Plastic Dielectric Films Market Size, Trends, Share and Innovations

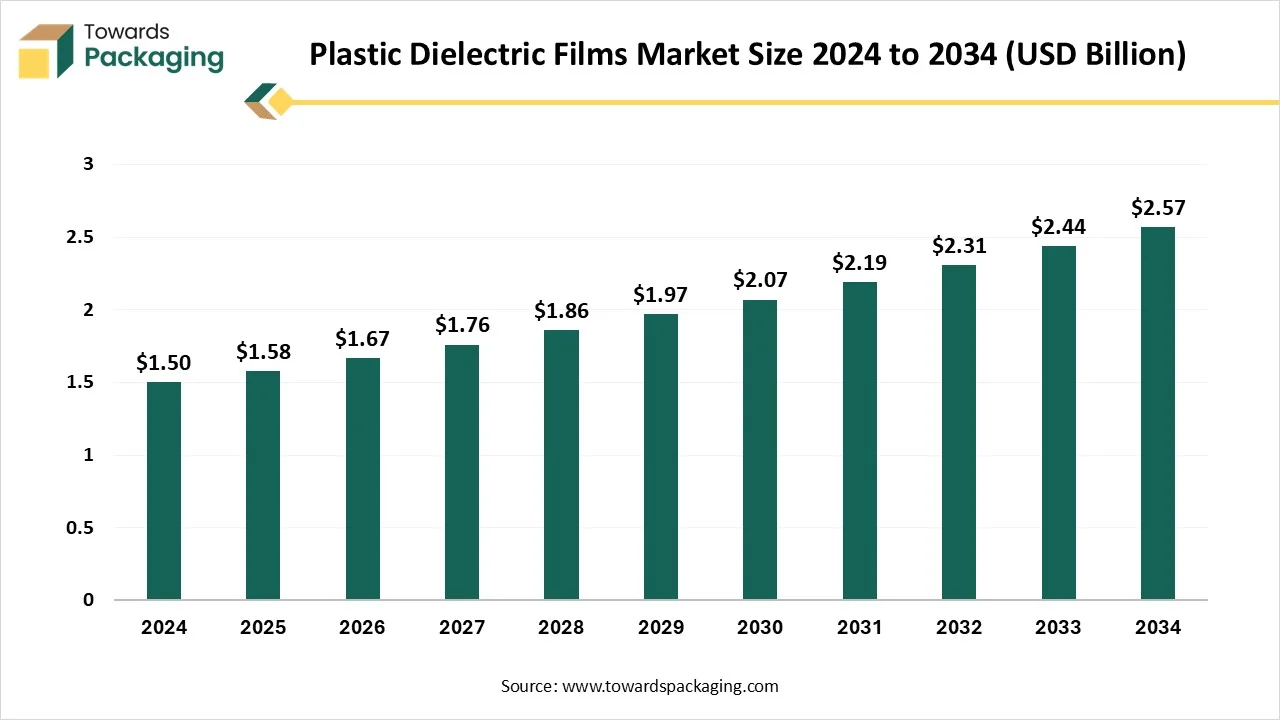

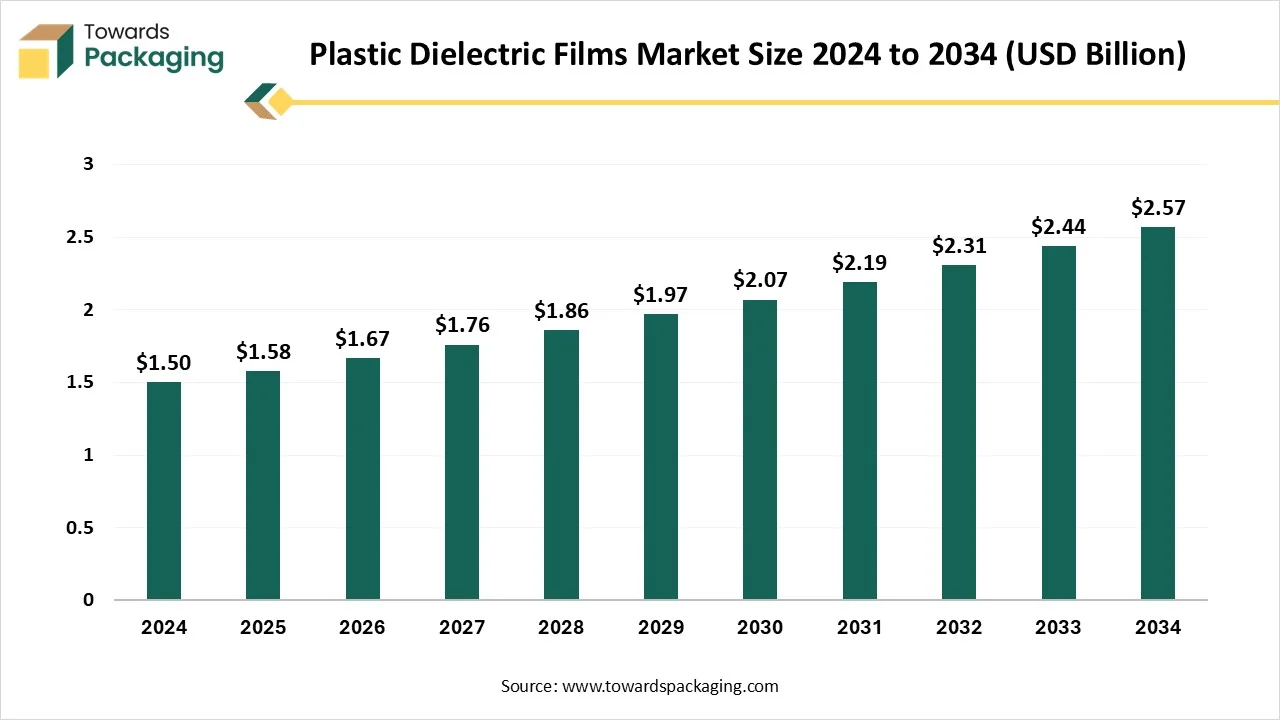

The plastic dielectric films market is forecasted to expand from USD 1.67 billion in 2026 to USD 2.71 billion by 2035, growing at a CAGR of 5.55% from 2026 to 2035. The rising demand for renewable energy sector, electric vehicles (EV), and electronics. With the continuous advancement of material science and production process the market is evolving rapidly.

There is a huge demand of these films in sectors such as solar and wind energy system, food packaging, aircraft, automobiles, electrical and electronics. The huge production demand has evolved the enhancement in this market.

Major Key Insights of the Plastic Dielectric Films Market

- In terms of revenue, the market is valued at USD 1.58 billion in 2025.

- The market is projected to reach USD 2.71 billion by 2035.

- Rapid growth at a CAGR of 5.55% will be observed in the period between 2025 and 2034.

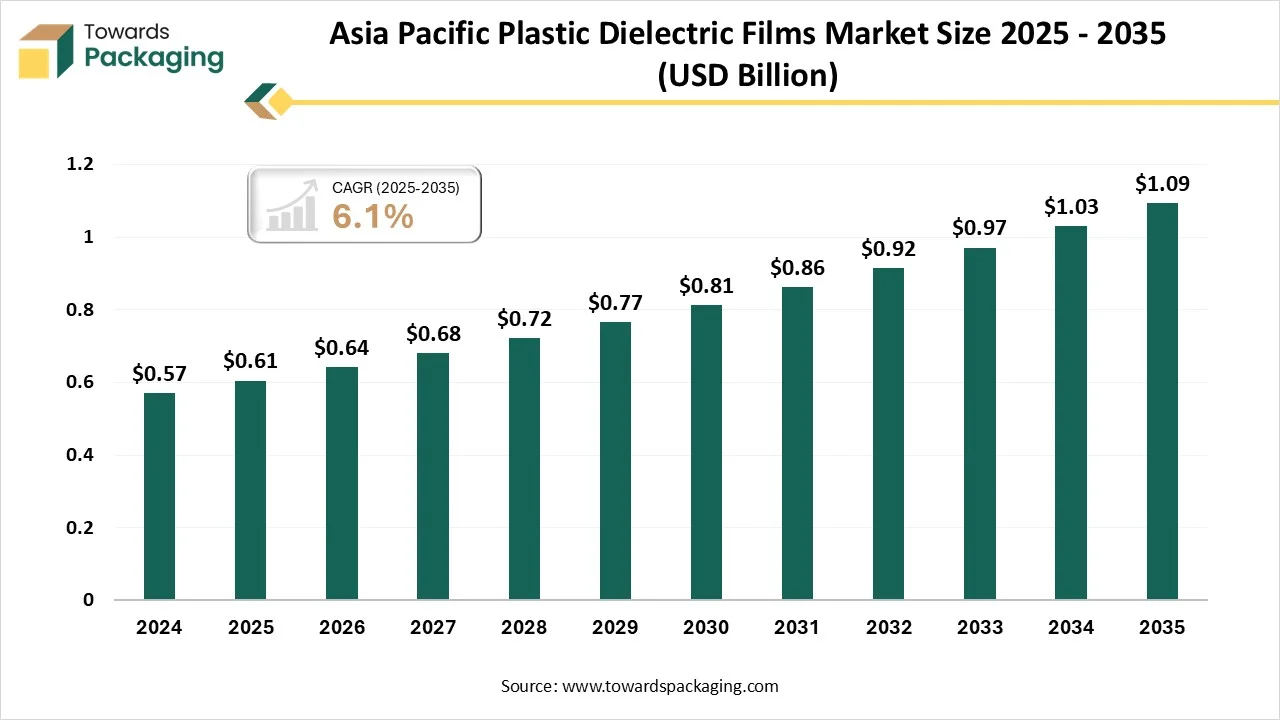

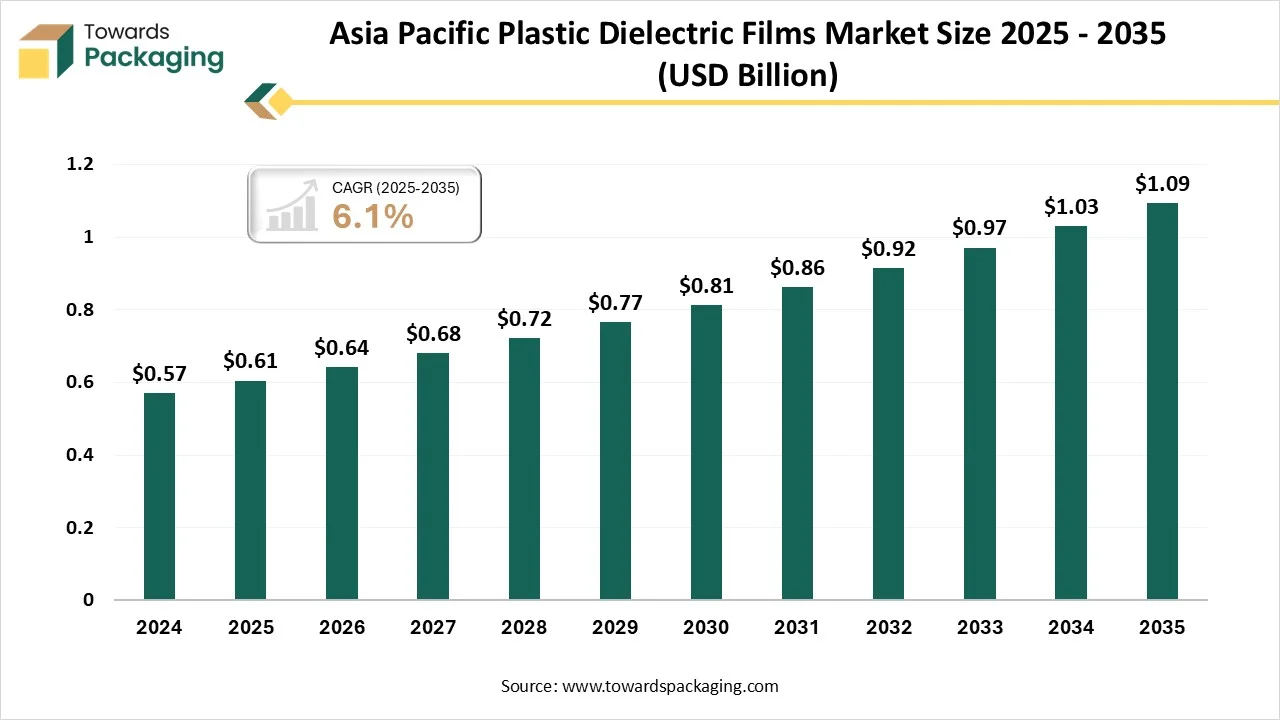

- By region, Asia Pacific dominated the global market by holding highest market share of approximately 35-40% in 2024.

- By region, North America is expected to grow at a notable CAGR from 2025 to 2034.

- By product / polymer type, the PET segment contributed the biggest market share of approximately 45-50% in 2024.

- By product / polymer type, the PEN segment will be expanding at a significant CAGR in between 2025 and 2034.

- By application, the Electrical & Electronics segment contributed the biggest market share of approximately 30-35% in 2024.

- By application, the solar & wind energy systems segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By end-user / industry, the electrical & electronics manufacturers segment contributed the biggest market share of 30-35% in 2024.

- By end-user / industry, the automotive OEMs & EV applications segment is expanding at a significant CAGR in between 2025 and 2034.

- By specification, the standard dielectric films segment contributed the biggest market share of approximately 50% in 2024.

- By specification, the high-temperature / low-loss specialty films segment is expanding at a significant CAGR in between 2025 and 2034.

What are Plastic Dielectric Films?

The plastic dielectric films refer to the global industry for polymer-based thin films that provide electrical insulation (high dielectric strength, low dielectric loss) and thermal/chemical stability for use in capacitors, transformers, flexible circuits, sensors, power electronics, and other high-voltage/high-frequency applications. Key film materials include PET, PEN, PP, PTFE, PVDF, PPS and specialty blends. The market growth is driven by increasing demand from consumer electronics, electrification of vehicles, renewable energy systems, miniaturization of electronic components, and the need for energy-efficient power conversion and insulation solutions.

Plastic Dielectric Films Market Outlook

- Rising Electronics and Automotives Sector: There is a rapid growth in the electronics and automotive sector with the rising demand of the consumers for products such as wearable watches, smartphones, and several other influenced the production process in this market.

- Demand for Renewable Energy: These packaging plays an essential role in energy saving process and production of solar panels helping the worldwide shift towards sustainable energy resources.

- High Performance Materials: Major companies are funding in R&D for the production of high-performance resources like PEN films, for the usage of electronic circuit protection, and high-voltage insulation.

- Startup Ecosystem: Development in the consumer electronics and automotives, and renewable energy industry majorly emphasizing on sustainability, advanced materials, and specialized applications. Advanced materials development, specialized application, and sustainability solutions has boosted this sector.

How Can AI Improve the Plastic Dielectric Films Market?

The incorporation of AI technology in the plastic dielectric films market plays an important role in enhancing the quality of the films, real-time data analysis, automated system, and enhanced efficacy. The continuous demand for advancement of material and designing with optimization of designing process has enhanced the demand for incorporation of AI technology. Generative AI is utilized for efficient designing of various components such as film capacitors and useful in reducing the generation of waste materials. Advanced technology is helpful in improving the recycling process.

Trade Analysis of Plastic Dielectric Films Market: Import & Export Statistics

- China is rapidly driven due to huge utilization of renewable energy segment and domestic electronics.

- India is growing significantly and valued around USD 111.7 million in 2022 which is anticipated to develop to USD 178.8 million by the end of 2030.

- Japan has huge growth in the electric market which has enhanced trade in this region. It is valued approximately $23.4 million in 2022 and expected to grow rapidly.

- Germany is a major exporter of non-cellular polyethylene films. It is valued around $72.3 million in 2023 and anticipated to reach $103.3 million by the end of 2033.

The U.S. is growing in domestic demand and import of plastic dielectric films in insulators and capacitors.

Plastic Dielectric Films Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), Polyphenylene Sulfide (PPS), Polyethylene Naphthalate (PEN), Polypropylene (PP), and Polyethylene Terephthalate (PET).

- Key Players: SABIC, Toray Industries

Component Manufacturing

The major components used in this market are aluminum foil, paper & paperboard, polyvinyl chloride, polyethylene, and several other materials.

- Key Players: UACJ Corporation, Berry Global Inc.

Logistics and Distribution

This segment plays an important role in interconnecting worldwide supply chain and manage handling in three steps primary, secondary, and tertiary.

- Key Players: United Parcel Service (UPS) Healthcare, CEVA Logistics

Pharmaceutical Packaging’ Regulatory Landscape: Global Regulations

| Regions/ Countries |

Regulatory Bodies |

Key Regulations |

| Canada |

Environment and Climate Change Canada (ECCC) |

EPR & single-use ban |

| Japan |

Ministry of the Environment (MOEJ) |

Plastic Resource Circulation Strategy |

| United States |

FDA (food contact) |

Prevent plastic pollution |

| India |

Central Pollution Control Board |

Monitor the quality of the plastics used for packaging to reduce plastic usage. |

Market Dynamics

Market Driver

Rising Demand for Electronic Products

The rising demand for electronics products has influenced the demand for the plastic dielectric films market. Increasing usage of devices such as laptops and smartphones has encouraged the development of this market. The rapid expansion of the renewable source of energy like wind and solar power has boosted the market to develop. Some of the major factors boosting the growth of the market are technological advancement, electronics and consumer devices, miniaturization and performance, electric vehicles, and material innovation.

Market Challenges and Restraints

Supply Chain Disruptions

Growing supply chain disruption of the dielectric films have hindered the growth of the market. Strict safety guidelines in the packaging industry have restricted the growth of this market. Huge development charges associated in this market has limited the innovation process of the industry.

Market Opportunity

High Performance Electronic Components

High performance electronic components have raised the opportunities for the market. Enhancing 5G/ IoT infrastructure, automotive sector, and consumer electronics industry has boosted innovation process in this market which resulted in widening scope. The development of 5G network and extended digital infrastructure need effective electronic components. The increasing worldwide production of flexible electronic modules has promoted several scopes in this market.

Product / Polymer Type Insights

Why Polyethylene Terephthalate PET Segment Dominated the Plastic Dielectric Films Market In 2024?

The polyethylene terephthalate PET segment dominated the plastic dielectric films market in 2024 due to its balanced performance and versatility. The growing consumer electronics industry, comprising wearable devices, smartphones, and tablets enhance the demand for this segment. This segment is driving the market for covering range from packing to films and fabrics to molded parts for automobiles and electronics, and others. It has enhanced thermal resistance, pushing the development of this market, thus influencing market segment for electric insulation resources.

The polyethylene naphthalate (PEN) segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to its chemical durability, dimensional stability, and excellent thermal resistance. This is accredited to its extensive application in film-grounded goods like optical displays, labels, flexible printed circuits, and laminates. PEN is considered as a high-performing fibre with improved hydrolytic steadiness and is mainly well-matched for things that are likely to oxidation due to its less oxygen penetrability.

Application Type Insights

Why Electrical & Electronics Segment Dominated the Plastic Dielectric Films Market In 2024?

The electrical & electronics segment dominated the plastic dielectric films market in 2024 due to rising consumer electronics demand. This development is influenced by growing demand for high presentation dielectric films in circuit safety, sensors, and capacitor engineering. The ability of these packing to provide continuous insulation and excellent power and compressed electronic arrangements. Growth of customer electronics, coupled with improvements in renewable energy and electricity flexibility, has additionally enhanced practice.

The solar & wind energy systems segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to the insulating and energy storage potential. Necessity for the utilization of renewable sources has enhanced the demand for these films. Contribution of major market players for the development of this sector has boosted its demand.

End-User Type Insights

Why Electrical & Electronics Manufacturers Segment Dominated the Plastic Dielectric Films Market In 2024?

The electrical & electronics manufacturers segment held the largest share of the plastic dielectric films market in 2024 due to smart electronics demand. Manufacturers majorly focus on efficiency of energy and develop insulating films. The increasing focus towards biodegradability and recyclability of the films has enhanced its demand in this market. The growing trend for miniature products has influenced the demand for this segment.

The automotive OEMs & EV applications segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to the rising demand for components in the automotive sector. High thermal resistance, safety features, and dielectric strength have upsurged the demand for this segment. The moldability and flexibility of the polymers facilitate integrated and complex EV designs which reduce part counts and simplify manufacturing processes.

Specification Type Insights

Why Standard dielectric films Segment Dominated the Plastic Dielectric Films Market In 2024?

The standard dielectric films segment held the largest share of the plastic dielectric films market in 2024 due to its cost-effectiveness and wide application in general insulation, electronics, and packaging. The upsurge in the demand of smartphones and various consumer electronics. It is cost-effective solution available in this market for safe packaging of the electronics products. The enhanced energy storage system has influenced the growth of this segment.

The high-temperature / low-loss specialty films segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to continuous material enhancement. The rising demand for superior insulation, high thermal resistance, and low power dissipation boost the growth for this market. The advancement in films make it lightweight and suitable for packaging a huge variety of electronic products.

Regional Insights

Presence of Electronics Companies Demand in Asia Pacific Promote Dominance

Asia Pacific held the largest share of the plastic dielectric films market in 2024, due to the presence of huge electronics companies in countries such as India, China, Japan, and several others. The well-established electronics producing ecosystem in this region, mixed with the increasing demand for energy-effectual capacitors and progressive electrical machineries, is enhancing the usage of high-presentation dielectric films. It is reinforced by flexible and automotive electronics engineering. China’s manufacture of capacitor film and innovative energy power storing approves PET dielectric film and polypropylene dielectric film, which grades top in the internal scale manufacture of the plastic dielectric films.

North America’s Well-established Industries Enhance Market Demand

North America expects fastest growth in the market during the predicted period. This market is growing due to the availability of well-established industries of automotive, electronics, renewable energy, and aerospace. This region assistances from well-recognized manufacturing outline, cultured research and expansion competences, and a robust assurance to energy-effectual, high-presentation electronic arrangements. The increasing acceptance of electric vehicles, development in solar and solar energy schemes, and the placement of 5G structure are growing the demand for reliable dielectric resources in circuit and capacitors shield components.

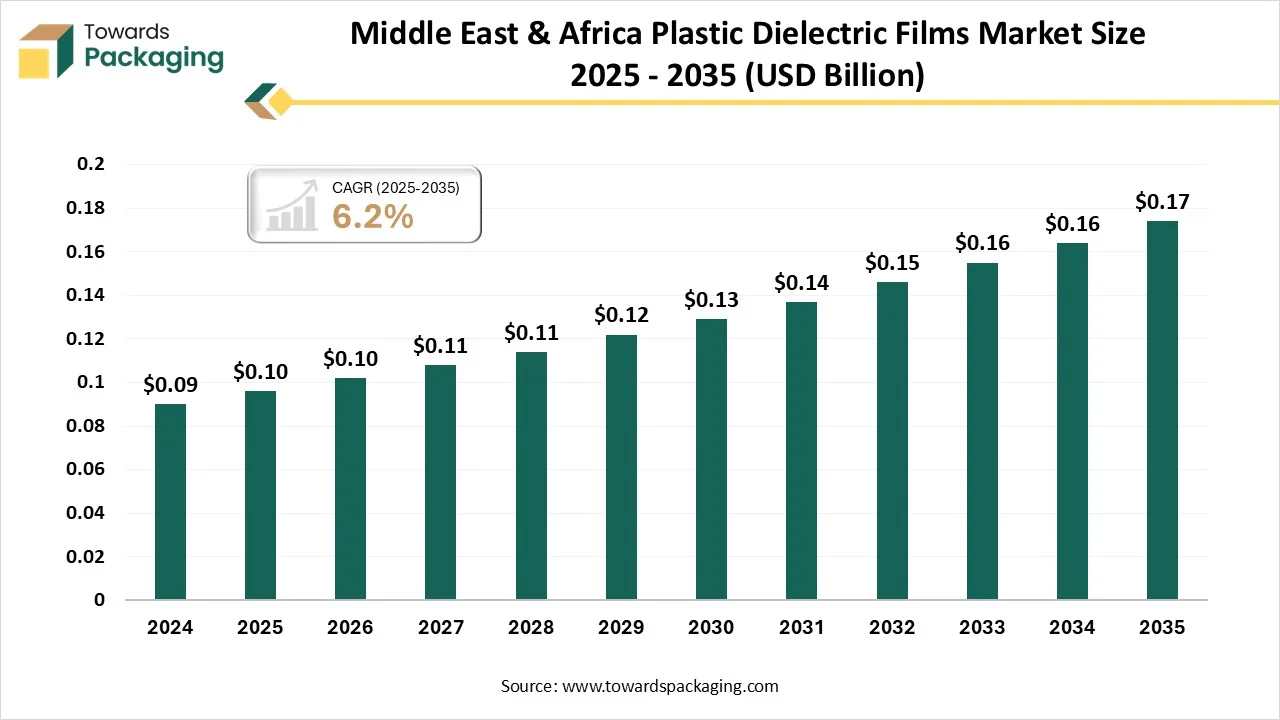

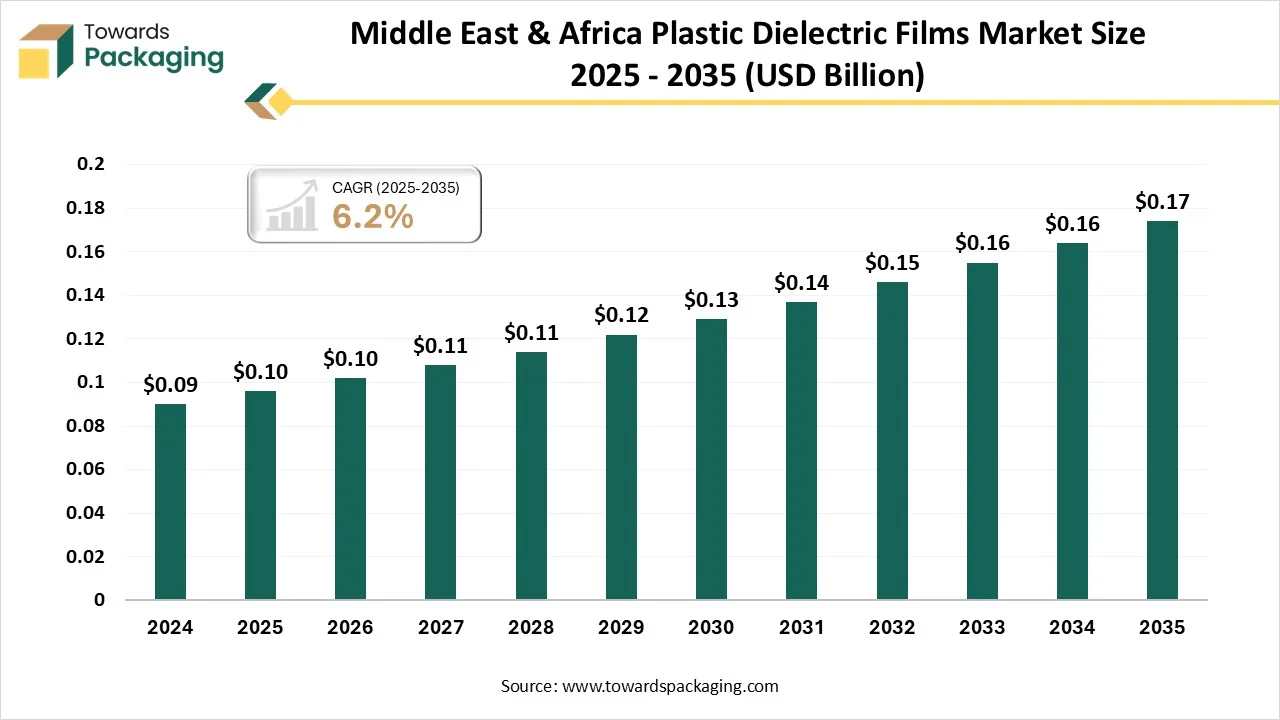

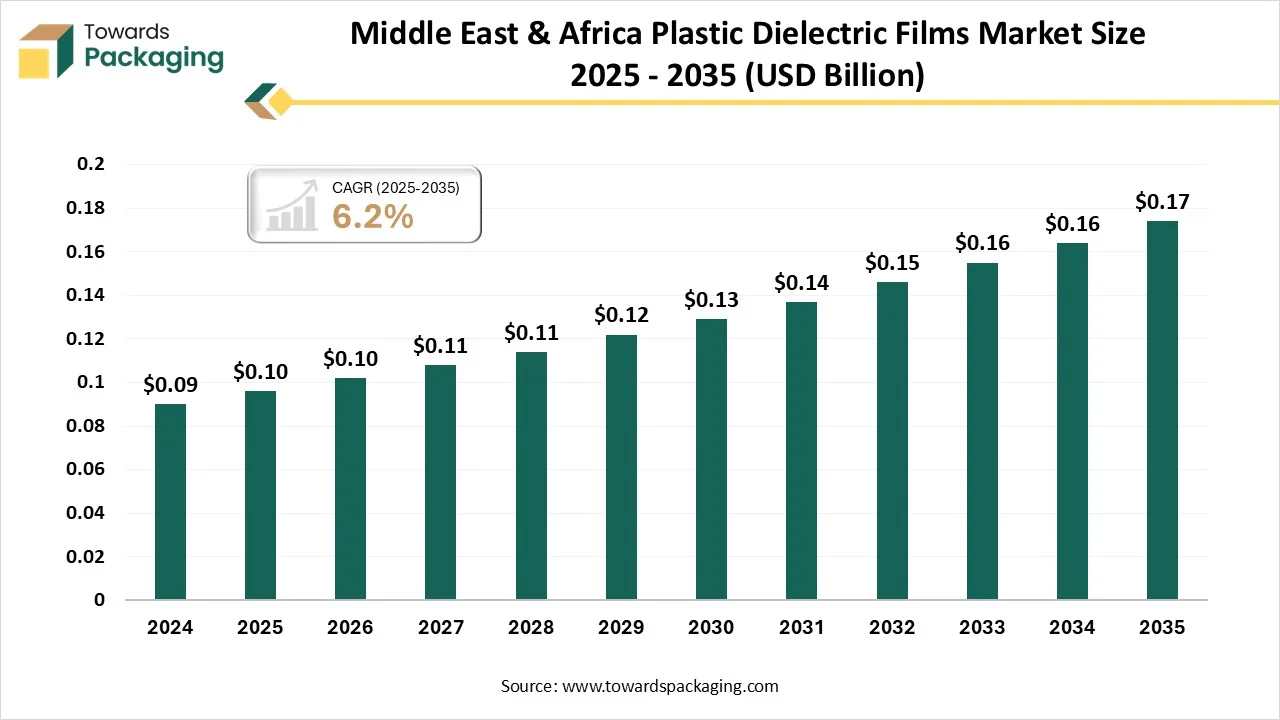

Middle East & Africa Plastic Dielectric Films Market Size 2025 - 2035 (USD Billion)

Recent Developments

- In March 2025, JPFL Films Private Limited declared as the first company to launch Biaxially Oriented Polyamide (BOPA) Nylon film packaging in India.

- In June 2025, Honeywell Aclar announced the development of packaging for Evercare pharmaceutical brand. These are medical grade flexible as well as rigid packaging solution which protect medicines from moisture and maintain drugs integrity.

Top Companies in the Plastic Dielectric Films Market

- DuPont Teijin Films: It is a major supplier of special materials and polymers and produce high-density polyethylene fibre.

- Toray Industries, Inc.: It is a global producer of advanced materials which had introduced GA Series.

- Treofan Group: It is a global producer of biaxially oriented polypropylene (BOPP) films.

- Coveme S.p.A.: It is an Italian producer of treated polyester packaging.

- SABIC: It is a global leader in polymers and chemicals which offer high-performer thermoplastics.

- Others: KOPAFLIM Elektrofolien GmbH, Bolloré Group, SMEC Limited, Plastic Capacitors, Inc., Mitsubishi Polyester Film (Mitsubishi Chemical / group), SKC Co., Ltd., PolyOne (Avient), Uflex Limited (converters / specialty films), Celanese Corporation (specialty polymer films), Polyplex (PET/PEN film manufacturer)

Plastic Dielectric Films Market Segment Covered

By Product / Polymer Type

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyethylene Naphthalate (PEN)

- Polytetrafluoroethylene (PTFE / Teflon)

- Polyvinylidene Difluoride (PVDF)

- Polyphenylene Sulfide (PPS)

- Others (specialty blends, bio-based variants)

By Application / Function

- Capacitors (film, power, decoupling)

- Electrical & Electronics

- Transformers & Inductors insulation

- High-Frequency Printed Circuit Boards (HFPBs), Flexible Circuits & Sensors

- Solar & Wind Energy Systems (inverters, PV module components)

- Automotive (EV power electronics, battery insulation)

- Aerospace & Defense (lightweight, harsh-environment insulation)

- Others (consumer electronics, electrical insulation, packaging)

By End-User / Industry

- Electrical & Electronics Manufacturers

- Automotive OEMs & Tier-1s

- Renewable Energy Companies

- Aerospace & Defense

- Consumer Devices / Wearables

- Industrial Power & Infrastructure

- Packaging & Other Industrial Uses

By Specification / Performance Attributes

- Dielectric Strength (voltage rating)

- Thickness / Gauge (microns)

- Temperature Stability / Max Operating Temperature

- Dielectric Loss / Dissipation Factor

- Moisture / Humidity Resistance

- Mechanical Properties (tensile strength, flexibility)

- UV / Environmental Stability

- Metallization or coating variants

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait