Plastic Cosmetic Packaging Market Overview Forecast, Segment Data, Regional Breakdown, Trade Analysis & Key Manufacturers

The plastic cosmetic packaging market covers a comprehensive assessment of global market size, growth patterns, and statistical projections across 2025–2034, including detailed segmentation by packaging type, material type, application, and price tier. The study also includes regional analysis for North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, highlighting key trends such as sustainability shifts, smart packaging, and premiumization. It further evaluates the competitive landscape of major players like AptarGroup, Amcor, Berry Global, Quadpack, Silgan Holdings, and analyzes value chain components from raw material sourcing (PP, PET, PE) to distribution logistics.

Major Key Insights of the Plastic Cosmetic Packaging Market

- By region, Asia Pacific dominated the global market by holding highest market share of 30% in 2024.

- By region, Middle East & Africa is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the bottles segment contributed the biggest market share of 35% in 2024.

- By packaging type, the tubes segment will be expanding at a significant CAGR in between 2025 and 2034.

- By material type, the polypropylene (PP) segment contributed the biggest market share of 30% in 2024.

- By material type, the others (bioplastics) segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By function/application, the skincare products segment contributed the biggest market share of 25% in 2024.

- By function/application, the fragrances & perfumes segment is expanding at a significant CAGR in between 2025 and 2034.

- By price tier/end use, the prestige/premium tier segment dominated the market with the share of 40% in 2024.

- By price tier/end use, the luxury/high-end tier segment will be expanding at a significant CAGR in between 2025 and 2034.

Market Overview

Plastic cosmetic packaging market refers to the global industry that designs, manufactures, and supplies plastic-based containers and components used for packaging cosmetic products (such as creams, lotions, lipsticks, mascaras, perfumes, and other personal-care items), encompassing forms like bottles, jars, tubes, pumps, sprayers, compacts, and more, utilizing materials including polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), acrylic (PMMA), and other specialty polymers. This market includes packaging types designed to ensure product protection, aesthetic appeal, functionality, and brand differentiation.

What are New Trends in the Plastic Cosmetic Packaging Market?

Increasing Demand for Eco-friendly and Sustainability

- The continuous increasing demand among consumers for eco-friendly and sustainable which has minimalist designs, bio-based plastic, and reusable & refillable option.

Rising Interactive and Smart Packaging

- The rising focus towards smart and interactive packaging such as NFC technology, e-commerce integrating, and augmented reality & QR codes has influenced this market.

Unique Design Trends and Aesthetic Packaging

- Unique designs trends and aesthetic packaging which has premiumization and minimalist & premium aesthetic packaging.

How Can AI Improve the Plastic Cosmetic Packaging Market?

The incorporation of AI technology in the market plays an important role in designing of the packages, customer engagement, and production of supply chain management. It enhances the efficacy, sustainability, and personalization of the plastic cosmetic packaging. It improves customized patterns, accelerated production process, and optimization of sustainability. Artificial intelligence optimizes equipment failure, automate manufacturing process with the help of robotics technology.

Market Dynamics

Market Driver

Rising Economic Development and Customer Demand Drive the Enhancement in the Plastic Cosmetic Packaging Market

The rising economic development and consumer demand for innovative packaging has driven the market. Increasing disposable earning has enhanced the demand for innovative and premium packaging of the cosmetics. Continuous shift towards urban areas has raised the development of the plastic cosmetic packaging which enhance shelf life of the products. The rising trend for premium packaging has enhanced the designing process of the plastic packaging.

Market Challenges and Restraints

Strict Government Guidelines Hindered the Plastic Cosmetic Packaging Market

The strict government guidelines in the packaging industry hindered the market. The rising safety standard of the packaging industry has restricted the usage of various forms of plastics which restricted the development of the market. Increasing awareness towards environmental impact of plastic packaging has limited the expansion of plastic packaging in cosmetic sector.

Market Opportunity

Innovation in the Designing Enhanced the Opportunities of the Plastic Cosmetic Packaging Market

The rapid innovation in the designing of the cosmetic packaging has raised several opportunities in the market. With the customization of cosmetic packaging companies are establishing brand identity. Smart packaging such as integration of QR code and NFC tags has helped the tracking and gathering of information about the cosmetic products in the rising e-commerce trend. The upsurge in the demand for tamper-evident packaging in the packaging sector has enhanced the opportunities of the plastic cosmetic packaging.

Segmental Insights

Packaging Type Insights

Why Bottles Segment Dominated the Plastic Cosmetic Packaging Market In 2024?

The bottles segment dominated the market in 2024 due to its versatility, hygiene, and protection against adverse ecological condition. The rising demand for products such as hair care products, lotions, and serums enhance the usage of bottles for packaging. The increasing production of convenient packaging to enhance the experience of the consumers. Enhancement of aesthetic packaging, airless pump systems, and refillable designs has increased the opportunities of the market.

The tubes segment expects the fastest growth in the market during the forecast period. This segment is growing rapidly due to sustainability, brand designs, and user experience enhancement. The increasing demand for convenient packaging of the cosmetic products and the demand for variation in the packaging size has raised the enhancement of the segment. This segment is majorly driven by the requirement of protection of products, and controlled dispensing.

Material Type Insights

Why Polypropylene (PP) Segment Dominated the Plastic Cosmetic Packaging Market In 2024?

The polypropylene (PP) segment held the largest share of the market in 2024 due to its clarity, low density, superior durability, and chemical resistance. These materials are considered as suitable for packaging of lotions and creams with convenient closure. Polypropylene (PP) materials are used in manufacturing rigid form of containers and jars for improved properties. These materials have low density which make containers lightweight and improve efficiency.

The others (bioplastics) segment is expected to grow at the fastest rate in the market during the forecast period. This segment consists of renewable, conventional, and petroleum-based plastics which influence the growth of this segment. The rising awareness towards eco-friendly solution and bioplastic innovation has attracted huge number of consumers towards this segment for cosmetic packaging.

Function/Application Insights

Why Skincare Products Segment Dominated the Plastic Cosmetic Packaging Market In 2024?

The skincare products segment held the largest share of the market in 2024 due to its versatility and cost-effectiveness. This segment is majorly driven by the rising awareness towards personal care and beauty. The rising inclination towards sustainable packaging of the cosmetic products has pushed this segment to adopt plastic packaging. Continuous innovation in the plastic packaging sector has raised the demand for packaging of skincare products.

The fragrances & perfumes segment is expected to grow at the significant rate in the market during the forecast period. This segment is growing due to sustainable packaging, accessible, and travel-friendly choices. These are portable and convenient solution for the packaging of fragrances & perfumes. Plastic packaging is affordable and lightweight which is easy for transportation of these products. The rapid expansion of fragrances companies in the e-commerce platform has pushed the demand for this segment.

Price Tier Insights

Why Prestige/Premium tier Segment Dominated the Plastic Cosmetic Packaging Market In 2024?

The prestige/premium tier segment held the largest share of the market in 2024 due to advanced designs, decorative techniques, and high standard designs. The presence of high-quality resources promotes the production of superior-quality packaging. The rising online retail and demand for unboxing experience has raised the demand for these packaging. This segment plays an important role in the development of the market with its sustainability innovation.

The luxury/high-end tier segment is expected to grow at the fastest rate during the forecast period. This segment is growing rapidly due to innovative functionality, customization and design features. These packaging provide protection against contamination of the products. Memorable and unique packaging due to enhanced unboxing experience of the consumers.

Regional Insights

Increasing Beauty Industry in Asia-Pacific Promote Dominance

Asia Pacific held the largest share of the plastic cosmetic packaging market in 2024, due to increasing beauty industry in this region. In countries such as China, India, Japan, South Korea, and several others the major factors driving this market are increasing disposable earning, rising customer consciousness, and rapid urbanization. The development is contributed due to the booming personal care and beauty industry which has influenced the demand for enhanced quality cosmetic packaging.

Huge Production of Plastic in China Promote Plastic Cosmetic Packaging Market

China is considered as world’s largest producer as well as consumer of plastic which plays a crucial role in the development of market in this region. The growing focus towards producing innovative packages, presence of raw materials, and low-charges labour has enhanced the investment of the major market players towards this market. The rising awareness towards adverse effect of plastic on the environment has influenced the production of bioplastics.

Presence of Well-established Industries in Middle East & Africa Support Growth

Middle East & Africa expects the significant growth in the market during the forecast period. The presence of well-established industries of beauty and personal care in this region has influenced the growth of the market. The strong demand for makeup, skincare, and haircare has promoted the development of plastic packaging in this region. The rising trend for e-commerce and online demand for beauty and cosmetic products has influenced the growth of superior quality packaging.

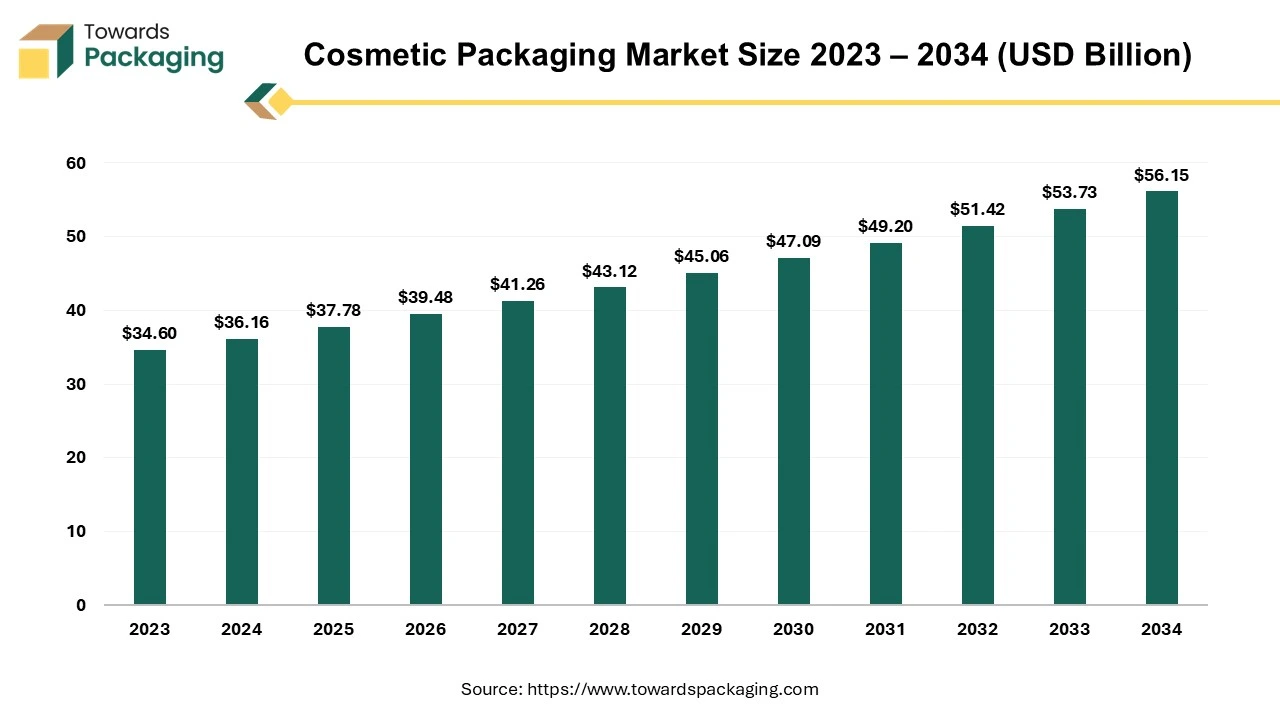

Future of Cosmetic Packaging Market

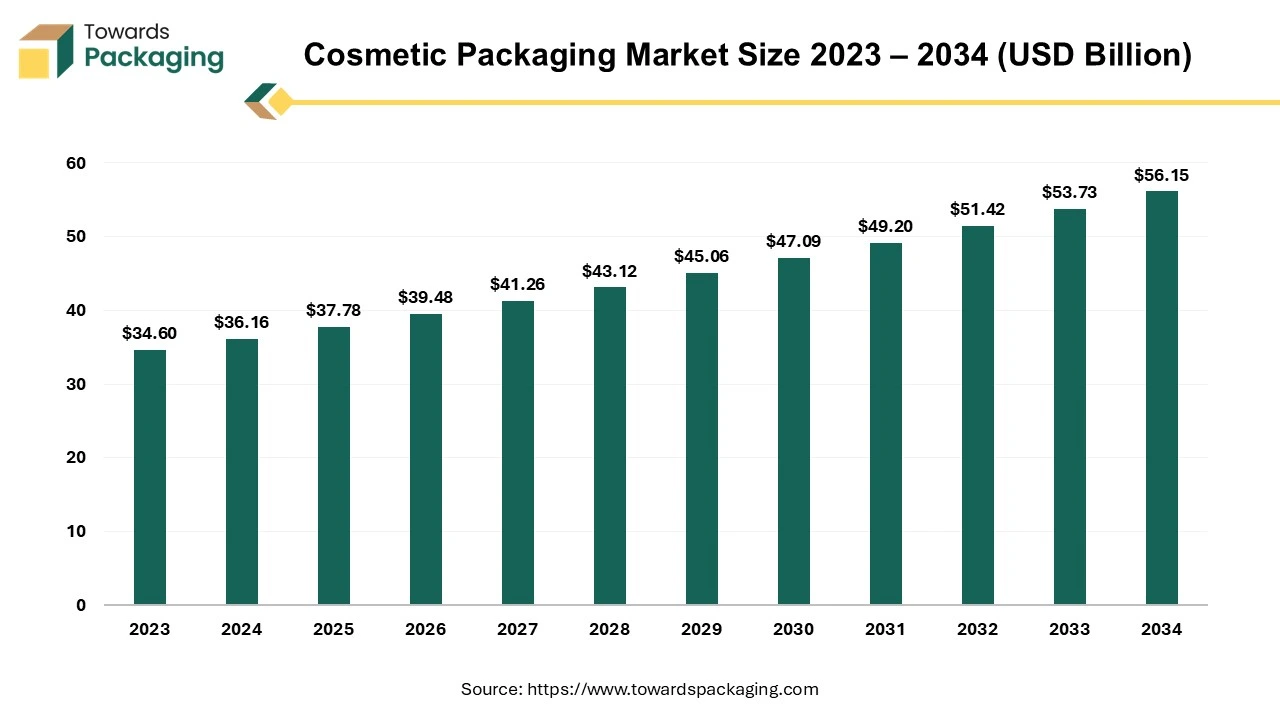

The global cosmetic packaging market size reached US$ 36.16 billion in 2024 and is projected to reach around US$ 56.15 billion by 2034, expanding at a CAGR of 4.5% during the forecast period from 2025 to 2034. The rising consumer focus on sustainability and eco-friendly products is driving innovation in packaging materials and designs. Additionally, the rapid expansion of online shopping and increasing disposable incomes in emerging markets are boosting demand.

Cosmetic packaging refers to the containers, materials, and wrapping used to store, protect, and present beauty and personal care products. It includes primary, secondary, and tertiary packaging designed for functionality, branding, and product preservation. The cosmetic brands use sustainable packaging – brands are using glass, bamboo, refillable containers, and PCR (post-consumer recycled) plastics. The consumers prefer clean, simple packaging that showcases the product.

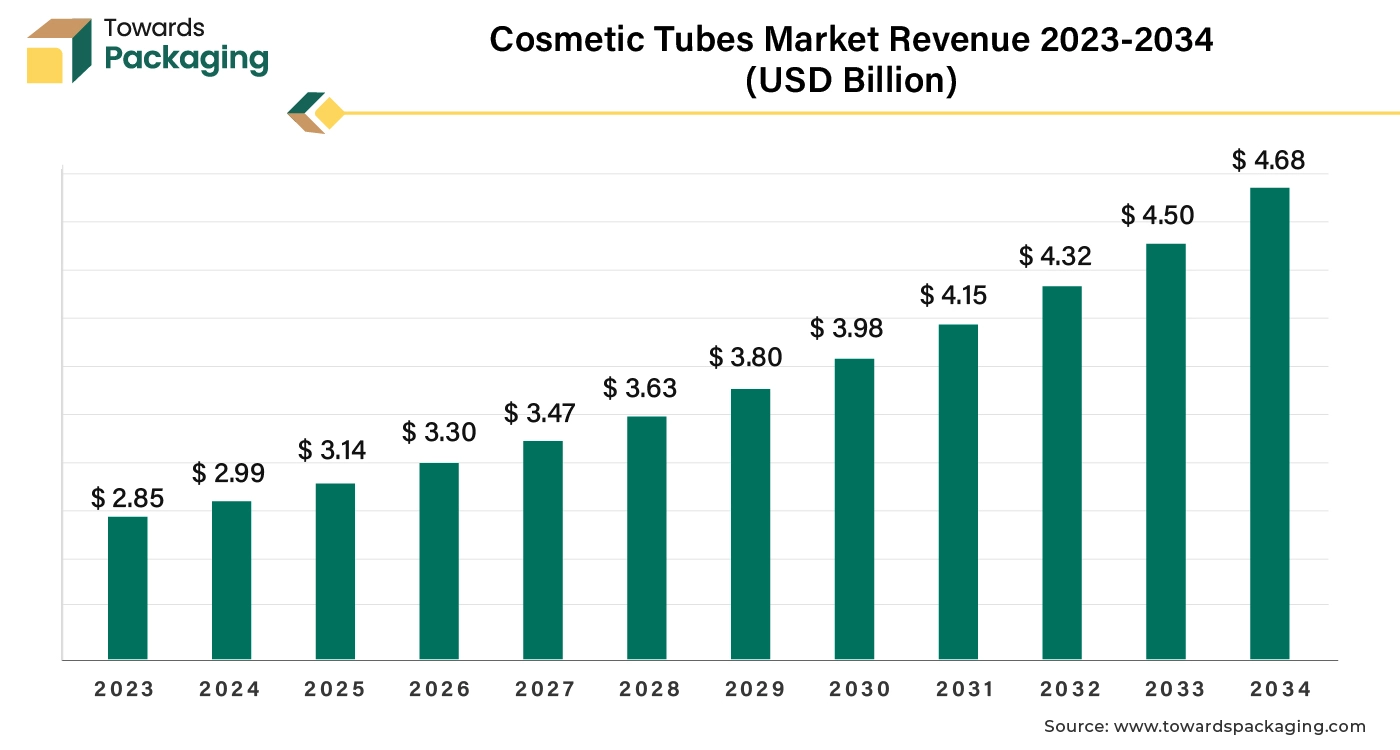

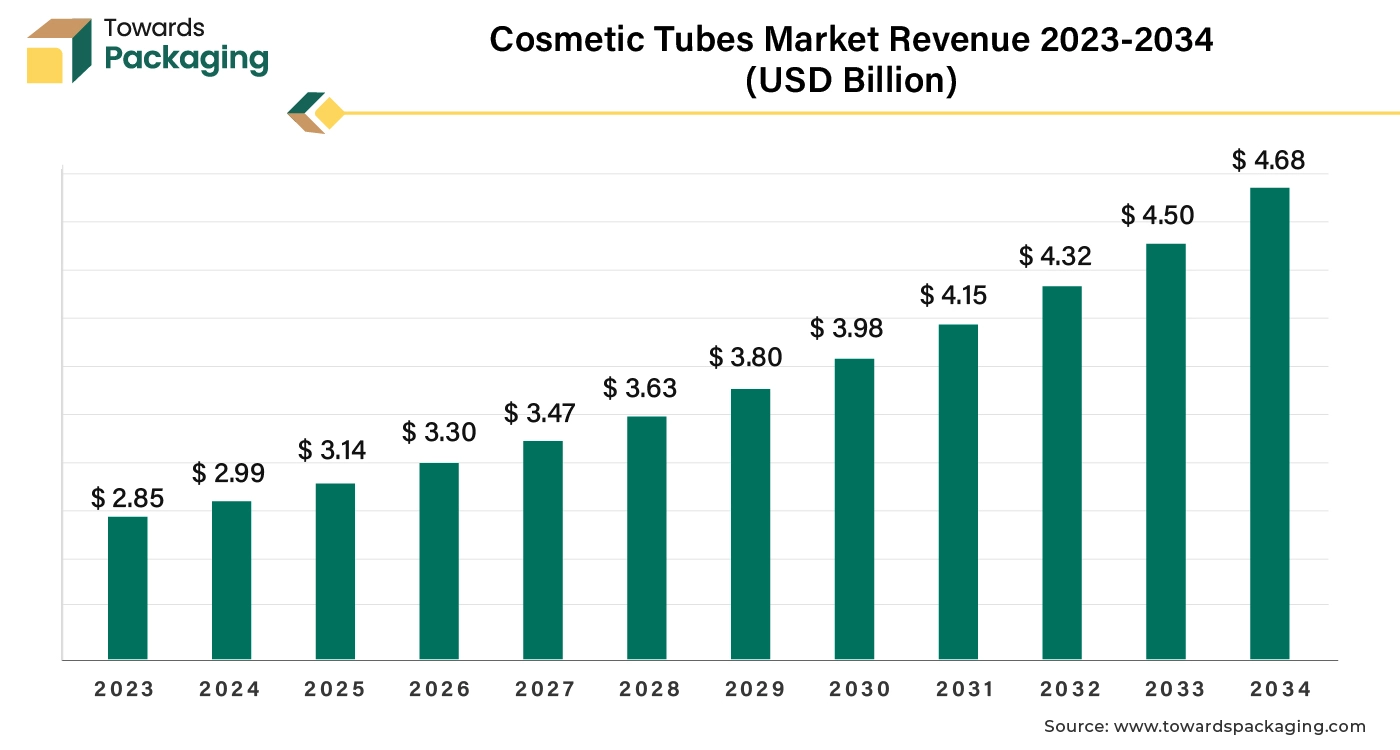

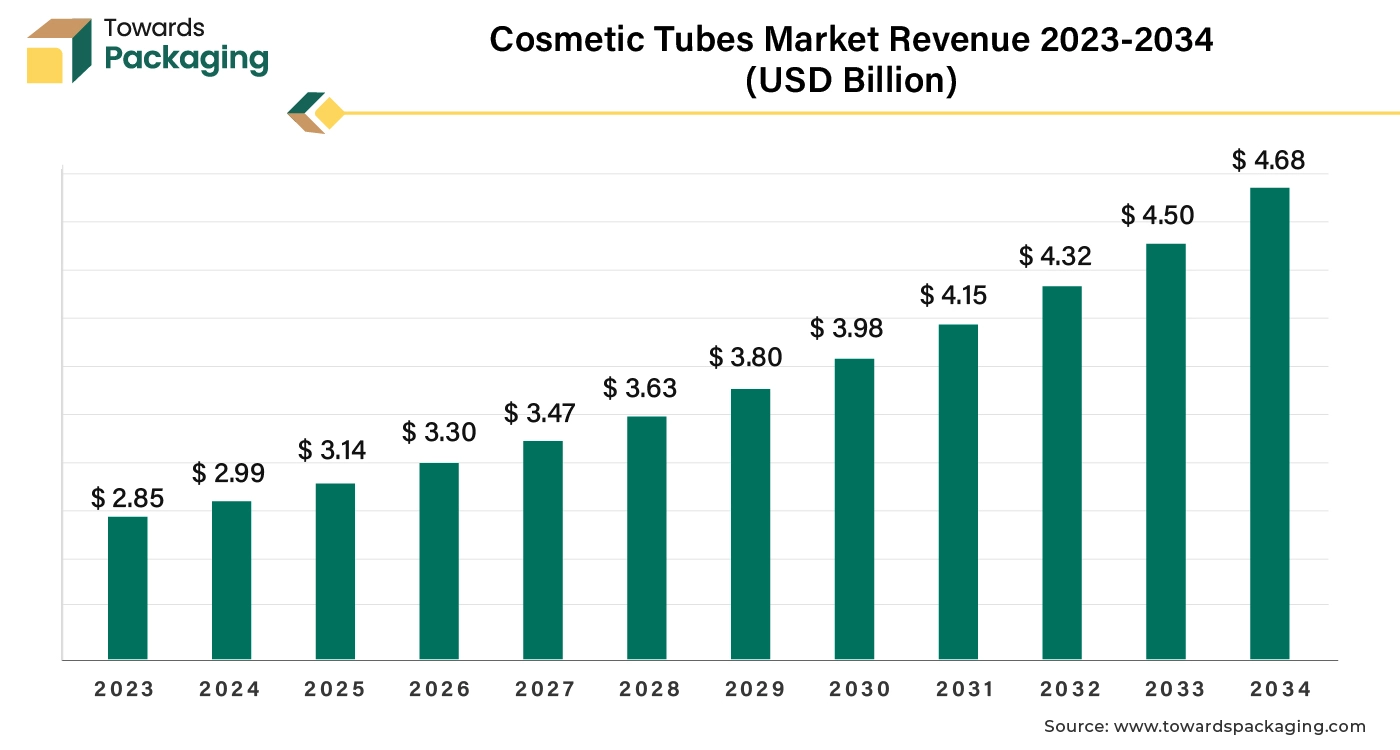

Future of Cosmetic Tubes Market

The cosmetic tubes market is projected to reach USD 4.68 billion by 2034, expanding from USD 3.14 billion in 2025, at an annual growth rate of 4.61% during the forecast period from 2025 to 2034.

The market is increasing due to the rising awareness towards personal hygiene, skincare and personal care, and social media influence which require cosmetic tubes for packaging due to safety concerns. The growing trend of social media is boosting the cosmetic tube market.

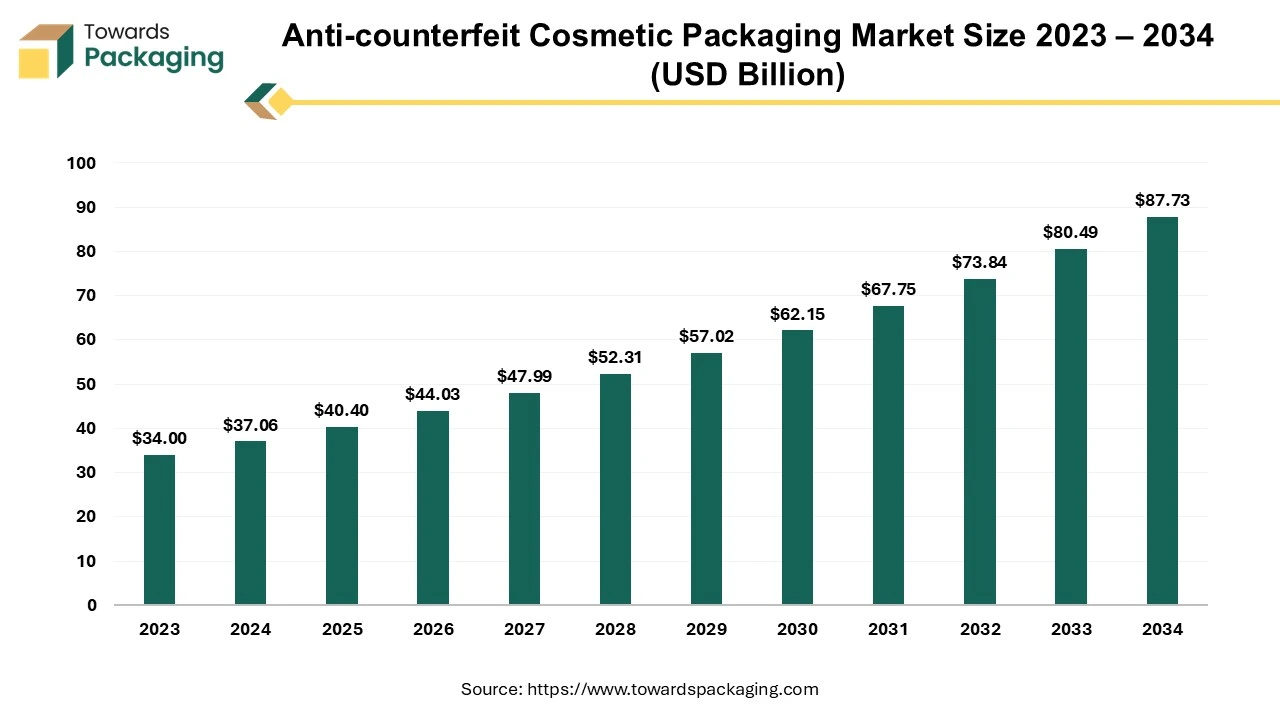

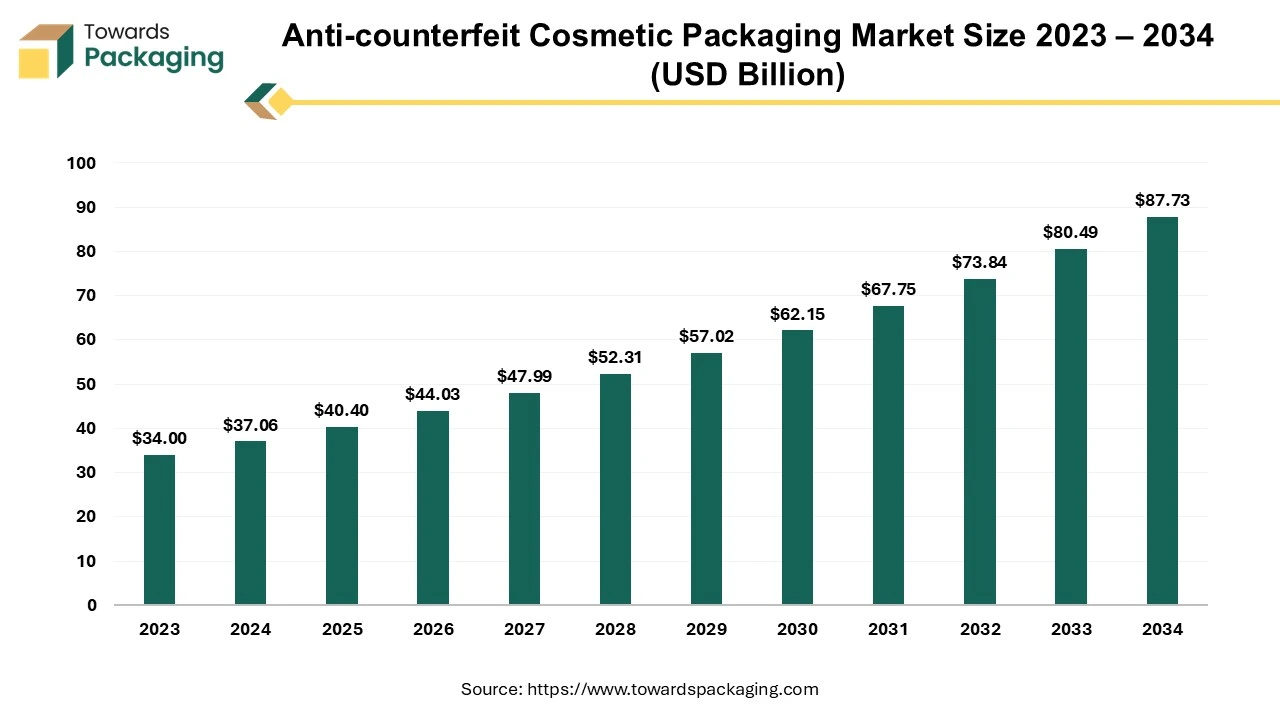

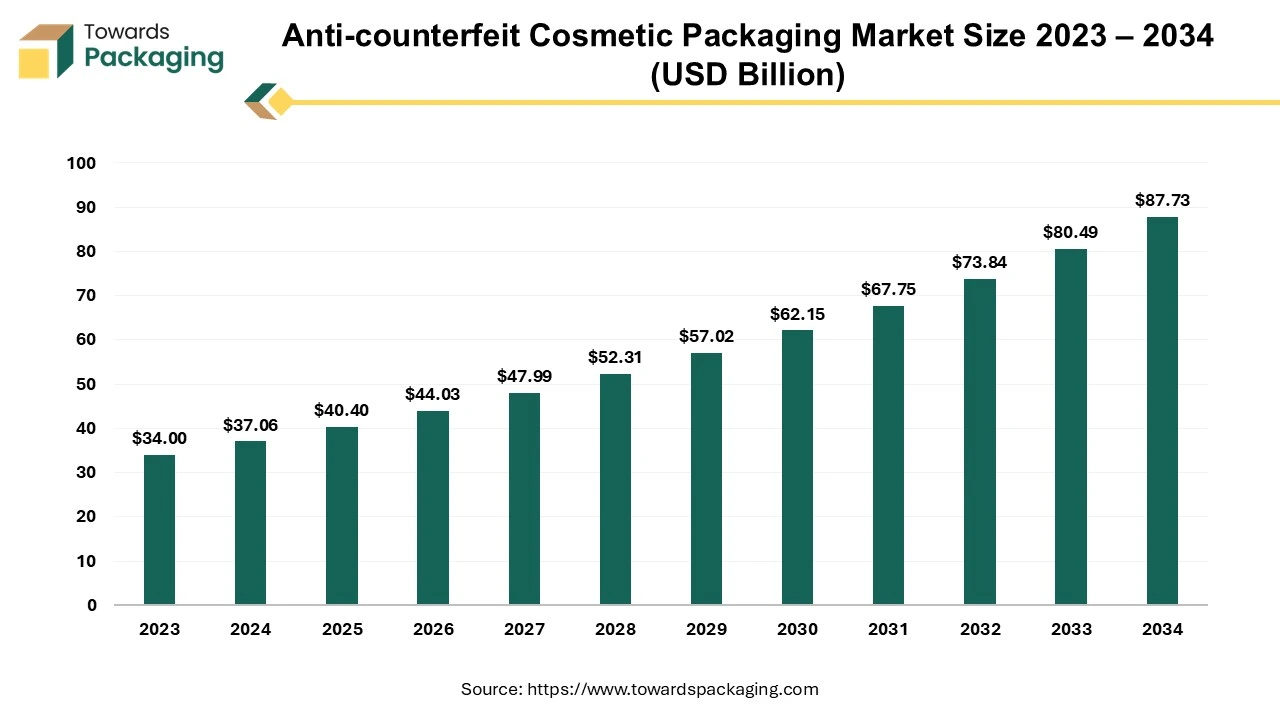

Future of Anti-counterfeit Cosmetic Packaging Market

The global anti-counterfeit cosmetic packaging market size was evaluated at US$ 37.06 billion in 2024 and is expected to attain around US$ 87.73 billion by 2034, growing at a CAGR of 9% from 2025 to 2034.

Anti-counterfeit cosmetic packaging refers to packaging solutions designed to prevent the production and sale of fake beauty products. These solutions use advanced technologies and security features to help brands and consumers verify authenticity, protect brand reputation, and ensure product safety. Many leading cosmetic companies incorporate security holograms into their packaging. These holograms are challenging to replicate and provide a visual indication of authenticity. For instance, heat-shrink labels with integrated holograms have been utilized in the personal care industry to combat counterfeiting.

Future of Plastic-Free Cosmetic Packaging Market

The plastic-free cosmetic packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising ecological awareness among consumers and government guidelines for packaging industries have influenced the demand for the plastic-free cosmetic packaging market. Paper-based materials are widely used in this sector due to customization and printing convenience. The Europe region is dominating in this market due to there strict government guidelines for eco-friendly packaging of the products.

The plastic-free cosmetic packaging market comprises packaging solutions used in the cosmetics industry that eliminate the use of conventional plastic materials. These solutions are designed with a focus on sustainability, biodegradability, compostability, and recyclability. Materials used in such packaging include paper, glass, metal, bamboo, wood, and biodegradable composites. The goal is to reduce plastic pollution, meet eco-conscious consumer demand, and comply with evolving regulatory frameworks.

Plastic Cosmetic Packaging Market- Value Chain Analysis

Raw Material Sourcing

The raw materials required to produce plastic cosmetic packaging are polyethylene terephthalate, polyethylene, and polypropylene.

- Key Players: TradeIndia, IndiaMart

Component Manufacturing

The major components used in this market are trays bottles, and caps, with enhanced designing and strength.

- Key Players: Aptar Group, HCP Packaging

Logistics and Distribution

It consists of superior protection, timely delivery, and temperature control with the usage of specialized logistics providers.

- Key Players: AMCOR PLC, Berry Global Inc.

Top Companies in the Plastic Cosmetic Packaging Market

- AptarGroup

- Amcor plc

- Berry Global Inc.

- Albea Group

- Silgan Holdings

- Gerresheimer AG

- Rexam

- Quadpack

- Amfora

- Alplast srl

- RPC Group

- Farécla

- Amacoil

- Guala Closures Group

- Pacojet

- Gerza

- Piramal Glass

- Zantye Plastic Technology Company

- Grace Manufacturing

- Zhongyao Packaging Group

Latest Announcements by Industry Leaders

- In August 2024, Director of Supply Chain and co-founder of zerooo at SEA ME GmbH, Mirko Waraszik, expressed, “ALPLA group successfully designed reusable packaging bottles with individual serialization straight for the production method for first time. This advanced technology enhanced the reuse of the plastic bottles for packaging.”

Recent Developments

- In March 2025, FANCL announced the launch of "toiro," which is a skincare reusable packaging manufactured with Eastman Tritan™ copolyester. This is the newest skincare brand that provides refillable cartilage and reusable primary packaging to customers.

- In April 2025, SVR which is a French dermocosmetics brand laboratories that offer airless packaging for its new eyecare, suncare, and skincare treatment. It is designed, customised, and produced by worldwide famous brand Aptar Beauty.

Plastic Cosmetic Packaging Market Segment Covered

By Packaging Type

- Bottles

- Rigid plastic bottles

- Soft/flexible plastic bottles (squeezable)

- Jars

- Wide-mouth jars

- Narrow-neck jars

- Tubes

- Laminate tubes

- Plastic extrusion tubes

- Compacts and Cases

- Pressed-powder compacts

- Lipstick/lip-gloss cases

- Eyeshadow palettes

- Pump Dispensers

- Airless pumps

- Standard piston pumps

- Dropper Bottles

- Built-in droppers

- Screw-top droppers

- Spray/Atomizer Bottles

- Fine mist spray

- Nebulizer atomizer

- Sachets and Blister Packs

- Single-use sachets (plastic laminate)

- Blister packs with plastic cavities

- Caps and Closures

- Screw caps

- Flip-top caps

- Disc-top caps

- Snap-on caps

By Material Type

- Polyethylene (PE)

- High-density PE (HDPE)

- Low-density PE (LDPE)

- Polypropylene (PP)

- Homopolymer PP

- Copolymer PP

- Polyethylene Terephthalate (PET)

- Acrylic (PMMA)

- High Impact Polystyrene (HIPS)

- Polycarbonate (PC)

- Others

- Bioplastics (PLA, bio-PE, bio-PET)

- Multilayer laminates

By Function / Application Format

- Skincare Products

- Creams & Lotions

- Serums & Oils

- Masks & Treatments

- Color Cosmetics

- Lipstick & Lip-care

- Foundations & Concealers

- Eye Makeup (mascara, eyeshadow)

- Fragrances & Perfumes

- EDT/Eau-de-Parfum bottles

- Atomizers

- Hair Care Products

- Shampoos & Conditioners

- Hair Serums & Oils

- Personal Hygiene Products

- Hand Sanitizers

- Deodorants & Roll-ons

- Soap dispensers

By Price Tier / End-Use Segment

- Mass / Drugstore

- Prestige / Premium

- Luxury / High-end

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait