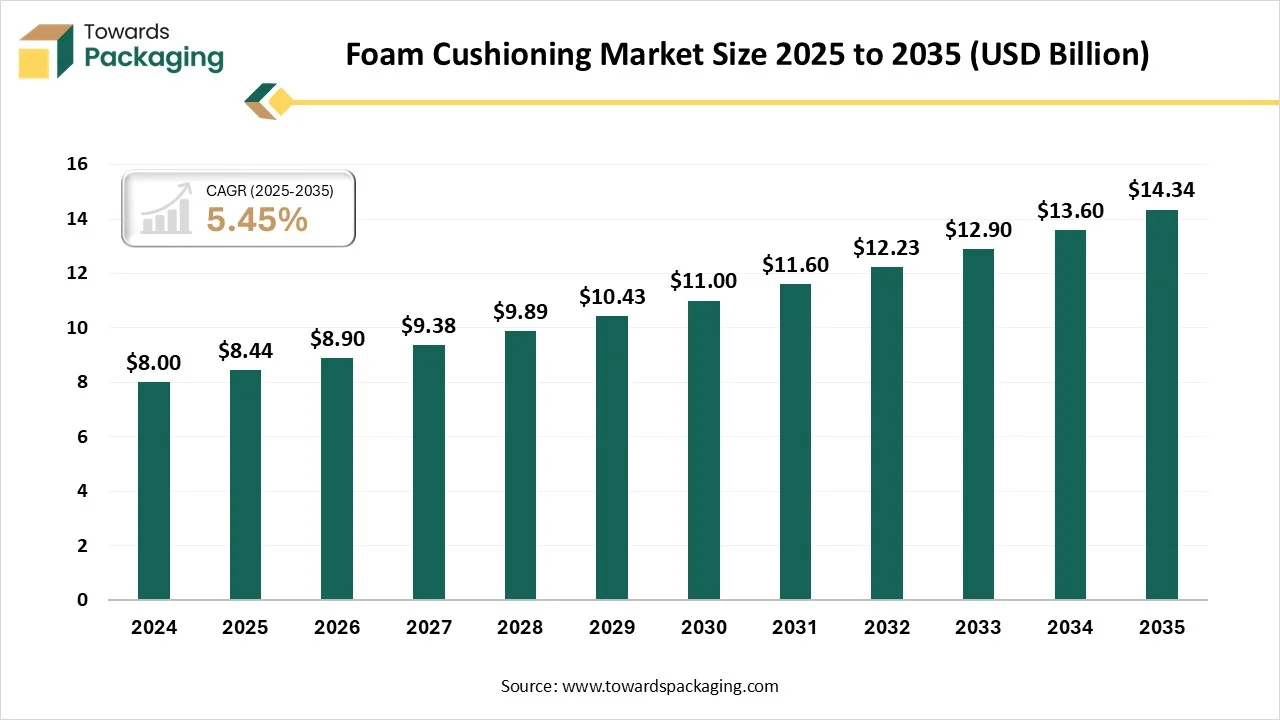

The foam cushioning market is forecasted to expand from USD 8.9 billion in 2026 to USD 14.34 billion by 2035, growing at a CAGR of 5.45% from 2026 to 2035. The foam cushioning industry is witnessing a major development due to develop urges for protective packaging solutions across different sectors like electronics, cosmetics, and food & beverage.

The foam cushioning market is a segment of the huge polymer foam sector that is focused on manufacturing and serving foam materials that are crafted for assistance, comfort, and shock absorption across different end-use fields. It is a main and developing market, which is being driven by the uses in furniture and bedding, packaging, automotive interiors, and medical devices too.

As the worldwide attention moves towards sustainability, foam producers will concentrate on growing environmentally friendly alternatives to regular PU foams. The eco-foam items are generally created with renewable or recycled raw materials, which lowers the environmental impact. Such inventive solutions assist the address by developing the user's urge for green items without compromising the performance and quality of the flexible foams.

Producers of foam are coordinating closely with the producers to serve the bio-based options, making sure that organizations in the automotive, furniture, and packaging industries can serve with sustainable products to their users.

As per the global import data, the globe has officially imported 13,811 shipments of the Foam Cushions during the period June 2024 to May 2025. Such importers were being supplied by the 1,256 exporters to the 1,699 overall buyers, which has marked a development rate of 24% as compared to the previous twelve months.

One main factor is to check the sensitivity of the case ingredients. This can be defined with respect to an object of measurement of the growth because of gravity, and it shows the point at which damage can occur. Stronger products can survive at higher g levels before they are damaged, as more sensitive items can be damaged at lower levels.

Reusing flawed or unneeded foam products is another convenient and green path to disposing of any waste foam in business items. Also, donating the old mattresses to charity is one way to solve this issue without disturbing the environment.

Logistics and Distribution: The logistics of the foam cushioning sector concentrates on smooth manufacturing, delivery, and storage that develops from foam’s main properties like light weight, shock absorption, and customization in order to reduce damage and lower shipping costs to develop sustainability through reusability and correct-sizing too.

The polyethylene foam segment dominated the market in 2025 as they are closed-cell foam, which means its design is created of millions of small bubbles, packed closely together. This serves as an opposition to water, furthermore, to a powerful and strong nature that does not display open-cell foams. It is accessible to petroleum items, solvents, and is antimicrobial as well, which includes the development of mildew, mold, and bacteria.

The EPP (Expandable Polypropylene) foam segment is expected to experience the fastest CAGR during the forecast period. It is highly reliable, closed-cell bead foam, which is known for its exceptional energy absorption, great power-to-weight ratio, and resistance to. These are crafted material that fills the gap between strong plastics and flexible foams, serving a different integration of characteristics, which makes it perfect for a huge series of challenging uses.

The foam sheets and rolls segment has dominated the foam cushioning market in 2025 as closed-cell foam, serving perfect shock absorption, water-resistant, which is reliable, and lightweight, making it perfect for packaging of the sensitive products, insulation, and floor mats too. Polyurethane foam is also an open-cell foam which is generally utilised for cushioning and convenient uses, such as mattresses, upholstery, and DIY projects.

The foam wraps segment is expected to experience the fastest CAGR during the forecast period. Foam wraps that come from polyethylene are a softer material for the cushioned foam as compared to the bubble wrap. It serves soft protection, which makes it the perfect candidate for the scratch-fragile layers, such as polished screens, metals, and some electronics. In contrast to the bubble wrap, foam wrap creates an even surface of protection, and hence, air pockets are not created. The advantage of foam wrapping material is the non-abrasive padding that protects the layer from scratches on sensitive items, which constantly maintains the quality of the product.

The protective packaging segment dominated the market in 2025 as the packaging behaves as a primary line of barrier against vibrations, effects, dust, moisture, and other elements that can damage the products. A perfectly-crafted protective packaging system that lessens risks, lowers the costs from defective or return items, and also develops the user’s point of view and the professionalism of the brand. Specifically, industries such as the medical industry, electronics, aerospace, among others, need high-level solutions for the sensitive transport, in which even the smallest amount of pollutants can cause significant losses.

The electronics & appliances protection segment is predicted to witness the fastest CAGR during the forecast period. Custom foam inserts are well-crafted to fit the dimensions and contours of particular electronic devices, which ensures a snug, secure fit within their packaging. This accuracy fit assists in preventing the machines from vibration, effect, and shipping-like damage, too, which develops the product's longevity during storage and transport. Foams such as polyethylene and polyurethane can be utilised in making multiplayer packaging solutions that provide developed protection for electronics.

The e-commerce and retail packaging segment dominated the market in 2025, as custom foam inserts are accurately cut foam elements that are crafted to hold, cushion, and protect the items during shipping and storage. Alike generic packaging materials like paper fillers or bubble wrap, the foam inserts are personalized to fit the perfect shape and size of every product. They are the leading reasons why e-commerce brands select foam inserts for protection. From the sensitive electronics to luxury cosmetics, custom inserts lower the risk of breakage and scratches that occur during transit.

The industrial & machinery segment is predicted to witness the fastest CAGR during the forecast period. In this sector, shock-absorbing foam completely absorbs vibration and dissipates energy in order to stay stable and cushion equipment. In contrast to regular cushioning materials, it redistributes stress in order to lower damage instead of just softening a hit. Polyurethane foam is applied in the majority of industrial uses because it hits hard and balances between durability and adaptability. Under effect, shock-absorbing polyurethane foam is being crafted in order to shorten and then rebound without indefinitely deforming. This flexibility allows it to perform constantly under repeated stress.

Asia Pacific dominated the foam cushioning market in 2025 as the packaging organizations are heavily concentrating on serving personalized cushioning solutions that match the particular needs and demands of the various markets. For instance, in countries such as South Korea and Japan, there is a greater demand for high-level cushioning materials because of the high level of items that are being shipped, such as luxury and electronics goods. On the other hand, countries such as India and China are driving the urge for more smooth cushioning solutions for big-market products, which include food and beverages, clothing, and consumer electronics too.

How is the Foam Cushioning Market Growing in India?

An azodicarbonamide blowing agent is a chemical element that has a higher temperature in order to release gases such as carbon monoxide, nitrogen, and carbon dioxide. Such gases create a cellular design in polymers that results in insulated, lightweight, and cushioned materials. The developing production sector is one of the key factors for the rising demand for azodicarbonamide. The construction industry is quickly accepting foam-based insulation and the panels for the perfect energy smoothness in every commercial and residential building. Furthermore, there are different sectors that are using foaming agents in order to reduce the weight of the products, which develops the complete smoothness and aligns with environmental regulations.

North America expects the fastest growth in the foam cushioning market in 2025, as furniture and bedding are the top uses for cushioning foams, which account for the greatest share, driven by the user choice for high-quality and ergonomic home furnishings and the growth of the housing and hospitality sectors. The demand in online retail has mainly developed the urge for protective cushioning foams like expanded polystyrene (EPS) and polyethylene in order to protect goods during transit.

Why is Canada using the Foam Cushioning Market Importantly?

There is a high demand for strong foams and high-performance construction insulation that continues due to Canada’s cold climate and the federal green building initiatives. Also, there is a foam wheelchair cushion industry in healthcare and mobility, which is growing constantly, filled by an aging population and government healthcare initiatives that concentrate on pressure ulcer protection.

The foam cushioning market in the European region is growing as the move towards more energy-efficient and sustainable buildings is updating the European market for foam insulation materials. With green building compulsion under the initiatives such as the EU Green Deal, the Energy Performance of Buildings Directive (EPBD), and national climate targets, the urge is growing for high-performance insulation that aligns with both sustainability and thermal performance.

Germany Foam Cushioning Market Trend

As a main overall automotive centre, Germany’s urge is highly encouraged by the transformation to lightweight materials and electric vehicles (EVs). Foam is complicated for the backrests, seat cushions, and noise/vibration reduction. The travelling segment in Germany is valued at approximately USD 800 million in the year 2025. Sustainable materials are a sharp development, and there is growth for bio-based polyols and less-VOC (volatile organic compound ) foams because of strict EU environmental regulations and the German user choice for “green” materials.

The foam cushioning market in the Middle East &Africa (MEA) region is growing quickly as flexible foam is the most dominant material for the sofas and mattresses, the foam was the biggest income-creating segment for the Middle East and Africa industry as the urge is developing for the lightweight foam materials in order to develop the fuel smoothness and the passenger comfort in the headrests, vehicle seating and armrests. There are big projects in Saudi Arabia and the UAE that are meeting the demand for office furniture and residential furniture, which indirectly develops foam cushioning demand.

UAE Foam Cushioning Market Trend

PU Foam machines point to the machine that is used in the production and processing of Polyurethane Foam (PU Foam). It plays an important role in the UAE, particularly in the manufacturing and construction sectors, because of the importance of Polyurethane (PU) foam in different uses. In the UAE’s construction industry, in which temperature regulation is important, PU foam is used for thermal insulation in buildings. PU foam machines invest in the manufacturing of insulation materials that improve energy efficiency and sustainability in construction.

In South America, the foam cushioning market is growing steadily as automotive and transportation are among the fastest-developing uses, driven by the demand for durable and lightweight components for armrests, seating, and headrests, too, to improve fuel efficiency and passenger comfort. There is also a development for e-commerce and packaging, as the growth of e-commerce has developed the demand for lightweight and protective foam cushioning for the sensitive consumer and electronics goods in this region.

Brazil Foam Cushioning Market Trend

The Brazilian industry counts worldwide companies, such as the regional brands and the latest innovators. Several of the main players are developing their product lines and updating their distribution networks in order to reach the users. They fund research, create collaborations, and gain support from other companies to stay proactive. Many of them are also using automation, sustainability practices, and digital tools to align with updated user demands.

By Foam Material

By Product Type

By Application

By End-Use Industry

By Region

February 2026

February 2026

February 2026

January 2026