The Omnichannel Packaging market is projected to reach hundreds of millions in revenue from 2025 to 2034, driven by rising demand from healthcare, cosmetics, fashion, food and beverages, and consumer electronics. This report covers market segments by packaging type, material, end-use industry, and channel type. Regional insights include North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Key players such as Sealed Air, Amcor, Uflex Ltd., Aptar, Mondi, and Berry Global are analyzed for their products, market share, and competitive strategies. Trends in sustainable and smart packaging, as well as AI integration, are also explored.

The omnichannel packaging is experiencing a retail plan concentrating on a reliable practice across every network to the consumers to interaction with the brand. From cultural brick-and-mortar retail supplies to digital shopfronts and social media networks, it depends on generating a combined experience across all stations. This means having reliable branding, messaging, graphics, and product packing that the consumer shops for the brands. By utilizing omnichannel packaging plans, companies can generate a continuous consumer experience, whether shopping online or in-store. Omnichannel is utilized in retail and ecommerce to define a business plan that goals to offer a unified shopping experience across all channels, comprising in online, store, and mobile.

| Metric | Details |

| Market Drivers | - Enhanced consumer experience - Branding consistency - Operational efficiency - Customization and smart packaging integration |

| Leading Region | Asia Pacific |

| Market Segmentation | By Packaging Type, By Material, By End-Use Industry, By Channel Type and By Region |

| Top Key Players | Sealed Air, Amcor, Uflex Ltd., Aptar, Mondi, Berry Global |

Germany Omnichannel Packaging Market Trends:

Germany will grow as manufacturers and retailers prioritize strong environmental compliance, high product protection, and effective logistics. Packaging that is robust, automated, and compatible with cutting-edge warehouse systems will become more in demand. Companies will depend increasingly on reusable and recyclable solutions that function flawlessly in both traditional retail channels and online deliveries due to stringent sustainability regulations

North America to Boom Rapidly: U.S. to Remain as a Largest Player

North America is growing rapidly because BOPIS (buy-online-pick-up-in-store) services, subscription boxes, and same-day delivery have grown in popularity. Packaging that can manage quick distribution, simple returns, and uniform branding across all touchpoints is what retailers will need. Demand in the future will favor affordable, eco-friendly, and lightweight formats that facilitate quick logistics and a positive customer experience.

In the U.S., the omnichannel packaging market will see strong future demand as fulfillment centers, last-mile networks, and retail giants scale up operations. Companies will prioritize packaging that reduces shipping costs, prevents product damage during rapid delivery cycles, and supports efficient returns. The market will increasingly focus on recyclable, personalized, and automation-ready packaging formats to meet evolving customer expectations.

Latin America is growing as retail channels become more integrated, and digital shopping expands. Businesses will need packaging that can survive long shipping distances, a variety of delivery circumstances, and changes in the weather. Cost-effective, long-lasting, and recyclable materials will be in high demand as retailers bolster their omni-channel capabilities throughout the region.

Brazil Omnichannel Packaging Market Trends

Brazil is growing rapidly, driven by a rise in e-commerce platforms, logistics networks, and hybrid retail models expanding. Businesses will look for packaging that ensures safe delivery over long routes and performs well in different weather conditions. The shift toward recyclable, reusable, and lightweight packaging will intensify as companies try to cut costs and improve customer satisfaction.

How is Omnichannel Packaging Market Expanding in Middle East and Africa?

In MEA, the omnichannel packaging market will accelerate due to significant investments in logistics, growing online shopping, and expanding retail formats. Packaging that is long-lasting, heat-resistant, and efficient for long-distance shipping will be required by retailers. Packaging solutions that are lightweight, eco-friendly, and multipurpose will become more significant as the area integrates traditional retail distribution with e-commerce.

UAE Omnichannel Packaging Market Trends

In the UAE, the omnichannel packaging market will see high future demand driven by booming e-commerce, premium retail experiences, and frequent promotional activities. Brands will focus on packaging that delivers durability, strong aesthetics, and sustainability. Adoption of smart packaging, such as QR-enabled or traceable designs, will grow as companies enhance customer engagement across online and offline platforms.

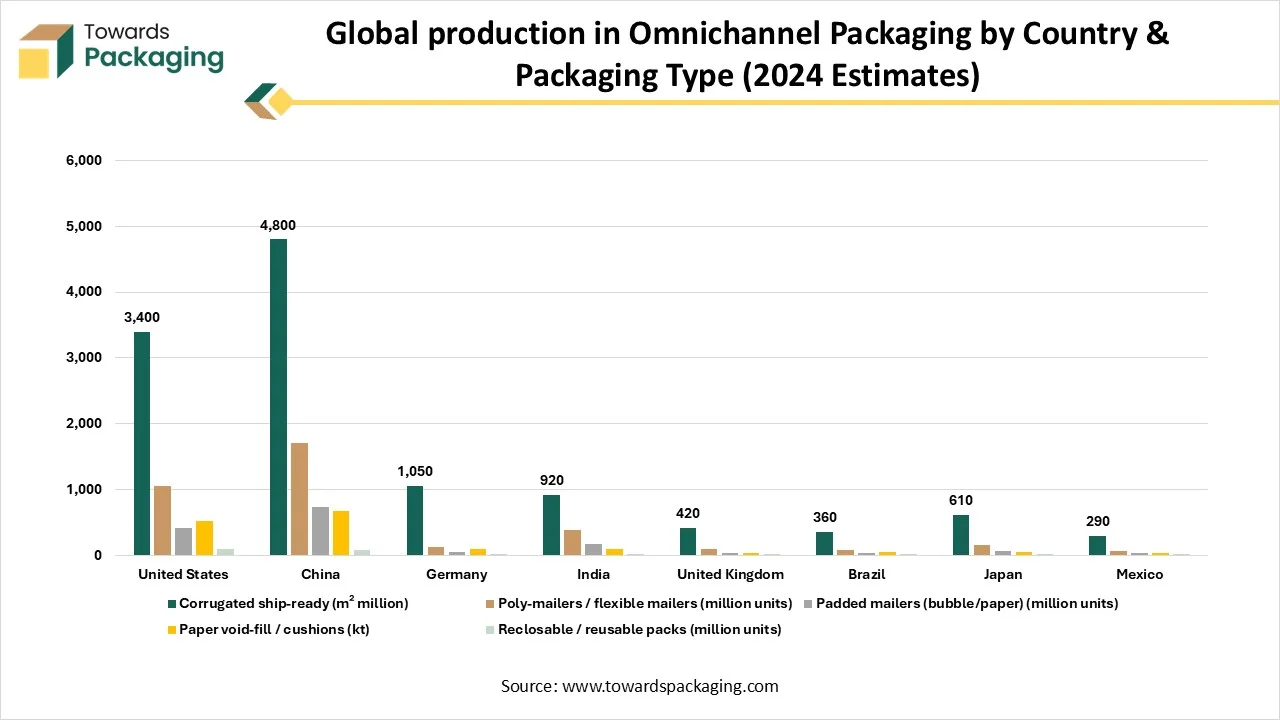

(Units: corrugated boxes - million m² equivalent; mailers - million units; padded mailers - million units; paper void-fill - kilotons; returnable/reusable packs - million units)

| Country / Region | Corrugated ship-ready (m² million) | Poly-mailers / flexible mailers (million units) | Padded mailers (bubble/paper) (million units) | Paper void-fill / cushions (kt) | Reclosable / reusable packs (million units) |

| United States | 3,400 | 1,050 | 420 | 520 | 95 |

| China | 4,800 | 1,700 | 740 | 680 | 75 |

| Germany | 1,050 | 120 | 55 | 90 | 18 |

| India | 920 | 380 | 170 | 95 | 12 |

| United Kingdom | 420 | 95 | 42 | 38 | 9 |

| Brazil | 360 | 80 | 30 | 45 | 6 |

| Japan | 610 | 150 | 60 | 48 | 11 |

| Mexico | 290 | 65 | 28 | 30 | 5 |

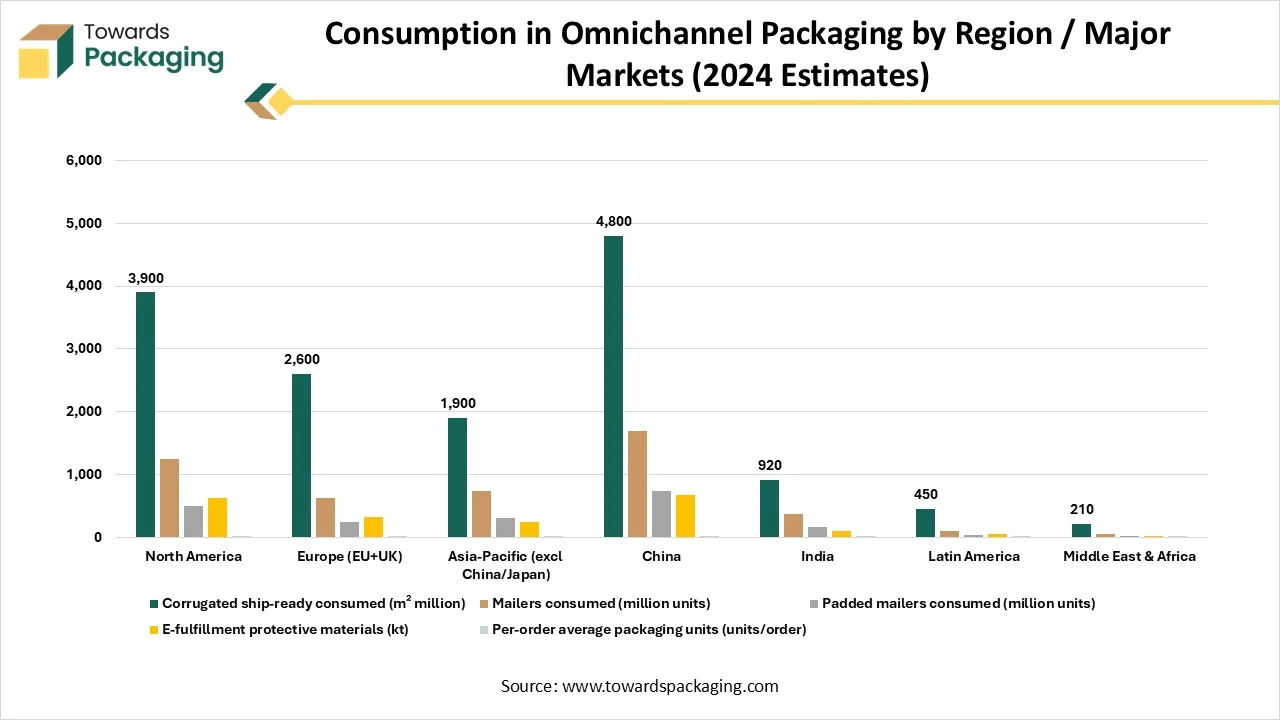

(Units: million units or kt as shown)

| Region / Country | Corrugated ship-ready consumed (m² million) | Mailers consumed (million units) | Padded mailers consumed (million units) | E-fulfillment protective materials (kt) | Per-order average packaging units (units/order) |

| North America | 3,900 | 1,250 | 500 | 620 | 1.8 |

| Europe (EU+UK) | 2,600 | 620 | 250 | 320 | 1.6 |

| Asia-Pacific (excl China/Japan) | 1,900 | 740 | 310 | 240 | 1.4 |

| China | 4,800 | 1,700 | 740 | 680 | 2 |

| India | 920 | 380 | 170 | 95 | 1.3 |

| Latin America | 450 | 95 | 40 | 60 | 1.5 |

| Middle East & Africa | 210 | 55 | 22 | 28 | 1.2 |

In omnichannel packaging, AI performs a role in customization and enhancing the whole consumer experience across numerous channels. Artificial intelligence for omnichannel marketing processes can be leveraged to analyze, collect, and utilize data from several sources, offering traders insights and competencies that were formerly inconceivable. The growth of artificial intelligence has catalysed noteworthy progressions in retail procedures. From demand prediction to dynamic charges, AI-driven resolutions authorize vendors to make data-driven choices and stay ahead of the curve. Omnichannel packaging powered by AI actually allows end-to-end personalization.

Improving Consumers' Experience

The rising concern of the brands towards improving consumers' experience majorly drives the omnichannel packaging market. The enhancement in the experience of customers attracts more consumers to this market. There are several factors driving this market to grow rapidly, such as brand consistency, accurate inventory, better customer data, increased operational efficiency, personalization, better customer insight, multichannel, flexibility, and various other factors. Product packaging that offers the same presentation on the shelf, online, and during the distribution chain. With the fast technical progress, traditional sellers have erased their contributions to multiple stages and are no longer limited to just in-store deliveries.

What Restricts the Growth of the Omnichannel Packaging Market?

Issues such as operational complexity, regulatory requirements, and technological integration problems are the major hindrances to the growth of the omnichannel packaging market. The major issues exist in internal alignment and communication across several departments, such as production, marketing, and logistics. It fosters cross-departmental association to confirm that packaging resolutions fulfil the different requirements of this market.

Evolving Customer Behaviour

There is constant change in the behaviour of the customers towards packaging of the products, technological enhancement, delivery pattern, and several others, which have led to the growth of the omnichannel packaging market. The major opportunity for the rapid development of this market is the smart packaging pattern, which comprises NFC tags, RFID, and QR codes that provide brands the capacity to deliver customized products. The innovation in this sector works as a bridge to fill the gap existing between online and offline experience by generating worthy interactions, which will help the brands to improve their reliability.

With the increasing demand for environment-friendly packaging, the scope for development of the omnichannel packaging market rises significantly. The development of direct-to-consumer (DTC) models fuels the scope for packaging that enhances the branding tools. The data analytics provide noteworthy potential for the development of this industry. This packaging solution can be incorporated with an advanced tracking process for collecting information about consumer preferences, handling conditions, and product movement.

(Revenue = packaging-related revenue where available; capacity ≈ annual installed output or converting capacity)

| Company | HQ | Primary omnichannel products / services | Estimated 2024 omnichannel packaging revenue (USD billion) | Estimated production / converting capacity (million units / yr) | Global sites |

| Smurfit Kappa | Ireland | Corrugated, ship-ready, e-fulfilment solutions | 7.2 | 2,400 (m² million corrugated) | 350 |

| DS Smith | UK | Corrugated e-commerce boxes, right-sizing tech | 5.6 | 1,900 (m² million) | 220 |

| Amcor (e-commerce segment) | Australia/Switz. | Flexible mailers, protective sleeves, mailers | 3.8 | 1,100 (million mailers) | 120 |

| Mondi | Austria/UK | Mailers, padded mailers, paper void-fill | 2.9 | 700 (million mailers & padding) | 120 |

| Ranpak | USA/Netherlands | Paper void-fill systems, automation for e-commerce | 0.37 | 142,000 installed systems (global) | 20+ |

| Sealed Air (including Cryovac/Sealedair e-commerce) | USA | Protective fillers, automated pack lines | 3.1 | 250 (kt protective materials) | 100 |

| WestRock / International Paper | USA | Corrugated, mailer boxes, fulfilment services | 6.4 (combined est.) | 2,000 (m² million corrugated) | 300 |

| Aptar (ecommerce/dispensing) | USA/France | Dispensing & omnichannel closures, small dispensers | 1.1 | NA (dispensing components) | 40 |

| Soneva / Hobby & Niche converters | Various | Custom reusable/reclosable packs & subscription packaging | 0.5 (aggregated niche) | 60 (m units) | 80 |

| Huhtamaki / Greiner | Finland / Austria | Mailers, molded fiber protective trays | 1 | 200 (m units) | 60 |

The corrugated boxes segment is expected to have a considerable share of the omnichannel packaging market in 2024 due to its cost-effectiveness, versatility, and durability. These boxes fulfil the necessity of the consumers. Their structural strength makes them suitable for delivering a huge variety of products from food and electronics to apparel and household products. The requirement for this packaging is to safely transport and storage several products that improve the branding significantly. Corrugated boxes are biodegradable and recyclable, which increases the preference of brands to use them.

The protective packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This segment is growing rapidly due to the growing demand for safety assurance at the time of high-volume logistics procedures. Protective packaging resolution, like foam inserts, bubble wrap, product stabilization, and impact resistance, readily decreases return rates or breakage issues.

The paper and paperboard segment is expected to dominant over the omnichannel packaging market in 2024 due to its versatility, consumer appeal, and sustainability. With the growth of omnichannel, packaging companies are searching for enhanced packaging solutions with the growing demand for eco-friendly packaging. The expansion of omnichannel packaging has raised the demand for packaging that is adaptable across the world in both the in-store and e-commerce industries. Paper-based resources fulfil the requirement by providing lightweight yet strong protection and an easy-to-customize option.

The bioplastic segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This sector is rising due to its unique capacity to combine ecological sustainability with functional presentation. Bioplastics provide a compelling substitute for petroleum-based plastics. Their qualities, such as moisture-resistance, durability, and flexibility, increase the demand for this material for packaging purposes.

The e-commerce and retail segment is expected its dominance the omnichannel packaging market in 2024 due to the changing digital and physical shopping experience. The continuous shift towards online shopping and the growing retail market has influenced the development of omnichannel packaging. This packaging confirms the protection of the products during delivery and improves the unboxing experience. In the meantime, in physical marketing, packing must be visually attractive, shelf-ready, and proficient of interactive brand value rapidly.

The healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. It is because of the strong requirement for safety, reliability, and compliance, as there is a rapid growth in the adoption of omnichannel packaging in the healthcare and pharmaceutical sector. The rising demand for secure and specialized packaging has influenced the demand for omnichannel packaging.

The online segment is expected to dominant over the omnichannel packaging market in 2024 due to the rapid development of e-commerce and changing customer shopping patterns as more customers choose online shopping for convenience in several sectors, from electronics to groceries. The online trade needs packaging that can withstand adverse ecological conditions during the time of last-mile shipping and storage. The growth in DTC models has raised higher importance of attractive and unique packaging to enhance the unboxing experience and influence the loyalty of consumers.

The offline instruments segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. The increasing demand for checking the quality of the packaging has raised the demand for offline shopping of products such as food and beverages, electronics, and many others. The offline channel for packaging is designed with customer engagement and shelf appeal. Enhanced quality printing with vibrant colours and unique designs, and these are important for manufacturing resources such as glass, paperboard, and flexible plastics, generally utilized for offline retail packaging.

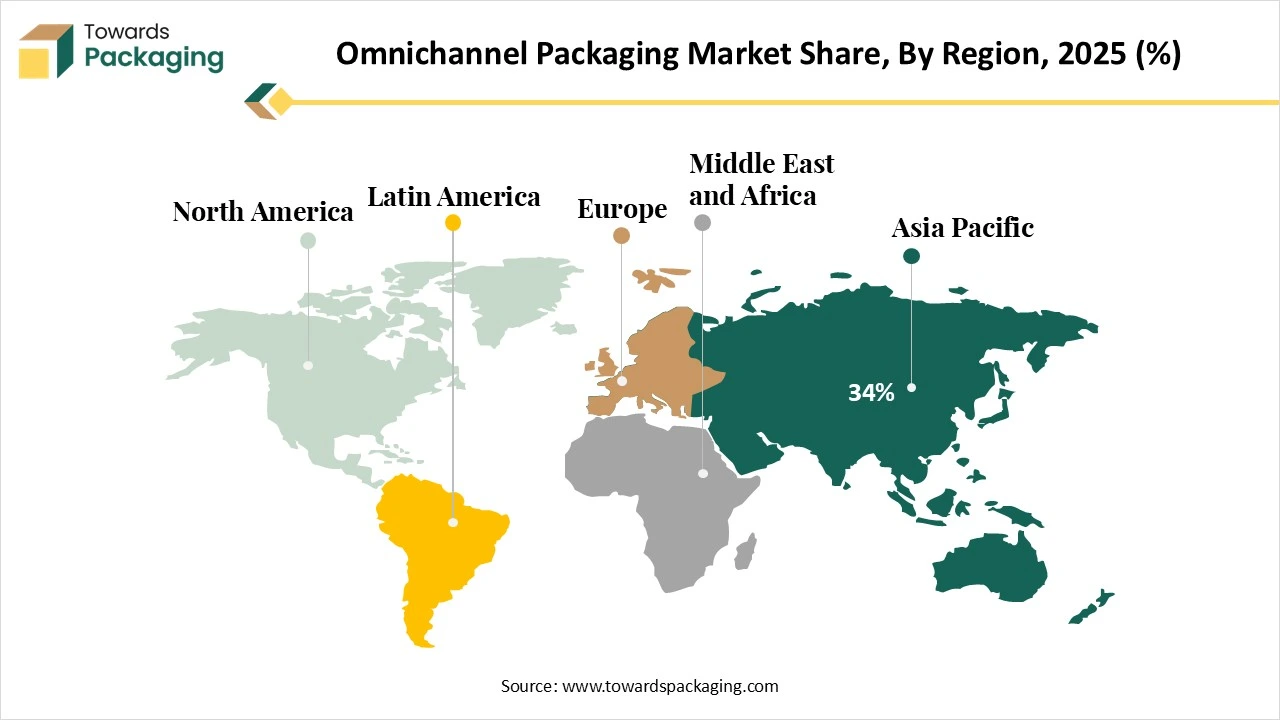

The Asia Pacific region held the largest share of the omnichannel packaging market in 2024, due to the rapid urbanization and increasing consumer demand for customized and convenient packaging. In countries such as India, Japan, China, South Korea, and Thailand, there is a huge support for the omnichannel packaging sector due to the rapid growth of the digital world. The growing influence of sustainable packaging has compelled the major market players to introduce innovation in this field.

How is India Booming in Asia Pacific’s Omnichannel Packaging Market?

India is growing as organized retail, quick-commerce, and e-commerce all keep growing together. Packaging that works well for a variety of delivery methods, from in-store pickup to doorstep drop-offs, will be sought after by brands. Stronger, lighter, and recyclable packaging formats that lessen damage and promote sustainable operations will become more popular as consumer demands for speed and safety rise.

Europe is estimated to grow at the fastest rate in the omnichannel packaging market during the forecast period. This growth is due to the rapid technological advancement and enhanced regulatory pressure from the supervisory bodies. The continuous evolution in the rules of the packaging sector regarding the resources utilized is influencing the demand of the market in this region. The growing adoption of ecological packaging by brands influenced the demand for omnichannel packaging. With the incorporation of advanced technology for intelligent packaging, the demand for this market is influenced.

| Supplier / Vendor | Product / service | Annual output / installed base (estimate) | Major markets served |

| Stora Enso / International Paper (containerboard) | Containerboard / kraftliner (kt) | 28,000 kt combined | Global (NA, EU, APAC) |

| Mondi / Smurfit (converted mailers) | Flexible mailers & padded mailers (million units) | 1,300 million units (combined) | EU, NA, APAC |

| Ranpak / FP International | Paper void-fill & systems (installed systems) | 142,700 systems (Ranpak est.) | Global warehouses & 3PLs |

| H.B. Fuller / Henkel | Adhesives, tapes, sealants for e-commerce | 210 kt adhesive solutions | Global |

| Sidel / Krones / KUKA | Automation & packing lines (units installed) | 15,000 fulfilment/pack lines | Global |

| Novelis / Alcoa (aluminum for protective liners) | Aluminum foil / liners (kt) | 1,900 kt (combined) | NA, EU, APAC |

| Avery Dennison / UPM Raflatac | Labels & RFID / smart labels (million m²) | 4,200 m² labels (est.) | Global |

| Sealed Air (protective films) | Cushions, bubble alternatives (kt) | 320 kt protective materials | Global |

| Resin / barrier film suppliers (Dow, BASF) | Barrier films & coatings (kt) | 250 kt specialty films | Global |

| Packaging IT / software (Pacd, Packsize) | Right-sizing/OMS integration (installations) | 12,000+ right-size installations | NA, EU, APAC |

By Packaging Type

By Material

By End-Use Industry

By Channel Type

By Region

February 2026

February 2026

February 2026

February 2026