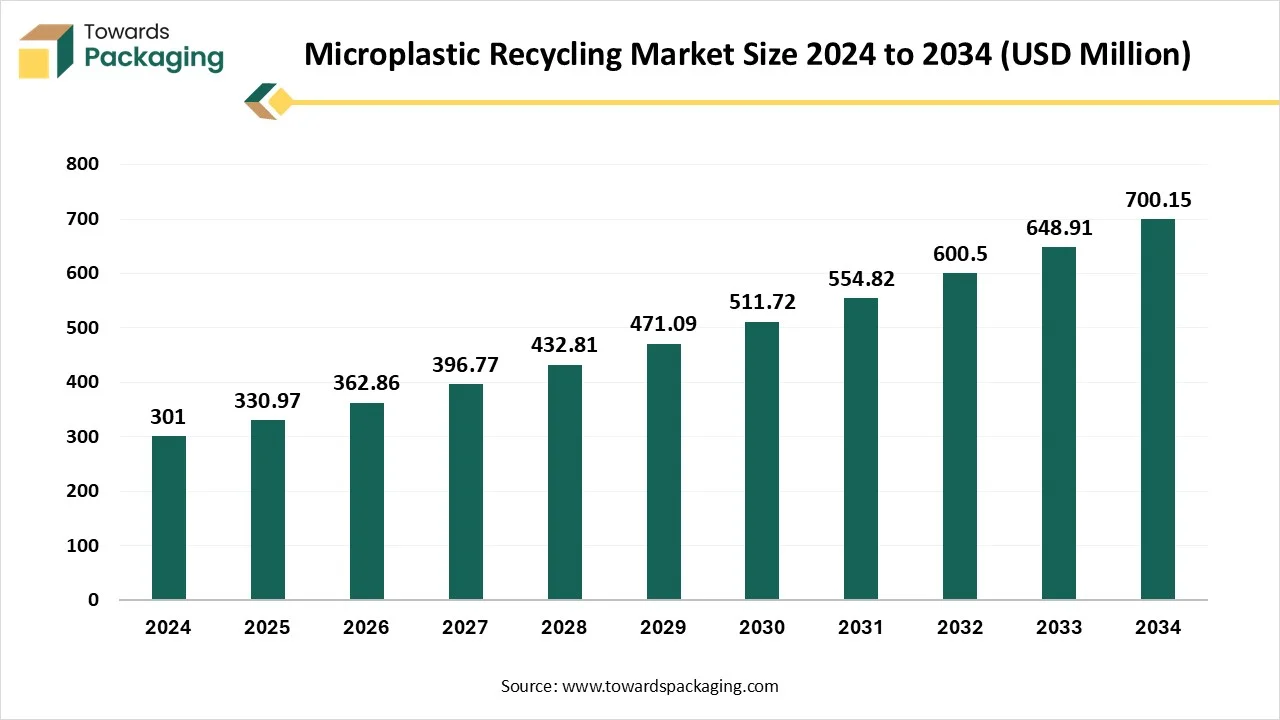

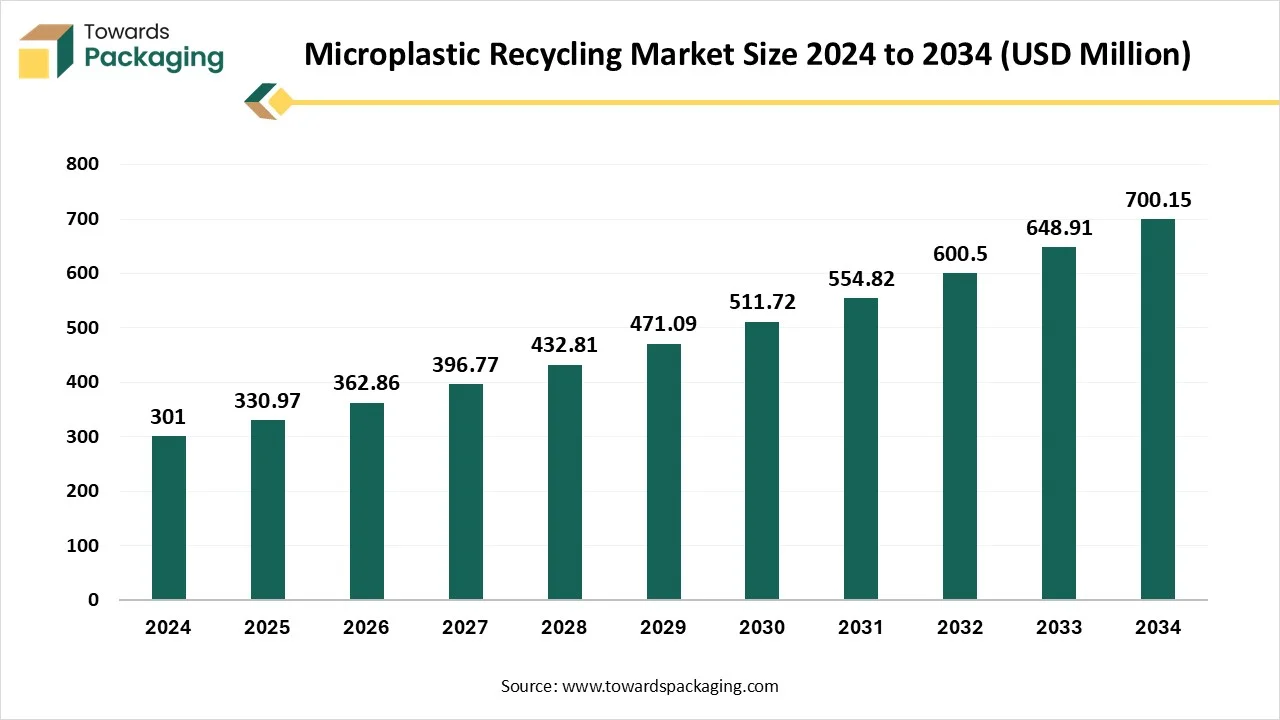

The microplastic recycling market is forecasted to expand from USD 361.76 billion in 2026 to USD 827.54 billion by 2035, growing at a CAGR of 9.63% from 2026 to 2035. The market is driven by growing environmental concerns, government regulations, and advancements in filtration and chemical recycling technologies. In 2024, Europe dominated the market, while Asia Pacific is expected to exhibit the fastest growth. The packaging segment led the market, and secondary microplastics accounted for the largest share in 2024. Key players like PlanetCare and Ioniqa Technologies are focusing on innovative solutions to scale up recycling efforts.

Innovations in filtration, separation, and chemical processing technologies are enabling the recovery of microplastics from water, soil, and industrial waste streams. Growing awareness of microplastic contamination in oceans, food chains, and drinking water is driving demand for recycling solutions. Additionally, support from environmental agencies, research institutions, and sustainability-focused companies is boosting investment and development in microplastic recycling infrastructure and technologies.

The process of recovering, removing, and reprocessing tiny plastic particles typically less than 5 millimeters in size that originate from the degradation of larger plastics or are intentionally manufactured, such as microbeads in personal care products, is known as microplastic recycling. Unlike conventional plastic recycling, it involves capturing these particles from water bodies, air, soil, and industrial waste using advanced filtration and separation technologies. Once collected, microplastics are treated through mechanical, chemical, or thermal methods to either reuse them or safely eliminate their environmental impact, supporting circular economy goals and protecting ecosystems.

AI integration is revolutionizing the microplastic recycling market by enhancing detection, sorting, and overall process efficiency. Advanced AI-powered imaging and machine learning systems enable precise identification of microplastics based on size, shape, and polymer type, allowing real-time, automated sorting and improving recycling purity. AI also optimizes recycling operations by controlling reaction parameters, reducing energy use, and increasing yield. Predictive maintenance minimizes equipment downtime, while data analytics help monitor contamination patterns and track performance. Additionally, AI-driven robotics automates microplastic handling, and smart waste management systems optimize collection and logistics, making microplastic recycling more scalable, cost-effective, and environmentally sustainable.

The microplastic recycling market is growing as environmental concerns and stricter regulations drive demand for effective recovery solutions. Advancements in separation and recycling technologies are improving feasibility and supporting wider adoption.

The market is shaped by circular economy initiatives focused on reducing microplastic pollution and reusing recovered materials. Innovative chemical and bio-based recycling methods help industries meet sustainability and compliance goals.

Startups play a key role by developing advanced microplastic capture and recycling technologies. Strong collaboration with governments and industries is accelerating pilot projects and commercialization efforts.

Advancement in Technology

Innovations in filtration, AI-driven sorting, chemical recycling, and biodegradable materials are enabling the effective capture and recovery of microplastics from wastewater, soil, and manufacturing processes. Technologies such as AI-powered imaging, infrared spectroscopy, and machine learning algorithms enable precise identification and classification of microplastics by size, shape, and polymer type. This enhances sorting efficiency and the purity of recycled outputs. Nano-filtration, membrane separation, and electrochemical treatments help extract even the tiniest microplastic particles from wastewater, oceans, and industrial discharge, expanding the scope of recoverable plastics.

Lack of Standardized Technology

The key players operating in the market are facing issues due to limited end-use applications and a lack of standardized technology, which is estimated to restrict the growth of the market. There is a lack of standardized recycling methods for microplastics, especially for complex mixtures and contaminated particles, which limits large-scale adoption. There are few commercially scalable uses for recycled microplastics, and quality concerns often limit their use in high-performance or food-grade applications.

Stricter policies and bans on microbeads, single-use plastics, and non-recyclable packaging in regions like Europe, Asia Pacific, and North America are fostering demand for effective microplastic recycling infrastructure.

Global brands across the packaging, textiles, and automotive sectors are increasingly incorporating recycled microplastics to meet ESG goals, regulatory compliance, and consumer demand for sustainable products.

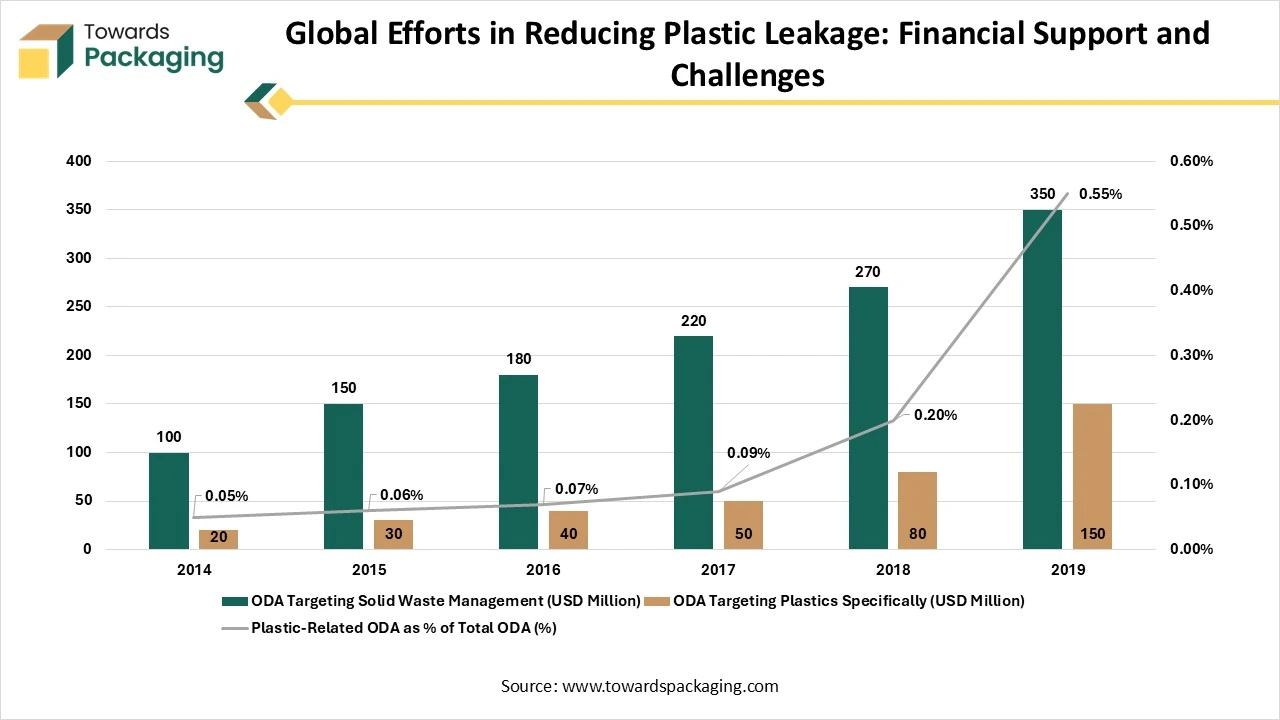

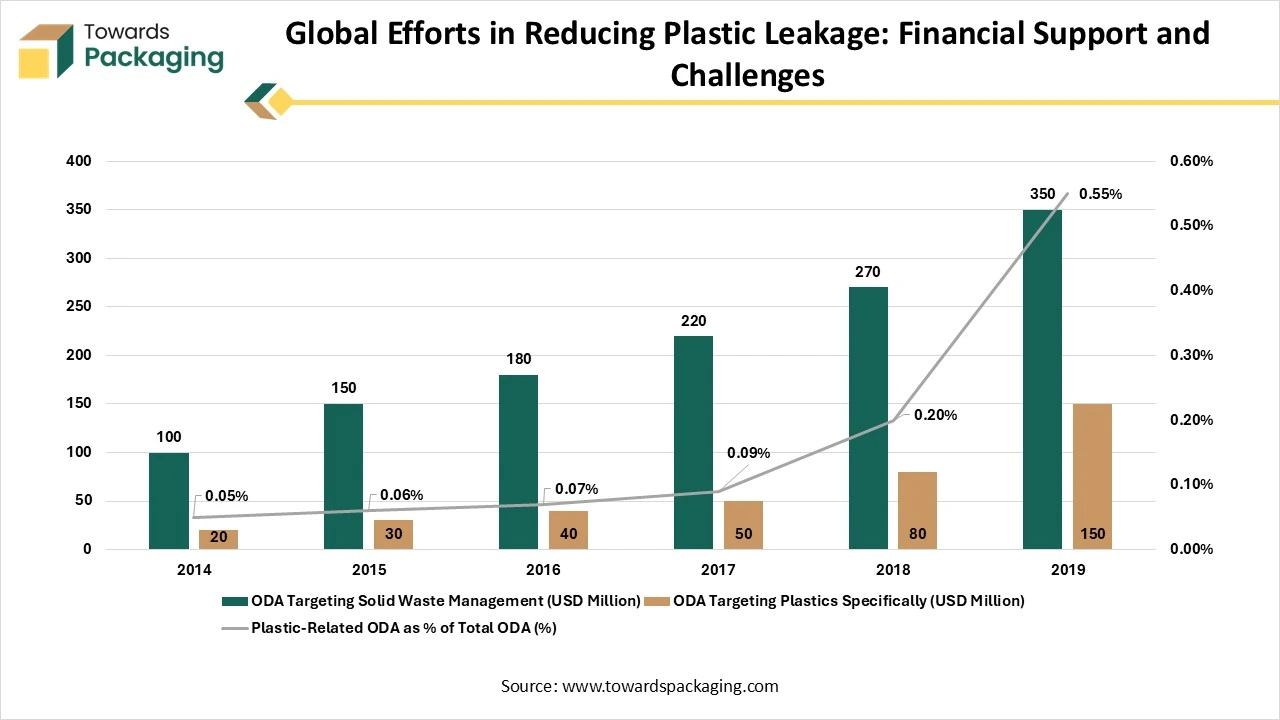

International collaboration is key to making plastic value chains more circular and reducing plastic leakage into the environment. The design and trade of plastic products should focus on sustainability, addressing health and environmental concerns across their lifecycle. Additionally, policy interventions and cross-border cooperation are essential to improve plastic management and waste recycling efforts.

Although plastic-related Official Development Assistance (ODA) has seen a gradual increase, it still remains a small portion of total ODA. In 2017, only 0.2% of global ODA was dedicated to plastic-related projects. To achieve the necessary reductions in plastic waste, especially in low- and middle-income countries where mismanaged waste is most prevalent, significant investments in infrastructure, waste management practices, and policies are required. While ODA plays a role, other funding sources such as private investment and domestic subsidies will also be critical to addressing these challenges.

The secondary segment dominates the microplastic recycling market due to the widespread presence and environmental impact of microplastics formed from the breakdown of larger plastic items. These secondary microplastics are the most abundant in oceans, rivers, soils, and wastewater, making them a primary target for recycling initiatives. Governments and environmental agencies prioritize their removal in regulations and cleanup programs, driving investments in related technologies. Additionally, current recycling methods, such as filtration and density separation, are more effective for secondary microplastics. Research and innovation efforts also focus heavily on this segment due to its traceability and scalability in recycling systems.

The primary product segment is growing at the fastest rate in the microplastic recycling market due to increasing demand for high-quality recycled materials that can be reintroduced into the production cycle. Industries such as packaging, textiles, automotive, and construction are incorporating recycled microplastics into their products to meet sustainability goals and regulatory requirements. Technological advancements in sorting and purification are enabling the production of cleaner, consistent recycled outputs. Additionally, growing consumer preference for eco-friendly products and circular economy initiatives are encouraging manufacturers to use recycled microplastics as a substitute for virgin raw materials.

The packaging segment dominates the microplastic recycling market due to its significant contribution to plastic waste, particularly from single-use items in the food, beverage, and retail sectors. This waste often breaks down into microplastics, making packaging a major source of recyclable material. Stringent government regulations mandating recycled content and restricting single-use plastics are accelerating recycling efforts. Additionally, leading consumer brands are committing to sustainability goals that include using recycled materials in packaging. Technological advancements in filtration and chemical recycling, along with strong waste management infrastructure and growing consumer demand for eco-friendly packaging, further support this segment’s dominance.

The automotive and transportation segment is experiencing the fastest growth within the microplastic recycling market, primarily due to its increasing adoption of recycled microplastics in lightweight, durable interior and exterior vehicle components. Post-consumer plastics like rPP and rPET, commonly used for seating, dashboards, door panels, and console parts, help reduce vehicle weight, improving fuel efficiency and lowering emissions. Regulatory mandates and automaker sustainability goals are driving this trend: major OEMs such as Ford, GM, and Tesla have pledged significant recycled-content usage, complemented by advanced purification and sorting technologies that now enable cleaner, high-grade recyclates suitable for automotive applications.

Europe dominates the microplastic recycling market due to a robust combination of policy, infrastructure, technology, and consumer engagement. Europe’s leadership stems from its stringent environmental regulations, notably the EU's Circular Economy Action Plan, Single-Use Plastics Directive, and REACH bans targeting microplastics, driving systemic removal and recycling efforts. The region benefits from advanced waste management infrastructure, including sophisticated collection systems and cutting-edge separation technologies like infrared sorting, boosting recovery rates from ~30% to over 90%. Additionally, Europe is a hotbed for R&D and innovation, with major investments (e.g., the €8.8M REMEDIES project) and companies like Ioniqa pioneering chemical recycling of microplastics. High public awareness and strong producer responsibility frameworks further reinforce the market, with Germany and the UK leading country-level initiatives.

Germany Market Trends

Germany leads the region thanks to its robust circular economy and extended producer responsibility (EPR) framework. The Packaging Act (VerpackG), aligned with EU mandates, sets high targets—63% plastic bag recycling and mandatory recyclability of packaging by 2035. Germany’s waste sorting infrastructure, including color-coded bins and advanced sorting technology, enables high-quality recyclate streams and efficient microplastic capture. Public-private R&D efforts, such as startups and academic projects, support innovations like the Wasser 3.0 water filtration system, reinforcing Germany’s microplastic recycling leadership.

U.K. Market Trends

The UK shows strong project-level innovation but lacks a cohesive national policy. Significant investments include the UK Shared Prosperity Fund–backed microfibre recycling center in Cornwall. However, regulation remains limited: only microbeads are banned under the 2017 Environmental Protection (Microbeads) Regulations. Experts warn the UK is lagging behind global benchmarks, with calls for a comprehensive strategy including enforceable targets, funding, and measures against major microplastic sources. Adoption of broader EPR and national recycling mandates, similar to EU standards or Germany’s Packaging Act, would significantly boost its market position.

The Asia Pacific region is growing at the fastest rate in the microplastic recycling market due to a combination of high plastic waste generation, supportive policies, and technological advancement. Rapid industrialization and urbanization in countries like China, India, Japan, and South Korea have led to massive volumes of microplastic waste, creating urgent demand for recycling solutions. Governments across the region are implementing bans on single-use plastics, extended producer responsibility (EPR) programs, and incentives for improved waste management. In parallel, investments in advanced sorting, filtration, and chemical recycling technologies are enhancing recycling efficiency. Strong public awareness and increased collaboration between governments, research institutions, and private companies further accelerate the development of scalable microplastic recycling systems.

China Market Trends

China is experiencing the fastest growth in the microplastic recycling market due to a combination of robust policies, technological innovation, and large-scale infrastructure development. The country’s strong emphasis on circular economy principles, as outlined in its 14th Five-Year Plan, drives investments in waste reduction, resource efficiency, and water treatment. Strict regulations on single-use plastics, domestic waste sorting, and the ban on plastic waste imports through “Operation National Sword” have accelerated local recycling initiatives. China also leads in technological advancements such as membrane filtration, electrocoagulation, and AI-driven sorting systems. Public-private partnerships, smart recycling infrastructure, and collaborations between universities, industries, and government bodies further enhance China’s capacity to develop and scale microplastic recycling solutions efficiently.

North America is expected to grow at a notable rate in the near future. The robust mix of regulatory action, technological advancement, and industry demand has driven the market growth. A strong environmental consciousness heightened by strict state-level policies like California’s recycled-content mandates and bans on microbeads has catalysed investment in infrastructure and innovation.

Advanced technologies, including specialized sorting, filtration, and chemical recycling, are making microplastic recovery more efficient and commercially viable. Additionally, North America’s large manufacturing base spanning packaging, automotive, and consumer goods drives demand for recycled microplastics, while significant public-private investments and R&D initiatives further expand the region’s capacity to lead in scalable recycling solutions.

MEA microplastic recycling market is growing, backed by growing concerns about plastic pollution and water scarcity. Microplastic capture and recycling technologies are being made possible by governments for progressive investments in environmental monitoring and wastewater treatment improvements.

UAE is emerging as a key adopter of microplastic recycling solutions, propelled by investments in cutting-edge water treatment infrastructure and robust sustainability agendas. Filtration and recycling technologies are being adopted to reduce microplastic pollution as a result of government-led environmental initiatives and smart city projects.

The Latin America microplastic recycling market is growing steadily due to pressure to preserve freshwater and marine ecosystems, growing urbanization, and plastic consumption. Improving waste management systems and testing microplastic removal technologies are the main regional priorities, especially in coastal regions.

Brazil leads Latin America, supported by its large industrial base and extensive coastline. Rising environmental regulations, research initiatives, and partnerships between public agencies and private players are driving demand for microplastic recycling and recovery solutions.

Microplastic recycling relies on waste streams from wastewater treatment plants, industrial effluents, textile facilities, and marine clean-up activities. Efficient collection and separation technologies are critical for sourcing usable microplastic feedstock.

Key Players: Veolia, SUEZ, BASF, Aquaporin

Governments partner with recycling firms to meet environmental and water quality regulations, while airlines adopt recycled materials and filtration systems to support sustainability goals.

Key Players: Veolia, TOMRA, Pentair, Danaher Corporation

Aftermarket offerings focus on maintenance, filter replacement, and system upgrades to improve recovery efficiency and extend equipment life.

Key Players: Xylem, Evoqua Water Technologies, Pall Corporation, Kurita Water Industries

By Product

By End-use

By Region

February 2026

February 2026

February 2026

February 2026