Packaging Automation Market Review, Key Business Drivers & Industry Forecast

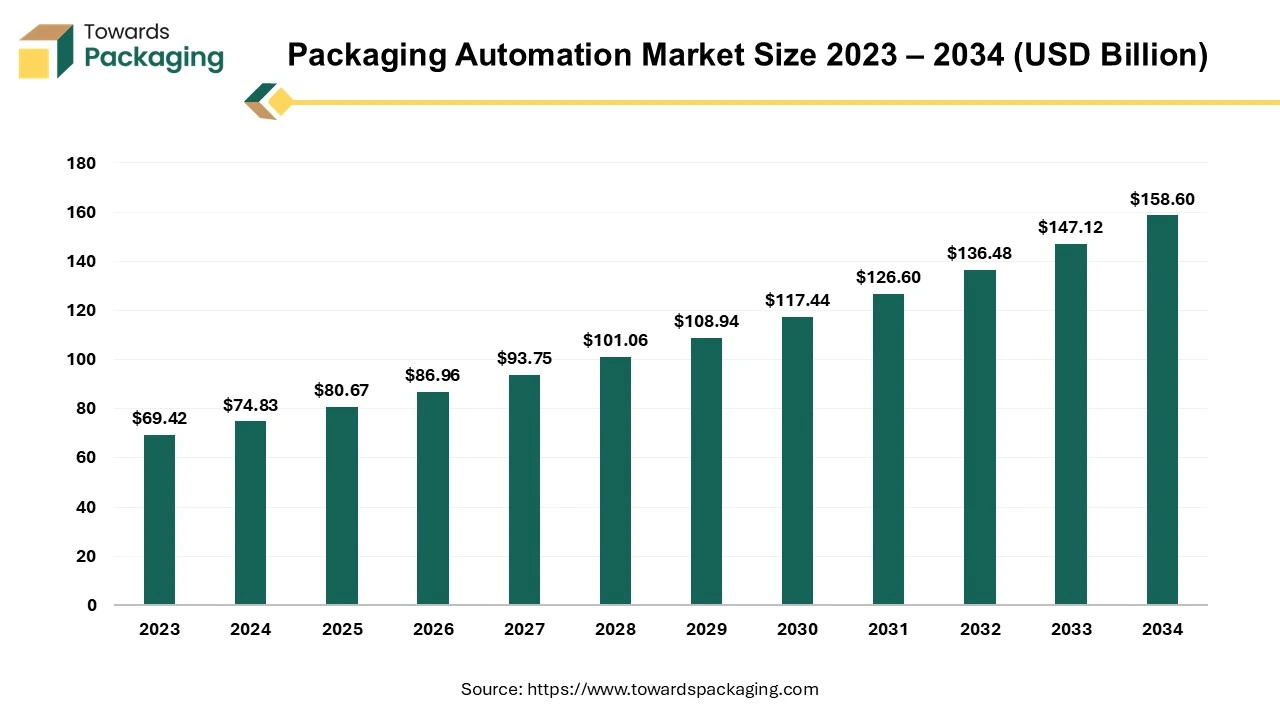

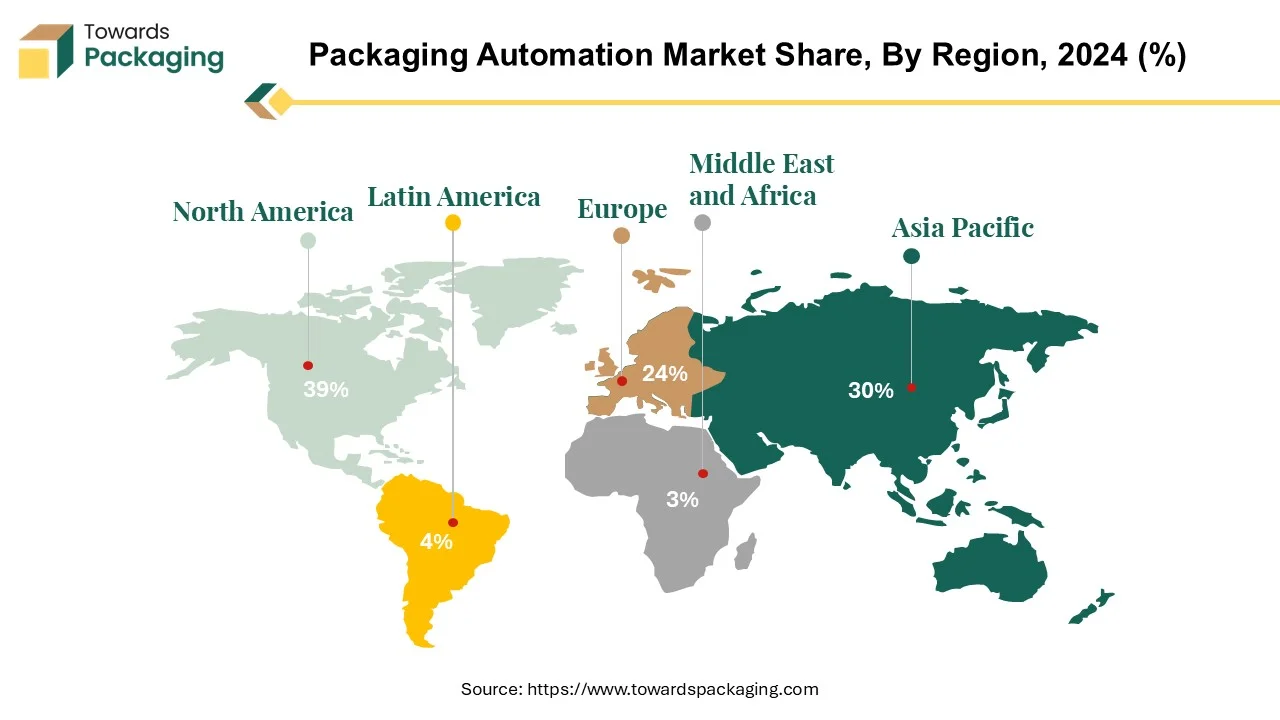

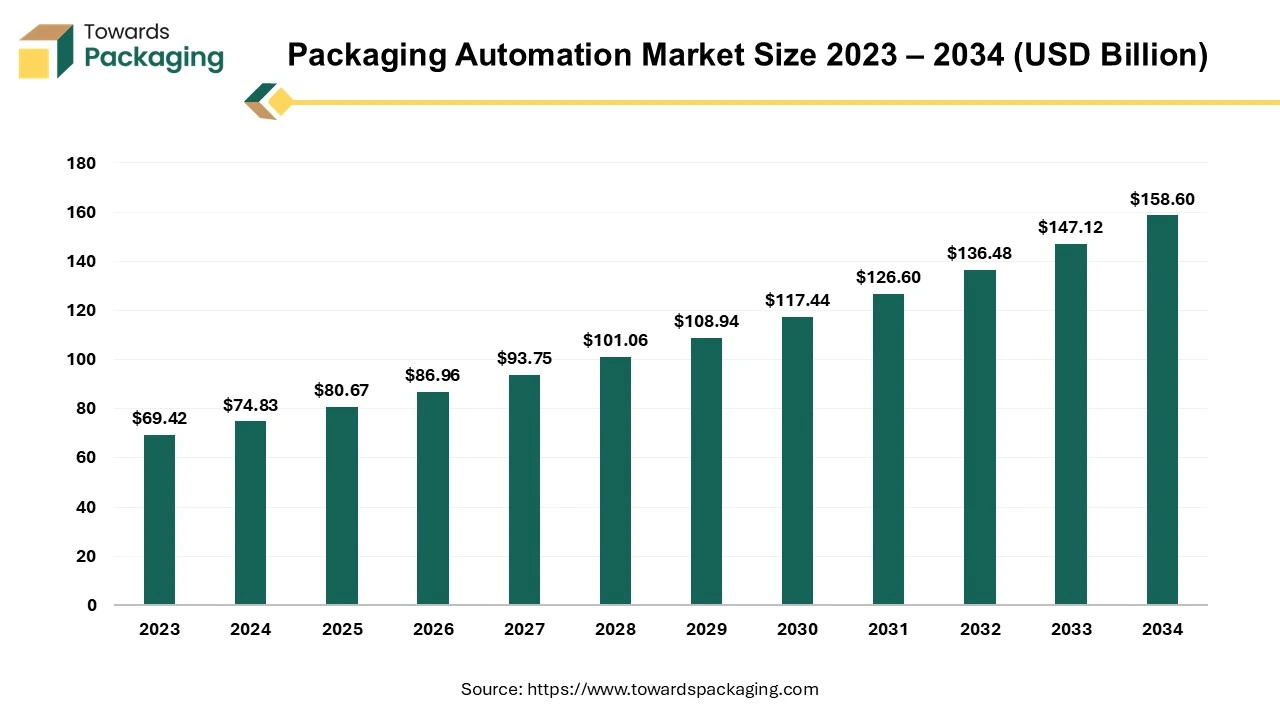

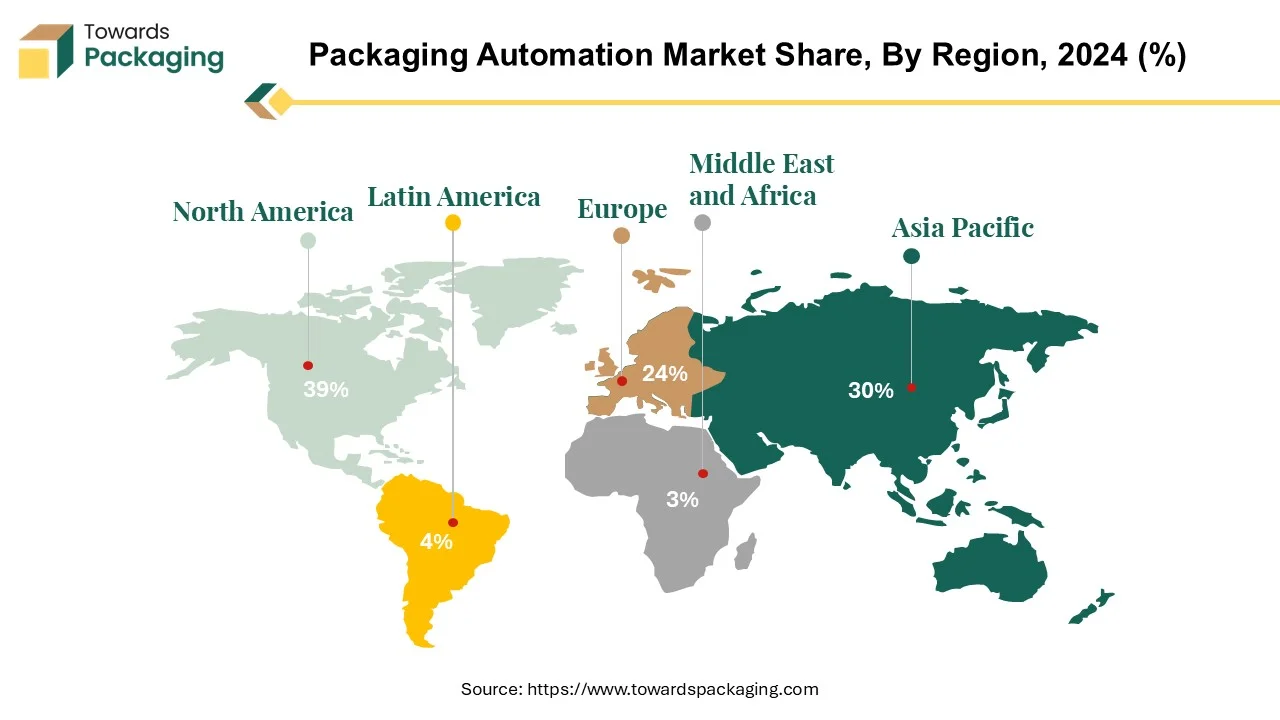

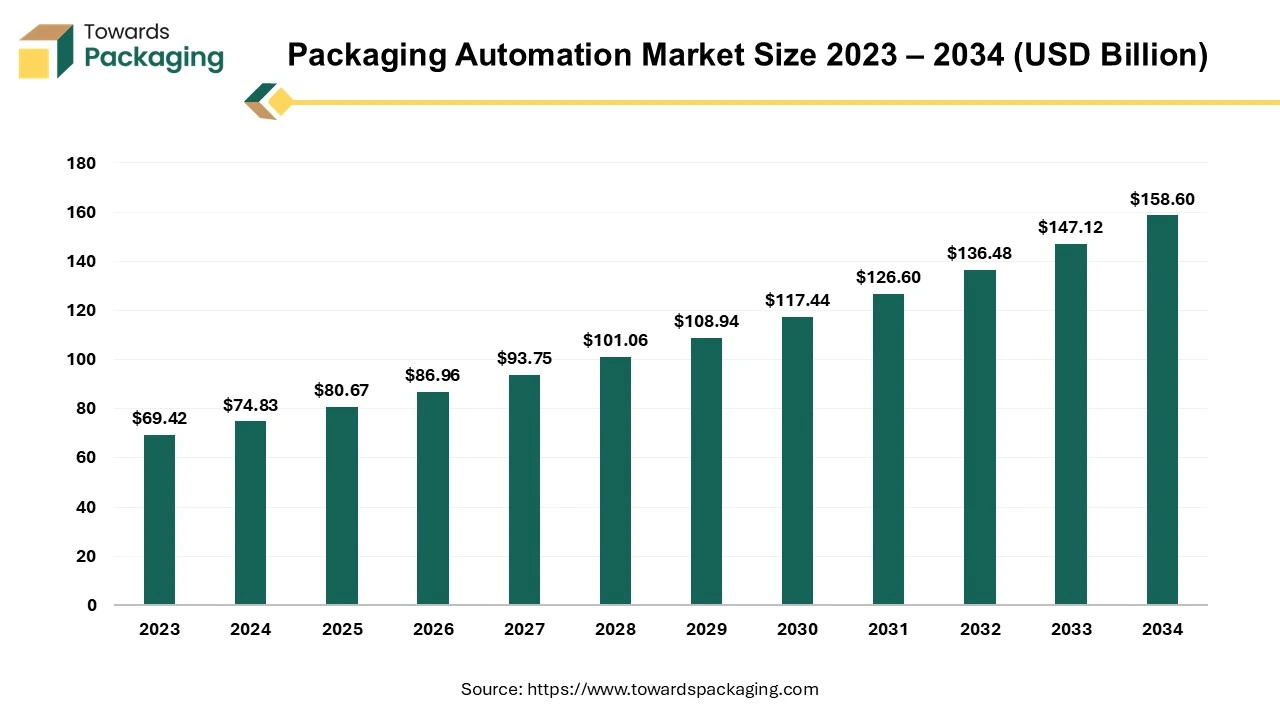

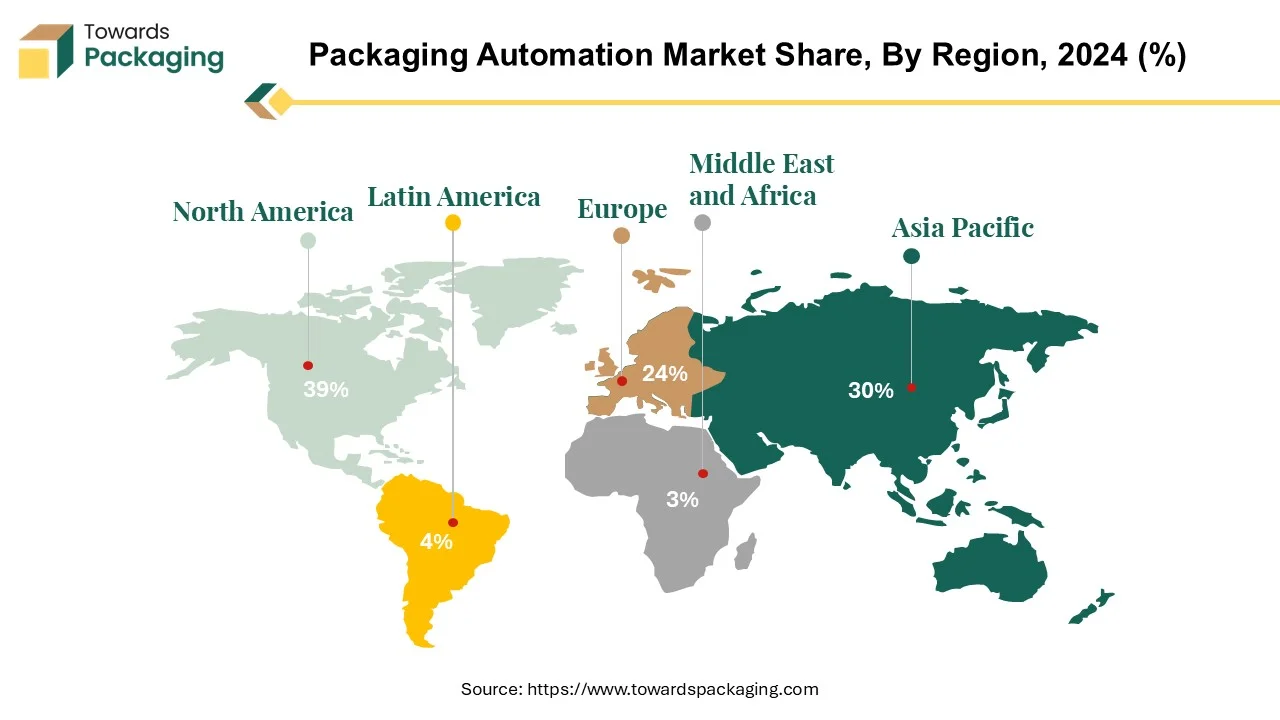

The packaging automation market is forecasted to expand from USD 86.96 billion in 2026 to USD 170.96 billion by 2035, growing at a CAGR of 7.8% from 2026 to 2035. North America leads in terms of market share, followed closely by Asia Pacific, driven by demand across the food, healthcare, and retail sectors.

The report covers key market segments like filling machines and palletizing, along with detailed competitive analysis of major players such as Siemens AG, Mitsubishi Electric, and ABB Ltd. Regional performance insights, coupled with value chain analysis, highlight the increasing adoption of robotics and automation in packaging operations across various industries.

Report Highlights: Important Revelations

- Unveiling North America's leadership in packaging automation across industries.

- Asia Pacific emerging as a force in the regional packaging automation industry.

- Utilizing filling machines' potential in packaging automation.

- Examining the impact of packaging automation in the food and beverage sector.

- Factors driving the growth of packaging automation in retail.

The packaging automation market is undergoing a fundamental revolution fueled by technology breakthroughs, shifting customer preferences, and rising demand for efficiency and sustainability. With the worldwide packaging business proliferating, automation has emerged as a critical solution for streamlining processes, increasing productivity, and meeting changing market needs. Automation technologies comprise many solutions, including robotic packaging equipment and advanced software platforms for optimizing production workflows. These technologies enable faster and more accurate packing operations, with advantages such as lower labour costs, fewer errors, and higher product quality.

The packaging automation market landscape is being shaped by a growing emphasis on sustainability, with manufacturers increasingly embracing eco-friendly packaging solutions and automating processes to optimize resource utilization and reduce waste.

As enterprises prioritize efficiency and sustainability, the packaging automation market is expected to develop significantly. Key businesses are investing in R&D to provide solutions adapted to the changing demands of various industries, resulting in ongoing expansion and innovation in the sector.

For Instance,

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

US$ 80.67 Billion |

| Projected Market Size in 2035 |

US$ 170.96 Billion |

| CAGR (2026 - 2035) |

7.8% |

| Leading Region |

North America |

| Market Segmentation |

By Product Type, By End Use, By Distribution and By Region |

| Top Key Players |

ABB Ltd, Automated Packaging Systems, BEUMER Group GmbH & Co., Coesia Spa, Emerson Electric Co., Kollmorgen Corporation |

Packaging Automation Market Trends

- The advent of Industry 4.0 principles and smart manufacturing technology is driving the integration of automation solutions into packaging processes.

- Manufacturers are increasingly using automation to improve packing efficiency and productivity.

- Artificial intelligence and machine learning technologies are rapidly used in packaging automation systems to improve decision-making, process optimization, and quality control.

- Flexibility and adaptability are essential in packaging automation because producers want to respond rapidly to changing market demands and product variants.

Leading Worldwide Manufacturers Market Share in Packaging Automation (2024)

| Manufacturer Name |

Estimated Market Share (%) |

| ABB Ltd. |

10.5% |

| KUKA AG |

9.2% |

| Fanuc Corporation |

8.7% |

| Siemens AG |

7.3% |

| Rockwell Automation |

6.8% |

| Schneider Electric |

5.6% |

| Mitsubishi Electric |

4.9% |

| Yaskawa Electric Corporation |

4.5% |

| Omron Corporation |

4.2% |

| Bosch Rexroth AG |

3.9% |

Explanation of Market Shares:

- ABB Ltd. (10.5%): ABB leads the market with its comprehensive automation solutions, including robotics, machine automation, and digitalization services, catering to various industries such as food and beverage, pharmaceuticals, and logistics.

- KUKA AG (9.2%): KUKA specializes in industrial robots and automation systems, offering flexible and scalable solutions that enhance production efficiency and adaptability across multiple sectors.

- Fanuc Corporation (8.7%): Fanuc is renowned for its high-precision robotics and CNC systems, providing reliable automation solutions that contribute to streamlined manufacturing processes.

- Siemens AG (7.3%): Siemens offers a wide range of automation products, including programmable logic controllers (PLCs), industrial software, and digitalization tools, supporting smart manufacturing initiatives.

- Rockwell Automation (6.8%): Rockwell Automation delivers integrated control and information solutions, focusing on industrial automation and information technology to optimize production operations.

- Schneider Electric (5.6%): Schneider Electric provides energy management and automation solutions, emphasizing sustainability and efficiency in industrial processes.

- Mitsubishi Electric (4.9%): Mitsubishi Electric offers a diverse range of automation products, including robotics, PLCs, and motion control systems, catering to various manufacturing needs.

- Yaskawa Electric Corporation (4.5%): Yaskawa specializes in motion control and robotics, providing automation solutions that enhance precision and productivity in manufacturing environments.

- Omron Corporation (4.2%): Omron offers automation products such as sensors, controllers, and robotics, focusing on innovation and efficiency in industrial automation.

- Bosch Rexroth AG (3.9%): Bosch Rexroth provides drive and control technologies, offering automation solutions that improve performance and flexibility in manufacturing processes.

Leading Worldwide Suppliers EBITDA Percentage in Packaging Automation (2024)

| Supplier Name |

Estimated EBITDA Margin (%) |

| ABB Ltd. |

18.2% |

| KUKA AG |

15.7% |

| Fanuc Corporation |

22.5% |

| Siemens AG |

14.8% |

| Rockwell Automation |

20.1% |

| Schneider Electric |

16.3% |

| Mitsubishi Electric |

13.9% |

| Yaskawa Electric Corporation |

12.7% |

| Omron Corporation |

11.5% |

| Bosch Rexroth AG |

10.2% |

Unpacking North America's Dominance in Packaging Automation Across Sectors

North America dominates the packaging automation market for numerous important reasons. For starters, the region is home to many well-known manufacturers from various industries, including food and beverage, medicines, consumer products, and e-commerce. These industries strongly demand packaging automation solutions, driven by the need to improve productivity, minimize costs, and meet rising consumer expectations for quick delivery and high-quality products. In 2022, installations in the Americas increased by 8% to 56,053 units, with the United States dominating the regional market, accounting for 71% of installations. Robot installations increased by 10% to a total of 39,576 units. Notably, the automobile sector's share has recovered to 37%, trailing only the metal and machinery industry (3,900 units) and the electrical/electronics industry (3,732 units).

North America has innovative technology infrastructure and widespread usage of automation across multiple industries. The region benefits from top-tier automation technology providers, prestigious research institutes, and a trained workforce, strengthening its position in the packaging automation market. North America's steadfast dedication to innovation and continuous improvement drives significant investments in next-generation automation technologies such as robotics, artificial intelligence, and machine learning, which propels market growth.

U.S. Market Trend

U.S. packaging automation market is driven by the strong manufacturing base and growth in e-commerce platform in the country. The U.S. has a well-established and diversified manufacturing sector (food & beverage, pharmaceuticals, consumer goods, etc.), which heavily invests in automation to increase productivity and reduce labor costs. Ongoing labor shortages and rising wages encourage companies to adopt automated solutions to maintain output and efficiency. The presence of leading automation and robotics companies (e.g., Rockwell Automation, Emerson, Honeywell) in the U.S. fosters innovation and rapid adoption of smart packaging systems. The surge in online shopping demands faster, more flexible, and accurate packaging solutions, driving investment in automated packaging.

For Instance,

- In August 2021, the introduction of AutoFill in North America was announced by Ranpak Holdings Corp., a leading global provider of paper-based packaging solutions that are environmentally sustainable and suitable for e-commerce and industry supply chains.

Asia Pacific Powerhouse Exploring the Packaging Automation Industry's Regional

The Asia Pacific dominates the packaging automation industry due to several important factors. Electronics, automotive, food and beverage, and pharmaceuticals are just a few businesses part of its rapidly expanding manufacturing sector. The demand for packaging automation systems has increased due to the rapid industrialization and economic expansion in China, India, Japan, and South Korea. This need drives the need to maintain competitiveness in the global market, raise consumer expectations, and improve production efficiency. The largest market in the world, China, will have 290,258 units installed annually by 2022. Domestic and foreign robot suppliers have increased their production capabilities in China to fulfill this demand.

Robot installations in Japan increased by 9% to 50,413 units, surpassing pre-pandemic levels. China leads the world market for industrial robots, with Japan coming in second. With 46% of the world's robot production, Japan is the global leader in robot manufacturing. In 2022, the market in the Republic of Korea witnessed a slight increase of 1%, amounting to 31,716 installations. After four years of dropping numbers, this year represents the second straight year of marginal gain. Despite this, the US, Japan, and China continue to lead the world's robot markets, with the Republic of Korea coming in fourth.

The Asia Pacific region has a significant presence in the packaging automation market, supported by its growing economy, strong manufacturing sector, and rising automation technology adoption, especially in nations like China, Japan, and the Republic of Korea.

China Market Trend

China packaging automation market is driven by the extensive manufacturing infrastructure in the country. As of 2025, China stands as the leading country in the global packaging automation market, driven by its expansive manufacturing base and significant investments in automation technologies. China's vast manufacturing sector, encompassing industries like electronics, automotive, food and beverage, and pharmaceuticals, fuels the demand for advanced packaging automation solutions. In 2022, China installed approximately 290,258 industrial robots, reflecting its commitment to automating manufacturing processes and enhancing efficiency. Chinese government policies and initiatives promote the integration of automation and Industry 4.0 technologies, further accelerating the adoption of packaging automation systems. Chinese manufacturers are increasingly implementing collaborative robots (cobots) and advanced automation solutions to address challenges related to labor costs and efficiency requirements.

For Instance,

- In January 2022, SIG announced the company has agreed to purchase Pactiv Evergreen Inc.'s Asia Pacific Fresh business ("Evergreen Asia") for $335 million.

Packaging Automation Market, DRO

Demand:

- One of the key goals of packaging automation is to increase efficiency and productivity in packaging operations. Automation systems promote faster throughput, less downtime, and higher output, allowing manufacturers to meet growing demand while lowering labor costs.

Restraint:

- The initial cost of packaging automation systems, which includes equipment, software, and integration, might be prohibitive for specific organizations and small and medium-sized enterprises (SMEs).

Opportunity:

- Automation technology advancements such as robots, machine vision, artificial intelligence (AI), and the Internet of Things (IoT) provide potential for innovation and differentiation in the packaging automation market.

Harnessing the Power of Filling Machines in Packaging Automation

The filling machine is the main product in the packaging automation market. Filling machines are widely used in various industries, including food and beverage, pharmaceuticals, cosmetics, and chemicals, to fill containers with liquid, powder, granules, or other items. These devices automate the filling process, ensuring precision, uniformity, and speed while increasing productivity and decreasing labor costs. Leading filling machines can handle various products and containers, precise volumetric or weight-based filling mechanisms, and integration with other packaging automation systems such as capping, sealing, and labeling.

Modern filling machines frequently combine innovative technology such as servo motors, PLC controllers, and touch-screen interfaces to ensure optimal efficiency and ease of use. Increasing production quantities increases the necessity for filling equipment, strict quality standards, and efficient packaging solutions to suit consumer demands. As a result, filling machines are critical to packaging processes' overall productivity and competitiveness across various sectors.

For Instance,

- In December 2023, TurboFil Packaging Machines, a company that designs and develops liquid filling and assembly machines, introduced a completely automatic system that uses its well-known TipFil syringe filling technology.

Exploring the Role of Packaging Automation in the Food Industry

Packaging automation is an advanced technology that uses machinery, robotics, and complex systems to improve different parts of the packaging process. Its importance is evident in the food business, where precision, efficiency, and adherence to quality standards are critical. This automation includes filling, labeling, sealing, and palletizing, formerly done manually. Automated systems accelerate and precisely execute these procedures, regularly outperforming human capabilities. Packaging automation is not a one-size-fits-all solution; it involves customizing solutions to match the unique needs of various products and packaging formats. Automation systems can be tailored to solve a wide range of issues, including packaging perishable goods and preserving the integrity of sensitive objects.

Innovation and efficiency are essential in the ever-changing food sector market. Packaging automation is ideal for meeting consumer needs, industry sustainability, and production goals. The fundamental motivation for implementing packaging automation is to increase productivity, cost-effectiveness, and overall quality.

The food automation and robotics market are expected to grow by around 5.5 billion units by 2030, showing that the seamless integration of AI and robots will impact the future of the food sector. This integration is predicted to drive innovation, efficiency, and sustainability, resulting in increased growth in the packaging automation market.

Food and beverage industries are dealing with labor shortages, increased demand as e-commerce grows, and shifting consumer preferences towards fresher, healthier, more artisanal products. Small and medium-sized firms (SMEs) have demonstrated agility in satisfying niche demands, outpacing more prominent manufacturers in growth rates. As a result, packaging automation is critical for all firms to maintain competitiveness and fulfill changing customer expectations.

For Instance,

- Coca-Cola uses AI and ML algorithms to improve its distribution and supply chain processes. These techniques aid in accurate demand forecasting, assuring timely product availability while reducing stockouts and surplus inventories.

Starbucks uses AI-driven personalisation tools in its mobile app to provide individualised recommendations to customers. The app analyses previous orders, preferences, and location data to provide personalised food and beverage recommendations based on each user's interests and preferences.

Forces Behind the Expansion of Packaging Automation in Retail

A number of factors are driving the expansion of the packaging automation market through the retail distribution channel. As consumers shift towards online shopping and e-commerce platforms, there is a greater need for efficient and automated packing solutions to accommodate the increasing number of orders. Retailers invest in packing automation solutions to simplify their fulfilment processes, shorten shipment times, and boost customer happiness. Packaging automation enables businesses to personalize packaging for particular products, ensuring maximum protection throughout transit and increasing brand awareness and presentation. This customization potential is significant in retail, where packaging is essential for marketing and branding initiatives.

Packaging automation improves inventory management by reducing packaging waste and the demand for surplus packaging materials. This results in cost savings and environmental benefits, making packaging automation a compelling investment for merchants wishing to improve their sustainability policies. The packaging automation market is expanding through the retail distribution channel because of the demand for efficiency, cost-effectiveness, and improved customer experience in a fast-changing retail landscape.

For Instance,

- In July 2023, EndFlex Packaging Machinery, based in the United States, introduced a new turnkey system for picking, placing, and sealing bottles in cartons.

Key Players and Competitive Dynamics in the Packaging Automation Market

The competitive landscape of the packaging automation market is dominated by established industry giants such include ABB Ltd, Automated Packaging Systems, BEUMER Group GmbH & Co., Coesia Spa, Emerson Electric Co., Kollmorgen Corporation., Linkx Packaging, Mitsubishi Electric Corp., Multivac Group, Rockwell Automation, SATO Holdings, Schneider Electric SE, Siemens AG, Swisslog Holding AG, Syntegon Technology and ULMA Packaging. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

ABB Ltd.'s Process Automation business provides many solutions for process and hybrid industries, including specific sectors incorporating automation, digitalization, electronic control technologies, software, advanced services, measurement and analytics, and maritime options. Process Automation is ranked second in the global market.

For Instance,

- In January 2024, ABB agreed to purchase a controlling stake in software service provider Meshmind to extend its research and development expertise in AI, Industrial IoT, and machine vision.

Coesia's on-demand packaging equipment includes wrapping, carton erecting, box forming, box filling, and inline printing solutions, all of which are intended to create customised, fit-to-size packaging that enhances the consumer experience. Its process automation capabilities, such as conveying equipment and sorting equipment, are suitable for improving operational efficiency and productivity in e-commerce businesses of all sizes.

- In January 2024, Coesia acquired Automation & Modular Components' entire share capital through its FlexLink subsidiary.

Industries Investing Heavily in Robotics and Automation

Companies in the industrial sector are investing heavily in robotics and automation. Over the next five years, many plan to spend 25% of their capital on these technologies.

Executives believe that automation will improve the quality of their products, increase efficiency, and reduce downtime. However, they are concerned about the high cost of equipment and a lack of in-house expertise.

Retail and consumer goods companies are expected to invest the most in automation, with 23% of them planning to spend over $500 million. In comparison, 15% of companies in the food and beverage sector and 8% in the automotive sector have similar plans. Logistics and fulfillment companies will invest the largest portion of their capital in automation, with it making up 30% or more of their spending over the next five years.

New Advancements in Packaging Automation Market

- On February 28, 2025, Città di Castello, Italy Space limitations, a labor scarcity, rising transportation costs, and the pressing need for environmentally friendly packaging solutions are some of the growing issues that businesses confront as commerce continues its explosive growth. As a leader in sustainable, cutting-edge packaging solutions worldwide, CMC is poised to revolutionize fulfillment operations with the introduction of two revolutionary innovations—CMC Super Vertical and CMC GenesysPRIMA - at LogiMAT in Stuttgart, Germany, March 11–13, 2025, and ProMat 2025 in Chicago, March 17–20, 2025. The CMC Super Vertical is the first 3D vertical bagger and auto-packer for single and multiple item orders. It is perfect for brownfield sites because of its incredibly small footprint, one-day installation, plug-and-play integration, and relocation capabilities.

- In March 2025, At ProMat 2025, the leading trade show for the packaging and material handling sector, which took place on March 17–20, 2025 at McCormick Place in Chicago, IL, Ranpak Holdings Corp., a global leader in sustainable paper-based packaging automation solutions for e-commerce and industrial supply chains, is poised to make waves. Ranpak is influencing the direction of environmentally friendly packaging and securing its position as one of the top brands in supply chain and manufacturing with three ground-breaking product launches, an educational session conducted by experts, and a finalist position for an MHI Innovation Award.

- In March 2025, Packsize launches the X6 automated packaging technology in ProMat 2025. At LogiMAT and ProMat 2025, Packsize will make its global premiere with its X6 automated packaging system. Businesses can cut down on packaging waste by implementing an on-demand solution that is the proper size.

Packaging Automation Market Companies

Packaging Automation Market Segments

By Product Type

- Filling Machine

- Labelling

- Palletizing

- Wrapping

- Others

By End Use

- Food & Beverages

- Healthcare

- Personal Care

- Industrial

By Distribution

By Region

- North America

- Asia Pacific

- Europe

- LA

- MEA