Oxygen Barrier Nutraceutical Packaging Market Growth, Emerging Trends, Regional Breakdown (NA, EU, APAC, LA, MEA), and Supplier Ecosystem Analysis

The oxygen barrier nutraceutical packaging market covers detailed insights on global market size, growth forecasts, and emerging trends shaping the industry from 2024-2035. The study includes a complete segmentation analysis by material, packaging format, application, and distribution channel, along with a granular regional assessment across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It also provides an in-depth competitive analysis of leading companies like Amcor, Berry Global, Mondi, Glenroy, and Constantia Flexibles. The report further includes value chain analysis, raw material sourcing, manufacturing landscape, supplier profiling, trade data, import–export statistics, pricing assessment, and detailed market drivers, restraints, and opportunities supported with all relevant numerical and statistical data.

The oxygen barrier nutraceutical packaging industry is likely to witness gradual yet steady growth during the analysis period. Oxygen barrier nutraceutical packaging is designed to protect nutraceutical products such as dietary supplements, functional foods, and herbal formulations—from the harmful effects of the oxygen exposure. These materials are engineered with high-barrier properties that considerably limit the oxygen permeability, thereby preventing oxidation that can degrade the active ingredients, reduce potency, as well as shorten the shelf life. Common materials used consist of ethylene vinyl alcohol (EVOH), polyvinylidene chloride (PVDC), and multilayer laminates. Through maintaining the product's stability, efficacy and safety over time, oxygen barrier packaging is helping in preserving the quality of the health supplements and meeting both consumer expectations and regulatory standards.

The rising global demand for nutraceuticals due to the increasing health awareness and preventive healthcare trends is anticipated to augment the growth of the oxygen barrier nutraceutical packaging market during the forecast period. Furthermore, the growing concerns over the product shelf life and quality along with the expansion of the e-commerce and direct-to-consumer delivery models are also expected to support the growth of the market. Additionally, the innovations in the packaging materials such as multilayer films and active barrier technologies as well as the shift toward clean-label and natural products coupled with the innovations in the automation and induction sealing equipment along with the regulatory requirements for labeling, safety and product consistency is also projected to contribute to the growth of the market in the near future.

Key Metrics and Overview

| Metric |

Details |

| Leading Region |

North America |

| Market Segmentation |

By Material, By Packaging Format, By Application, By Distribution Channel and By Region |

| Top Key Players |

Amcor plc, Berry Global, Glenroy, Constantia Flexibles, Mondi Group, Sealed Air |

| Growth Drivers |

Rising health awareness, preventive healthcare trends, expansion of e-commerce & D2C, innovation in materials and packaging tech |

Key Trends and Findings:

- Flexible and convenient packaging formats are emerging as a major trend in the packaging industry. Resealable pouches, single-serve sachets, as well as other flexible options are increasingly favored for their portability, ease of use and space efficiency. These formats go with the modern on-the-go consumer lifestyles and the rise of e-commerce through providing practical choices for storage and transportation. Their user-friendly design improves the consumer experience and at the same time helps in maintaining the product integrity, making them a preferred choice among the manufacturers and end-users alike.

- Premium and aesthetic designs is another considerable trend in the market as brands are looking forward to stand out in a competitive landscape. Through incorporating visually appealing elements, premium finishes, along with the innovative packaging designs, companies aim to capture the consumer attention and elevate the perceived value of their products. This trend supports the brand differentiation and also augments the consumer trust and loyalty, since the attractive packaging mostly indicates quality as well as strengthens the brand's commitment to excellence.

- Active packaging technologies are also becoming a prominent trend in the nutraceutical packaging. This approach goes beyond the traditional passive packaging, integrating oxygen scavengers, moisture absorbers as well as antimicrobial agents directly into the materials. Utilizing the actively preserving product quality, specifically in the sensitive nutraceuticals like probiotics and omega-3 supplements, this trend guarantees longer shelf life with maintained potency. As the market demands effective preservation options, active packaging is steadily gaining traction for its ability to deliver superior product stability and consumer trust.

- North America held considerable market share in 2024. This is due to the increasing demand for the health supplements and stringent regulatory standards coupled with the growing focus on the wellness, preventive healthcare and advanced packaging technologies.

- Asia-Pacific is expected to grow at a fastest CAGR owing to the rising health awareness, increasing disposable incomes, and the growing consumption of the nutraceuticals in countries like India, China and Japan.

Market Drivers:

Growing Health Consciousness:

The increasing awareness about health and wellness owing to the rising lifestyle-related health issues with rise in the chronic conditions is anticipated to support the growth of the oxygen barrier nutraceutical packaging market during the estimated timeframe. In recent years, there has been a shift toward wellness and preventive healthcare, with consumers looking for different dietary supplements, functional foods, and natural remedies to maintain their well-being. The global economy is now substantially influenced by wellness. The market for the global wellness economy is currently bigger than that of other important sectors such as sports, IT, and pharmaceuticals.

Additionally, there is an increasing prioritization of preventive healthcare at a national and regional level. As per the data by the Eurostat, the EU Member States spent €95.3 billion on preventive healthcare in 2021 reflects a broader shift toward promoting wellness and reducing the burden of the chronic diseases. This growing investment supports the rising demand for nutraceuticals thereby contributing to the growing need for packaging. This expenditure also indicates the importance of health for the consumers influencing related markets such as nutraceuticals and their packaging.

Furthermore, according to the Global Wellness Institute, the global wellness economy reached $6.3 trillion in 2023, with a growth of over 25% since 2019. This illustrates a substantial and ongoing shift in the consumer behavior toward healthier living. Also, the rapid growth of the brain-boosting nutraceuticals as well as botanicals, which is the second-largest segment of the mental wellness market, reached $84 billion. This shows how the health-conscious consumers are progressively investing in the targeted supplements to improve their well-being. Such rapid growth in the nutraceutical categories increases the need for effective packaging.

Market Restraints:

Environmental Concerns over Non-Recyclable Materials:

The environmental concerns over the non-recyclable materials are likely to hamper the growth of the oxygen barrier nutraceutical packaging market during the forecast period. Many high-barrier packaging options are composed of multi-layered laminates made-up of combinations of plastic, aluminum and synthetic polymers. While these materials provide protection against oxygen, moisture, as well as light, they are difficult and sometimes impossible to recycle due to their mixed composition. This creates challenges in the end-of-life disposal and adds to the growing global issue of the packaging waste.

With consumers becoming environmentally conscious, demand is rising for the packaging that performs well and also aligns with the green values. As per the recent Sustainable Packaging Consumer Report by Shorr, in the past six months, over half of the Gen Z (which is 56%) and Millennials (59%) made mindful purchases of products packaged sustainably. Also, over one-third (that is 39%) of the customers have moved to rival companies due to their eco-friendly packaging. This puts pressure on the nutraceutical brands to adopt eco-friendly packaging, even if it means compromising slightly on the barrier performance or shelf life.

Additionally, the regulatory frameworks are increasing. The EU Green Deal and Extended Producer Responsibility (EPR) schemes in countries like Canada and Germany now hold companies accountable for the environmental impact of their packaging. This adds an additional compliance burden for the brands utilizing non-recyclable barrier materials. As a result, while these materials deliver important functional benefits, their environmental footprint considerably limits their widespread adoption in a market increasingly shaped by sustainability goals.

Market Opportunities:

Expansion of E-commerce and Direct-to-Consumer (D2C) Channels:

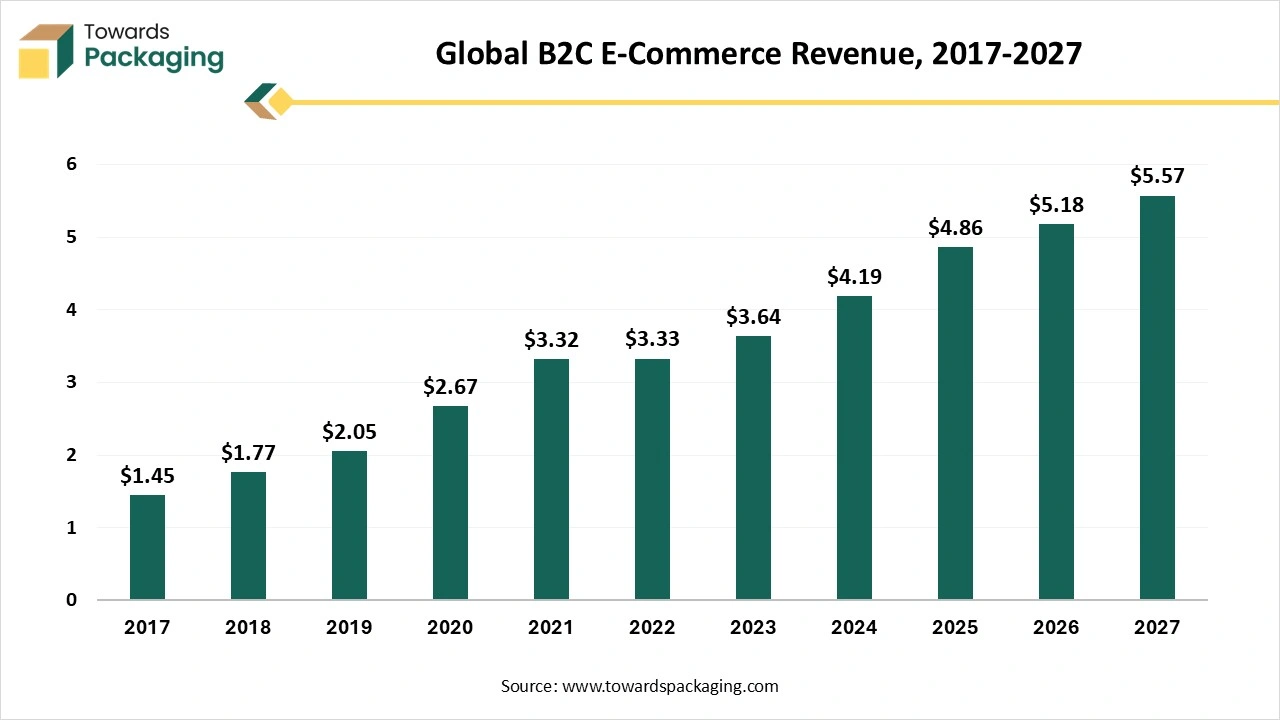

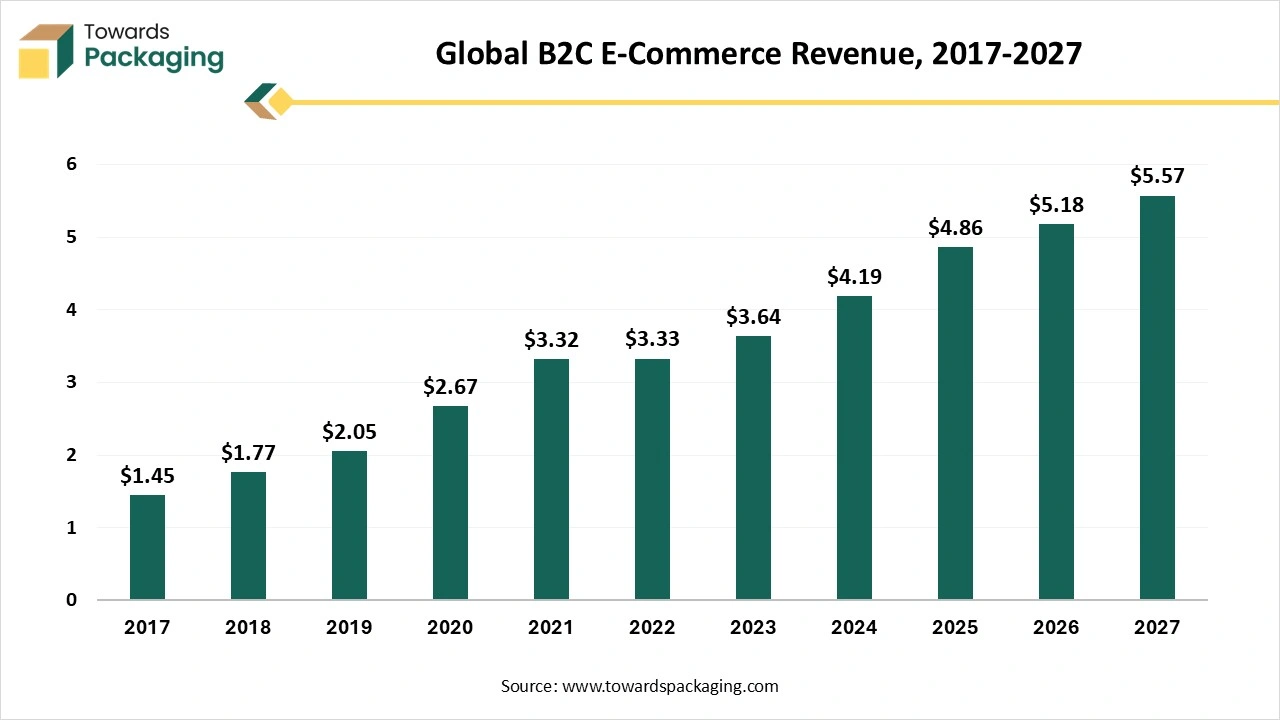

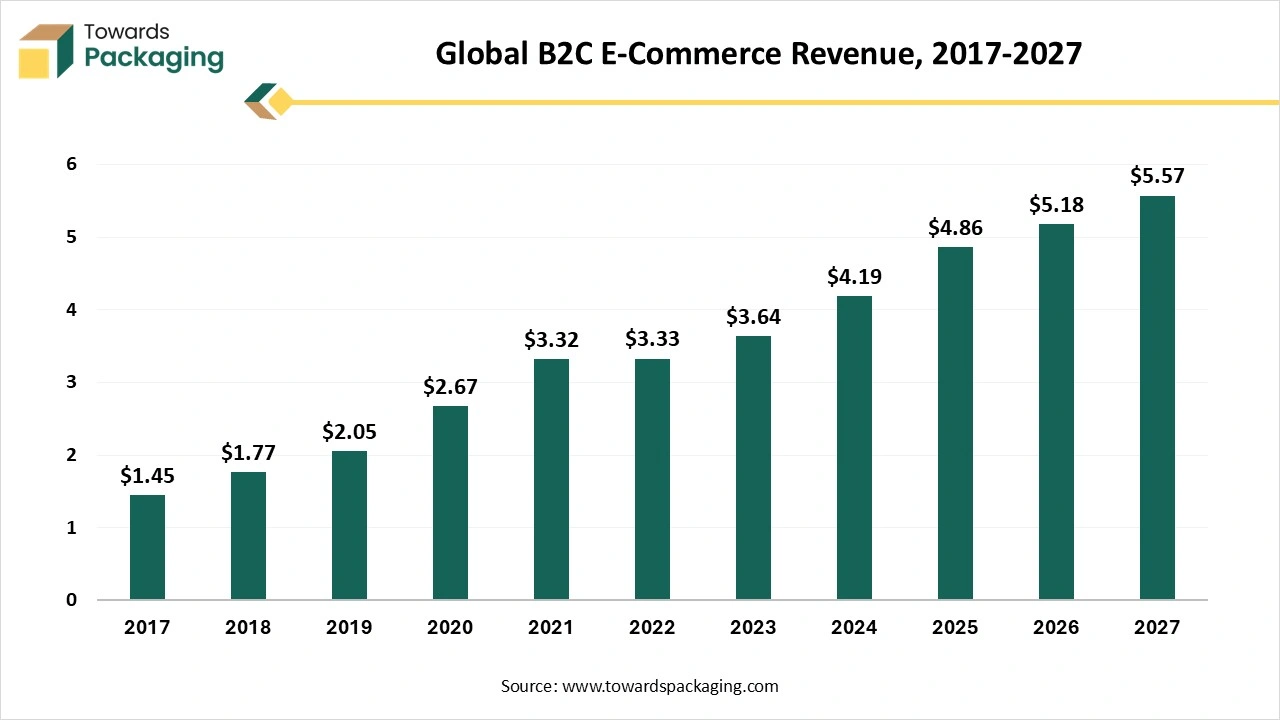

The growth of the e-commerce and D2C brands in the nutraceutical space due to the shifting consumer preferences toward convenience and digital engagement is expected to create growth opportunities for the global oxygen barrier nutraceutical packaging market in the near future. As consumers turn to the online platforms to purchase health supplements, the demand for the packaging that guarantees product safety throughout the supply chain has surged. According to the data by the International Trade Administration, U.S. Department of Commerce, the B2C ecommerce sales at a global level is likely to reach USD$5.5 trillion by 2027 at a compound annual growth rate of 14.4%. Similarly, as per Eurostat, the e-sales in EU increased to 23.83% in 2023 from 17.21% in 2013. This illustrates the increasing reliance on the digital platforms for various product purchases.

Unlike the traditional retail, e-commerce and D2C models involve longer transit times, exposure to the fluctuating environmental conditions, as well as minimal control over the storage environments. This makes oxygen barrier packaging essential, specifically for the sensitive nutraceuticals that are likely to degrade when exposed to oxygen, heat, and moisture. High-barrier films, vacuum-sealed pouches, and blister packs are increasingly being adopted to make sure that the products remain effective and safe until they reach the end user.

Furthermore, the rising popularity of the subscription-based wellness boxes and personalized nutrition services also intensifies the need for the tamper-evident protective packaging. Oxygen barrier options not only meet these requirements but also add value through guaranteeing product integrity in a competitive digital market, creating a strong opportunity for the market expansion.

Artificial Intelligence (AI) Impact on the Market:

In a market where product efficacy centres on the protection from oxygen exposure, artificial intelligence is likely to emerge as a silent architect of transformation in the oxygen barrier nutraceutical packaging industry. AI is redefining how packaging is conceptualized, manufactured and optimized, bringing intelligence to every layer of the supply chain. From predicting shelf life based on the real-time environmental data to automating precision in the barrier material production, AI is infusing agility, accuracy, as well as sustainability into the packaging choices that are designed for the wellness economy.

Machine learning models can simulate various oxygen barrier materials behaviour under different conditions, helping brands to select the most effective configurations for the sensitive nutraceuticals. Advanced vision systems that are based on the AI are modernizing quality control, identifying microscopic flaws in seals or film coatings in real time significantly reducing the risk of contamination. Meanwhile, AI based robotics and automation are streamlining the packaging processes, increasing the efficiency without compromising the precision.

On the innovation front, AI supports the shift toward sustainability through identifying the optimal material combinations that maintain barrier strength and reduce the carbon footprint. As nutraceuticals gain prominence in the D2C and e-commerce space, AI guarantees that packaging is protective and at the same time it is smart as well as strategically matches with the evolving market demands.

Key Segment Analysis:

Packaging Format Segment Analysis Preview

The bottle & jar segment held largest share in the year 2024. This is due to their ability to shield contents from the external factors. Their reliable shape guarantees longevity while reducing the risk of breakage and contamination during transportation and storage, making them perfect for retail and e-commerce distribution. Consumers also opt for bottles and jars for their convenience—they are easy to open, resealable and helps with precise dosage control. Additionally, these formats provide ample space for labeling, branding and other important information, which is important in the health-related products. Glass bottles normally appeal to the premium brands that are in search of a clean sustainable image. With the growing demand for visual appeal, bottles and jars continue to dominate the nutraceutical packaging landscape.

Distribution Channel Segment Analysis Preview

The online segment is expected to grow at a substantial CAGR during the forecast period. This is due to the widespread availability of the high-speed internet and smartphones that has made it easier for the consumers to access online platforms anytime, anywhere. Furthermore, the changing consumer preferences toward convenience, personalized experiences, as well as contactless transactions are also likely to support the growth of the segment in the global market. Additionally, the growth of the e-commerce platforms and digital marketplaces as well as the global reach of the online distribution is expected to contribute to the segmental growth of the market during the forecast period.

Regional Insights:

North America held considerable market share in the year 2024. This is due to the strong focus on the preventive healthcare and wellness as well as growing consumers’ willingness to pay for the premium packaging in the U.S. and Canada. Furthermore, the growing aging population is likely to contribute to the growth of the region in the global market. According to the U.S. Census Bureau, by 2050, there will be 82 million Americans aged 65 and over, up 47% from the 58 million that were in 2022. Additionally, the proportion of the population that is 65 and older is expected to increase from 17% to 23%. Additionally, the presence of major manufacturers in the region along with the mature online retail ecosystem and the stringent regulatory standards is also expected to support the regional growth of the market.

Asia Pacific is likely to grow at a fastest CAGR during the forecast period. This is due to the economic growth and rising disposable income in the region. Additionally, the growing e-commerce sales owing to the rapid digital adoption and smartphone penetration are also expected to contribute to the regional growth of the market. According to the Statistics Korea, in March 2025, the value of online transactions reached 22.4163 trillion won, a 2.6% increase over March 2024. Also, the value of mobile retail transactions reached 17.2435 trillion won, a 4.8% increase over March 2024. Furthermore, the rising nutraceutical production and exports along with the urbanization and lifestyle shifts is likely to contribute to the regional growth of the market.

Recent Developments by Key Market Players:

- In April 2025, TCI Biotech (TCI Co., Ltd.) declared the launch of its full US-based glass bottling solution for liquid supplements, presenting it as an essential part of its expanded CDMO+ offerings. TCI's glass bottling infrastructure, which is intended for nutraceutical and wellness brands looking for high-end, environmentally friendly, and scalable solutions, demonstrates the company's dedication to providing excellence throughout the whole product lifecycle.

- In October 2024, Berry Global introduced a line of healthcare-use clarified polypropylene (PP) bottles that are more sustainable and provide better product protection than conventional colored PET pill bottles. When paired with Berry's PP closures, the new ClariPPil bottle has earned a RecyClass A certification for its recyclability in nations with the necessary recycling infrastructure in place, making it perfect for a wide range of products such as nutraceuticals, vitamins, beauty supplements, dietary supplements and over-the-counter treatments.

Oxygen Barrier Nutraceutical Packaging Market Key Players:

Oxygen Barrier Nutraceutical Packaging Market Segments

By Material

- Plastic

- Aluminum Foils

- Glass

- Paper & Paperboard

- Others

By Packaging Format

- Bottles & Jars

- Blister Packs

- Pouches & Sachets

- Stick Packs

- Others

By Application

- Dietary Supplements

- Probiotics & Prebiotics

- Herbal Supplements

- Others

By Distribution Channel

- Pharmacies

- Online

- Supermarkets/Hypermarkets

- Health & Wellness Stores

- Direct-to-Consumer (D2C)

By Region

- North America

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa