Automated Bagging Solutions Market Size, Share, Trends and Growth Forecast

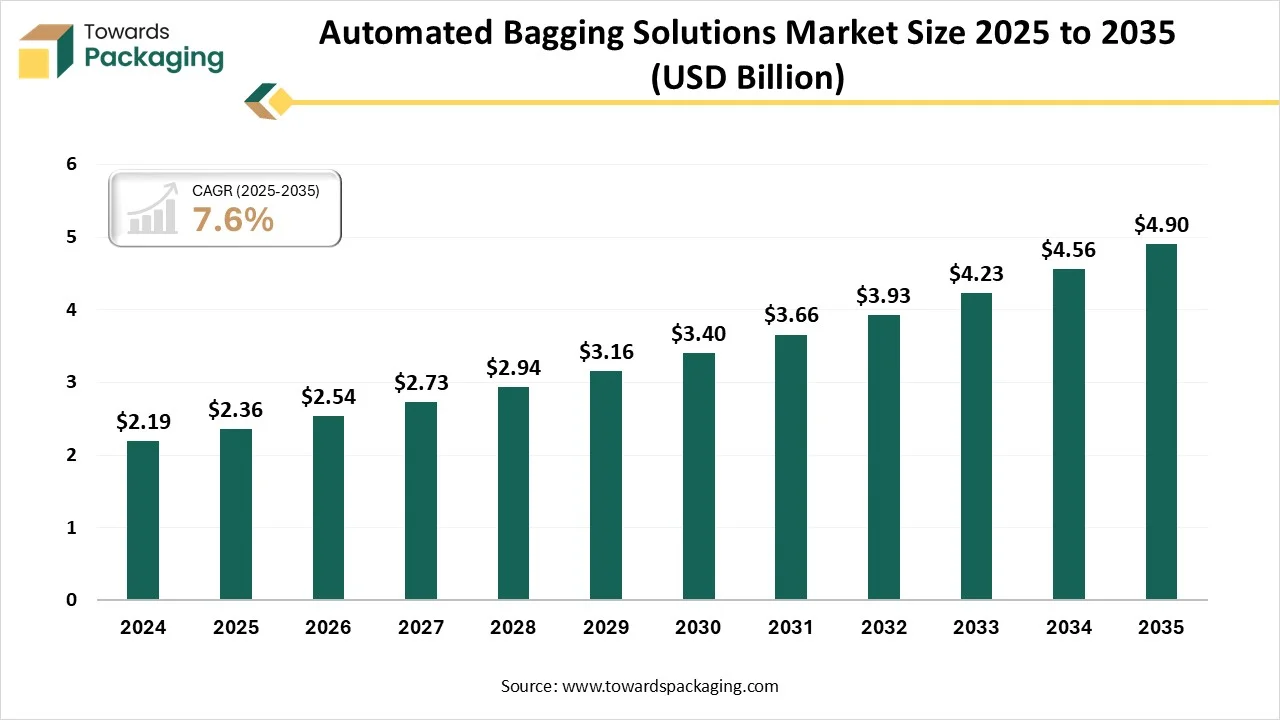

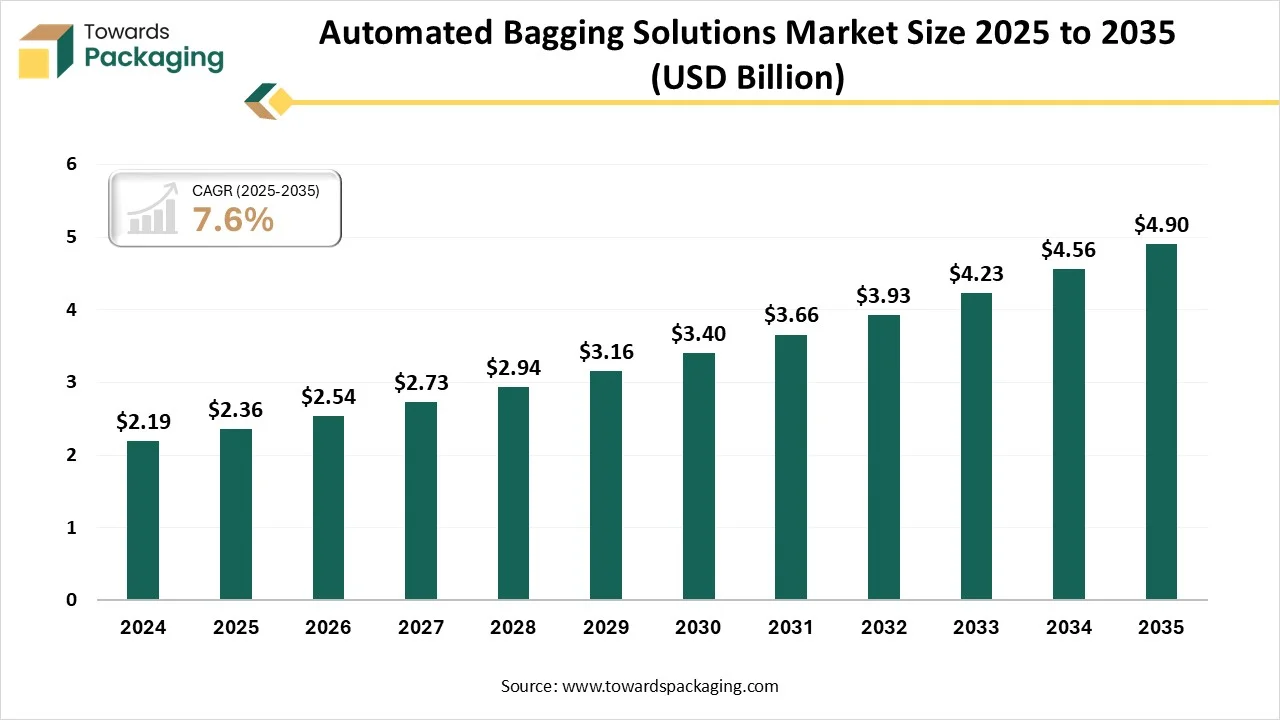

The automated bagging solutions market is projected to reach USD 4.9 billion by 2035, growing from USD 2.54 billion in 2026, at a CAGR of 7.6% during the forecast period from 2026 to 2035. This market is growing due to increasing demand for faster, cost-efficient packaging processes and rising adoption of automation to reduce labor dependency and improve accuracy.

Key Takeaways

- By region, Asia Pacific has dominated the market having the biggest share of approximately 38% in 2025.

- By region, North America is expected to rise at the fastest CAGR between 2026 and 2035.

- By product type, the vertical form fill seal (VFFS)machines segment has contributed to the largest market share of approximately 40% in 2025.

- By product type, the robotic automated bagging systems segment will grow at the fastest CAGR between 2026 and 2035.

- By automation level, the fully automatic bagging systems segment contributed to the largest share of approximately 60% in 2025.

- By automation level, the semi-automatic bagging systems segment will grow at the fastest CAGR between 2026 and 2035.

- By bag type, the pillow bags segment has contributed to the largest market share of approximately 35% in 2025.

- By bag type, the stand-up pouches segment will grow at the fastest CAGR between 2026 and 2035.

- By application, the food packaging segment contributed the largest share of approximately 38% in 2025.

- By application, the e-commerce & logistics packaging segment will grow at the fastest CAGR between 2026 and 2035.

- By end user industry, the food & beverage industry segment has contributed the largest market share of approximately 40% in 2025.

- By end user industry, the retail & e-commerce segment will grow at the fastest CAGR between 2026 and 2035.

Market Overview

The automated bagging solutions market is witnessing rapid growth due to a focus on equipment and systems that automatically fill, seal, and label bags in a variety of industries, including manufacturing, food, pharmaceuticals, and e-commerce. The market is growing as businesses manage increasing production volumes while looking for faster packaging, consistent quality, and lower labor costs. Adoption of automated bagging systems is being aided by the growing demand for customizable and adaptable packaging formats. The efficiency and dependability of the system are also being improved by developments in robotics, smart sensors, and integration with digital production lines.

Market Trends

- Industry Growth Overview: The automated bagging solutions market is growing steadily as industries adopt automation to increase packaging speed, reduce labor dependency, and improve accuracy. Rising demand from the e-commerce, food, and pharmaceutical sectors is further supporting market expansion.

- Sustainability Trends: Sustainability is driving the adoption of automated bagging systems that support recyclable and eco-friendly packaging materials. Manufacturers are focusing on reducing material waste, improving energy efficiency, and enabling right-sized packaging through automation.

- Startup Ecosystem: The startup ecosystem is expanding with companies developing AI-enabled, modular, and smart bagging solutions. These startups are introducing flexible and cost-effective technologies that integrate easily with existing packaging and warehouse systems.

Technological Shifts

- Increasing integration of robotics and automated pick-and-place systems to improve speed and reduce manual intervention.

- Adoption of smart sensors and machine vision for accurate bag filling, sealing, and quality inspection.

- Growing use of AI-enabled and data-driven systems for real-time monitoring, predictive maintenance, and reduced downtime.

- Shift toward flexible and modular bagging machines that can handle multiple bag sizes and materials.

- Integration with Industry 4.0 and IoT platforms for seamless connectivity with upstream and downstream packaging lines.

- Rising deployment of energy-efficient and low-waste technologies to support sustainability and cost reduction goals.

Trade Analysis

- According to Global Export data, between June 2024 and May 2025 (TTM), the world exported 5,807 shipments of automatic packaging machines. These were handled by 2,026 exporters and bought by 2,341 buyers, reflecting an 18% increase from the previous month.

- Most automatic packaging machines from the world are destined for Vietnam, the United States, and Russia.

- Globally, the top three exporters are China, Vietnam, and Turkey, with China leading at 7,663 shipments, followed by Vietnam with 1,544 , and the Turkey with 1,062 shipments.

Value Chain Analysis

Raw Materials Sourcing:

Manufacturers of automated bagging systems rely on a mix of steel, aluminum, electronic components, sensors, and robotic parts sourced from both global and regional suppliers, with sustainable sourcing gaining focus to reduce costs and carbon footprint; key players like ABB and Siemens help drive sensor and automation component innovation.

Supply to Government and Airlines:

Automated bagging solutions are increasingly used by government agencies and airlines for secure, fast, and accurate baggage and cargo handling, requiring highly reliable systems that meet strict safety and traceability standards; key players such as Vanderlande and Siemens Logistics lead in airport and government automation deployments.

Aftermarket Services and Upgrades:

Aftermarket support is a major value driver with services like maintenance, software updates, retrofits, and training to ensure long‑term reliability and reduced downtime; key providers like Bosch Packaging Technology and Rockwell Automation offer extensive service networks and upgrade options.

Segmental Insights

Product Type Insights

Which Product Type Dominates The Automated Bagging Solutions Market?

The vertical form of fill seal (VFFS) machines segment dominate the market with around 40% share in 2025, because they can handle a wide range of bag sizes and types, guarantee consistent product filling, and automate high-volume packaging. Their speed, efficiency, and dependability make them popular in sectors like food and pharmaceuticals production line automation is further improved by VFFS machines ability to integrate with labeling and coding systems.

The robotic automated bagging systems segment is expanding at the fastest CAGR during the forecast period, as businesses use cutting-edge automation to increase labor efficiency, accuracy, and flexibility. AI and smart robotics integration increases demand across industries by enabling customization and lowering manual intervention. Additionally, these systems increase versatility by enabling easy adaptation to various product shapes and packaging formats.

Automation Level Insights

Which Automation Level Dominates The Automated Bagging Solutions Market?

Fully automatic bagging segment systems hold an approximately 60% market share in 2025 because of their great productivity capacity to manage large quantities and lower labor needs. They are particularly well-liked in fast-paced production settings where consistency and dependability are essential. Market dominance is further reinforced by ongoing technological advancements, such as improved control systems.

The semi-automatic bagging systems segment is growing at the fastest CAGR during the forecast period, as small and medium enterprises adopt them to balance automation benefits with lower capital investment. These systems provide flexibility and cost efficiency for lower-volume or specialized packaging operations. Their compact design and easier maintenance make them ideal for a smaller facility and an emerging market.

Bag Type Insights

Which Bag Type Dominates Automated Bagging Solutions Market?

The pillow bags segment dominate the market with around 35% share in 2025, favored for their straightforward design, effective packaging, and compatibility with a variety of goods such as powders, grains, and snacks. High customer acceptance and ease of production contribute to their popularity. Additionally, they work very well with automated bagging machines, guaranteeing constant throughput and quality.

The stand-up pouches segment is growing at the fastest CAGR during the forecast period, due to their superior appearance, ease of use, and resealability, all which appeal to contemporary consumer tastes. Their fast expansion is being driven by growing adoption in the food and beverage and cosmetic industries. Adoption is accelerated by the growing need for multi-layered, environmentally friendly packaging.

Application Insights

What Made The Food Packaging Segment Dominate The Automated Bagging Solutions Market In 2025?

Food packaging segment dominates with around 38% share in 2025, driven by the widespread demand for quick, hygienic, and effective packaging options for grain snacks and processed food. This market is supported by strong demand in both developed and emerging markets. Growth in this category is further supported by the increase in packaged and ready-to-eat food items.

The e-commerce & logistics packaging segment is growing at the fastest CAGR during the forecast period, driven by the rise in online shopping worldwide and the demand for quick personalized packaging solutions. Automation helps handle a range of products and reduces shipping errors. Growing customer demands for accurate and timely deliveries are driving the adoption of automated systems.

End User Industry Insights

Which End-user Industry Dominates The Automated Bagging Solutions Market?

The food & beverage industry segment dominates the market with 40% market share because of the high demand for quick, hygienic, and effective packaging solutions. Manufacturers can lower labor costs, maintain food safety regulations, and increase packing speed with automated bagging. This market's dominant position is further reinforced by the rising consumption of packaged foods and ready-to-eat items.

The retail & e-commerce segment is growing at the fastest CAGR during the forecast period; automation is being used more by online retailers to increase order fulfillment accuracy and meet rising demand. Growth is being driven by the need for flexible, fast packaging solutions. Automation is essential for this industry due to seasonal demand fluctuations and growing trends in online shopping.

Regional Insights

Which Region Dominates The Automated Bagging Solutions Market?

Asia Pacific dominates with around 38% market share due to its growing manufacturing base, strong demand from the food and beverage industries, and rising automation adoption in nations like China and India. Market leadership is reinforced by cost advantages and large production facilities. The market is further strengthened by government assistance with infrastructure development and industrial automation.

India Automated Bagging Solutions Market Trends

In India automated bagging solutions market is growing steadily, driven by the quick growth of the food processing industry, the increase in packaged food consumption, and the growing use of affordability and suitability for high-volume snack and grain packaging. Vertical form fill seal (VFFS) machines are the industry standard; however, small and mid-sized manufacturers are starting to adopt semi-automatic systems. Market adoption across manufacturing hubs is being further supported by government initiatives like Make in India and the increasing demand for e-commerce fulfillment.

North America expects the fastest growth in the market during the forecast period, driven by e-commerce packaging growth, robotic bagging solutions for widespread use, and technological advancements. The emphasis on sustainability, efficiency, and customization is fostering quick expansion. Regional expansion is also fueled by rising investments in Industry 4.0 programs and smart factories.

U.S. Automated Bagging Solutions Market Trends

In the U.S. market, demand centers on high-speed data-driven automation that integrates with smart factories and warehouse management systems. Companies prioritize precision, uptime, and software to enable customization to support omnichannel distribution and same-day delivery models.

Europe is a dominating market for automated bagging solutions, driven by the food, pharmaceutical, and industrial packaging industries robust demand for high automation standards. The region's emphasis on effective quality assurance and environmentally friendly packaging methods encourages the extensive use of cutting-edge bagging systems. Market leadership is further reinforced by ongoing improvements to the infrastructure and logistics.

Germany Automated Bagging Solutions Market Trends

Germany is dominating the market, propelled by a strong emphasis on industrial automation and a highly developed manufacturing ecosystem. Large manufacturers of industrial goods, chemicals, and food processing contribute to the ongoing need for accurate and fast bagging systems. Efficiency, consistency, and adherence to stringent packaging regulations are given top priority by German manufacturers, who also promote ongoing equipment upgrades.

MEA demand is shaped by imports of dependent food supply chains and the need for durable packaging systems suitable for harsh operating conditions. Automated begging is increasingly used to improve consistency and reduce wastage in food, cement, and bulk material packaging.

UAE Automated Bagging Solutions Market Trends

The automated bagging solutions market in the UAE is supported by the country's strong role as a regional trade and logistics hub. To increase packaging accuracy and speed, food processing facilities and high-volume distribution centers are implementing automated bagging systems. Demand is increasing throughout the packaging value chain because of ongoing investments in industrial automation and smart warehouses.

South America is a notable market for automated bagging solutions, supported by growing automation in consumer goods, packaging, agriculture, and food processing. Manufacturers are being pushed to switch from manual to automated systems by increasing production volumes and the need to increase packaging efficiency. Due to growing industrial and export-oriented packaging activities, nations like Brazil are at the forefront of adoption.

Brazil Automated Bagging Solutions Market Trends

Brazil is a notable and fast-developing market for automated bagging solutions, bolstered by its sizable consumer goods, food processing, and agricultural sectors. The nation's robust demand for retail and bulk packaging for processed foods, sugar grains, and coffee is driving the transition from manual to automated systems. Export-focused packaging specifications aid in the expansion of the market.

Recent Developments

- In September 2025, Sealed Air Corporation announced the launch of the AUTOBAG® 850HB Hybrid Bagging Machine, an automated bagging solution capable of handling both paper and poly mailers to support flexibility and sustainability in fulfillment operations. The machine allows quick changeover between materials without tools, reducing downtime and improving packaging throughput. It also includes on-bag printing for shipping and compliance information, helping brands streamline processes and reduce waste.

- In September 2025, CMES Robotics and PAC Machinery introduced an AI-powered robotic bagging system for PACK EXPO Las Vegas. It supports efficiency and sustainability objectives by combining PAC Rollbag R3200 with CMES's piece picking technology to enable quick, precise pick to pack automation using both paper and poly bag.

Top Companies

- Premier Tech: A global leader specializing in high-capacity industrial bagging, palletizing, and weighing systems for bulk products.

- Sealed Air Corporation: The manufacturer of the Autobag brand, specializing in high-speed, flexible poly bagging solutions for e-commerce and retail.

- Syntegon Technology: Formerly Bosch Packaging, they provide AI-driven, high-speed vertical and horizontal bagging machinery for food and pharmaceuticals.

- BW Flexible System: A division of Barry-Wehmiller that offers a comprehensive range of flexible packaging and form-fill-seal (VFFS) bagging machines.

Other Players

- IMA Group

- Duravant

- Coesia S.p.A.

- Ishida Co., Ltd.

- Tetra Pak

- Multivac Group

- Fuji Machinery Co., Ltd

- BEUMER Group

Automated Bagging Solutions Market Segments Covered in the Report

By Product Type

- Vertical Form-Fill-Seal (VFFS) Machines

- Horizontal Form-Fill-Seal (HFFS) Machines

- Pre-Made Bagging Machines

- Robotic Automated Bagging Systems

By Automation Level

- Semi-Automatic Bagging Systems

- Fully Automatic Bagging Systems

By Bag Type

- Pillow Bags

- Gusseted Bags

- Stand-Up Pouches

- Flat Bags

- Wicketed Bags

By Application

- Food Packaging

- Beverage Packaging

- Pharmaceutical & Medical Packaging

- Chemical & Industrial Packaging

- Agricultural & Fertilizer Packaging

- E-Commerce & Logistics Packaging

By End-User Industry

- Food & Beverage

- Pharmaceuticals & Healthcare

- Chemicals

- Agriculture

- Retail & E-Commerce

- Manufacturing & Industrial

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA