Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Size, Trends, Share and Innovations

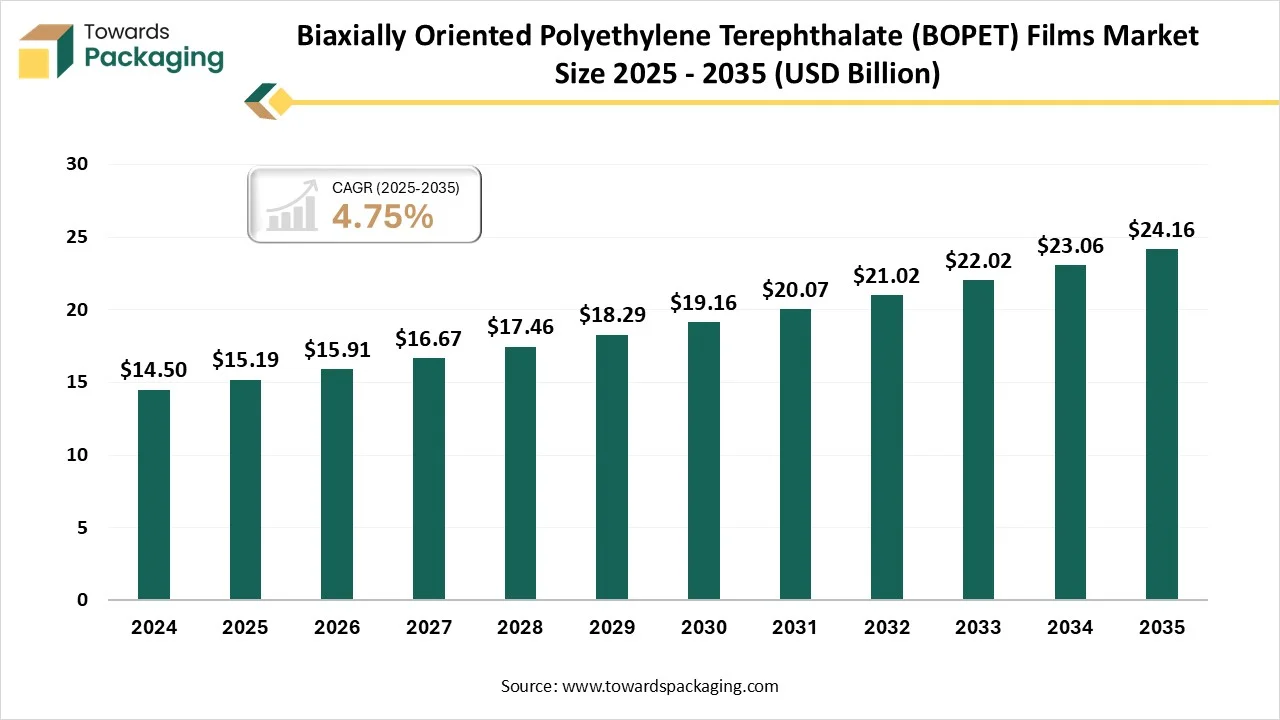

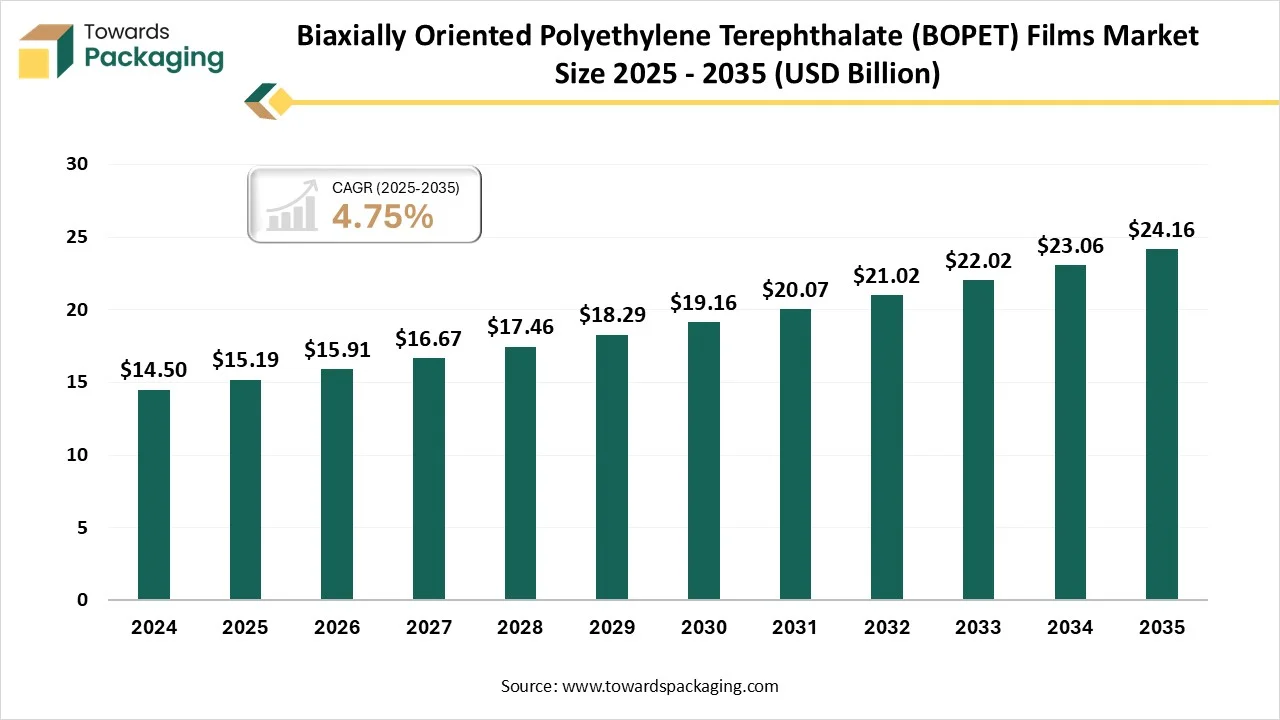

The biaxially oriented polyethylene terephthalate (BOPET) films market is projected to grow from USD 15.19 billion in 2025 to USD 24.16 billion by 2035, with a CAGR of 4.75%. This market is driven by rising demand in packaging, electrical, and industrial applications. North America leads with a strong packaging industry, while Asia-Pacific is the fastest-growing region. The key segments include metallized BOPET films, coated BOPET films, and thin to medium gauge films. Major players include DuPont Teijin Films, Toray Industries, and UFlex.

Market Summary

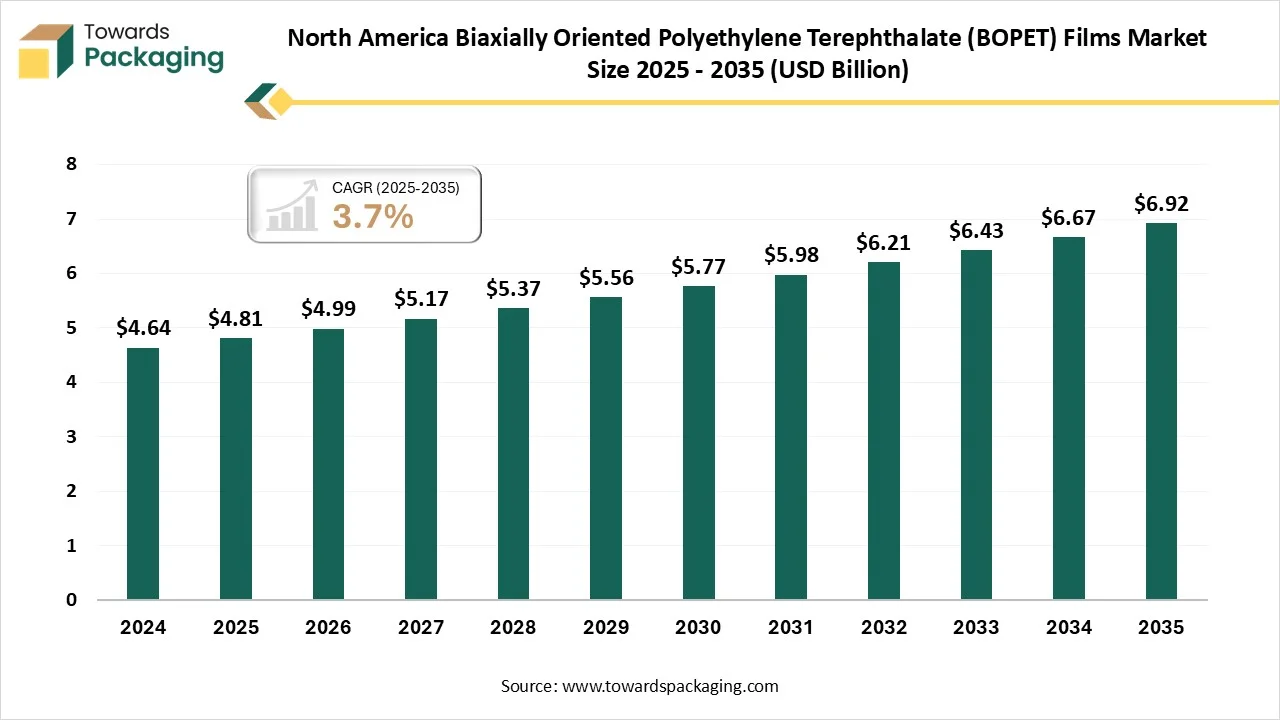

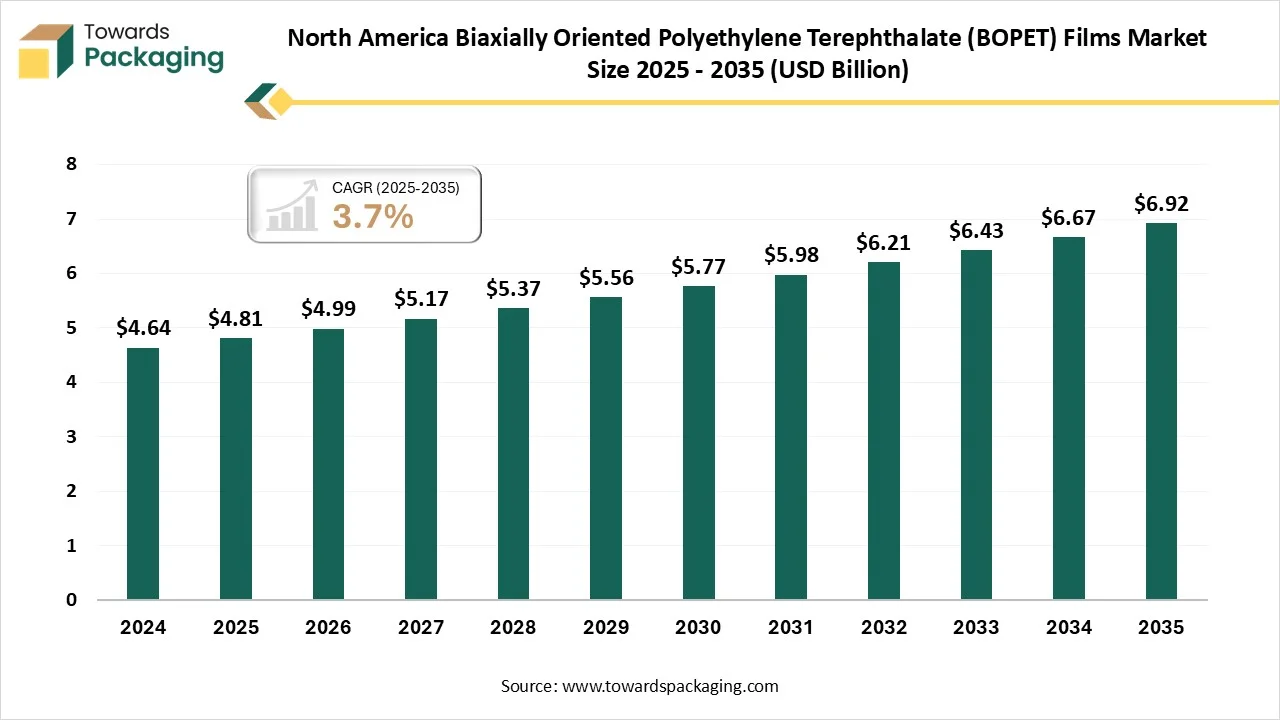

The biaxially oriented polyethylene terephthalate (BOPET) films market is witnessing steady growth driven by rising demand from packaging, electrical, and industrial applications. North America dominated the market due to its strong manufacturing base, advanced film processing technologies, and increasing use of flexible and sustainable packaging materials. The region’s well-developed food and beverage sector, coupled with growing adoption in electronics, solar, and automotive industries, further supports market expansion. Continuous R&D investments and recyclability initiatives enhance product innovation and regional competitiveness.

Key Takeaways

- North America held a major revenue share of in the market in 2024.

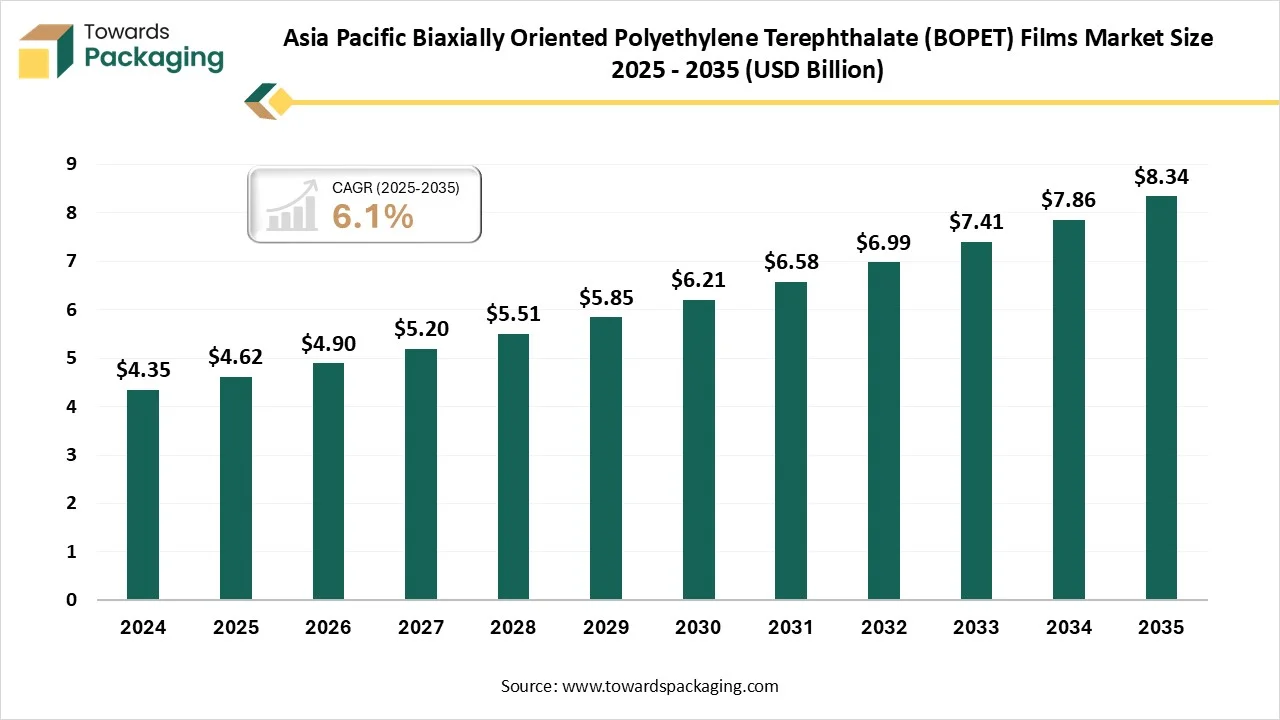

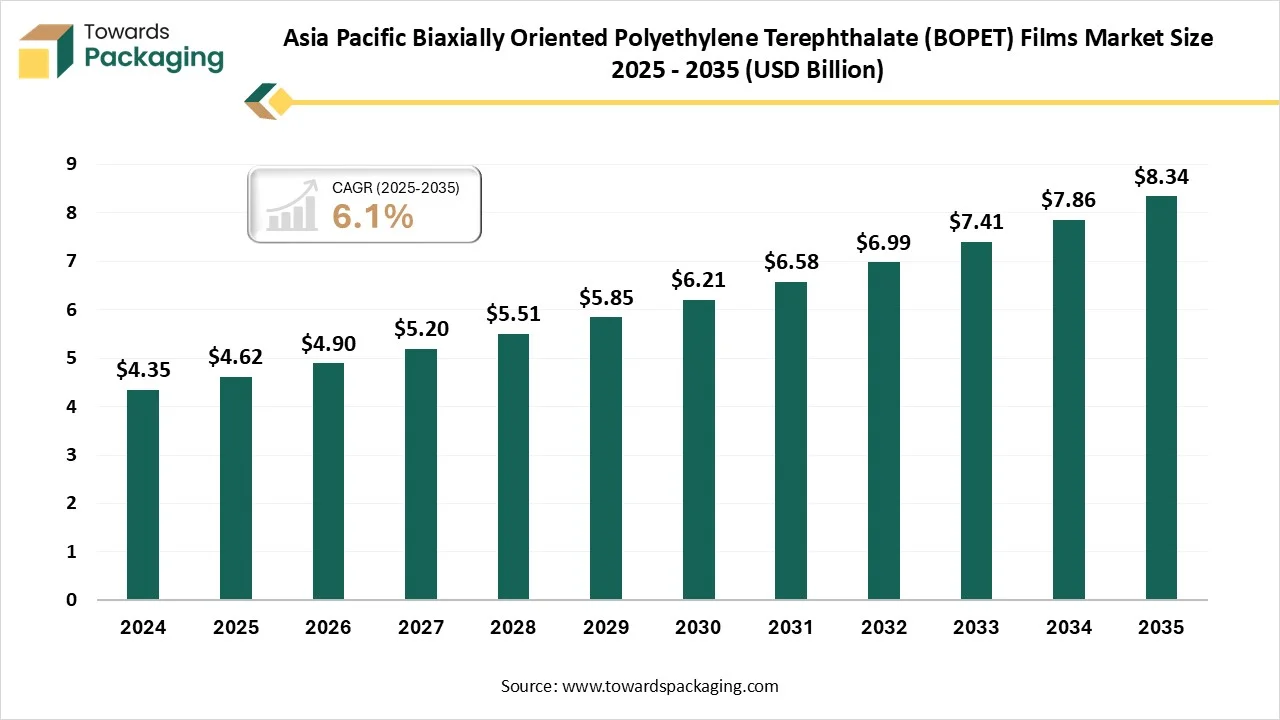

- Asia-Pacific is expected to witness the fastest growth during the predicted timeframe.

- By Packaging Type, the metallized BOPET films segment registered its dominance over the global market with a share in 2024.

- By Packaging Type, the Coated BOPET Films segment is expected to grow with the highest CAGR in the market during the studied years.

- By Application, the Packaging segment held the largest revenue share of in the market in 2024.

- By Application, the Electrical & Electronics segment is expected to show the fastest growth over the forecast period.

- By End-User, the Packaging Industry segment held a dominant presence in the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market with a share in 2024.

- By End-User, the Electrical & Electronics Industry segment is expected to witness the fastest growth in the market over the forecast period.

- By Thickness / Grade, the medium gauge segment contributed the biggest revenue share of in the market in 2024.

- By Thickness / Grade, the thin gauge segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By Revenue Model, the direct product sales segment held a dominant presence in the Biaxially Oriented Polyethylene Terephthalate (BOPET) films market with a share in 2024.

- By Revenue Model, the customized solutions and services segment is expected to witness the fastest growth in the market over the forecast period.

What is meant by BOPET (Biaxially Oriented Polyethylene Terephthalate) Films?

The biaxially oriented polyethylene terephthalate (BOPET) films market is driven by growing demand for durable, high-barrier, and recyclable materials in packaging, electrical, and industrial applications. BOPET films are polyester films produced by stretching polyethylene terephthalate in both the machine and transverse directions, which enhances their strength, clarity, and dimensional stability.

This biaxial orientation gives the films superior mechanical, thermal, and chemical resistance compared to standard plastic films. They are widely used in food packaging, labels, electronics, insulation, and solar applications due to their excellent barrier properties, glossy appearance, and ability to maintain performance under varying environmental conditions.

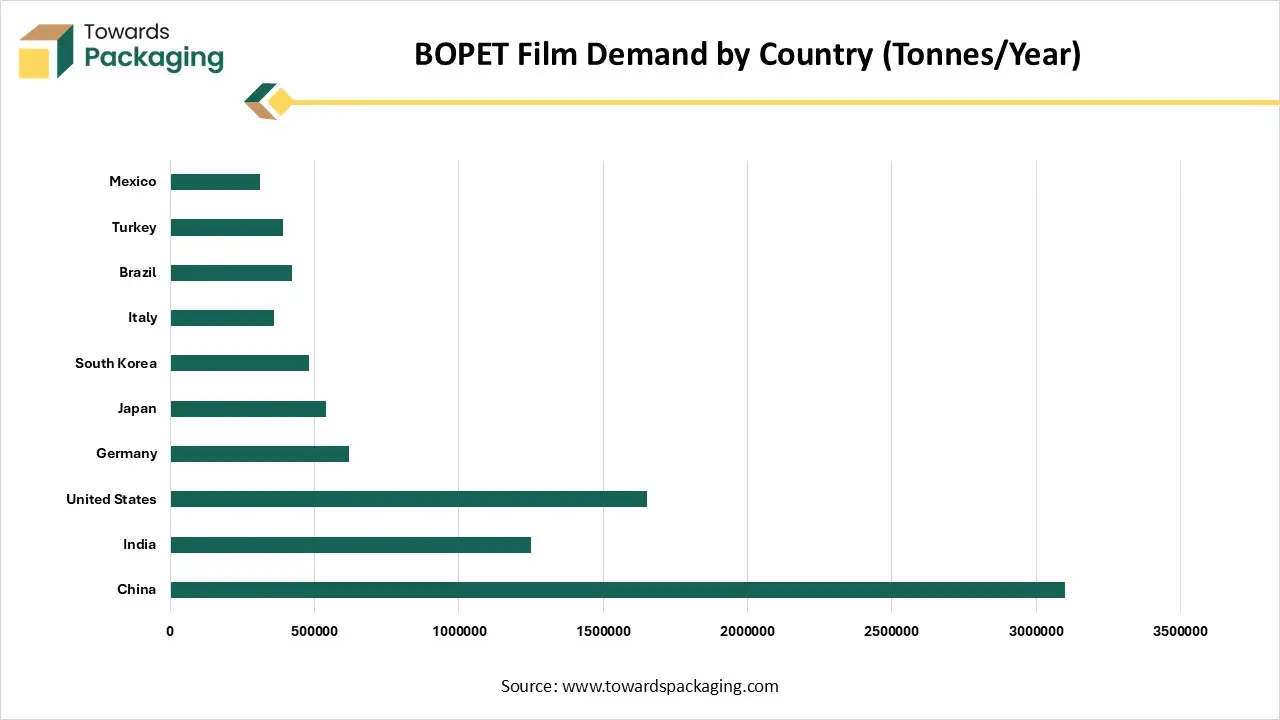

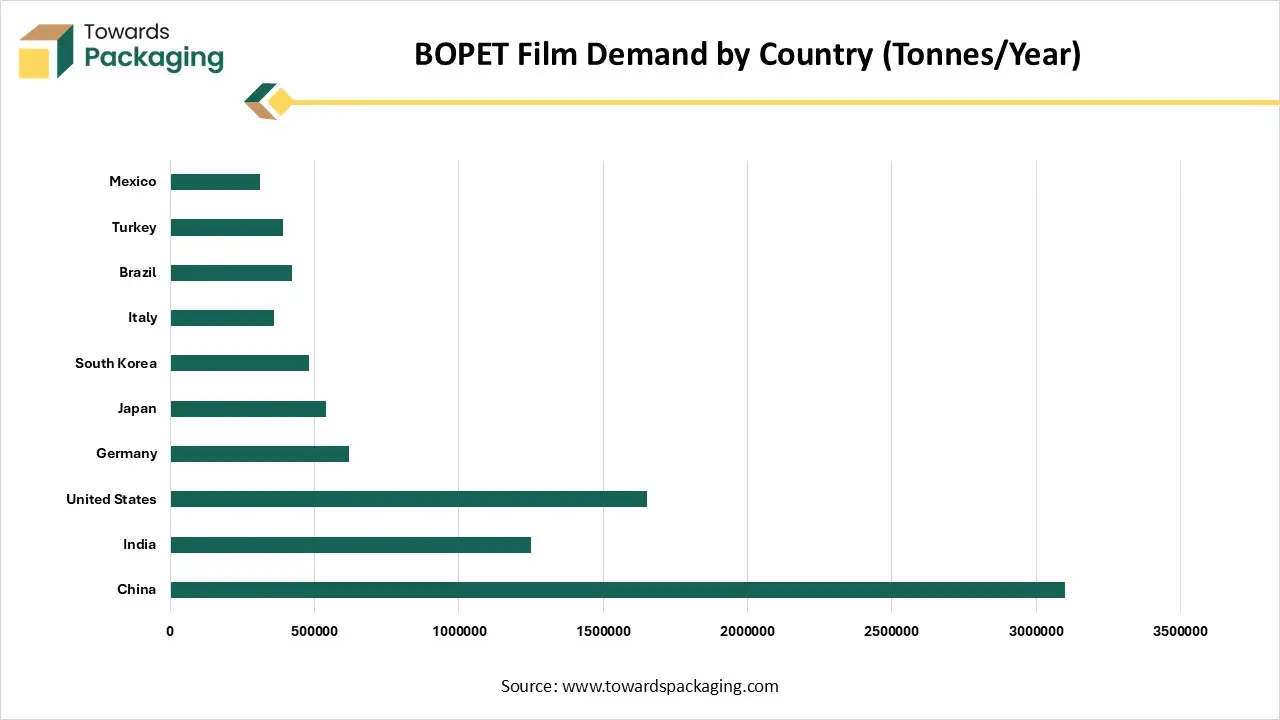

BOPET Film Demand by Country (Tonnes/Year)

| Country | Demand |

| China | 3100000 |

| India | 1250000 |

| United States | 1650000 |

| Germany | 620000 |

| Japan | 540000 |

| South Korea | 480000 |

| Italy | 360000 |

| Brazil | 420000 |

| Turkey | 390000 |

| Mexico | 310000 |

Market Outlook

- Industry Growth Overview -: The biaxially oriented polyethylene terephthalate (BOPET) films market is experiencing steady growth driven by rising demand for flexible packaging, advanced film processing technologies, and expanding applications in electronics, solar energy, and industrial sectors across global and regional markets.

- Global Expansion- The global expansion of the biaxially oriented polyethylene terephthalate (BOPET) films market is being driven by strategic developments and capacity growth across major regions. In North America, the market is expanding through technological advancements, sustainable film innovations, and the rising adoption of flexible packaging in the food and electronics sectors.

- Major Investors -: Major investors in the biaxially oriented polyethylene terephthalate (BOPET) films market include companies such as DuPont Teijin Films, Toray Industries, Mitsubishi Chemical, Jindal Poly Films, UFlex, and Polyplex, focusing on sustainable production, capacity expansion, and advanced coating technologies globally.

- Startup Ecosystem -: The start-up ecosystem of the biaxially oriented polyethylene terephthalate films market is growing with new entrants focusing on sustainable materials, circular economy solutions, and innovative film technologies. Emerging companies are investing in bio-based and recyclable BOPET films to meet rising environmental standards. Start-ups are also collaborating with packaging converters and research institutions to enhance film performance, barrier strength, and cost efficiency. Regions like Asia-Pacific and Europe are witnessing active participation of green-tech ventures emphasizing eco-friendly production methods, waste reduction, and technological integration to compete with established global manufacturers.

Key Metrics and Overview

| Metric | Details |

| Market Size in 2025 | USD 15.19 Billion |

| Projected Market Size in 2035 | USD 24.16 Billion |

| CAGR (2026 - 2035) | 4.75% |

| Leading Region | North America |

| Market Segmentation | By Film Type / Product Type, By Application, By End-User, By Thickness / Grade, By Revenue Model and By Region |

| Top Key Players | DuPont Teijin Films, Toray Industries, Inc., Mitsubishi Polyester Film, Inc., Garware Hi-Tech Films Ltd., Terphane, Foshan Jingxin Plastic Co., Ltd., Zhejiang CIFU Group |

Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Trends

Sustainability and Eco-Friendly Innovations

- Recyclable and Biodegradable Films: There's a significant shift towards developing BOPET films that are recyclable and biodegradable. Companies are focusing on creating films that can be easily recycled, reducing environmental impact.

- Post-Consumer Recycled (PCR) Content: Manufacturers are incorporating higher percentages of post-consumer recycled content into BOPET films, aligning with global sustainability goals. For instance, Dunmore launched DUN-GREEN, a sustainable, printable polyester film containing 75% PCR content.

- Technological Advancements in Manufacturing

- Advanced Coating Technologies: Developments in coating technologies are enhancing the barrier properties and functionality of BOPET films, making them more suitable for a variety of applications.

E-Commerce and Packaging Demand

- Growth in E-Commerce: The expansion of e-commerce is driving the demand for durable, lightweight, and protective packaging solutions. BOPET films offer high strength, barrier properties, and recyclability, making them ideal for e-commerce packaging needs.

- Consumer Preference for Transparent Packaging: There's an increasing consumer preference for transparent packaging that allows product visibility. Transparent BOPET films cater to this demand, enhancing product appeal.

High-Performance Applications

- Halogen-Free Flame Retardant Films: The market for halogen-free flame retardant BOPET films is growing, driven by the adoption of eco-friendly and non-toxic materials in electronics, automotive, and construction sectors. These films offer superior thermal stability and dielectric strength.

- Specialty Films for Electronics and Automotive: There's an increasing demand for specialty BOPET films in electronics and automotive applications due to their enhanced properties, such as high tensile strength and excellent barrier performance.

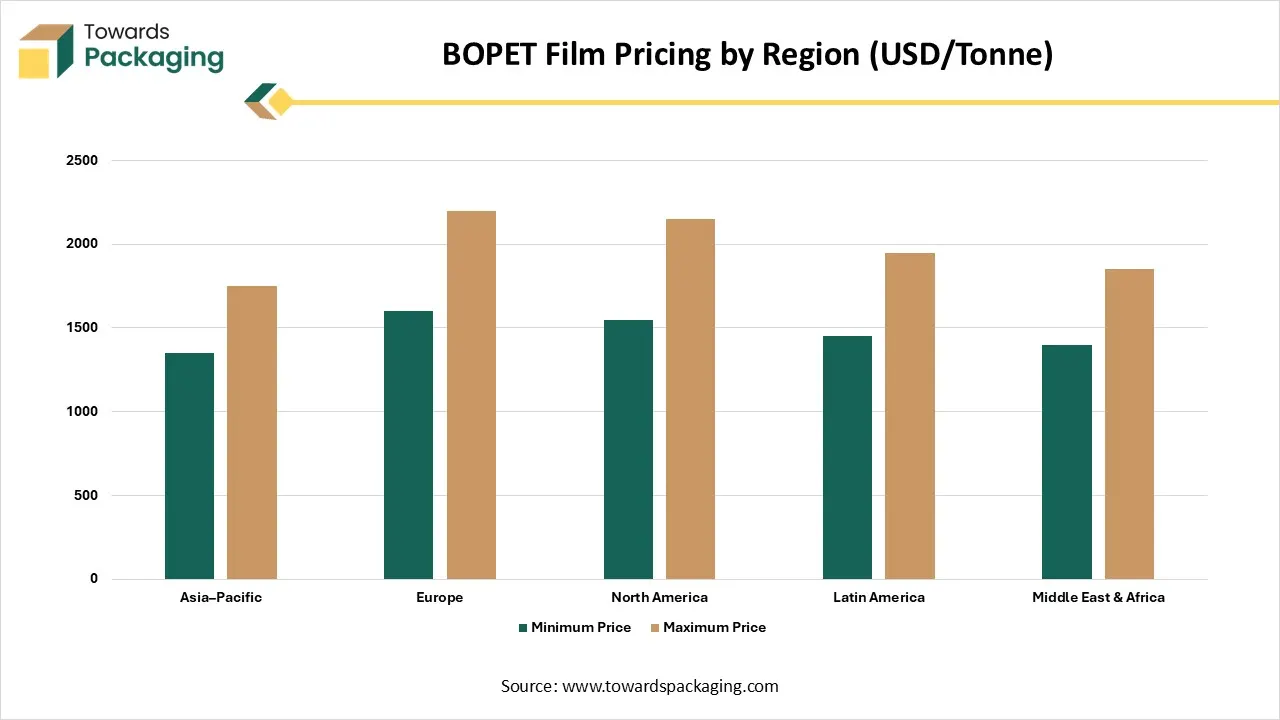

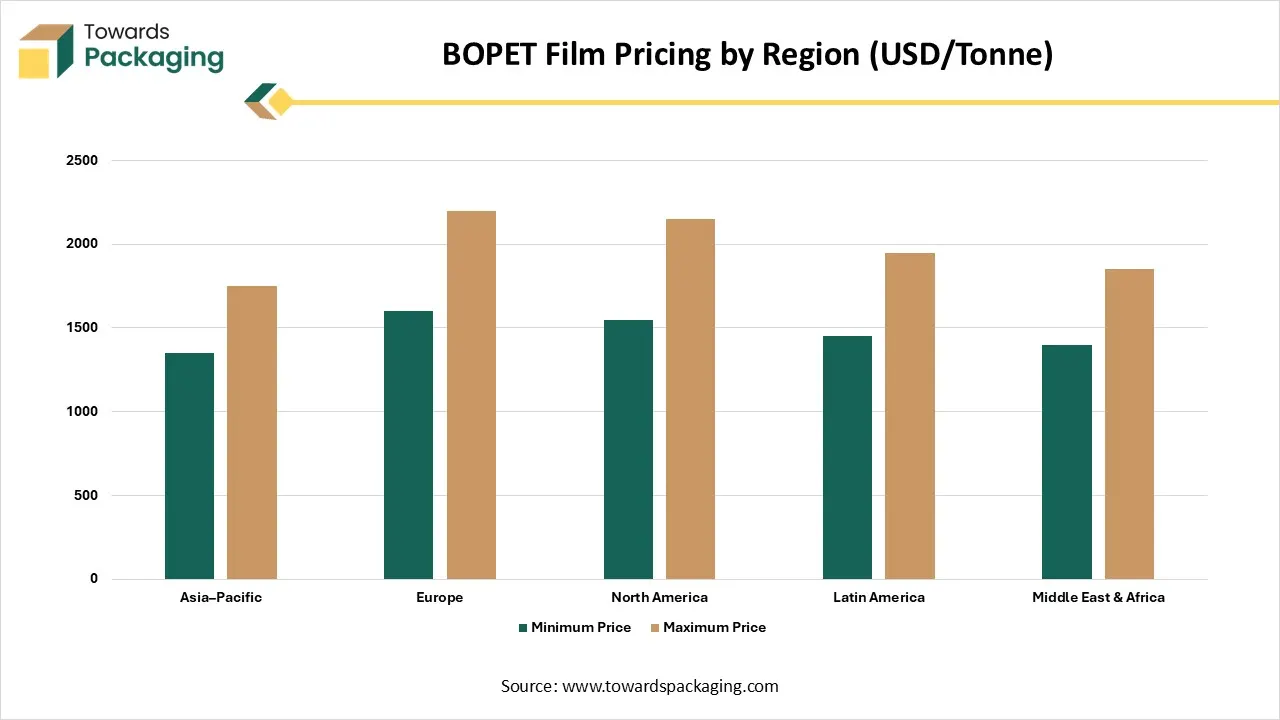

BOPET Film Pricing by Region (USD/Tonne)

| Region | Minimum Price | Maximum Price |

| Asia Pacific | 1350 | 1750 |

| Europe | 1600 | 2200 |

| North America | 1550 | 2150 |

| Latin America | 1450 | 1950 |

| Middle East & Africa | 1400 | 1850 |

How Can AI integration Improve the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market

AI integration can significantly enhance the biaxially oriented polyethylene terephthalate (BOPET) films industry by optimizing production processes, improving quality control, and reducing material waste. Predictive analytics enable manufacturers to anticipate demand, streamline supply chains, and adjust production in real-time. AI-driven research accelerates development of high-performance, sustainable films with better barrier, thermal, and mechanical properties.

Additionally, AI supports market insights, identifying emerging trends, regional demands, and customer preferences, allowing companies to innovate strategically, expand applications, and strengthen competitiveness across packaging, electronics, and industrial sectors.

Key Insights About Recent Advances in the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market

| Region | Key Developments |

| North America |

- Polyplex commissioned a new 50,000-ton BOPET film production line in Decatur, Alabama, increasing resin capacity to 86,000 tons, enhancing supply reliability and reducing lead times. UFlex Limited invested USD 200 million in Egypt to enhance backward integration and market reach, allocating USD 70 million for a PET chips facility, a key raw material for BOPET films. |

| Asia-Pacific | - China and India are witnessing significant growth in BOPET film production, driven by increasing demand in packaging and electronics sectors. |

| Europe | - Germany and Italy are focusing on sustainable BOPET film production, with advancements in recycling technologies and eco-friendly manufacturing processes. |

| Latin America | - Brazil is investing in BOPET film production facilities to cater to the growing demand in the packaging industry, focusing on both domestic supply and export opportunities. |

Recent Advancements in BOPE Film Manufacturing

| Category | Advancement | Key Benefits |

| Material Innovation | Development of BOPE-HD and MDO-HDPE resins by NOVA Chemicals. | Enables fully recyclable, all-PE laminates with high stiffness, excellent heat resistance, and outstanding optical properties. |

| Process Enhancement | Introduction of advanced biaxial stretching technology for BOPE films. | Results in films with superior mechanical strength, transparency, gloss, low fish-eye counts, contamination-resistant sealing, puncture resistance, low-temperature impact performance, printability, and sustained wetting tension. |

| Sustainability Focus | Emphasis on reducing material usage and enhancing recyclability. | Achieves up to 50% reduction in packaging substrate thickness, conserving resources, lowering costs, and aligning with global sustainability goals. |

| Application Expansion | Adoption of BOPE films in niche markets such as frozen food packaging. | Addresses limitations of traditional PE films in low-temperature applications, reducing bag breakage rates from 7%-8% to nearly 0%. |

| Technological Integration | Integration of automated gauge control, infrared heating, and low-friction rollers in manufacturing lines. | Increases line efficiency and reduces downtime, enabling the production of multi-layer films with specific functions. |

| Monomaterial Solutions | Development of all-PE film structures using HD-BOPE technology. | Facilitates the creation of recyclable multi-layer films that perform as well as traditional mixed-material structures, supporting the transition to a circular economy. |

| Trial and Testing | Conducting extensive trials of PureFive™ resin in BOPP film production. | Demonstrates the feasibility of using new resins in BOPP film manufacturing, paving the way for innovative materials and processes. |

Segmental Insights

Metallized biaxially oriented polyethylene terephthalate (BOPET) films dominate the market due to their excellent barrier properties, high tensile strength, and superior gloss and printability. These films effectively protect against moisture, oxygen, and light, making them ideal for food, beverage, and pharmaceutical packaging. Additionally, their lightweight nature and recyclability enhance sustainability, while their aesthetic appeal supports premium product presentation.

Coated Biaxially Oriented Polyethylene Terephthalate (BOPET) films are specialized films treated with surface coatings to enhance specific properties such as adhesion, printability, heat resistance, and barrier performance. These coatings allow the films to be used in high-performance applications including flexible packaging, labeling, electronics, and industrial uses. They offer improved durability, chemical resistance, and compatibility with inks, adhesives, and laminates, making them versatile for various industries.

The packaging segment dominates the biaxially oriented polyethylene terephthalate (BOPET) films market due to its superior barrier properties, high tensile strength, and versatility across food, beverage, and pharmaceutical applications. Its ability to ensure product safety, extend shelf life, and support attractive printing makes it essential. Rising e-commerce and consumer demand for sustainable, durable packaging further drive growth.

The Electrical and Electronics segment is the fastest-growing application in the BOPET films market due to the films’ excellent dielectric strength, thermal stability, and dimensional accuracy. These properties make them ideal for insulating capacitors, transformers, and flexible printed circuits. Rapid advancements in consumer electronics, increasing demand for lightweight and high-performance components, and the growth of electric vehicles are driving adoption, positioning this segment for accelerated growth in the global market.

What Made Packaging Industry the Dominant Segment in the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market?

The packaging industry is the dominant end-user segment in the biaxially oriented polyethylene terephthalate (BOPET) films market due to the films’ exceptional barrier properties, durability, and versatility. They effectively protect products from moisture, oxygen, and light while enhancing shelf life. Additionally, their excellent printability and transparency support attractive branding and labeling. Growing demand for convenient, sustainable, and high-performance packaging in food, beverage, and pharmaceutical sectors further reinforces this segment’s dominance.

The Electrical and Electronics industry is the fastest-growing segment in the biaxially oriented polyethylene terephthalate (BOPET) films market due to the films’ excellent electrical insulation, thermal stability, and dimensional precision. These properties make them ideal for capacitors, transformers, flexible printed circuits, and other electronic components. Rapid growth in consumer electronics, increasing adoption of electric vehicles, and the demand for lightweight, high-performance materials are driving the accelerated expansion of this segment globally.

Which Medium Gauge Segment Led the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market?

The medium gauge segment dominates the BOPET films market due to its optimal balance of strength, flexibility, and processability, making it suitable for a wide range of applications. It offers excellent barrier properties, durability, and dimensional stability while remaining cost-effective. Its versatility supports packaging, electrical, and industrial uses, meeting both performance and economic requirements. This adaptability across multiple end-use industries reinforces the medium gauge segment as the preferred choice in the market.

The Thin Gauge segment in the BOPET films market is gaining attention due to its lightweight, flexible, and cost-effective characteristics. Thin gauge films offer excellent clarity, printability, and barrier properties while reducing material usage, making them ideal for food and beverage packaging, labels, and flexible laminates. Their adaptability for high-speed processing and compatibility with advanced coatings and printing technologies further drives their growing adoption across multiple industries.

Which Direct Product Sales Segment Led the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market?

The direct product sales segment dominates the BOPET films market due to its ability to provide manufacturers with stronger customer relationships, customized solutions, and reliable supply chains. Direct sales enable better communication regarding product specifications, quality requirements, and delivery schedules, ensuring high customer satisfaction. Additionally, this approach reduces dependency on intermediaries, allows competitive pricing, and strengthens brand loyalty, making it the preferred distribution strategy for high-performance and specialized BOPET films.

The customized solutions and services segment is the fastest-growing in the BOPET films market due to increasing demand for tailored films that meet specific barrier, thickness, coating, and printing requirements across industries like packaging, electronics, and automotive. Manufacturers are offering specialized coatings, metallization, and surface treatments to enhance functionality and performance. Rising consumer preference for premium, high-quality, and application-specific products drives the adoption of these customized solutions, accelerating growth in this market segment.

Which Factors Contribute to North America’s Dominance in the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market?

North America dominates the BOPET films market due to its well-established packaging, electrical, and electronics industries, which demand high-performance films with excellent barrier, tensile, and thermal properties. Strong consumer preference for convenient, sustainable, and visually appealing packaging drives adoption. Advanced manufacturing infrastructure, rapid technological innovations, and stringent quality standards further support market leadership. Additionally, growing e-commerce, food, and pharmaceutical sectors in the region contribute to robust demand, reinforcing North America’s position as the dominant market for BOPET films. The United States and Canada are pivotal players in the North American Biaxially Oriented Polyethylene Terephthalate (BOPET) films market, driven by significant investments from leading manufacturers and a robust demand across packaging, electronics, and pharmaceutical sectors.

U.S. Market Trends

The U.S. is a major hub for BOPET film production, hosting several key manufacturers:

- Toray Plastics (America), Inc.: A subsidiary of Japan's Toray Industries, Toray Plastics (America) produces Lumirror® BOPET films, renowned for their high strength, dimensional stability, and optical clarity.

- Mitsubishi Polyester Film, Inc.: A division of Mitsubishi Chemical America, Inc., this company manufactures a wide range of BOPET films for applications in packaging, electronics, and industrial uses.

- Polyplex USA LLC: A subsidiary of India's Polyplex Corporation, Polyplex USA operates a manufacturing facility in Decatur, Alabama, producing thin polyester films for packaging and industrial applications.

- Dunmore Corporation: Based in Bristol, Pennsylvania, Dunmore specializes in metallized and coated BOPET films, serving industries such as packaging, electronics, and automotive.

- Inteplast Group: Headquartered in Livingston, New Jersey, Inteplast manufactures a variety of plastic films, including BOPET films, for packaging and industrial applications.

Canada Market Trends

Canada's BOPET films market is expanding, with notable investments from key players:

- Taghleef Industries: A global manufacturer of BOPET films, Taghleef Industries operates in Canada, producing films for flexible packaging, labeling, and industrial applications.

- Integrated Packaging Films, Inc.: Based in Canada, Integrated Packaging Films specializes in manufacturing BOPET films for various applications, including packaging and labeling.

- FAM Ti Canada: A leading flexible packaging solution provider, FAM Ti Canada distributes BOPET films and related substrates, catering to the packaging industry.

Regional Demand Split BOPET vs BOPP vs CPP (Tonnes/Year)

| Region | BOPET | BOPP | CPP |

| Asia-Pacific | 4200000 | 8900000 | 3600000 |

| Europe | 2100000 | 3600000 | 1500000 |

| North America | 1850000 | 3100000 | 1300000 |

| Latin America | 620000 | 780000 | 460000 |

| Middle East & Africa | 480000 | 720000 | 340000 |

How Big is the Opportunity for the Growth of the BOPET Films Market?

The Asia-Pacific region is the fastest-growing market for biaxially oriented polyethylene terephthalate (BOPET) films due to rapid industrialization, rising disposable incomes, and expanding packaging, electronics, and automotive sectors. Growing demand for convenient, durable, and sustainable packaging, coupled with increasing e-commerce and food and beverage consumption, drives adoption. Additionally, the presence of major manufacturers, government initiatives supporting advanced manufacturing, and investments in modern production facilities enhance regional capacity, making Asia-Pacific a hub for high-performance BOPET films and fostering accelerated market growth. China and India are pivotal players in the Asia-Pacific Biaxially Oriented Polyethylene Terephthalate (BOPET) films market, driven by robust industrial growth and significant investments from leading manufacturers.

China Market Trends

China stands as a global leader in BOPET film production, with major manufacturers such as Hengli Group, Jiangsu Yuxing Film Technology, Fuwei Films, and Zhejiang Haibin Film Technology. These companies specialize in producing a wide range of BOPET films for applications in packaging, electronics, and industrial sectors. For instance, Jiangsu Yuxing Film Technology is noted for its medium and thick special polyester films, catering to industries like IT, LCD, and solar cell modules.

The Chinese government supports the BOPET film industry through favorable policies and investments in advanced manufacturing technologies. This support has led to the establishment of state-of-the-art production lines and testing equipment, enhancing the quality and competitiveness of Chinese BOPET films in the global market.

India Market Trends

India's BOPET film market is characterized by significant investments from both domestic and international players. Polyplex Corporation, a leading manufacturer, has announced an investment of ₹558 crore to establish a new BOPET film plant, aiming to increase production capacity by 52,400 metric tonnes per annum. Jindal Poly Films, another major player, is investing US$ 7.89 million through its subsidiary, JPFL Films, to set up new BOPP, PET, and CPP lines in Nashik, Maharashtra. Additionally, Dhunseri Poly Films, part of the Dhunseri Group, plans to invest US$11.27 million (₹1,000 crore) to establish two polyester film manufacturing units in West Bengal.

These investments underscore India's growing prominence in the BOPET film industry, driven by increasing demand in packaging, electronics, and automotive sectors. The country's strategic initiatives, including infrastructure development and policy support, further bolster its position in the global BOPET film market.

Top Companies in the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market

Tier 1

- DuPont Teijin Films

- Toray Industries, Inc.

- Mitsubishi Polyester Film, Inc.

- SKC, Ltd.

- Jindal Poly Films Ltd.

- Uflex Ltd.

- Polyplex Corporation Ltd.

- Indorama Ventures Ltd.

- SRF Limited

Tier 2

- Garware Hi-Tech Films Ltd.

- Terphane

- Cosmo Films Ltd.

- Kolon Industries

- Fuwei Films (Shandong) Co., Ltd.

- Jiangsu Shuangxing Color Plastic New Material Co., Ltd.

- Jiangyin Film-Maker Plastic Co., Ltd.

- Ester Industries Ltd.

- SK Chemicals Co., Ltd.

- Kuraray Co., Ltd.

- Hangzhou Heshun Technology Co., Ltd.

- FSPG Hi-Tech (Foshan Plastics Group)

Tier 3

- Foshan Jingxin Plastic Co., Ltd.

- Zhejiang CIFU Group

- YUXING

- Sumilon Industries Ltd.

- Chintec (Xiamen) Plastic Film Technology Co., Ltd.

- HSQY Plastic Group

- Solenis

- Hangzhou Shanying Technology Co., Ltd.

- Dongwoo Fine-Chem Co., Ltd.

Recent Development in the Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market

- In July 2025, Polyplex Corporation announced the commencement of its $100 million PET film expansion project at the Decatur, Alabama facility, aiming to enhance production capacity and meet the growing demand for high-performance films in packaging and electronics sectors.

- In June 2025, Flex Films, the global film manufacturing arm of UFlex, unveiled its patented BOPET high-barrier film, F-UHB-M, designed to replace aluminum foil in flexible packaging applications. This innovation aims to provide enhanced protection and sustainability in packaging solutions.

- In May 2025, Polyplex Corporation reported that its $100 million PET film expansion project at the Decatur, Alabama facility is expected to commence operations in the first quarter of 2025, reinforcing its commitment to meeting the increasing demand for BOPET films in North America.

- In March 2025, Polyplex Corporation revealed plans for a significant investment in a new BOPET film manufacturing plant, with an estimated investment of ₹558 crore, aiming to bolster its production capabilities and cater to the growing demand in the BOPET films market.

Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Segments

By Film Type / Product Type

- Metallized BOPET Films

- Transparent / Clear BOPET Films

- Coated BOPET Films (Barrier, Corona, Heat Seal, UV)

- Printed / Laminated BOPET Films

- Other Specialty Films (Flame Retardant, Anti-fog, Anti-static)

By Application

- Packaging

- Electrical & Electronics

- Solar & Photovoltaics

- Industrial Applications (Labeling, Laminates, Insulation)

- Imaging & Graphics (Printing, Decorative, and Optical Films)

- Other Applications (Automotive, Aerospace, Specialty Coatings)

By End-User

- Packaging Industry

- Electrical & Electronics Manufacturers

- Solar & Renewable Energy Companies

- Industrial & Automotive Users

- Other End-Users (Printing, Graphics, Aerospace, Specialty Industries)

By Thickness / Grade

- Thin Gauge Films (<25 µm)

- Medium Gauge Films (25–75 µm)

- Thick Gauge Films (>75 µm)

By Revenue Model

- Direct Product Sales (Films, Laminates, Coated Films)

- Licensing / IP-based Revenue

- Customized Solutions & Technical Services

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (6)