U.S. Rigid Packaging Market Size, Growth Trends Companies, Trade Flows & Supply Chain Insights

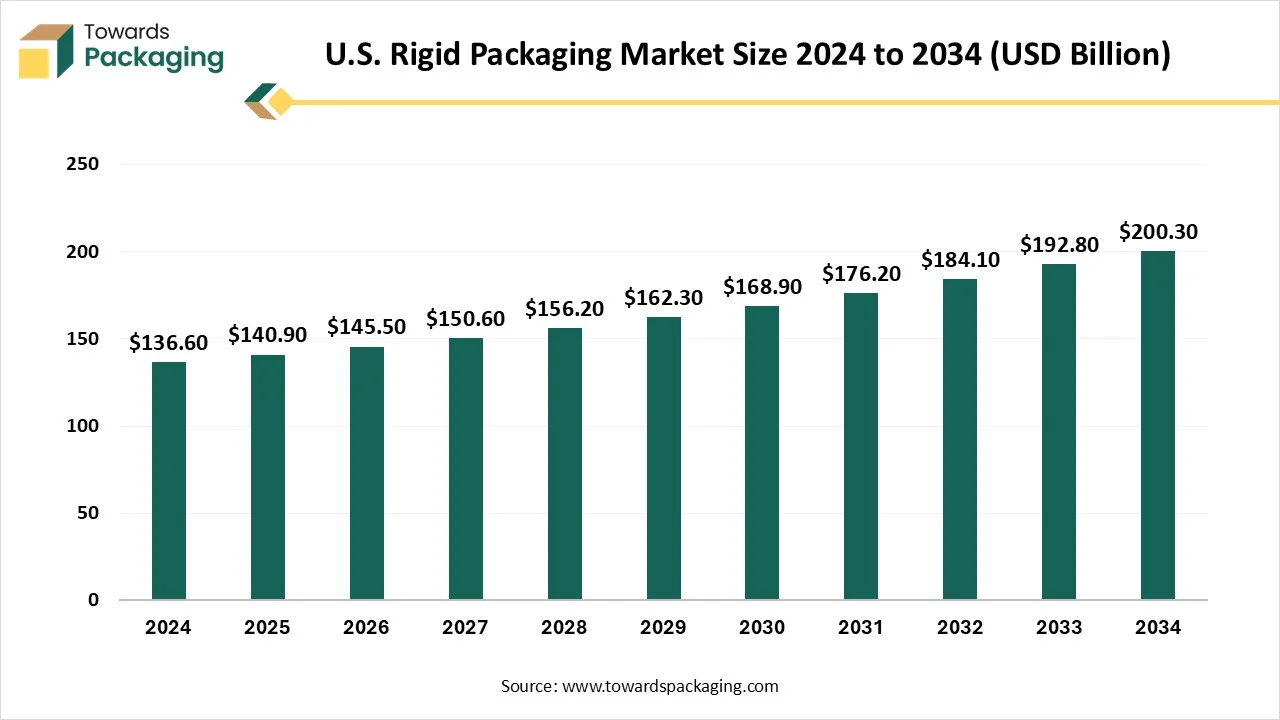

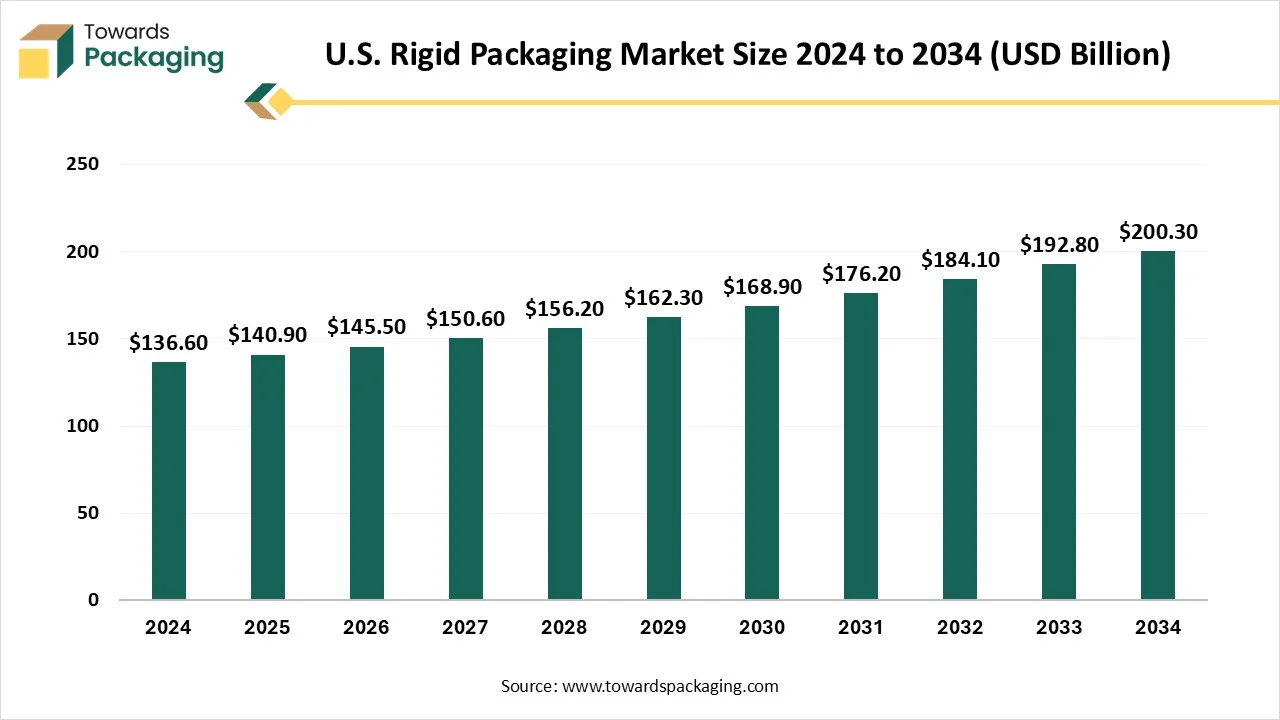

The U.S. rigid packaging market is thoroughly analyzed with complete coverage of its market size, forecast growth from USD 140.9 billion in 2025 to USD 200.3 billion by 2034, emerging trends, and segment-wise performance across material, product type, end-use, production process, and sustainability initiatives. The report covers detailed regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, supported by competitive analysis of major players such as Amcor, Berry Global, Crown Holdings, Ball Corporation, and Sonoco. It also includes value chain analysis, trade flow data, manufacturing ecosystem insights, supplier mapping, innovation updates, and regulatory influences shaping the U.S. rigid packaging landscape.

Major Key Insights of the U.S. Rigid Packaging Market

- In terms of revenue, the market is valued at USD 140.9 billion in 2025.

- The market is projected to reach USD 200.3 billion by 2034.

- Rapid growth at a CAGR of 3.9% will be observed in the period between 2025 and 2034.

- U.S. dominated the global market by holding highest market share in 2024.

- By material type, the plastic segment contributed the biggest market share of 45% in 2024.

- By material type, the biodegradable packaging segment will be expanding at a significant CAGR in between 2025 and 2034.

- By product type, the bottles and jars segment contributed the biggest market share of 38% in 2024.

- By product type, the tubs and buckets segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By end-use industry, the food and beverages segment contributed the biggest market share of 50% in 2024.

- By end-use industry, the pharmaceuticals segment is expanding at a significant CAGR in between 2025 and 2034.

- By production process, the blow molding segment dominated the market with the share of 30% in 2024.

- By production process, the thermoforming segment will be expanding at a significant CAGR in between 2025 and 2034.

- By sustainability initiatives, the recyclable materials segment contributed the biggest market share of 40% in 2024.

- By sustainability initiatives, the biodegradable packaging segment is expanding at a significant CAGR in between 2025 and 2034.

Market Overview

The U.S. rigid packaging market encompasses the segment of the packaging industry in the United States that involves the use of rigid materials such as plastics, metals, and glass to create containers and packaging solutions. These packaging solutions are characterized by their solid, inflexible structures, providing durability and protection for a wide range of products, including food and beverages, pharmaceuticals, personal care items, and industrial goods. The market is driven by factors such as consumer demand for convenience, advancements in packaging technologies, and the need for sustainable and eco-friendly packaging solutions.

Future Demands

- Demand will grow steadily because food, beverage, pharma, and household products still depend on rigid containers.

- Brands will adopt lightweight and recyclable rigid packaging to meet sustainability targets.

- Growth will be moderate, but long-term and reliable, because rigid formats offer strength, safety, and shelf impact.

- Demand will be influenced by consumer convenience, safety regulations, and e-commerce distribution.

- Manufacturers will invest in mono-material rigid designs that are easier to recycle.

- Increased demand for premium rigid packaging in cosmetics and personal care products.

- Higher sales of HDPE and PET rigid containers due to better recycling infrastructure.

- Automation and smart packaging technologies will make rigid packaging more efficient to produce.

Emerging Technologies

- Advanced lightweighting technologies to reduce material usage without compromising structural strength.

- Smart caps and closures with tamper-detection, freshness sensors, and time–temperature indicators.

- Digital printing for rigid formats supporting personalization, short-run packaging, and brand differentiation.

- High-performance recycled resins (rPCR/rPET) are designed for food-grade and industrial applications.

- 3D printing for packaging prototypes to speed up product development and reduce tooling costs.

- Molded fiber and pulp-based rigid packaging are replacing single-use plastics for eco-friendly applications.

Sustainability and Compliance

Sustainability in the U.S. rigid packaging market is increasingly shaped by regulations demanding higher recycled content, reduced waste generation, and lower emissions. In response, businesses are adopting reusable systems, lightening rigid formats, and using food-grade post-consumer recycled materials. Extended producer responsibility regulations at the state level are pressuring companies to fund recycling, enhance waste collection, and implement more transparent labeling procedures.

Investments in cutting-edge purification technologies are also being influenced by FDA safety regulations for recycled plastics to guarantee compliance for food and beverage applications. All things considered, regulatory pressure is hastening the transition from linear packaging systems to circular, traceable, and low-carbon alternatives.

U.S. Government Initiatives For Rigid Packaging:

- In year 204, legislators as then revealed an EPR bill, HB1630, Furthermore, the developing of the making of an producer Responsibility Organization (PRO) in the state is to check the EPR program as the bill had also solved to develop passionate goals for the producer to lower the packaging by up to 50% over an year and receive an 70% recycling rate within the 12 years.

- Currently, California’s PFAS law AB347 requires the Department of Toxic Substances Control to accept and enforce the limitations of food packaging that requires perfluoroalkyl and polyfluoroalkyl substances (PFAS).

- Regulations and Policy: Governments and organizations can set goals or laws to reduce plastic usage, which pushes the accurate disposal of plastic waste and addresses the most pressing issue of plastics. It is compulsory to have the data that assists in the instances of working localities that can be used to track plastic waste.

- Partnerships: Local government, governmental organizations, the informal waste sector, and other interested parties can operate collectively to develop public awareness and implementation of policies or educational campaigns that concentrate on plastic pollution.

What are New Trends in the U.S. Rigid Packaging Market?

- Growing Trend for Smart PackagingThe continuously growing demand for smart packaging due to traceability, product information, and consumer engagement.

- Demand for Portability & Convenience: The rising demand for packaging which are portable, convenient, durable, and easy-to-carry has raised the demand in this market.

- Huge Customization OptionGrowing customization options in this market has attracted various industries to adopt this type of packaging in the U.S.

- Food and Beverage: Rigid packaging is advantageous for the food and beverage industry, particularly in tracking their freshness and quality. Prevalent packaging for soda, wine, and juice counts on glass bottles to maintain their quality..Plastic containers are very common for soft drinks, ready meals, and butter for their easily accessible and lightweight opposition.

- Pharmaceutical and Healthcare: Rigid packaging is necessary in the pharmaceutical and healthcare sector to ensure sterility and safety of products. It is prevalently used glass vials to keep the medicine and vaccine that require protection for an extended shelf life. Rigid plastic pill bottles that have child-proof lids securely and economically complete the aim of storing tablets and capsules without any damage.

- Personal Care and Cosmetics: The personal care and cosmetics rely too much on rigid packaging, as both are perfect for working and good for appearance. Shampoos, lotions, and conditioners are usually put in plastic pump bottles that serve the convenience of use and managed dispensing too.

- Household and Service use: Household products and the use of sectors demand strong packaging with other qualities that ensure the safe handling of the products. Hence, the cleaning against, detergent bottles, and tool cases are rigidly covered to prevent spills, leaks, or any other damage.

- Electronics and Luxury goods: Exclusive electronics and premium goods need rigid packaging to develop the brand value and protection. Rigid containers have been used for watches, smartphones, and jewellery for safe storage and transportation. Producers use many plastic containers for cameras, headphones, and other electronic products to integrate durability with polished style.

How Can AI Improve the U.S. Rigid Packaging Market?

The addition of AI technology in the U.S. rigid packaging market plays a crucial role from designing of the packaging to its distribution process. It is widely used to fulfil the sustainability goal of the major market players. Incorporation of AI in the production process enhance efficiency, reduce time, and lessen charges associated with these packages. It improves the quality of the packages to fulfil the demand of the consumers. Advanced technology help in choosing smart packaging materials such as compostable or bio-based plastics.

Government Initiatives for Rigid Packaging in the United States

This longstanding federal law sets the foundation for waste management and recycling regulation in the United States. It establishes national goals to reduce waste generation, encourage recycling and source reduction, and ensure hazardous and nonhazardous waste (including packaging waste) are managed in an environmentally sound manner. The FPLA regulates how many consumer products must be packaged and labeled when sold across state lines. For rigid packaging used in consumer goods, the law requires clear labeling of contents, manufacturer/packer/distributor identity, net quantity (in both U.S. customary and metric units), and other disclosures.

State-Level Extended Producer Responsibility (EPR) Laws for Packaging

In recent years, a growing number of U.S. states have passed legislation under the EPR framework. These laws shift responsibility for post-consumer packaging waste including rigid packaging, onto producers rather than municipalities.

- States such as Maine, Oregon, Colorado, California, Minnesota, and Washington have enacted or recently updated packaging-specific EPR legislation.

- Under these laws, producers must finance and manage collection, recycling, and disposal of packaging. Often, they pay into a Producer Responsibility Organization (PRO) or similar entity, which in turn supports municipal recycling infrastructure, waste-management systems, and public education about sustainable disposal.

- Many of these laws encourage or require design changes, prompting packaging producers to use more recyclable materials, minimize waste, and consider recyclability from the design stage onward which directly impacts how rigid packaging is developed.

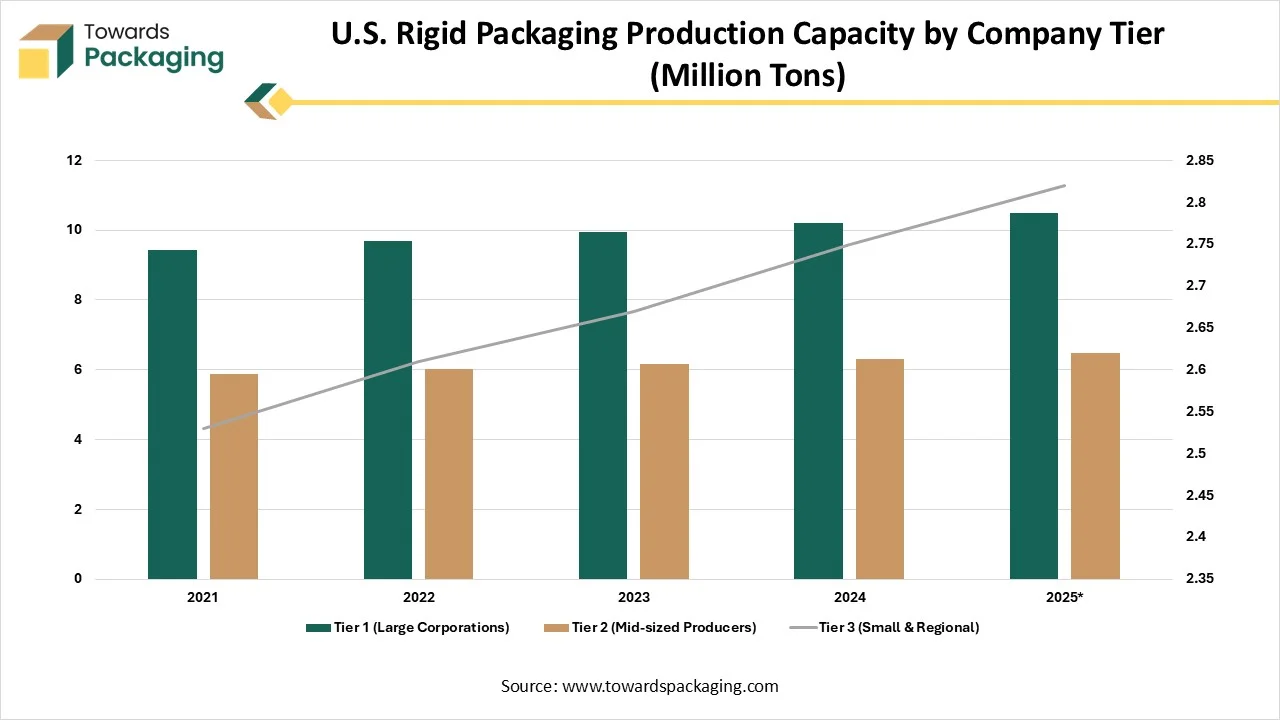

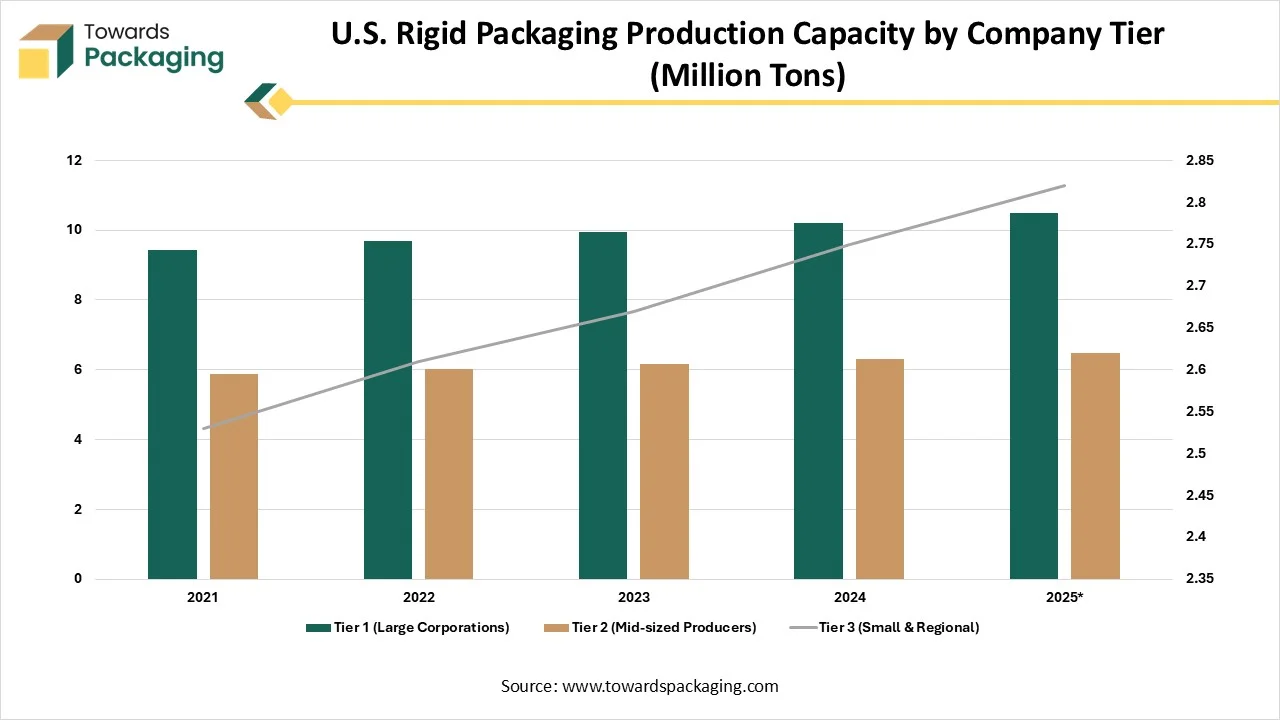

U.S. Rigid Packaging Production Capacity by Company Tier (Million Tons)

| Company Tier |

2021 |

2022 |

2023 |

2024 |

2025 |

| Tier 1 (Large Corporations) |

9.44 |

9.7 |

9.96 |

10.22 |

10.49 |

| Tier 2 (Mid-sized Producers) |

5.87 |

6.01 |

6.16 |

6.32 |

6.48 |

| Tier 3 (Small & Regional) |

2.53 |

2.61 |

2.67 |

2.75 |

2.82 |

Market Dynamics

Market Driver

Changing Consumers Lifestyle & Convenience Drive the U.S. Rigid Packaging Market

The changing consumers lifestyle and demand for convenience has driven the U.S. rigid packaging market. The major market players of this packaging concentrate on paper-based alternates due to increasing plastic waste and also its adverse effect on environment. The growing trend for sustainable packaging draw attention towards paper packaging and it is thriving as a noteworthy trend in the worldwide industry. Government authorities and organizations in the U.S. have increased their attention towards development of sustainable ecology. With its high strength and firmness, plastic is an ideal material for manufacturing rigid packaging for several products.

Challenges and restraints

Ecological Pressures for Reduction of Plastic Waste Hindered the U.S. Rigid Packaging Market

The increasing ecological pressure associated with plastic packaging has hindered the expansion of the U.S. rigid packaging market. Instability in raw resource charges needed in production of the packaged goods is the main aspect hindering the development of the worldwide market. High charges connected with emerging the packing goods are also appraised to restrict market extension.

Market Opportunity

Rising Product Safety Extended the Opportunities of the U.S. Rigid Packaging Market

The increasing product safety extended has raised the opportunities for development of the U.S. rigid packaging market. The increasing adoption for recyclable, durable, and reusable packaging of products has boosted the innovation for rigid packaging in the U.S. The packaging protects from contamination, prevent the goods, simplifies storing & delivery, and comforts the procedure of managing packed goods in huge quantity. It offers an inaccessible inert ecology for the goods throughout transportation and storing, further permitting safe products delivery over long distances.

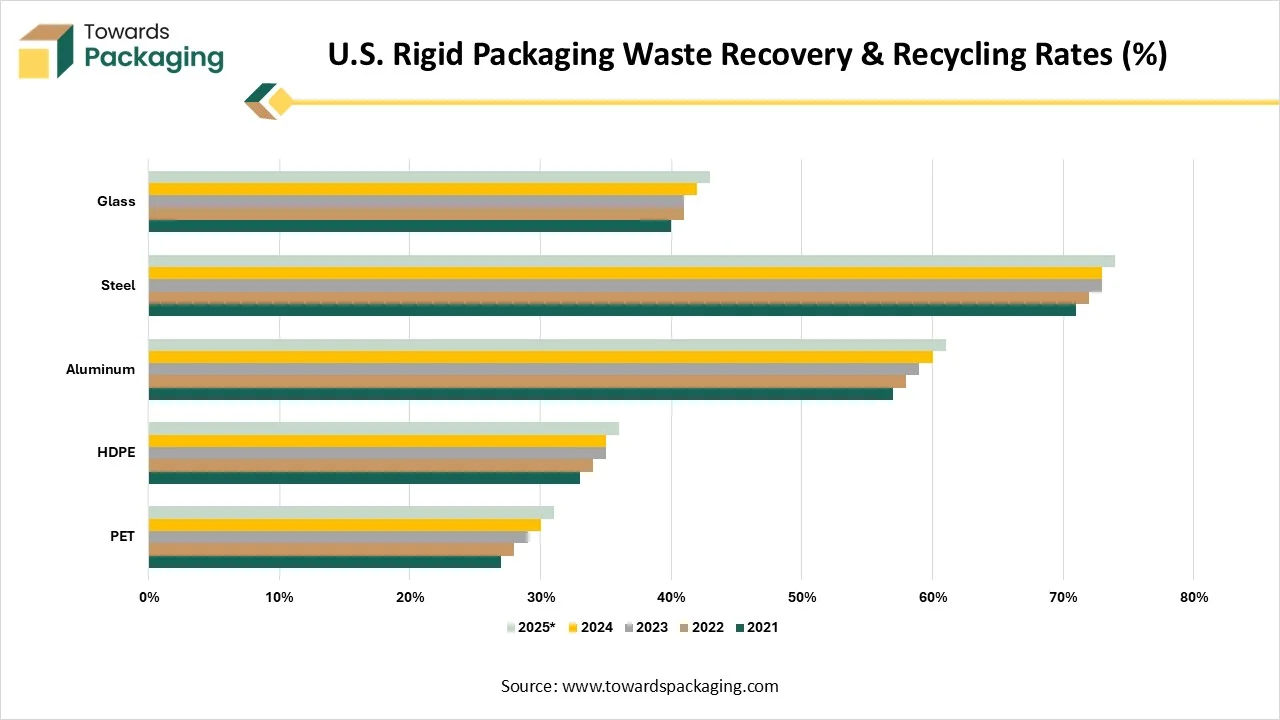

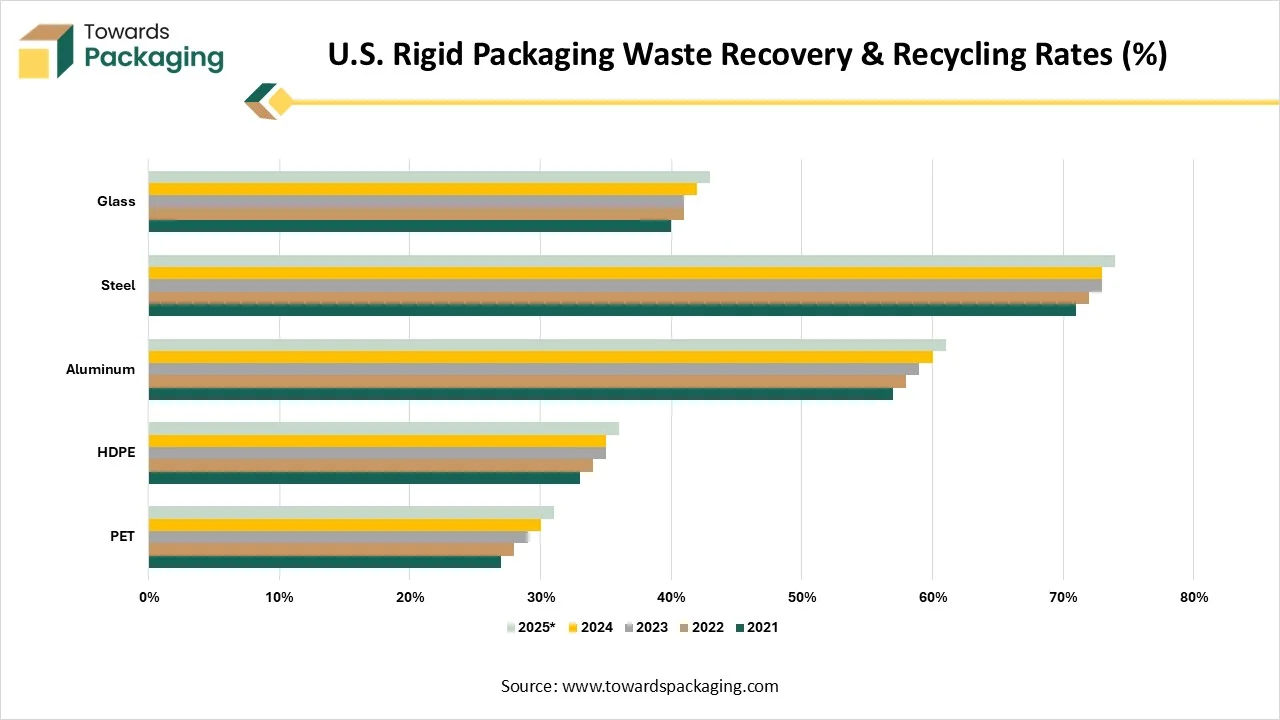

U.S. Rigid Packaging Waste Recovery & Recycling Rates (%)

| Material |

2021 |

2022 |

2023 |

2024 |

2025 |

| PET |

27% |

28% |

29% |

30% |

31% |

| HDPE |

33% |

34% |

35% |

35% |

36% |

| Aluminum |

57% |

58% |

59% |

60% |

61% |

| Steel |

71% |

72% |

73% |

73% |

74% |

| Glass |

40% |

41% |

41% |

42% |

43% |

Material Type Insights

Why Plastic Segment Dominated the U.S. Rigid Packaging Market In 2024?

The plastic segment dominated the U.S. rigid packaging market in 2024 due to its high stability and strength. Plastic packaging resources are extensively utilized to grow inflexible packaging goods by producers worldwide. High easy molding, strength, and stability into several forms & dimensions are the essential properties that resulted in the development of this section in the worldwide packaging industries. Rigid plastics are majorly chosen over several other resources due to its low weight, charge, and formability features.

The biodegradable packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to strict government guidelines and rising consumer awareness. The rising sustainability goal of the market players has influenced the demand for this segment. The increasing awareness about the adverse effect of plastics on the ecology has also enhanced the shifting towards this sector.

Product Type Insights

How Bottles and Jars Segment Dominated the U.S. Rigid Packaging Market In 2024?

The bottles and jars segment dominated the U.S. rigid packaging market in 2024 due to increasing demand for versatility, durability, and protective qualities. Bottles & jars are utilized on a huge scale in various end-use trades like food & beverages, personal, and household care due to their adaptable and biodegradable properties. These preserve and maintain the cleanliness of the goods for a prolonged period. Moreover, the exterior structures do not mark the goods, therefore resulting in huge demand.

The tubs and buckets segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to changing lifestyle of people and growing e-commerce sector. The rising demand for ready-to-eat food has enhanced the usage of tubs and buckets in food & beverage industry. The growing expansion of e-commerce sector also enhances the demand for this segment for safe transportation of food products.

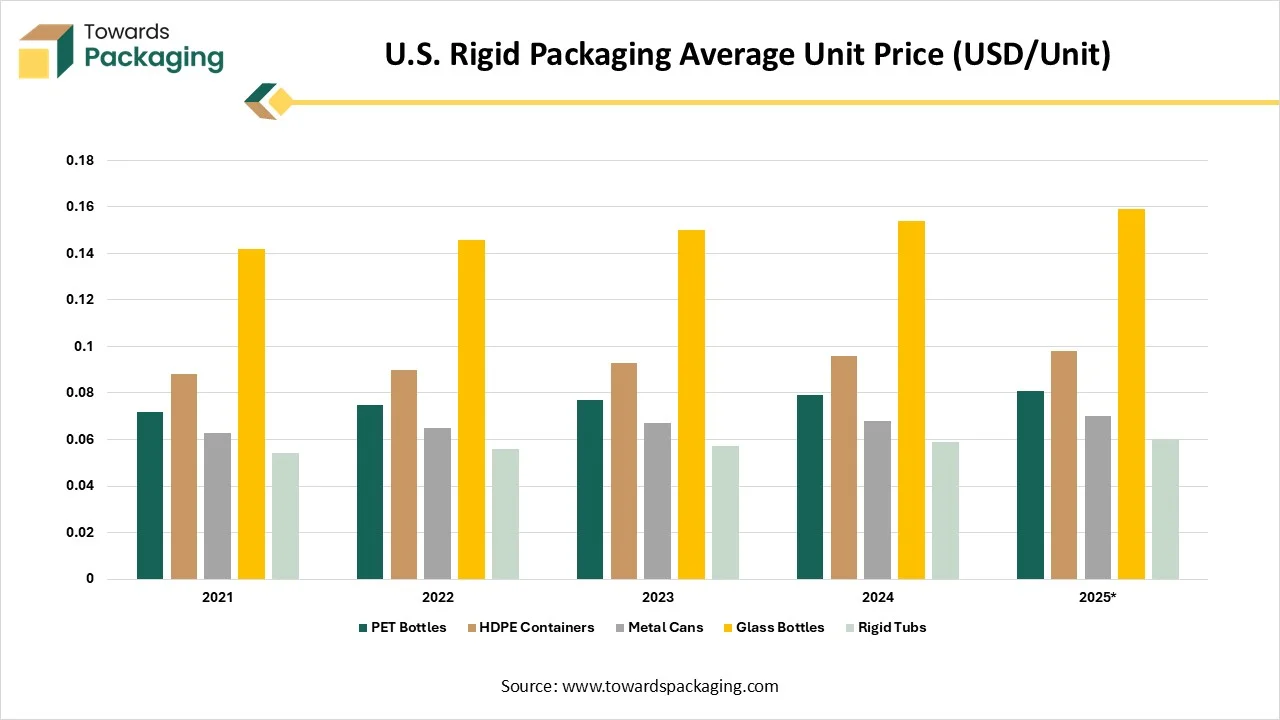

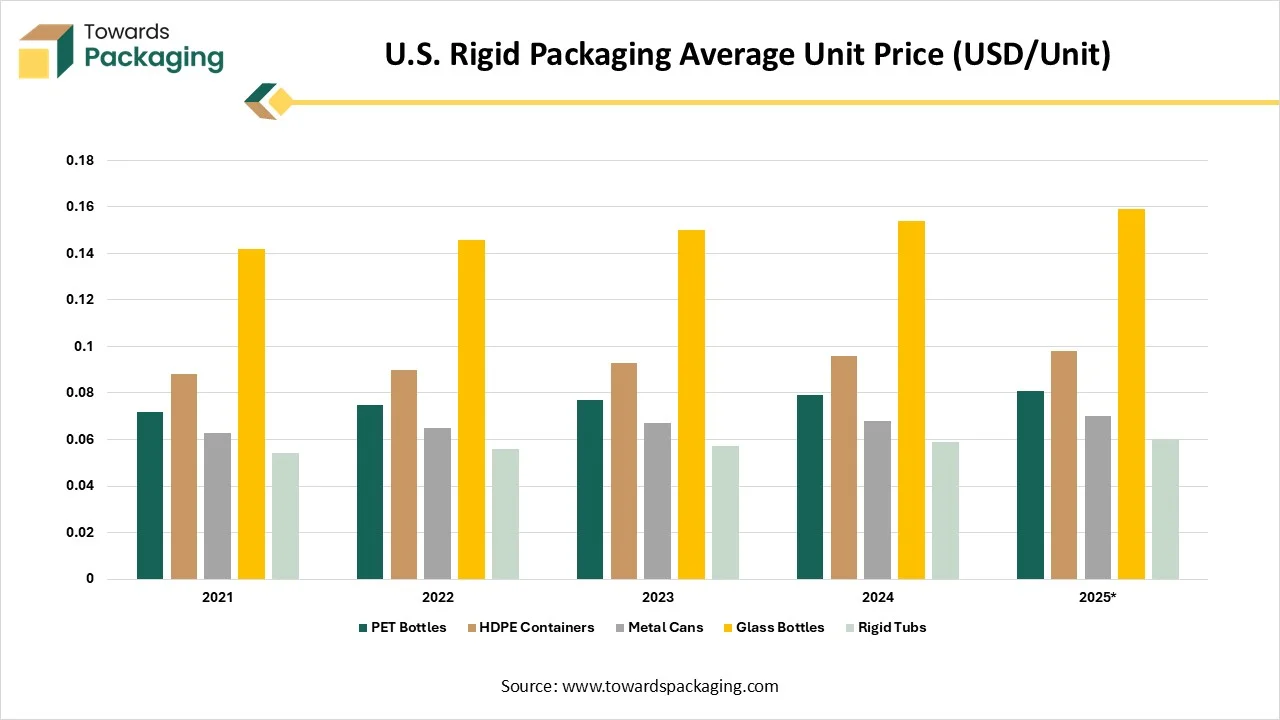

U.S. Rigid Packaging Average Unit Price (USD/Unit)

| Format |

2021 |

2022 |

2023 |

2024 |

2025 |

| PET Bottles |

0.072 |

0.075 |

0.077 |

0.079 |

0.081 |

| HDPE Containers |

0.088 |

0.09 |

0.093 |

0.096 |

0.098 |

| Metal Cans |

0.063 |

0.065 |

0.067 |

0.068 |

0.07 |

| Glass Bottles |

0.142 |

0.146 |

0.15 |

0.154 |

0.159 |

| Rigid Tubs |

0.054 |

0.056 |

0.057 |

0.059 |

0.06 |

End-Use Industry Insights

How Food and Beverages Segment Dominated the U.S. Rigid Packaging Market In 2024?

The food & beverages segment held the largest share of the U.S. rigid packaging market in 2024 due to busy lifestyle of working individuals. The expanding demand for packed and administered food items due to the changes in the lifestyle habits is the major factor influencing the development of the food & beverage in the end-use industry section. Furthermore, the growing demand for ready-to-eat food items aids the development of the segment. Growing retail food vents and expansion in food items are expected to enhance the growth of the segment.

The pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to rising concern towards safety of the packaged products. It is highly controlled to safeguard the safety and effectiveness of the drugs. This requires packaging keys that fulfil strict standards for traceability, protection, and tamper evidence. Rigid packaging in this industry like blister packs, bottles, and vials, offers the essential security and durability to obey with these guidelines.

Production Process Insights

How Blow Molding Segment Dominated the U.S. Rigid Packaging Market In 2024?

The blow molding segment held the largest share of the U.S. rigid packaging market in 2024 due to increasing demand for sustainable packaging in various industries. The significant expansion in the construction and automotive industries has raised the demand for this sector. These are lightweight components which are fuelled the development of the construction industry. This production process is majorly used in the consumer goods, food & beverages, and industrial packaging sector where there is a huge demand for hollow containers and bottles.

The thermoforming segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to its high recyclability capacity. This process helps in producing enhanced shelf-life and highly recyclable packaging which boost its huge adoption by the major market players. There is a wide scope of innovation available in the production technology which attract several brands towards this segment.

Sustainability Initiatives Insights

How Recyclable Materials Segment Dominated the U.S. Rigid Packaging Market In 2024?

The recyclable materials segment held the largest share of the U.S. rigid packaging market in 2024 due to rising ecological concern. The major materials used in this segment are polyethylene (PE), polyethylene terephthalate (PET), glass, and paper. These are also used for their strength and clarity which attract huge consumers towards this segment. Increasing construction of recycling infrastructures has also influenced the use of this segment.

The biodegradable packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to presence of advance materials for packaging. The growing sustainability goals among major market players has raised the demand for this sector. The major factors behind the growth of this sector are ecological concern and rising sustainability goals worldwide.

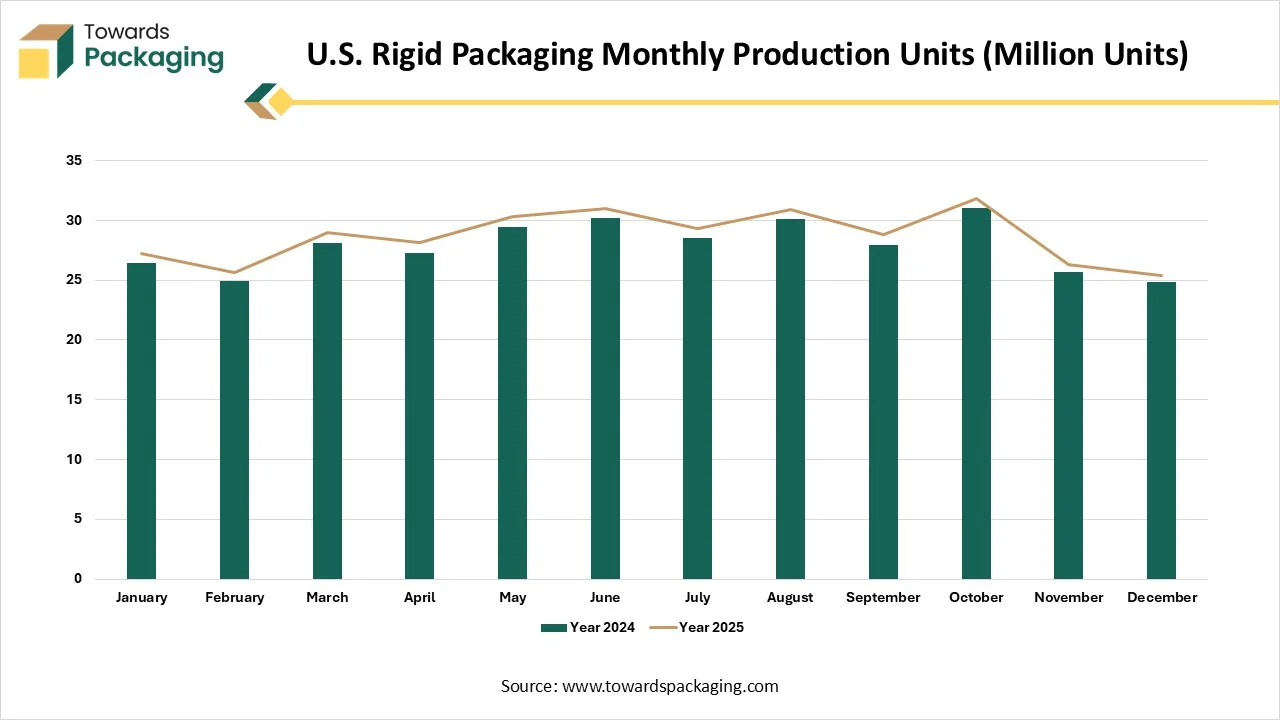

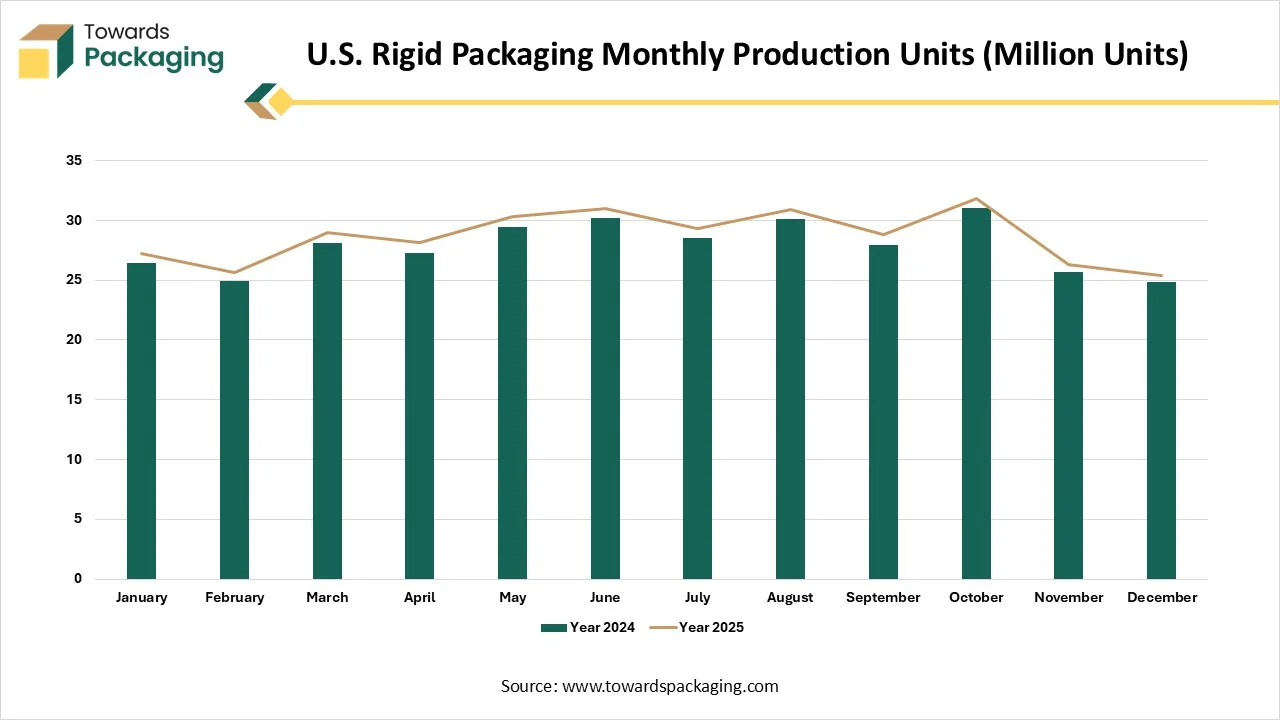

U.S. Rigid Packaging Monthly Production Units (Million Units)

| Month |

Year 2024 |

Year 2025 |

| January |

26.4 |

27.2 |

| February |

24.9 |

25.6 |

| March |

28.1 |

29 |

| April |

27.3 |

28.1 |

| May |

29.4 |

30.3 |

| June |

30.2 |

31 |

| July |

28.5 |

29.3 |

| August |

30.1 |

30.9 |

| September |

27.9 |

28.8 |

| October |

31 |

31.8 |

| November |

25.7 |

26.3 |

| December |

24.8 |

25.4 |

Country-level Insights

Considering North American market, U.S. held a substantial share in rigid packaging market, due to the presence of strict packaging guidelines. The rapid growth in online shopping has also raised the demand for such packaging in this country for safe delivery of products. Rigid packaging guards an extensive variety of goods, from cosmetics to electronics, confirming intact transportation. Moreover, customers and producers have progressively become more ecologically aware, influencing the requirement for eco-friendly and recyclable packaging resolutions. In accumulation, rigid packaging produced from materials comprising glass and a few types of plastics which has gained significant traction as it brings into line with worldwide sustainability goals.

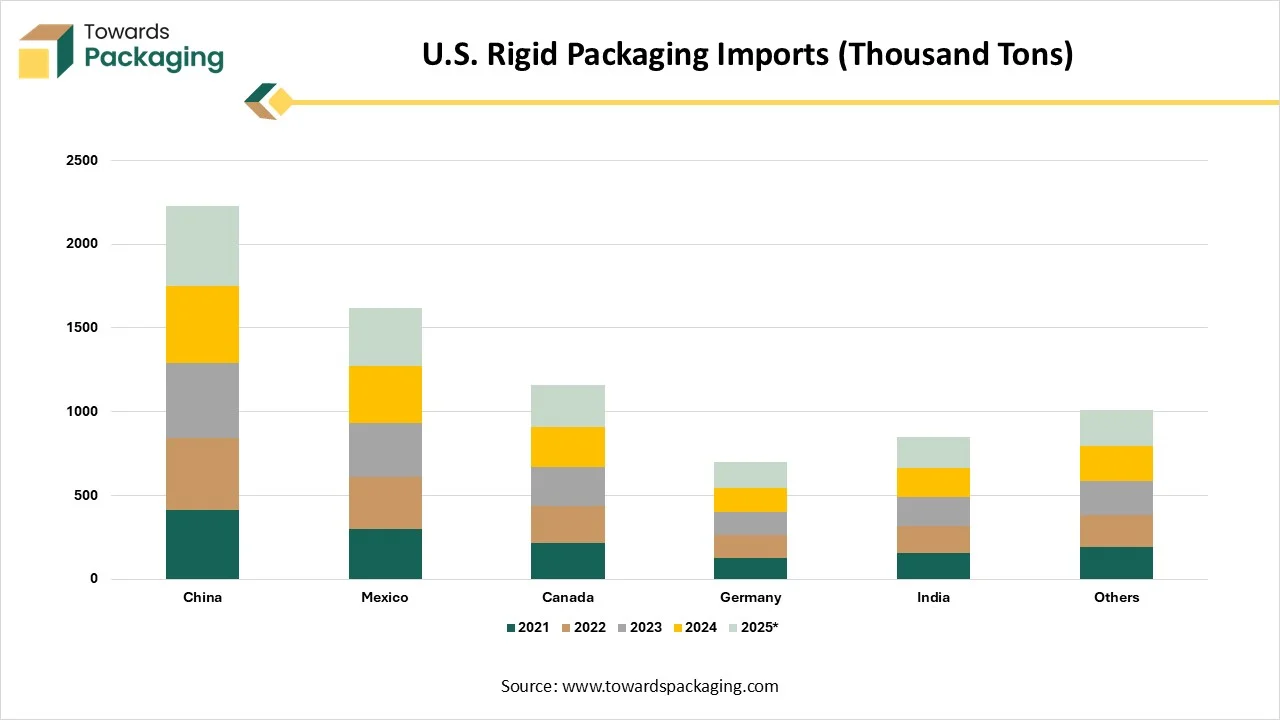

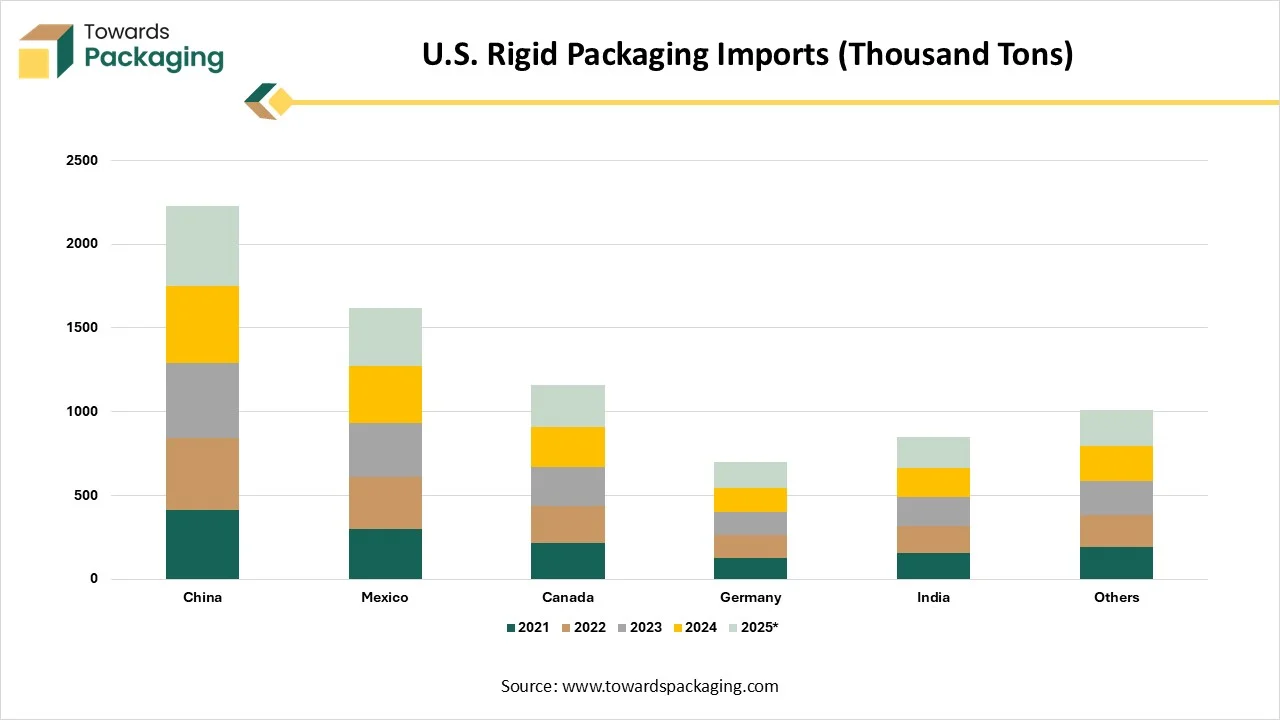

U.S. Rigid Packaging Imports (Thousand Tons)

| Country of Origin |

2021 |

2022 |

2023 |

2024 |

2025 |

| China |

412 |

431 |

446 |

462 |

478 |

| Mexico |

297 |

312 |

324 |

337 |

351 |

| Canada |

214 |

223 |

231 |

241 |

250 |

| Germany |

128 |

133 |

139 |

145 |

151 |

| India |

155 |

163 |

170 |

177 |

184 |

| Others |

189 |

196 |

202 |

208 |

215 |

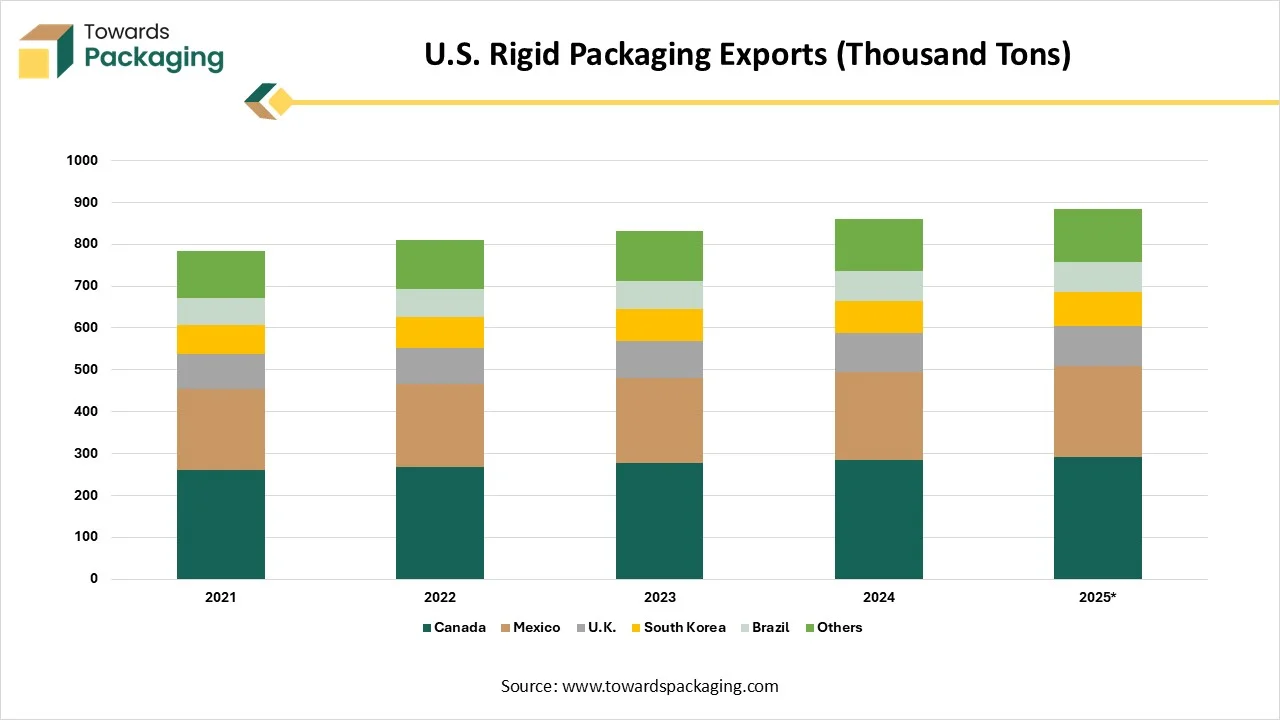

U.S. Rigid Packaging Exports (Thousand Tons)

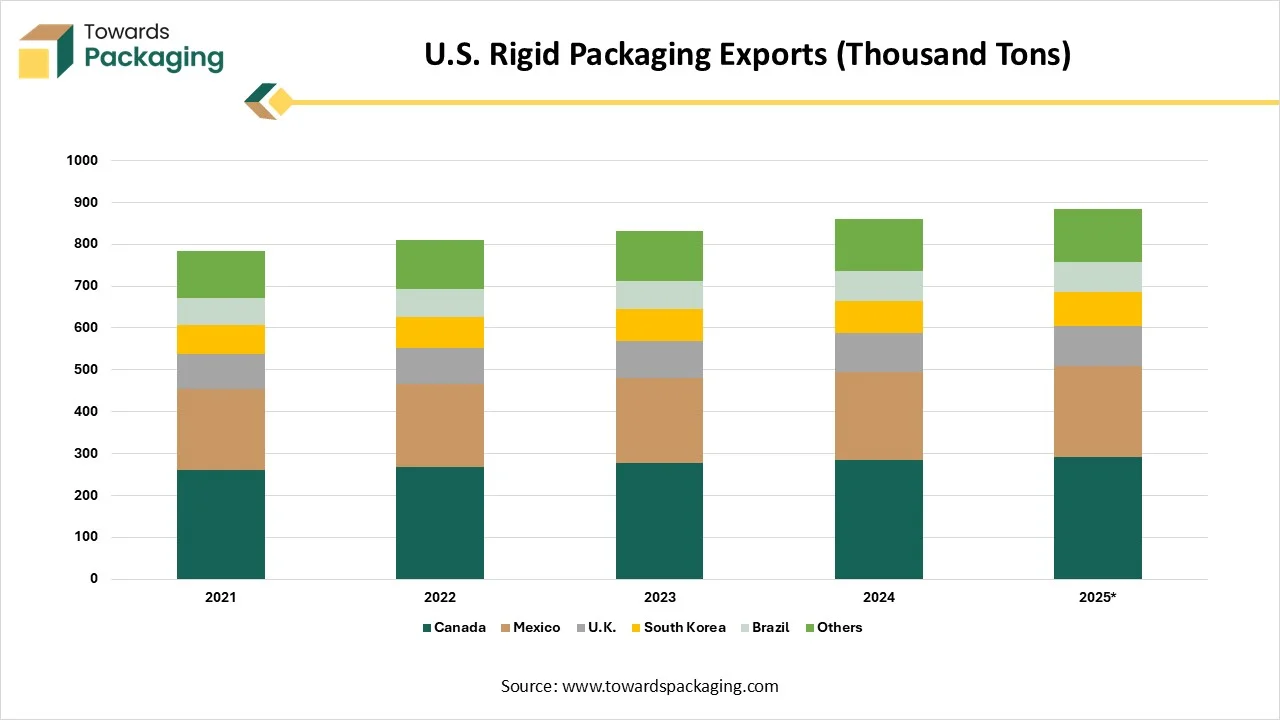

| Destination |

2021 |

2022 |

2023 |

2024 |

2025 |

| Canada |

261 |

268 |

276 |

284 |

292 |

| Mexico |

192 |

199 |

204 |

211 |

218 |

| U.K. |

84 |

86 |

89 |

92 |

95 |

| South Korea |

71 |

74 |

76 |

78 |

80 |

| Brazil |

63 |

66 |

68 |

71 |

73 |

| Others |

112 |

116 |

119 |

123 |

126 |

U.S. Rigid Packaging Market- Value Chain Analysis

Raw Material Sourcing

The raw materials used in this market are majorly glass, metal, paperboard, polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET) and several others.

- Key Players: Sonoco, Sealed Air

Component Manufacturing

The components manufacturing sector includes preforms, bottles, containers, and closures.

- Key Players: Silgan Holdings, Berry Global

Logistics and Distribution

It is important for safe product transportation to meet the demand of the consumers with standardized format.

- Key Players: Sonoco, Amcor Plc

Amcor Delivers Strong First Quarter Following Berry Acquisition

GAAP Results (Three Months Ended September 30)

| Metric |

FY 2024 |

FY 2025 |

Change (Reported) |

| Net Sales |

$3,353M |

$5,745M |

+71% |

| Net Income |

$191M |

$262M |

— |

| Diluted EPS (US cents) |

13.2 |

11.3 |

— |

Adjusted (Non-GAAP) Results

| Metric |

FY 2024 |

FY 2025 |

Change (Reported) |

Change (Constant Currency) |

| Net Sales |

$3,353M |

$5,745M |

+71% |

+68% |

| EBITDA |

$466M |

$909M |

+95% |

+92% |

| EBIT |

$365M |

$687M |

+88% |

+85% |

| Net Income |

$234M |

$448M |

+91% |

+88% |

| Diluted EPS (US cents) |

16.2 |

19.3 |

+20% |

+18% |

| Free Cash Flow |

-$395M |

-$343M |

— |

— |

Segment-Level Performance

Global Flexible Packaging Solutions

| Metric |

FY 2024 |

FY 2025 |

Reported Change |

Constant Currency Change |

| Net Sales |

$2,552M |

$3,257M |

+28% |

+25% |

| Adjusted EBIT |

$329M |

$426M |

+29% |

+28% |

| EBIT Margin |

12.9% |

13.1% |

— |

— |

Global Rigid Packaging Solutions

| Metric |

FY 2024 |

FY 2025 |

Reported Change |

Constant Currency Change |

| Net Sales |

$801M |

$2,488M |

+211% |

+205% |

| Adjusted EBIT |

$62M |

$295M |

+377% |

+365% |

| EBIT Margin |

7.7% |

11.9% |

— |

— |

Synergies & Integration

| Category |

Amount |

| Total Q1 Synergies |

~$38M |

| Impact to EBIT |

~$33M |

| Impact to Interest Expense |

~$5M |

| Expected Total FY26 Synergies |

≥ $260M |

| Total Identified Synergies by FY28 |

$650M |

Dividend Details

| Detail |

Value |

| New Quarterly Dividend |

13.0 cents per share |

| Prior Year Q1 Dividend |

12.75 cents |

| ASX Holder Payment |

19.78 AUD cents |

| Ex-Dividend Dates |

Nov 27 (ASX), Nov 28 (NYSE) |

| Record Date |

Nov 28, 2025 |

| Payment Date |

Dec 17, 2025 |

Fiscal 2026 Outlook (Reaffirmed)

| Metric |

FY26 Guidance |

| Adjusted EPS |

80–83 cents (12–17% growth) |

| Free Cash Flow |

$1.8–$1.9B |

| Capex |

$850–$900M |

| Net Interest Expense |

$570–$600M |

| Effective Tax Rate |

19–21% |

| Expected FY26 Synergies |

≥ $260M |

Top Companies in the U.S. Rigid Packaging Market

- Amcor plc

- Berry Global Inc.

- Crown Holdings Inc.

- Ball Corporation

- Sealed Air Corporation

- Silgan Holdings Inc.

- Sonoco Products Company

- Alpla Werke Alwin Lehner GmbH & Co KG

- Mondi plc

- Huhtamaki Inc.

Latest Announcements by the U.S. Rigid Packaging Market

- In April 2024, Amcor Marketing Director, Krishna Valluripalli, expressed, “It offers a huge variety of selection and declared a new launch of one-litre PET bottles for CSD stock. It shows rising demand of the consumers and recycled content.”

New Advancements in the U.S. Rigid Packaging Market

- In March 2025, LyondellBasell, declared the innovation of Pro-fax EP649U which is a polypropylene influenced copolymer intended for the U.S. rigid packaging market. It is majorly developed for injection molding which make suitable for the packaging of food products.

- In May 2025, Oroville flexible packaging declared the launch of packaging solution called “Oroflex” for food service and retail sectors. It can be highly customized and recyclable packaging solution.

U.S. Rigid Packaging Market Segments

By Material Type

- Plastic

- Metal

- Glass

- Paperboard

By Product Type

- Bottles and Jars

- Cans

- Containers and Trays

- Tubs and Buckets

- Boxes and Cartons

By End-Use Industry

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Household and Industrial Products

- Healthcare and Medical Devices

By Production Process

- Injection Molding

- Blow Molding

- Thermoforming

- Extrusion

- Compression Molding

By Sustainability Initiatives

- Recyclable Materials

- Biodegradable Packaging

- Reusable Containers

- Lightweight Packaging

- Minimalistic Packaging Designs