Collapsible Rigid Containers Market: Global Industry Segments, Regional Outlook, Growth Dynamics & Competitive Benchmarking

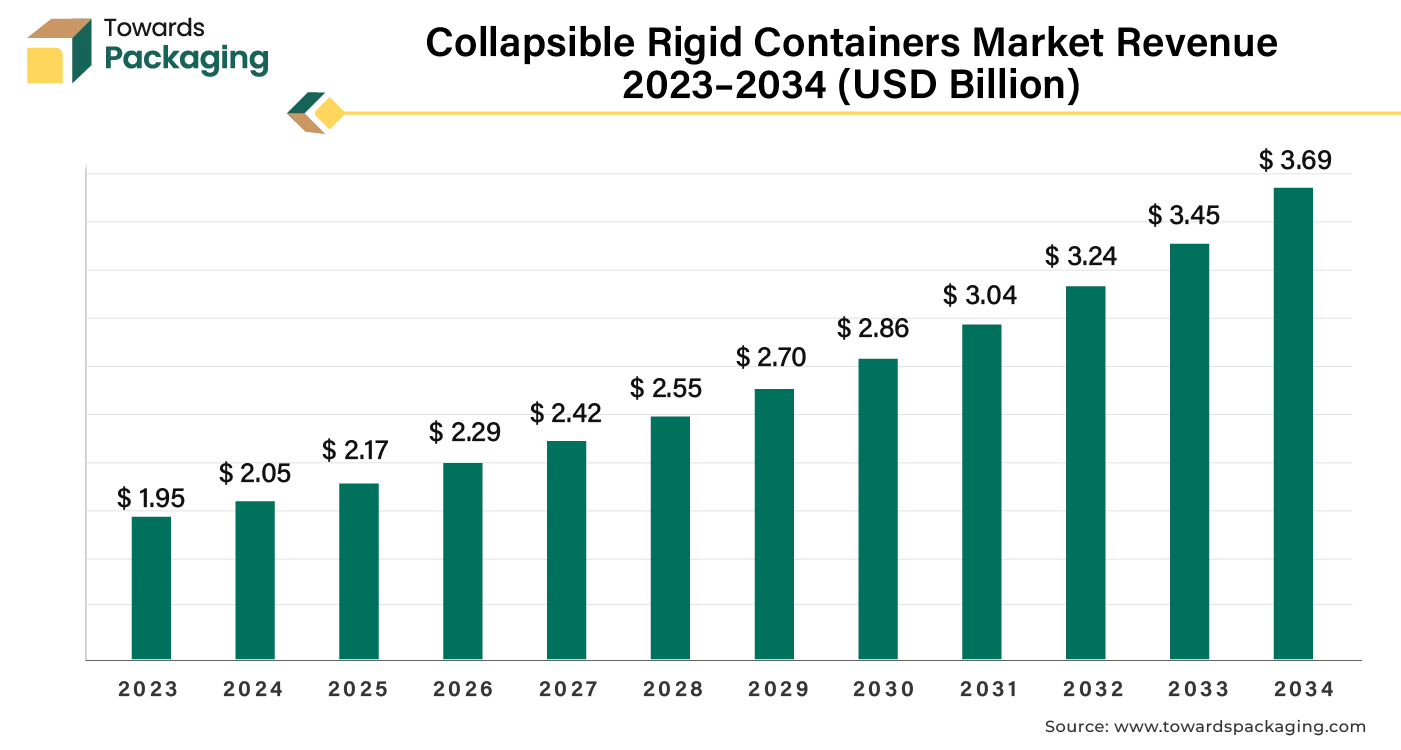

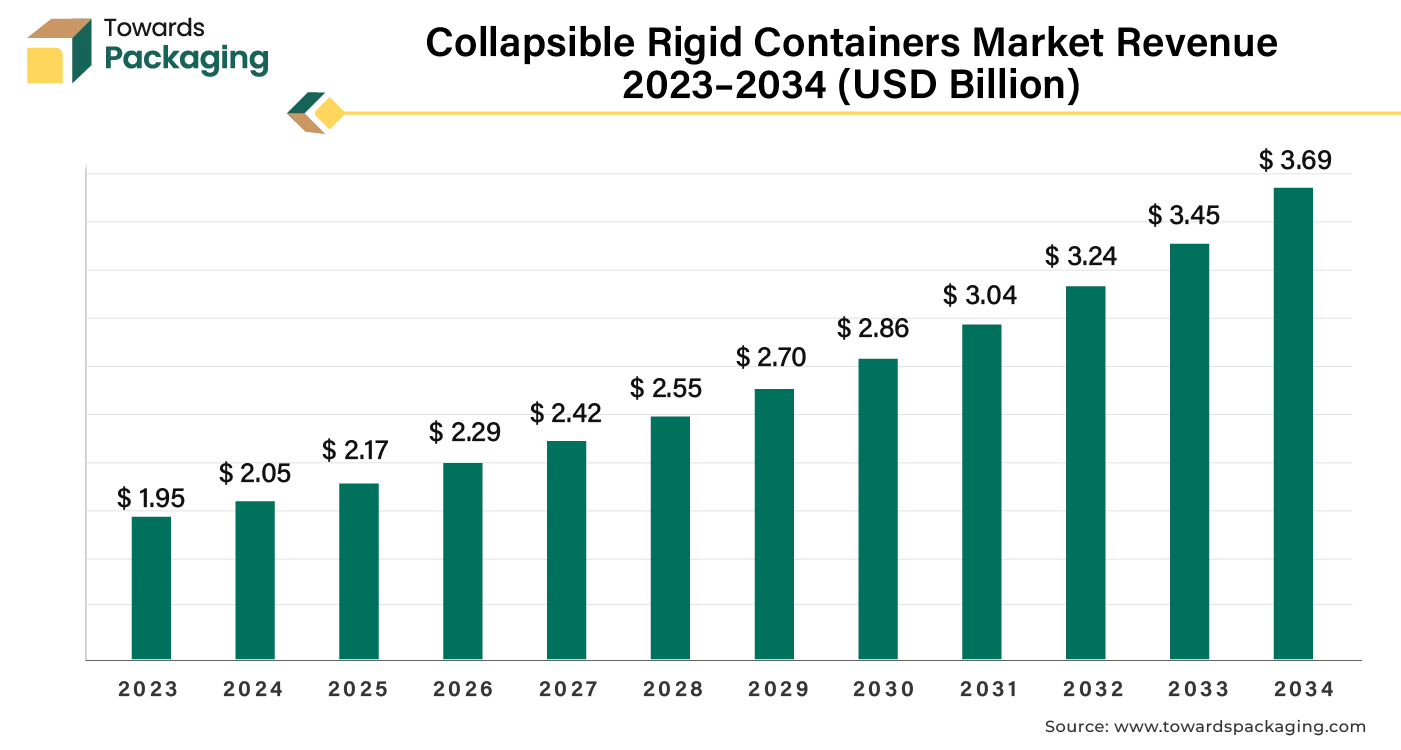

The collapsible rigid containers market is forecasted to expand from USD 2.28 billion in 2026 to USD 3.66 billion by 2035, growing at a CAGR of 5.4% from 2026 to 2035. This report covers in-depth market size, segmentation (by material, product type, sales channel, and end use), and regional analysis across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It includes insights into key players such as DS Smith plc, Berry Global, Schoeller Allibert, Brambles, and ORBIS Corporation, along with trade data, value chain analysis, and manufacturers & supplier mapping. The study examines the impact of AI, robotics, and sustainability on market competitiveness and supply chain dynamics.

Rising regulations and industry standards around packaging safety and quality encourage the adoption of robust, complaint packaging solutions which is estimated to drive the global collapsible rigid containers market over the forecast period.

Major Key Insights of the Collapsible Rigid Containers Market

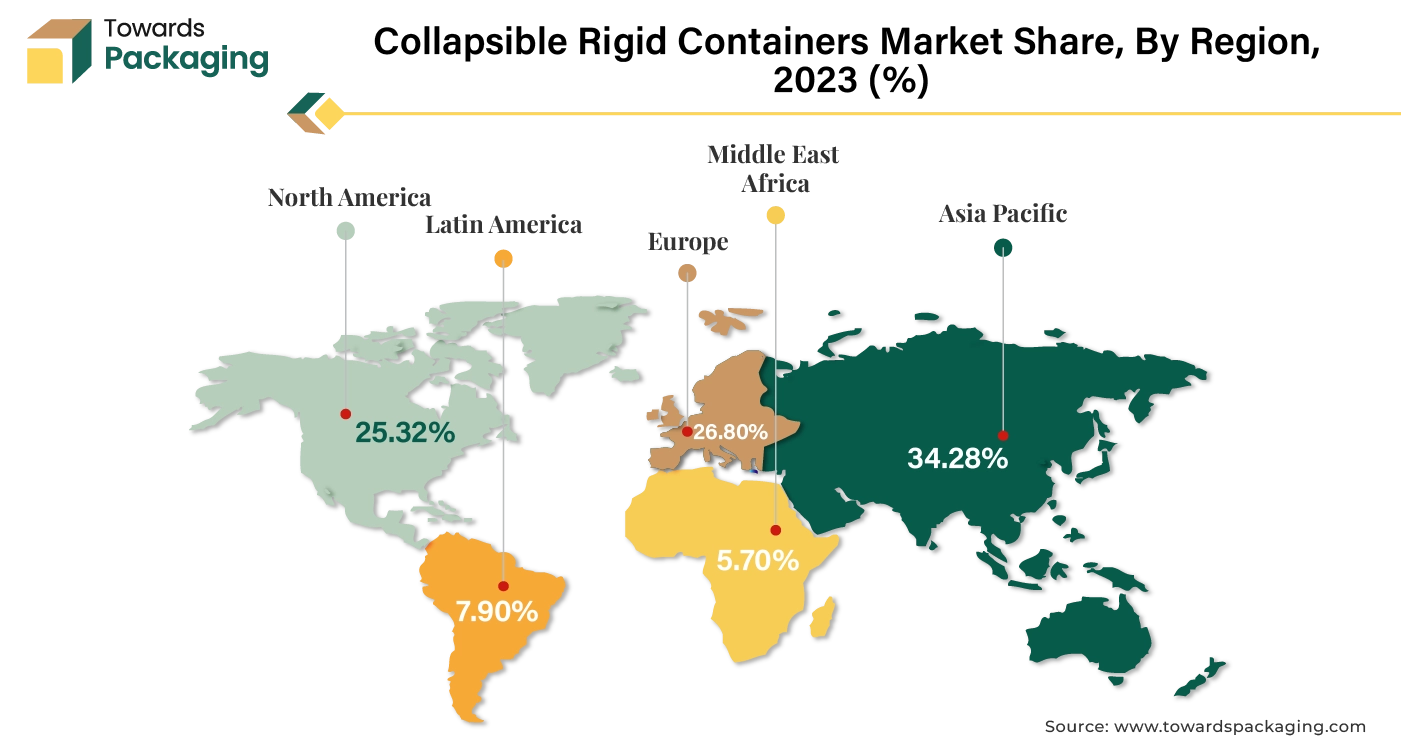

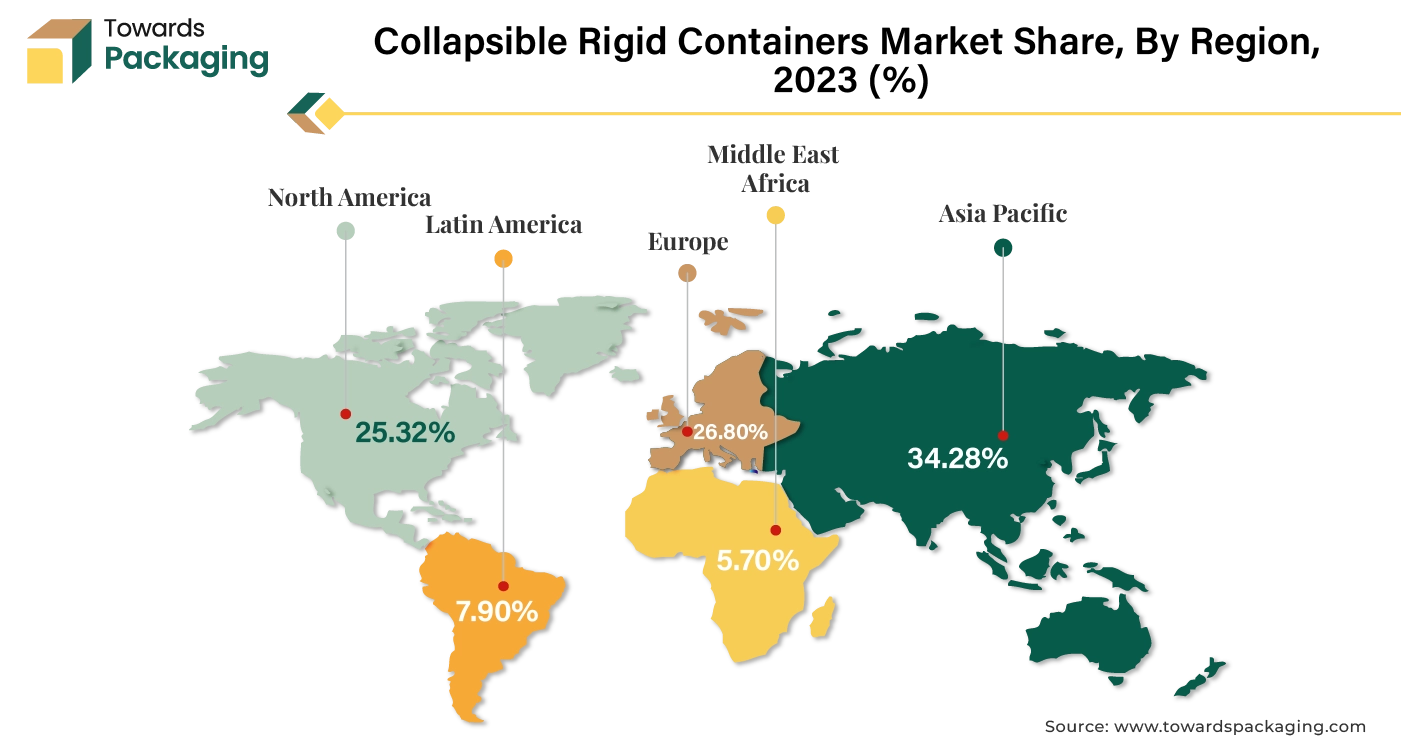

- Asia Pacific dominated the collapsible rigid containers market in 2024.

- Europe is expected to grow at a significant rate in the market during the forecast period.

- By material type, the plastic segment dominated the market with the largest share in 2024.

- By product type, crates segment is expected to grow at significant rate during the forecast period.

- By sales channel, the indirect segment dominated the collapsible rigid containers market in 2024.

- By end use, chemical segment is expected to grow at significant rate during the forecast period.

Collapsible Rigid Containers Market: Globalization and Trade

Packaging that combines the strength of rigid boxes with the flexibility of collapsible design is known as collapsible rigid boxing. Collapsible rigid containers are made of sturdy materials like cardboard or plastic, these boxes are able to hold their shape and offer strong protection for the contents inside. However, because they are made to be folded or collapsed when not in use, they take up less space in storage and during transportation. In summary, collapsible rigid boxes combine the strength and protection of rigid packaging with the practical benefits of lower storage and shipping costs because of their ability to collapse flat.

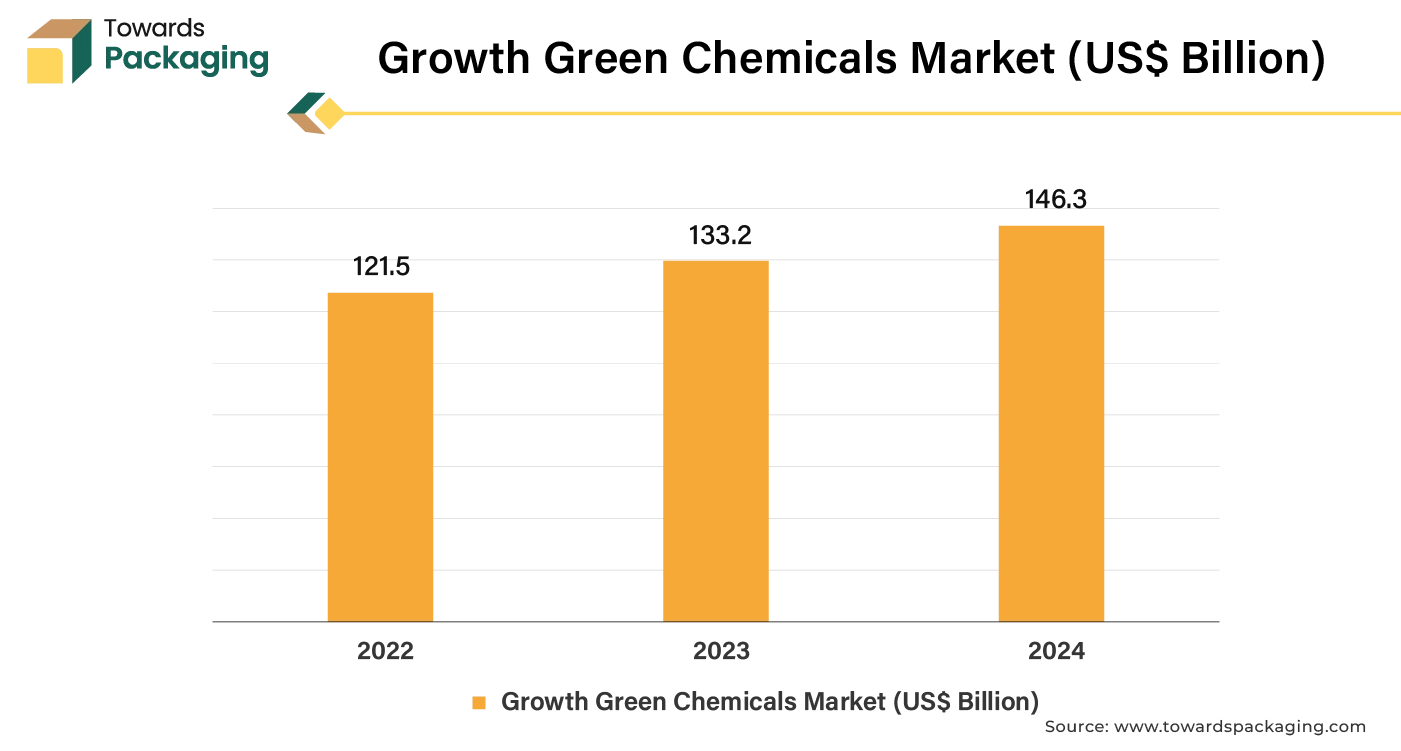

The collapsible rigid containers offer premium presentation as well as space-saving convenience. They readily unfold into robust boxes after folding flat for compact storage and transportation. They minimize environmental effect while providing a beautiful look and feel, making them ideal for high-end products, presents, and clothing. All things considered, collapsible rigid boxes provide a flexible, eco-friendly packaging option that blends style and utility. Their compact size, simplicity in assembly, and elegant presentation make them a well-liked option for companies trying to maximize their packaging while preserving a superior brand image. The global packaging industry size is growing at a 3.16% CAGR.

8 Key Factors Driving Collapsible Rigid Containers Market Growth

- The shift of the consumers towards sustainable and durable packaging solutions has risen use of biodegradable and recyclable materials in rigid boxes, driving environmentally conscious consumers.

- The key players operating in the market are focused on adopting inorganic growth strategies like acquisition to develop rigid box is expected to drive the growth of the collapsible rigid containers market over the forecast period.

- Increasing launch of the high-end and sensitive pharmaceutical products has risen the demand of the rigid box for packaging purpose which is estimated to fuel the growth of the collapsible rigid containers market over the forecast period.

- Emerging markets and trends for rigid box packaging is expected to drive the growth of the market over the forecast period.

- Increasing regulatory support to manufacture rigid box is estimated to drive the growth of the market over the forecast period.

- Increasing in adoption of the advanced technology for the production of rigid box is estimated to drive the growth of the global collapsible rigid containers market in the near future.

- The key players operating in the market are focused on geographic expansion and launching their brand in other countries which is expected to drive the growth of the global collapsible rigid containers market in the near future.

- Increasing focus on cost reduction and production efficiency can drive the specialty market growth further.

How Can AI Improve the Collapsible Rigid Containers Industry?

AI can evaluate an immense amount of data to support the creation of more robust and effective containers. The ideal compromise between strength, weight, and cost can be found by simulating various materials and designs using algorithms. AI-driven analytics, based on usage trends and wear-and-tear data, may forecast when containers are likely to fail or need maintenance. This prolongs the life of the containers and cuts down on downtime. By anticipating demand, maximizing inventory levels, and enhancing logistics, artificial intelligence (AI) can improve supply chain management. Better resource allocation and lower operating expenses may result from this.

In comparison to human inspections, AI-powered image recognition and sensors may automate the inspection process, guaranteeing that containers satisfy quality standards and rapidly and accurately identifying problems. AI can make container solutions more customized and flexible. By examining consumer demands and usage trends, artificial intelligence (AI) can facilitate more customized and adaptable container solutions, resulting in more specialized goods that satisfy certain specifications.

DS Smith's Trial on AI Integration in Packaging

- In March 2024, DS Smith plc, packaging company, revealed the introduction of the expanded languages and conversation AI functionality for training the employees working in the company to increase the efficiency and productivity of the rigid and corrugated packaging. The DS Smith company integrated AI and e-learning platform for training the employee and assisting company for enhancing the productivity of the packaging. DS Smith invested in learning platform. DS Smith company added new content, expanded the languages, and launched conversational Al functionality for over 70 subjects where people can practice their skills with an Al coach. The DS Smith plc company witnessed a further increase in the numbers of people using e-learnino. The DS Smith plc company also have a Digital Learning Academy, a Finance Academy, an Operations Learning Academy, and an Innovation Academy. All of these learning programs have delivered learning, expanding their coverage and finance management.

Driver

Rising innovation and Advancement in Materials

Companies have started using collapsible containers, which are recyclable and cut down on waste volume, as a result of a greater emphasis on recycling and waste reduction. Because they require less money for transit and storage, collapsible containers are frequently more economical. When empty, they can be compressed to maximize space and save on shipping costs. These containers' capacity to stack and collapse contributes to increased storage and transit efficiency. This is particularly useful in sectors where logistics requirements are dynamic and large volume. As sustainability becomes a top priority for consumers and companies alike, there is increasing demand for recyclable and eco-friendly collapsible rigid box options. The key players operating in the market are focused on developing eco-friendly collapsible rigid containers which is estimated to drive the growth of the collapsible rigid containers market over the forecast period.

Restraint

Market Fragmentation and Availability of Alternative Solutions

The high initial investment required for manufacturing units and varying standards and specifications across various region, is expected to restrict the growth of the collapsible rigid containers market over the forecast period. Certain companies, especially smaller ones, may be discouraged from implementing this technology due to the substantial initial outlay needed for high-quality collapsible rigid containers and the related infrastructure. Certain sectors or geographical areas might not have a complete understanding of the advantages of collapsible rigid containers, or they could be reluctant to abandon conventional packaging techniques. It can be difficult and technically demanding to design and manufacture collapsible containers that adhere to particular industry standards and durability criteria; this could result in increased prices and longer lead times.

Opportunity

Rising Adoption of Robotics and Automation and Diversifying Market

Rapid industrialization and increasing logistics needs in emerging markets offer significant opportunities for adopting collapsible rigid containers. Incorporating IoT (Internet of Things) and Radio-Frequency Identification (RFID) technologies into collapsible containers can provide real-time tracking and inventory management, improving efficiency and creating new value propositions. Advances in manufacturing technologies, such as 3D printing and automation, can minimize production costs and enhance the efficiency of collapsible container manufacturing. The key players operating in the market are focused on adoption and deployment of the advanced technology for the designing and manufacturing of the collapsible rigid containers, which is estimated to create lucrative opportunity for the growth of the collapsible rigid containers market over the forecast period.

For instance,

- In May 2024, HBD Packaging Pvt. Limited, packaging solutions providing company, revealed the investment in a fully automatic machine, twin line (DP4030M, manufacturing top and bottom boxes in line) collapsible rigid box-manufacturing machine from Guangdong Hongming Intelligent Joint Stock Co., Ltd., technology and equipment company. Partner in India for Guangdong Hongming Intelligent Joint Stock Co., Ltd., company, NBG Printographic Machinery, is providing the DP4030M manufacturing machine and assisting instalment of it in HBD Packaging Pvt. Limited.

Segment Insights

Plastic Led Collapsible Rigid Containers Market in 2024

The plastic segment held the dominating share of the collapsible rigid containers market in 2024. As plastic is resistant to corrosion and has immense mechanical strength it is extensively utilized for manufacturing collapsible rigid containers. Plastic is lightweight and poses ability to modify the structure because of which it is perfect material for making collapsible rigid containers. The plastic has high durability and are resistant to atmospheric conditions moisture and sunlight. Plastic containers fold up easily, which makes them a popular choice for industries with limited space, such as logistics and storage. Plastic is also less expensive than other material varieties, which makes it a sensible choice for both manufacturers and final users.

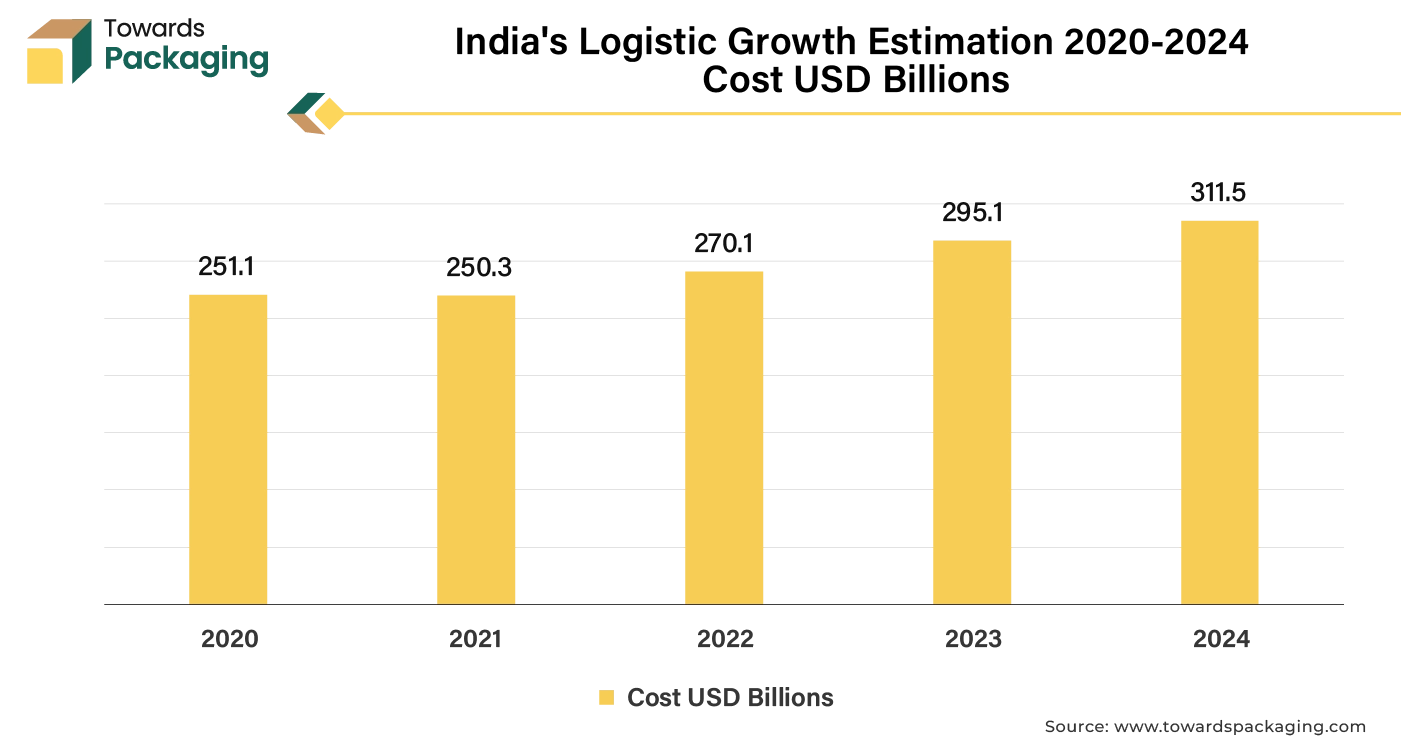

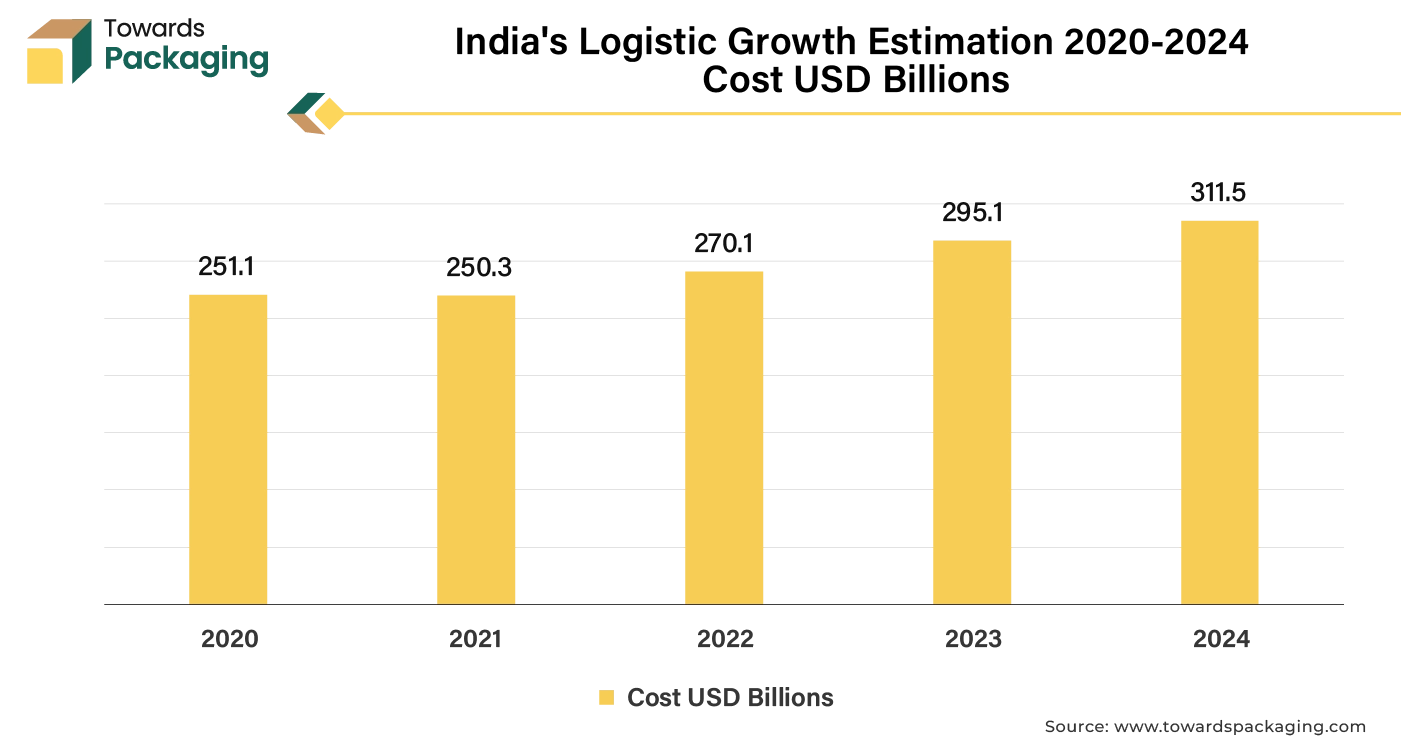

The pharmaceutical and food industry are highly responsible for the growth of the plastic collapsible rigid containers. Demand-side and supply-side trends broadly impact the collapsible rigid containers market. Logistics growth is rising the demand for the plastic collapsible rigid containers which is estimated to drive the growth of the segment over the forecast period. Moreover, increasing launch of the new warehouse has risen the demand for the collapsible rigid containers which is projected to fuel the growth of the segment over the forecast period.

- In July, 2024, A.P. Møller – Maersk A/S, shipping company, revealed the introduction of the new warehouse in Fredericia, Denmark, U.K. The Port of Fredericia is one of Denmark's main import and export ports and the major container port in Southern Denmark. Additionally, it is still undergoing significant construction to handle anticipated increases in freight volume and emerging environmental concerns. Due to the site's solid integration with Denmark's Triangle Area, cross-country connection can be achieved in 3–4 hours.

Crates Segment Held a Notable Share in the Market

The crates segment held the dominating share of the collapsible rigid containers market in 2024. Plastic crates are ideal for transporting perishable items since they are strong, lightweight, and stackable. They are employed in the transportation of an extensive variety of goods between different points in the supply chain, such as fruits, vegetables, dairy products, meat, and drinks. Because of their robust construction, which enables them to withstand heavy loads and rough handling, crates are a popular choice in a variety of industries, including retail, food and beverage, and agriculture. Because of their foldable design, which also makes storage and transportation simple, they are an inexpensive and room-saving option.

As a result, organizations searching for durable and efficient storage and transit solutions always turn to crates. Vegetables, fruits, processed foods, and other goods are frequently carried and stored in crates. Therefore, over the forecast period, it is anticipated that the expanding global demand for packaged foods and door-to-door delivery would continue to fuel the rise of the crates segment. The key players operating in the market are focused on launching new crates for meeting the consumer demand which is estimated to drive the growth of the segment over the forecast period.

- In April 2024, Jiangsu Xuan Sheng Plastic Technology Co., Ltd., company focused on providing plastic packaging solution, revealed the launch of its revolutionary line of foldable plastic crates. The company introduced the reusable crates that aligns with the growing global emphasis on eco-friendly practices. The newly launched range of the crates allows companies to enhance their sustainability packaging goals while maintaining operational efficiency.

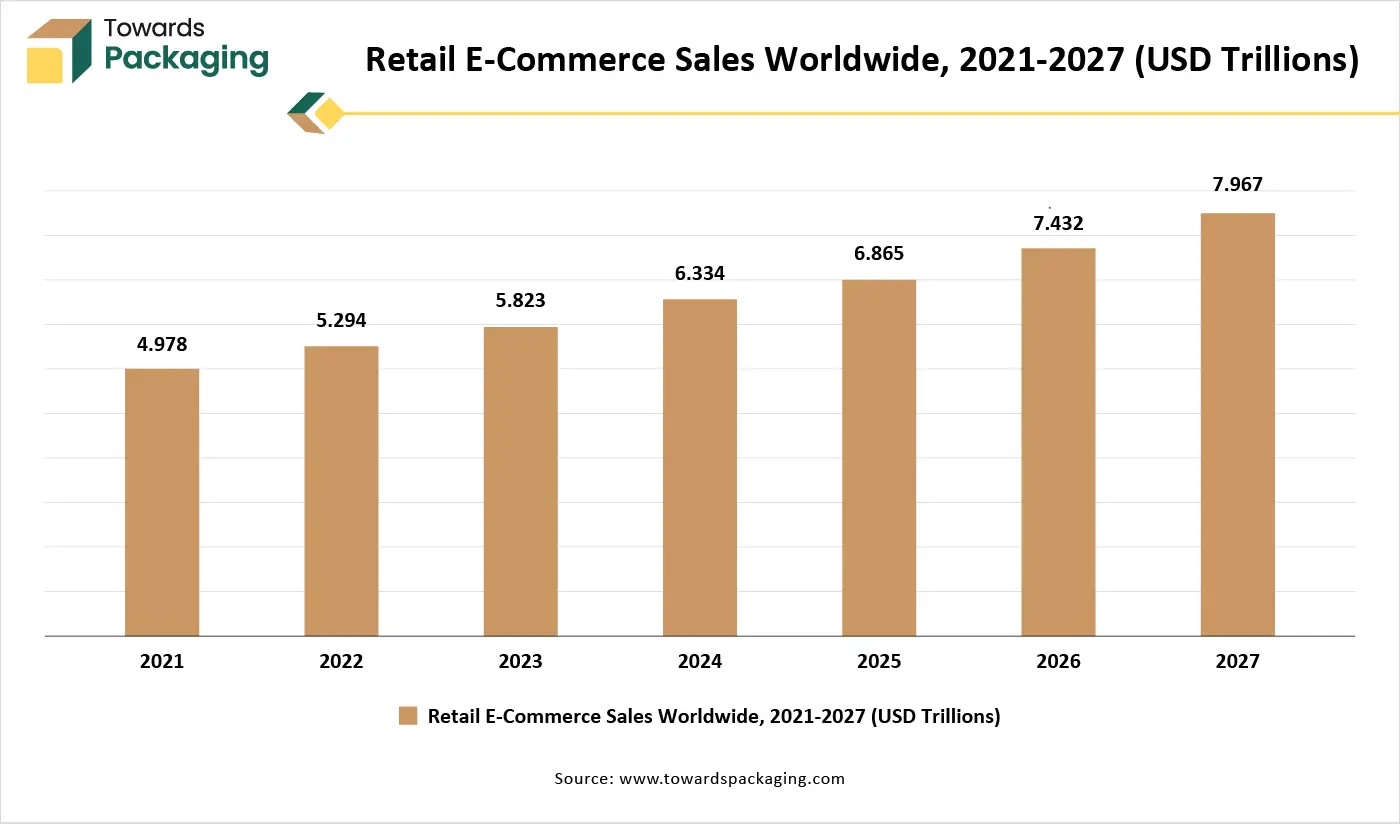

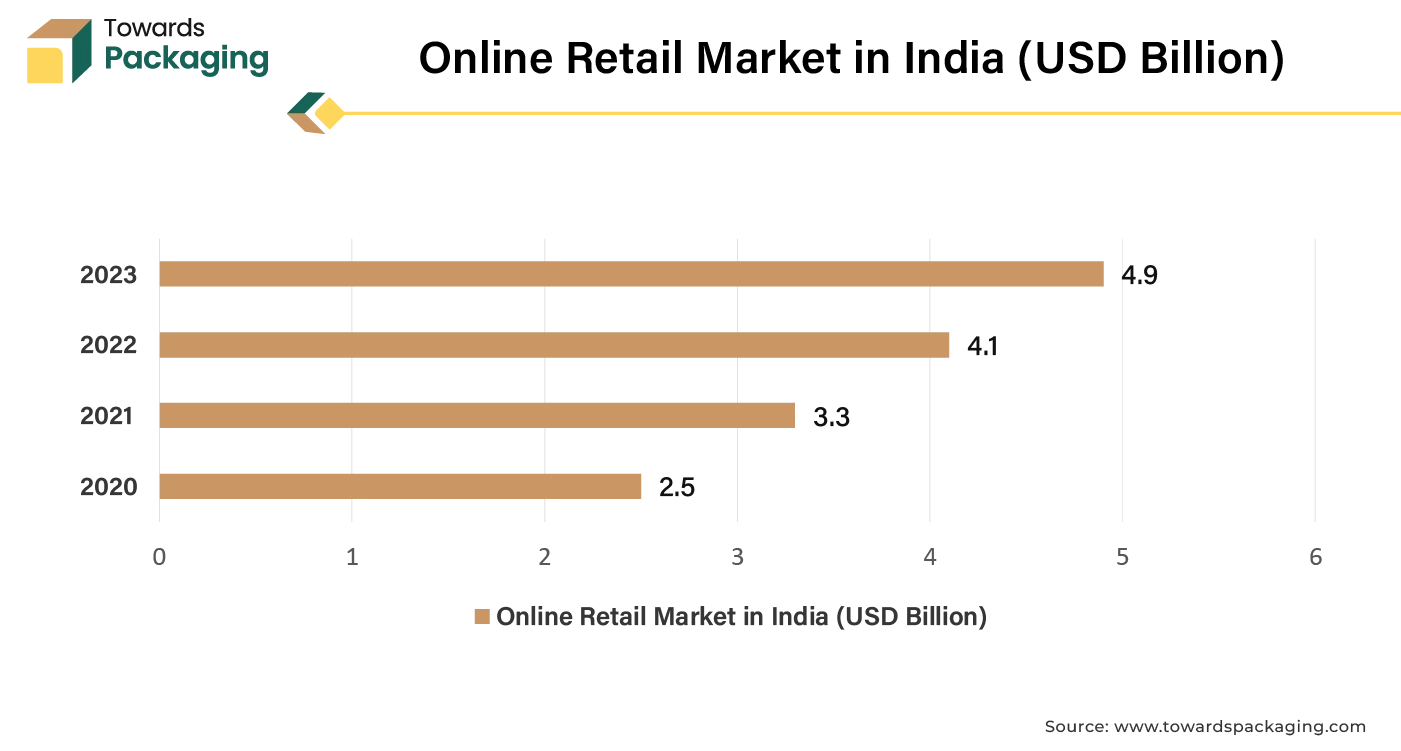

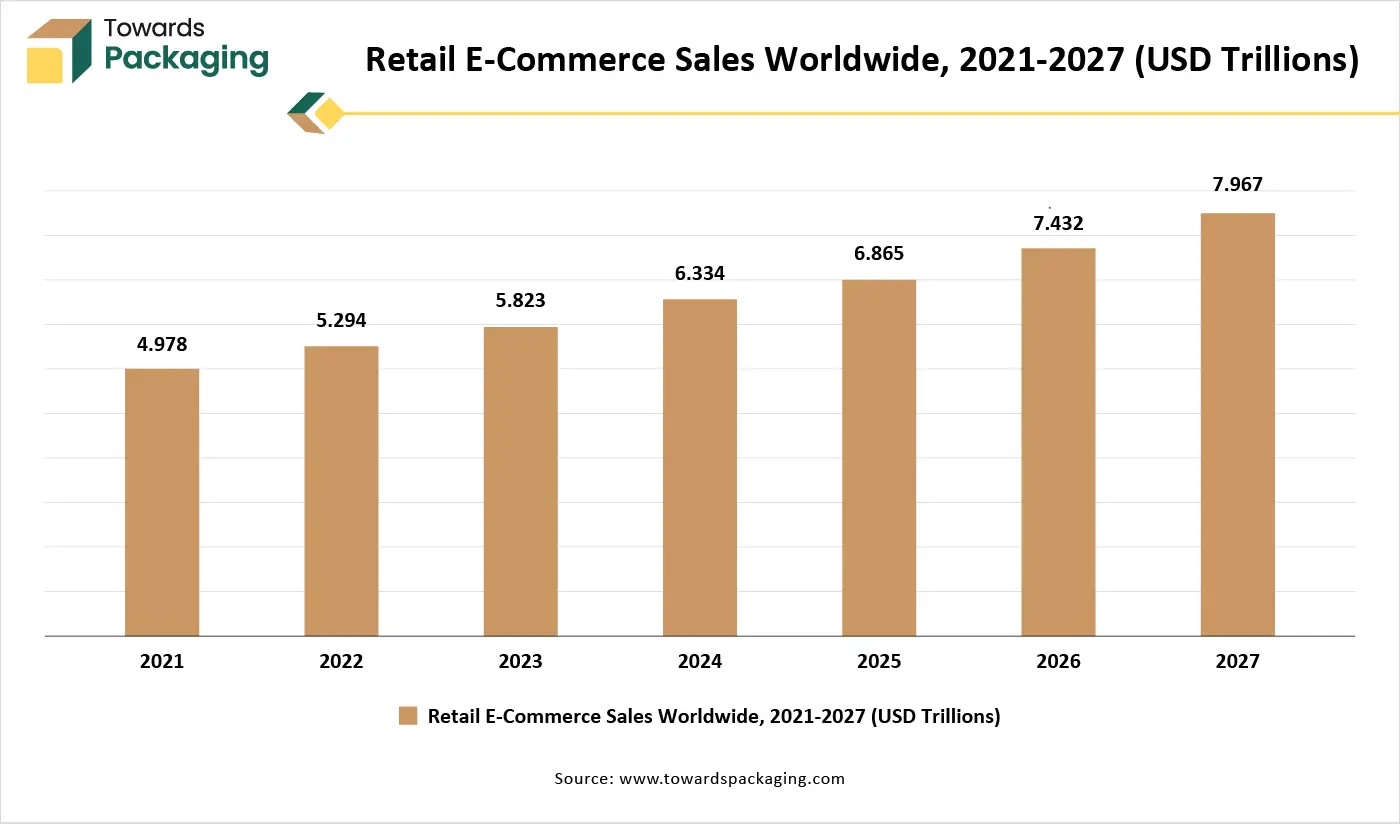

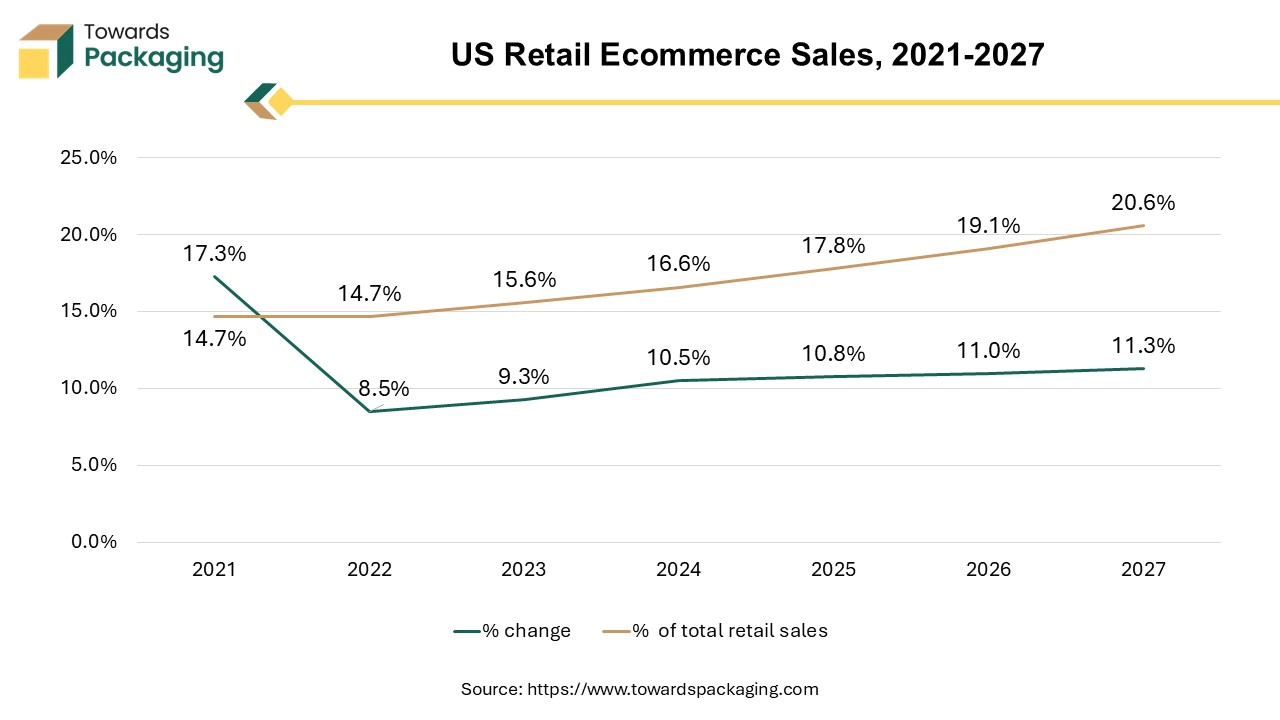

The pallet box segment is estimated to grow at fastest rate over the forecast period. Expansion of the E-commerce is rising the demand for the pallet boxes. Pallet boxes play significant role in managing the transportation and storage of goods in e-commerce fulfilment centers and shipping distribution networks.

Indirect Sales Channel: A Major Segment of the Market

Indirect sales channel segment held a significant share of the market. One of the main advantages of using indirect channels is that manufacturers can reach a wider audience and increase their reach. Another advantage of employing indirect sales channels is cost savings, which is particularly important for products like collapsible rigid containers that are used in a variety of industries and applications.

By contracting with outside partners to handle their logistics and distribution needs, manufacturers can avoid the expenses associated with building and managing their own distribution networks. Small businesses can greatly benefit from this, as they frequently lack the resources to create these networks on their own. The direct sales channel is estimated to grow at fastest rate over the forecast period. Rapid urbanization and advancement in technology has developed the direct sales channel. Due to rising trend of online shopping and E-commerce trade, the manufacturers find it easy to reach customers.

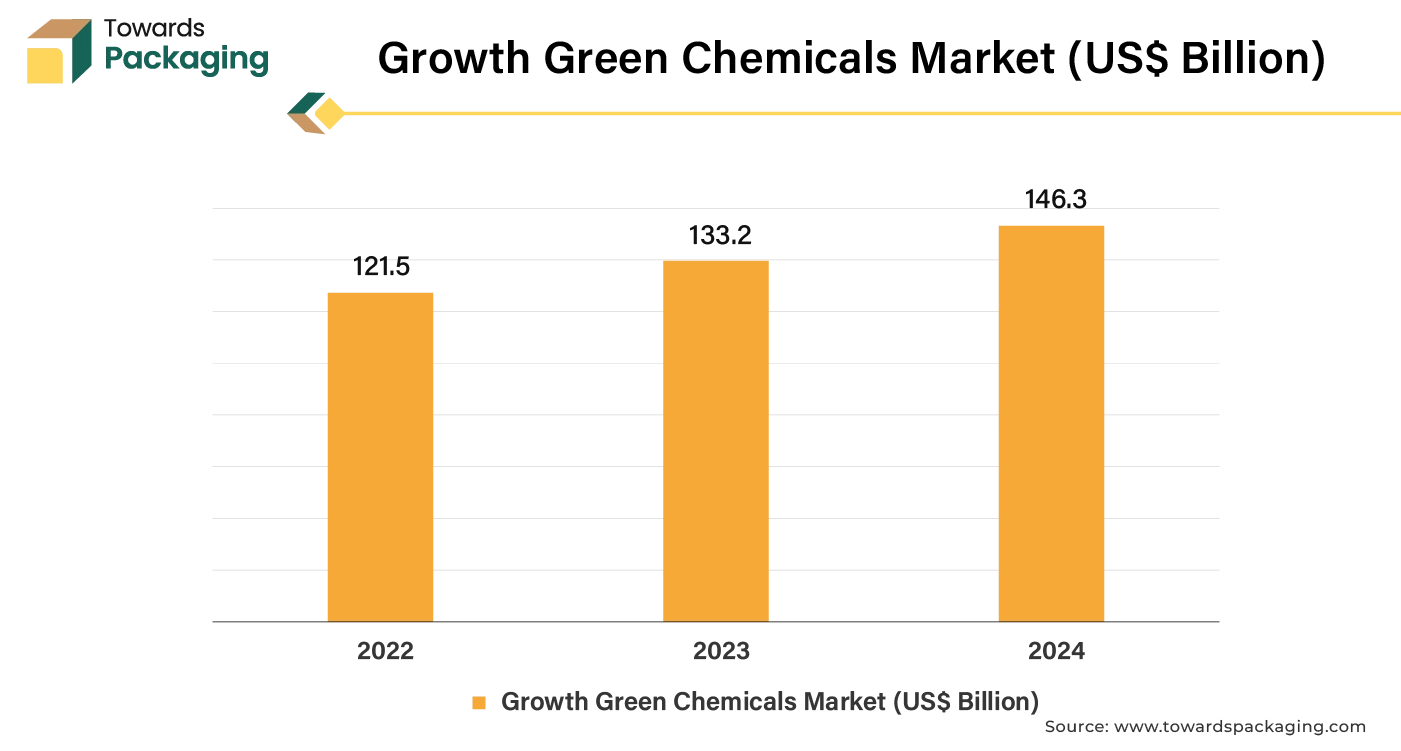

Expansion of Chemical Industry to Support Dominance

The chemical segment is estimated to hold notable share. The handling of combustible and hazardous materials in the chemical industry demands for the adoption of specific packaging solutions that can withstand the rigors of storage and transportation. Thus, the growth and development of the chemical sector will have a significant impact on the collapsible rigid containers market in the near future. The key players operating in the market are focused on launching collapsible rigid containers which is estimated to drive the growth of the segment over the forecast period.

- In June 2024, Berry Global Group, Inc., packaging solutions providing company, revealed the launch of the collapsible rigid container namely closed politainer combi pack. This offers a closed system that makes it simple and safe to dispense delicate liquids without letting them come into contact with air.

The food & beverage segment is expected to grow at fastest rate over the forecast period. Demand for reusable and collapsible food containers is predicted to increase as sustainability and plastic waste reduction become more important. Due to the growing need for portable and space-saving water storage options, the market for collapsible water containers is also anticipated to rise significantly. There is an increasing demand for portable, lightweight water containers since outdoor activities like hiking, camping, and picnics are becoming more and more popular.

Plastic crates are the best option for effectively transporting perishable items because they are strong, lightweight, and stackable. They are used to move a variety of goods between different points in the supply chain, such as fruits, vegetables, dairy, meat, and beverages. The key players operating in the market are focused on adopting the inorganic growth strategies like partnership or collaboration to develop the collapsible rigid containers which is estimated to drive the growth of the segment over the forecast period.

- In November 2023, Fresh Del Monte Produce Inc., agriculture company signed partnership agreement with A.R. Arena Products, Inc., packaging solution providing company, to develop and launch reusable plastic containers for storing bananas. The launch of the reusable plastic containers made the banana shipment easy, with improved shelf life and airflow.

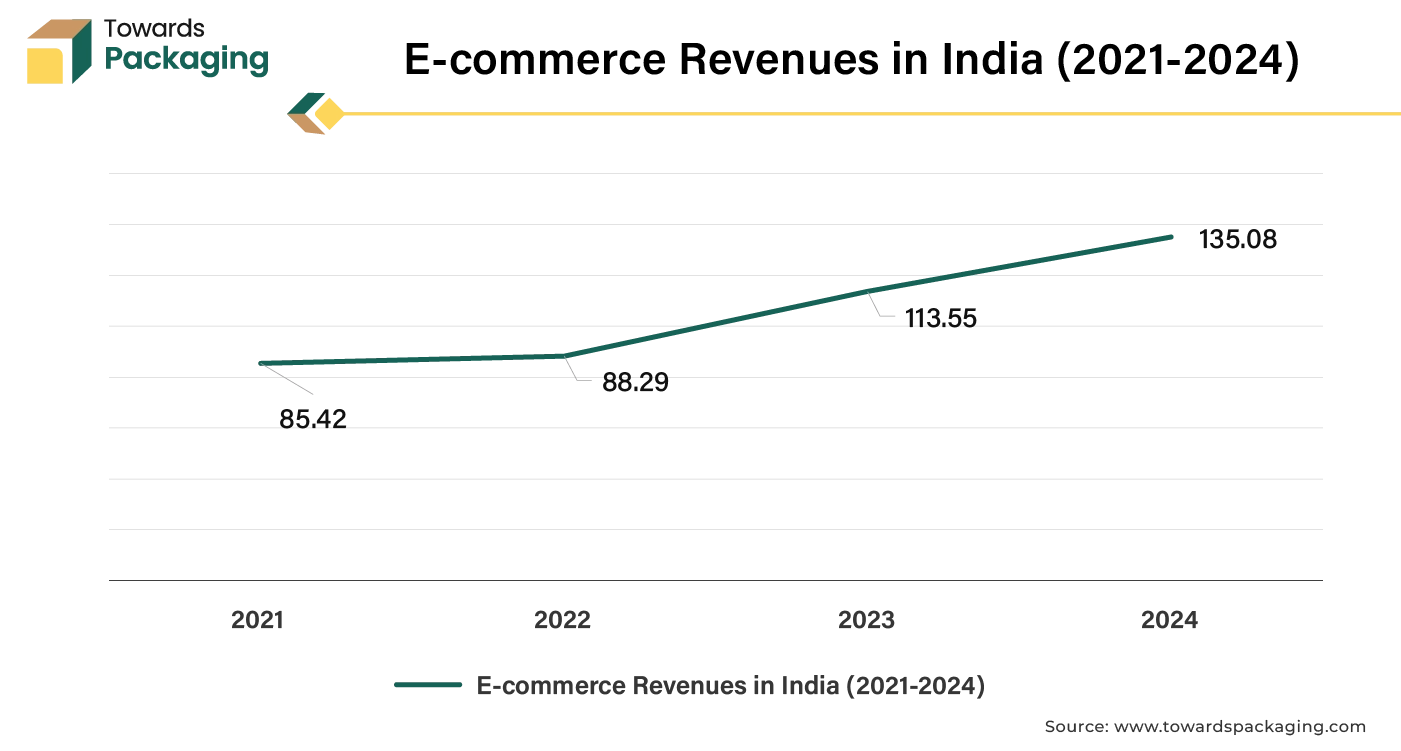

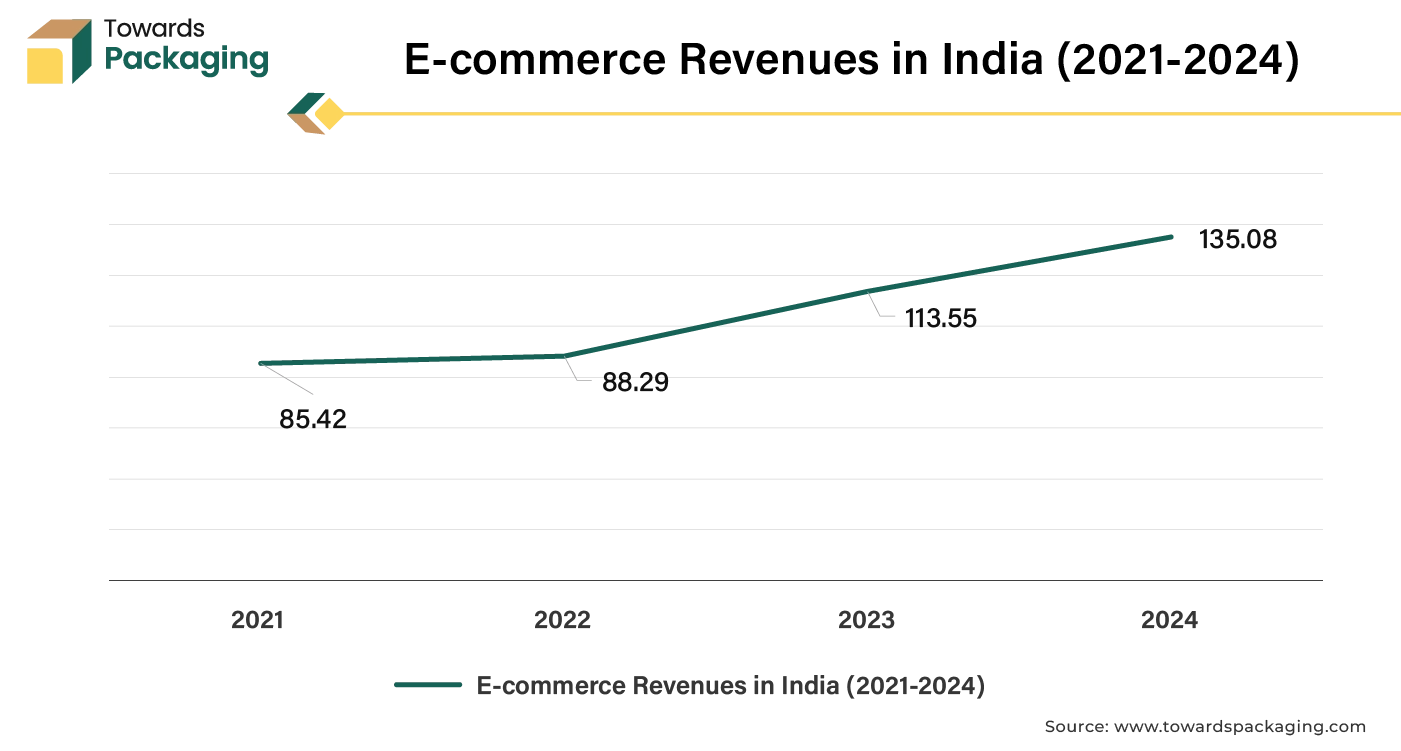

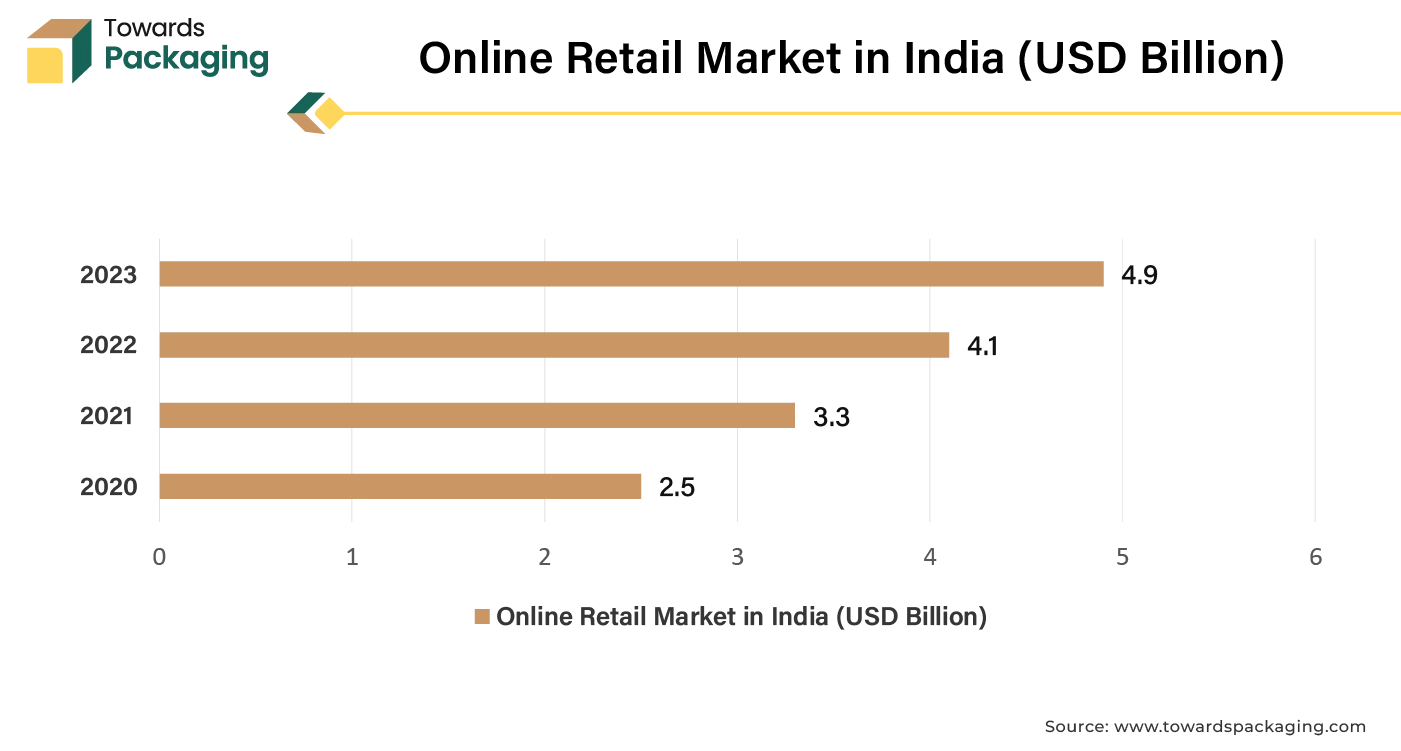

Industrial Growth: Asia Pacific's Projection as a Leader

Asia Pacific held dominant revenue shares for the year 2024. Rapid industrialization and urbanization increase the demand for exclusive, versatile and space-saving logistics solutions. The market for collapsible rigid containers is also significantly influenced by the growth of e-commerce and home delivery services. The pandemic-induced shift to online shopping has resulted in a major surge in demand for robust and space-saving packaging. The market in Japan has also been influenced by just-in-time logistics' rising popularity. The need for these containers is growing in Japan as a result of these considerations as well as the growing need for strong, long-lasting containers that can resist the rigors of storage and transit. In India due to changing lifestyle the trend of online shipping is increasing day-by-day, which is expected to drive the growth of the collapsible rigid containers market in India in the near future.

- In April 2024, according to the data published by the Entrepreneurs Association of India, non-profit organization, it is reported that India’s e-commerce sector is estimated to reach US$ 52.7 billion in 2024.

According to same source it is reported that Government e-marketplace (GeM), Government owned & National Public Procurement Portal of India, achieved its highest Gross Merchandise Value (GMV) record of US$ 2011 billion in 2022-2023.

- In March 2024, according to the data published by the E-commerce Council, it was estimated that Nykaa, Indian cosmetic brand, revenue collection raised from US$ 5 billion to US$ 51 billion in fiscal year 2023.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition for expansion of market presence, which is estimated to drive the growth of the collapsible rigid containers market in Asia Pacific.

- In 2023, Parksons Packaging Ltd., packaging solution providing company headquartered in India signed acquisition with Fortuner Packaging, packaging company headquartered in Himachal Pradesh, North India, to expand its presence in North India. The acquisition even assisted in designing foldable rigid boxes and introduction of new design of rigid boxes in North India region.

Europe’s 25% Recyclable Packaging to Promote the Growth

Europe region is estimated to grow at fastest rate over the forecast period. The growing industrialization and companies have been assisting many end-users, including pharmaceutical, food and beverage, automotive, and retail industries, among others, to meet their changing demands. The use of collapsible rigid boxes can enhance the unboxing experience for consumers, adding to appeal of the product. The key players operating in the market are focused on launching the collapsible rigid containers to meet the rising demand of the consumers, which is estimated to drive the growth of the collapsible rigid containers in Europe over the forecast period.

- In January 2024, IFCO, a company providing reusable packaging containers (RPCs) revealed the introduction of Dora, a reusable plastic pallet in the Europe. The Dora, reusable plastic pallet is 25% light-in-weight than conventional wood pallets, hence the transportation cost are cut-down to lowest while shipment.

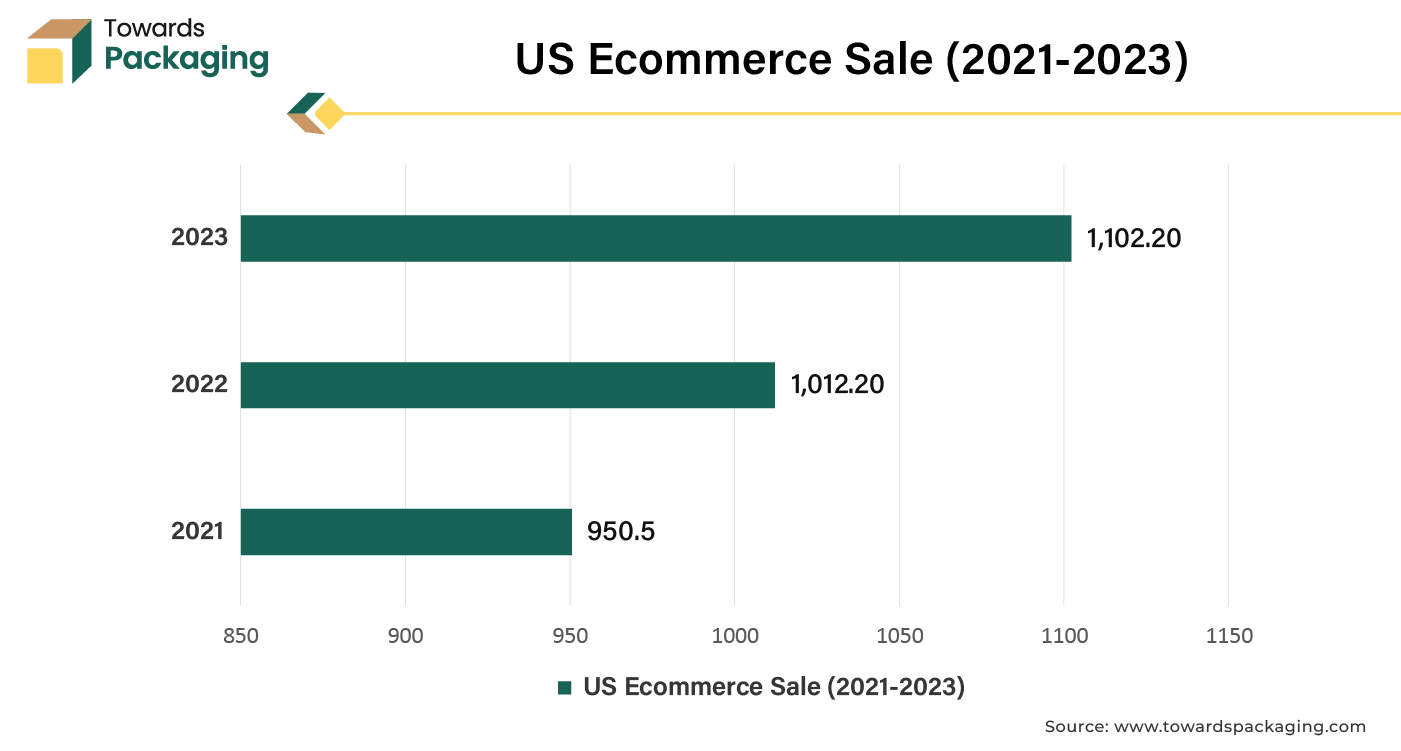

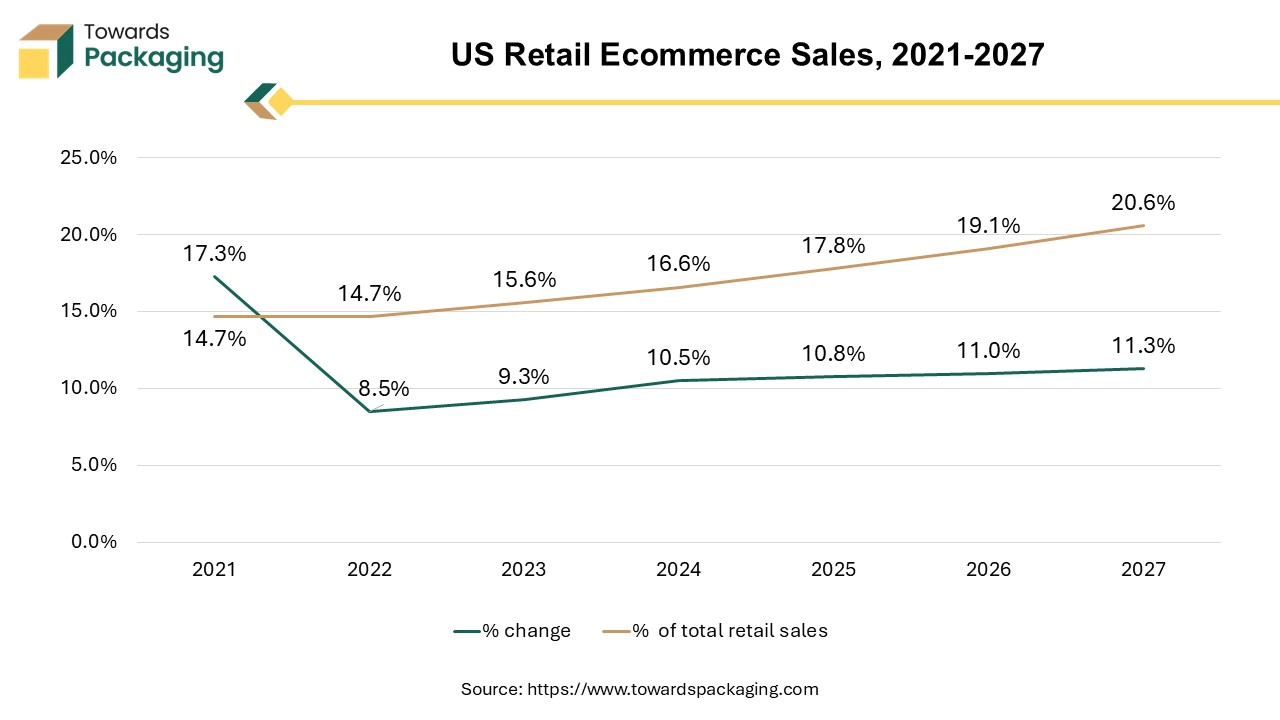

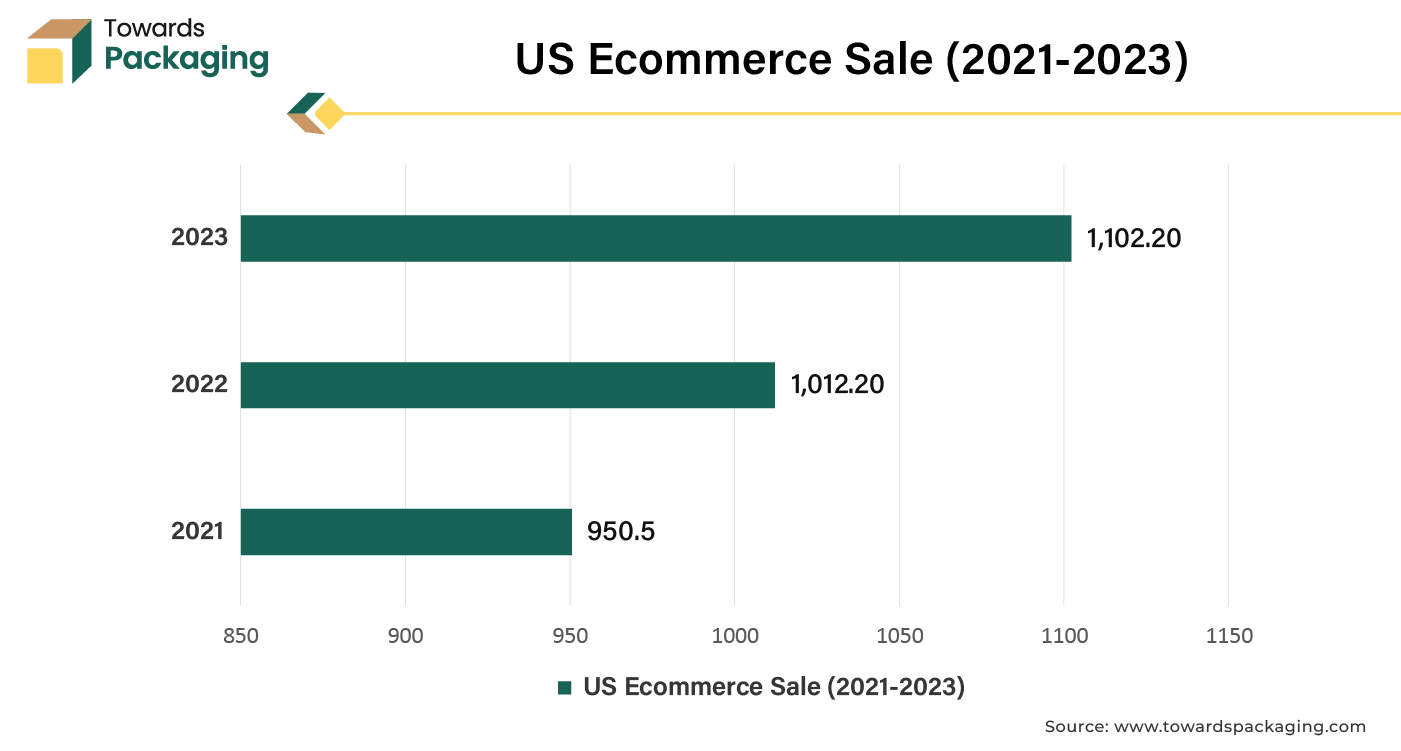

North America is estimated to hold notable share in the upcoming period. Rapid industrialization, expansion of e-commerce and online retail increases the demand for efficient and flexible packaging solutions to manage varying volumes and types of products. Collapsible rigid containers provide durability and protection for consumer goods, ensuring safe transportation and minimizing product damage.

- In August 2024, U.S. Census Bureau of the Department of Commerce published an announcement today estimating that U.S. retail e-commerce sales for the second quarter of 2024 were $291.6 billion, up 1.3 percent (+0.7) over the first quarter of 2024 after accounting for seasonal fluctuation but not price adjustments. Compared to the first quarter of 2024, total retail sales were predicted to have increased by 0.5 percent (+0.2) to $1,826.9 billion for the second quarter. E-commerce was up 6.7 percent (+1.2) in the second quarter of 2024 compared to the same period in 2023, while overall retail sales were up 2.1 percent (+0.4). Sales through e-commerce made up 16.0 percent of overall sales in the second quarter of 2024.

New Advancements in Collapsible Rigid Containers Industry

- In April 2024, KraftPal, packaging solutions developing company revealed the launch of the corrugated cardboard pallets at the LogiPharma event held in France, U.K.

- In July 2024, Versalis, chemicals company, signed collaboration with Forever Plast, plastic fabrication company, to launch REFENCE, an innovative range of recycled polymers for food contact packaging. The line of rigid and expanded packaging, including yogurt pots, meat and fish trays, and other applications utilizing polystyrene, is currently offered in the market. Through the expansion of their application range and the facilitation of direct contact with food, these new solutions will add to the Versalis Revive portfolio of mechanically recycled materials. Versalis and Forever Plast have a co-development partnership that allows Versalis to create NEWER technology in their Mantua research laboratories, while Forever Plast uses this technology to industrialize REFENCE in its Lograto (Brescia) facilities.

Collapsible Rigid Containers Market Key Companies

Collapsible Rigid Containers Market

By Material Type

- Plastic

- Metal

- Others (Wood, etc.)

By Product Type

- Crates

- Foldable IBCs

- Pallets Boxes

- Jerry Cans

By Sales Channel

By End Use

- Chemical

- Food & Beverage

- Automobile

- Pharmaceutical

- Agriculture

- Shipping & Logistics

- Other Manufacturing (Apparel & Textile, etc.)

By Region

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- North America

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait