PP Rigid Plastic Packaging Market Growth Analysis, Market Size & Forecast 2025-2035

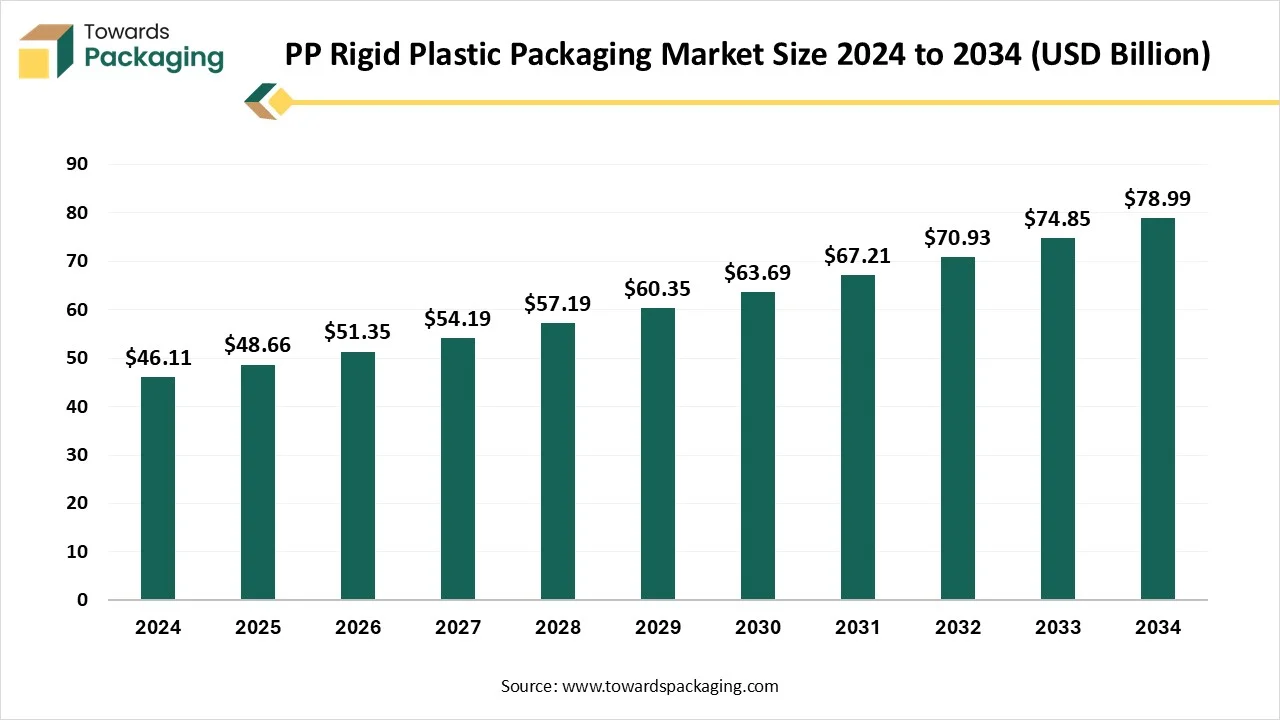

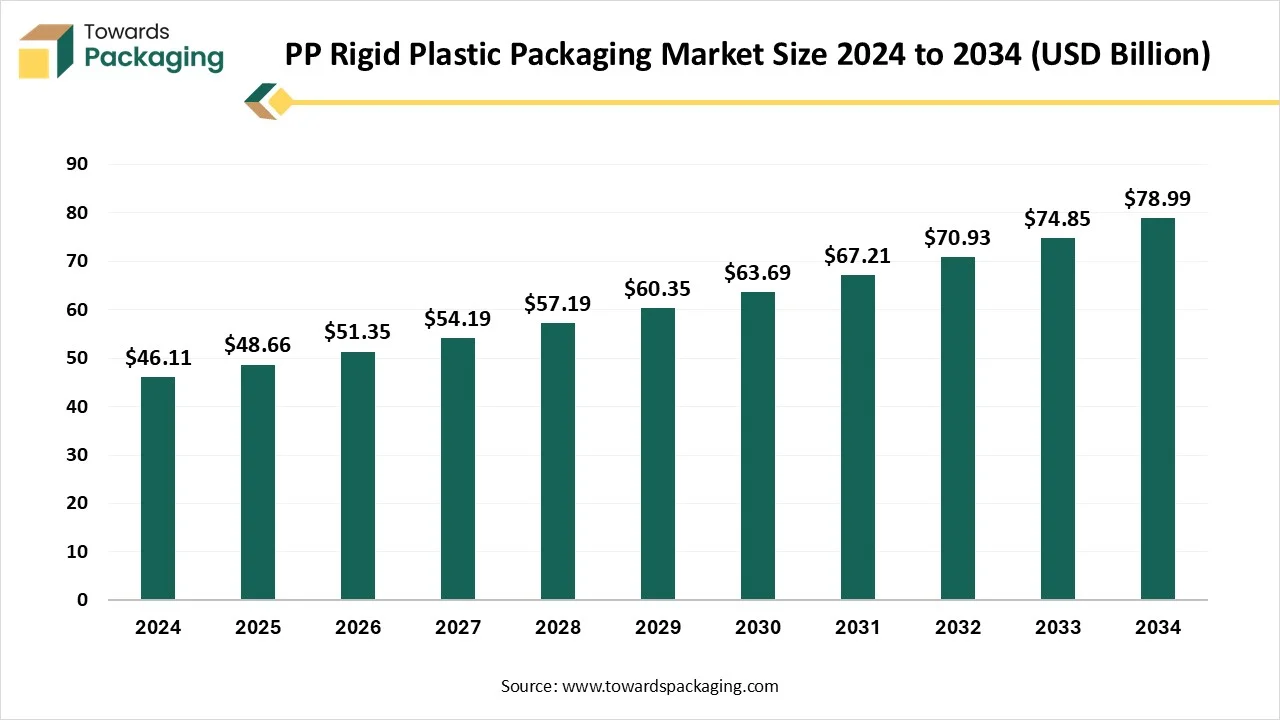

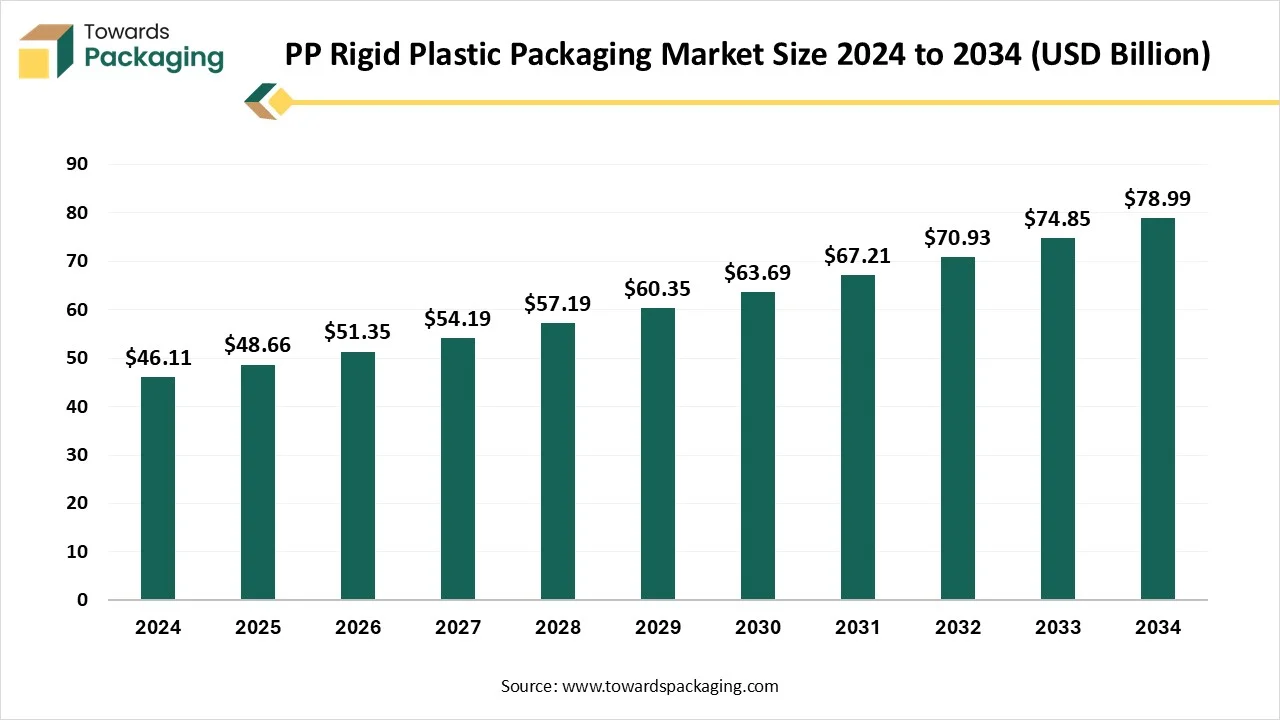

The PP rigid plastic packaging market is forecasted to expand from USD 51.35 billion in 2026 to USD 83.35 billion by 2035, growing at a CAGR of 5.53% from 2026 to 2035. This report delivers comprehensive insights into product categories, end-use industries, manufacturing processes, and distribution channels, with bottles & jars accounting for 38% share, food & beverage leading with 42%, injection molding dominating at 45%, and direct OEM/brand contracts holding 56% share in 2024.

The study provides in-depth regional analysis across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting Asia Pacific’s 44% dominance and MEA as the fastest-growing region. It also includes trade flow statistics, production and consumption volumes, recycling data, value chain analysis, and competitive profiling of key manufacturers and suppliers.

Key Takeaways

- In terms of revenue, the market is valued at USD 48.66 Billion in 2025.

- The market is expected to reach USD 83.35 Billion by the year 2035.

- Rapid Growth at a CAGR of 5.53% will be experienced in the year between 2025 and 2034.

- By region, Asia Pacific dominated the global market, having the largest share of 44% in 2024.

- By region, Middle East and Africa are predicted to grow at a notable CAGR between 2025 and 2034.

- By product category, the bottles and jars segment has contributed to the largest share of 38% in 2024.

- By product category, the containers and tubes segment will expand at a notable CAGR between 2025 and 2034.

- By end-use industry, the food and beverage segments have contributed to the largest share of 42% in 2024.

- By end-use industry, the healthcare and pharmaceuticals segment will expand at a significant CAGR between 2025 and 2034.

- By manufacturing process, injection moulding segments have contributed to the largest share of 45% in 2024.

- By manufacturing process, the blow moulding segment will stretch at a notable CAGR between 2025 and 2034.

- By distribution channel, the direct OEM / Brand contracts segment has contributed to the largest share of 56% in 2024.

- By distribution channel, e-commerce and B2B marketplaces will expand at a significant CAGR between 2025 and 2034.

Market Overview

The PP (polypropylene) rigid plastic packaging market covers durable, non-flexible packaging products made from polypropylene (homopolymer and copolymer grades) used to store, protect, and transport goods. Typical products include bottles, jars, tubs, caps & closures, trays, crates & pallets, clamshells, and rigid containers used across food & beverage, personal care, household, healthcare/pharma, industrial, and retail/e-commerce applications. PP is favoured for its chemical resistance, low density, heat resistance for hot-fill and sterilization, recyclability (mono-PP streams), and low cost making it a workhorse material for rigid packaging transformation and substitution away from heavier or multi-material formats.

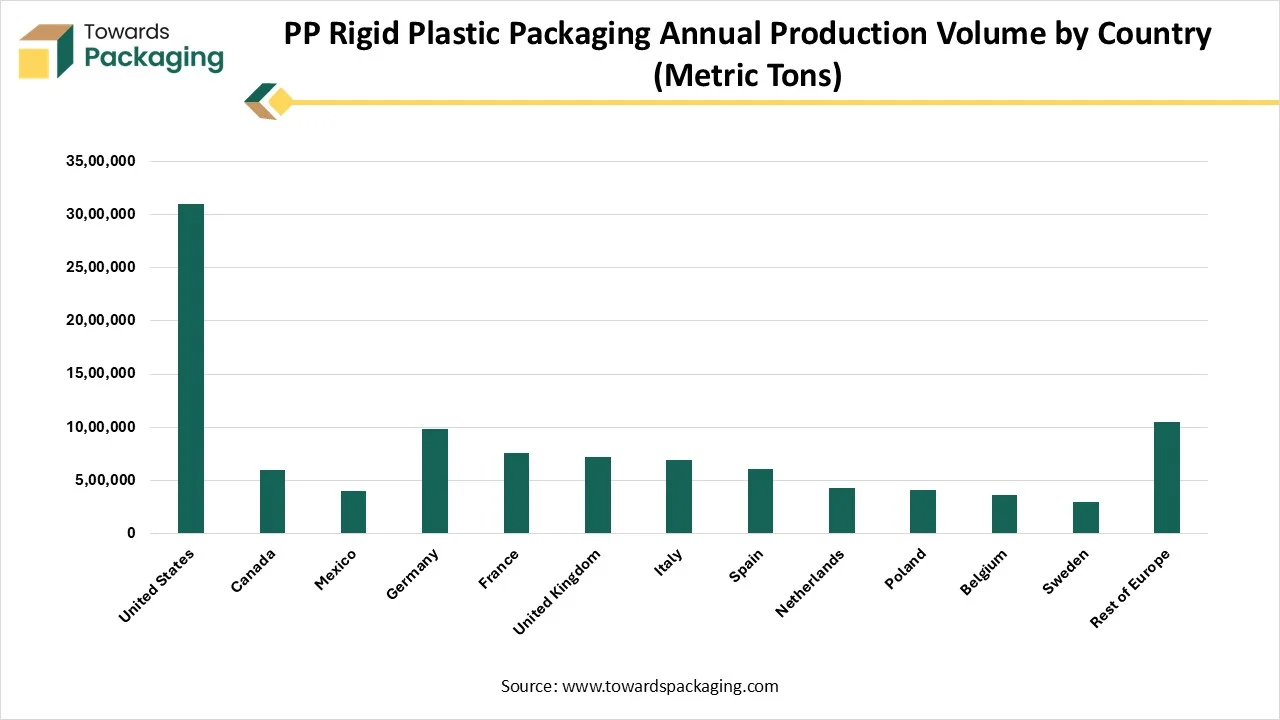

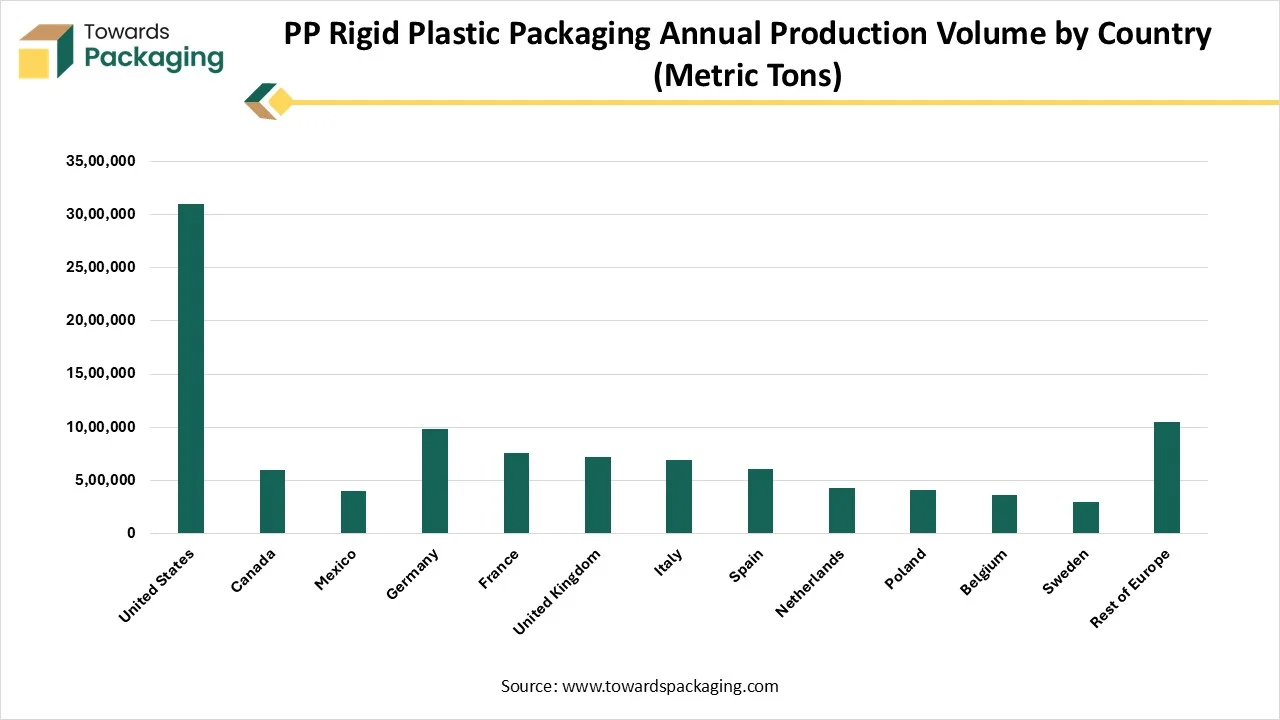

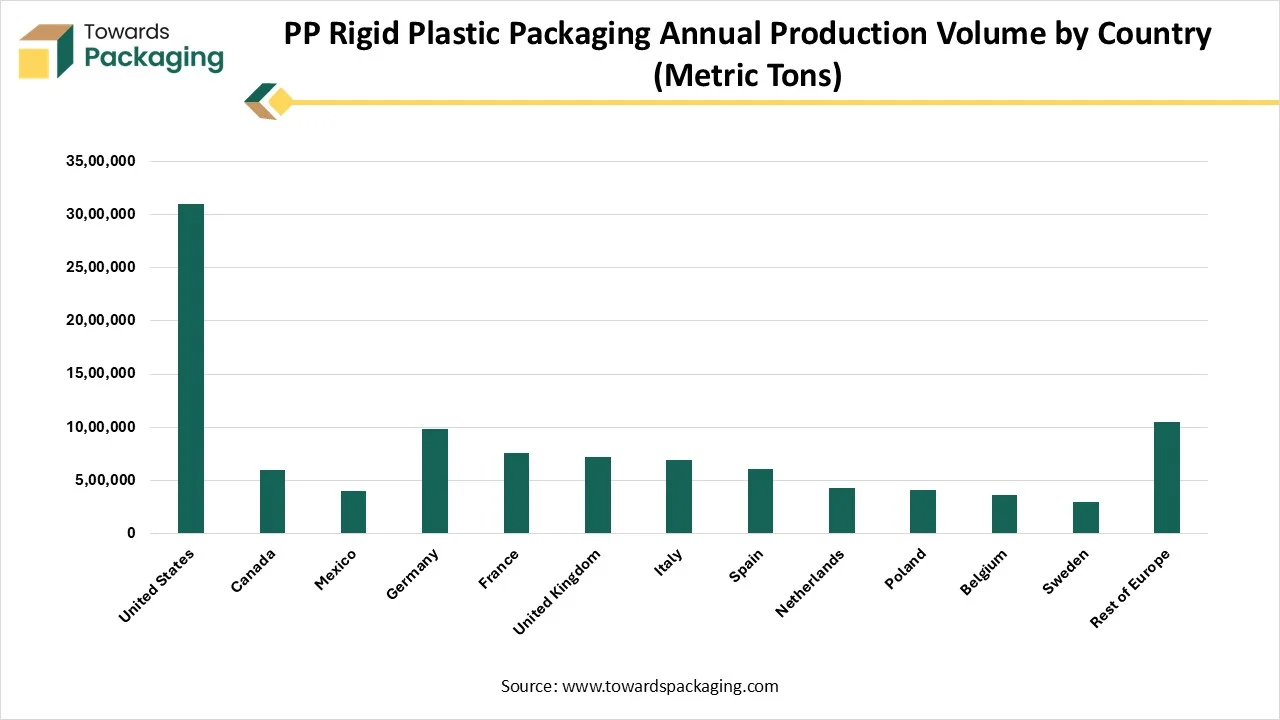

PP Rigid Plastic Packaging Annual Production Volume by Country (Metric Tons)

| Region |

Country |

Production |

| North America |

United States |

3,100,000 |

| North America |

Canada |

600,000 |

| North America |

Mexico |

400,000 |

| Europe |

Germany |

980,000 |

| Europe |

France |

760,000 |

| Europe |

United Kingdom |

720,000 |

| Europe |

Italy |

690,000 |

| Europe |

Spain |

610,000 |

| Europe |

Netherlands |

430,000 |

| Europe |

Poland |

410,000 |

| Europe |

Belgium |

360,000 |

| Europe |

Sweden |

300,000 |

| Europe |

Rest of Europe |

1,050,000 |

Emerging Trends in PP Rigid Plastic Packaging Market

- Circularity: Polypropylene rigid plastic is increasingly at the centre of circular economy strategies because of its recyclability, versatility, and wide usage in caps, food containers, closures, and bottles, too. Circularity in PP rigid packaging means designing products and systems so that material can flow continuously through the value chain without becoming waste.

- Smart Plastics: Masterbatch craftsmen are serving a series of smart plastics currently, which can protect against rodents, insects, and fire, reducing the decline of food. From insect-repellent plastic that prevents water irrigation systems in the surrounding areas, to smart plastics that discourage rodents, as these products are becoming available today, and display the supernatural capabilities of the plastics.

- Anti-Microbial Plastics: Antimicrobial plastics are high-level materials engineered to inhibit or eliminate the development of harmful micro-organisms such as fungi, bacteria, and viruses on their surface. These plastics are typically infused with agents like silver ions, zinc, or organic antimicrobial compounds during manufacturing, which continually serve protection without altering the physical properties of the plastic. Widely used in healthcare devices, food packaging, consumer electronics, and public touchpoints, antimicrobial plastics assist in tracking hygiene.

- Regulatory Frameworks: The regulatory framework that governs PP rigid plastic packaging is being driven by its huge usage in beverages, food, pharmaceuticals, and consumer goods, making safety, sustainability, and recyclability central concerns. In the United States, the Food and Drug Administration regulates polypropylene for food-contact use, making sure that additives, stabilizers, and processing aids align with toxicological safety standards.

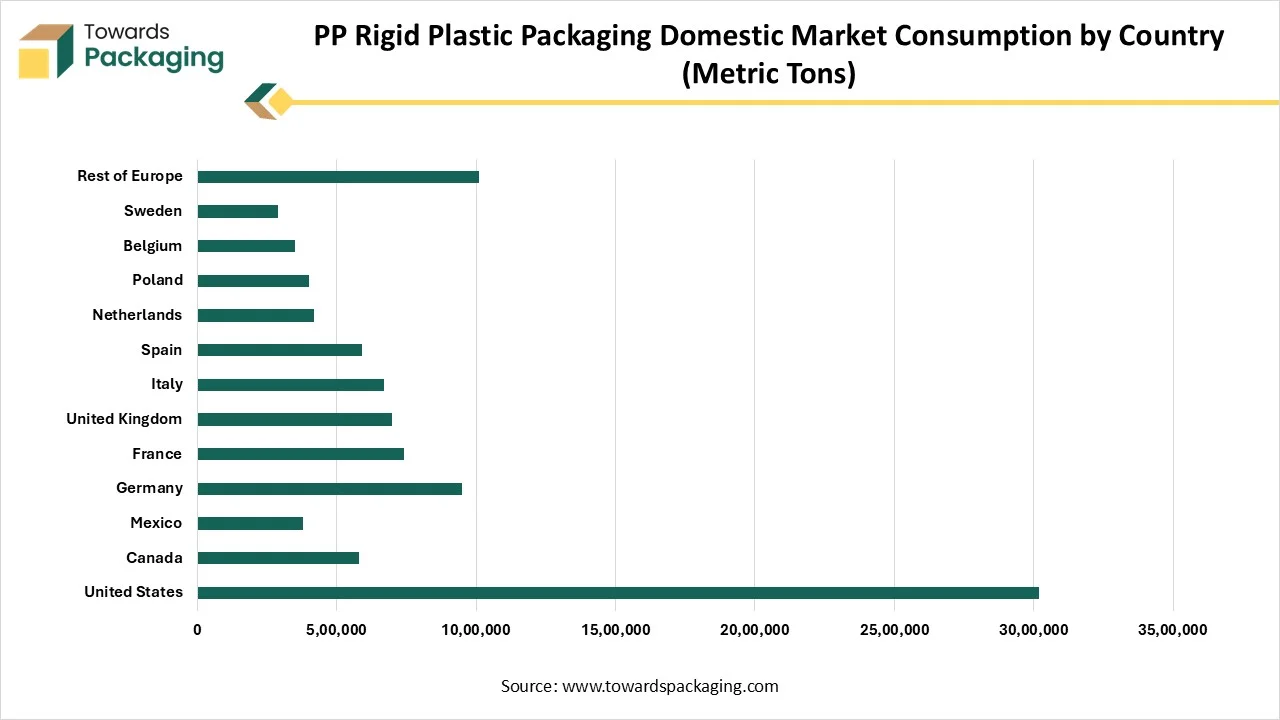

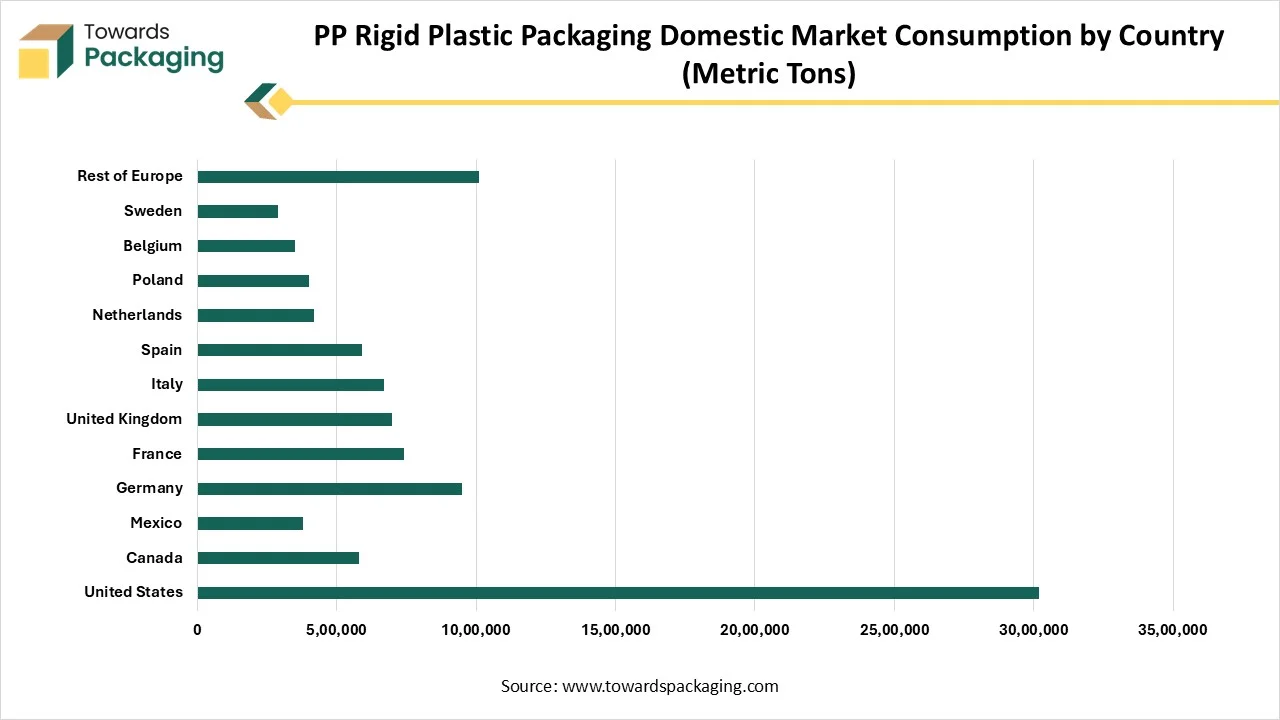

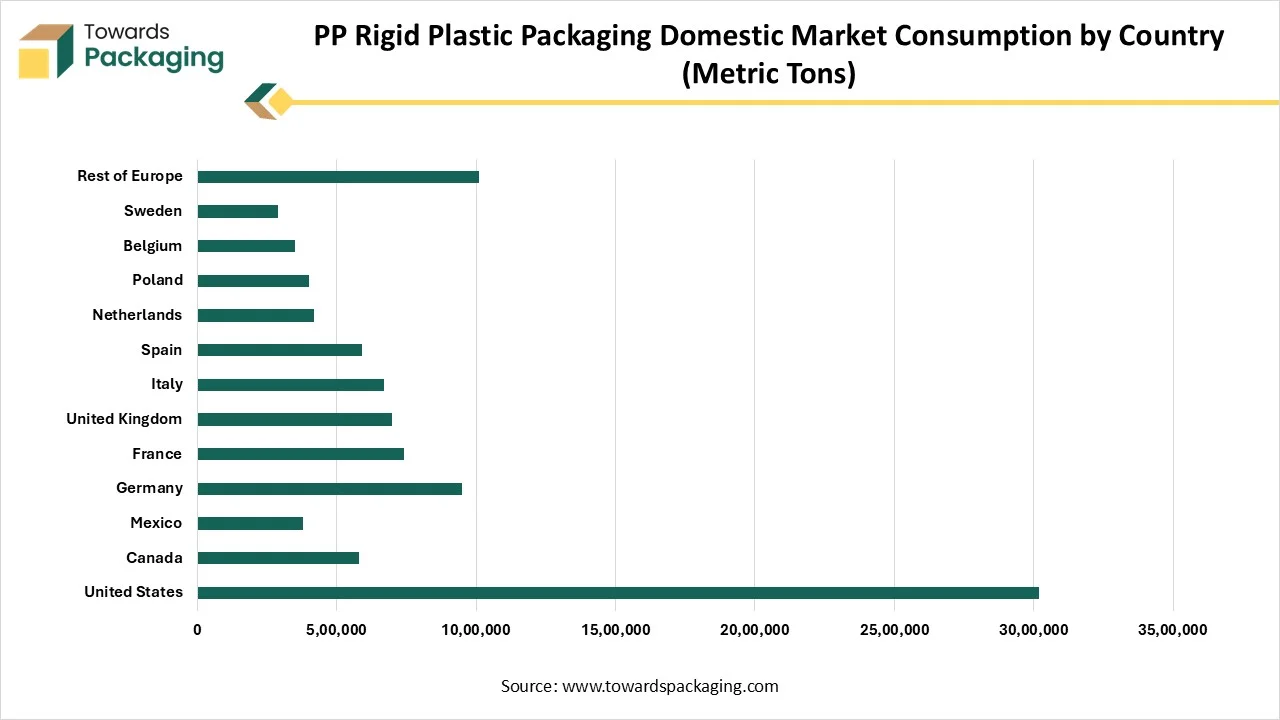

PP Rigid Plastic Packaging Domestic Market Consumption by Country (Metric Tons)

| Region |

Country |

Consumption |

| North America |

United States |

3,020,000 |

| North America |

Canada |

580,000 |

| North America |

Mexico |

380,000 |

| Europe |

Germany |

950,000 |

| Europe |

France |

740,000 |

| Europe |

United Kingdom |

700,000 |

| Europe |

Italy |

670,000 |

| Europe |

Spain |

590,000 |

| Europe |

Netherlands |

420,000 |

| Europe |

Poland |

400,000 |

| Europe |

Belgium |

350,000 |

| Europe |

Sweden |

290,000 |

| Europe |

Rest of Europe |

1,010,000 |

How Artificial Intelligence Has Contributed Towards The PP Rigid Plastic Packaging Market?

AI-powered vision systems can detect packaging quickly and precisely, making sure quality standards are aligned. These kinds of systems can detect defects, like scratches, dents, or printing issues, in real time, mainly lowering the risk of faulty products reaching the sector. The usage of AI is leading to the development of predictive maintenance systems, which can identify potential problems even before they occur. , reducing the risk of machine failure and unscheduled downtime. In the current term, both OEMs and consumer packaged goods producers believe that predictive maintenance will be where AI has its perfect impact. Furthermore, AI-driven robots are changing packaging operations, growing in accuracy and speed. These robots can carry out repetitive tasks, like placing, picking, and packaging items, which frees human workers for more value-added activities. High-level AI AI-Algorithms streamline programming and allow robots to accept transforming conditions, which makes them highly versatile in different packaging landscapes.

- In March 2025, the Reclaim Project, which is managed by a Consortium of European Entities and funded by the European Union’s Horizon 2020 program, has grown into a low-cost and portable artificial intelligence (AI) -AI-powered robotic recycling plant that assists primarily and will be implemented in the Greek Islands.

Market Dynamics

Market Driver

Polypropylene And Its Importance

One of the compelling aspects of polypropylene is the classification of grades that are available for this polymer, each with its different characteristics and behaviours. The three main grades of polymer that drive the PP rigid plastics packaging are random copolymer, homopolymer, and impact copolymer. Homopolymer PP stands out as the strongest grade among all. Random copolymer stands for PP resins incorporating ethylene, which develops the power and serves a soft texture as compared to homopolymers. And finally, block copolymer PP resins have a higher ethylene content, resulting in a strong material with exceptionally effective resistance, even in low-temperature surroundings. ICPG serves polypropylene rollstock formulations in three grades to meet a variety of products for packaging demands.

Market Restraint

Limitations of Accurate Engineering

Polypropylene has a big Coefficient of Thermal Expansion (- -150 Mm/°C) which is responsible for dimensional transformations under Temperature fluctuations. This limits the usage in terms of precision engineering or high-temperature surroundings unless linked with Stabilizers or Fillers like Glass Fiber in order to reduce deformation. The material’s Non-Polar Surface has adhesion that makes it challenging to paint or Glue without personalized Surface Treatments. Painting often needs Primers, while bonding totally depends on cyanoacrylate adhesives or Epoxy that is crafted for Polyolefins.

Market Opportunity

Sustainable Solutions are the Future of PP Rigid Plastic Packaging

Invention in plastic packaging is accelerating, driven by the demand for more sustainable solutions and the urge to align with growing consumer choices. One of the main inventions is the growth of compostable and biodegradable plastics, whose goal is to reduce environmental impact. These alterations to regular plastics are crafted to break down conveniently and lower the load on oceans and landfills. Another space for invention is smart packaging that includes technologies like RFID tags and QR codes to serve users with more information about the item, including the ingredients, starting points, and surrounding impact. These technologies not only develop the user experience but also assist in perfect inventory management and traceability for generators.

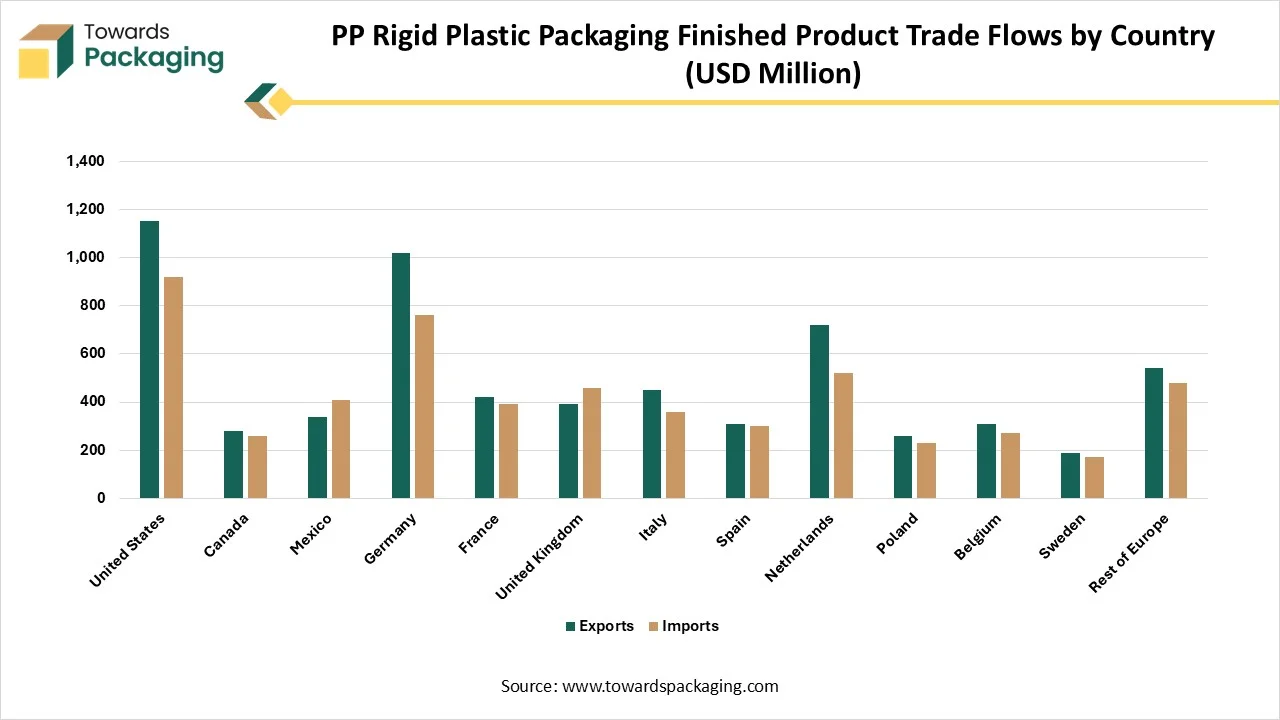

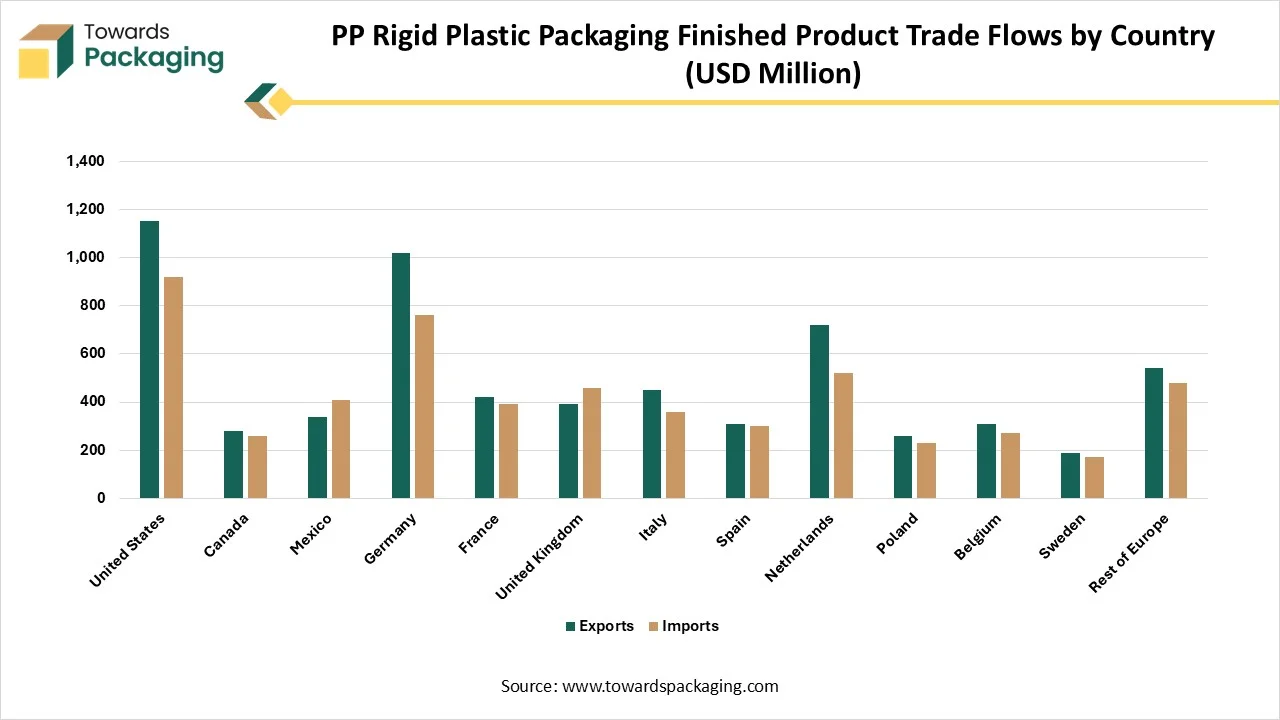

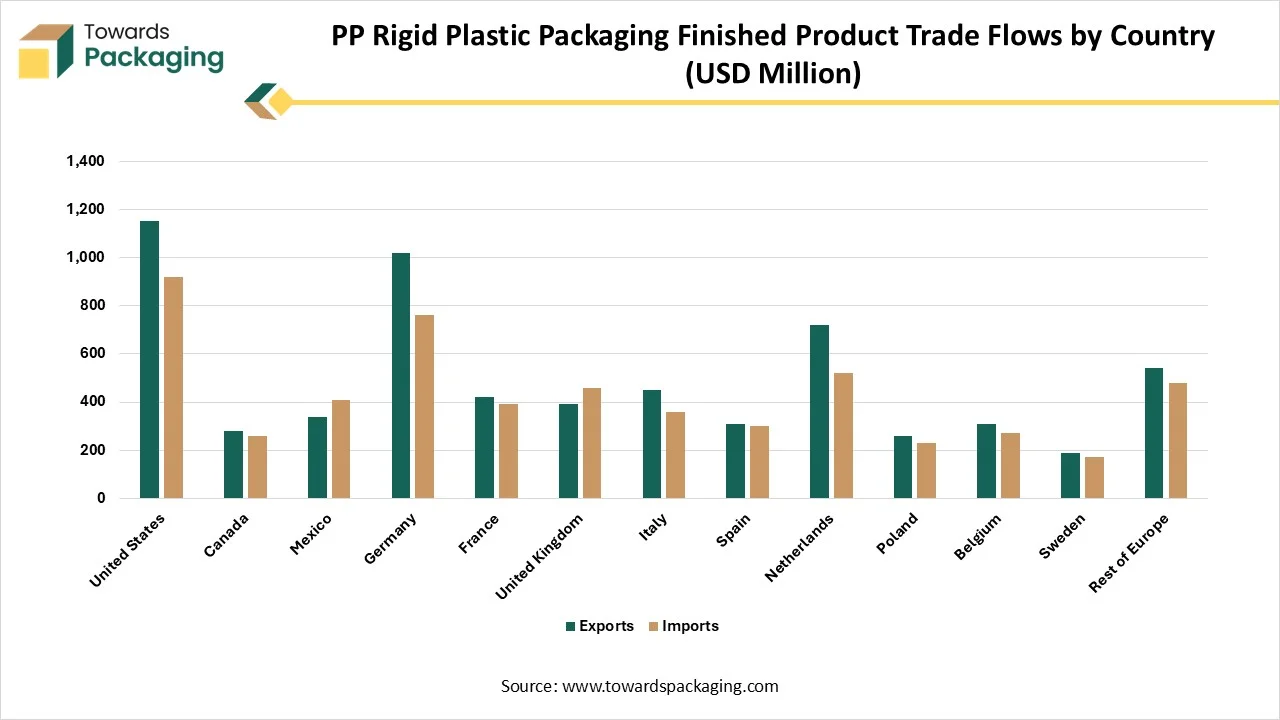

PP Rigid Plastic Packaging Finished Product Trade Flows by Country (USD Million)

| Region |

Country |

Exports |

Imports |

| North America |

United States |

1,150 |

920 |

| North America |

Canada |

280 |

260 |

| North America |

Mexico |

340 |

410 |

| Europe |

Germany |

1,020 |

760 |

| Europe |

France |

420 |

390 |

| Europe |

United Kingdom |

390 |

460 |

| Europe |

Italy |

450 |

360 |

| Europe |

Spain |

310 |

300 |

| Europe |

Netherlands |

720 |

520 |

| Europe |

Poland |

260 |

230 |

| Europe |

Belgium |

310 |

270 |

| Europe |

Sweden |

190 |

170 |

| Europe |

Rest of Europe |

540 |

480 |

Segmental Insights

Product Category Insights

How Have Bottles And Jars Segment Dominated The PP Rigid Plastic Packaging Market?

The bottles and jars segment dominated the market in 2024. They have become a selected choice across sectors due to their perfect balance of chemical resistance, durability, and lightweight performance. Just like PET, which dominates beverages, PP bottles and jars are widely used in nutraceuticals, cosmetics, and pharmaceuticals, where heat resistance and product protection are complicated. Their ability to withstand hot filling and sterilization procedures makes them suitable for sauces, dairy items, and baby food packaging.

- In January 2025, a current collaboration of Dove and Crumbl brands in terms of limited-edition, Crumble-Pink packaging under the Unilever sells the latest Crumble collection exclusively for Walmart Stores and Walmart.com. There are a total of four different products in the Dove * Crumble program, like body scrub, body wash, hand wash, and deodorant.

The Containers and Tubes segment is predicted to be the fastest in the market during the forecast period. Polypropylene plastic containers point to storage units that are designed using different types of polymers that are derived from natural gas or crude oil. These polymers are made through a range of complicated procedure that transforms raw petroleum into thermoplastics. Such materials are carefully designed to be shaped, moulded, and formed into highly durable, robust, and long-lasting transport and storage containers. Since their advent during the industrial transformation inception, plastic containers have become essential elements for industrial uses and logistics operations. Rigid plastic tubes are being made from PP, which can be used in microwaves. Thor rounded corners develop the rigidity and reduce the risk of puncturing the lidding film.

- In June 2025, Tubex continues its loyalty to developing aluminium tube packaging with the latest MonoSence all-aluminum applicator tube. As the world’s primary applicator tube created from completely recycled aluminium, the MonoSense is a mono-material solution that eliminates multi-material components without adjusting to aesthetics and performance.

End-Use Industry Insights

How Did The Food And Beverage Segment Dominate The PP Rigid Plastic Packaging Market?

The food and beverage segment dominated the PP Rigid plastic packaging market in 2024, as the agile nature of polyethylene packaging material points to its ability to fulfill a series of performance characteristics that are needed for packaging applications across the end-use industry. For instance, the usage of PE is very prevalent in the food and beverage sector to safeguard the products right from fresh fruits, vegetables, to frozen food items and liquids, due to its moisture resistance and the potential to preserve freshness. So, rigid polypropylene containers are being used for dairy products, yoghurt, and ready-to-eat meals. These kinds of containers are durable and lightweight in nature and resistant to cracking under stress.

Because of its high heat-resistance, polypropylene is frequently used for microwave-safe containers, enabling consumers to reheat the food again. Polypropylene’s flexibility enables the creation of resealable lids, developing convenience for users. One of the main roles of polypropylene in food packaging is to protect the quality and freshness of food. Its perfect barrier properties assist in tracking the texture, taste, and nutritional value of packaged food products.

The Healthcare and Pharmaceuticals segment is predicted to be the fastest-growing segment in the market during the forecast period. Polypropylene rigid plastic packaging plays an important role in the healthcare sector, serving as a durable, safe, and cost-effective solution for strong, sensitive medical products. Its perfect chemical resistance makes it perfect for packaging medicines, tablets, syrups, and capsules without the risk of leaching or communication with active ingredients. PP’s lightweight yet strong structure reduces the risks of leaching or interaction.

Manufacturing Process Insights

How Did The Injection Moulding Segment Dominate The PP Rigid Plastic Packaging Market?

The injection moulding segment dominated the market in 2024 as it is a procedure that involves injecting molten plastic resin into a mold cavity. The molten plastic then updates and cools, taking the shape of the mold cavity. The mold is then opened, and the part is dismissed. Smoothie, the procedure is highly automated, and it can be utilised to manufacture a huge series of plastic parts, from small components to large and complicated assemblies too.

Polypropylene is another kind of plastic polymer that is utilised for plastic packaging films and labels. It has a hygiene finish and a friction surface that assists in protecting sensitive contents, like medical supplies and food items, from pollutants. The textile sector often accepts PP to generate rug and carpet fibres. When it is manufactured in its rigid version, PP is utilised for household products like microwavable dishes, kitchen utensils, and washing-up bowls.

The blow moulding segment is expected to be the fastest in the market during the forecast period. It is a production procedure that enables plastic parts to be formed. Air pressure is utilised to inflate soft plastic into a mold cavity. The technology of blow moulding begins from the glass sector, and the plastics are complete in the recyclable and disposable bottle industry. The three main kinds of blow molding are extrusion blow molding, injection stretch blow molding, and injection blow molding, too. Blow moulding can make containers and jars, such as blow-moulded PETE or PET, for packaging. Apart from these, a hot plastic tube named a parison is first created in a typical blow moulding operation.

Distribution Channel Insights

How Did The Direct OEM/Brand Contracts Segment Dominate The PP Rigid Plastic Packaging Market?

Brand contracts segment dominated the PP rigid plastic packaging market in 2024 due to polypropylene rigid packaging's popularity, as it is cost-effective, durable, and versatile in products like cosmetics, food, and pharmaceuticals. The growing demand for convenience, e-commerce, and expanded shelf life is being met by the need for protective, strong, and personalized packaging. High-level manufacturing procedures and digital printing techniques are being enabled for accurate, personalized designs that match the brand identity and user choice, further driving acceptance too.

E-commerce /B2B Marketplaces segment expected to be the fastest-growing in the market during the forecast period. The development in the e-commerce industry means a growing focus on creating packaging and shipping procedures that are more sustainable to align with the urge for eco-conscious materials. In several cases, packaging is also the first and only point of contact e-commerce businesses have with consumers, so packaging choices are a possibility to develop brand commitment and awareness. Creating the transformation to use safe and sustainable protective e-commerce packaging materials is made convenient with a compostable and high-performance foam solution.

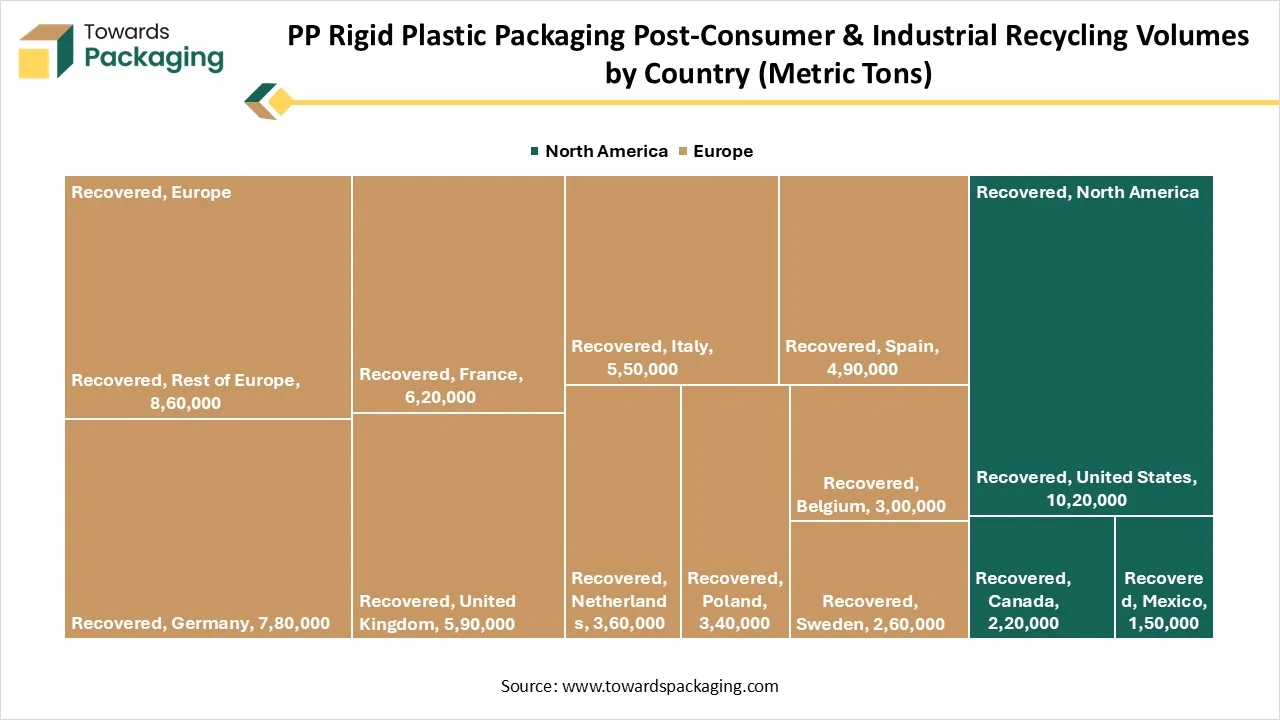

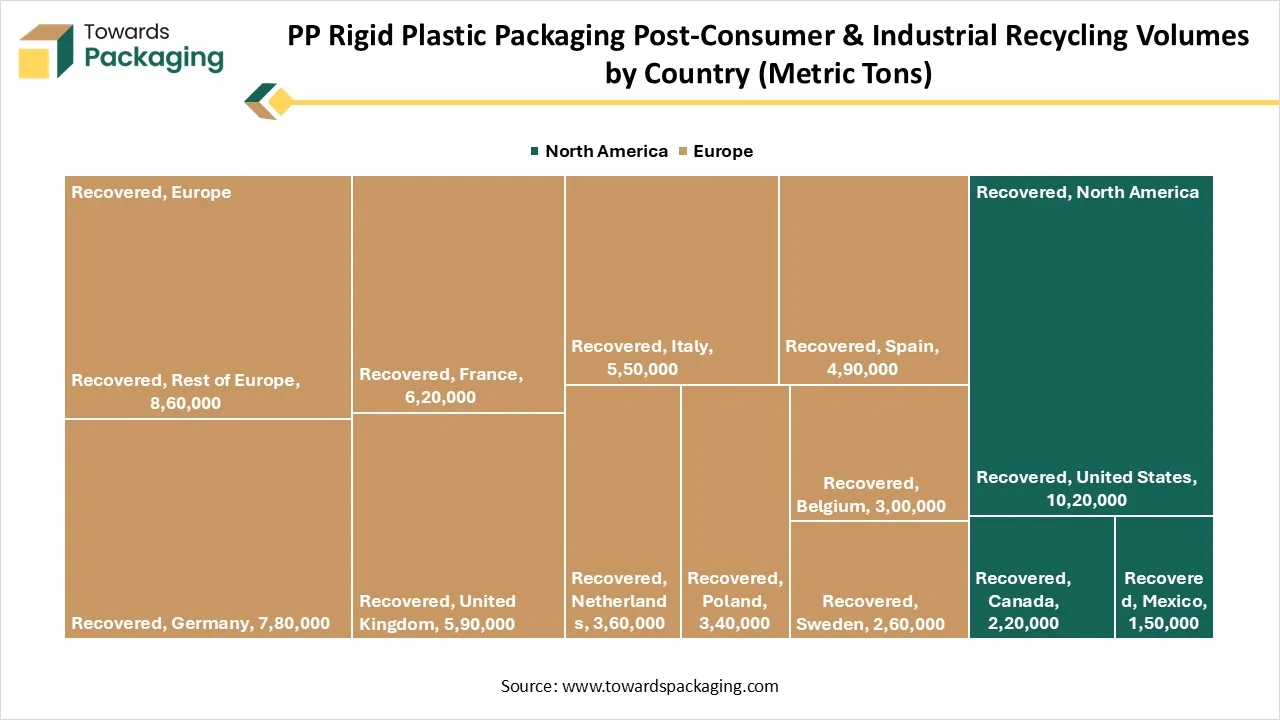

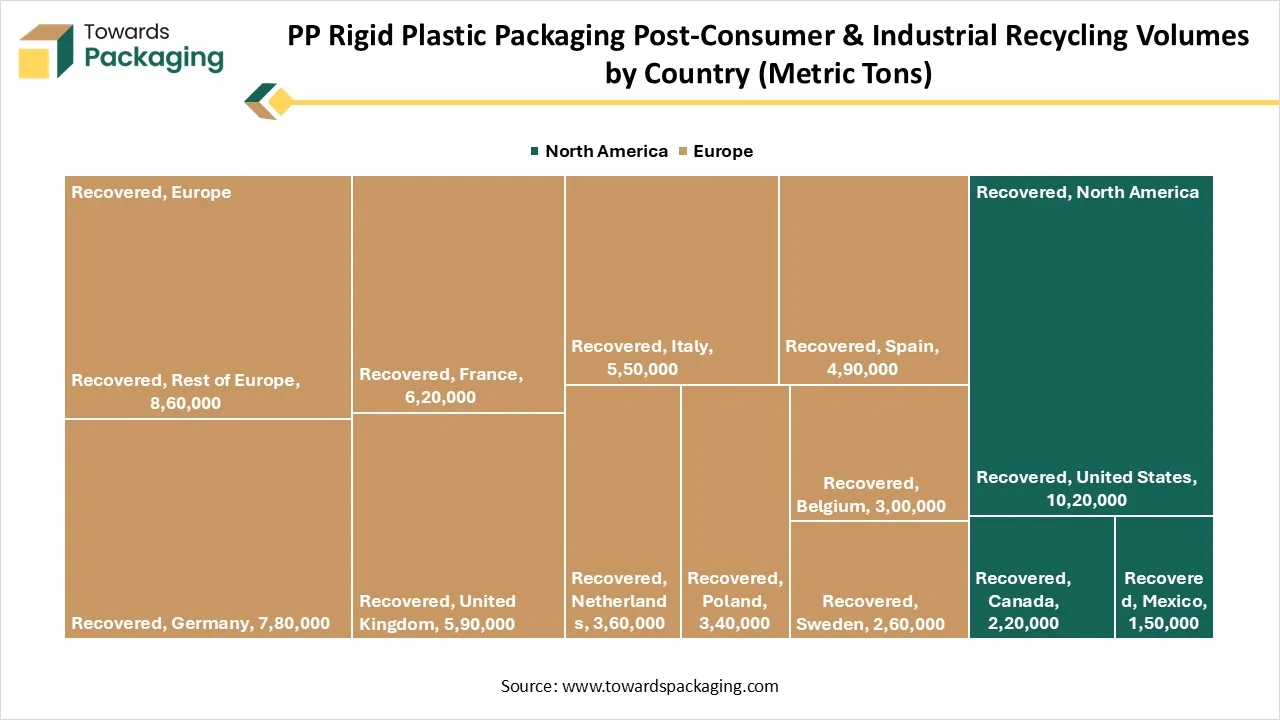

PP Rigid Plastic Packaging Post-Consumer & Industrial Recycling Volumes by Country (Metric Tons)

| Region |

Country |

Recovered |

| North America |

United States |

1,020,000 |

| North America |

Canada |

220,000 |

| North America |

Mexico |

150,000 |

| Europe |

Germany |

780,000 |

| Europe |

France |

620,000 |

| Europe |

United Kingdom |

590,000 |

| Europe |

Italy |

550,000 |

| Europe |

Spain |

490,000 |

| Europe |

Netherlands |

360,000 |

| Europe |

Poland |

340,000 |

| Europe |

Belgium |

300,000 |

| Europe |

Sweden |

260,000 |

| Europe |

Rest of Europe |

860,000 |

Regional Insights

How Did The Asia Pacific Dominate The PP Rigid Plastic Packaging Market?

Asia Pacific dominated the PP rigid plastic packaging market in 2024. The production and demand for PP rigid plastic packaging in this region are experiencing constant growth, driven by the region’s expanding industrial base, growing consumption of packaged goods, and fast urbanization. Countries like China, India, Japan, and Southeast Asian are experiencing heightened demand from industries like food and beverages, pharmaceuticals, household and personal care products, in which PP packaging is valued for its lightweight, durability, and cost-efficiency. The growing middle-class population with higher disposable incomes is fueling the choice for safe and convenient packaging formats.

The Middle East and Africa are predicted to be the fastest in the market during the forecast period. Rigid packaging is updating the PP rigid plastic packaging market in the Middle East and Africa, which serves as a cornerstone for different sectors that depend on packaging for their products. The recyclable rigid plastic packaging products are being created from plastic jars with open tops and independent lids, covers, and closures. Large rigid containers are widely used in shops and supermarkets to transport different products, including food and pharmaceuticals. Hence, the ability and durability to be recycled are the initial factors in the region. Plastics show a main environmental risk if they are not accurately tracked at the beginning of the value chain and throughout their prolonged life, especially in the ocean.

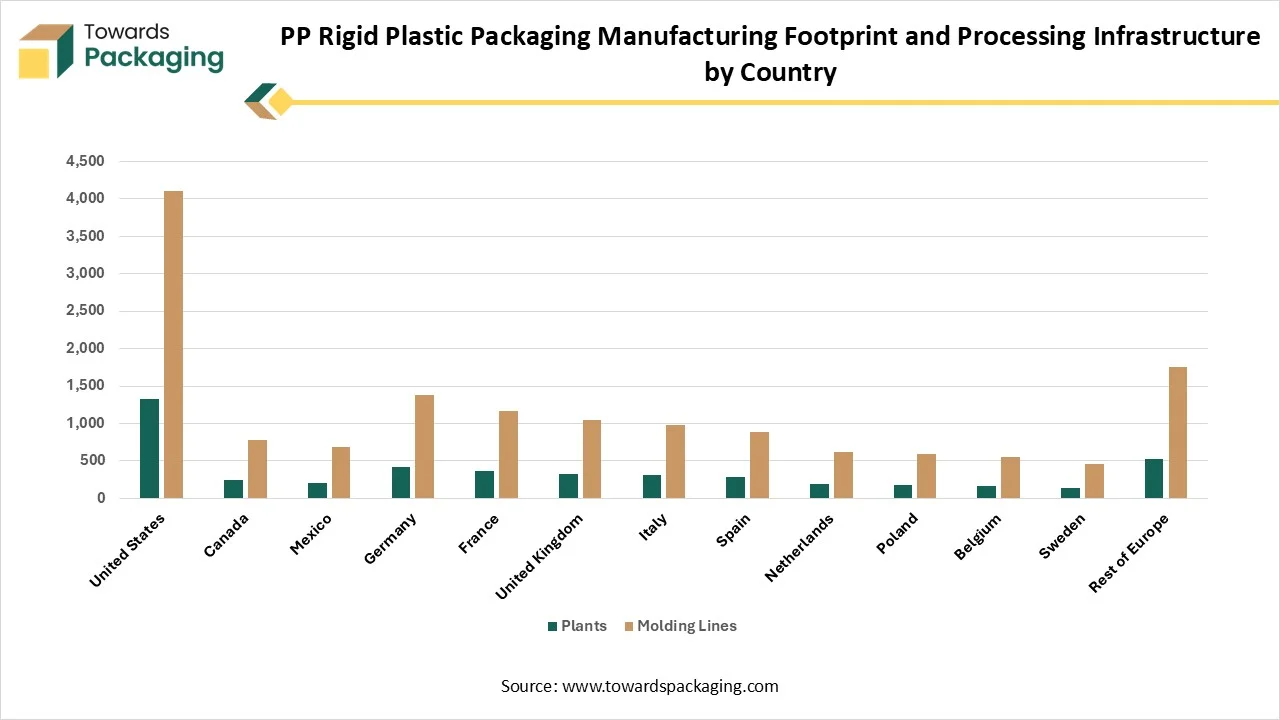

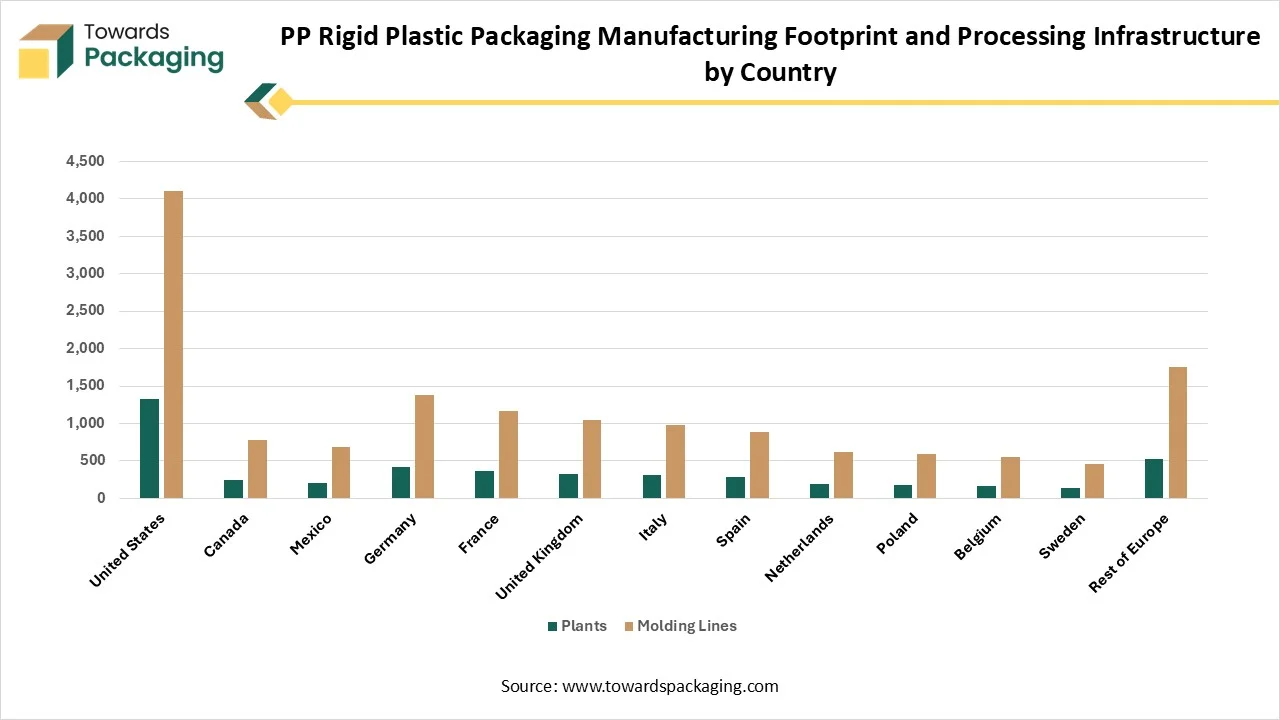

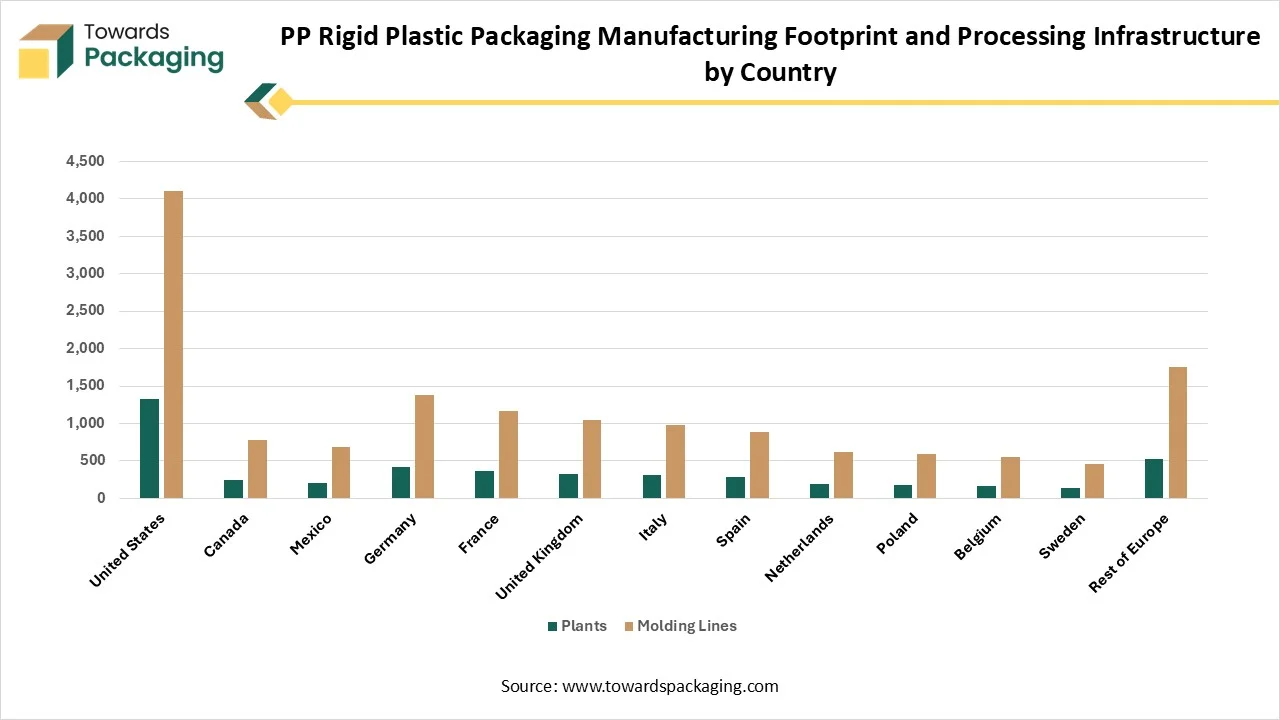

| Region |

Country |

Plants |

Molding Lines |

| North America |

United States |

1,320 |

4,100 |

| North America |

Canada |

240 |

780 |

| North America |

Mexico |

210 |

690 |

| Europe |

Germany |

420 |

1,380 |

| Europe |

France |

360 |

1,160 |

| Europe |

United Kingdom |

330 |

1,050 |

| Europe |

Italy |

310 |

980 |

| Europe |

Spain |

280 |

890 |

| Europe |

Netherlands |

190 |

620 |

| Europe |

Poland |

180 |

590 |

| Europe |

Belgium |

170 |

550 |

| Europe |

Sweden |

140 |

460 |

| Europe |

Rest of Europe |

520 |

1,750 |

PP Rigid Plastic Packaging Market Value Chain Analysis

Material Processing and Conversion: Polypropylene is a convenient packaging material, even for injection moulding, despite its semicrystalline nature. The absence of any actual demand for high molecular weight, from the mechanical properties viewpoint, leads to low melt viscosity. The pseudoplastic nature of polypropylene develops this effect at high shear rates. Moulding shrinkage of polypropylene is generally around 1 % but the expectation of the actual value is challenging due to the string pull of moulding conditions.

Package Design and Prototyping: Generating recycled food-grade PP that is safe to be counted in food-contact packaging, which is now the close horizon. To assist the brand owners in gaining a precise understanding of how best to create their packaging as recyclable as possible, that has been partnering with their participants on the main packaging, design facts that have the biggest effect on packaging design, and prototyping.

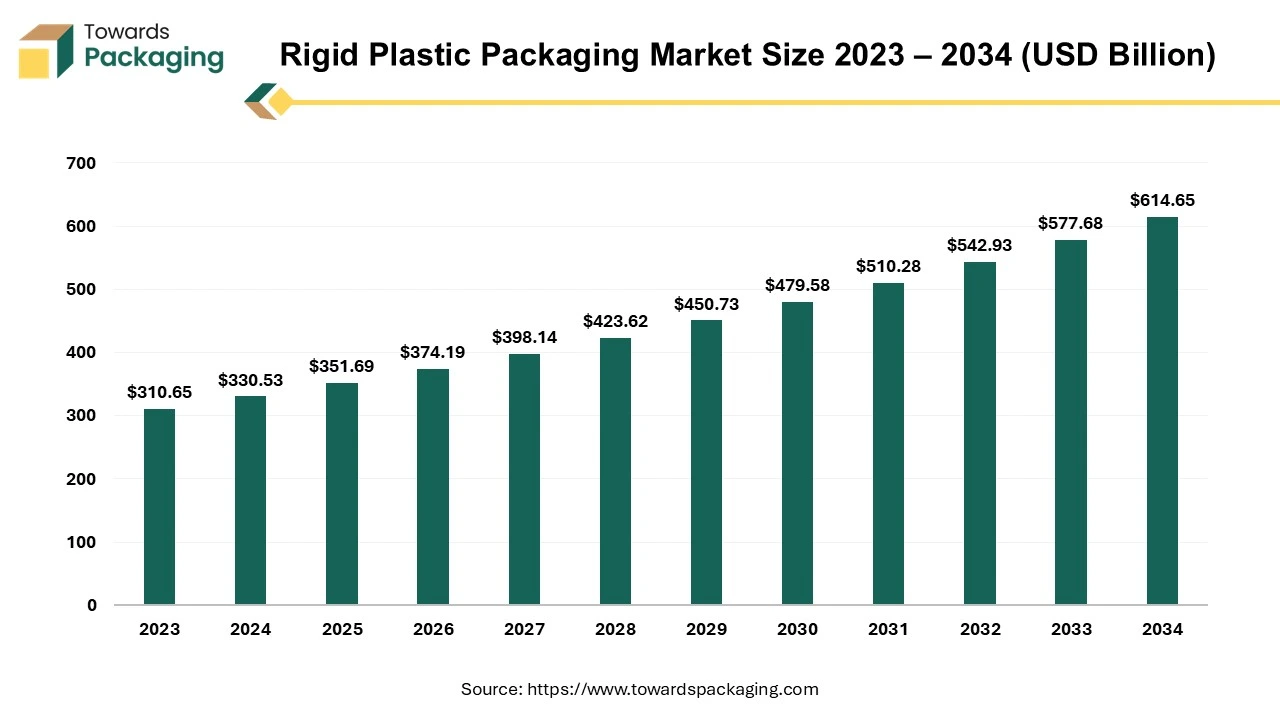

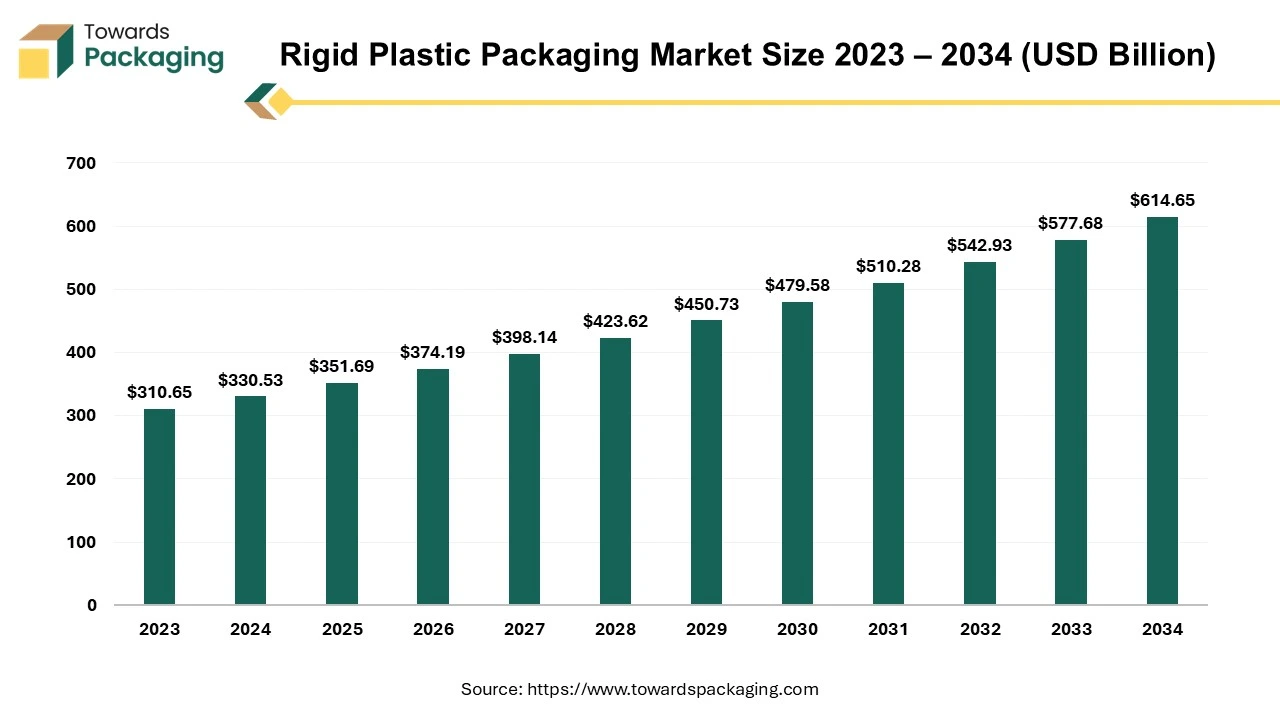

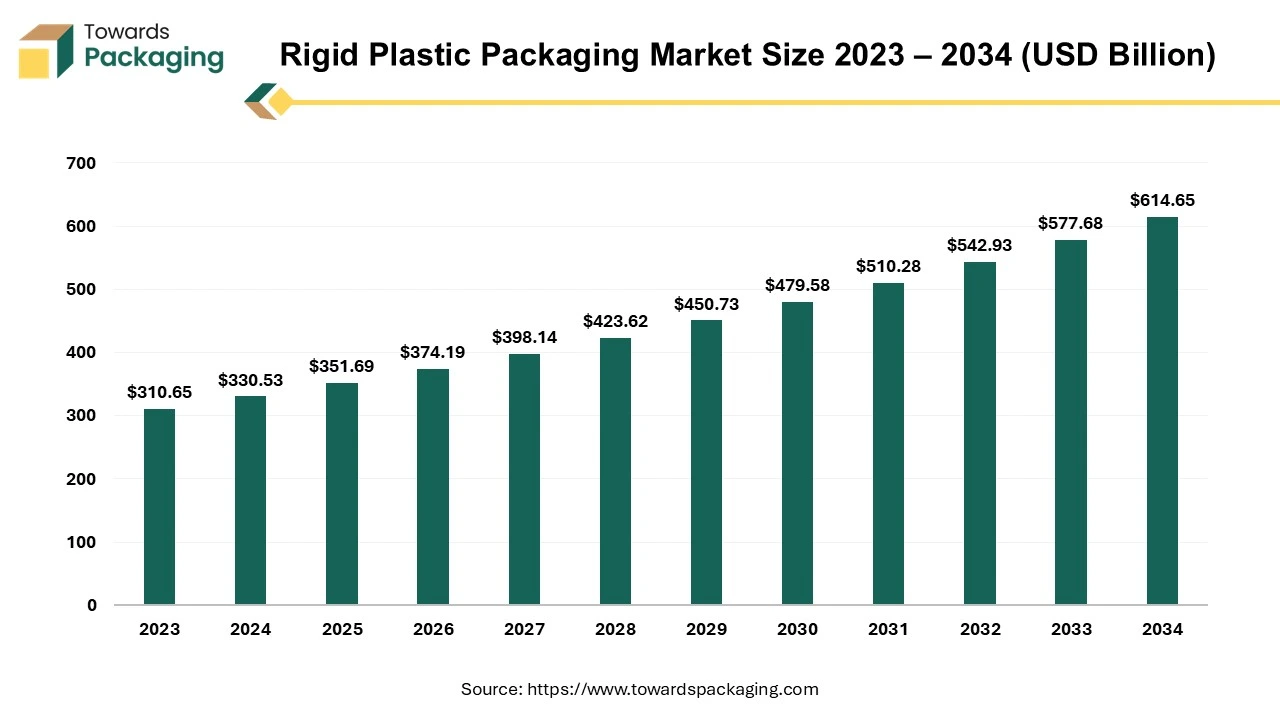

Future of Rigid Plastic Packaging Market

The rigid plastic packaging market is expected to increase from USD 351.69 billion in 2025 to USD 614.65 billion by 2034, growing at a CAGR of 6.4% throughout the forecast period from 2025 to 2034. This growth is supported by the rapid expansion of e-commerce and online food delivery, which demand durable, protective and convenient packaging solutions.

Rigid plastic packaging means packaging products that are made from hard, inflexible plastic. These packages keep their shape even when you press or handle them. They are strong, protective, and used to store and transport a wide range of goods safely. The example of rigid packaging has been mentioned here as follows: plastic bottles (for water, milk, shampoo), jars (for creams, sauces), trays (for fruits, electronics) and food containers (like yogurt cups, takeaway boxes).

Future of PET Rigid Plastic Packaging Market

The PET rigid plastic packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. The rising demand recyclability and versatility in industries such as personal care, pharmaceutical, and food & beverages has influenced the rapid innovation in the PET rigid plastic packaging market. The increasing trend for packaged food products and huge sustainable efforts has enhanced the demand for PET rigid plastic packaging. This market is dominating in the Asia Pacific due to rapid economic growth.

PET rigid plastic packaging refers to packaging products manufactured principally from polyethylene terephthalate (PET) in non-flexible forms bottles, jars, containers, trays, preforms and related rigid items used across beverages, food, personal care, household, pharmaceutical and industrial applications. PET rigid packaging includes virgin PET and recycled PET (rPET), and is produced via blow-moulding, injection moulding and thermoforming processes; it is valued for light weight, clarity, barrier options, recyclability and suitability for high-speed filling.

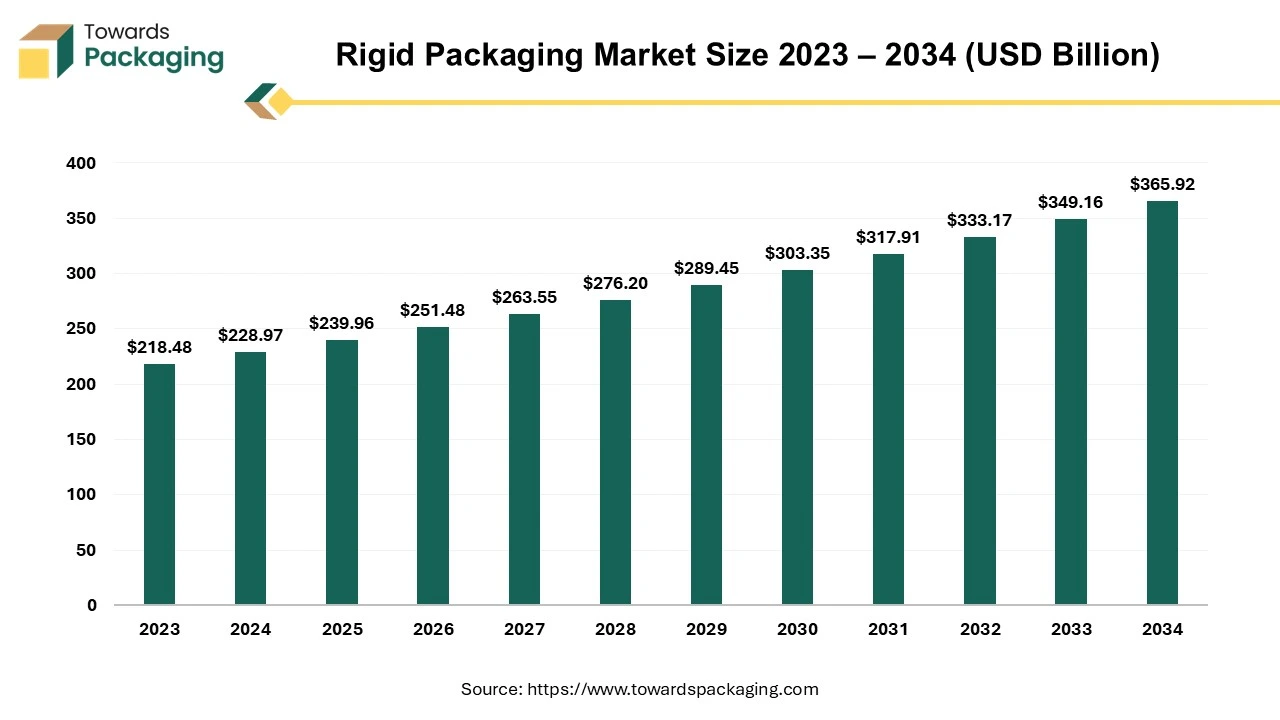

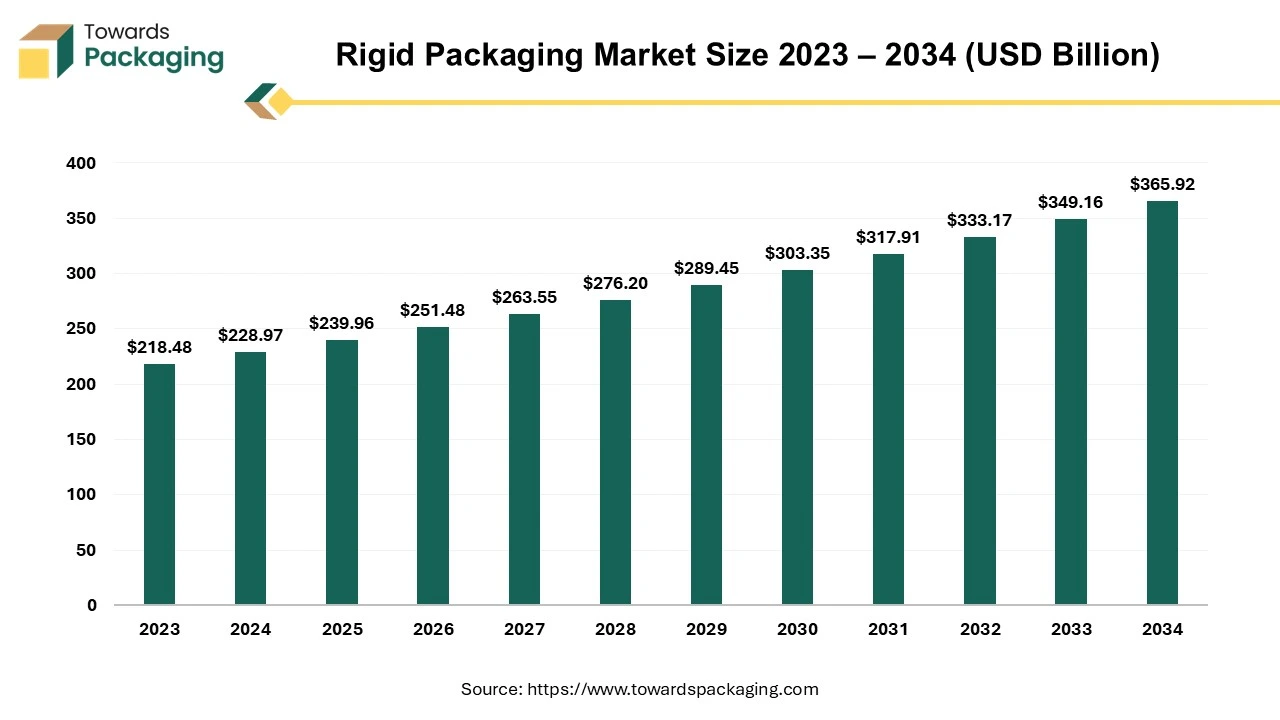

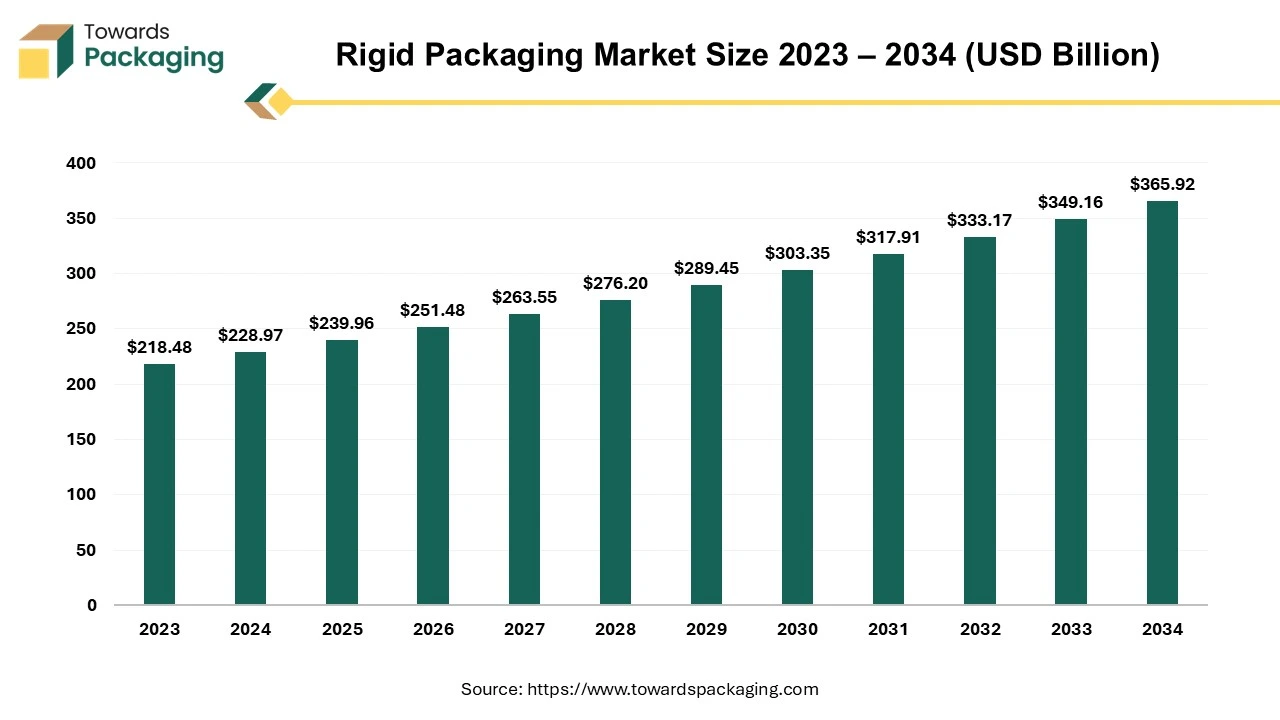

Future of Rigid Packaging Market

The rigid packaging market is set to grow from USD 550.49 billion in 2025 to USD 1020.61 billion by 2034, with an expected CAGR of 7.1% over the forecast period from 2025 to 2034.

The rigid packaging sector makes prominent use of plastic owing to their numerous advantages, include becoming durable, portable, chemically impermeable, and reasonably priced. Considering 31% of the world's plastic utilisation volume going to the packaging, the industry certainly is dominating with the manner when plastics are used. Comparing to other forms of packaging, rigid packaging is more lightweight. It also reduces food waste and spoiling, protects against breakage, and offers a host of other advantages. Rigid plastic widely used in various industries such as food and beverage, personal care, healthcare and others.

PP Rigid Plastic Packaging Manufacturing Cost, Average Selling Price, and EBITDA Margin by Country

| Region |

Country |

Cost (USD/MT) |

ASP (USD/MT) |

EBITDA |

| North America |

United States |

1,100 |

1,520 |

17 |

| North America |

Canada |

1,110 |

1,530 |

16 |

| North America |

Mexico |

1,040 |

1,480 |

18 |

| Europe |

Germany |

1,160 |

1,600 |

15 |

| Europe |

France |

1,170 |

1,610 |

14 |

| Europe |

United Kingdom |

1,180 |

1,620 |

14 |

| Europe |

Italy |

1,150 |

1,590 |

15 |

| Europe |

Spain |

1,140 |

1,570 |

15 |

| Europe |

Netherlands |

1,190 |

1,640 |

14 |

| Europe |

Poland |

1,100 |

1,520 |

16 |

PP Rigid Plastic Packaging Market Leading Companies

- Berry Global

- Plastipak Packaging

- Alpla

- Silgan Holdings

- AptarGroup

- Huhtamäki

- Graham Packaging

- Logoplaste

- Sonoco Products Company

- Nampak

- Novolex / Hilex

- PACCOR / Berry (regional units)

- Graham / Resilux

- Kautex / Sidel / Sipa

- SHL Medical / Haselmeier / Nemera

- Gerresheimer / West Pharmaceutical Services

- LyondellBasell

- SABIC

- Borealis / Braskem / ExxonMobil Chemical

- Amcor

Latest Announcements by Industry Leader

- In January 2025, PAG, which is an Asia Pacific-concentrated producer of an alternative investment firm, gained a majority stake in Pravesha Industries, which is a pharmaceutical packaging company, at an enterprise valuation of USD 200 million, as per a source close to the development. This partnership reflects the PAG’s concentration on the bolding of the development potential of India’s pharmaceutical packaging industry, driven by strong export demand as stated by Prasha Industries.

- rn

- In March 2025, LyondeBasel, who is leading in the chemical sector, had disclosed the launch of Pro-Fax EP649U, a current polypropylene effect copolymer which is being crafted for the rigid packaging sector. This innovative product is specifically formulated for thin-walled injection moulding, which makes it ideal for food packaging solutions.

Recent Developments

- In October 2024, Berry Global revealed a series of clarified polypropylene (PP) bottles for healthcare uses, which consist of approximately 71% in CO2 emissions and have developed recyclability as compared to regular coloured PET pill bottles.

- In January 2025, Antalis disclosed Pripalak R30, a white and coloured polypropylene range having 30% post-industrial recycled content, which is designed for utilising it in packaging, point-of-sale displays, labels, and more.

PP Rigid Plastic Packaging Market Segments

By Product Category

- Bottles & Jars

- Containers & Tubs (e.g., yogurt tubs, margarine tubs)

- Caps, Closures & Lids

- Trays & Clamshells (food trays, retail clamshells)

- Crates, Pallets & Transport Packaging

- Specialty Rigid Parts & Medical Trays

- Others (dispensers, pourers, fitments)

By End-Use/Industry

- Food & Beverage

- Personal Care & Cosmetics

- Household & Home Care (detergents, cleaners)

- Healthcare & Pharmaceuticals

- Industrial & Chemical Packaging

- E-commerce / Retail & DME (durable goods packaging, multipacks)

- Others (agricultural, automotive ancillaries)

By Manufacturing Process

- Injection Molding

- Blow Molding (Extrusion & Injection Stretch Blow Molding)

- Thermoforming (trays & clamshells)

- Extrusion / Sheet & Profile

- Secondary operations & assembly (overmoulding, decoration)

By Distribution Channel

- Direct OEM / Brand Contracts

- Packaging Distributors & Converters

- E-commerce / B2B Marketplaces

- Contract Packaging & Co-packing Services

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait