PFAS-Free Food Packaging Market Trends, Regional Insights, and Competitive Landscape Analysis

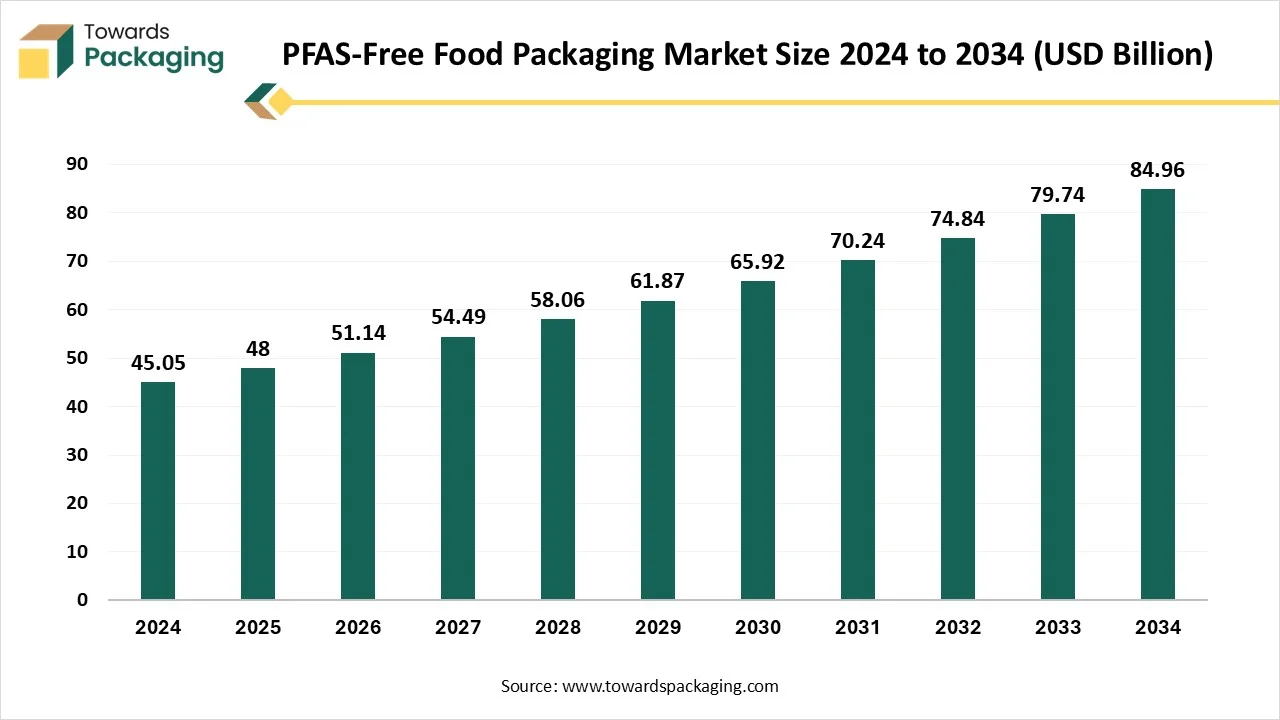

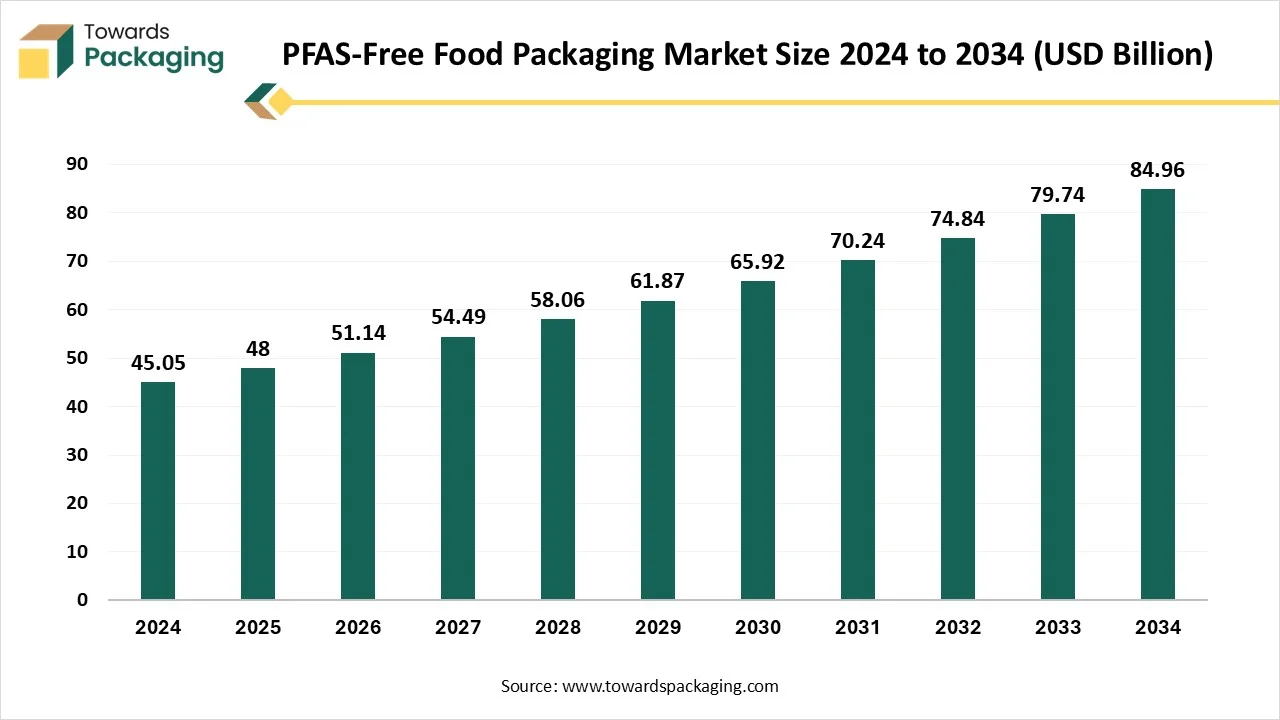

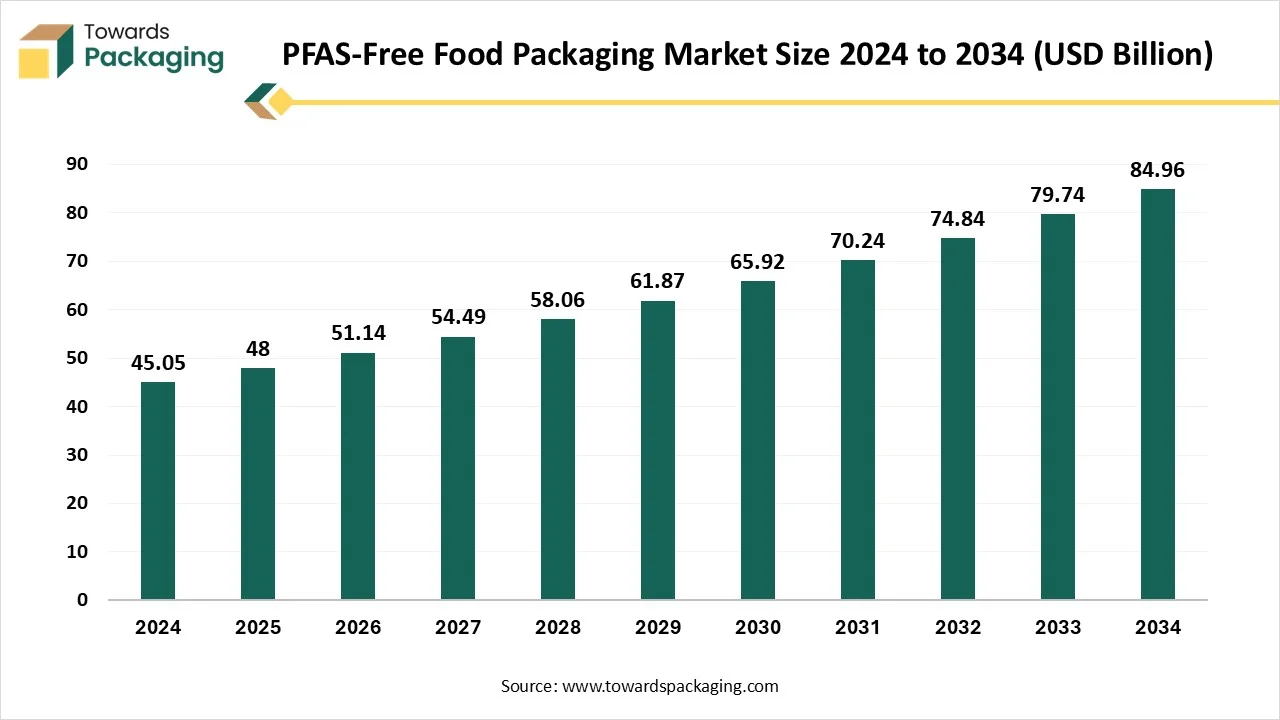

The PFAS-Free Food Packaging market is forecasted to expand from USD 51.14 billion in 2026 to USD 90.53 billion by 2035, growing at a CAGR of 6.55% from 2026 to 2035. This report provides comprehensive insights into market trends, segmentation by packaging type, material, and end-use sector, and detailed regional analysis covering North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Key players such as Huhtamaki, Footprint, Georgia-Pacific, Stora Enso, Vegware, and Sabert Corporation are profiled with information on their products, market presence, and strategies.Competitive analysis, trade flows, and value chain dynamics are also discussed to guide manufacturers and suppliers in identifying growth opportunities.

Over the years, sustainability has gained significant traction, with prominent market players increasingly focusing to leverage leveraging their expertise in sustainable packaging solutions to strengthen their market presence. Additionally, the market is expanding in various emerging economies. North America is expected to dominate the region, fuelled by growing awareness regarding the health risks associated with PFAS compounds and a stringent government framework.

Key Insights

- In terms of revenue, the market is valued at USD 48 billion in 2025.

- The market is projected to reach USD 90.53 billion by 2035.

- Rapid growth at a CAGR of 6.55% will be observed in the period between 2025 and 2034.

- North America dominated the PFAS-free food packaging market in 2024.

- Europe is expected to grow at a significant CAGR during the forecast period.

- By packaging type, the wraps and liners segment dominated the market with the largest revenue share in 2024.

- By packaging type, the clamshells and hinged containers segment is expected to grow at a notable CAGR.

- By material type, the paper and paperboard (PFAS-free coated) segment dominated the market in 2024.

- By material type, the bioplastics segment is expected to grow at the fastest CAGR in the coming year.

- By end-use sector, the quick-service restaurants segment held the major revenue share in 2024.

- By end-use sector, the retail and supermarkets segment is projected to grow at the fastest CAGR between 2025 and 2034.

Market Overview

PFAS-free food packaging refers to food-contact packaging materials that do not contain per- and polyfluoroalkyl substances (PFAS), a group of synthetic chemicals widely used for their grease, oil, and water-resistant properties. Due to growing health concerns, regulatory bans, and consumer demand, PFAS-free alternatives are being rapidly adopted across packaging applications.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 48.00 Billion |

| Projected Market Size in 2035 |

USD 90.53 Billion |

| CAGR (2026 - 2035) |

6.55% |

| Leading Region |

North America |

| Market Segmentation |

By Packaging Type, By Material Type, By End-Use Sector and By Region |

| Top Key Players |

Huhtamaki, Footprint, Georgia-Pacific, Stora Enso, Vegware, Sabert Corporation |

What Are the Latest Trends in the PFAS-free Food Packaging Market?

- The increasing focus on sustainability and rising environmental awareness is anticipated to promote the growth of the PFAS-free food packaging market.

- The regulatory compliance and safety standards of regulatory bodies regarding food products are expected to accelerate the market’s revenue during the forecast period.

- The increasing consumer demand for safer and sustainable packaging solutions significantly contributes to the overall growth of the PFAS-free food packaging market.

- The rising consumer awareness of the harmful effects of per- and polyfluoroalkyl substances (PFAS) on health is expected to fuel the expansion of the market during the forecast period.

- The rising bans and restrictions on PFAS usage in food packaging films in various countries around the world are expected to support the growth of the market during the forecast period.

How Can AI Improve the PFAS-Free Food Packaging Market?

In today's rapidly evolving technological landscape, AI integration emerges as a game-changer and holds the potential to revolutionize PFAS-free food packaging by enhancing sustainability, reducing wastage, and streamlining operations. Artificial integration-driven solutions significantly increase the use of multiple materials or components within the packaging to improve functionality and boost sustainability. In the packaging industry, AI is widely being adopted by businesses to achieve unprecedented efficiency and innovation. Machine learning (ML) algorithms can effectively analyze the data related to material properties, environmental impact, and production processes, as well as predict valuable insights to increase overall productivity through efficient resource allocation.

Market Dynamics

Driver

How is the Rising Consumer Awareness of the Harmful Effects of PFAS Impacting the Market’s Growth?

The increasing consumer awareness of the harmful effects of PFAS on human health is expected to drive market growth during the forecast period in the packaging industry. PFAS-free food packaging plays an integral role in the safety of consumers. Per- and polyfluoroalkyl substances are a group of man-made chemicals that have been commonly linked to chronic health issues such as immune disorders, cancer, rising cholesterol levels, hormonal imbalance, developmental effects in children, and others. As consumers are becoming more aware of the potential health risks associated with PFAS has led to an increasing demand for safer and PFAS-free alternatives, compelling food service industries to adopt PFAS-free options.

Restraint

High Costs

The high costs associated with PFAS-free alternatives are anticipated to hamper the market's growth. PFAS-free alternatives with high-performance abilities are significantly more expensive than conventional PFAS-containing packaging, which can adversely impact the affordability of food items, particularly for budget-conscious consumers. Moreover, the need for rigorous testing and certification to ensure safety is likely to limit the expansion of the global PFAS-free food packaging market.

Opportunity

Stringent Government Regulations

The stringent government regulations are projected to offer lucrative growth opportunities to the PFAS-free food packaging market during the forecast period. Several governments around the world continue to tighten the ban or restrictions on these harmful chemicals. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), Canadian Food Inspection Agency (CFIA), and European Union (EU) have implemented their own PFAS regulations to address health concerns and provide additional protection to consumers. Such stringent policies are compelling manufacturers operating in the food packaging industry to adopt safer and eco-friendly alternatives as well as increase their investment in research and development (R&D) to ensure compliance.

Segment Insights

What Causes the Food and Beverage Segment to Dominate the PFAS-free Food Packaging Market?

The quick-service restaurants (QSR) segment holds a dominant presence as PFAS is the most widely utilised to create grease-proof and water-resistant barriers. These harmful chemicals can be commonly found in products such as fast-food wrappers, pizza boxes, bakery papers, and others. The growth of the segment is mainly driven by the rising awareness regarding food safety to prevent serious health issues associated with PFAS food packaging and stringent regulatory compliance. Quick-service restaurant businesses require meeting regulatory requirements for product packaging to stay ahead and meet evolving consumers' desires.

On the other hand, the retail and supermarket segment is expected to grow at a notable rate. PFAS-free packaging solutions are increasingly being adopted in retail and supermarkets to address growing consumer concerns about food safety and sustainable alternatives. Food items such as frozen foods, beverages, ready-to-eat meals, snacks, and others require protective packaging to prevent contamination and maintain integrity as well as freshness. In addition, stringent regulatory frameworks are encouraging retail and supermarkets to align with sustainability and adopt non-toxic packaging materials.

Paper and Paperboard Dominated in 2024

The paper and paperboard (PFAS-free coated) segment dominated the market with the largest share in 2024, owing to the rising investment of key market players for innovations in barrier coating and increasing use of these materials in packaging formats such as boxes, cartons, wraps, and trays. In the food packaging industry, PFAS-free coated paper and paperboard are widely adopted to ensure health compliance with food safety standards and prevent the risk of health disorders associated with PFAS exposure. Paper and paperboard serve as sustainable packaging alternatives owing to its due to their biodegradable nature and becoming more prevalent in response to meet the eco-conscious consumer demand.

On the other hand, the bioplastics are anticipated to grow at the fastest CAGR, owing to the rising concerns about the environmental and health impacts of PFAS chemicals. Bioplastics are gaining immense popularity as PFAS-free alternatives in the food packaging sector owing to their versatility, durability, lightweight, and excellent protection properties against moisture and oxygen, which also makes them ideal for various applications, including wraps, containers, and pouches.

Which Segment Dominates the PFAS-free Food Packaging Market by Packaging Type?

The wraps and liners segment registered its dominance over the global PFAS-free food packaging market in 2024, owing to the rising adoption of PFAS-free wraps and liners to reduce the potential environmental and health risks associated with "forever chemicals" or PFAS. In the food packaging industry, PFAS-free wraps and liners are widely utilized for wrapping sandwiches, hamburgers, cheeses, and other food items to prevent cross-contamination. PFAS-free wraps and liners also serve as an eco-friendly alternative to plastic as they use plant-based coatings and barrier materials while maintaining recyclability and compostability.

On the other hand, the clamshells and hinged containers are expected to witness remarkable growth during the forecast period. Clamshell and hinged containers are widely used in the food packaging industry, mainly for takeout and to-go meals. These PFAS-free containers are often biodegradable or compostable, breaking down naturally as well as eliminating the risk of harmful chemicals leaching into food. These containers are generally being produced using PFAS-free materials like bagasse and other plant-based fibers, offering an eco-friendlier alternative to conventional plastics.

Regional Insights

Asia Pacific

In the year 2025, the Asia Pacific region is predicted to witness a major evolution in its chemical tracking frameworks, including the acceptance of the Globally Harmonized System, enhanced control of pre-and polyfluoroalkyl substances, and heavily stringent regulations, which are designed after the usage of the EU’s Registration, Authorization, Evaluation and Restrictions of Chemicals systems, among others. The APAC region is leading the globe in chemical manufacturing, with the most current data displaying the integrated countries selling approximately USD 3 trillion of chemicals in 2023. As nations in the region accept more rigid measures, the concentration on toxic chemicals is changing with a notable move towards restricting or banning materials that showcase significant risk.

North America

North America, especially the U.S. and Canada, has a well-established presence of the food and beverage industry, which spurs the demand for PFAS-free food packaging as a safe and sustainable packaging solution. Factors such as stringent government standards, growing emphasis on sustainability, increasing adoption of non-toxic packaging materials, surging consumer demand for safe food packaging, and rapid technological innovation are expected to drive the growth of the PFAS-free food packaging market during the forecast period. In addition, numerous key players in the region are heavily investing in innovative barrier technologies, such as bio-based polymers, plant-based coatings, and water-based alternatives, to gain a competitive edge and meet the evolving consumer demand for safer food packaging options.

On the other hand, the growth of the European market is mainly attributed to the implementation of stringent regulatory compliance by the authorized bodies like the EU, rapid technological improvement in bio-based packaging materials and green packaging, rising awareness of the harmful effects of per- and polyfluoroalkyl substances (PFAS), and increasing consumer inclination for safer and sustainable packaging solutions. Europe's stringent environmental regulations have created a strong market presence for the PFAS-free food packaging market. Moreover, the rapid expansion of the food and beverage industry has led to an increasing demand for PFAS-free food packaging to address potential health issues with the use of harmful chemicals and improve environmental sustainability by replacing conventional plastics.

- In June 2025, Clariant announced the launch of its new AddWorks PPA product line, a new generation of PFAS-free polymer processing aids designed specifically for polyolefin extrusion applications. This innovative solution addresses the industry's growing need for more sustainable alternatives to conventional fluoropolymer-based processing aids while maintaining strong performance standards.

PFAS-Free Food Packaging Market Key Players

Latest Announcement by the Industry Leader

- In June 2025, Lecta Self-Adhesives announced the expansion of its self-adhesive materials portfolio with the introduction of ‘Adestor Gloss GP PFAS-free’, a new label solution tailored for the food packaging industry. This product is designed to meet stringent environmental and health regulations. The labels are ideal for a range of food products such as meats and dairy.

Recent Developments

- Specialty chemicals company named Archroma has revealed the launch of its Crataseal OG8 F10 barrier coating, which is crafted for PFAS-Free oil and grease opposition in food and non-food paper and board packaging. This barrier is evidently water-based, grease and oil-resistant, and allows papermakers to serve sustainability and high-quality-minded packaging by substituting fluoro-based substances and polyethylene with a repulpable and recyclable coating.

- In June 2025, Clariant revealed the launch of its current AddWorks PPA product line, a latest generation of PFAS-free polymer processing that aims to craft polyolefin extrusion uses. This inventive solution solves the industry’s rising demand for more sustainable alterations to regular fluoropolymer-based processing aids while tracking strong performance standards.

- In June 2025, BiOrigin Specialty Products, which is a North American Company, revealed the 100% food-safe oil and grease-resistant paper, which is crafted to block oil and grease that leaks with the assistance of food service, which covers bags and wrappers.

- In March 2025, YUTOECO launched fluozero, an innovative PFAS-free greaseproof technology specifically engineered for molded fiber food packaging. This breakthrough directly addresses critical challenges in sustainable and high-performance greaseproof solutions. The demand for PFAS-free greaseproof solutions in the catering packaging industry continues to grow. However, existing alternatives often have significant limitations.

- In August 2024, PA Consulting and Searo Labs unveiled seaweed-based packaging items, aiming to reduce global plastic consumption, single-use packaging, and PFAS use in the food, personal care, and home care sectors.

PFAS-Free Food Packaging Market Segments

By Packaging Type

- Plates, Bowls, and Trays

- Molded fiber trays

- Sugarcane bagasse plates

- Cups and Lids

- Paper cups with PLA/aqueous lining

- Compostable biopolymer lids

- Clamshells and Hinged Containers

- Kraft paper-based

- Plant-based plastics (e.g., PLA, PHA)

- Wraps and Liners

- Grease-resistant paper (non-fluorinated coatings)

- Wax-based or clay-coated paper

- Bags and Pouches

- Bakery bags

- Sandwich wrapsShape, Picture

By Material Type

- Molded Fiber and Pulp

- Bagasse (sugarcane fiber)

- Wheat straw

- Bamboo

- Paper and Paperboard (PFAS-free coated)

- Aqueous-coated

- Biopolymer-coated (e.g., PLA, CMC)

- Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- PBAT blends

- Cellulose-based Films

- Regenerated cellulose

- Coated kraft films

- Others

- Clay-coated substrates

- Bio-waxesShape, Picture

By End-Use Sector

- Quick-Service Restaurants (QSR)

- Burger wrappers, fry sleeves, clamshells

- Retail and Supermarkets

- Bakery trays, meat pads, frozen food wraps

- Cafés and Beverage Chains

- Cups, cup sleeves, lids

- Institutional Catering

- Trays, wraps

- Others

- Airlines, events, schools

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

- Global Market Overview (2025–2034): Market Size 2025 = USD 48.00 B; Market Size 2034 = USD 84.96 B; CAGR 2025–2034 = 6.55%.

- Regional Revenue Share, 2024: North America 34%, Europe 28%, Asia Pacific 24%, Latin America 8%, Middle East & Africa 6%.

- North America-Country Share, 2024: U.S. 82%, Canada 18%.

- Europe-Country Share, 2024: Germany 22%, UK 18%, France 15%, Italy 12%, Spain 12%, Sweden 8%, Norway 7%, Denmark 6%.

- Asia Pacific-Country Share, 2024: China 34%, India 22%, Japan 18%, South Korea 12%, Thailand 14%.

- Latin America-Country Share, 2024: Brazil 58%, Mexico 28%, Argentina 14%.

- Middle East & Africa-Country Share, 2024: South Africa 35%, Saudi Arabia 30%, UAE 25%, Kuwait 10%.

- Market by Packaging Type, 2024: Wraps & Liners 32%, Clamshells & Hinged Containers 22%, Plates/Bowls/Trays 18%, Cups & Lids 15%, Bags & Pouches 13%.

- Wraps & Liners-Sub-type Share, 2024: Grease-resistant paper (non-fluorinated) 70%, Wax-/clay-coated paper 30%.

- Clamshells & Hinged Containers-Sub-type Share, 2024: Kraft paper-based 55%, Plant-based plastics (PLA, PHA) 45%.

- Plates/Bowls/Trays-Sub-type Share, 2024: Molded fiber trays 60%, Sugarcane bagasse plates 40%.

- Cups & Lids-Sub-type Share, 2024: Paper cups with PLA/aqueous lining 72%, Compostable biopolymer lids 28%.

- Bags & Pouches-Sub-type Share, 2024: Bakery bags 56%, Sandwich wraps 44%.

- Market by Material Type, 2024: Paper & Paperboard (PFAS-free coated) 38%, Molded Fiber & Pulp 24%, Bioplastics 20%, Cellulose-based Films 10%, Others 8%.

- Paper & Paperboard-Coating Split, 2024: Aqueous-coated 62%, Biopolymer-coated (PLA, CMC) 38%.

- Bioplastics-Polymer Split, 2024: PLA 48%, PHA 32%, PBAT blends 20%.

- Market by End-use Sector, 2024: Quick-Service Restaurants 36%, Retail & Supermarkets 24%, Cafés & Beverage Chains 18%, Institutional Catering 14%, Others (Airlines/Events/Schools) 8%.

- QSR-Application Split, 2024: Burger wrappers 44%, Fry sleeves 28%, Clamshells 28%.

- Retail & Supermarkets-Application Split, 2024: Frozen food wraps 40%, Bakery trays 34%, Meat pads 26%.

- Cafés & Beverage Chains-Application Split, 2024: Cups 62%, Cup sleeves 20%, Lids 18%.

- Institutional Catering-Application Split, 2024: Trays 60%, Wraps 40%.

- Others (Airlines/Events/Schools)-Application Split, 2024: Airlines 35%, Events 33%, Schools 32%.

- Competitive Landscape-Vendor Market Share, 2024: Huhtamaki 12%, Novolex (Eco-Products) 10%, Georgia-Pacific 9%, Stora Enso 8%, Sabert 7%, Vegware 7%, Genpak 6%, Footprint 6%, Duni Group 5%, Biopak 4%, Others 26%.

- CAGR by Region (2025–2034): Asia Pacific 7.8%, Latin America 6.5%, Europe 6.2%, Middle East & Africa 6.0%, North America 5.8%.

- CAGR by Packaging Type (2025–2034): Clamshells & Hinged Containers 7.4%, Bags & Pouches 6.6%, Cups & Lids 6.3%, Wraps & Liners 6.1%, Plates/Bowls/Trays 6.0%.

- CAGR by Material Type (2025–2034): Bioplastics 8.2%, Cellulose-based Films 6.7%, Molded Fiber & Pulp 6.4%, Paper & Paperboard (PFAS-free coated) 6.0%, Others 5.5%.

- Demand Drivers-Regulatory vs Sustainability vs Consumer Awareness, 2025 Share of Influence: Regulatory restrictions 38%, Sustainability initiatives 32%, Consumer awareness 30%.

List of Tables

- Global Market Size & Growth Summary (2025–2034): 2025 = USD 48.00 B; 2034 = USD 84.96 B; CAGR = 6.55%.

- Regional Revenue Distribution, 2024: North America 34%, Europe 28%, Asia Pacific 24%, Latin America 8%, Middle East & Africa 6%.

- North America-Revenue by Country, 2024: U.S. 82%, Canada 18%.

- Europe-Revenue by Country, 2024: Germany 22%, UK 18%, France 15%, Italy 12%, Spain 12%, Sweden 8%, Norway 7%, Denmark 6%.

- Asia Pacific-Revenue by Country, 2024: China 34%, India 22%, Japan 18%, South Korea 12%, Thailand 14%.

- Latin America-Revenue by Country, 2024: Brazil 58%, Mexico 28%, Argentina 14%.

- Middle East & Africa-Revenue by Country, 2024: South Africa 35%, Saudi Arabia 30%, UAE 25%, Kuwait 10%.

- Market by Packaging Type, 2024: Wraps & Liners 32%, Clamshells & Hinged Containers 22%, Plates/Bowls/Trays 18%, Cups & Lids 15%, Bags & Pouches 13%.

- Wraps & Liners-Sub-type Mix, 2024: Grease-resistant paper (non-fluorinated) 70%, Wax-/clay-coated paper 30%.

- Clamshells & Hinged Containers-Sub-type Mix, 2024: Kraft paper-based 55%, Plant-based plastics (PLA, PHA) 45%.

- Plates/Bowls/Trays-Sub-type Mix, 2024: Molded fiber trays 60%, Sugarcane bagasse plates 40%.

- Cups & Lids-Sub-type Mix, 2024: Paper cups with PLA/aqueous lining 72%, Compostable biopolymer lids 28%.

- Bags & Pouches-Sub-type Mix, 2024: Bakery bags 56%, Sandwich wraps 44%.

- Market by Material Type, 2024: Paper & Paperboard (PFAS-free coated) 38%, Molded Fiber & Pulp 24%, Bioplastics 20%, Cellulose-based Films 10%, Others 8%.

- Paper & Paperboard-Coating Split, 2024: Aqueous-coated 62%, Biopolymer-coated (PLA, CMC) 38%.

- Bioplastics-Polymer Split, 2024: PLA 48%, PHA 32%, PBAT blends 20%.

- Market by End-use Sector, 2024: Quick-Service Restaurants 36%, Retail & Supermarkets 24%, Cafés & Beverage Chains 18%, Institutional Catering 14%, Others (Airlines/Events/Schools) 8%.

- QSR-Application Mix, 2024: Burger wrappers 44%, Fry sleeves 28%, Clamshells 28%.

- Retail & Supermarkets-Application Mix, 2024: Frozen food wraps 40%, Bakery trays 34%, Meat pads 26%.

- Cafés & Beverage Chains-Application Mix, 2024: Cups 62%, Cup sleeves 20%, Lids 18%.

- Institutional Catering-Application Mix, 2024: Trays 60%, Wraps 40%.

- Others (Airlines/Events/Schools)-Application Mix, 2024: Airlines 35%, Events 33%, Schools 32%.

- Competitive Landscape-Vendor Market Share, 2024: Huhtamaki 12%, Novolex (Eco-Products) 10%, Georgia-Pacific 9%, Stora Enso 8%, Sabert 7%, Vegware 7%, Genpak 6%, Footprint 6%, Duni Group 5%, Biopak 4%, Others 26%.

- CAGR by Region (2025–2034): Asia Pacific 7.8%, Latin America 6.5%, Europe 6.2%, Middle East & Africa 6.0%, North America 5.8%.

- CAGR by Packaging Type (2025–2034): Clamshells & Hinged Containers 7.4%, Bags & Pouches 6.6%, Cups & Lids 6.3%, Wraps & Liners 6.1%, Plates/Bowls/Trays 6.0%.

- CAGR by Material Type (2025–2034): Bioplastics 8.2%, Cellulose-based Films 6.7%, Molded Fiber & Pulp 6.4%, Paper & Paperboard (PFAS-free coated) 6.0%, Others 5.5%.

- Demand Drivers-Share of Influence, 2025: Regulatory restrictions 38%, Sustainability initiatives 32%, Consumer awareness 30%.