Single-Use Plastic Water Bottles Market Size, Trends, Share and Innovations

The single-use plastic water bottles market is projected to see rapid growth from 2025 to 2034, with significant revenue gains. The North America region dominates the market in 2024, holding the highest market share. Asia Pacific is expected to grow at the fastest CAGR due to rising urbanization and increasing demand for convenient hydration options. Polyethylene terephthalate (PET) is the most used material, contributing the largest share in 2024. The market is supported by major players like Coca-Cola, PepsiCo, and Nestlé, and key packaging manufacturers such as Berry Global and Amcor. Trade statistics show China as the top exporter, followed by the United States as the leading importer.

Major Key Insights of the Single-Use Plastic Water Bottles Market

- By region, North America dominated the global market by holding highest market share in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the polyethylene terephthalate (PET) segment contributed the biggest market share in 2024.

- By material type, the polypropylene (PP) segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By application type, the food & beverages segment contributed the biggest market share in 2024.

- By application type, the pharmaceutical segment will be expanding at a significant CAGR in between 2025 and 2034.

What Is Single-Use Plastic Water Bottles?

Single-use plastic water bottles are sealed plastic containers those are generally used once and then thrown away. These are disposable containers manufactured majorly from polyethylene terephthalate (PET) which is planned for one-time drinking of water. These are generally thrown away instead of reusing or refilling. These are light weight, transparent and cost-effective bottles.

Single-Use Plastic Water Bottles Market Outlook

- Market Growth Overview: The increasing demand for cost-effective and convenient packaging has influenced the demand of this market. The light weight and easy-to-carry bottles are exclusively in demand among consumers.

- Global Expansion: Regions such as North America, Asia Pacific, and Europe are witnessing rapid urbanization which enhance the demand for these water bottles due its lightweight and convenience. These are easily accessible at any place with reasonable costs influence the growth of the market.

- Major Market Players: Single-use plastic water bottles market comprises Coca Cola, nestle, and PepsiCo which are water and beverages companies and the major packaging manufactures are Berry Global, Amcor, Novolex, Pactiv Evergreen, and several others.

- Startup Ecosystem: The major focus of the startup industries are to develop new materials which are biodegradable and cause less pollution in the environment such as polyactide (PLA) bioplastics, sea-weed based packaging, mineral-coated paper, and many others.

Key Metrics and Overview

| Metric | Details |

| Major Players | Nestlé Waters, Coca-Cola Company, PepsiCo, Danone, Cott Corporation |

| Leading Region | North America |

| Market Segmentation | By Material Type, By Application and By Region |

| Top Key Players | Berry Global, Amcor, Novolex, Pactiv Evergreen |

Key Technological Shifts In Single-Use Plastic Water Bottles Market

The single-use plastic water bottles market is experiencing major technological shift due to enhanced material formulation to resolve the rising ecological concern. The major innovation in this market comprises production of bio-based plastics and biodegradable plastic packaging. Improvement in the recycling technology plays an important role in enhancing the adoption of such packaging. The major packaging companies are producing sleek and smart connected water bottles. Personalized hydration demand has enhanced the adoption of these bottles which add convenience to the consumers.

Trade Analysis Of Single-Use Plastic Water Bottles Market: Import & Export Statistics

- China: It is the top exporters of plastic bottles and flasks with exporting $1.81B.

- United States: It is considered as top importer of plastic bottles and flasks with importing $1.14B in 2023 and exporting $818M.

- Germany: It is recorded as exporting $833M and importing $734M of plastic bottles and flasks in 2023.

- France: It is also considered as one of the major importers of the plastic bottles and flasks which is reported of approximately $723M.

Single-Use Plastic Water Bottles Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polycarbonate, high density polyethylene (HDPE), and polyethylene terephthalate (PET).

- Key Players: SABIC (Saudi Basic Industries Corporation), Alpek, S.A.B. de C.V.

Component Manufacturing

The major components used in this market are bottle body, cap, and label.

- Key Players: Indorama Ventures, Reliance Industries

Logistics and Distribution

This segment comprises well-coordination among supply chain distributors.

- Key Players: PepsiCo, Danone S.A.

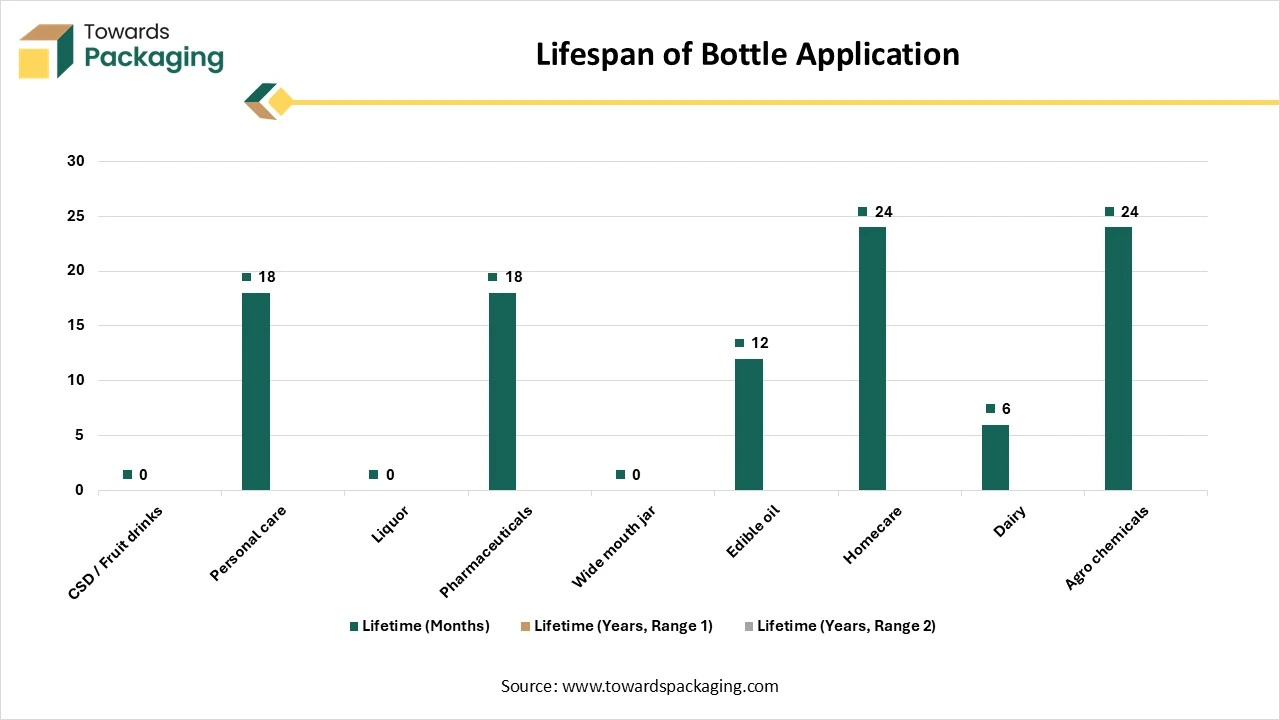

Lifespan of Bottle Applications

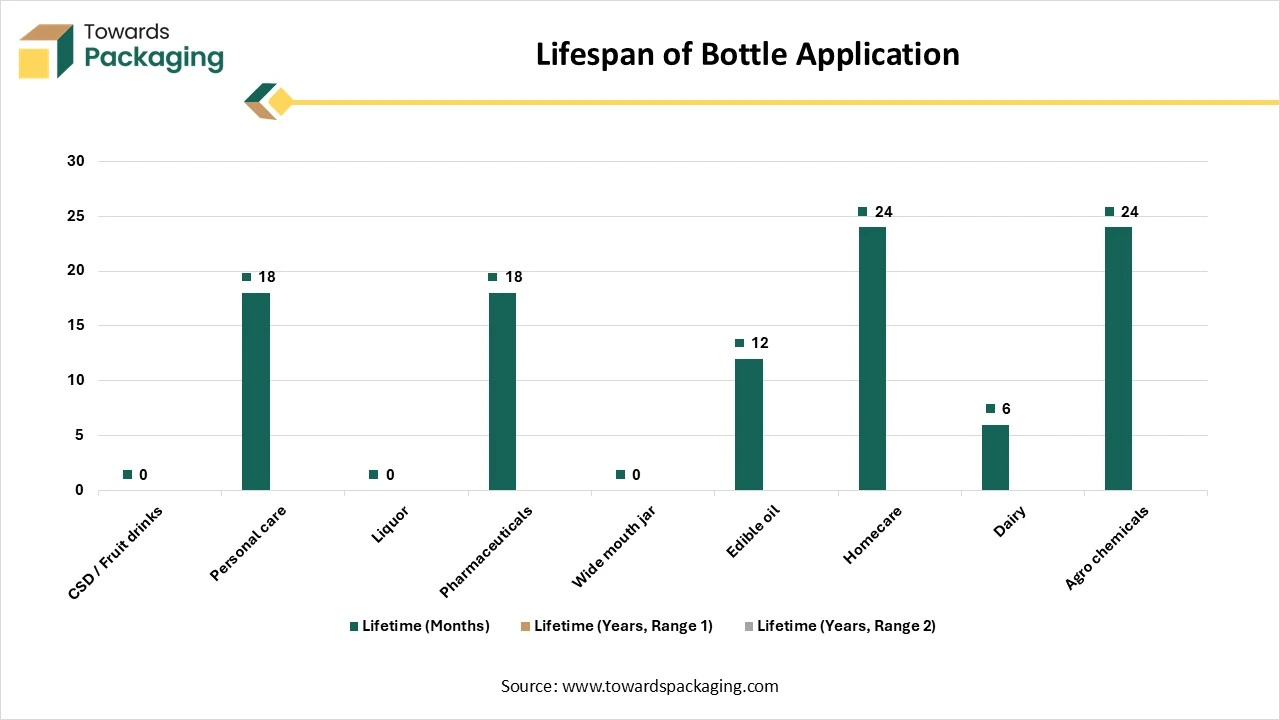

Different bottle applications have different usage lifespans depending on what they hold. Short-life products like CSD, fruit drinks, and wide-mouth jars are used for only a few months. Personal care, pharma, homecare, and edible oil bottles last longer, typically 12–24 months. The longest-lasting applications are liquor and agrochemical bottles, which may stay in use for more than two years. These lifespan ranges help estimate how long PET packaging remains in circulation before it becomes waste, which is important for recycling and circular-economy planning.

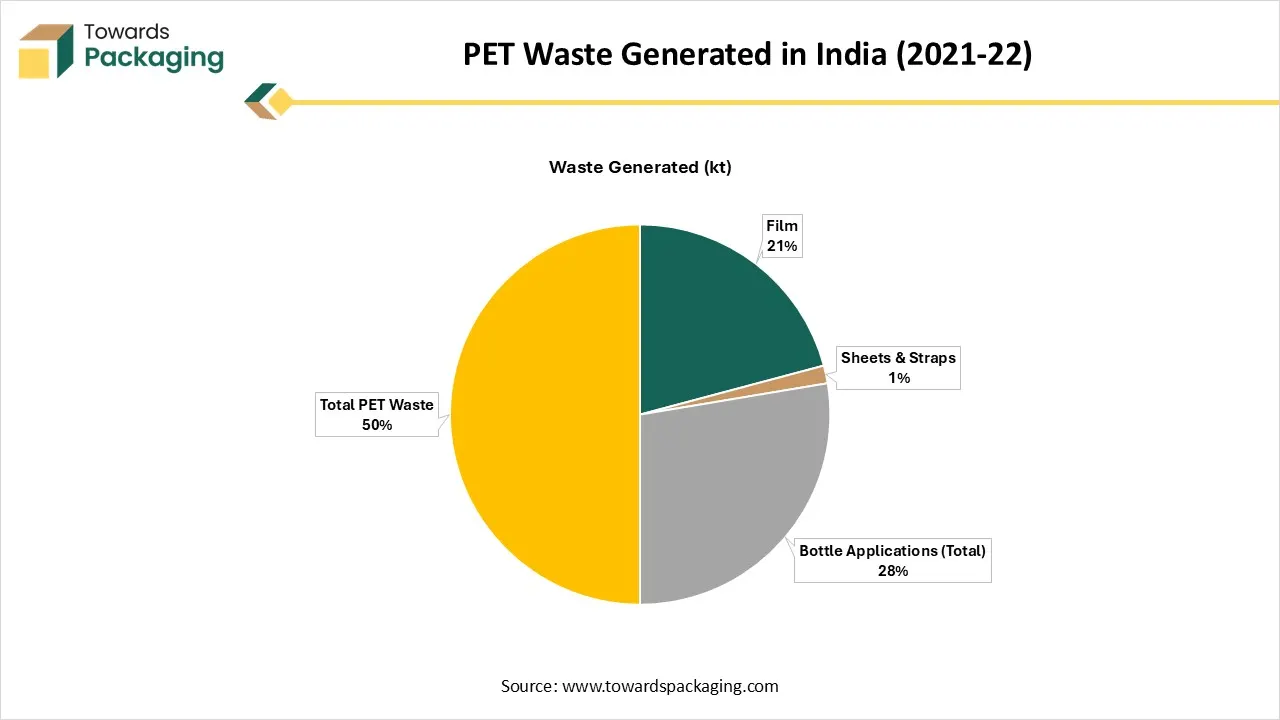

PET Waste Generated in India (2021-22)

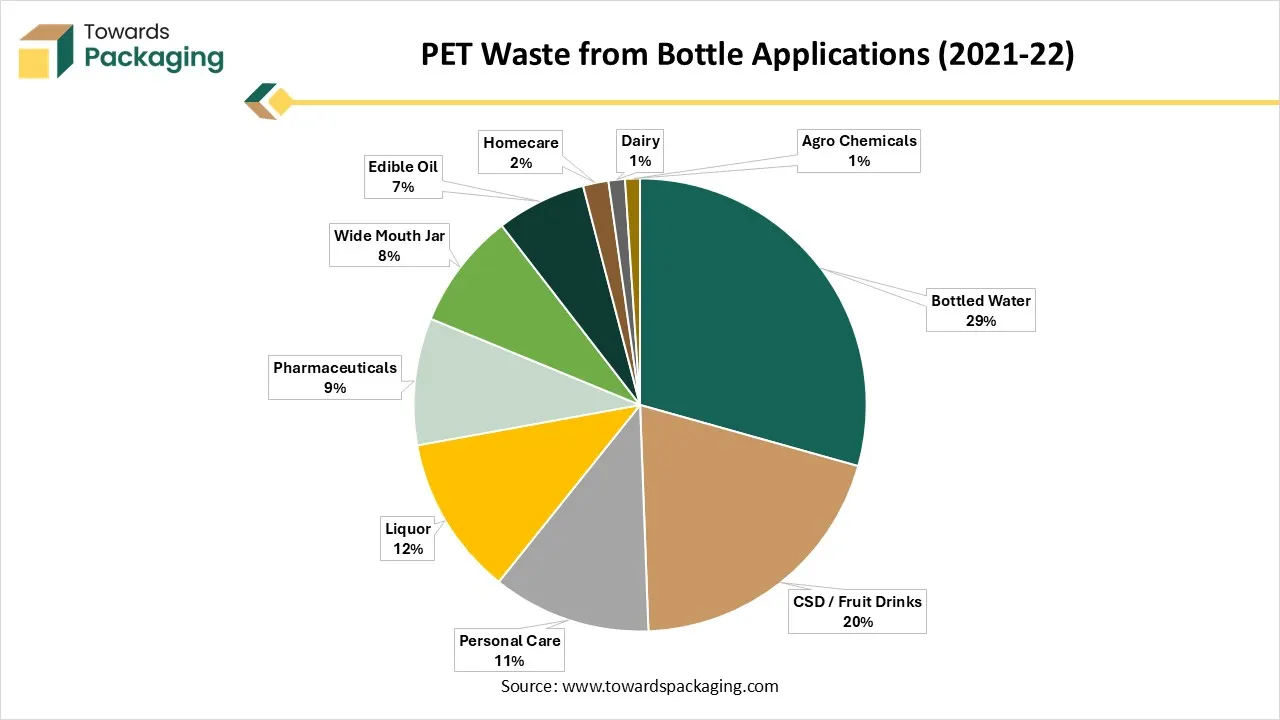

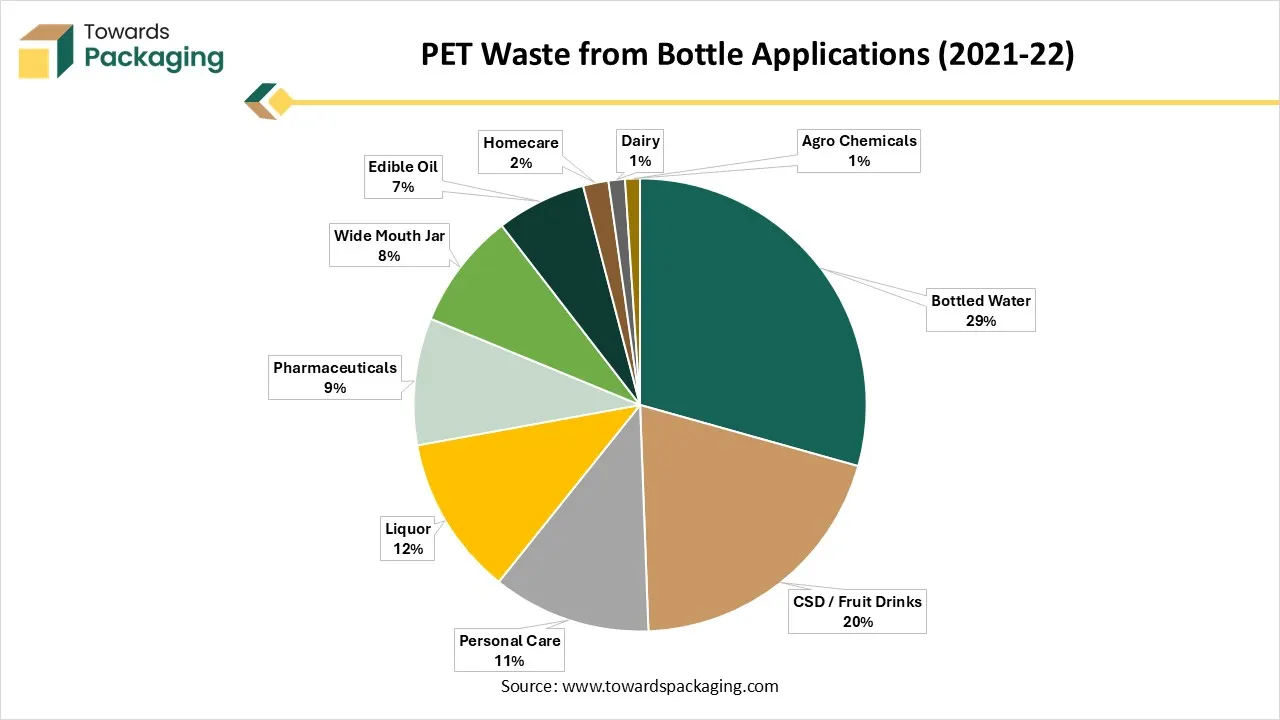

PET Waste from Bottle Applications (2021-22)

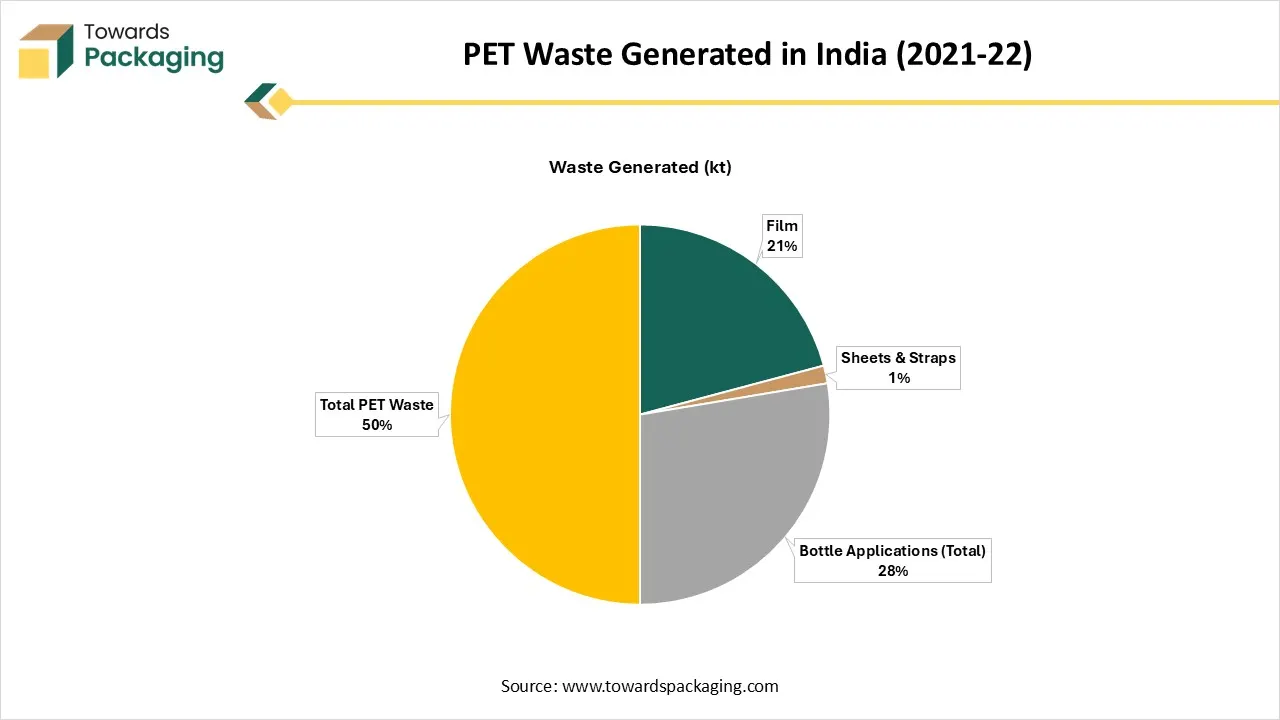

In 2021-22, India generated 1.69 million tonnes (kt) of PET waste. A large share of this came from film applications (around 706 kt), which are widely used in flexible packaging. Bottle applications were the second biggest contributor, generating 936 kt of waste, mainly from bottled water, CSD/fruit drinks, and personal care bottles.

Material Type Insights

Why Polyethylene Terephthalate (PET) Segment Dominated The Single-Use Plastic Water Bottles Market In 2024?

The polyethylene terephthalate (PET) segment dominated the market with highest share in 2024 due to its cost-effectiveness and lightweight. It is cheaper than glass with low risk of damage. These bottles are durable, easy to handle, and transport which is fulfilling several purposes. The increasing food and beverages sector with the declaration of carbonated drinks boosting the packaging of the products. These are balancing between safety, durability, and transparency. The rapid advancement in the recycling technologies has influenced the demand of this segment.

The polypropylene (PP) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to the balance between chemical and mechanical strength of the material. This material is widely used for manufacturing closures, caps, and other packaging closures. These are highly recyclable, and eco-friendly nature has promoted the utilization of this material. It has superior heat-resistant properties which boost the adoption of this segment.

Application Type Insights

Why Food & Beverages Segment Dominated The Single-Use Plastic Water Bottles Market In 2024?

The food & beverages segment dominated the market with highest share in 2024 due to increasing consumption of packaged water. The rising health concern, urbanization, and changing lifestyle of people has influenced the adoption of this market in beverages sector. These bottles provide superior durability, cost-efficacy, and lightweight designs has boost its demand in the single-use plastic water bottles sector. Continuous advancement and enhancement in the recycling potential of the plastic bottles have expanded this market in the segment. With the evolving circular economy and sustainability of the food & beverages sector is investing continuously for innovation in this field.

The pharmaceuticals segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rising storage of medicines and various other healthcare related products. There is a huge upsurge in the demand for contamination-free, safety, and sterility while storing healthcare products for longer period. It is widely utilized for the packaging of saline water, oral medication, nutritional supplements, and several other healthcare products. This type of packaging help in maintaining the integrity of the medicines and prevent microbial growth.

Summary of LCA Studies on Beverage Packaging

| Material Types Compared | Plastic Types Included | Geographic Scope | Functional Unit | Single-Use / Reusable |

| Single-use plastic bottles | Virgin PET, Recycled PET, Bio-based PET | USA | 0.5 L PET bottle | Single-use |

| Single-use plastic bottles | Fossil-based PET, Bio-based PET | USA | 1 kg of PET bottles (~100 × 0.5 L bottles) | Single-use |

| Single-use plastic bottles | PET, PLA | Thailand | 1000 units × 0.25 L bottles | Single-use |

| Plastic vs glass vs carton | PET, HDPE | Denmark, Finland, Norway, Sweden | 1000 L chilled/ambient beverages | Single-use |

| Plastic vs glass vs carton | PET, HDPE, PP | Belgium, Ireland, Netherlands, UK | 1000 L chilled/ambient beverages | Single-use |

| Glass vs aluminium vs PET | PET | UK | 1 L carbonated drink | Single-use (Reusable analysed in sensitivity) |

| Reusable bottles | Steel, Aluminium | N/A | N/A | Reusable |

| PET bottles vs Non-container options (water at home) | PET | India | 20,000 L drinking water at consumer home | Mixed |

Regional Insights

Widespread Availability of Plastics in North America Promote Dominance

North America held the largest share in the single-use plastic water bottles market in 2024, due to widespread availability of plastics. Busy lifestyle of the consumers in this region has fuelled the demand for portable, convenient, and lightweight water bottles which are easily accessible. The rising health and wellness concern has enhanced the demand for single-use plastic water bottles. Increasing consumption of carbonated sodas has raised the production process of the plastic bottles. The functional and premium packaging demand has enhanced the adoption of this market.

Trend in Canada of Single-Use Plastic Water Bottles

Canada displays a rigid development towards lowering the single-use plastic water bottles, which is being driven by the municipal bars, federal regulations, and developed consumer environmental awareness, and a rising market for sustainable alternatives. Hence, the move experiences opposition from the plastic sector and doubts too from current legal challenges.

Rising environmental awareness among users is an initial driver for the reusable water bottle industry. Hence, the past years have witnessed big strides that are being made to address the huge plastic issue. Particulars around the globe are personally creating up[updates in their lifestyle to cut down on the plastic usage, and several of the governments around the globe have made strides to reduce or avoid the single-use plastics in an overall manner.

Rising Demand For Consumer Convenience Boost The Single-Use Plastic Water Bottles Market In The U.S.

The rising demand for consumer convenience for carrying and widely accessible facilities promote this market in the U.S. Continuous innovation in this sector has evolved this market to grow rapidly as it fulfils the demand of the consumers. The rising preference for portable hydration options has influenced the expansion of this market rapidly. Presence of various major market players has a prominent impact in the growth of the industry. There is a huge manufacturing hub of rPET in the U.S. and the estimated PET bottles available for recycling in 2023 was 5,952 million pounds approximately.

Asia Pacific’s Growing Urban Population

Asia Pacific expects the significant growth in the single-use plastic water bottles market during the forecast period. This market is growing due to growing urban population in some countries of this region has influenced the growth of this market. Several other factors such as rising disposal earning and increasing adoption of plastic packaging majorly in food & beverages sector boosting the growth of this market. Some countries such as China, India, Japan, Thailand, and many others are demanding for enhanced hygienic bottled water. The rising concern towards consumption of tap water which result in the spread of several diseases has raised the demand for bottled water.

Trend in China of Single-Use Plastic Water Bottles

In China, a rising middle class and fast urbanization have led to a developed demand for the easy, on-the-go hydration procedure. For many, bottled water is the easiest solution. With more spending greatness, users are eager to pay a luxury for water, which is perceived as safer or healthier water. The government’s marketing for healthier lifestyles has moved consumer choices from sugary drinks to bottled water. Some of the Barbados give importance to this by featuring mineral content and water quality too.

Producers and users are witnessing reusable water bottles from sustainable materials like glass, stainless steel, and durable plastics, too. Intelligent water bottles having characteristics like hydration tracking and temperature control are also gaining attention.

Demand for Japan of Single-Use Plastics Water Bottles

Single-use plastic water bottle consumption in Japan is classified by a high volume of waste that has strong recycling rates, which includes incineration and rising governmental and user efforts to move towards a circular economy. Japan is chosen as a top leader in collecting PET bottles for recycling, which makes an impressive collection rate of 94% in the year 20222. Hence, the recycling process counts as a nuance for what is typically recognized as recycling by European Standards. While the collection rate is high, over half of the collected plastics are being thermally recycled instead of being reprocessed into current materials. Material recycling, in which bottles have shifted into the latest textiles and bottles, only accounts for half of the total.

Increasing Health And Hygiene Concern In India Promote Single-Use Plastic Water Bottles Market

There is huge demand for clean drinking water to avoid the usage of tap water consumption encouraged the demand market in India. Increasing demand for convenience and portability has raised the demand for these packaging sector. The rising expansion of middle-class population has boosted the demand for this market with affordable packaging. The expansion of e-commerce and retail sector are enhancing the accessibility of this sector.

Europe Is Notably Growing Region In The Single-Use Plastic Water Bottles Market

Europe is notably growing due to strong recyclable infrastructure has influenced the demand of market. High demand for consumer trust in convenience, safety, and purity has upsurge the demand for this market. The rising awareness among consumers, and advanced recycling technologies has raised the demand for the usage of single-use of plastic water bottles. Various countries such as the UK, France, Germany, Italy, and many others has contributed significantly towards the development of this market.

High Consumption of Packaged Water Raised the Demand for Single-use Plastic Water Bottles Market

Rising consumption of packaged water bottles has influenced the demand for the market. The major factor driving this market in France is affordability of these water bottles with low risk of breakage. There is a huge demand for convenient packaging with easy-to-carry bottles has raised the demand for this market. Presence of huge working professionals raised the demand for portable water bottles with lightweight packaging.

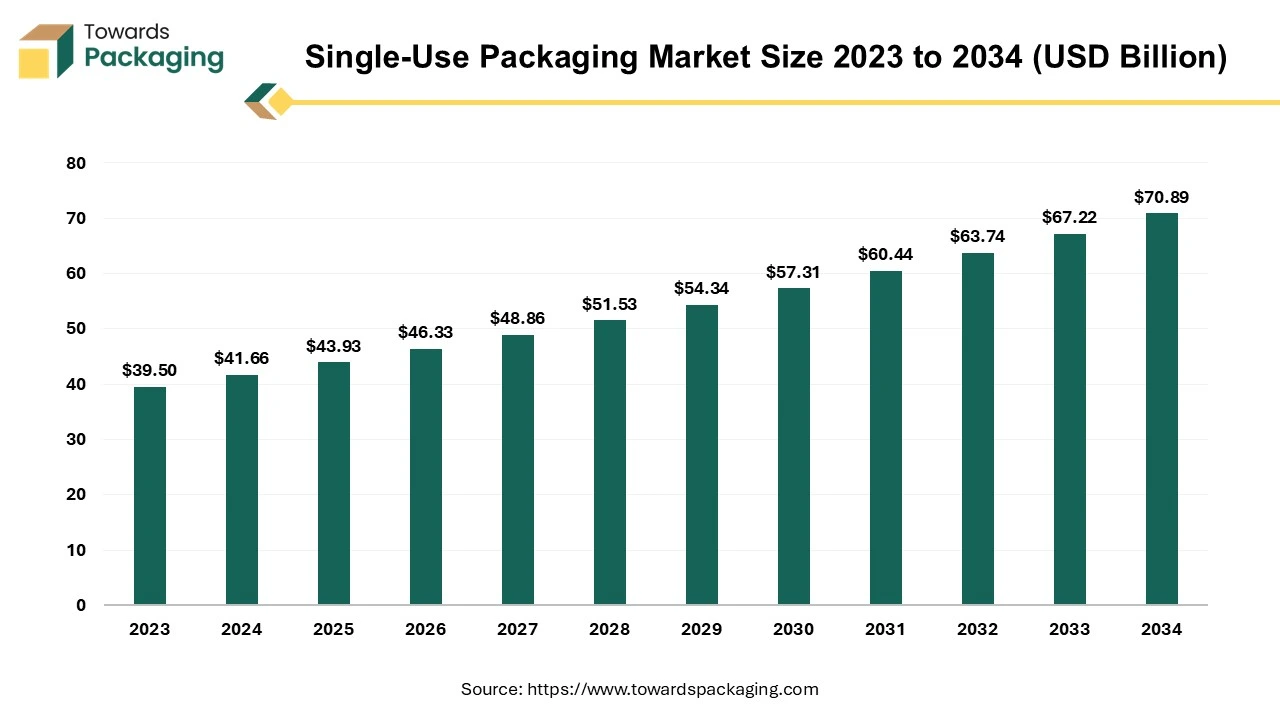

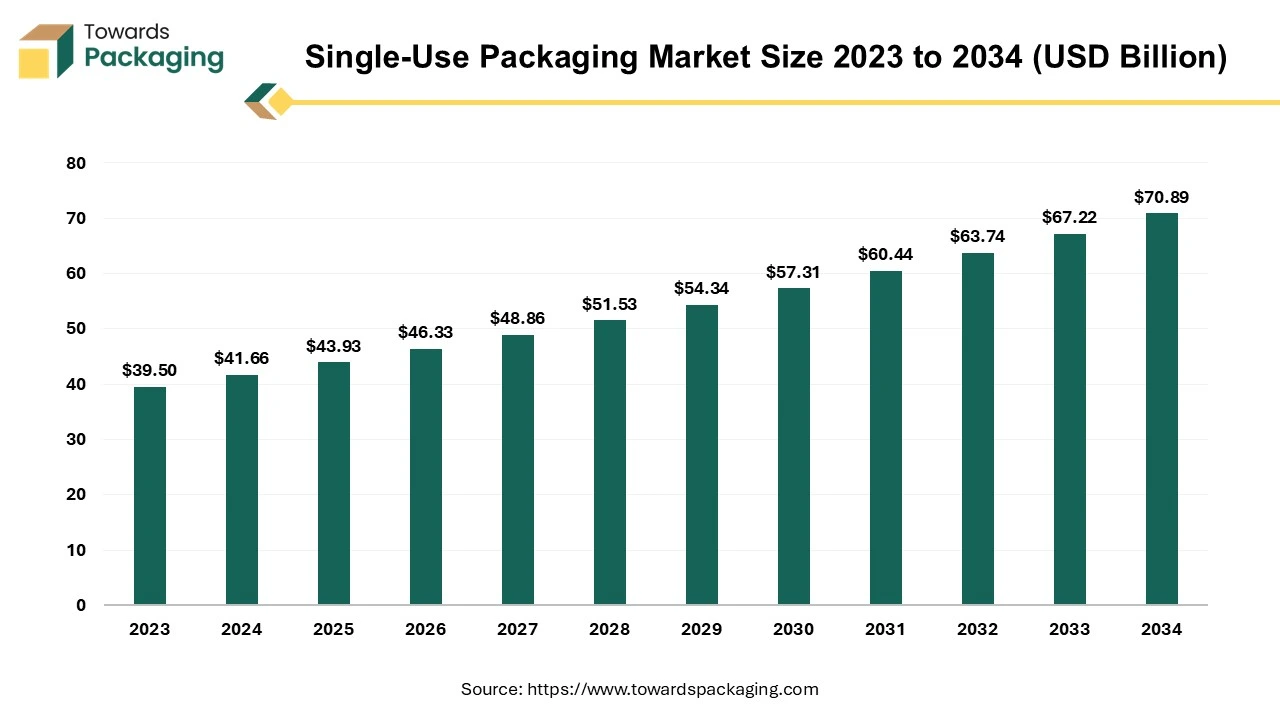

Analysis of the Single-Use Packaging Market: Size, Trends, and Strategic Insights

The single-use packaging market is projected to grow from USD 43.93 billion in 2025 to USD 70.89 billion by 2034, at a CAGR of 5.46%. The market is divided into key segments by material (Plastic, Paper, Glass, and others) and type (Food & Beverage, Pharmaceuticals, Personal Care). The Asia-Pacific region leads with the highest market share, while North America and Europe show steady growth, especially in the healthcare and beverage sectors. Key players include Pactiv LLC, Sealed Air Corporation, and Winpak Limited, with competitive analysis focusing on sustainable practices and packaging innovations.

Key Insights and Strategic Revelations in the Single-Use Packaging Market

- The single-use packaging market is projected to reach USD 70.89 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.

- Single-use packaging plays a critical role in healthcare by ensuring product sterility and preventing cross-contamination.

- The environmental impact of single-use plastic packaging is a growing concern, with 90% of plastic waste going unrecycled.

- The demand for single-use packaging is increasing in Asia-Pacific, driven by the rise of e-commerce and fast-food services.

- North America’s single-use packaging market is expanding, especially in the pharmaceutical and beverage industries.

- Government regulations in regions like India are pushing for bans on single-use plastic packaging due to its environmental impact.

- Diageo's partnership with ecoSPIRITS aims to reduce the carbon footprint and waste from single-use spirits packaging.

- There is a rising focus on developing sustainable alternatives to single-use packaging, including biodegradable and recyclable materials.

- Starbucks has expanded globally, and single-use packaging remains essential in its food and beverage offerings.

- Consumers’ concerns over hygiene and food safety in packaging have fluctuated post-COVID-19, with a decline in heightened concerns over time.

Single-use Pouches Market Insights, Forecast and Competitive Strategies

The single-use pouches market is experiencing rapid expansion, with revenue expected to reach hundreds of millions of dollars between 2025 and 2034. This growth is driven by the increasing demand for lightweight, convenient, and eco-friendly packaging solutions across industries such as food & beverages, pharmaceuticals, and personal care.

The single-use pouches market is expected to experience significant growth during the forecast period. The single-use pouches are designed for one-time use. These pouches are made-up of flexible materials like plastic, paper as well as combination of materials and come with features such as zippers, spouts or tear notches to improve its usability. They are commonly utilized across industries such as food and beverages, pharmaceuticals, cosmetics and household products, where convenience, portability and lightweight packaging are important. Single-use pouches can be utilized for products such as snack packs, sauces, personal care items and pharmaceutical doses. Due to their lightweight nature, they also reduce the transportation costs as well as environmental impact compared to the traditional rigid packaging.

Single-Use Glass Packaging Market Demand, Size and Growth Rate Forecast

The single-use glass packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising expansion of the retail and e-commerce sector, rapid economic growth, increasing demand for premium packaging, rising trend toward reducing plastic waste, growing demand from emerging markets, and increasing demand for single-use glass packaging from various industries food and beverage, cosmetics, pharmaceuticals, and personal care, and others, are expected to drive the global single-use glass packaging market over the forecast period. Single-use glass packaging is designed with excellent finishes that enhance the product's appeal. The integration of smart technologies in single-use glass packaging solutions is expected to fuel the market’s expansion in the coming years.

Single-use glass packaging is equipped with sensors that provide real-time data on its contents. This technology offers valuable information that assists in more effective inventory tracking and management. Sustainability is increasingly becoming a key focus in the packaging industry, which has compelled the prominent players to heavily focus on adopting recycled packaging materials. Additionally, the market is expanding exponentially in various developing and developed regions, particularly Europe, fuelled by the growing demand for single-use glass packaging from multiple industries and growing emphasis on sustainability.

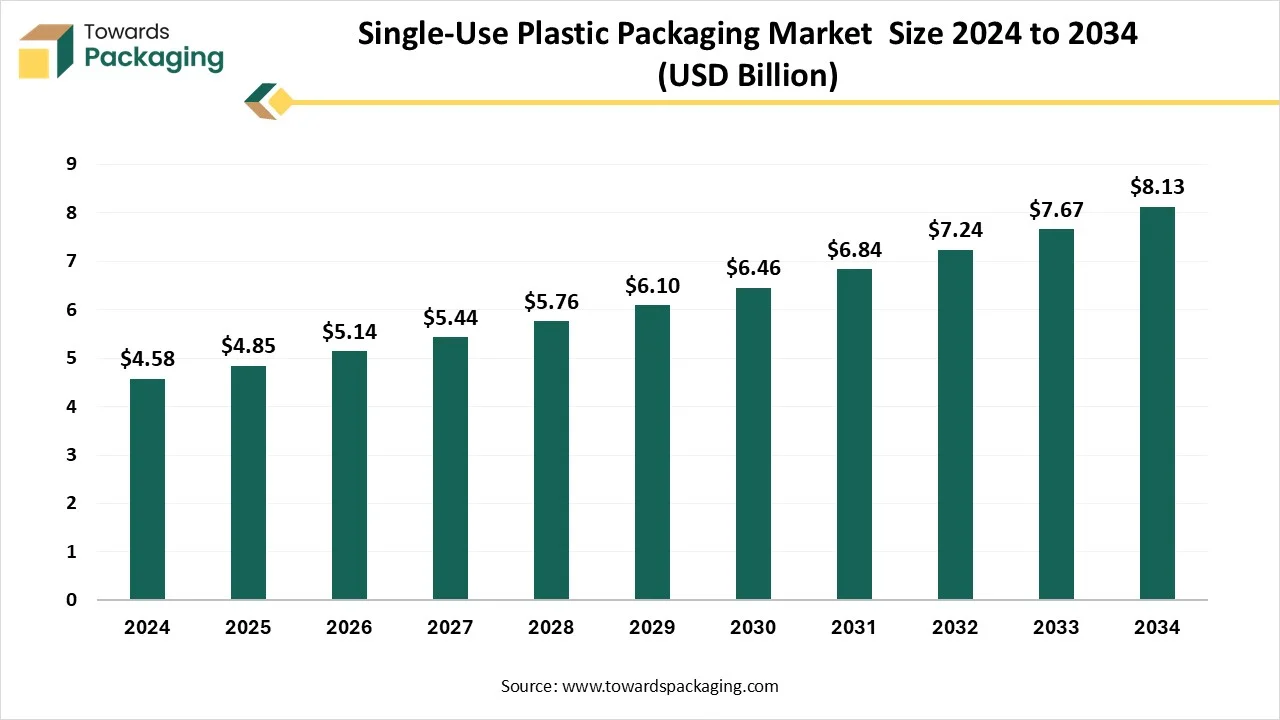

Single-Use Plastic Packaging Market Size, Share, Trends, and Forecast Analysis

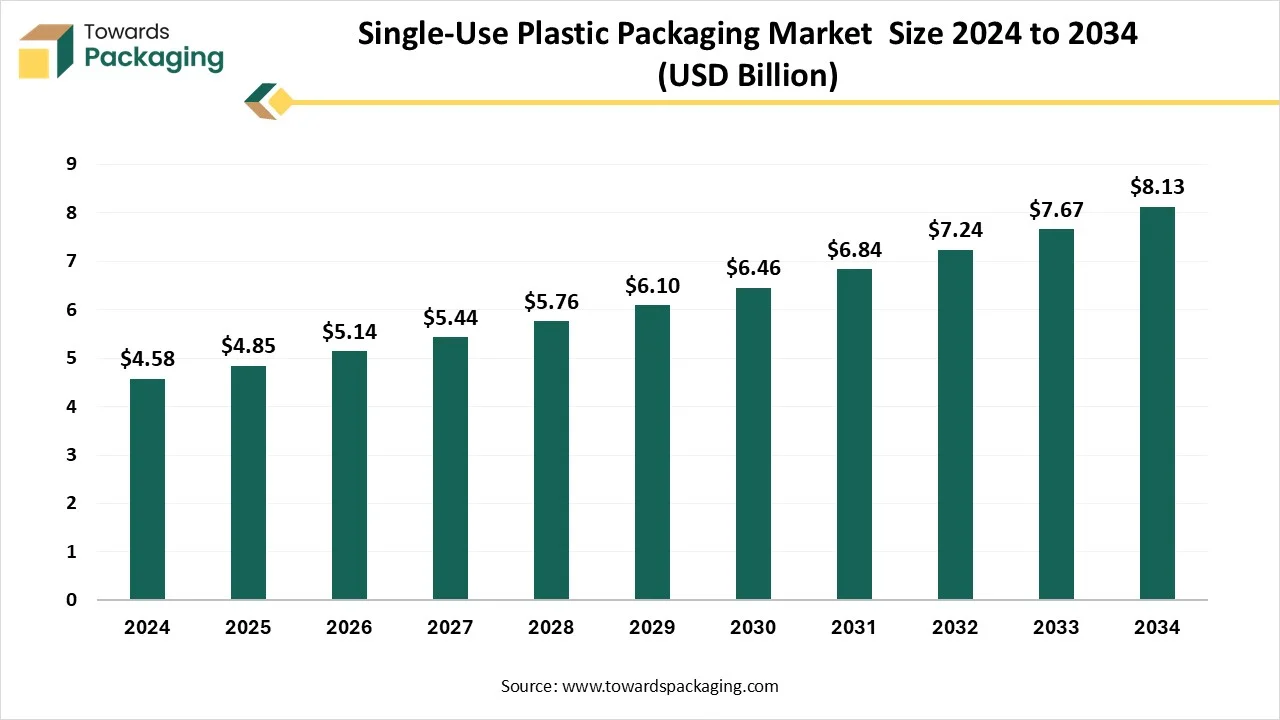

The single-use plastic packaging market is projected to reach USD 8.13 billion by 2034, expanding from USD 4.85 billion in 2025, at an annual growth rate of 5.90% during the forecast period from 2025 to 2034.

The rising demand for cost-effective, durable, and hygienic packaging has influenced the development of the single-use plastic packaging market. Continuous innovation in this sector to fulfil the shifting demand of the consumers has influenced the growth of this market. Due to the presence of major market players and investors, this industry is dominating in the Asia Pacific region.

Key Insights

- Asia Pacific dominated the global market by holding more than 45% of the market share in 2024.

- Asia Pacific dominated the global market with the largest share in 2024.

- Europe is expected to grow at a notable CAGR from 2025 to 2034.

- By material, the polyethylene (PE) segment contributed the biggest market share of 42% in 2024.

- By material, the bio-based plastics segment is expected to expand at a significant CAGR between 2025 and 2034.

- By product type, the bags & pouches segment contributed the biggest market share of 38% in 2024.

- By product type, the bottles & jars segment will be expanding at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment held the major market share of 51% in 2024.

- By end-use industry, the pharmaceuticals & healthcare segment is projected to grow at a CAGR between 2025 and 2034.

Recent Developments

- In May 2025, Rhea Raheja, who is an icon of the K Raheja Group, partnered with her school friend Ishaan Nangia, who is a partner at Terra Casa Hospitality, in order to launch Impact Water, which has penetrated India's USD 9.5 billion packaged water market. This latest business has created young entrepreneurs with direct competition with fronted players like Ramesh Chauhan, Visleri, Coca-Cola’s Kinley, and Himalayan too.

- In February 2025, Phitons has declared the development of an exclusive polymer configuration that blends PBAT (polybutylene adipate co-terephthalate) with minerals such as talcum and calcium carbonate, offering an eco-friendly resolution for daily packaging requirements.

- In January 2025, Stasher, which is a loyal choice for the reusable food storage products, had disclosed the launch of its primary Water Bottle, which is a hydration solution that accurately mixes style and convenience.

- In January 2025, A startup company from Kerela in collaboration with Kerala Irrigation Infrastructure Development Corporation Ltd has declared to introduce water bottle brands ‘Hilly Aqua’. It is an eco-friendly and organic water packaging solution.

- In October 2023, Coca-Cola India has declared to introduce Coca-Cola packaging in 100% recycled plastic (rPET) bottles. These are smaller pack sizes, comprising 250 ml and 750 ml bottles.

Top Companies In The Single-Use Plastic Water Bottles Market

- Nestlé Waters: A global leader developed recyclable packaging bottles including Perrier and Pure Life.

- Coca-Cola Company: It developed recyclable plastic bottles for the packaging of beverages.

- PepsiCo: It produces Gatorade, Aquafina, and Lifewtr single-use plastic water bottles.

- Danone: It is a major market player for manufacturing packaged water bottles.

- Cott Corporation: It has transformed from soft drink labelling to bottled water packaging solution.

- Others: Alpla Group, Berry Global Inc., Manjushree Technopack Limited, AG Poly Packs Private Limited, JSK Plastic Industries, Bisleri International Pvt Ltd, Hindustan Coca-Cola Beverages Pvt Ltd.

Single-Use Plastic Water Bottles Market Segments Covered

By Material Type

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Polyvinyl Chloride (PVC)

- Low-Density Polyethylene (LDPE)

By Application

- Beverages

- Personal Care Products

- Pharmaceuticals

- Chemicals

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (5)