Mono-oriented Polypropylene (MOPP) Films Market Size, Share, Trends and Forecast Analysis

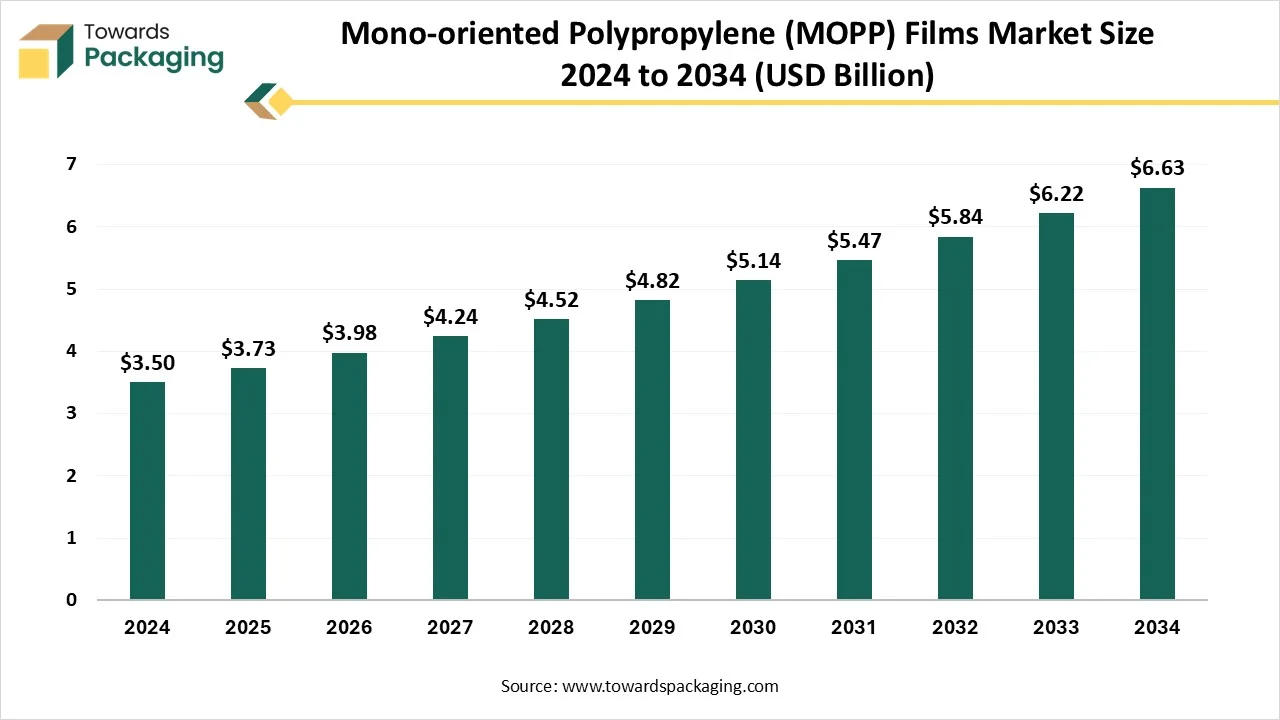

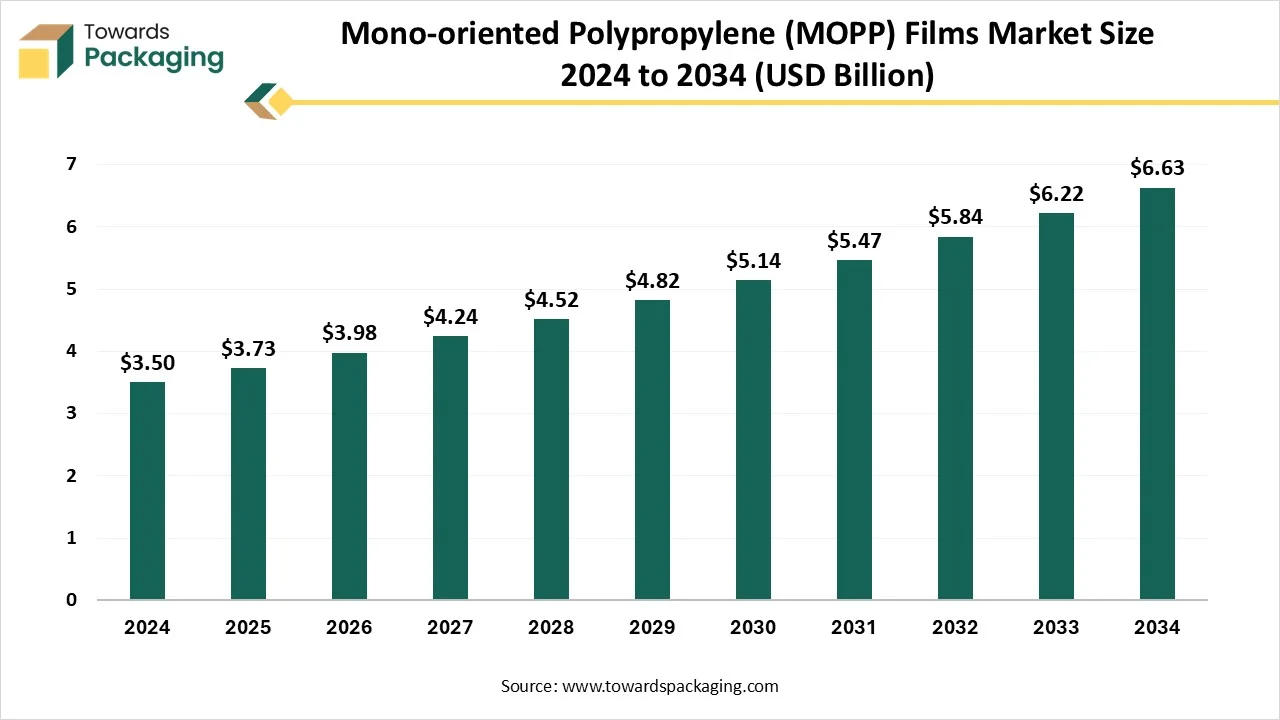

The mono-oriented polypropylene (MOPP) films market is forecasted to expand from USD 3.73 billion in 2025 to USD 7.07 billion by 2035, growing at a CAGR of 6.6% from 2026 to 2035. The rising demand for lightweight and recyclable packaging in industries such as labelling, pharmaceutical, and food & beverages.

The major development comprises mono-material packaging, enhanced mechanical properties, and sustainability of the packaging. Major drivers of this industry are increasing consumers’ awareness, sustainability goals, technological advancements, and growing food & beverages sector. The market is dominating in Asia Pacific region due to presence of large-scale production.

Major Key Insights Of The Mono-Oriented Polypropylene (MOPP) Films Market

- In terms of revenue, the market is valued at USD 3.73 billion in 2025.

- The market is projected to reach USD 7.07 billion by 2035.

- Rapid growth at a CAGR of 6.6% will be observed in the period between 2025 and 2034.

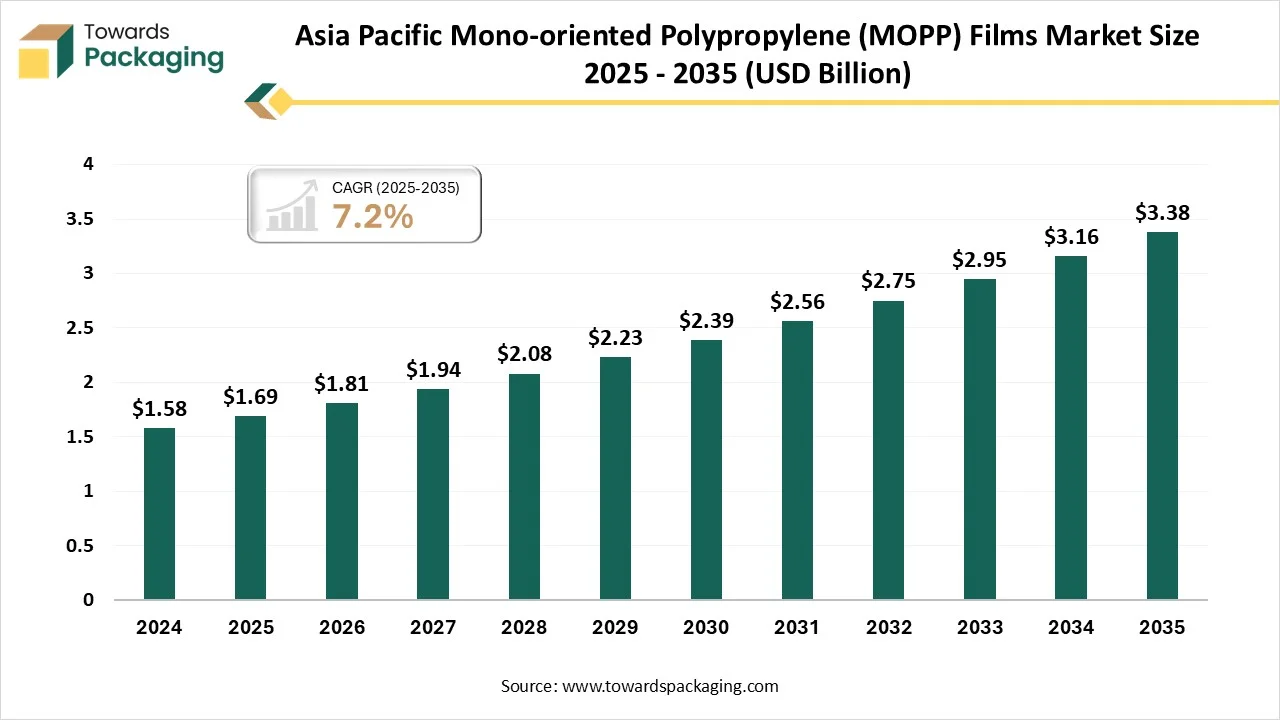

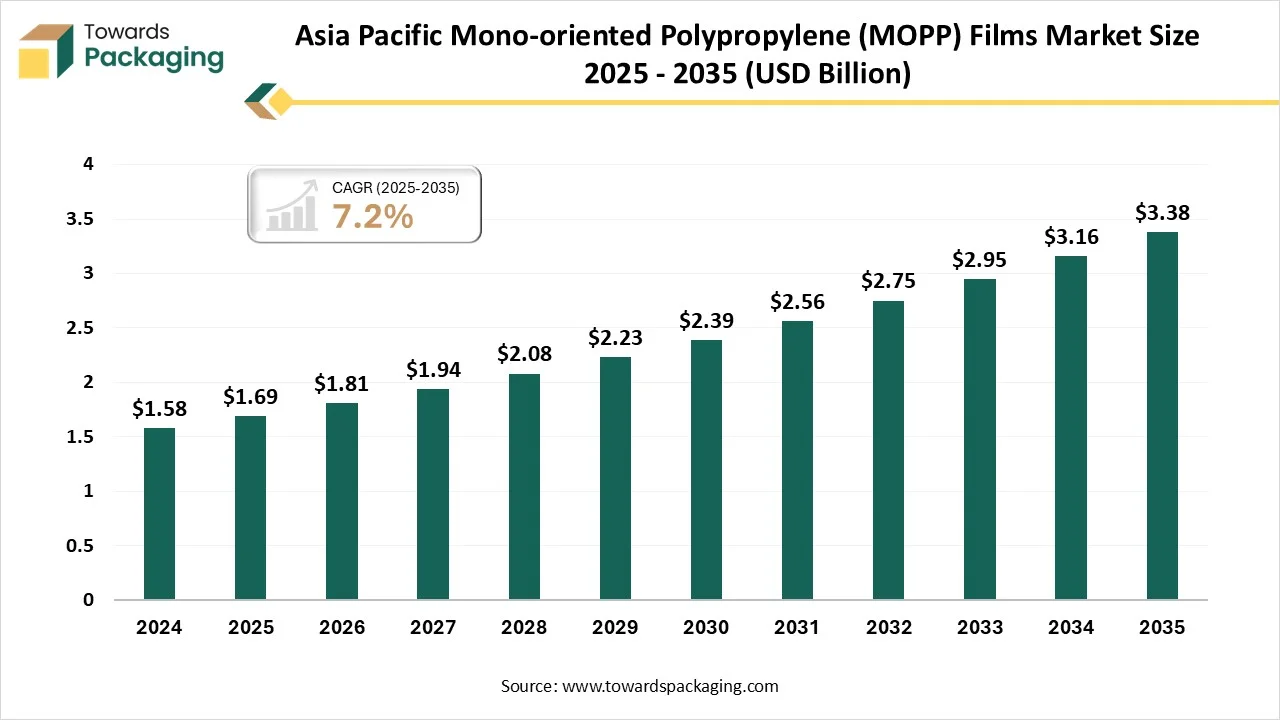

- By region, Asia Pacific dominated the market by holding highest market share of 45% in 2024.

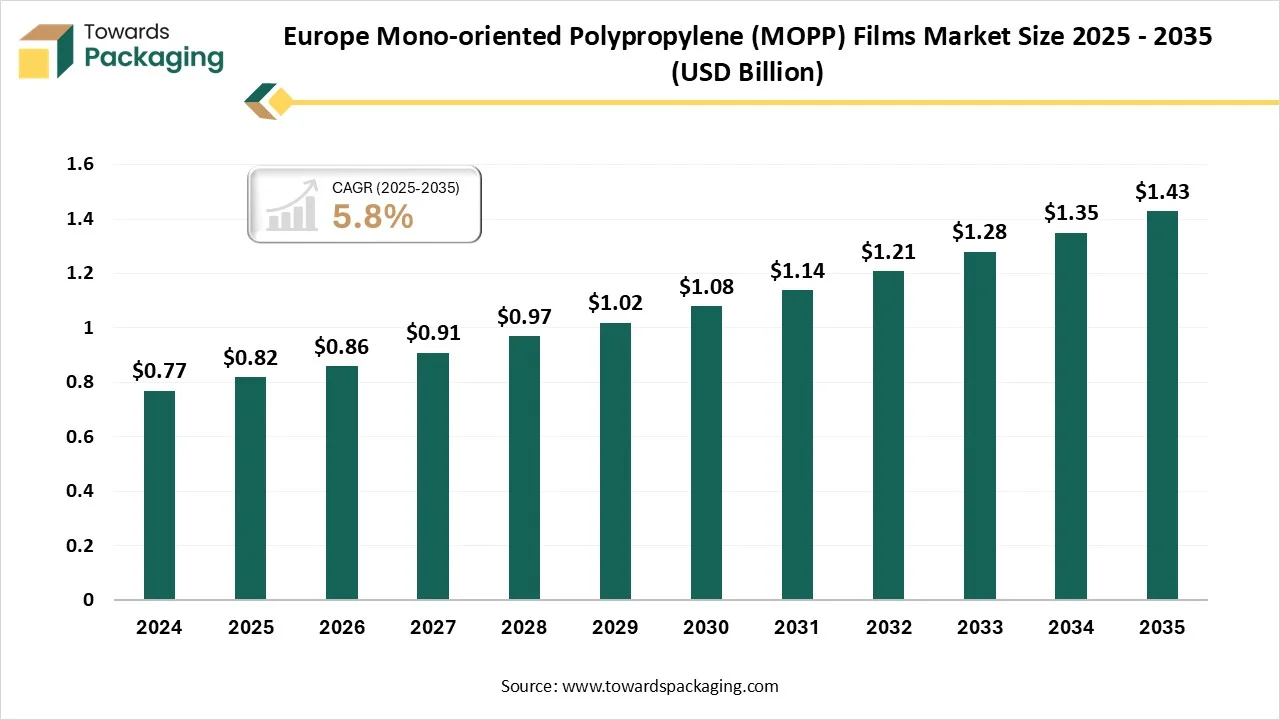

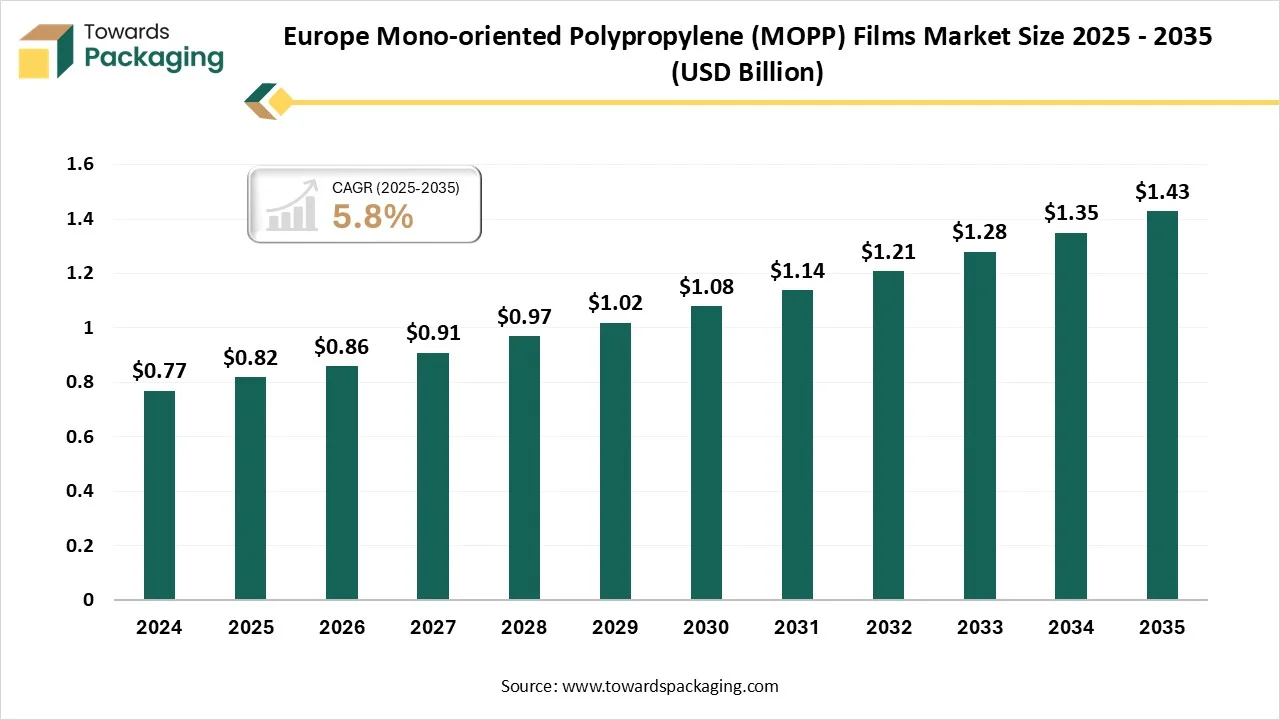

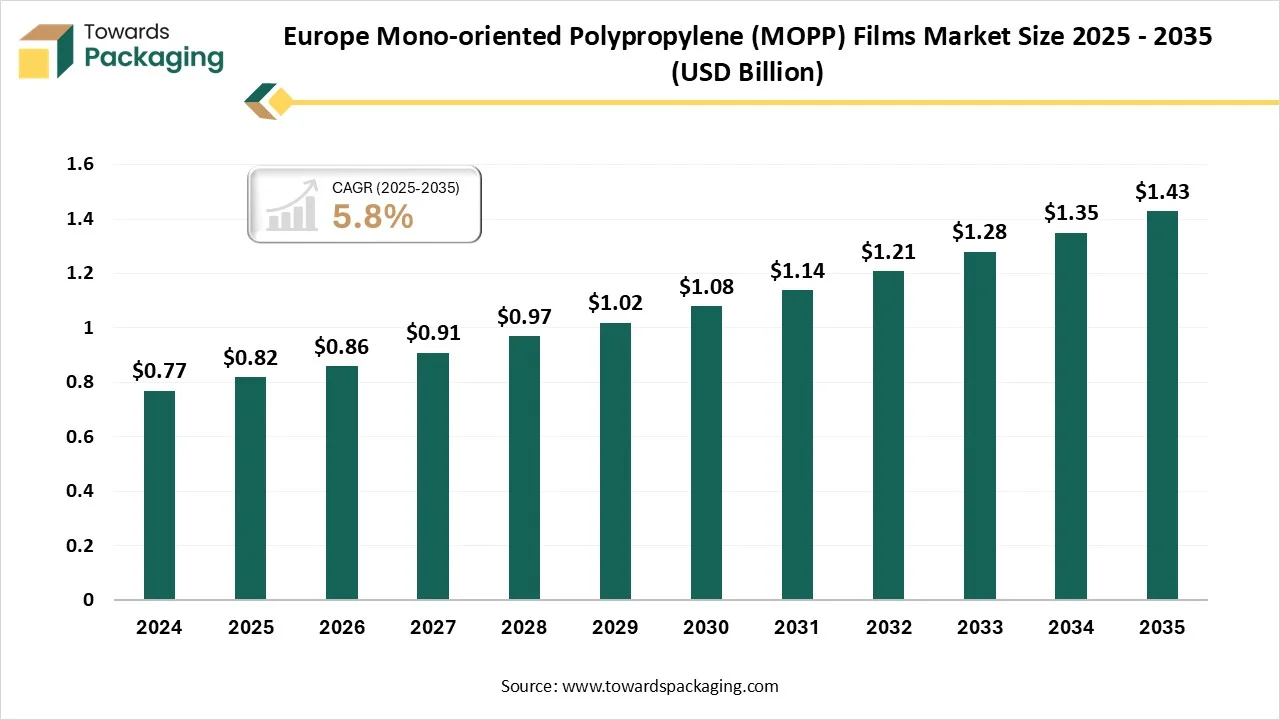

- By region, Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By thickness type, the 51–100 µm segment contributed the biggest market share of approximately 55% in 2024.

- By thickness type, the below 50 µm segment will be expanding at a significant CAGR in between 2025 and 2034.

- By application type, the packaging films segment contributed the biggest market share of approximately 50% in 2024.

- By application type, the labels & tags segment is expanding at a significant CAGR in between 2025 and 2034.

- By end-use industry type, the food & beverage packaging segment contributed the biggest market share of approximately 45% in 2024.

- By end-use industry type, the pharmaceutical packaging segment is expanding at a significant CAGR in between 2025 and 2034.

What Is Mono-Oriented Polypropylene (MOPP) Films?

Mono-oriented polypropylene (MOPP) films are the plastic films which are made up of polypropylene which is stretched highly and oriented in one direction while manufacturing. These films provide tear resistance and high tensile strength, these features made it appropriate for several usage such as packaging tapes, labels, and several types of straps. These are lightweight and durable films used for packaging purpose and are considered as highly suitable for printing. These films are cost-efficient solution for industrial packaging purpose as it offers high dimensional stability.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 3.5 Billion |

| Projected Market Size in 2035 |

USD 7.07 Billion |

| CAGR (2026 - 2035) |

6.6% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Thickness, By Application, By End-Use Industry and By Region |

Mono-Oriented Polypropylene (MOPP) Films Market Outlook

- Sustainability Focus: There is a huge demand for development of eco-friendly products due to increasing consumers awareness and strict packaging guidelines of the government. This pushes the development of recyclable and biodegradable films packaging.

- Advancement in Supervisory Guidelines: The advancement in supervisory guidelines push producing companies towards development of complaint, transparent, and sustainable products. Several guidelines such as ban on single-plastic usage, and circular economy initiatives has promoted this market.

- Enhancing Personalized Packaging: Enhancement of films which are moisture resistance, cost-efficient, high clarity, and strength has encouraged the adoption of these films.

- Startup Ecosystem: Development of innovative films, advanced supply chain management, and strategic partnership has boosted the expansion of this market. Low-cost and high moisture barrier films are developed for these films that provide enhanced UV stability.

How Can AI Improve The Mono-Oriented Polypropylene (MOPP) Films Market?

The incorporation of AI technology in the market plays an important role in operational efficacy with automated control, predictive maintenance. It helps in the development of product with the integration of smart packaging, accelerated R&D, and tailored properties. AI is widely used for waste reduction and generation recyclable formulas for manufacturing of MOPP films. It supports in enhancing opportunities and cost saving properties.

Trade Analysis Of Mono-Oriented Polypropylene (MOPP) Films Market: Import & Export Statistics

- China has exported huge amounts of raw materials such as polypropylene from 2020 to 2023. The estimated value is 425,000 tonnes in 2020 to 1.6 million tonnes in 2023 which encourage this market to grow.

- India is considered as a major producer of BOPP and continue its exchange process with China, Germany, and Vietnam by MOPP.

- Japan has huge polypropylene market, which is valued around $851.3 million in 2022, and it is growing significantly.

- Germany is a huge consumer of polypropylene which is used in various industries like food, dairy, and pharmaceuticals.

- UK has reported to expand this market with the increasing demand for convenience of the consumers.

Mono-Oriented Polypropylene (MOPP) Films Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market is polypropylene resins, renewable and recycled materials.

- Key Players: DOW, Borouge

Component Manufacturing

The major components used in this market are polymerization, monoaxial stretching, extrusion.

- Key Players: 3B Films, Uflex

Logistics and Distribution

This segment plays an important role in enhancing strategic partnership of the major market players.

- Key Players: CCL Industries, Profol GmbH

Market Dynamics

Market Driver

Increasing Demand For Sustainable Packaging

The increasing demand for sustainable packaging has influenced the demand for the market. The market has encouraged move in the direction of biodegradable and recyclable options. MOPP films are being decomposable, bring into line well with these ecological initiatives, creating them a favoured choice among producers and customers alike. MOPP films provide superior barrier belongings, defending food items from contaminations and moisture, thus improving their safety and longevity. This rising trend in the direction of accessibility in food packing suggestively uplifts the market.

Market Challenges And Restraints

Volatile Raw Materials Charges

Volatile raw material charges in the packaging sector have hindered the growth of the market. The creation of MOPP films depends on polypropylene, that is dependent on variations in charges because of factors like geopolitical stress and fluctuations in crude oil charges. This contradiction can restrict the acceptance of MOPP films, as producers may be cautious to capitalize in resources that are not extensively recyclable in their goal markets.

Market Opportunity

Burgeoning E-commerce Industries

Burgeoning e-commerce industries has raised the opportunities for the market. Huge demand for effective packaging choices has enhanced the scope of development in this market. The incorporation of technology in the packaging resolutions like QR codes and moisture pointers can improve consumer interface and offer useful data about the freshness of the product. This trend is currently acquisitioning momentum, according to indication by the Food and Drug Administration (FDA), which shows the rising customer interest in clear and enlightening packaging.

Thickness Type Insights

Why 51–100 µm Segment Dominated The Mono-Oriented Polypropylene (MOPP) Films Market In 2024?

The 51–100 µm segment dominated the market in 2024 due to its barrier properties, flexibility, and strength. It is used for applications like tapes, rolled stocks, labels and tags. Films with this thickness are widely used in food & beverages, pharmaceuticals, and cosmetic industries. It meets the specific requirement of the packaging industries.

The below 50 µm segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to its cost-effectiveness and flexibility. These are used in food packaging, tapes, and labels as these are thin yet strong which is required for these purposes. Constant innovation with this segment has boosted the development of these films.

Application Type Insights

Why Packaging Films Segment Dominated The Mono-Oriented Polypropylene (MOPP) Films Market In 2024?

The packaging films segment held the largest share of the market in 2024 due to its high clarity and cost-effective solution for packaging. These packaging films are widely accepted for their superior strength and oxygen barrier properties. With the increasing demand for recyclable and sustainable packaging solution has influenced the growth of this segment. It is widely used for the protection of freshness of food products and extend its shelf life.

The labels & tags segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to its water-resistance and printability. Soft texture of this segment improves the aesthetic appeal and handling of the labels. Innovation in the opacity and thickness of the films has boosted the development of this segment.

End-User Type Insights

Why Food & Beverage Packaging Segment Dominated The Mono-Oriented Polypropylene (MOPP) Films Market In 2024?

The food & beverage packaging segment held the largest share of the market in 2024 due to its sustainability, durability, and cost-effectiveness. It protects against ecological factors and meets consumers requirements for convenience. The inherent hygiene and strength have made these films widely accepted by several food & beverages brands. Rising consumption of packaged food products such as ready-to-eat meals and snacks has promoted the demand for this segment. Increasing necessity for packaging of frozen food products for convenience promote the development of this segment.

The pharmaceutical packaging segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to fulfilling strict regulatory needs. These films play an important role in producing multilayered packaging which protect drugs from oxygen and moisture barrier. The rising focus on mono-material and recyclable solution packaging development has evolved this market.

Regional Insights

Large-Scale Production Demand in Asia Pacific Promote Dominance

Asia Pacific held the largest share of the market in 2024, due to its large-scale production demand of these films. These films are widely used in pharmaceuticals and cosmetics, food & beverages, and e-commerce and retail packaging industries. The increasing demand for protection from factors like sunlight and heat, enhance shelf-life, and product preservation has raised the production and advancement of these films. The rising focus towards adoption of more sustainable packaging has boosted the growth of this industry.

Focus on Mono Material Packaging Films in Europe Promote Dominance

Europe held the largest share of the mono-oriented polypropylene (MOPP) films market in 2024, due to enhanced focus towards mono material packaging films. Strict supervisory guidelines in Europe have promoted the usage of the utilization of eco-friendly packaging. The major market players are widely investing for the development of packaging that can be recycled multiple times.

Polypropylene Packaging’ Regulatory Landscape: Global Regulations

| Regions/ Countries |

Regulatory Bodies |

Key Regulations |

| UK |

Food Standards Agency |

National FCM guidance and authorisation routes for GB |

| Japan |

Ministry of Health, Labour & Welfare (MHLW) |

Permitted polymers, additives, and monomers. |

| Germany |

BfR (Federal Institute for Risk Assessment) |

It issues scientific recommendations on substances |

| India |

FSSAI |

BIS standards plastic cover packaging types. |

| China |

National Health Commission |

GB standards for food contact plastics |

Recent Developments

- In May 2025, Innovia Films Ltd. has introduced the innovation of film coating lines which is the first company with such facilities in western Mexico. It expands this film production by enhancing metalizing capabilities.

- In April 2025, UFLEX Ltd. announced about its woven polypropylene bags for the packaging of pet food. The company has invested $50 million plant for recycling packaging production in upcoming period.

Top Companies in the Mono-oriented Polypropylene (MOPP) Films Market

- Taghleef Industries: A major market player which has a huge consumer base. It offers high-barrier films, graphic arts films, and luxury packaging films.

- Uflex Limited: It produces huge variety of packaging comprising CPP and BOPP films to provide innovation in the food packaging industries.

- Polyplex Corporation Ltd.: It is mainly known for the development of PET films but also produced enhanced quality of CPP, blown PP/PE, and BOPP.

- Profol GmbH: It plays an important role in fulfilling the demand of a huge market base.

- Poligal S.A.: It is involved in the production process of the oriented polypropylene films.

- Others: 3B Films Pvt. Ltd., Schur Flexibles Holding GesmbH, Oben Holding Group S.A.C., Thai Film Industries Public Company Limited, PT Bhineka Tatamulya Industri, Jindal Poly Films Limited, Mitsui Chemicals, Inc., Copol International Ltd., NOWOFOL, Lenzing Plastics, Trico Specialty Films, Futamura Chemical, Yangzhou Shengzhibao New Materials, Hi-Tech International, MJW International.

Mono-oriented Polypropylene (MOPP) Films Market Segment Covered

By Thickness

- Below 50 µm

- 51–100 µm

- Above 100 µm

By Application

- Packaging Films (Rolled Stock, Laminates)

- Labels & Tags

- Tapes

- Industrial & Specialty Films

By End-Use Industry

- Food & Beverage Packaging

- Pharmaceutical Packaging

- Cosmetic Packaging

- Industrial Use

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait