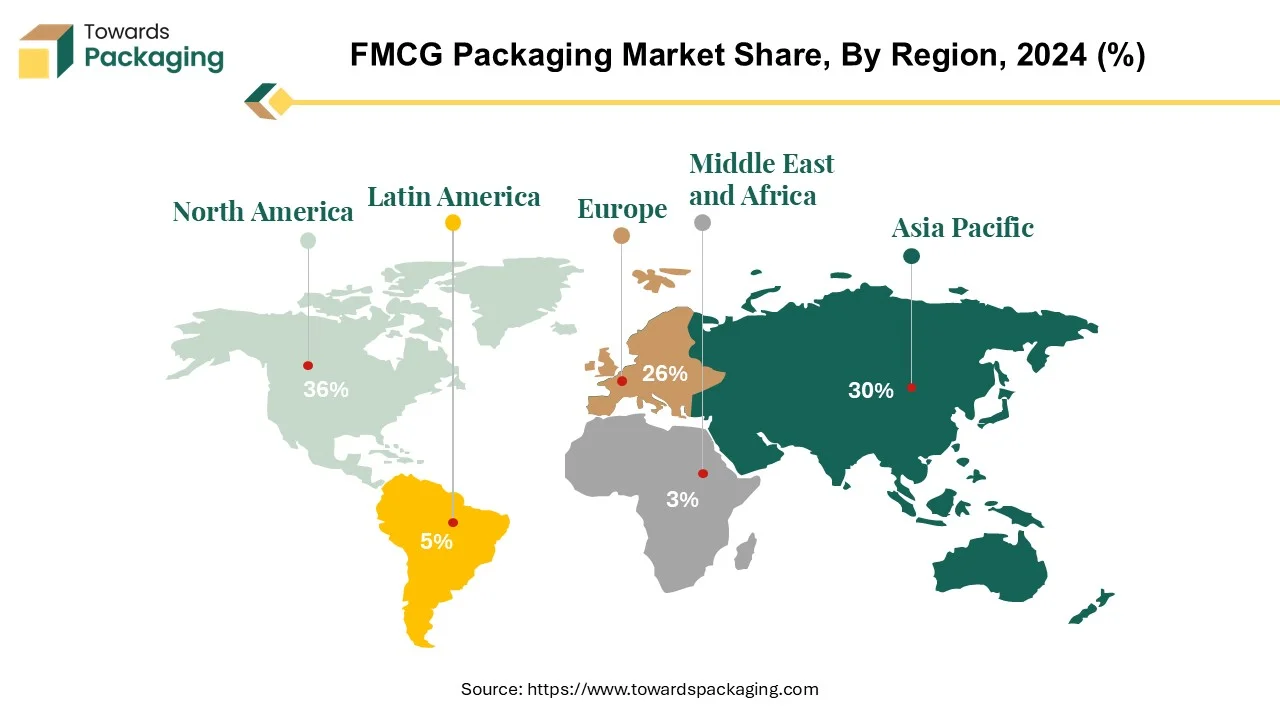

Regional insights span North America, Europe, Asia-Pacific, Latin America, and MEA, highlighting consumption trends and trade data. Competitive profiling includes global manufacturers such as Amcor, Dow Chemical, Berry Global, Coveris, and Sealed Air, along with analysis of their strategies, value-chain positioning, and supply-demand balance.

Meat packaging films are essential in preserving the meat's general functional qualities as well as its colour, flavour, aroma, and nutritional value. Materials like polyethylene, polypropylene, polyethylene terephthalate, polyvinyl chloride, polyamide, and ethylene vinyl alcohol are commonly used to create these films. Meat packing wrap film plays the significant role in the preservation of the freshness and quality of meat products while also permitting storage and handling convenience. Its features like good anti-fog and a mechanical strength make it a proper fit for various processes like automatic and manual packaging. Packaging design in meat industries, in which there is a wide volume and a sharp competition, has an important role in differentiating products and brands.

Despite the magnitude of the meat industry and its inherent competitiveness, some firms fail to understand the importance of packaging design, and they believe that product quality is good enough. However, this viewpoint is not all-inclusive, since packaging is vital in branding and consumer perception. Therefore, the packaging of meat will be more and more highlighted by the fact that it is lightweight, visually more attractive and practical.

| Majority Of Gen Z Unaware of How Meat Consumption Impacts Climate, 2022 (%) | |

| Coal/Fossil Fuel and Other Energy | 85.4% |

| Deforestation and Destruction of Biodiversity | 59.5% |

| Waste | 57.8% |

| Consumption and Lifestyle Practices | 55.3% |

| Transport | 55.0% |

| Big Corporation | 53.2% |

| Growing World Population | 44.8% |

| Livestock and Agriculture | 39.0% |

| Fast Fashion | 22.2% |

| Political Inaction | 19.3% |

| Sun | 8.0% |

Many individuals in Generation Z are not fully aware of the connection between meat consumption and its impact on climate change, particularly in relation to meat packaging. Packaging design of meat products is an ever-changing field within which companies are always trying to find a balance between that which preserves the product and that which improves its marketing. This progress is characterized by a use of new materials, printing methods, and structural engineering in order to keep up with the changing behaviour of shoppers and retailers.

Manufacturing and packaging facilities, meat wrap films have uses in retail space including in supermarkets and deli counters. These films are specified taking into consideration standard sizes and thicknesses, offering solutions for particular perishable food applications. Due to their versatility, implementation becomes possible at all stages of meat manufacturing process, from slaughterhouses to grocery stores.

The purpose of meat packaging wrap film is not only functional but also a tactic in the industry that helps to construct brand identity, attract consumers and to maintain product quality. It is a manifestation of the adaptability of the meat industry and the ongoing process of companies oriented toward better competition and meeting consumers' demands.

North America and especially, the United States take up the leading position in the growth of meat packaging films which are driven by the high consumption of meat products combined with constantly changing consumer preferences. According to the FAO of the United Nations, the US is among the leading meat-consuming countries in the world with an average consumption per person amounting to 224.6 pounds each year. Thus, a big chunk of the industry requires using packaging materials that inhibit the loss of quality and freshness.

Chicken, beef, pork, and turkey account for the demand for meat packaging films as they are the most commonly preferred meat by Americans. One of the major products is chicken which accounts for a significant share of the meat consumed in the country. Hence, a particular packaging film is required, which possesses specific features like anti-fog properties for visual and freshness maintenance.

Brazil and the USA are the top leading exporters of meat globally. Though meat consumption is dominant in the United States according to other North American countries like Canada and Mexico as well, this too plays a role in supply and demand regarding meat packaging films. These states have their own meat processing sectors and consumer markets, and thus, the market of meat packaging films shall also grow.

The consumption pattern of traditional meat, the changing tastes with regards to diet, and lifestyle decisions impacts the demand for customized packing solutions. With consumers more aware of food safety and sustainability, packaging materials that are environmentally friendly and ensure extended shelf life are getting more and more attention. The meat-eating preference of North America and the following changes in consumer tastes and regulations complement each other in fostering the expansion and development of the meat packaging film market.

Asia-Pacific is a prime growth area for the meat packaging films market because of its large population, the continuing urbanization, and increasing disposable incomes of people. Countries such as China, Japan, India and South Korea, which are now growing quickly economically and experiencing higher levels of urbanization, are seeing changes in their people's dietary patterns and food consumption habits.

| Top Exported Products to China, 2024 (Kg, USD) | |

| Product | Bovine Meat/Frozen |

| Volume | 367,397,964 Kg |

| Value | 2,445,688,482 USD |

China consumes large amount of beef or bovine meat. In China, the expanding middle class and urbanization have resulted in increased demand for processed meat products, thus, the need for innovative and effective meat packaging alternatives. One million metric tons in that were produced in that year by 11 countries in that region. As a result, poultry meat will account for almost half of the total meat consumption in Asia by the year 2031. On the other hand, India which is a country with relatively low consumption of the meat is now experiencing a rise in demand for packaged meat products due to change in lifestyles and dietary preferences thus contributing to the growth of the meat packaging films market.

Along with the growing concern of food safety and hygiene in the area, there is a trend for the packaging materials which enable keeping meat products fresh and of good quality. This observation is particularly visible in countries such as Japan and South Korea where people consider food safety and quality as paramount factors.

Retail infrastructure development in the form of supermarkets and hypermarkets, which also further drives the demand for meat packaging films because packaged meat products gain popularity among urban consumers seeking convenience and quality assurance. In fact, for the meat packaging films market in the Asia Pacific countries, there are large opportunities due to demographic, economic, and cultural factors.

Polyethylene (PE) is a key feature of the meat packaging industry. It is cheap, easy-to-use and widely used. Such as LDPE (Low-Density Polyethylene), HDPE (High-Density Polyethylene) or LLDPE (Linear Low-Density Polyethylene) PE offers the widest possible range of materials designed to satisfy various packaging needs.

LDPE, which known to be for its flexibility and transparency, is widely applied in the meat packaging films where the product showing and visibility is critical. It’s a perfect choice for wrapping meats and deli products because of its pliability and ability to provide great moisture protection. HDPE has high tensile strength and puncture resistance as well and thus can be used for packaging heavier meats or those that have sharper edges, such as frozen goods and bone-in cuts.

LLDPE is a blend that unites the best properties of both LDPE and HDPE such as extra strength, flexibility, and punctuality. This is acceptable to a variety of meat packaging applications from vacuum packed clear films to stand-up pouches.

The PE films that are commonly used in the meat packaging industry offer an impenetrable shield to moisture, oxygen and microbial contaminants, preserving the quality and freshness of the meat while adding to the convenience of handling. Furthermore, low cost of PE ensures it as first selection for manufacturers who are looking for the best combination of production costs and packing efficiency. Through the Property of polyethylene materials, the meat packaging industry offers the combination of function, cost-effectiveness, and easy to use.

The global shares of various meat products reveal significant consumption patterns the beef has a 20%, pork has 34%, and mutton has 5%. Americans eat 57 pounds of beef on average per person each year. Nevertheless, the sustainable nature of beef is becoming better known to the public. According to studies, it is possible to solve the climate change problem with the beef consumption in the western countries decreasing by about 90%.

There is a debate on whether the demand for meat is sustainable or not based on its nutritive value as a top source of protein. While beef, particularly, presents certain difficulties due to its short lifespan of 3-5 days in refrigerating it. This is responsible for a huge amount of meat loss and waste, with the Food and Agriculture organization (FAO) estimating that a whopping 17-20% of meat that is globally produced is lost or wasted.

| Production and Consumption of Chicken Meat (In Metric Tons) | |||

| Region | Production | Consumption | Overproduction |

| Brazil | 14,466 | 10,024 | 4,443 |

| USA | 20,993 | 17,675 | 3,319 |

| Europe | 10,971 | 9,960 | 1,012 |

| Thailand | 3,301 | 2,310 | 992 |

Demand for chicken meat promotes innovations in packaging for convenience and freshness. Because of its limited shelf life, beef needs sturdy packaging. Both have an effect on local packaging methods. To rectify this problem different package types have been created in order to minimize the wastage and to prolong the life time of meat products. There has been high demand for beef packaging films as a result of the alarm situation created by the short shelf life of beef together with the growing consumption levels. These movies not only play a critical part in keeping beef top-quality and fresh but also lower the number of beef wasted, thus improving the sustainability in the beef industry.

Modified Atmosphere Packaging (MAP) is a method common in the meat packaging industry to lengthen the aging of meat products by changing the mixture composition of the environment within the packaging. This method includes substituting the air in the package with a mixture of gases like nitrogen, carbon dioxide, and oxygen, which has been tuned to slow down microbial growth and obstruct microbial and oxidative processes.

The MAP gas composition composition is a key element that determines the mining of spoilage microorganisms and thereby controls the color and texture of the meat. For instance, reducing the amount of oxygen delays aerobic rancidity and maintains fresh meats' color, while elevating the level of carbon di oxide blocks the growth of aerobic bacteria.

MAP is one of the broadest meat packaging practices, which is used for fresh cuts, processed meats, and pre-cooked items. Extending the shelf life of perishable meats and reducing food waste are the main advantages of cryopreservation. Moreover, it can support the production of fresher and quality products that the modern consumer craves.

The global market for MAP in meat packaging is an extremely rapidly growing market and is being fueled by factors including the growth of demand for convenience foods, awareness of quality and safety food as well as the expansion of retail chains and supermarkets. Due to increasing demands of consumers for longer shelf life and easy to use meat products, the implementation of MAP technology is estimated to increase even further, providing MAP manufacturer and supplier of meat films with development opportunities.

The competitive landscape of the meat packaging films market is dominated by established industry giants such as Dow Chemical Company, Amcor Limited, Berry Plastics Group, Inc., Coveris Holdings SA, Bemis Company, Inc., Graphic Packaging Holding Company, Sealed Air Corporation, AEP Industries Inc., Charter NEX Films Inc., Taghleef Industries Group, Hilex Poly Co LLC, RKW SE, Wipak OY, DuPont Teijin Films, Jindal Poly Films Ltd., and Innovia Films Ltd. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Dow Chemical Company focuses on innovation and technology to develop advanced packaging solutions that offer improved shelf life and sustainability. They prioritize research and development to stay ahead in the market.

Amcor Limited known for its global presence and extensive portfolio of packaging solutions. They emphasize customer-centric strategies, providing tailored solutions to meet specific market needs and preferences.

Berry Plastics Group, Inc Concentrates on diversification and expansion, acquiring complementary businesses to strengthen its position in the meat packaging films market. They aim to offer a comprehensive range of packaging options to cater to diverse customer requirements.

Coveris Holdings SA, Inc. Strives for differentiation through product quality and performance. They focus on enhancing their manufacturing capabilities and operational efficiency to deliver high-quality packaging solutions that meet stringent industry standards.

By Material

By Meat

By Packaging Technology

By Region

February 2026

February 2026

February 2026

February 2026