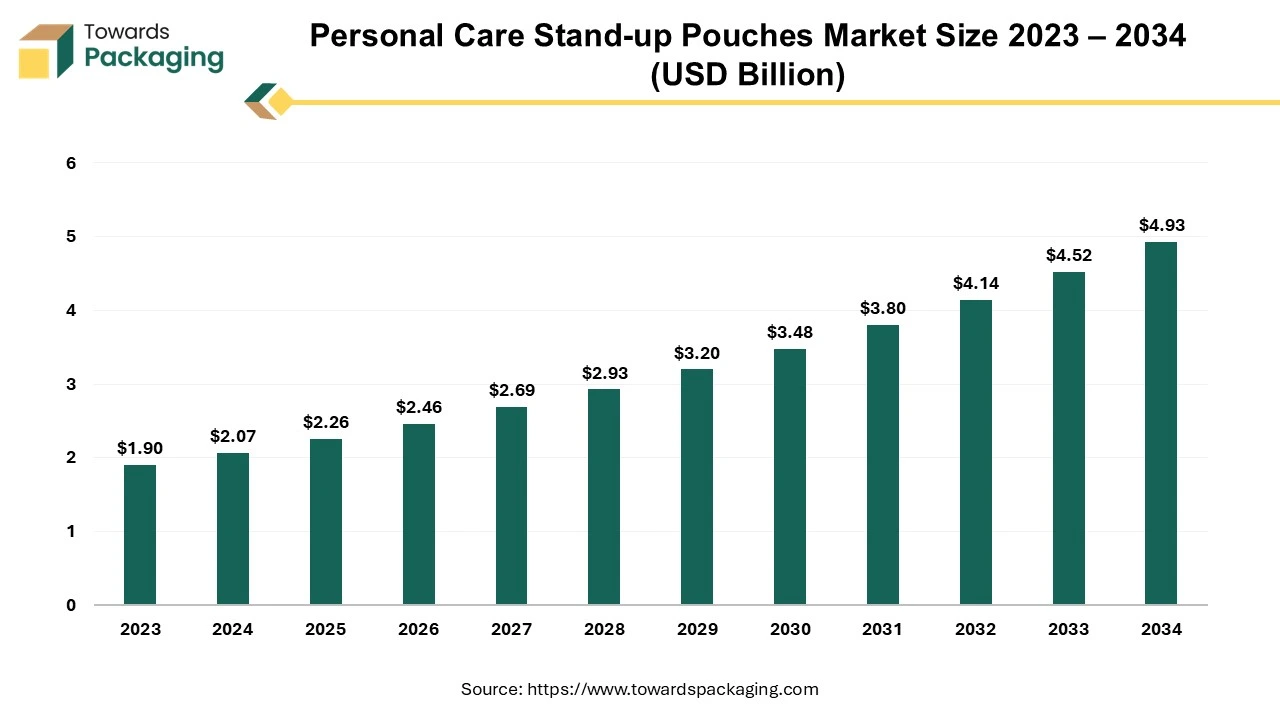

The personal care stand-up pouches market is forecasted to expand from USD 2.46 billion in 2026 to USD 5.37 billion by 2035, growing at a CAGR of 9.05% from 2026 to 2035. It presents detailed segment data showing the dominance of valve-type pouches and the strong presence of the cosmetics segment. Regional insights highlight North America as the 2024 leader, with Asia-Pacific projected to grow fastest. The report also includes competitive analysis, value chain structure, raw material mapping, global trade data, and a complete profile of leading manufacturers and suppliers.

With the rising demand for portion control cosmetic products, the demand for stand-up pouches is increasing. The rising awareness of personal hygiene and skincare boosts the demand for personal care products, significantly fueling the growth of the market. Moreover, ongoing innovations in recycling technologies to reduce the waste of stand-up pouches are projected to enhance market growth in the upcoming period.

Personal care stand-up pouches are convenient, flexible packaging solutions for personal care products like skincare, haircare, cosmetics, fragrance, oral care, and many more. They are convenient due to their ease of use and portability, making them suitable for on-the-go use. Growing sustainability concerns, premiumization, and the growth of e-commerce are the key factors driving the growth of personal care stand-up pouches.

Regulatory affairs initiatives are boosting the growth of the personal care stand-up pouches market. Several government entities are imposing strict regulations on using single-use plastic packaging due to increasing environmental concerns. Stand-up pouches are recyclable and biodegradable, which maintains environmental sustainability. They protect packaged products and are lightweight and affordable.

Environmental regulations enhance the production of eco-friendly packaging solutions like stand-up pouches in the personal care industry, support the circular economy, and promote the importance of upcycling and recycling. Environmental regulations like carbon footprint reduction targets and waste reduction laws are driving innovations for sustainable packaging solutions.

The demand for sustainable packaging materials like bioplastics and recyclable materials is increasing due to rising environmental concerns. Carbon and greenhouse gas emissions concerns are responsible for boosting the adoption of sustainable stand-up pouches. Major companies are innovating and investing heavily to increase the production of such pouches. Several cosmetic brands focus on reducing their carbon footprints, boosting the demand for sustainable packaging solutions. Moreover, government and regulatory bodies are investing and encouraging businesses to innovate in research and development for smart, sustainable personal care stand-up pouches.

Significant expansion into emerging markets further propels the market growth. Due to the growing awareness about personal hygiene, people are increasingly embracing personal care products. Moreover, consumers' increasing disposable income and growing urbanization contribute to market growth.

Technological advancements in packaging processes create immense opportunities in the market. Implementing artificial intelligence, automation, and robotics boosts the packaging process by reducing manual errors and material waste. Technology advancements also help improve the performance of materials like PE, PP, and PET used for personal care stand-up pouches.

Moreover, technological advancement can boost purchase rates by focusing on customizing packaging solutions. Advancements in nanotechnology improve barrier resistance properties and boost the development of sustainable materials. Additionally, 3D printing technology helps to reduce production costs and enhance packaging designs, which drives consumer attraction toward personal care stand-up pouches. Advanced technology in manufacturing can enhance quality, efficiency, and productivity, which improves customer experiences.

North America dominated the personal care stand-up pouches market with the largest share in 2024 due to the presence of major personal care brands. There is a high demand for premium personal care and cosmetic products in the region, driving the demand for personal care stand-up pouches. With growing sustainability concerns and the adoption of eco-friendly products, the U.S. led the market. The expansion of e-commerce has influenced the demand for premium and luxury personal care products in the country. Moreover, the rising need for customized packaging and regulatory frameworks bolstered the market.

The growing middle-class population and awareness of hygiene and personal care contribute to market growth in Asia Pacific. China is the leading country in the market due to its increased population and demand for premium skincare products. India is the second-largest country in the region, holding a large market share. Increasing demand for cosmetics, growth of e-commerce, and government regulations on reducing the use of single-use plastic boost the market in the region. Moreover, the rising usage of premium skincare products fuels the regional market growth.

By type, the global personal care stand-up pouches market is divided into with valves and without valves. The with valves segment dominated the market in 2024 due to its convenience and portability. Increasing demand for liquid personal care products, like shampoo, liquid soaps, creams, lotions, and conditioners, is the major factor driving segment growth.

The body care segment is projected to expand at the fastest rate during the forecast period. The rising demand for high-quality and effective body care products is a major factor boosts the segmental growth. Increased awareness of the importance of body care boosts the demand for creams, lotions, and moisturizers, significantly fueling the growth of the segment. Increasing demands for natural and organic body care products and the need for protective packaging are contributing to segmental growth. Additionally, the rising demand for premium and luxury body care products propels the segment.

| Source | 2020 | 2021 | 2022 | 2023 | 2024 |

| Flexible Packaging | 2.31 B | 2.40 B | 3.62 B | 3.33 B | 3.32 B |

| Corrugated Packaging | 1.64 B | 2.12 B | 2.51 B | 1.96 B | 1.89 B |

| Uncoated Fine Paper | 1.28 B | 1.39 B | 1.32 B | 1.08 B | 1.07 B |

| Personal Care Components (Divested) | — | — | 144.19 M | — | — |

| Engineered Materials | 684.51 M | 721.06 M | — | — | — |

| Fibre Packaging | — | — | — | — | — |

| Consumer Packaging | — | — | — | — | — |

| Packaging Paper | — | — | — | — | — |

| South Africa Division | — | — | — | — | — |

| Corporate | — | — | — | — | — |

| Bags & Coatings | — | — | — | — | — |

| Merchant | — | — | — | — | — |

| Packaging South Africa | — | — | — | — | — |

| Containerboard | — | — | — | — | — |

| Business Paper | — | — | — | — | — |

| Country / Region | 2020 | 2021 | 2022 | 2023 | 2024 |

| Poland | 873.86 M | 1.07 B | 1.35 B | 1.11 B | 1.14 B |

| Austria | 944.09 M | 974.60 M | 1.40 B | 1.13 B | 994.66 M |

| Rest of Emerging Europe | 740.51 M | 1.03 B | 929.15 M | 771.45 M | 777.95 M |

| Rest of Western Europe | 569.83 M | 600.74 M | 757.66 M | 688.82 M | 610.34 M |

| Czech Republic | 462.26 M | 517.38 M | 699.64 M | 571.41 M | 596.79 M |

| South Africa | 363.59 M | 379.01 M | 569.09 M | 570.54 M | 564.63 M |

| North America | 427.59 M | 412.53 M | 540.94 M | 487.92 M | 548.54 M |

| Germany | 680.95 M | 758.02 M | 689.40 M | 503.57 M | 469.82 M |

| Turkey | — | — | 502.54 M | 370.50 M | 414.79 M |

| Other | 152.90 M | 124.62 M | 153.58 M | 170.47 M | 159.99 M |

| Russia | 707.62 M | 772.63 M | — | — | — |

| Asia and Australia | — | — | — | — | — |

| United Kingdom | — | — | — | — | — |

| Rest of Africa | — | — | — | — | — |

By Type

By Application

By Region

January 2026

January 2026

December 2025

November 2025