December 2025

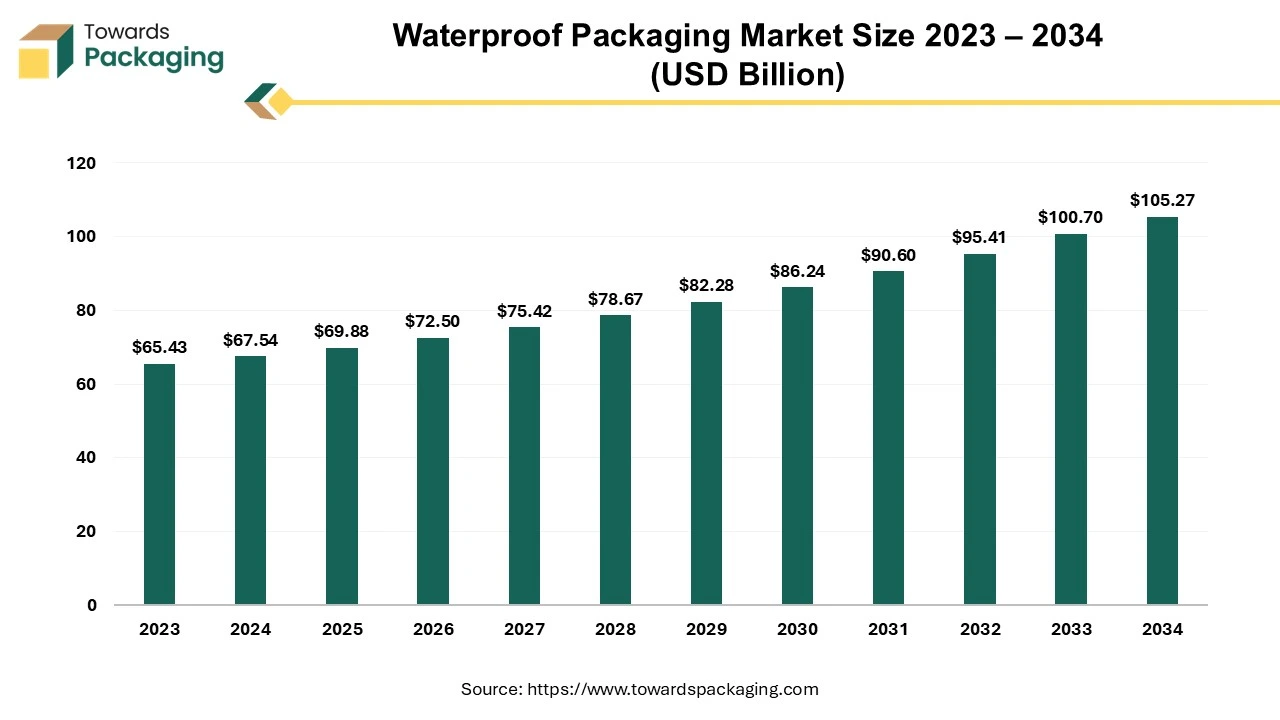

The waterproof packaging market is projected to grow from USD 72.50 billion in 2026 to USD 105.27 billion by 2034, registering a CAGR of 4.54%. Our report covers complete market size evaluation, detailed segmentation by materials, packaging types, and end-use industries, along with regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It also includes extensive trend analysis such as e-commerce growth, sustainability shifts, and technological advancements plus competitive profiling of leading players like Amcor, Mondi, Smurfit Kappa, Berry Global, Huhtamaki, WestRock, and others. The study also presents value chain analysis, import-export statistics, supplier and manufacturer mapping, pricing trends, and comprehensive strategic benchmarking.

The waterproof packaging industry is projected to achieve remarkable growth over the forecast period. Waterproof packaging prevents water and moisture from reaching the product inside. This packaging acts as a protective barrier against the environment elements such as rain, moisture and humidity that can damage or degrade the products. Waterproof packaging normally uses materials like plastic films, coated papers, metalized layers and laminates that are engineered to be impermeable to the water. These packaging materials are more long-lasting. This makes it possible for packaging, such as gift boxes, to maintain its appealing appearance that is important for the products' ability to be sold. The company's commitment to providing customers the best service is also demonstrated by the adoption of higher-quality packaging.

The increasing consumer demand for moisture-sensitive products such as electronics and pharmaceuticals along with the rising awareness about food safety and hygiene are expected to augment the growth of the waterproof packaging market during the forecast period. Furthermore, the surge in the e-commerce activity has intensified the need for packaging as online retailers look for materials that preserve product quality during transportation as well as the growth of the personal care and cosmetics industry is also anticipated to augment the growth of the market. Additionally, the technological advancements in the barrier coatings and manufacturing process along with the improvements in the materials science are also projected to contribute to the growth of the market in the near future.

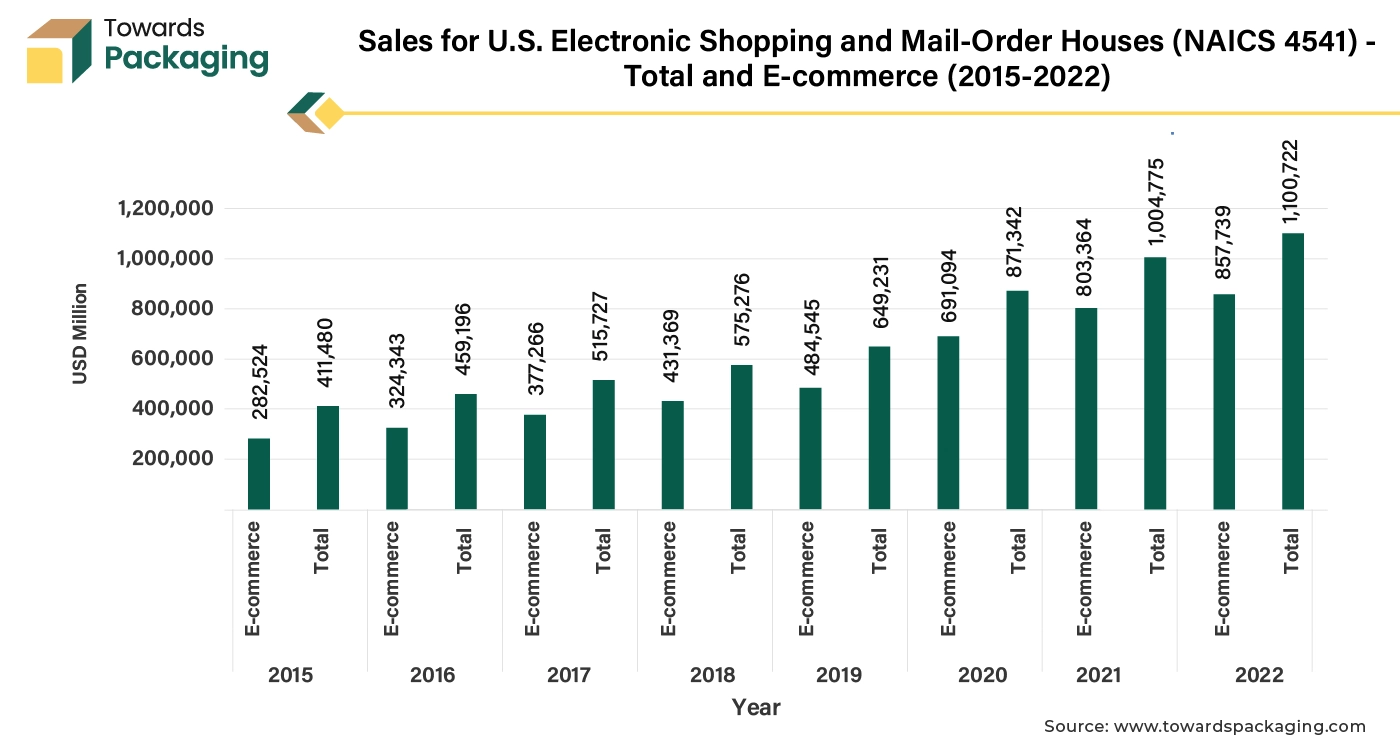

The growth in the retail and online shopping are anticipated to augment the growth of the waterproof packaging market during the forecast period. This is owing to the growing consumer preference for convenience and direct-to-doorstep delivery. The 2022 Annual Retail Trade Survey (ARTS) from the U.S. Census Bureau shows that U.S. retail sales (NAICS 44–45) climbed 8.0% to reach $7,041.0 billion in 2022 as compared to $6,519.8 billion in 2021. Also, the sales of Electronic Shopping and Mail-Order Houses (NAICS 4541) were $1,117.0 billion in 2022, up by 9.5% against $1,019.9 billion in 2021. Additionally, the total expected e-commerce sales in 2023 were $1,118.7 billion, up 7.6% from 2022. 2023 saw a 2.1 percent increase in the total retail sales over 2022. In 2023, e-commerce sales made up 15.4% of total sales. In 2022, e-commerce sales made for 14.7% of total sales.

This continuous increase in the online and retail sales shows the need for waterproof packaging in maintaining product integrity during the delivery process. Packaging has a number of uses in the e-commerce industry. It guarantees that the goods arrive at the consumers' location are in ideal condition by protecting them from damage while in transportation. This is very important for the perishable or fragile goods as well as for those products that are susceptible to changes in the humidity and temperature. E-commerce companies can reduce the probability of the product damage and consumer disapproval by investing in the safe and dependable packaging materials. Waterproof packaging offers an effective solution, specifically for the moisture-sensitive goods such as electronics, pharmaceuticals and cosmetics, which could easily be damaged if exposed to water.

The challenges in recycling the multi-layered packaging and environmental concerns are expected to hamper the market growth within the estimated timeframe. The composite structure of the multilayer plastic, which combines many layers of the different materials to fully utilize their unique capabilities, sets it apart from the single-layer plastics. For example, one layer may offer strength and flexibility while another may provide resistance to the moisture, making them perfect for packing pharmaceuticals and food items. Also, the manufacturing of this packaging consists of intricate procedures like lamination or co-extrusion and are more expensive than making single-layer plastics. Despite their higher functionality, multilayer plastics are less beneficial for the environment since it is more difficult to separate the layers during recycling. Multilayer plastics have many benefits, but their complexity creates problems with manufacturing and recycling that must be resolved to minimize their negative effects on the environment.

Furthermore, around 40% of the plastic waste worldwide originates from packaging, consisting of packaging made-up of multi-layered plastic. The practical difficulties in collecting as well as sorting multi-layered plastics also involve labor-intensive tasks, storage space limitations because of their volume. Due to this, recycling MLP is not profitable and it probably winds up in the landfills. As consumers become more eco-conscious, brands may face pressure to avoid multi-layered waterproof packaging or invest in the other alternatives. The complexity and restricted recyclability of multi-layered packaging will continue to be a major barrier to market growth in regions with stringent environmental regulations and among customers that prioritize sustainability until scalable, sustainable recycling alternatives are developed.

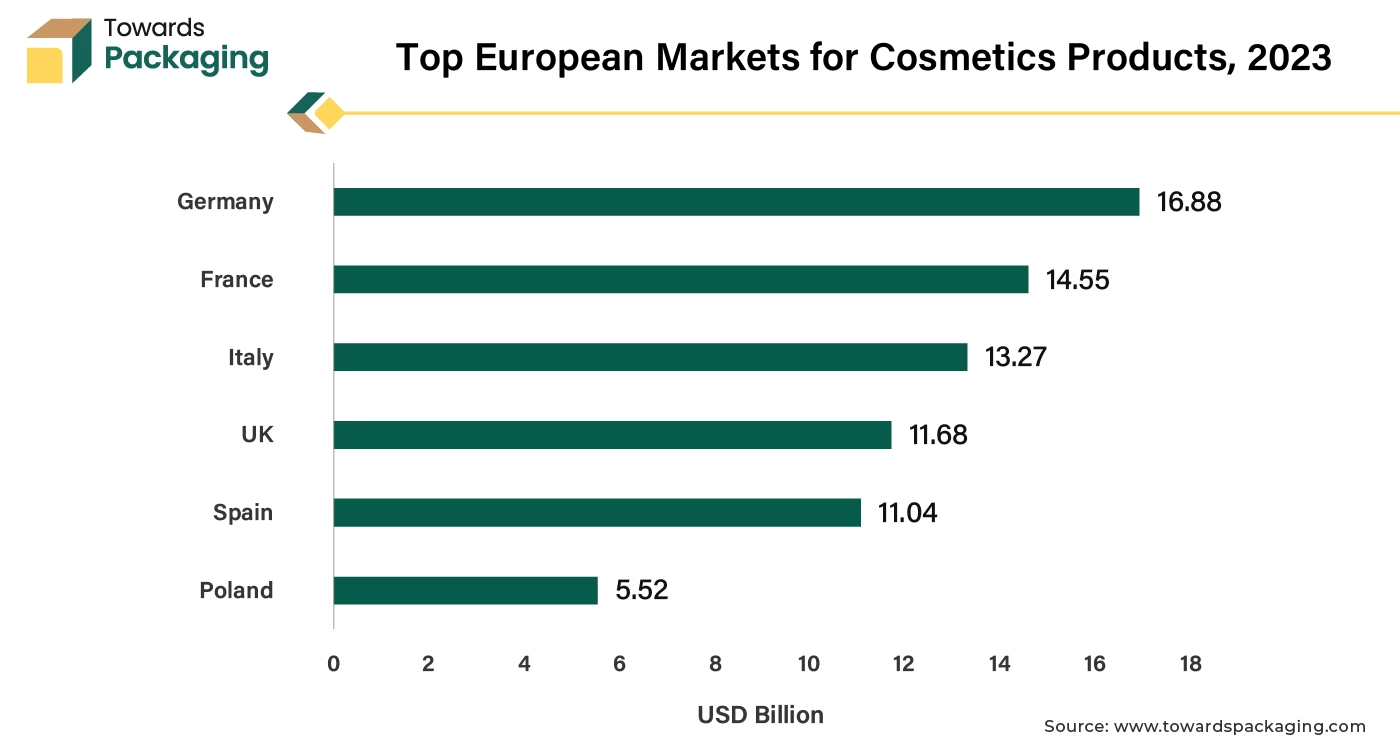

The expansion of the healthcare and personal care industries is projected to fuel the growth of the market in the near future. This is owing to the increasing awareness about health, wellness and hygiene, rising consumer demand for preventive and therapeutic healthcare products along with a growing focus on the self-care and personal grooming. According to the 2023 report by Cosmetics Europe-The Personal Care Association, Europe is a worldwide major market for the cosmetics and personal care goods, with a retail sales value of €96 billion. Among the European countries, Germany (with €15.9 billion), France (with €13.7 billion), Italy (with €12.5 billion), the United Kingdom (with €11.0 billion), Spain (with €10.4 billion) and Poland (with €5.2 billion) are the largest markets for the cosmetics and personal care goods.

Products such as skincare, makeup and hair care formulations are most of the times sensitive to the moisture, which can alter their quality and shelf life. As consumer demand for the personal care products grows, brands are likely to invest in the waterproof packaging to guarantee that these products remain fresh and effective until they reach the consumer. Furthermore, products utilized in the healthcare like medications, medical equipment and diagnostic kits needs packaging that retains the product integrity as well as sterility while being stored and transported. Waterproof packaging options are important for safeguarding these materials against the humidity and potential water exposure that may impact effectiveness and safety.

| Source | 2020 | 2021 | 2022 | 2023 | 2024 |

| Americas Paperboard Packaging | 4.65 B | 5.00 B | 6.01 B | 6.20 B | 6.10 B |

| Europe Paperboard Packaging | 764.60 M | 992.00 M | 1.97 B | 2.02 B | 1.89 B |

| Paperboard Manufacturing | 988.10 M | 1.01 B | 1.29 B | 1.02 B | 655.00 M |

| Corporate and Other | 157.10 M | 161.00 M | 162.00 M | 182.00 M | 158.00 M |

| Paperboard Packaging | — | — | — | — | — |

| Flexible Packaging | — | — | — | — | — |

| Multi Wall Bag | — | — | — | — | — |

| Specialty Packaging | — | — | — | — | — |

| Containerboard and Other | — | — | — | — | — |

| Country / Region | 2020 | 2021 | 2022 | 2023 | 2024 |

| United States | 5.20 B | 5.54 B | 6.74 B | 6.65 B | 6.19 B |

| International | 1.36 B | 1.61 B | 2.70 B | 2.78 B | 2.62 B |

| Americas | — | — | — | — | — |

| Europe | — | — | — | — | — |

| Asia Pacific | — | — | — | — | — |

| United States/Canada | — | — | — | — | — |

| Central/South America | — | — | — | — | — |

The plastic segment held considerable market share of 62.64% in 2023. Plastics such as polyethylene (PE), polypropylene (PP) and polyvinyl chloride (PVC) are popular due to the excellent moisture-resistant properties, durability as well as versatility. These materials provide an effective barrier against water and humidity, thus making them perfect for applications in industries like food & beverage, healthcare, personal care and electronics. Plastics are also lightweight that reduces the transportation costs and helps in easier handling, an attractive feature for the manufacturers and retailers alike. Furthermore, advancements in the plastic manufacturing have made it possible to create flexible cost-effective packaging options that can be easily molded or shaped to fit different product types. These factors are expected to contribute to the segmental growth of the market.

The food & beverages segment held largest market share of 46.25% in 2023. This is due to the increasing the demand for the convenient, ready-to-eat and packaged food products. Furthermore, the mail-order food and meal kits are also growing more popular with the consumers. All of the ingredients for a meal such as fresh vegetables, spices, cereals and grains, are packaged separately in plastic containers and sent to the customer in a box, which is also expected to contribute to the segmental growth of the market. Additionally, the growth of the online grocery shopping and food delivery services is expected to support the growth of the segment in the global market.

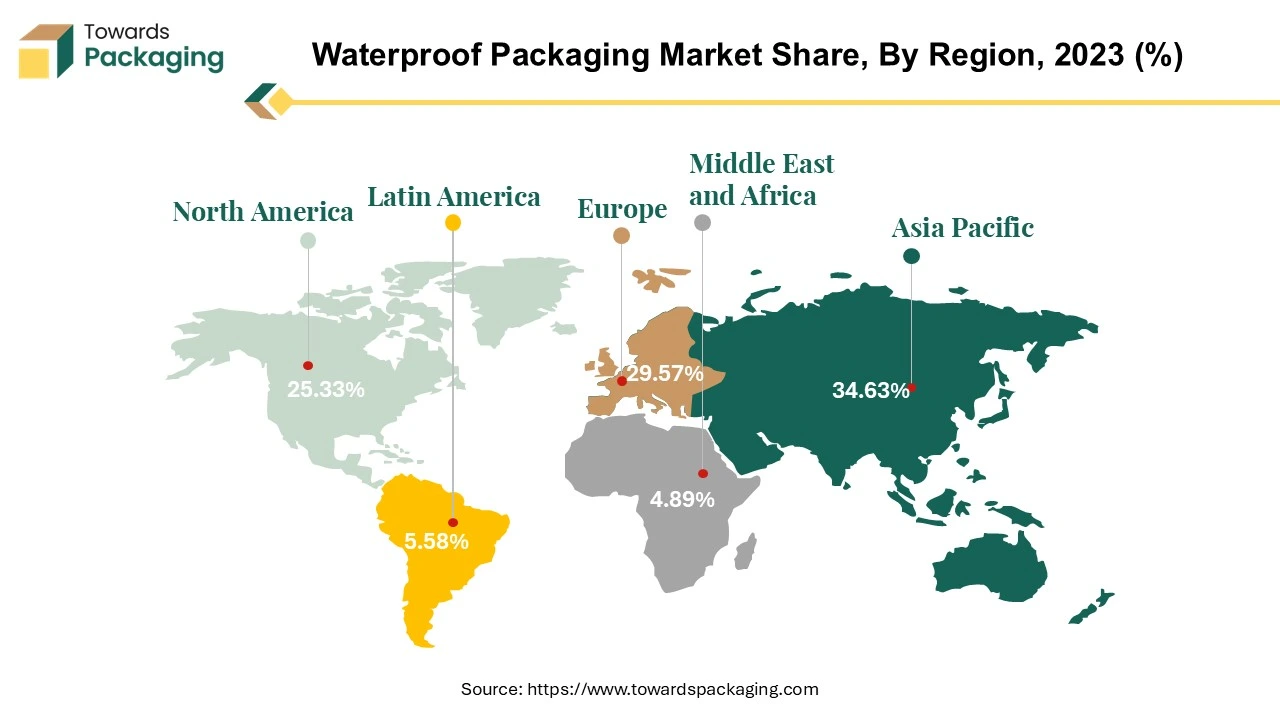

Asia Pacific is likely to grow at fastest CAGR of 6.20% during the forecast period. This is due to the fast-paced urbanization and industrialization in economies such as China, India and Southeast Asian nations. Also, the surge in the online shopping and food delivery services is likely to contribute to the regional growth of the market. As per the India Brand Equity Foundation, there are around 350 million mature internet users actively participating in transactions among India's 936.16 million internet members. In fiscal year 2023, India's e-commerce platforms reached a noteworthy milestone, achieving a Gross Merchandise Value (GMV) of US$ 60 billion, a 22% growth from the year before. Furthermore, the growing middle-class population and disposable incomes is also expected to contribute to the regional growth of the market.

North America held considerable market share of 25.33% in 2023. This is owing to the increased focus on product safety and hygiene as well as stringent standards by regulatory bodies has strict guidelines for packaging. Furthermore, strong demand in the food and beverage sector and growth of the e-commerce and online retail in the U.S. and Canada is also expected to contribute to the regional growth of the market. Additionally, the preference for premium and eco-friendly packaging along with the growing outdoor recreation industry are also anticipated to promote the growth of the market in the region in the near future.

Some of the key players in waterproof packaging market are Amcor plc, Mondi Group, Sealed Air Corporation, Sonoco Products Company, Berry Global Inc., Smurfit Kappa Group, Huhtamaki Oyj, WestRock Company, JBM Packaging, Tetra Pak International S.A., DS Smith Plc, Clondalkin Group, AptarGroup, Inc., Uflex Ltd., International Paper Company, and Coveris Holdings S.A., among others.

By Material

By Packaging Type

By End-Use Industry

By Region

December 2025

December 2025

December 2025

December 2025