Robotic Palletizers & De-Palletizers Market Size, Demand and Trends Analysis

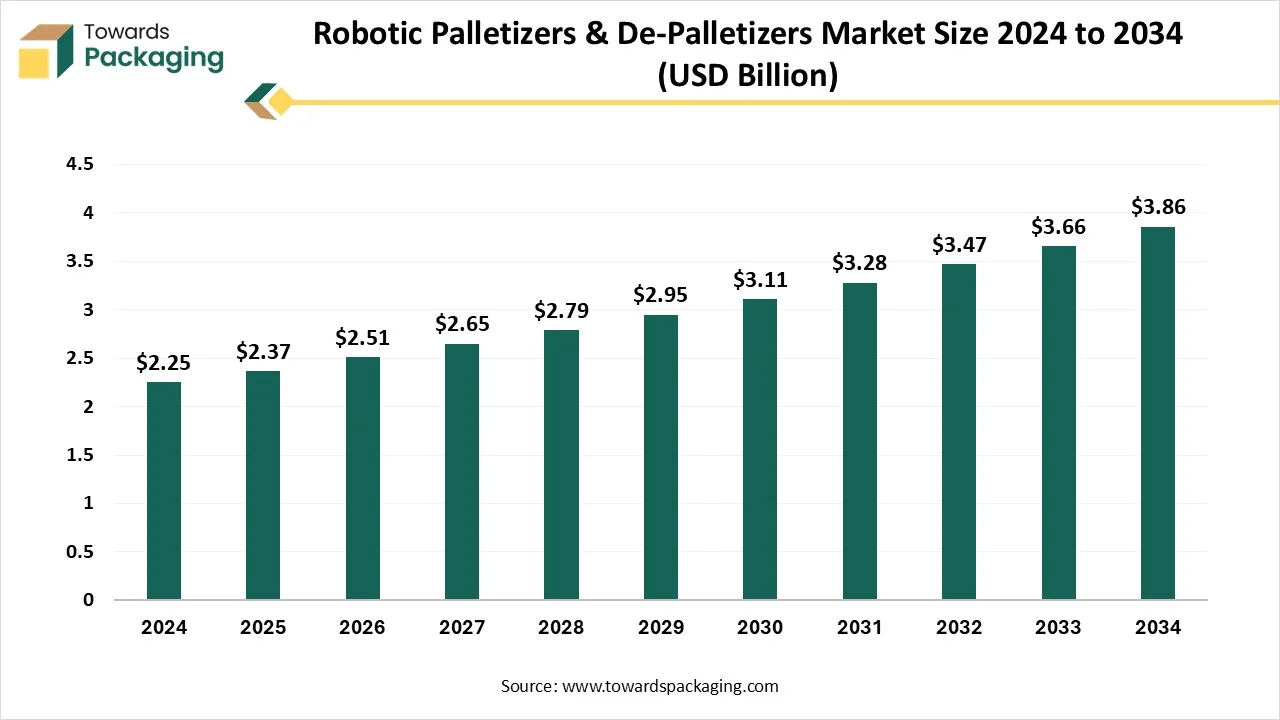

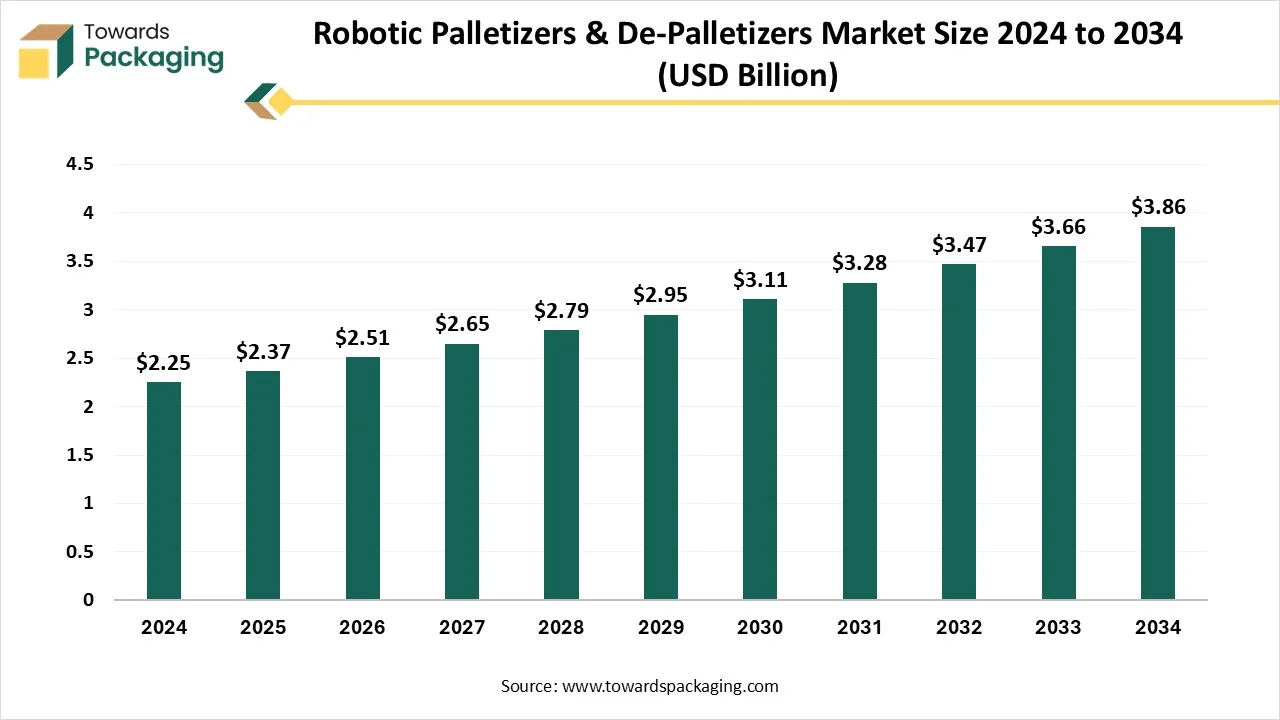

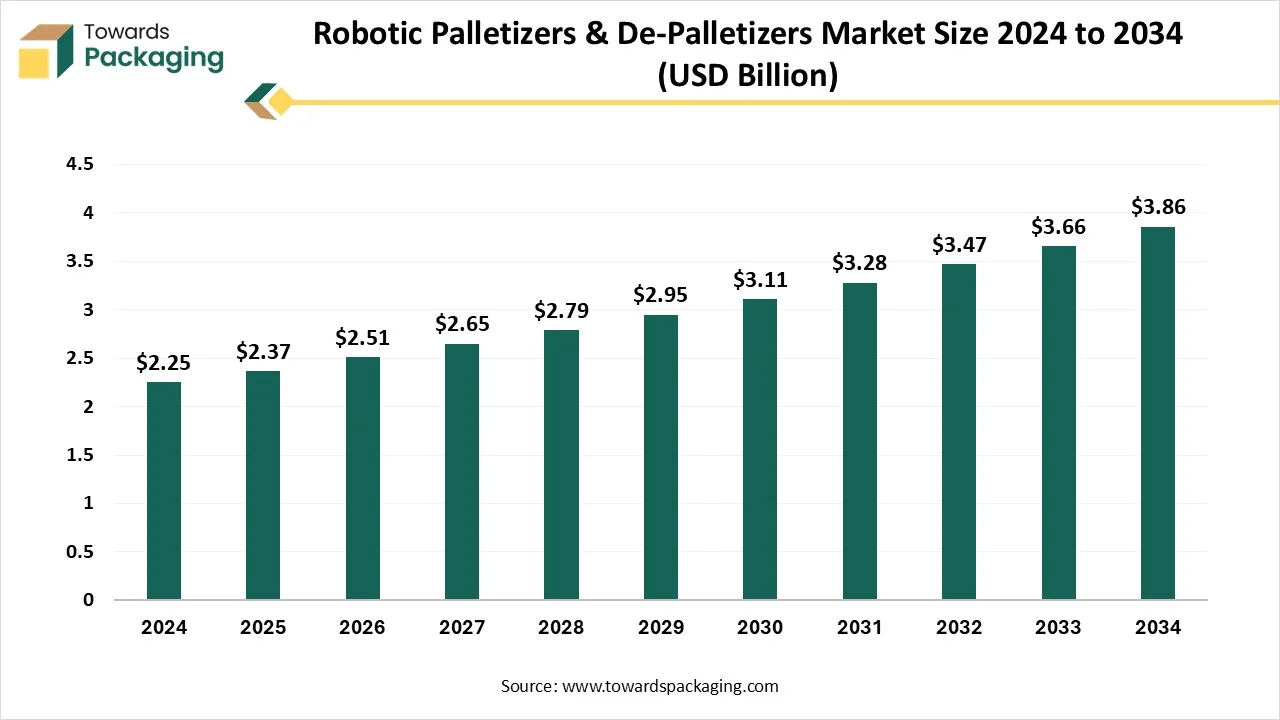

The robotic palletizers & de-palletizers market is predicted to expand from USD 2.51 billion in 2026 to USD 4.07 billion by 2035, growing at a CAGR of 5.55% during the forecast period from 2026 to 2035. The demand for robotic palletizers is very high as they automate the palletizing procedure, which eliminates the manual labour costs linked with this task. Also, automation develops the effectiveness and consistency that leads to cost savings for the manufacturing process.

Key Highlights

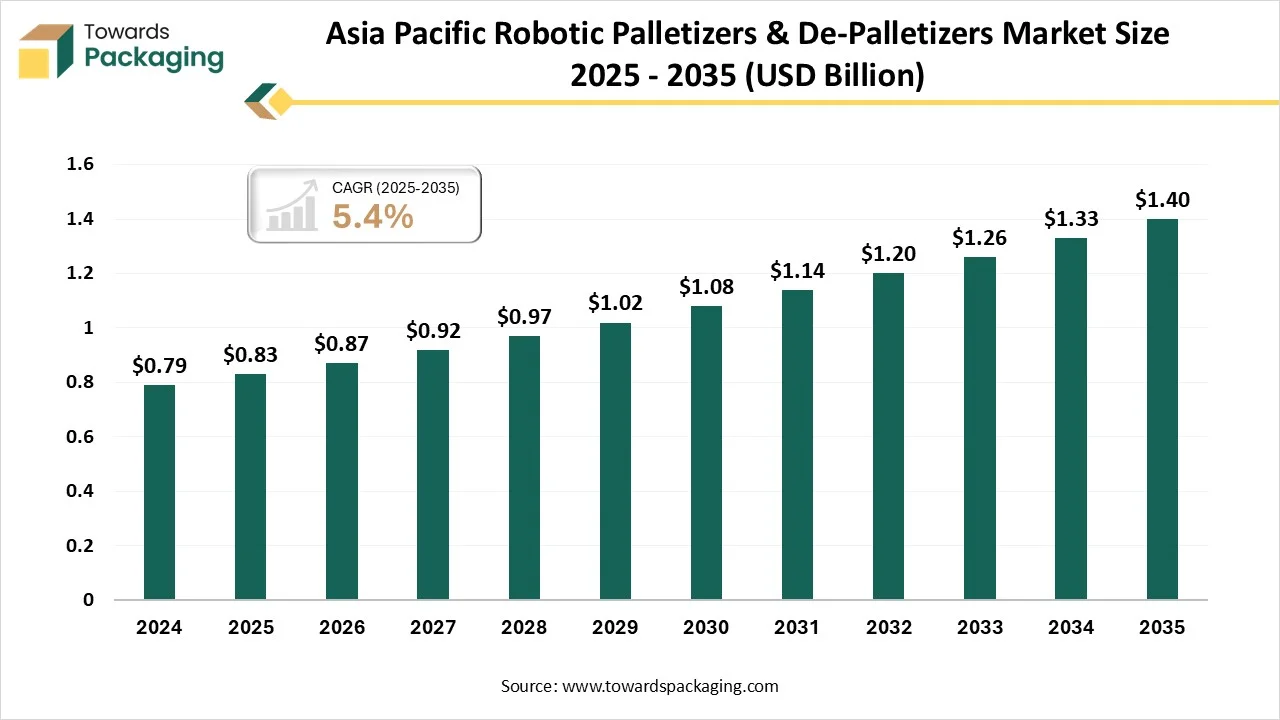

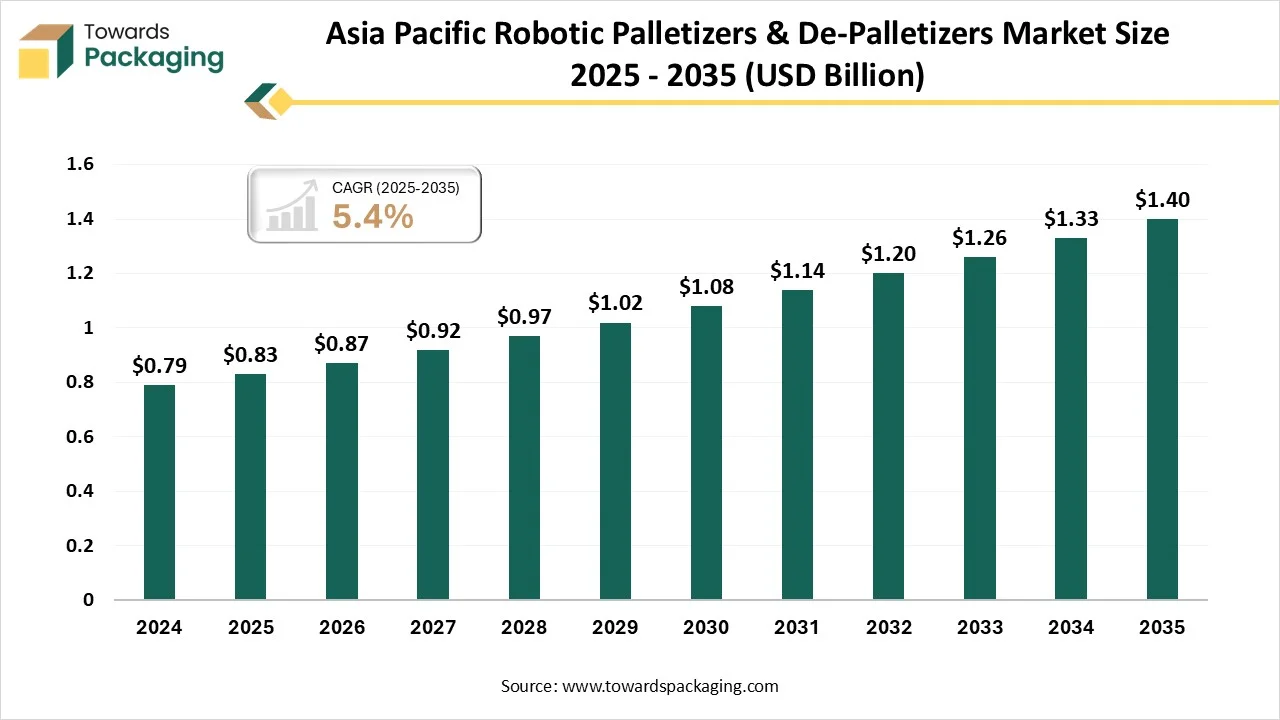

- In terms of revenue, the market is valued at USD 2.25 Billion in 2024.

- The market is predicted to reach USD 4.07 Billion by the year 2035.

- Rapid growth at a CAGR of 5.55% will be officially experienced between 2025 and 2034.

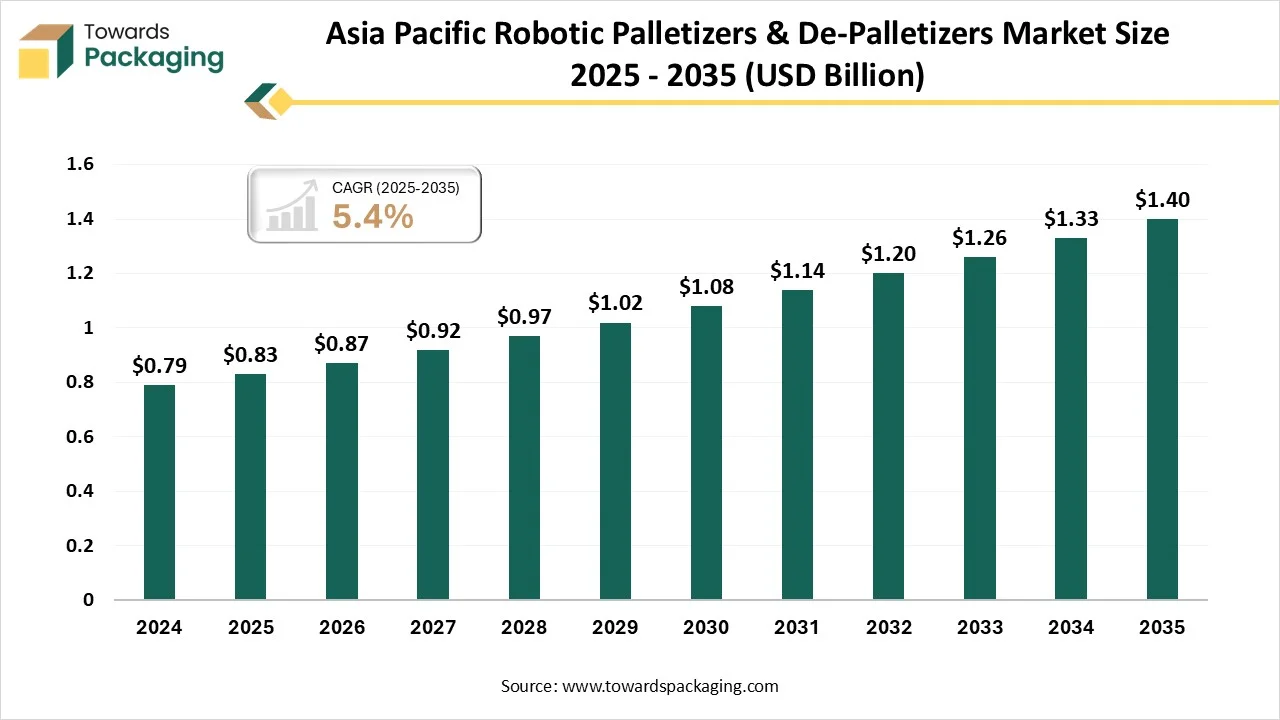

- The Asia Pacific region has dominated the region, having the largest share of 35% in 2024.

- North America is expected to grow at a notable CAGR between 2025 and 2034.

- By robot type, articulated robots have contributed to the largest share of 50% in 2024.

- By robot type, collaborative robots will grow at a notable CAGR between 2025 and 2034.

- By automation level, fully automated palletizing systems have contributed to the largest share of 60% in 2024.

- By automation level, robotic de-palletizing systems will develop at a notable CAGR between 2025 and 2034.

- By product type, cartons and boxes have contributed to the largest share of 38% in 2024.

- By product type, containers and bottles will grow at a notable CAGR between 2025 and 2034.

- By end-use industry, the food and beverage industry has contributed the largest share of 30% in 2024.

- By end-use industry, logistics and e-commerce will grow at a notable CAGR between 2025 and 2034.

Market Overview: Importance of Robotic Palletizers and De-palletizers

Robotic palletizers & de-palletizers: Automated robotic systems that pick, place, stack, unstack, and organize goods onto or off pallets using programmable robots, end-of-arm tooling, control systems, and conveyor/infeed/outfeed integrations for end-of-line pallet load formation and depalletization.

Automated palletizing systems are a main part of the industrial palletizing system that has changed the way organizations manage goods. From the food and beverage sector to manufacturing and pharmaceuticals. Robot palletizing is a main area of current production lines. These machines deliver speed, continuity, and reliability to the procedure, which substitutes the sameness of manual labor with the accuracy of high-level robotics.

Emerging Trends in Robotic Palletizers and De-Palletizers Market

Enhanced Safety: A robot palletizer can palletize more than 300 pounds and track finished loads of more than 4,000 pounds. These potentials can help us reduce lifting and continuous motion injuries, such as lower back pain. Lower back injuries are the main issue causing disability and account for nearly half of worker compensation claims.

Collaborative robots (Cobots): The growth of collaborative robots, or cobots, is laying the path for high-level automated palletizing Technology. Cobots are being crafted to work with human operators and do not need caging like regular palletizing robots. These kinds of machines use AI Algorithms to integrate into human workflows, ensuring effective collaboration while minimizing downtime.

Minimal Maintenance: Deploying robots does not require too much maintenance. These tracking and controlling systems totally rely on the surroundings in which they are used. Some variables count workplace cleanliness, refrigeration, and moisture.

Advanced robotic arms from medium to high loads: Regular palletizers have been the benchmark for carrying the heavy payloads in sectors demanding reliable automation and rigid too. These machines have the potential to control substantial weights with accuracy and consistency, which makes them indispensable in industries like chemicals, beverages, and construction materials. Hence, high-level AI-powered palletizing technology is serving to bridge the gap in carrying heavy loads, paving the path for more flexible and smart automation solutions.

Easy to customize: RMH Systems can craft and include custom robotic palletizer systems that align with different demands. From high-speed depalletizers to bulk depalletizers to tailored individual product carrying, the correct solutions have been crafted.

How has Artificial Intelligence Developed the Robotic Palletizer and De-Palletizer Market?

The future of robotic palletizing looks perfect as current technologies continue to develop. One of the most exciting areas of growth is the usage of machine learning and AI to assist high-level advanced systems in tracking data in real-time for smarter automation. This potential allows them to update stacking designs and adjust to variations in product shape and size.

Apart from these, a highlighting trend is the growth of collaborative robots, “cobots”.Just like regular robotic systems, which run individually, cobots are crafted to work with human operators, growing productivity by allowing mixed workflows in which humans and robots partner.

Sustainability is also becoming a main point in robotic palletizing. With growing demand for energy-efficient solutions, robotic palletizers are being crafted to use less energy while still developing complete efficiency.

Market Dynamics

Market Driver

Different Industries Use Robotic Palletizers and De-palletizers

In industrial packaging, palletizing robots develop productivity and lower labour costs. Among these uses, the food and beverage industry is the fastest-growing segment, driven by growing demand for efficiency and automation in the distribution process and production. The development in terms of e-commerce and the quest for updated supply chains further develop market development. Inventive solutions count on high-level machine learning algorithms for developed operations, partnership between robots and humans to develop flexibility and safety, and the integration of IoT for real-time tracking and monitoring.

Restraint

Setup Cost Leads to Many Barriers in the Robotic Sector

While robotic palletizers are increasingly preferred for their flexibility and efficiency, they also deliver some limitations. The starting setup cost is significantly higher compared to a conventional palletizing system, which can be a barrier for small and medium-scale enterprises. Their working demands skilled technicians for maintenance and dependency. Robotic palletizers may also face challenges in carrying extremely heavy loads or oversized products, for which conventional palletizers are most rigid.

Opportunity

Automation Leads the Development

Robotic palletizers and depalletizers serve as the main growth opportunities across sectors as companies move towards sustainability, efficiency, and automation. Growing labor costs, workplace safety concerns, and the demand for uninterrupted operations are pushing businesses to accept robotic solutions. The growing trend of e-commerce, fast-moving consumer goods, and the flexible packaging design is driving demand for robots that can handle diverse product shapes and sizes with accuracy.

Additionally, the integration of robotics with AI, IoT technologies, and machine vision opens avenues that lower adaptive palletizing systems, smarter systems that lower downtime and boost productivity. Also, customization opportunities for multi-line, multi-product operations and the move toward sustainable, energy, and space-saving further strengthen the market outlook.

Segmental Insights

How did the Articulated Robots Dominate the Robotic Palletizers and De-palletizers Market?

Articulated robots have dominated the robotic palletizers and de-palletizers market in 2024 as they are differentiated by their multi-axis joint structure, enabling higher flexible movement in three-dimensional space. The pattern of an articulated arm allows for accurate execution of complicated motion sequences, making them perfect for a huge range of industrial uses.

Their sequentially linked joints serve extensive flexibility and reach, enabling them to work smoothly in terms of complex industrial robot cells. This merger of precision, versatility, and reliability makes articulated robots an important part of current industrial manufacturing, assisting tasks across many industries with high consistency and efficiency.

The pattern of an industrial articulated robot is being classified by a collar at its end, which facilitates the linking of different end effectors, such as suction cups, grippers, and welding torches. This acceptability allows for a huge range of tasks, from electronics assembly to automotive welding.

The collaborative robots segment is expected to be the fastest in the market during the forecast period. Cobots are classified from normal robots by working with employees instead of replacing them. A robot works with speed or in surroundings that can’t handle, a cobot that shares the current condition with the employee. A palletizer is a kind of automated packaging system that transforms boxes or products from a conveyor and loads them on a pallet for storage or transportation. Collaborative robots operate safely and need no extra space or safety precautions to avoid injuring workers.

How did the Fully Automated Robotic Palletizing System Dominate the Robotic Palletizers and De-palletizer Market in 2024?

The fully automated robotic palletizing system had dominated the robotic palletizer and de-palletizer market in 2024 as it is a high-level material-handling solution that avoids the demand for manual intervention in stacking, arranging, and transporting products onto pallets. Unlike semi-automated or conventional systems, these setups integrate robotic arms with vision systems, conveyors, and automated guided vehicles or autonomous mobile robots for seamless end-to-end palletizing. Such systems can manage multiple product types, shapes, and sizes, making them ideal for sectors with high-volume and high-mix production, such as food and beverages, e-commerce, and pharmaceuticals. Main advantages include reduced labor dependency, higher accuracy, and operational safety productivity. Additionally, when combined with AI-driven software and IoT-enabled monitoring, these types of systems accept real-time product variations, update pallet patterns, and allow predictive maintenance.

Robotic de-palletizing systems are expected to be the fastest in the market during the forecast period. A depalletizing robot is a high-level industrial robot, particularly designed to remove products from pallets and move them to a designated location, whether it is a manufacturing line or a storage area. An procedure that regularly need an perfect deal fro manual labor is now fully automated through the usage of complete automated through the use of depalletizing robots. They are greatly quicker than manual unloading. Such systems are crafted to handle almost every pallet configuration, packaging types, and product mixes. They also vanish user-friendly, labour, and safety availability problems which come with the manual uploading process.

How did the Cartons and Boxes Dominate the Robotic Palletizers and De-palletizers Market?

Cartons and boxes have dominated the market in 2024 as palletizing denotes the practice of arranging items onto a pallet, in which depalletizing includes systematically unloading these items. A pallet is basically a square platform crafted to facilitate the traveling and secure handling of different items simultaneously. Depalletizers excel at smoothly uploading these pallets once they reach their destination. These kinds of machines are expendable for managing different items on pallets, arranging the unpacking of products such as cans, bottles, open trays, cardboard boxes, and other boxes using specialized depalletizers.

Bottles and containers are predicted to be the fastest-growing segment in the market during the forecast period. Robotic palletizers and de-palletizers use high-level robotic arms, vision systems, grippers, and conveyors to smoothly handle bottles and containers of different sizes, shapes, and materials. In palletizing, filled bottles or containers are being received from manufacturing lines via conveyors, accurately selected using end-of-arm-tooling such as vacuum grippers, suction cups, magnetic clamps, or mechanical grippers, and stacked on pallets in a stable, that is programmed design. Robotic systems ensure gentle handling to avoid damage or leakage, especially with sensitive glass bottles.

How did the Food and Beverage Industry Dominate the Robotic Palletizers and De-palletizers Market?

Food and beverages dominated the robotic palletizer and de-palletizer market in 2024, as the use of automation and robots in food manufacturing has led to faster production. Collaborative robots can now pack many bottles and packages and perform other complicated tasks more smoothly than humans can. For instance, warehouses and palletizing robots have led to organizations boosting production in a short period. Place and pick robots utilized for food picking applications are another game-changer for each company using them.

Apart from these, the running environment has a great effect on the palletizing system. The food and beverage industry has demands, just like other industries. So, it adds to particular hygiene orders and material handling. Food and beverage factories often demand more floor space. They may also demand a palletizing system to fit into the current production line.

Logistics and E-commerce are predicted to be the fastest-growing sectors in the market during the forecast period. As supply chain and logistics operations are deeply involved in e-commerce, the handling and processing of goods demands efficiency and speed. One of the main inventions helping the growing demand in e-commerce warehouses is warehouse automation. Sophisticated warehouse automation solutions like robotic palletizers for e-commerce are becoming increasingly crucial as order grows and delivery speed becomes compulsory.

E-commerce warehouses deal with many inventory items daily, making it compulsory to have effective and fast processing of packaging and palletizing. Robotic palletizers serve e-commerce as a smooth alternative to regular palletizing systems, ensuring high-accuracy stacking of products.

By Region

How did the Asia Pacific Dominated the Robotic Palletizers and De-palletizers Market in 2024?

Asia Pacific dominated the robotic palletizer and de-palletizer market in 2024, as Asia is not just accepting robotic palletizing, but is also accelerating adoption with confidence and invention. In China, many large-scale facilities specialising in robotic palletizing have emerged across e-commerce and user electronics sectors, signaling that automation is now mainstream to competitive supply chains. In Japan, industrial zones equipped with automation labs are pushing the frontier by refining robot efficiency for complicated packaging workflows.

Additionally, in Southeast Asia, food production plants are racing to develop automated canning and palletizing lines that elevate fuel and output exports. This tapestry of deployment speaks to a region-wide change; robotic palletizers are being developed as vital tools for overcoming labor constraints, growing productivity, and building resilience across fast-evolving industries.

North America region is predicted to be the fastest-growing market during the forecast period. As it continues to lead in accepting robotic palletizer and depalletizer systems, with the United States accounting for approximately 68% of regional growth. This dominance is filled by challenges like labor shortages, increasing automation, and rising wages initiatives across industries. Businesses are shifting to robotics to boost efficiency, improve safety in material handling, and reduce manual labor.

The growth of e-commerce, especially in fulfillment and logistics, is driving demand for systems that can manage diverse SKUs accurately and flexibly, precisely. With North American manufacturers actively investing in AI, machine vision, and Industry 4.0 Technologies, the region remains a major and powerful hub for both the production and deployment of high-level palletizing information.

Robotic Palletizers and De-Palletizers Market Value Chain Analysis

Material Processing and Conversion: Material processing and conversion in robotic palletizers and depalletizers mainly include the effective handling of products during loading and unloading operations. In palletizers, material processing involves arranging, orienting, and stacking items such as bags, boxes, bottles, or containers onto pallets in a systematic manner. Robots filled with high-level end-of-arm tooling like suction cups, grippers, and clamps ensure accurate placement while tracking product safety and stability.

Package Design and Prototyping: Artificial Intelligence is updating the way packaging is crafted. Generative design algorithms can quickly make hundreds of capable packaging designs depending on particular parameters like material constraints, aesthetic choices, and cost targets. This specifically grows the design procedure, enabling companies to discover a huge series of options that would be possible with regular methods.

Logistics and Distribution: Robotic palletizing systems have the potential to work in quick surroundings at a much faster rate than the manual palletizing procedure, resulting in increased manufacturing efficiency. The robots are fully programmed in order to pick and place products in a particular design, which can be done quickly and accurately.

Top Robotic Palletizers and De-palletizers Companies

Robotic Palletizers and De-Palletizers Market Segmentation

By Robot Type

- Articulated robots (6-axis and multi-axis)

- SCARA robots

- Delta (parallel) robots

- Cartesian/gantry robots

- Collaborative robots (cobots)

By Automation Level

- Fully automated robotic palletizing systems

- Semi-automated robotic palletizing systems

- Robotic de-palletizing systems

By Product Type

- Cartons and boxes

- Bottles and containers

- Bags and sacks

- Drums and barrels

- Trays and bundles

By End-use Industry

- Food & Beverage

- Consumer Packaged Goods (CPG)

- Pharmaceuticals & Healthcare

- E-commerce & Logistics

- Automotive & Industrial Goods

- Chemicals & Fertilizers

- Paper & Pulp

- Agriculture

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa