Polypropylene Foam Trays Market Size, Share, Trends and Forecast Analysis

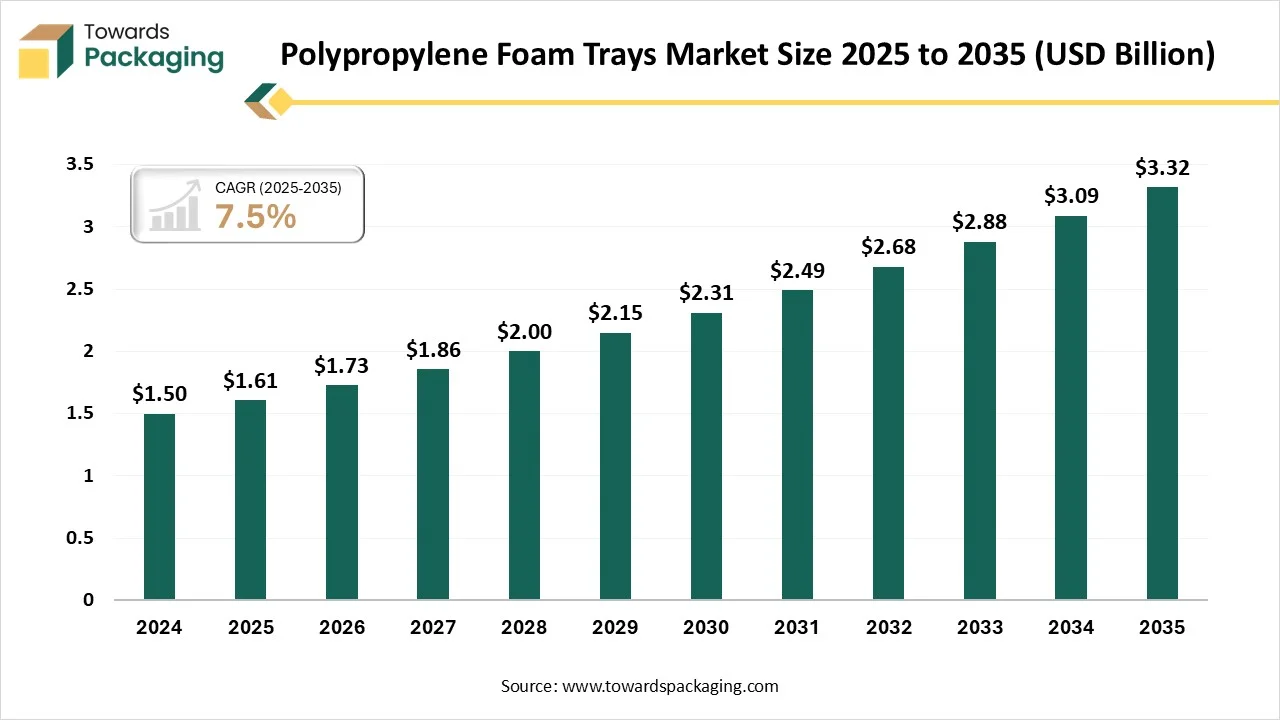

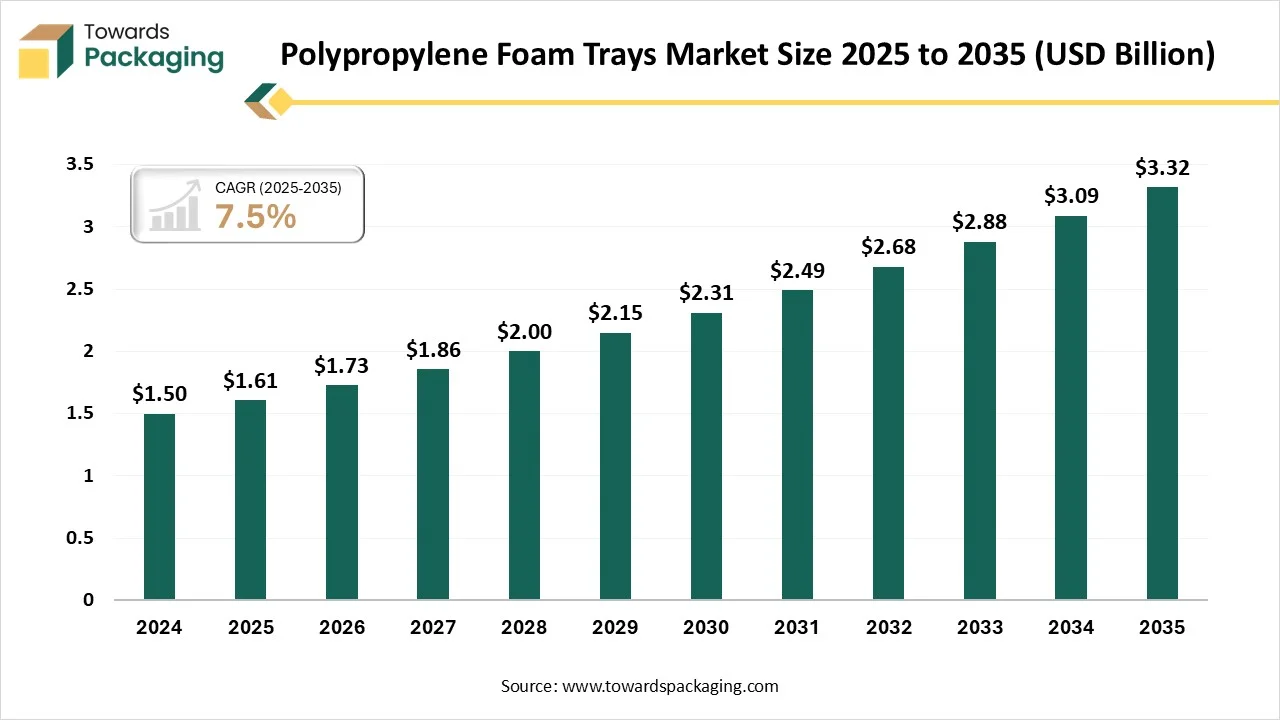

The polypropylene foam trays market is forecasted to expand from USD 1.73 billion in 2026 to USD 3.32 billion by 2035, growing at a CAGR of 7.5% from 2026 to 2035. The market is driven by increasing demand for sustainable packaging, growth in fresh food distribution, rising usage in retail and foodservice, and expanding adoption of recyclable and temperature-stable packaging solutions.

Major Key Insights of the Polypropylene Foam Trays Market

- In terms of revenue, the market is valued at USD 1.73 billion in 2026.

- The market is projected to reach USD 3.32 billion by 2035.

- Rapid growth at a CAGR of 7.5% will be observed in the period between 2026 and 2035.

- By region, Asia Pacific dominated the market with 46.8% share in 2025.

- By region, North America expects the rapid growth in the market during the forecast period.

- By product type, the expanded polypropylene foam trays segment has invested the biggest market share of 64.6% in 2025.

- By product type, the extruded polypropylene foam trays segment will be expanding at a significant CAGR of 5.6% between 2026 and 2035.

- By thickness, the 2-4mm thickness segment has contributed to the largest market share of 56.8% in 2025.

- By thickness, the above 4mm segment will be growing at a significant CAGR of 5.5% between the years 2026 and 2035.

- By application, the food packaging segment dominated the market with a 28.6% share in 2025.

- By application, retail & foodservice segment is expected to experience the fastest CAGR of 5.7% during the forecast period.

- By end-user, supermarkets and hypermarkets have invested in the biggest market share of 34.3% in 2025.

- By end-user, the food processors segment will be developing at a significant CAGR of 5.8% between the years 2026 and 2035.

- By tray type, the single-use trays segment has contributed to the biggest share of 43. 6% in 2025.

- By tray type, the multi-use trays segment will be rising at a significant CAGR of 5.8% between the years 2026 and 2035.

What is the Polypropylene Foam Trays Market?

The polypropylene foam trays market includes lightweight, durable, and heat-resistant trays made from expanded polypropylene (EPP) or extruded polypropylene foam. These trays are widely used in food packaging, ready meals, pharmaceuticals, electronics, and industrial applications due to their high impact strength, insulation, recyclability, and cost-effectiveness.

Polypropylene Foam Trays Market Trends

Technological Developments of the Polypropylene Foam Trays Market

An alternative moisture quantification procedure, which contains microwave moisture tracking, radio frequency sensing, and capacitance measurements, has been discovered for inline tracking. Microwave moisture analysis uses dielectric heating to measure moisture levels, while the radio frequency sensing counts capacitance or impedance updates due to moisture. Capacitance measurement procedure that tracks dielectric property fluctuations with moisture are perfectly suited for mixing in a manufacturing line for real-time readings.

These procedure changes are due to sensitivity, precision, and suitability for various plastics and conditions, and have yet to be completely accepted for the plastic waste that features the demand for a strong and non-destructive moisture quantification procedure for recycling uses.

Trade Analysis of Polypropylene Foam Trays Market: Import & Export Statistics

- Worldwide, the leading three importers of polypropylene foam trays are India, China, and Colombia. China has topped the globe in terms of this sector with 61 shipments, followed by India with 9 shipments, and Colombia has taken the third position with 8 shipments.

- The globe has imported its Polypropylene Foam Trays from China, Finland, and Vietnam.

- As per the global data, world imported 40 shipments of polypropylene foam trays from April 2024 to March 2025. These imports were being supplied by 9 exporters to 5 overall buyers, which marks a development rate of 3900% as compared to the leading twelve months.

Polypropylene Foam Trays Market - Value Chain Analysis

Raw Material Sourcing: The primary step in manufacturing EPP includes choosing good-quality polypropylene (PP) particles as the foundation material, with the consistency and purity of these particles, which directly affect the mechanical and physical properties of the outcome EPP item. In addition to PP resin, auxiliary materials such as catalysts, foaming agents, and stabilizers are used. Such additives ensure structural stability, effective foaming, and developed product performance with precise proportioning, while making it complicated to achieve consistent outcomes.

- Key Players: Tekni-Plex, Inc., Sealed Air Corporation, and Sonoco Products Company, too.

Component Manufacturing: Polypropylene Foam consists of polymers that come from propylene monomers, which makes a thermoplastic design that is resilient and tough but also lightweight. Its closed-cell designs develop its opposition to moisture and water, and the foam is also resistant to several solvents, chemicals, and greases too.

- Key Players: Reynolds Group Holdings Ltd, Novipax LLC, and Pactiv Evergreen Inc.

Logistics and Distribution: Aeronautical and airport procedures have limitless tools, parts, and users per day. PP sheet parts, bins, and crates are a very lightweight and reusable storage solution. It stands to a weight which is less than a metal or wooden storage option, which means less fuel usage in the vehicles that shift them. PP storage solutions also give perfect reasons in humid and changing temperatures around cargo or hangar areas.

- Key Players: Knauf Industries, Huhtamaki Oyj, and Groupe Guilin SA.

Product Type Insights

Why the Expanded Polypropylene Foam (EPP) Trays Segment Dominated the Polypropylene Foam Trays Market In 2025?

The expanded polypropylene foam trays segment dominated the market in 2025 with 64.6% share because it is a versatile and lightweight material, which is well known for its exceptional insulating and cushioning characteristics. EPP Foam is prevalent in different sectors like automotive manufacturing, packaging, and consumer goods production. It is being used for its potential to absorb effects and to protect sensitive items during handling and transport. EPP foam is also resilient, reliable, and resistant to moisture and chemicals, which makes it appropriate for a wide range of applications.

The extruded polypropylene foam trays segment is expected to experience the fastest CAGR of 5.6% during the forecast period. This foam is a kind of closed-cell foam created from polypropylene, a thermoplastic polymer. Like regular foams, which are made with the assistance of blowing agents, Xpp foam is manufactured via an extrusion procedure. This includes melting polypropylene pellets and pressing the molten material with the help of a die that creates a constant sheet or profile, which is cooled and cut into desired shapes.

Thickness Insights

Why the 2-4 mm Segment Dominated the Polypropylene Foam Trays Market in 2025?

The 2-4 mm segment dominated the market in 2025 with 56.8% share as polypropylene foam in this thickness, which is available in different forms, initially as Expanded Polypropylene (EPP), and is utilised for shock absorption, floor protection, and packaging. It is expanded polyethylene for floor protection. Expanded Polyethylene is a prevalent alternative that is more widely available in this thickness series for the same uses.

The above 4mm segment is expected to experience the fastest CAGR of 5.5% during the forecast period. This thick polypropylene foam is a permanent, lightweight, and closed-cell material that is known for its perfect chemical resistance, thermal stability, and shock absorption characteristics. It is greatly used across different sectors in the creation of rolls, sheets, and tailored products. It is utilised for interior elements such as door panels, headliners, and dashboards because of its sound insulation and heat resistance. It is greatly used in expansion joints, industrial fixtures, and other uses, which require a chemical-resistant, durable material.

Application Insights

Why the Food Packaging Segment Dominated the Polypropylene Foam Trays Market In 2025?

The food packaging segment dominated the market in 2025 with a 28.6% share, as the PP plastic food tray is one of the most famous plastic packaging currently, as it is utilised to pack vegetables, meat, fruits, dry food, fresh food, and processed food. It is created by high-quality polypropylene plastic, which is chemical-resistant, food-grade, heat-resistant, and non-toxic to health. It is a perfect food tray that is a perfect choice for the food sector, available in transparent and black colors. Black plastic food trays have features that match the color of food, which delivers a modern and elegant image.

The retail & foodservice segment is expected to experience the fastest CAGR of 5.7% during the forecast period. In foodservice, polypropylene is utilised to make different products such as cups, food containers, cutlery, and food storage bins. Its heat opposition makes it perfect for dishwasher usage and microwave, which makes it a famous choice for reusable food storage containers and takeout containers too. On the other hand, PP foam is very lightweight yet rigid and impact-resistant, which assists in protecting during handling and transporting in fast-paced retail surroundings. They are also shatter-resistant even in cold environments, which makes them ideal for frozen foods.

End-Use Insights

Why Supermarkets and Hypermarkets' Packaging Segment Dominated the Polypropylene Foam Trays Market In 2025?

The supermarkets and hypermarket segment dominated the market in 2025 with 34.3% share as they initially use polypropylene foam trays to showcase, package, and transport fresh food products such as poultry, meat, fruits, vegetables, and seafood too. These trays serve a necessary functionality to track product quality and hygiene with the help of the supply chain. PP foam trays make a hygiene barricade that protects the food from external pollutants and lowers the risk of bacterial spread. They prevent items from leaking, which is important for tracking the cleanliness of the display unit and freezer, too.

The food processors segment is expected to experience the fastest CAGR of 5.8% during the forecast period. Polypropylene (PP) foam trays are utilised by food processors as lightweight, durable, and hygienic packaging solutions for different ready-to-eat items and are sensitive to. They are a famous alternative option to regular foam polystyrene trays and are compatible with current processing equipment. The trays serve a sanitary and safe procedure for the packaging of frozen and fresh protein products that protects them from physical damage and contamination.

Tray Type Insights

Why the Single-Use Trays Segment Dominated the Polypropylene Foam Trays Market In 2025?

The single-use trays segment has dominated the market with a 43.6% share in 2025, as they are frequently used for food packaging that is available from different industrial suppliers and online retailers. Such trays are being valued for being durable, lightweight, and perfect for both cold and hot food uses. But the actual and standard foam trays are frequently made from polystyrene (EPS) and not polypropylene, which is typically used for PP material.

The multi-use trays segment is expected to experience the fastest CAGR of 5.8% during the forecast period. Multi-use polypropylene foam trays are a lightweight, versatile, and durable solution that are applied in various industries that include industrial parts, food packaging, and scientific and laboratory uses. They serve advantages like moisture proofing, chemical opposition, and reusability, which make them ideal for environmentally friendly alternatives to single-use options. They are conveniently available in many shapes and sizes, which leads to options with multiple compartments.

Regional Insights

How Asia Pacific is Dominating in the Polypropylene Foam Trays Market?

Asia Pacific held the largest share in the market in 2025 with a 46.8% share because the development of the food and beverage industry is being linked with the rise of e-commerce, take-away food services, and online grocery deliveries as a main driver. PP Foam trays are perfect for these uses because of their heat resistance and durability, which makes them perfect for these uses due to their durability and moisture barrier characteristics. Fast urbanization, industrialization, and growing disposable incomes across countries like India, China, and Southeast Asian nations are driving user investment in convenience and packaged foods.

Why is the Polypropylene Foam Trays Market Dominating in India?

The demand for polypropylene (PP) foam trays in India is witnessing fast development, initially driven by the growth of the food packaging and automotive sectors, as well as the rising importance of sustainable and recyclable solutions. The packaging industry is a major user of polypropylene, accounting for approximately 40% of the total PP demand in India. Additionally, the automotive sector is a main driver of demand for PP foam, which is utilised in seat cores, battery trays, interior trims, and bumper systems for its lower weight and perfect energy absorption characteristics.

Why is the Polypropylene Foam Trays Market Growing Rapidly in North America?

The urge for polypropylene foam trays in North America is strong and rising because of their application in automotive parts and the industrial uses, which is driven by demand for durable, lightweight, and cost-effective solutions. The encouragement for fuel smoothness and electric vehicles has developed for the application of polypropylene foam in door panels and seating to lower the vehicle weight without compromising safety. Also, organizations are concentrating on product invention, like developing foam trays with developed characteristics like stackable designs, anti-microbial coatings, and microwave safety too.

How is the Polypropylene Foam Trays Market Expanding in the United States?

The United States government and industry players are transforming the application of recyclable and biodegradable materials to match global sustainability goals. Additionally, rising e-commerce entry and the demand for protected and damage-proof packaging solutions are pushing the acceptance of high-performance PP foam trays. The Current growth of inventive production procedures that push the strength-to-weight ratio and promote customization has also urged the market development.

Which Factor is Responsible for the Growth of Polypropylene Foam Trays in Europe?

The main factors influencing the growth of the polypropylene foam trays market are demand for eco-friendly imperatives, regulatory compulsion, and industry development. European Commission policies push sustainable packaging and the circular economy usage, which are developing the findings in recyclable PP foam technologies. Food safety frameworks made mandatory by the European Food Safety Authority (EFSA) are also pushing packaging upgrades across the meat, fresh produce, and dairy industries.

Why is Germany using Polypropylene Foam Trays Market Significantly?

Germany is utilizing this foam mainly due to its strict environmental regulations, which push the application of biodegradable and recyclable materials. As legislative bodies shift to ban single-use polystyrene foam. PP foam trays are a compliant and viable alternative option that aligns with a circular economy strategy. Additionally, the biggest driver is the developing retail sector and food processing, with rising demand for ready-to-eat, convenient, and fresh produce packaging.

- In September 2025, Prevented Ocean Plastic in collaboration with Spectra Packaging, Innovia Films, Bantam Materials UK Ltd, and PETMAN, revealed the “first-ever” food-safe polypropylene that is recycled to the European standard.

The polypropylene foam trays market in the Middle East & Africa (MEA) region has a material that has perfect thermal insulation elements that are important for tracking food freshness at the time of storage and transport, as well as for energy-efficient building insulation. In Africa, foam packaging helps solve food preservation issues in which cold chain infrastructure can be limited. Also, the packaging sector is the biggest end-user of polypropylene in the MEA region. Fast urbanization, growing disposable incomes, and the stretching of e-commerce and retail are filling the demand for hygienic and safe food packaging, for which polypropylene foam trays are perfect.

UAE Polypropylene Foam Trays Market Trend:

Technological developments in foam production develop product versatility and quality, which further fulfill market growth. Government initiatives market sustainable construction practices and the growth of smart cities, which also contribute at a crucial level. Furthermore, the stretching logistics industry is in urgent need of protective packaging solutions, for which EPP foam serves. Overall, an integration of technological invention, infrastructural growth, and sustainability trends is a main factor that encourages market development.

In South America, the polypropylene foam trays market is growing steadily as rising environmental awareness and rigid regulations on single-use plastics address issues. At the same time, it drives a trend towards the growth of recyclable, sustainable, and potentially bio-based polypropylene foam solutions with companies like Braskem in Brazil that discover bio-based selections from sugarcane ethanol. Also, polypropylene’s foam is reliable and cost-effective, which makes it a preferred choice over regular materials in price-sensitive South American markets.

Brazil Polypropylene Foam Trays Market Trend

Surfacing trends feature the mixing of Industry 4.0 Technologies like AI-powered quality control and IoT -allowed supply chain tracking that changes the manufacturing traceability and efficiency both. User selection is moving towards convenience, and smart-focused packaging with a big shelf life and freshness preservation is highlighted. Such trends are making possibilities for companies that invest in eco-conscious and innovative polypropylene foam solutions to capture share and encourage competitive positioning.

Recent Developments

- In July 2024, the current ProActive Recyclable Fresh Tray named as FT-1000 taurus launched by ProAmpac serves food retail and grocery an strong and sustainable packaging solution which meets smoothly with their working demands as said by Pascal Labrie, who is general manager.

- In August 2024, Pactiv Evergreen Inc, who is focused to making incentive and high-quality packaging with less environmental effect with Lake Forest and Illinois has launched Recycleware reduced-density polypropylene meat trays.

Top Companies in the Polypropylene Foam Trays Market

- JSP Corporation: JSP’s main technologies surround different foam plastics, but its well-known and encouraging product is EPP (expanded polypropylene).

- Knauf Industries: Knauf Industries’ main business is using foaming technology to generate high-performance and lightweight plastic solutions. Its product line concentrates on two main materials, such as expanded polystyrene and insulation.

- Epsole: Alike to the worldwide big JSP, Epsole's main material is EPP. It has heat resistance, high electrical resistance, and recyclability, which makes it a perfect material for various sectors.

- Sonoco Products Company (USA): Sonoco’s business is big and is initially being driven by two divisions, such as industrial packaging and user packaging, which are experts in packaging for end-user items, like health supplements, food, beverages, and personal care products.

- Hanwha Corporation: Hanwha’s foam material business directly has competition with Knauf Industries and JSP, which were mainly mentioned at a previous time, and its product lines are highly similar to Expanded Polypropylene.

- Kaneka Corporation: Kaneka Polymeric Foam; it is an internally used PPE( polypropylene ether) foam, which is a high-performance engineering foam with perfect flame retardancy, heat resistance, high stiffness, and less smoke toxicity too.

- AR Packaging: AR Packaging is a top company in the packaging industry that serves a complete series of solutions, including trays, and can be related to any interest in plastic trays.

- Roltex: Roltex is an official supplier of reliable food service products that include plastic trays. Their commitment to sustainability and quality is proven in their European production and current efforts to align with surrounding goals.

- Multi Tray B.V.: Multi Tray is a producer with over 30 years of experience in thermoforming, which is perfect for the manufacturing of different packaging solutions, leading to food products like fruits and cakes, as the company gives importance to tailoring product development and sustainable practices.

- ORBIS Corporation: The organization, ORBIS, serves reusable plastic trays, including the NPL 650 Plastic Bakery Tray, which is crafted to develop the smoothness in the supply chain by pilling nesting and securely when it is empty. Such trays are completely recyclable and available in FDA-approved materials that meet sustainability goals.

Polypropylene Foam Trays Market Segments Covered

By Product Type

- Expanded Polypropylene (EPP) Foam Trays

- Extruded Polypropylene Foam Trays

By Thickness

- Up to 2 mm

- 2–4 mm

- Above 4 mm

By Application

- Food Packaging

- Pharmaceuticals

- Electronics

- Industrial Packaging

- Consumer Goods

- Retail & Foodservice

By End Use

- Supermarkets & Hypermarkets

- Food Processors

- Restaurants & Cafés

- Hospitals & Pharmacies

- Electronics Manufacturers

- Industrial Users

By Tray Type

- Compartment Trays

- Single-Use Trays

- Multi-Use Trays

- Custom-Shaped Trays

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA