Hard Coat Film Market Size, Share, Trends and Forecast Analysis

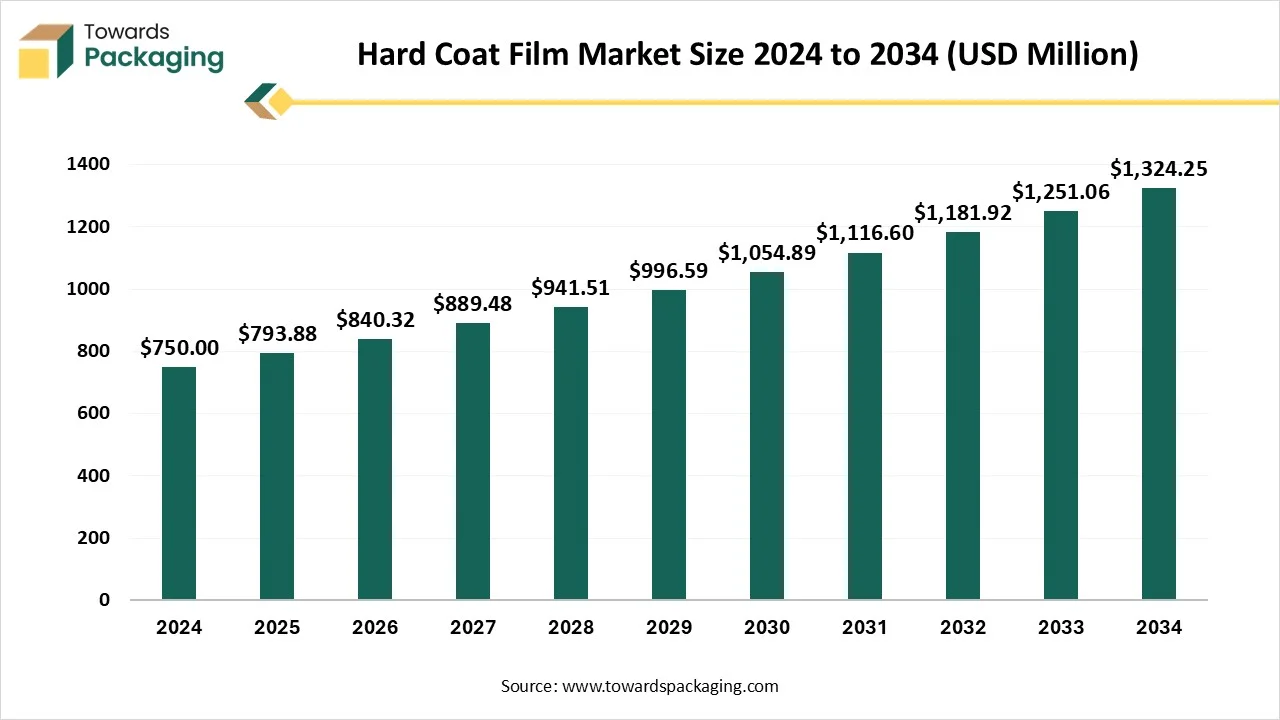

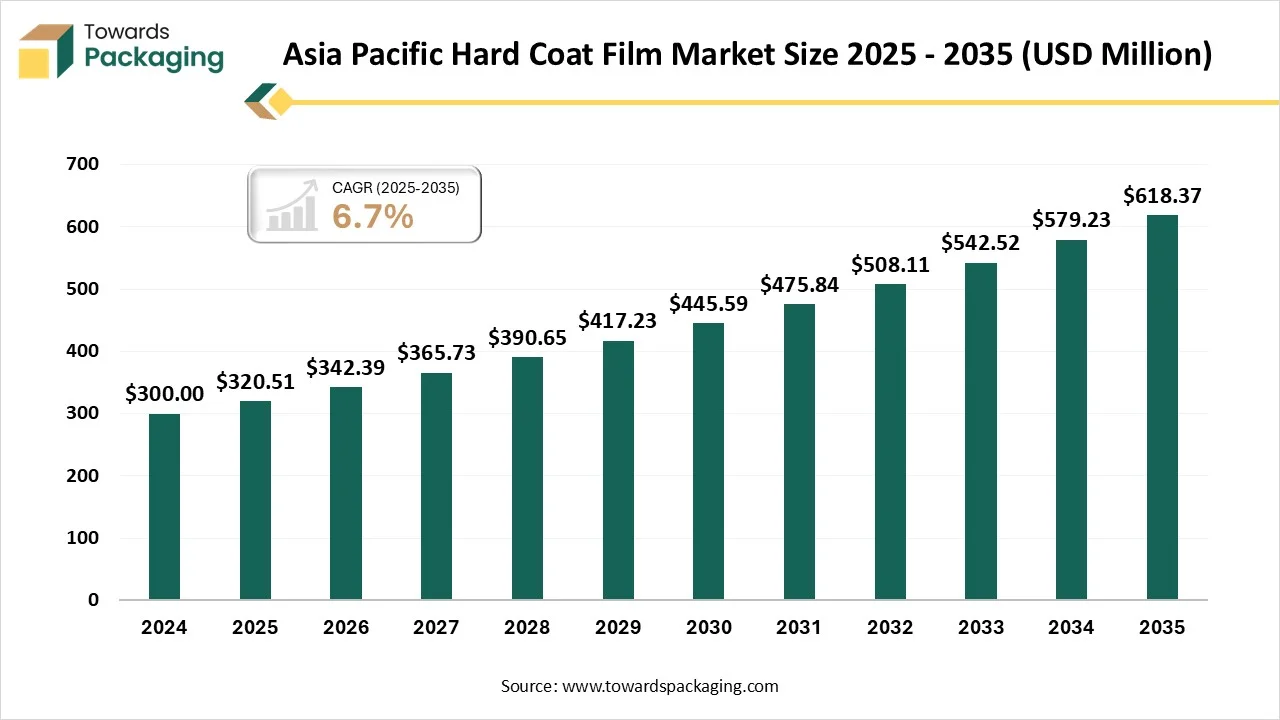

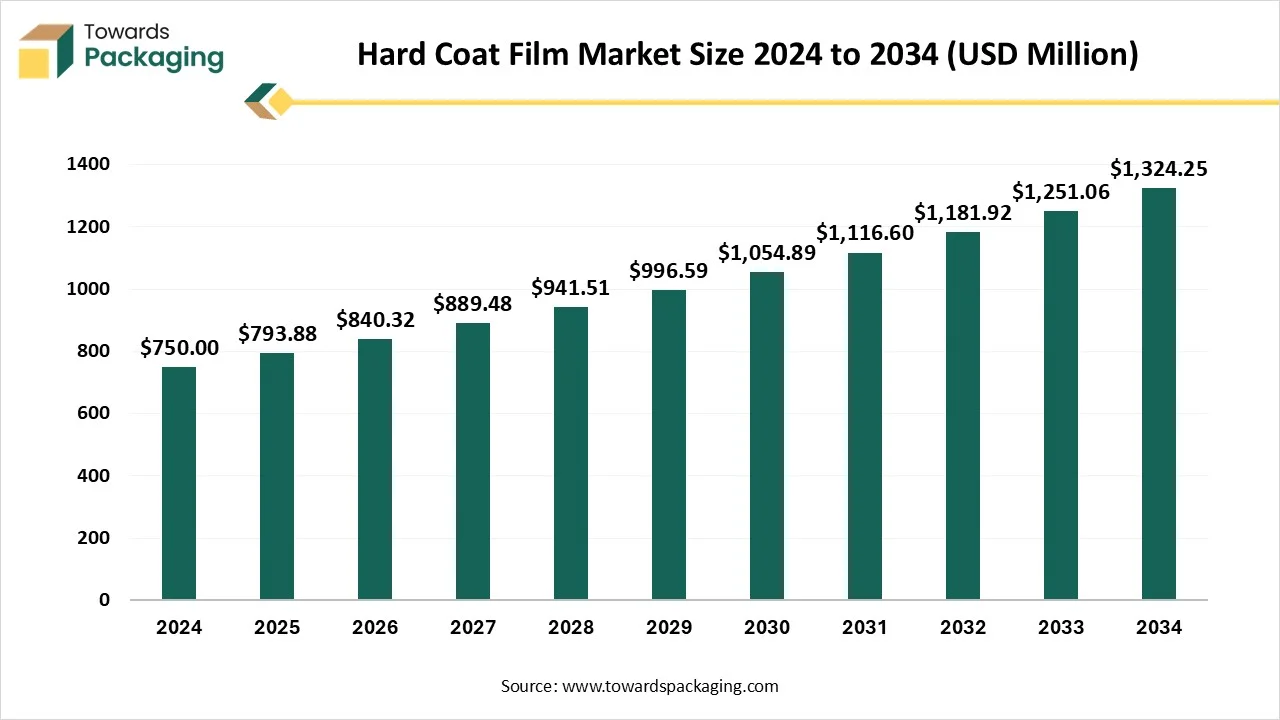

The hard coat film market is projected to grow from USD 793.88 million in 2025 to USD 1401.72 million by 2035, with a CAGR of 5.85%. The market's expansion is fueled by increased demand for scratch-resistant films in the electronics, automotive, and medical sectors. Asia Pacific dominated the market in 2024, holding around 40% of the share. Key players like 3M, Toray Industries, and Nitto Denko lead the market, with polycarbonate and acrylic coatings making up a significant portion of the market share.

Major Key Insights of the Hard Coat Film Market

- In terms of revenue, the market is valued at USD 793.88 million in 2025.

- The market is projected to reach USD 1324.25 million by 2034.

- Rapid growth at a CAGR of 5.85% will be observed in the period between 2025 and 2034.

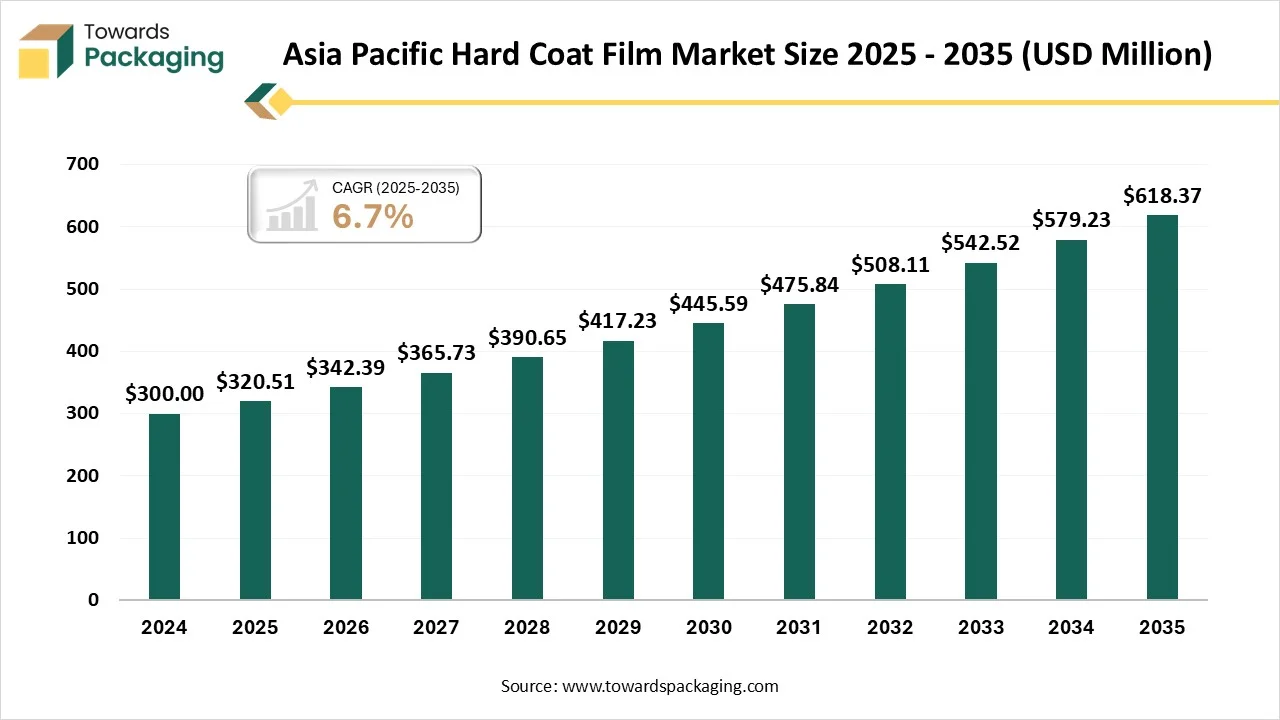

- By region, Asia Pacific dominated the global market by holding highest market share of approximately 40% in 2024.

- By region, North America is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the polycarbonate segment contributed the biggest market share of approximately 40% in 2024.

- By material type, the polyethylene terephthalate (PET) segment will be expanding at a significant CAGR in between 2025 and 2034.

- By coating, the acrylic segment contributed the biggest market share of approximately 35% in 2024.

- By coating, the urethane segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By application, the mobile devices segment contributed the biggest market share of approximately 45% in 2024.

- By application, the medical devices & packaging segment is expanding at a significant CAGR in between 2025 and 2034.

- By end-use industry, the consumer electronics segment contributed the biggest market share of approximately 45% in 2024.

- By end-use industry, the medical segment is expanding at a significant CAGR in between 2025 and 2034.

What is Hard Coat Film?

Hard coat film refers to a thin protective layer that is applied to cover the product and protect it from scratch, weatherability, and chemical resistance. These capacities make it perfect for window covering, touch screens, and scratches. It protects products from its surface hardness which enhance the life of the product.

Hard Coat Film Market Outlook

- Rising Chronic Diseases: There is a rapid growth of chronic diseases due to increasing number of aged populations which has enhanced strong demand for pharmaceutical packaging that can help in maintaining the integrity of the medicines.

- Advancement in Supervisory Guidelines: The advancement in supervisory guidelines for AI printing technology and huge variety of customization option to decrease waste and provide enhanced protection to products.

- Startup Ecosystem: Development of advanced manufacturing process, sustainable materials, and intelligent packaging has boosted the market. Incorporation of smart technologies such as NFC, AI, and blockchain for monitoring the condition of the drugs, traceability, and enhanced security.

How Can AI Improve the Hard Coat Film Market?

The incorporation of AI technology in the market plays an important role in maintaining the thickness of the film. It enhances automation process for high-speed production of the hard coat films. It helps in manufacturing customized films in industries such as electronics, consumer goods, and automotive. AI speed up the development and help in the generation of upcoming films with services like anti-reflective or self-healing properties for automotive and smart device applications.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 750 Million |

| Projected Market Size in 2034 |

USD 1324.25 Million |

| CAGR (2025 - 2034) |

5.85% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material Type, By Coating Type, By Application, By End-Use Industry and By Region |

| Top Key Players |

3M, Toray Industries, Inc., Nitto Denko Corporation, Tekra, LLC, MacDermid Alpha (Autotex Films), LINTEC Corporation, BOTH HARVEST Technology Co., Ltd., Mirwec Coating, Inc., Vergason Technology, Inc. |

Trade Analysis of Hard Coat Film Market: Import & Export Statistics

- China is significantly growing in this market with an average export of 180,368 shipments in between November 2023 and October 2024 which is an increment of 12% from past year.

- Japan has huge market of import and export of these films of approximately USD 0.6 billion by 2030.

- Germany is well-known for its optical hard films which is around $0.7 billion in 2024 and is projected to grow significantly, reaching $1.1 billion by 2033.

- UK has reported hard coat film market of around 17.51% in 2025, with a projected market assessment of $150 million for hard coat film by 2028.

- U.S. has hard coat film market of worth $1 billion in 2024. It is anticipated to develop up to $1.6 billion by the end of 2033.

Hard Coat Film Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene, polycarbonate (PC), polyethylene terephthalate (PET).

- Key Players: DIC Corporation, SDC Technology

Component Manufacturing

The major components used in this market include both using the hard coating layer and the plastic substrate.

- Key Players: 3M, SKC Inc.

Logistics and Distribution

This segment plays a crucial role in maintaining the integrity, quality, and timely delivery of main sensitive films.

- Key Players: Dunmore, SDC technologies

Market Dynamics

Market Driver

Increasing Sales of Hard Films

The increasing sales for hard films have influenced the demand for the market. There is an advanced demand for protecting films that improved the longevity and durability of vehicle machineries. Hard coat films are widely utilized for defending touch panels, displays, and several other internal parts from wear, scratches, and abrasions creating them crucial in current automotive engineering. Moreover, the rising trend for electric vehicles (EVs) is additional pushing the demand for high-presentation hard coat films, mainly those with anti-fingerprint and anti-glare properties, to enhance user experience and security.

Market Challenges and Restraints

Expensive Manufacturing Process

Expensive manufacturing process have hindered the growth of the market. The high charges for setting up this business is high which has huge risk that restricted the development of this industry. Intense competition in this market has raised its charges and made it challenging to develop in low costs.

Market Opportunity

Growing Electronics Industry

Growing electronics industry has raised the opportunities for the market. The fast propagation of laptops, smartphones, tablets, and various other movable electronic equipment has result in an enhanced requirement for defensive films that protect touch panels and display screens. Hard coat films provide anti-glare properties, superior scratch resistance, and optical clarity, making them perfect for the usage in customer electronics. Additionally, the continuing progressions in display technologies, like flexible displays and OLED, are generating new opportunities for the advancement of the hard coat films to improve the durability and performance of these advanced devices.

Material Type Insights

Why Polycarbonate Segment Dominated the Hard Coat Film Market In 2024?

The polycarbonate segment dominated the market in 2024 due to their superior influence resistance, thermal stability, and optical clarity. These characteristics make them extremely appropriate for usage in the electronics and automotive industries, where performance and durability are crucial. The continuing progressions in polycarbonate film constructions and coating skills are additionally improving their belongings, constructing them progressively popular across several applications. This segment is highly demanded in sectors such as healthcare, automotive, and electronics because of its lightweight and durability.

The polyethylene terephthalate (PET) segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to its durability and scratch-resistance properties. It offers superior strength, resistance to chemicals, and clarity which make it suitable for personal care products packaging, graphic art, and protective covers. It is highly in-demand as industries has huge need for visually appealing packaging, protective, and high-quality packaging.

Coating Type Insights

Why Acrylic Segment Dominated the Hard Coat Film Market In 2024?

The acrylic segment dominated the market in 2024 due to its optical clarity, scratch resistance, durability, and excellent hardness. It has huge demand in industries like construction and design, automotive, and electronics industry. The rising demand for improved durable surface and in-car technology is boosting the development of this segment. It provides a protective and aesthetic finish for furniture and wall panels.

The urethane segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing due to its anti-scratch and strong protection quality. These qualities make them suitable for usage in high-wear purposes. These films are widely utilized in industrial machinery, automotive interiors, and consumer electronics, where preserving the aesthetic visual and functionality of shells is important. The rising demand for long-lasting protective and durable films in these businesses is influencing the development of the urethane hard coat film sector.

Application Type Insights

Why Mobile Devices Segment Dominated the Hard Coat Film Market In 2024?

The mobile devices segment held the largest share of the market in 2024 due to increasing adoption of tablets and smartphones. The massive increment in the adoption of smartphones has enhanced the demand for this market. Rising consumer awareness required protection of the expensive electronics. Invention in the blue light filters, self-healing films, and anti-glare packaging has enhanced the desire of the consumers.

The medical devices & packaging segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to high-performance, durable, and scratch-resistance properties. There is a high usage of surgical equipment, which require such packaging which is durable. To protect the touch display of healthcare devices such as monitoring screens, and diagnostic devices has raised the demand for these hard coat films.

End-Use Type Insights

Why Consumer Electronics Segment Dominated the Hard Coat Film Market In 2024?

The consumer electronics segment held the largest share of the hard coat film market in 2024 due to scratch resistance and durability. The huge demand for protection of devices in electronics sector has enhanced the demand for these packaging. The advancement of nanotechnology has raised the utilization of this segment. It offers a combination of excellent durability, visual clarity, and scratch resistance. The rising demand for foldable smartphones, wearable technologies, tablets, and several other products require strong films for covering purpose.

The medical segment is expected to grow at the fastest rate in the market during the forecast period. This segment is growing rapidly due to infection controlling capacity, advanced technology, and minimally invasive process. This development is majorly contributed by rising demand for concern regarding hospital-attained infection. These coatings play an important role in maintaining the stability of the drugs and enhancing patients’ experience.

Regional Insights

High-Performance Films Huge Demand in Asia Pacific Promote Dominance

Asia Pacific held the largest share of the hard coat film market in 2024, due to demand for tough and high-presentation shielding films in main industries. In this region, the industry is anticipated to observe substantial development at the time of predicted period. The rapid growth of industrialization, joined with the growing electronics and automotive industries, is generating a considerable demand for hard coat films. Several countries like India, China, Japan, and South Korea are important hubs for electronics producing, and the existence of foremost automotive producers in the region additional intensifies the demand for defensive films.

North America’s Major Companies Enhance Market Demand

North America expects significant growth in the market during the forecast period. This market is growing due to the presence of major market players of electronics and automation sector. The rising acceptance of progressive infotainment processes and cooperating shows in vehicles, accompanied by the growing demand for enhanced-quality presentation screens in customer electronics, is influencing the market in this area. Moreover, the focus on product invention and the existence of top technology market players are additionally enhancing the demand for this market.

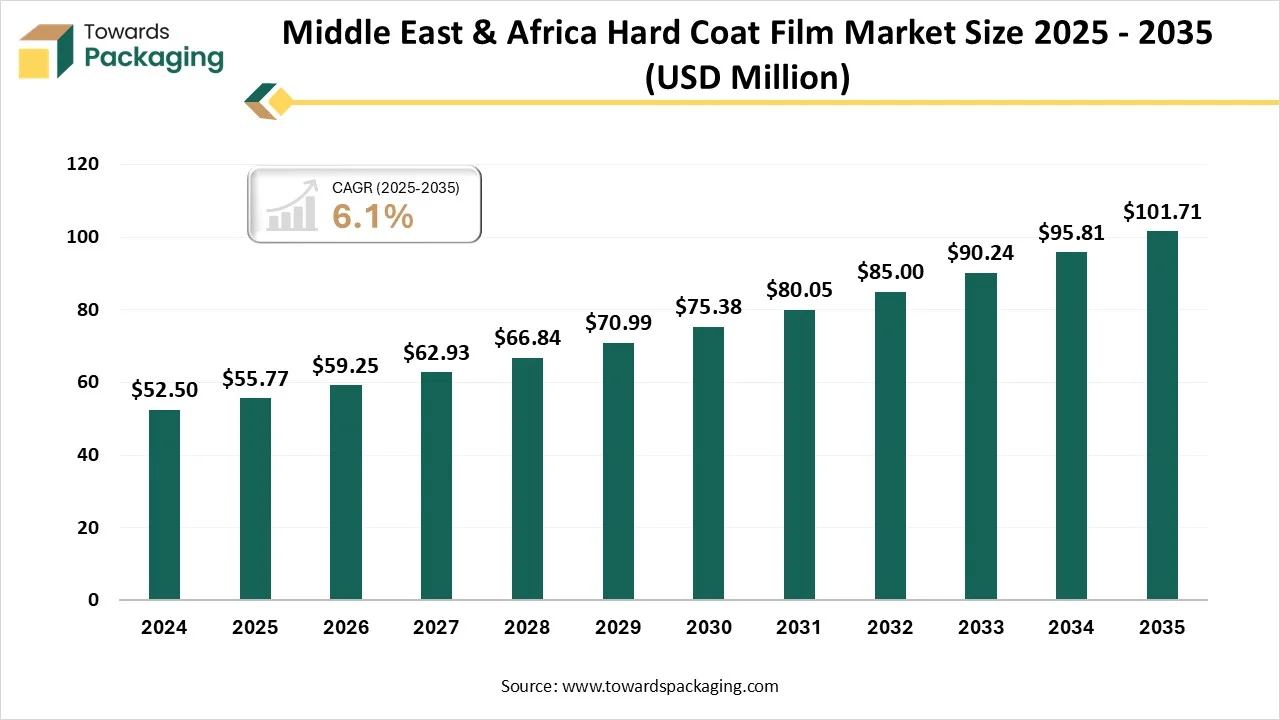

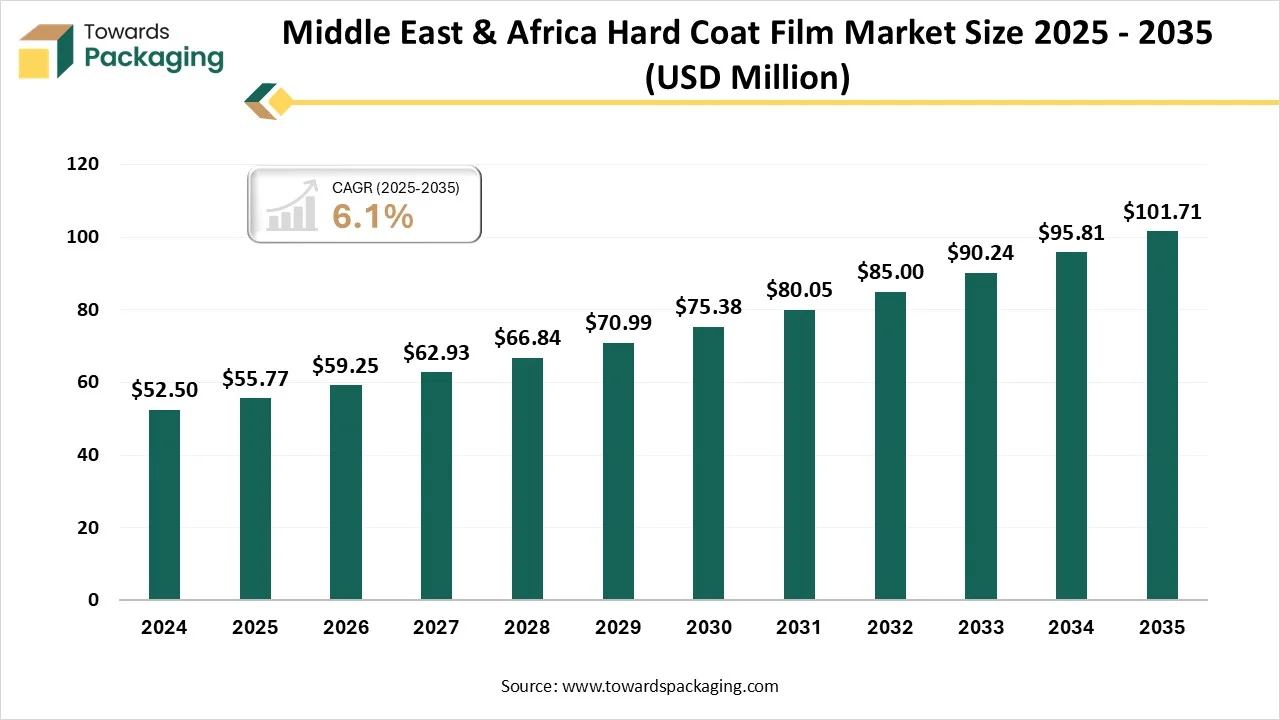

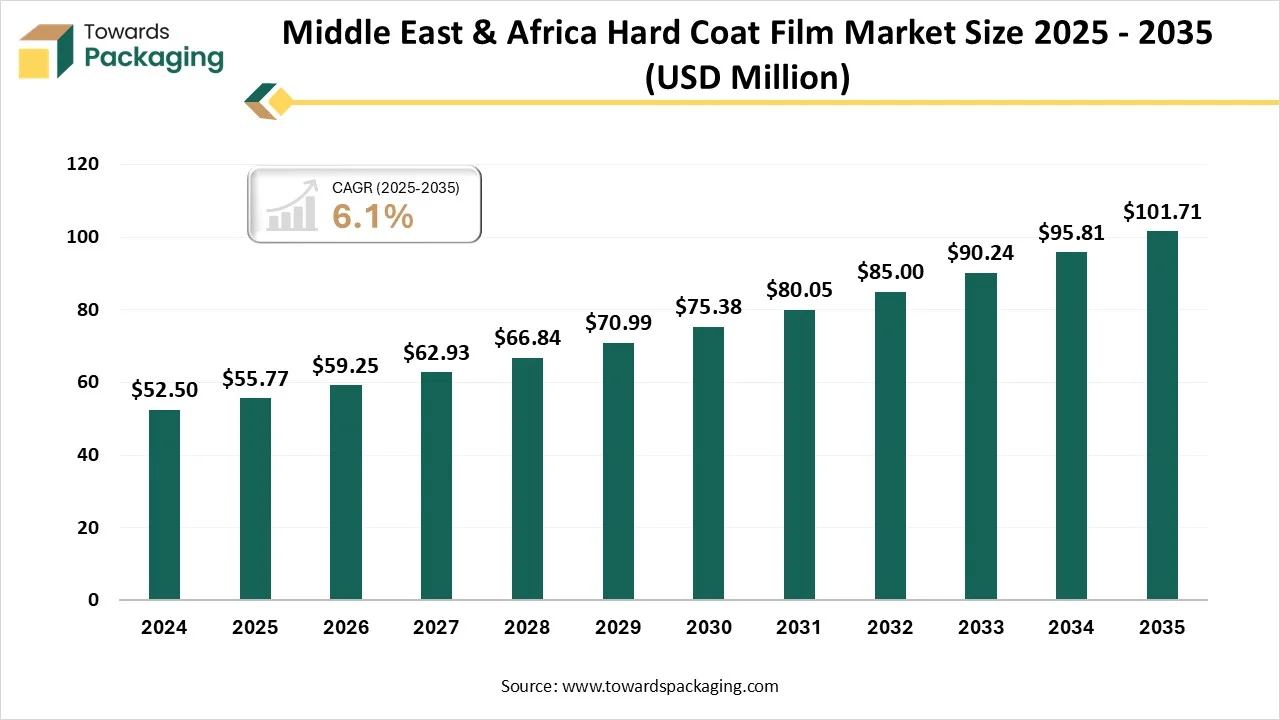

Middle East & Africa Hard Coat Film Market Size 2025 - 2035 (USD Million)

Top Companies in the Hard Coat Film Market

- 3M Company: A top technology-based company that produced a huge diversity of films, comprising hard coat structures.

- Eastman Chemical Company: It offers flexible products with material science and advanced chemistry expertise.

- Lintec Corporation: It combines material designs, hard coating, and adhesives technologies to grow high-performance optical films.

- Saint-Gobain: It provides special films with enhanced features for high chemical resistance and improved abrasion.

- Dai Nippon Printing Co., Ltd.: A company that utilizes enhanced functional films which can be used for weather resistance, resin glass, and improving wear.

- Other: Daicel Corporation, Toray Plastics (America), Inc., Flex Films (USA) Inc., Taghleef Industries, SCHOTT AG, HOYA Corporation, Corning Incorporated, AGC Inc., Madico, Inc., Pyrotech, Labforinvention Corp, Techmetals, Inc., GGB, Plas-Tech Coatings, Protection Engineering

Pharmaceutical Packaging Regulatory Landscape: Global Regulations

Tier 1

Tier 2

- Tekra, LLC

- MacDermid Alpha (Autotex Films)

- LINTEC Corporation

- Gunze Limited

- Arisawa Manufacturing Co., Ltd.

- Kriya Materials

- Vampire Optical Coatings

- Kimoto Ltd.

- Momentive Performance Materials Inc.

- Precision Coatings, Inc.

Tier 3

- BOTH HARVEST Technology Co., Ltd.

- Mirwec Coating, Inc.

- Vergason Technology, Inc.

- Duralar Technologies

- Shincron Co., Ltd.

- Hefei Lucky Science & Technology Co., Ltd.

- WeeTect, Inc.

- Taica Corporation

- Fujifilm Corporation

- Jindal Poly Films Ltd.

Recent Developments

- In May 2025, Nippon Paint (Coatings) Philippines, Inc. introduced its newest innovation in external wall shield the Weatherbond Quartz sequence auspicious to set an exceptional standard in protecting homes and constructions from strict weather situations.

- In May 2024, iPROS GMS announced the launch of Lumia Art which is a 3-D attractive hard coat film that holds high hard coat presentation while surpassing in post-handing out and moldability which does not need UV therapeutic after moulding

Hard Coat Film Market Segment Covered

By Material Type

- Polycarbonate

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polypropylene (PP)

- Others

By Coating Type

- Acrylic

- Silicone

- Epoxy

- Urethane

- Others

By Application

- Mobile Devices

- Touch Panels

- Appliance Overlays

- Automotive Components (Interior/Exterior)

- Aerospace Components (Interior/Exterior)

- Packaging (Flexible/Rigid)

- Architectural & Protective Films

- Medical Devices & Packaging

- Industrial Equipment & Packaging

By End-Use Industry

- Consumer Electronics

- Automotive

- Aerospace

- Medical

- Industrial

- Packaging & Construction

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait