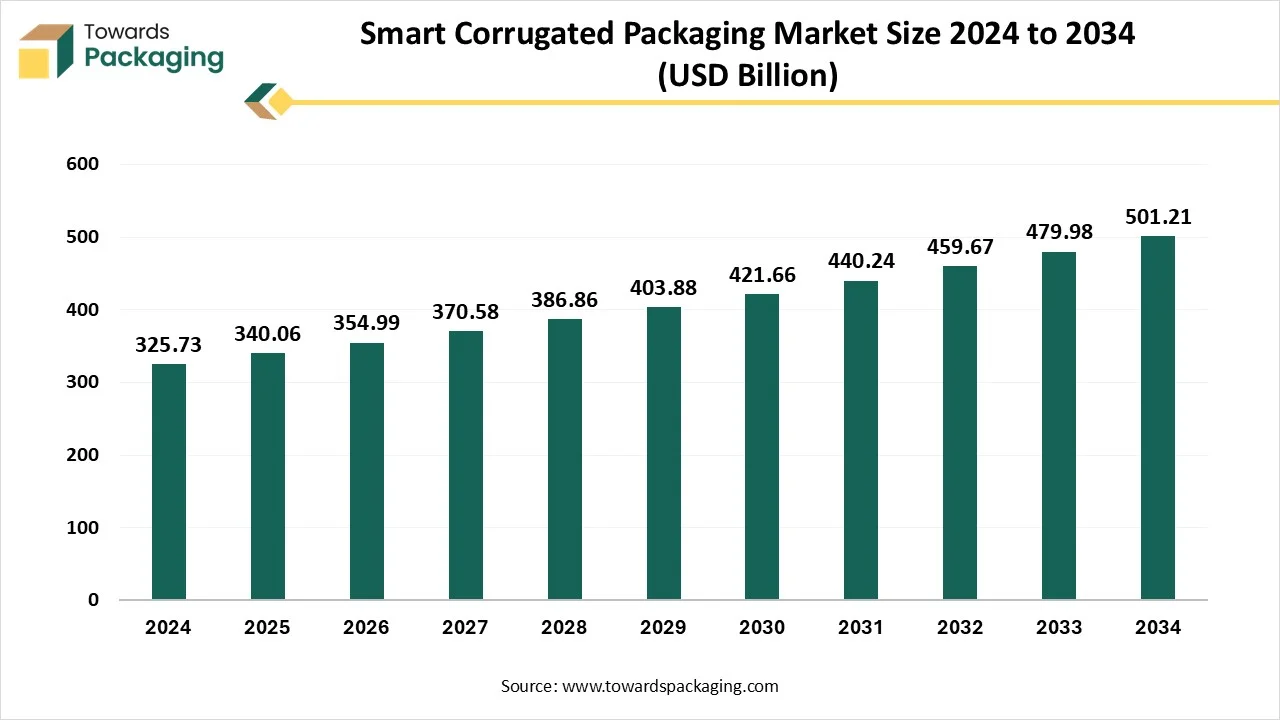

The smart corrugated packaging market is forecasted to expand from USD 355.02 billion in 2026 to USD 523.07 billion by 2035, growing at a CAGR of 4.40% from 2026 to 2035. This report provides an in-depth analysis of market trends, types of smart corrugated boxes, flute profiles, and board constructions. The study covers regional insights, including North America, Europe, Asia Pacific, Latin America, and MEA, highlighting Europe as the leading market and APAC as the fastest-growing region.

Smart corrugated packaging is increasing significantly due to the growing demand for smart, digitally integrated, intelligent, and sustainable packaging options. Smart corrugated packaging incorporates technologies like QR codes, sensors, RFID, and NFC, which permit tracking in real-time, enhance consumer engagement, authenticity, and product monitoring. The major drivers contributing to the development of this market are the growing e-commerce industry, inclination towards eco-friendly packaging, and transparency in the supply chain with evolving regulatory guidelines.

| Metric | Details |

| Market Size in 2025 | USD 340.06 Billion |

| Projected Market Size in 2035 | USD 523.07 Billion |

| CAGR (2026 - 2035) | 4.40% |

| Leading Region | Europe |

| Market Segmentation | By Type, By Flute Profile, By Board Construction, By Smart Integration/Technology, By End-Use Industry and By Region |

| Top Key Players | American Thermal Instruments, Amcor Group GmbH, Avery Dennison Corporation, Crown Holdings, Inc., Linde plc, Point Five Packaging |

The growing demand for technologically advanced packaging has influenced the demand for this market development.

The growing adoption of circular and sustainable packaging due to the rising awareness regarding ecological issues has influenced the demand for smart corrugated packaging.

The growing demand for monitoring of humidity, tampering, and temperature has raised this packaging in electronics, pharma, and the food industry.

In the smart corrugated packaging sector, AI plays an important role in incorporating technologies such as data-driven packaging, smart designing, supply chain optimization, and several others. It is widely used in optimizing the packaging material and structure for sustainability, durability, and cost-efficiency. It can quickly create custom corrugated patterns that are manufactured according to the logistics conditions, branding needs, and dimensions of the products. It supports optimizing route planning, inventory management, and demand forecasting to reduce charges as well as decrease waste material generation.

Growing Adoption of Connected and Intelligent Packaging

The continuous growth in the packaging pattern which are connected to consumers and incorporated with smart technology has raised the growth of this smart corrugated packaging market. The intelligent packaging includes the incorporation of QR codes, RFID, and several other advancements, has raised the research and development work in this market by the major market players. The rapid development of the e-commerce sector has raised the demand for such packaging due to its quality, pattern, and ability to meet the diverse demands of people.

Fluctuation in the Charges of Raw Materials

The continuous fluctuation in the raw material of the smart corrugated packaging has limited the growth of this market. The major market players are mainly focusing on resolving this issue to expand the market rapidly. High initial set-up investment has restricted the expansion of this market. Majorly, it has raised the issue for low-class business people who have less capital for investment.

Enhanced Consumer Experience

The continuous growth in the technology of packaging, which helps to get all the details regarding the packaged products and track their route while the product gets delivered, has enhanced the growth opportunities of the smart corrugated packaging market. With the advanced sensor technology, such smart packaging has helped in checking the quality of the product, mainly in the food industry. Such smart packaging helps to include all the details regarding the products, which maintains transparency between the brands and consumers which helping to maintain the authenticity of the products. The incorporation of RFID tags or sensors protects food products from spoilage and prevents ts wastage of food materials. The continuous research and development have enhanced the scope of evolution in this market, which increases several opportunities for development to meet the demand of the consumers.

The slotted boxes segment holds a considerable share of the smart corrugated packaging market due to its Simple structure, adaptability, and cost-efficacy. The growing demand for packaging which are budget-friendly yet provides high-quality protection has raised the demand for slotted boxes demand by consumers. These boxes are commonly called regular slotted containers, which are significantly utilized by the pharmaceutical, food, beverage, and e-commerce sectors for retail display, storage, and shipping purposes. The versatility of these boxes increases their demand significantly due to the easy incorporation of support for technologies such as NFC chips, QR codes, sensors, and RFID tags. The incorporation of such enhanced technologies enables the authenticity of the products and customer interaction.

The rigid/die-cut/custom-shaped boxes segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. It is growing significantly due to its premium look, structural integrity, and product-specific designs. These help to enhance the brand’s value by providing an enhanced unboxing experience to the consumers. It helps to maintain the structure of the packaged product during transportation, which reduces the risk of damage.

The A-flute segment dominated the smart corrugated packaging market in 2024 due to the compatibility, cushioning properties, and structural strength of the packaging technique. The thickness of the A-flute provides compression resistance and excellent rigidity, which makes it an ideal choice for the transportation of electronics and several other fragile products. It provides sufficient space for smart and digital printing, which permits the insertion of temperature indicators, interactive labels, and tracking codes.

The E-flute packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to versatility, thin profile, and smooth surface in branding and smart printing applications. These are widely accepted by the pharmaceutical, electronics, and cosmetics sectors.

The single wall segment dominated the smart corrugated packaging market in 2024 due to the compatibility with smart technology, strength, and cost-efficacy of the product. These are extensively utilized in the e-commerce sector, pharmacy, and food industry. The growing demand for intelligent packaging with tracking facilities has led to the growth of this segment.

The double wall segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its suitability, strength, and durability. These packages provide a stable structure to the products, which decreases the risk of damage during transportation.

The timetemperature indicators / modified atmosphere packaging (MAP) segment was dominant over the smart corrugated packaging market in 2024 due to the rising demand for high shelf-life of products, freshness, and safety. These smart solutions are widely accepted by the food and beverage and pharmaceutical industries. These are tiny labels that show the exposure of products to the high-temperature range.

The IoT-enabled sensor segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These packages are evolving this market by connecting it with data-driven resolutions. The rising adoption of communication and real-time monitoring provides exclusive visibility into shock, tamper event, location, temperature, and humidity.

The food and beverage segment led the smart corrugated packaging market in 2024 due to the growing concern for preserving the quality and customer engagement. These smart packaging comes with RFID tags, IoT-enabled sensors, and QR codes has influenced the brands to accept such packaging, that maintains transparency with consumers. These types of inventions help to track real-time data and prevent from wastage of products.

The pharmaceutical and healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. These packages enhance the connectivity between brands and consumers by providing QR codes with detailed information regards the packaged products.

The Europe region held the largest share of the smart corrugated packaging market in 2024, due to the growing adoption of sustainable packaging of products. Several other factors, such as stringent packaging guidelines, strict alliances, and many others, have influenced the growth of this market. Integration of advanced packaging industries with huge manufacturing units has raised the demand for such packaging to fulfill the demand of the consumers.

There is a high recycling rate of the packaging, which influences the usage of smart packages. The strict regulatory rules of the packaging industry, eco-friendly packaging demand, and various other factors influence the growth of this industry.

The initiation of the government towards plastic packaging tax and robust e-commerce development has raised the demand for the smart corrugated packaging market. The rising inclination towards sustainability in the packaging industry and the sizeable food sector has raised the demand for this industry.

The Asia Pacific region is estimated to grow at the fastest rate in the smart corrugated packaging market during the forecast period. The market is promoted due to the growing e-commerce industry, sustainability alternatives, rapid industrialization, and tech innovation. Several countries, such as China, India, Japan, South Korea, and many others, have boosted this market due to huge volume exports and the growing e-commerce industry. The adoption of such smart corrugated packaging has fulfilled the consumer’s demand.

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

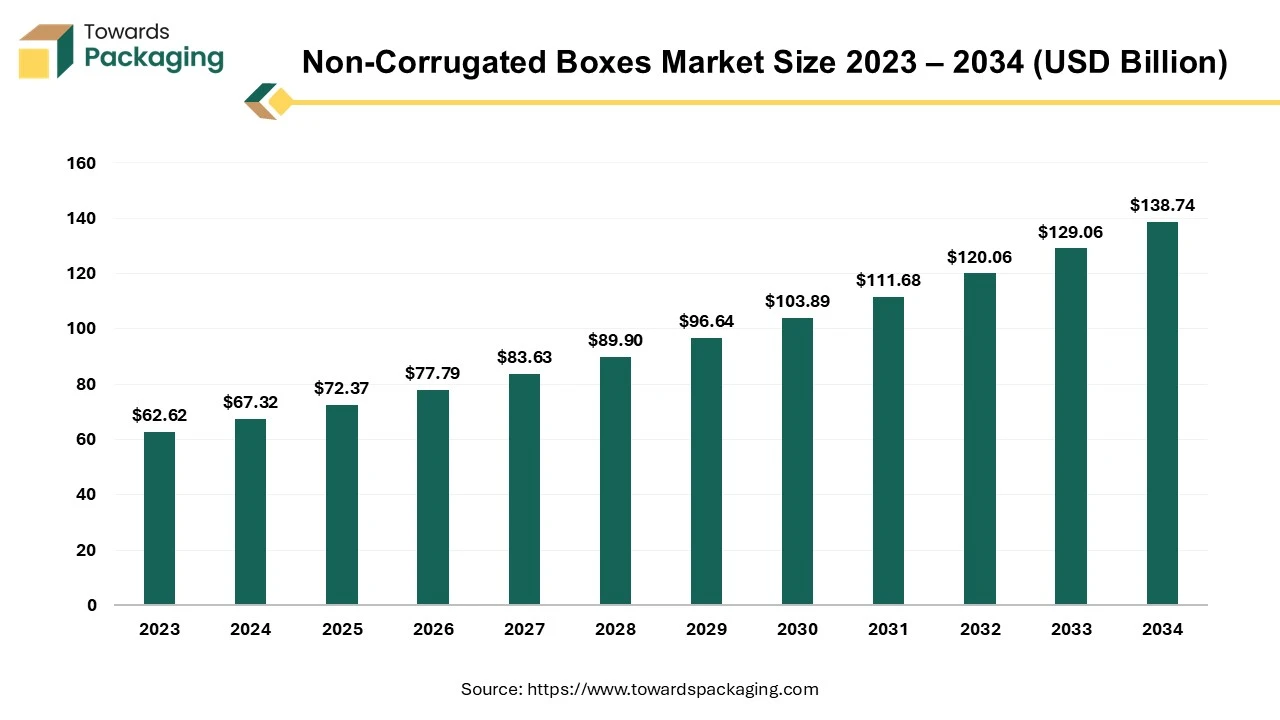

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

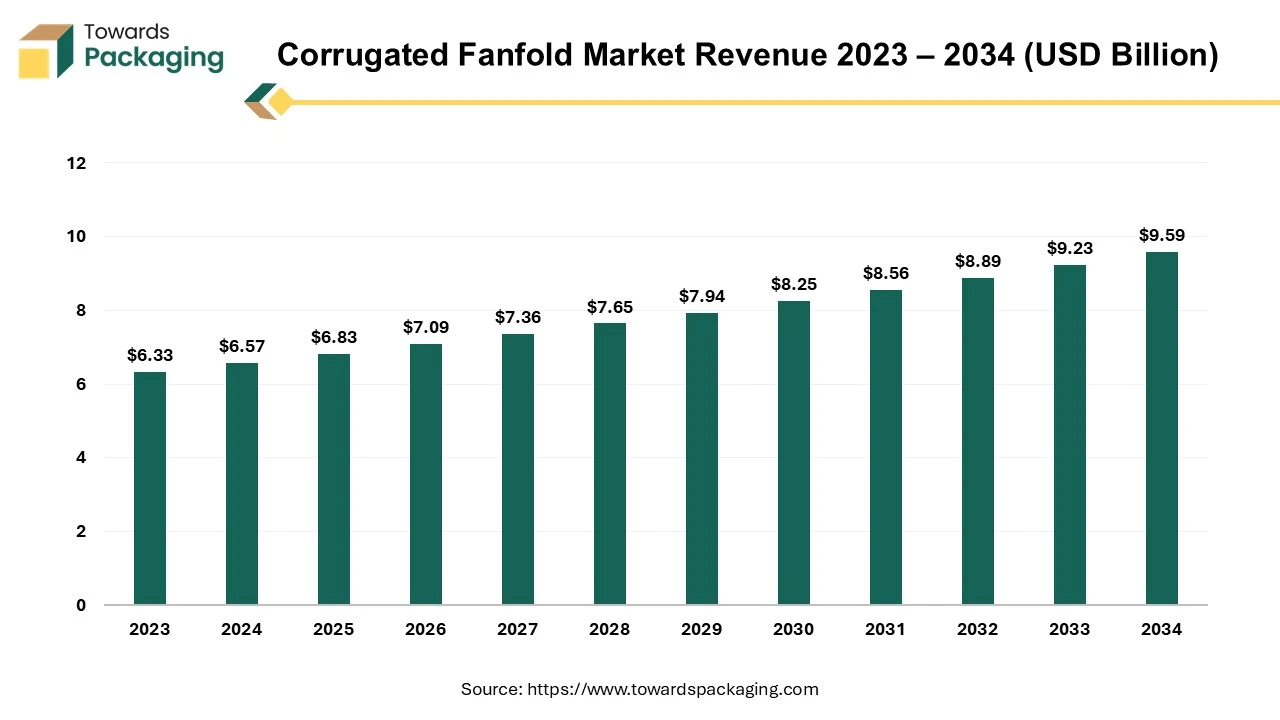

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

By Type

By Flute Profile

By Board Construction

By Smart Integration/Technology

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026