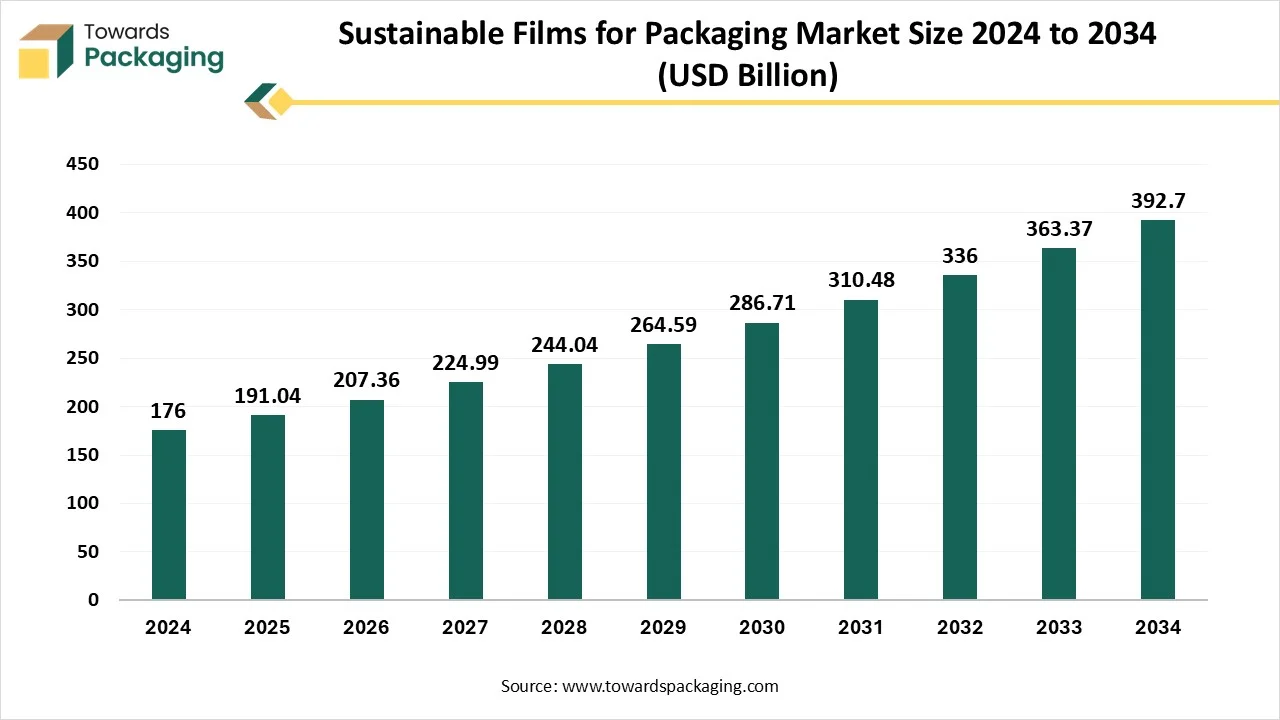

The global sustainable films for packaging market is projected to grow from USD 191.04 billion in 2025 to USD 392.7 billion by 2034, representing a robust CAGR of 8.54%. This report covers products segmentation (PLA, cellulose, PP, PE, PET, others), application segmentation (food & beverages, pharmaceuticals, consumer goods, others), and detailed regional analysis across North America, Europe, Asia Pacific, Latin America, and MEA. It also provides a comprehensive review of key companies including Amcor, Mondi, Berry Global, UFlex, Sealed Air, Pregis, and Constantia Flexibles, along with competitive benchmarking, trade statistics, import-export data, value chain assessment, raw material supply analysis, pricing trends, and manufacturing & distribution ecosystem insights. Europe held the largest share in 2024, while APAC is expected to post the fastest growth.

Several companies operating in the market are focused on adopting sustainable materials to develop sustainable packaging films and align with the principles of the circular economy. The market is also experiencing significant growth, driven by the growing demand from various end-use businesses, including food and beverage, pharmaceutical, consumer goods, and others, which require high-quality standards and sustainable films for packaging. Additionally, the market is expanding rapidly in Europe, fuelled by stringent government initiatives, rising focus on adopting biodegradable packaging, and growing demand from multiple industries.

Sustainable films for packaging are films are often made from eco-friendly and sustainable materials. Sustainable films for packaging can be recyclable, reusable, biodegradable, and are generally made from renewable resources or recycled content. Plastic takes nearly 1000 years to decompose, which has increased the demand for sustainable packaging materials. In recent years, these films have become increasingly popular owing to their numerous benefits, such as natural resource conservation, reduced greenhouse gas emissions, and minimized overall waste generation. Sustainable films for packaging are films are manufactured to align with principles of the circular economy, by reducing landfill and boosting sustainability.

| Metric | Details |

| Market Size in 2025 | USD 191.04 Billion |

| Projected Market Size in 2034 | USD 392.7 Billion |

| CAGR (2025 - 2034) | 8.54% |

| Leading Region | Europe |

| Market Segmentation | By Products, By Applications and By Region |

| Top Key Players | Amcor plc, Rani Group, Mondi, Berry Global Inc., UFlex Limited, Pregis LLC, Constantia Flexibles, Sealed Air |

In today's rapidly evolving technological landscape, artificial intelligence integration holds great potential to reshape the landscape of sustainable packaging films by improving manufacturing efficiency, optimizing material usage, and enhancing sustainability. AI-powered solutions in sustainable film packaging offer new innovative ways to enhance recyclability, reduce waste, and eliminate the chances of human error. The utilization of advanced Machine learning (ML) algorithms can identify, sort, and process recyclable materials effectively. The effective biodegradable materials and eco-friendly alternatives significantly lower the overall environmental footprint and promote economic circularity in the packaging industry landscape. Therefore, AI-driven recycling systems provide a systematic approach to address the issue of packaging waste and optimize the use of recycled materials.

Growing Consumer Demand for Sustainable Packaging Film

The rising consumer demand for sustainable packaging film is expected to fuel the growth of the sustainable films for packaging market during the forecast period. Sustainable packaging films reduce the environmental footprint while maintaining their functional requirement. In recent years, sustainability is playing a crucial role in developing packaging materials, encouraging businesses across various industries such as food & beverage, consumer goods, and pharmaceutical sectors to adopt mono-materials. Consumers are increasingly demanding eco-friendly and sustainable packaging options, which increases the demand for recyclable and biodegradable films to reduce the usage of traditional fossil fuel-based plastic. Bio-based packaging significantly increases the utilization of renewable resources and reduces greenhouse gas emissions. Thus, driving the market’s growth.

Rising Recycling Issues

The recycling issues related to plastic waste are expected to hamper the market's growth. The market often faces the complexity of recycling issues, particularly in middle and lower-income countries, owing to limited recycling infrastructure. In addition, the fluctuation in the price of raw materials, which are widely used in sustainable packaging films, can adversely impact the profitability of manufacturers. Such factors may hinder the growth of the global sustainable films for packaging market during the forecast period.

How is the Rising Emphasis on the Circular Economy and the Government's Stringent Policies Impacting the Growth of the Market?

The rising emphasis on the circular economy, along with the government's stringent policies, is projected to offer lucrative growth opportunities to propel the growth of the sustainable films for packaging market. Several governments around the world have implemented stringent policies to promote biodegradable and compostable materials. Governments are responsibly addressing the ongoing environmental concerns about single-use packaging waste by enacting stringent regulations to reduce plastic waste and promote a circular economy. Moreover, the surge in the number of awareness campaigns and implementation of various strategies for zero–plastic waste to reduce landfill, oceans, and other ecosystems, is driving the market’s expansion in the coming years.

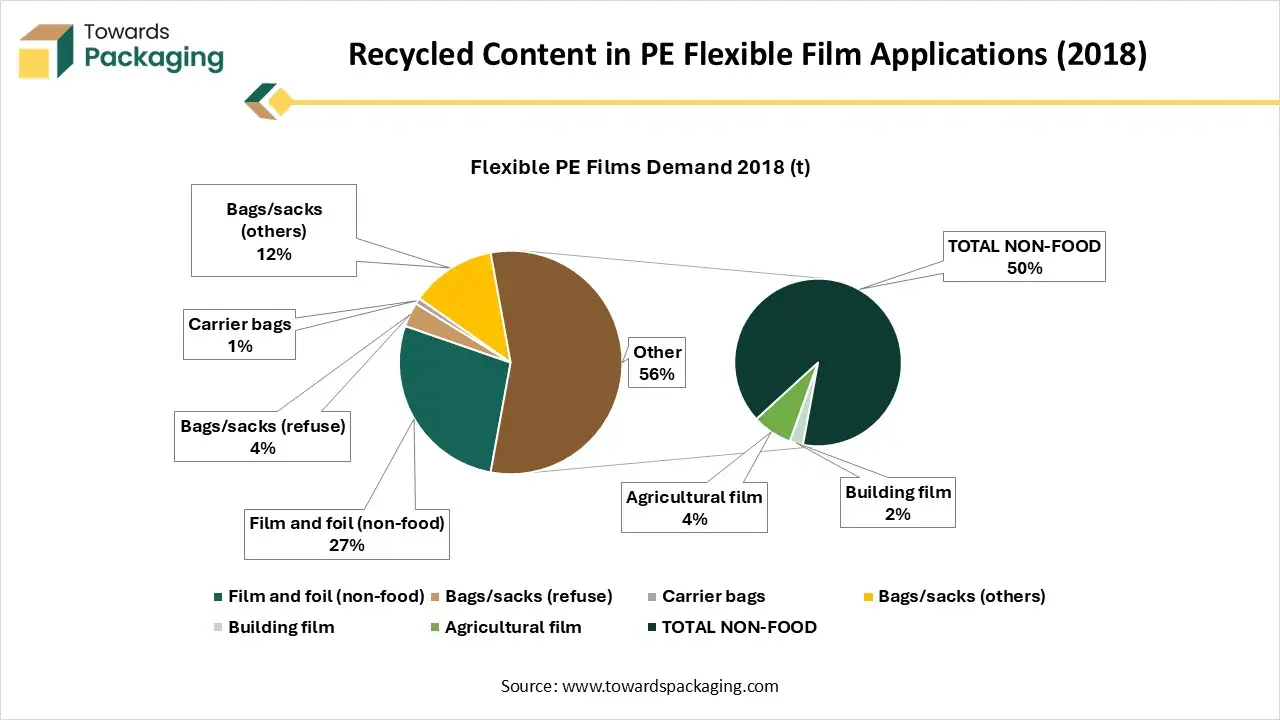

In 2018, the European market produced 1.8 million tonnes of recycled PE films, which represented roughly 20% of total PE flexible film demand. Of this, an estimated 1.2–1.3 million tonnes were high enough quality to be reused in film applications again, about 20% of all non-food film demand.

Recycled PE from films cannot currently be used in food-contact packaging, but there is significant untapped potential in almost all other flexible film sectors.

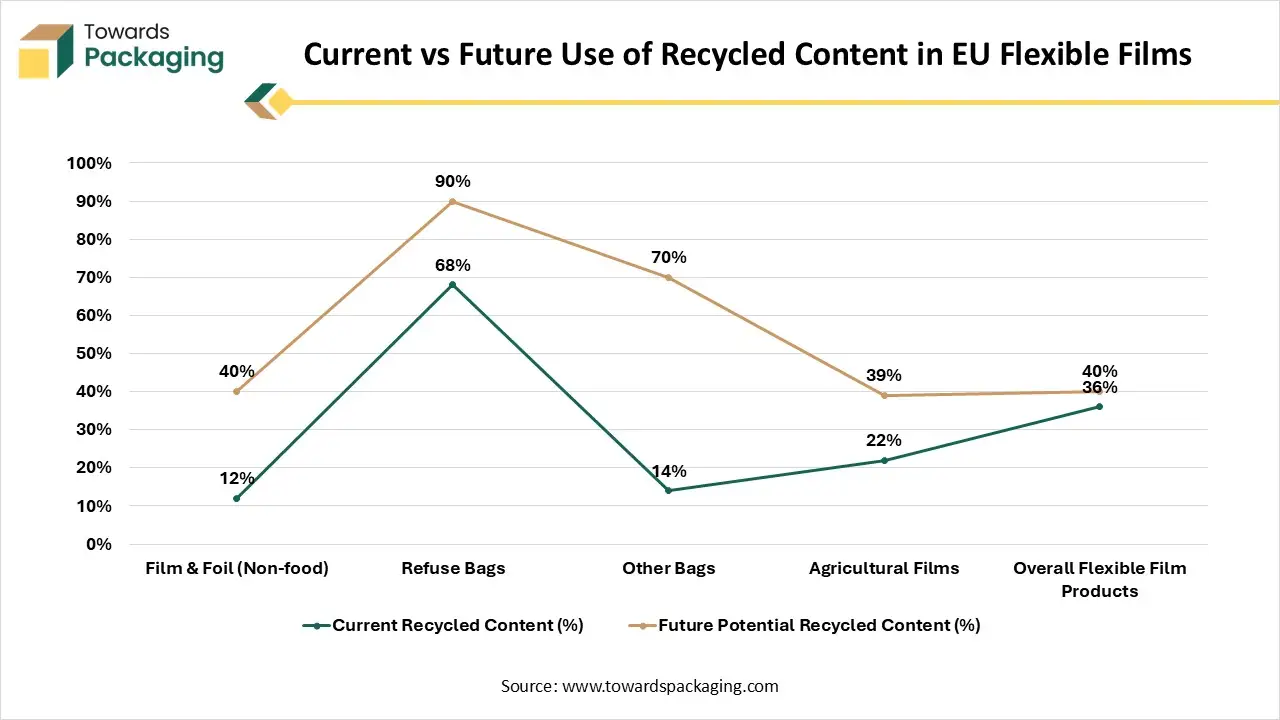

Refuse bags already use large amounts of recycled material (68%) and could reach 90% in the future.

| Growth Scenario (PE Film Production) | Estimated Demand for Recyclate (2030) |

| 1% Annual Growth | 3.6 million tonnes (Mt) |

| 4% Annual Growth | 5.0 million tonnes (Mt) |

| Additional recyclate usable in refuse bags | Up to 200 kt |

Across all flexible films, recyclate uptake could be dramatically expanded if technical and quality barriers are addressed. By 2030, depending on the growth of PE flexible packaging production, Europe could require between 3.6 Mt and 5 Mt of PE recyclate for flexible film applications alone.

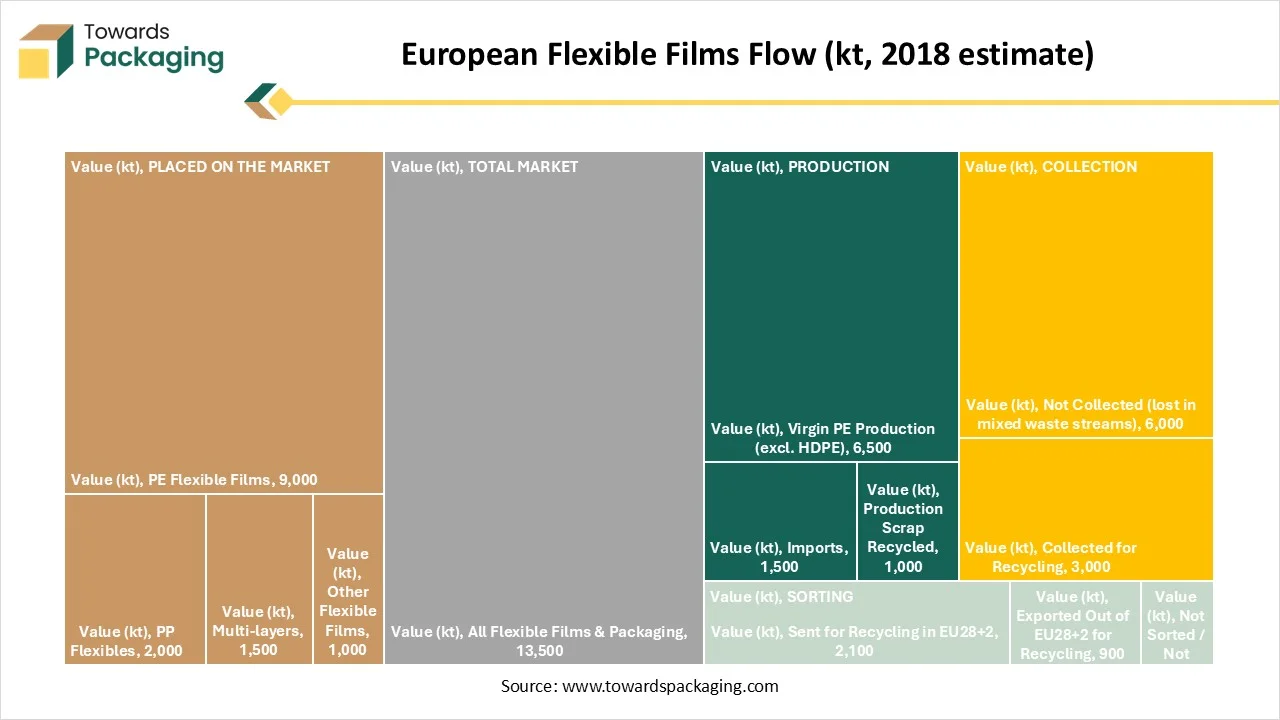

The diagram shows how flexible plastic films mainly polyethylene (PE) move through the European market from production to recycling.

Europe places around 13.5 million tonnes of flexible films on the market each year.

In short, the chart shows that most flexible films placed on the market are not recovered, and only a minority becomes recyclate—highlighting major challenges in collection, sorting, and recycling infrastructure.

The polylactic acid (PLA) and cellulose segments held a dominant presence in the sustainable films for packaging market in 2024, owing to their efficient recyclability and biodegradability properties, which make them an attractive option for sustainable film packaging. PLA is derived from renewable resources such as sugarcane or cornstarch. Polylactic acid (PLA) and cellulose are widely adopted for the packaging of food and beverage goods.

On the other hand, the polyethylene (PE) segment is expected to grow at a significant rate, due to its lightweight and recyclable nature. The lightweight nature of PE films significantly lowers greenhouse gas emissions during transportation, and it also requires less energy during production compared to other packaging materials. Polyethylene (PE) film is extensively used in numerous forms, such as stretch wrap, shrink wrap, and other types, to meet the needs of diverse products. In addition, a rising focus on sustainability and stringent environmental concerns, such as bans on single-use plastics, are expected to fuel the segment’s expansion during the forecast period.

The food & beverages segment accounted for a significant share of the sustainable films for packaging market in 2024. The surge in the consumption of fruits, vegetables, and processed meats & sausages has led to an increasing demand for sustainable packaging films owing to their lightweight, adaptable, and protective packaging options. The rapid urbanization, along with the rising trend of grocery shopping in supermarkets, has significantly increased the demand for sustainable packaging films. In addition, stringent environmental regulations are promoting the use of biodegradable and compostable materials in the food & beverage Industry.

On the other hand, the pharmaceuticals segment is expected to grow at a notable rate during the projection period, owing to the rising need for safe, secure, and sustainable packaging solutions in the pharmaceutical industry. This film has temperature control & moisture-resistant properties to protect the content from microbial contamination. Additionally, the rapid technological innovation includes new material formulations to enhance the strength, functionality, and flexibility of sustainable films has led to an increase in their adoption in the pharmaceutical segment.

Europe held the dominant share of the sustainable films for packaging market in 2024. The region has an established packaging sector supporting food & beverage, consumer goods, and pharmaceuticals, major users of sustainable films for packaging solutions. The region's high per capita income drives demand for fresh & packaged foods such as processed meats, sausages, fruits, and vegetables. The rapid shift toward biodegradable, recyclable, and compostable materials, mainly due to the rising regulatory pressures to minimize carbon emissions and increasing emphasis on environmental sustainability, is significantly contributing to the regional market’s growth. In addition, the integration of smart packaging technology, the rising expansion of the e-commerce industry, bans on single-use plastics, and rapid advancement in biodegradable packaging and recycling technologies are expected to support the growth of the sustainable films for packaging market during the forecast period.

On the other hand, Asia Pacific is expected to grow at the fastest CAGR. The growth of the region is driven by the rising awareness of its environmental benefits, rapid urbanization, increasing consumer inclination for sustainable packaging films, and growing demand from various end-user industries. Asia Pacific has an ever-growing population base, a surge in disposable income, an abundance of raw materials, and increasing expansion of food processing operations, which are positively influencing the market’s growth. Furthermore, the expansion of the e-commerce sector, coupled with the increasing expansion of the retail supply chain, is expected to bolster the market’s revenue in the region. Government organizations are increasingly promoting the use of sustainable packaging to reduce the environmental impact of packaging waste and improve sustainability.

By Products

By Applications

By Region

December 2025

December 2025

December 2025

December 2025