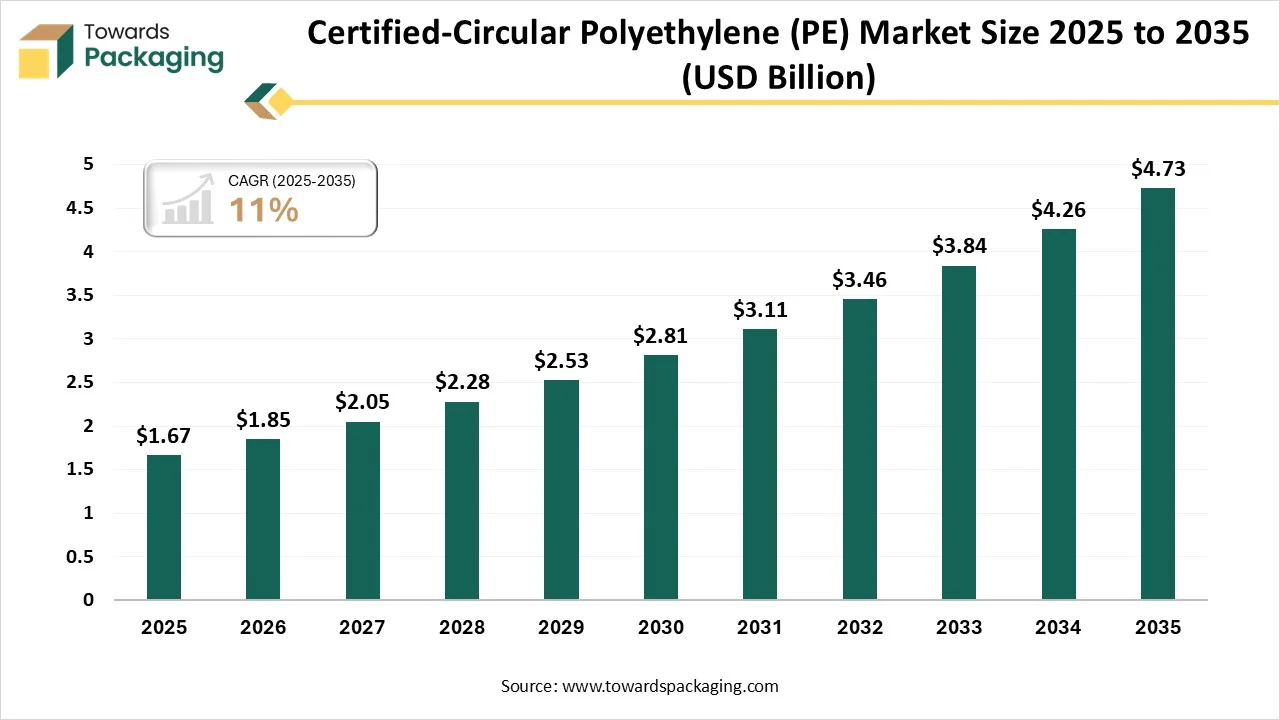

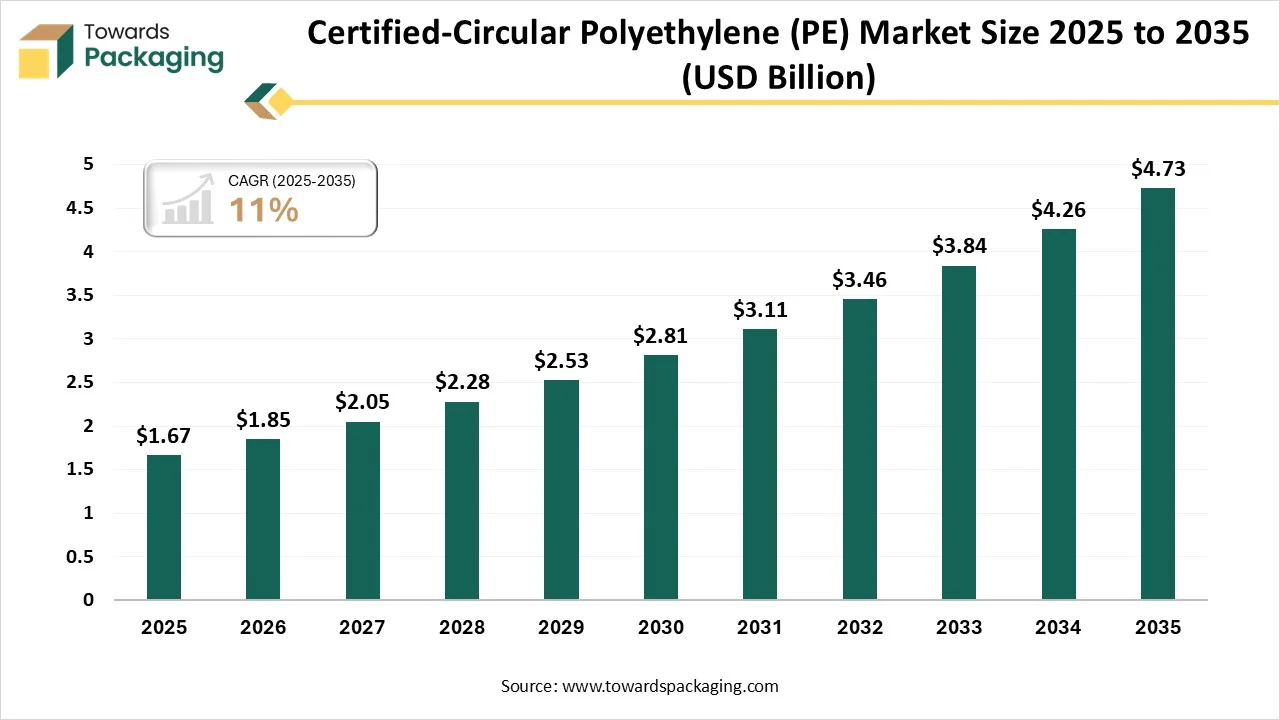

The certified-circular polyethylene (PE) market is forecasted to expand from USD 1.85 billion in 2026 to USD 4.73 billion by 2035, growing at a CAGR of 11% from 2026 to 2035. The growth is being driven by high-performance materials that align with stronger safety standards.

The certified circular polyethylene (PE) points to the segment of the plastics sector that completely concentrates on manufacturing and selling virgin-quality PE polymers that come from recycled plastic waste, which has the latest fossil- based feedstocks. Such products are generally certified by a third party, such as the International Sustainability and Carbon Certification (ISCC) Plus scheme, to ensure dependency and traceability for the sustainability standards through an “mass-balance” machine.

By the year 2030, recycled plastic usage is expected to be in the range of 200% and 300%, which is higher than the current surface, for the recycled plastic. Recycled plastics have matched 6% of today's urge for prevalent problems such as polyethylene terephthalate (PET), polypropylene (PP), and polyethylene (PE). From an accessible amount of recycled plastics, certified recycled plastic comes up with even smaller spaces, as several organizations have the goal to reduce their usage of virgin plastic.

Machine learning (ML) and Artificial Intelligence (AI) are updating the plastic sector, which has optimized the production procedure, making materials with particular properties that improve the quality of materials and lower the waste. Such technologies enable companies to develop and maintain the efficiency of their operations with the assistance of advanced data analysis and automation. It makes it relevant to track the volume of data on the formulations and developments of the plastic materials to check whether a material will have particular physical, mechanical, and optical properties by using supervised regression models such as Random Forest and Decision Trees.

Polyethylene packaging is a versatile and indispensable choice that serves a myriad of benefits that match various demands of current sectors. Primarily, polyethylene is transformed for its unique resilience and reliability that serves strong protection against external factors like chemicals, moisture, and physical effects too.

Recycling and Waste Management: Certified-Circular polyethylene is heavily recyclable, and the recycled polyethylene can be utilised many times for producing particular products and/or utilised in the resin mixture to lower the cost of the plastic products produced. This not only lowers the dependency on virgin polymers but also reduces the eco-friendly effect.

The logistics and distribution of the certified polyethylene include a variety of complicated supply chains, from the manufacturing of raw pellets to traveling through personalized links that depend strictly on national and international certification standards for the BIS and ISO worldwide.

The low-density polyethylene (LDPE) segment dominated the market in 2025 as it is classified for its durability and flexibility, which makes it a popular choice for uses like plastic bags, packaging films, and containers. Its different molecular design makes a material that is both strong and malleable, which serves perfect performance in both specialized and general applications. Its lower melting point enables its processing, which allows effective molding into various shapes.

The high-density polyethylene segment is predicted to witness the fastest CAGR during the forecast period. They are well -known for their surrounding and mechanical rigidity. A crucial explanation for its common use lies in its rigid tensile power and high tensile strength, which copies the durability of heavyweight boxers in the realm of materials, a factor that is attributed to its appropriately packed polymer chains. Furthermore, high-density polyethylene is an expert in delivering sustainable solutions that promote complete recyclability.

The certified recycled (PE) segment dominated the certified-circular polyethylene (PE) market in 2025, as this certification checks that a product or packaging has a particular percentage of recycled materials. Such certification confirms that the material used in the packaging or product has been updated or transformed from waste streams and is reused in a new product. Recycled content certification ensures that organizations are linked to sustainable practices and align with particular regulatory needs and demands. For companies that seek to create eco-friendly conscious decisions and market their products as “green,” certification assists them in differentiating themselves in the eco-conscious industry.

The certified bio-based PE segment is predicted to witness the fastest CAGR during the forecast period. This polyethylene has a high ratio of renewable raw materials, which has 80% of sugarcane in it, which is the beginning material and a conventional option for fossil polyethylene. A crucial benefit of certified bio-based polyethylene is that the material has a negative oxygen balance. Also, biobased PE has the exact material structure as regular PE, and hence it also has perfect material elements as compared to recycled plastics.

The food and beverages segment has dominated the certified-circular polyethylene (PE) market in 2025, as they are a safe material for linking with food and beverages, which do not release toxic substances and are used with global quality and food safety standards too. Such a kind of plastic has impact-resistant properties that prevent products from damage during transportation and storage. Worldwide, the manufacturing of plastic packaging for food and beverages accounts for the largest portion of total plastic usage, which has made a demand for recycling steps and waste reduction initiatives.

The e-commerce and retail segment is expected to experience the fastest CAGR during the forecast period. Both sector excessively depends on effective and trusted packaging solutions to ensure that the products reach users in perfect condition. They are a kind of packaging that serves strong protection against physical damage, moisture, and pollutants. This is important in e-commerce, in which packages are subject to rough handling during transportation. It can be molded into different sizes and shapes, which makes it perfect for packaging different products, from clothing to electronics to food products.

The pellets/granules segment dominated the market in 2025 as they are a raw material form of polyethylene. These are generally small in shape and have spherical pellets that range in size from a few millimetres to more millimetres in terms of diameter. Such granules are generated through a polymerization procedure and come in different grades that rely on the intended application. Its structure mainly encourages its characteristics and results, too. The foundation block of PE is ethylene, in which two carbon atoms are connected by a single covalent bond and have two hydrogen atoms.

The films and sheets segment is expected to experience the fastest CAGR during the forecast period. Certified circular polyethylene (PE) films are the thin sheets of flexible polyethylene that are made during different procedures, such as film blowing, for instance, or through extrusion. PE films cover a huge series of elements, such as strong, lightweight, and chemically opposite, which can have different uses for applications in several industries. Various particular thermal, mechanical, and barrier characteristics of the PE films will be dependent on the resin, each of which has its own path of being processed.

Asia Pacific dominated the certified-circular polyethylene (PE) market in 2025 as it is a dynamic factor in the global petrochemical industry, which is being driven by the urge for different polyethylene (PE) types, such as High-Density polyethylene (HDPE), low-density polyethylene, and linear low-density polyethylene (LLDPE). This industry is experiencing fast development because of elements like urbanization, industrialization, and a growing consumer base. The packaging industry is the main usage area in the Asia Pacific polyethylene industry. Its use in rigid and flexible packaging, specifically in personal care, food and beverages, and pharmaceuticals, is experiencing constant development.

How is the Certified-Circular Polyethylene (PE) Market Growing in India?

The Bureau of Indian Standards (BIS) certifications necessarily confirm that any polyethylene resin aligns with the described Indian Standards, which is IS 7328:2020, in such a case. Polyethylene is in everything, as in the Indian sector, from tarpaulins to irrigation to high-end blow-moulded tanks. This Indian standard has been defined in a simple manner by the demand for testing and sampling methods for low-density polyethylene (LDPE),high-density polyethylene (HDPE), and linear low-density polyethylene. Such grades or resins are usually available as pellets, granules, or powders for extrusion or moulding too.

North America expects the fastest growth in the market during the forecast period, as it is undergoing main growth, which is driven by the growing industrial uses, developing consumer demands, and technological developments. Polyethylene, which is well-known for its chemical resistance, reliability, and variety, is excessively used in the production of custom-shaped elements across industries such as construction, automotive, healthcare, and packaging. As industries find cost-effective, lightweight, and sustainable solutions, the urge for a certified circular polyethylene industry is growing.

Why is Canada using the Certified-Circular Polyethylene (PE) Market Importantly?

The Canadian polyethylene industry is witnessing constant development, which is initially driven by the rigid demand in the construction and packaging sector, as the packaging industry, specifically rigid and flexible packaging for food and beverages, is the biggest user of PE. The automotive and construction industry also includes mainly demand due to the materials’ lightweight and reliability properties. Furthermore, there are strict government regulations on single-use plastics and plastic pollution, which are encouraging the industry towards sustainable alterations, such as bio-based and recycled polyethylene.

The Certified-Circular Polyethylene (PE) Market in the region is Growing, as in Europe. There is a precise trend in the fast growth of chemical recycling infrastructure and funding in high-level mechanical recycling projects in several companies. There is growing interest and acceptance of the bio-based polyethylene that is generated from renewable sources like sugarcane, and recycled PE is a main ingredient, with organizations that have launched products with high recycled content to align with user demand and sustainability goals.

Germany Certified-Circular Polyethylene (PE) Market

The German certified circular polyethylene industry is on the verge of changing updates, which is driven by the fast technological developments, growing regulatory scenario, and changing user requests. With global supply chains experiencing fresh sustainability and volatility updates, sector leaders should behave decently to show direction in order to overcome challenges and opportunities.

In South America, the Certified-Circular Polyethylene (PE) Market is Developing Steadily as the initial driver of the PE urge, which is fueled by the development of the food and beverage sector and the growth of e-commerce activities in regions like Mexico and Brazil. Polyethylene (PE) is utilised in different agricultural uses, such as mulch films and greenhouses, which are specifically used in countries with large agricultural industries like Brazil. There is growing alertness, and the government regulations in terms of plastic, which are driving the urge for bio-based and recyclable solutions, with organizations such as Braskem having topped initiatives in terms of renewable plastics manufacturing.

Brazil Certified-Circular Polyethylene (PE) Market

Brazil is one of the biggest economies in South America that displays a convincing opportunity that links to its abundant biomass resources that stretch user markets and developing regulatory pressures in terms of single-use plastics. Penetrating into the Brazilian certified–circular polyethylene meets with corporate sustainability loyalty that serves the capability for competitive classification and positions as the organization is to highlight the region’s developing demand for renewable plastics.

In the Middle East and Africa, the Certified-Circular Polyethylene (PE) Market is Growing Steadily as this is a crucial material for this region due to the mixing of huge petrochemical resources and its huge usage cases, including packaging design, agriculture, automotive, and household products. The Middle East is a central part of some of the biggest petrochemical generators in the world, with organizations such as SABIC in Saudi Arabia and Borouge in the United Arab Emirates that have topped the large-scale polyethylene operations. The government of Saudi Arabia has highlighted goal of 2030 that gives importance to diversification of its economy and counts sustainability commitments which directly affect the plastic industry through carbon reduction targets.

UAE Certified-Circular Polyethylene (PE) Market

The acceptance of the latest inventions is developing the industry entry of polyethylene in the UAE through the involvement of automation and robotics technologies. Automated material -carrying machines, which use robotic arms and AI-driven gripping solutions, are developing production accuracy that lowers labor costs and improves the result. Intelligent factories filled with IoT sensors allow real-time tracking of manufacturing factors, which ensure constant quality and compliance with International Standards.

By Product Type

By Certification Type

By End-Use Industry

By Form

By Region

January 2026

January 2026

January 2026

December 2025