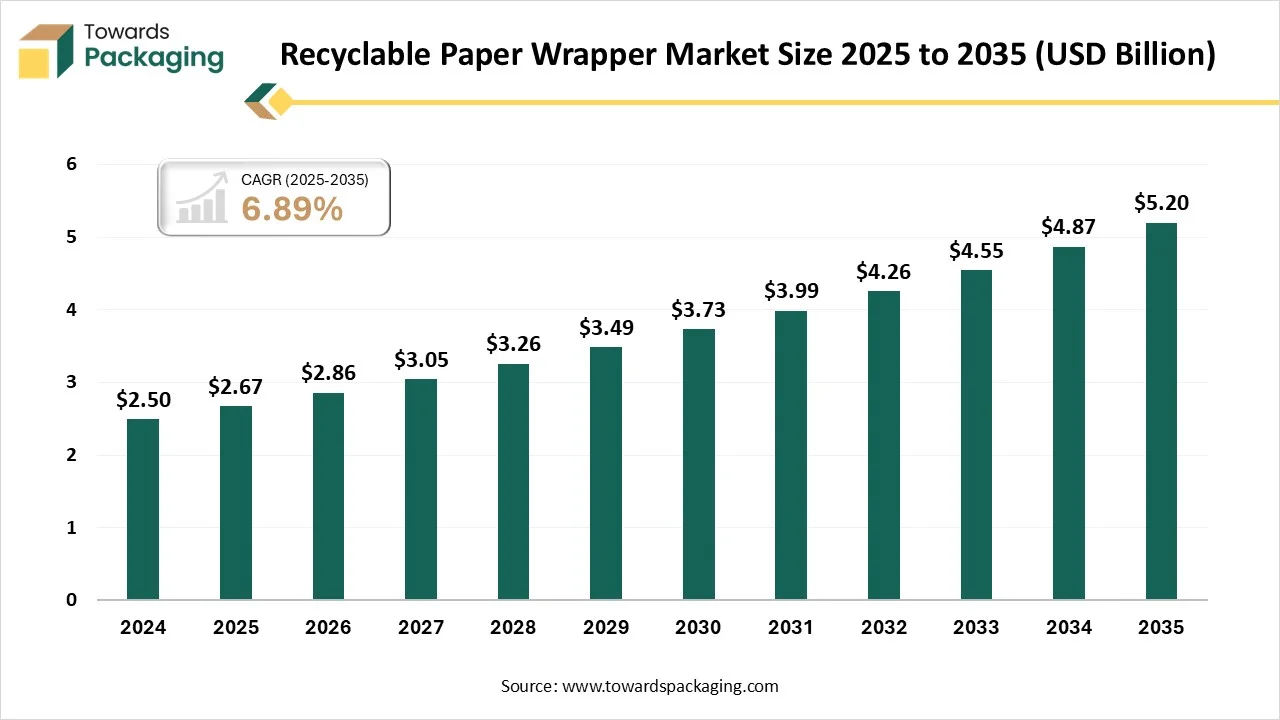

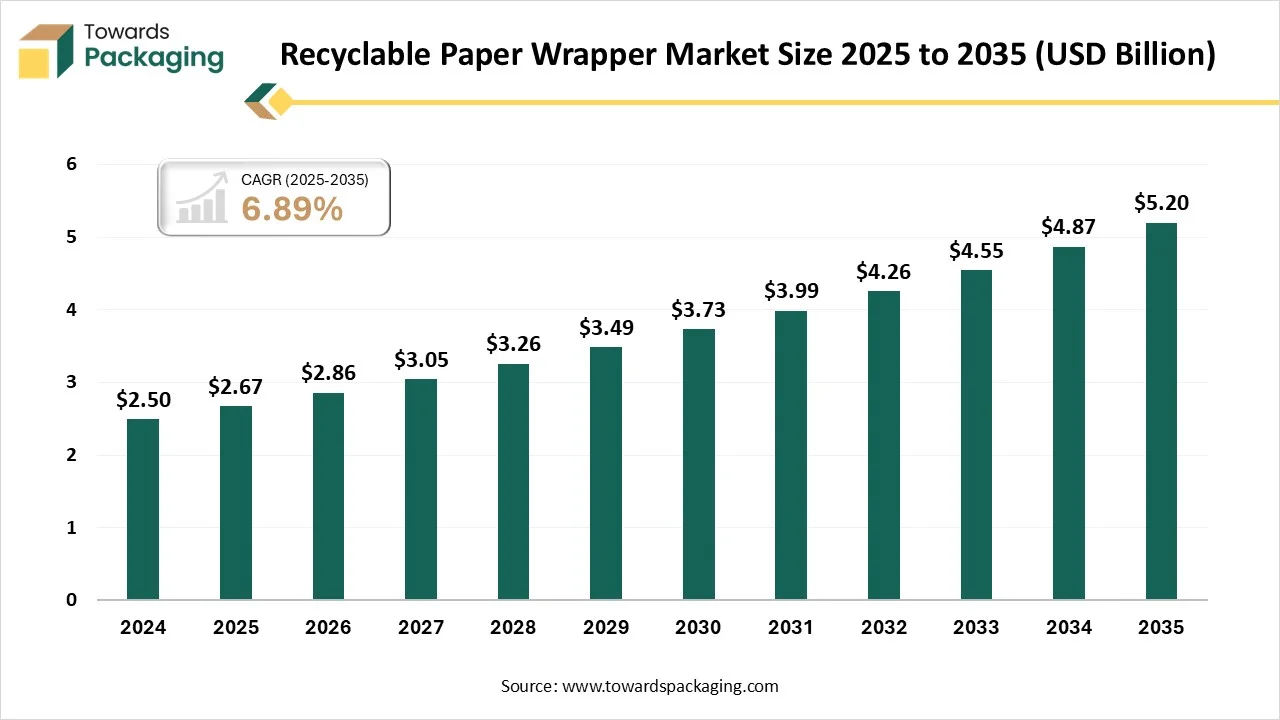

The recyclable paper wrapper market is forecasted to expand from USD 2.86 billion in 2026 to USD 5.2 billion by 2035, growing at a CAGR of 6.89% from 2026 to 2035. The demand for this wrapper is due to developing user environmental alertness, growing government regulations, and the integral advantages of paper-based packaging.

Recycled paper wrapping means to wrap paper generated by using reclaimed paper fibres, which reduces the demand for virgin materials and lowers the environmental impact. They are frequently completed in tactile textures, soft neutral tones, and the subtle designs that integrate sustainability with maintained touch, which makes them a popular selection for both responsibility and style. It serves a sustainable alternative to regular gift wrap while tracking an updated and stylish look which feels precisely are home in current interiors and counted celebrations.

Automated systems are updating paper recycling by using Artificial Intelligence, machine learning, and sensors to precisely check and classify various paper types. Facilities across Canada are accepting optical sorters, robotic arms, and high-level scanning tools to lower the pollutants and smooth the sorting procedure. Such technologies develop the sorting speed, lower the labour costs, and mainly develop the quality of recycled fibre that assists paper recycling operations in aligning with industrial standards. Also, advanced fibre recovery machines are maintaining the paper recycling by removing usable pulp even from lesser -grade or excessively polluted paper waste.

The facilities that are currently recovered with the high-quality fibre from mixed office paper, industrial by-products, and food-stained packaging, too. These are developed to recover waste and assist more sustainable paper manufacturing across Paper Recycling centres globally.

One of the most prevalent recyclable packaging materials is cardboard, which is versatile, strong, and convenient to produce. It is greatly used for food packaging, shipping boxes, and product cartons, too. And another one is paper packaging, which is an eco-friendly choice utilized for bagging, wrapping, and cushioning products. Users and organizations can use recycled paper packaging smoothly, which lowers the landfill waste and deforestation.

Recycling paper helps to protect trees, lower energy usage, and decrease landfill waste. So, this directly includes a healthier planet. So, just by recycling paper, we can lower the costs linked to waste disposal and resource usage, too. It can also help in avoiding the new paper items. So, effective paper recycling can develop awareness and push others to accept sustainable practices, which makes a ripple effect that expands beyond any workplace or household, too.

Produced paper is covered into the jumbo reels and then cut and rolled into smaller commercial rolls. So, such packed and barcoded packaging is there to protect against transit damage. These rolls are kept in the warehouses before being dispatched to the end-product producers, such as those making wrapping paper or office supplies, too.

The corrugated boxes segment dominated the market in 2025, as corrugated paper rolls are an eco-friendly packaging solution that delivers perfect cushioning and protection for different products. They are flexible, lightweight, and convenient to cut as these rolls are ideal for padding, wrapping, and void filling too. By selecting every corrugated paper roll, we can accept a sustainable and versatile packaging strategy that meets the eco-conscious user's choice. Such rolls are ideal for businesses that are seeking to lower their environmental impact while tracking the high-quality packaging standards.

The folding cartons segment is predicted to experience the fastest CAGR during the forecast period. Folding cartons are usually considered more eco-friendly than plastic packaging as they are widely recyclable in several municipal recycling programs. Paperboard can be easily recycled into the latest paper products, while plastic packaging has many issues for recycling because of the multitude of different plastic types and restricted recycling design, too. They are even compostable and biodegradable under perfect conditions. So, biodegradability is specifically beneficial for single-use items as it lowers the long-term environmental effect linked with the packaging waste.

Kraft paper segment has dominated the market as they naturally break down in weeks to months and leaves no toxic factors behind. Like plastic, they are conveniently compostable at home and in the industrial sector, too. Such quality makes it perfect for the eco-conscious brands and users, too. They are even convenient and recyclable to repurpose. We can pulp the waste kraft paper and process it for the latest sheets several times.

The recycled paper/paperboard segment is expected to witness the fastest CAGR during the forecast period. Recycled paper is a kind of paper manufactured from recovered pulp after every usage, so it is not created directly from wood or other natural fiber sources. So, recycled paper results from the reuse and processing of old paper into new products, which assists in lowering the pressure on forest resources and restricting the waste that is released into the surrounding environment. By using recycled paper, which is not only an economical choice but also a practical step towards a greener, cleaner, and more sustainable future.

The food and beverage packaging segment dominated the market in 2025, as red food paper is a kind of food-safe paper that is particularly crafted for wrapping, lining, and displaying food products. It is frequently waxed or greaseproof to oppose the oil and moisture, which makes it perfect for the packaging of burgers, sandwiches, smoked meats, snacks, and baked goods. The paper is produced to align with food-grade safety standards, which ensures it does not shift harmful elements, tastes, or odours to the food that comes into contact with it. It has a bright red colour which assists in developing food display and brand differentiation, while several varieties are recyclable or biodegradable, which helps in environmentally-friendly packaging goals.

The e-commerce and retail segment is expected to experience the fastest CAGR during the forecast period. Paper void fill is a protective packaging solution created from paper, which is used to fill empty spaces in the interior of a box or parcel. Its main goal is to protect products from shifting during transportation, which helps to lower the risk of damage due to bumps and vibrations they experience during the supply chain. There are different types of paper void fill that are accessible, such as fan -folded paper, crumbled paper, shredded paper, and honeycomb paper. At the time of shipping, paper void operates by absorbing the effect and distributing pressure equally inside the carton. This integration of reliability, versatility, and effectiveness makes paper void fill an effective solution for current protective packaging.

The secondary packaging segment has dominated the recyclable paper wrapper in 2025, as it uses recyclable materials, which sends a precise message that any brand cares about the globe. The circular economy is at the heart of paper, depending on the packaging sector, which utilizes recyclable, renewable, and recycled materials to make sustainable packaging solutions. Furthermore, it can assist in preventing damage from environmental conditions, stacking pressure, and rough handling. A perfectly designed secondary packaging can also help protect costly complaints and returns, as it lowers the possibility of products being damaged even before they reach the end user.

The flexible paper packaging segment is predicted to experience the fastest CAGR during the forecast period. There is a main move towards biodegradable and sustainable options which is a main driver as users and regulations encourage alterations t plastic. There is a development in online retail and food delivery services which has developed the demand for lightweight, durable and cost-effective packaging solutions for logistics and shipping. There are inventions in high-barrier coatings, digital printing and laminates which are improving the performance and aesthetic appearance of paper packaging which makes them perfect for a huge range of uses.

Asia Pacific dominated the recyclable paper wrapper market in 2025 as it is developing as the main centre for recyclable paper wrappers due to fast industrialization, a rising e-commerce sector, and growing environmental awareness. Countries such as India, China, and Japan are experiencing substantial development in terms of the food and beverage sector, user goods that develop the demand for eco-friendly packaging alternatives. The region is also witnessing a main movement towards sustainable packaging, which has 60% of users showing a choice for biodegradable and recyclable selections.

How is the Recyclable Paper Wrapper Market Growing in India?

The Indian paper sector utilises various kinds of waste paper, which includes post-consumer waste, such as magazines, newspapers, and packaging materials, as well as post-industrial waste, which includes offcuts and waste from manufacturing procedures. Deinked paper is another crucial category, which counts paper from which the ink is removed for reuse. Such materials are being processed by using the advanced recycling procedures, which include pulping and washing in some scenarios, and bleaching to generate high-quality recycled paper.

North America is the fastest-growing region in the recyclable paper wrappers in 2025, as the regulatory environmental surrounding legislation, which is a major factor that has shaped the paper packaging sector. The United States loyalty is to waste reduction targets, which show a direction to 50% of waste from landfills by the year 2030, which has further given importance to the importance of sustainable materials. Due to strict principles, tracked recycling practices and packaging waste, companies are currently shifting towards compliance with the assistance of developed usage of the paper packaging solutions that has aligned with regulations.

Why is Canada using the Recyclable Paper Wrapper Market Importantly?

The Canadian recyclable paper wrapper shows rigid, region-particular development designs shaped by the economic conditions, technological acceptance, regulatory environments, and the development of user choice. This regional tracking serves a strategic point of view of how the urge is opening across the main global markets and marks the commercial uses that are most related to business leaders who find investment, expansion, or competitive positioning.

The recyclable paper wrapper market in the region is growing, as in Europe, as users from the European countries counted in this analysis value packaging solutions that meet the circularity rules, such as reusability, recyclability, and the usage of recycled content. Hence, these sustainability features should not come at the price of the main functional attitude, like shelf life, food safety, and durability, too. Packaging companies should concentrate on making solutions that align with a complete range of user demands, which means integrating rigid sustainability credentials with fast, practical performance.

Germany Recyclable Paper Wrapper Market Trend

Germany’s regulatory environment is heavily giving importance to sustainability and the economic rules, which are driven by the directives from the European Union and the national policies whose aim is to reduce plastic waste. The EU circular economy and the European Green Deal Action plan are encouraging producers to accept more eco-friendly packaging materials that include eco-recyclable paper. As per the German federal Environment Agency, the regulations need higher recycled content in terms of packaging materials, which are predicted to be in place by 2025, necessitating major adjustments to manufacturing procedures.

The recyclable paper wrapper market in the Middle East &Africa (MEA) region is growing quickly as the development of retail and e-commerce across this region is driving particularly demand for sustainable and durable packaging. Among containerboards, every kraft paper series that includes Sack Kraft, Bag Kraft, and specialty kraft papers serves as a sustainable alternative for the packaging, industrial, and retail uses. Such grades are crafted to align with the biggest performance standards while assisting environmental responsibility.

UAE Recyclable Paper Wrapper Market Trend

The United Arab Emirates has revealed a main eco-friendly policy, which is ready to take effect by the year 2026, as a nationwide ban on single-use plastic products, including plastic food packaging. Such a decisive shift matches the worldwide encouragement towards sustainability and lowering the plastic pollution that directly affects marine life, urban waste management, and landfills, too. As users and organizations make this move, the urge for perfect alteration to the plastic food packaging in the UAE in the current year is growing.

In South America, the recyclable paper wrapper market is growing steadily as compulsory recycled -content quotas and the bans on single-use plastics in countries such as Chile, Brazil, and Colombia are encouraging brands to fill plastic films with recyclable paper wraps. The food applications are the main volume driver that accounts for 35.5% of the paper packaging industry. There is a high demand for current wrappers in terms of frozen meals, snacks, and bakery products. The growth of online retail in Argentina and Brazil has developed the demand for secondary paper wrappers, and the recyclable and lightweight protective materials are present.

Brazil Recyclable Paper Wrapper Market Trend

The growth in terms of food and beverage packaging is meant by developing user choice for sustainability and organic items, linked with the government's regulations on plastic reduction. So, e-commerce packaging development stems from growing online retail sales and the demand for lightweight and recyclable packaging to avoid shipping costs. The personal care sector benefits from brand loyalty, user alertness, and the sustainability of environmental effects.

By Product Type

By Material Type

By End-Use

By Packaging Type

By Region

February 2026

February 2026

February 2026

January 2026