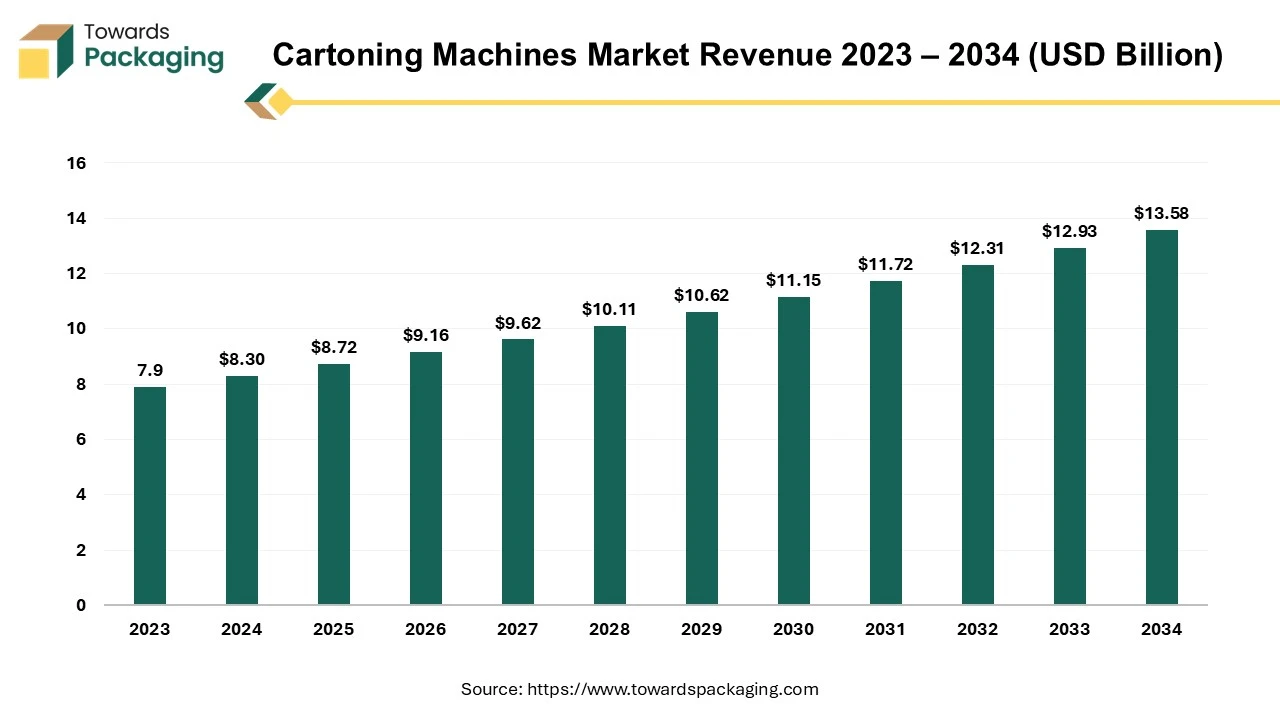

The cartoning machines market is forecasted to expand from USD 9.16 billion in 2026 to USD 14.27 billion by 2035, growing at a CAGR of 5.05% from 2026 to 2035. This report covers complete segmentation by machine type, packaging material, and end users, alongside five-region data for North America, Europe, Asia Pacific, Latin America, and MEA. It provides competitive benchmarking of major companies, value chain analysis, pricing structure, import-export statistics, and profiles of leading manufacturers and suppliers operating across global markets.

The market proliferates due to rising globalisation, the e-commerce sector, international trade, and many other sectors where the packaging of products is required. There is an increasing demand for sustainable packaging among consumers, drawing industries towards carton packaging, which results in the growth of cartooning machine market development.

The cartoning machine market is developing significantly worldwide due to the rising demand for sustainable packaging in all sectors. The strict guidelines of governmental bodies associated with the transportation of goods result in the rising cartoning packaging which as a result contributes to the growth of this market. Growing import-export businesses in upcoming times demand eco-friendly packaging of products with safety which plays a vital role in the development of the market. To pack products with maximum safety there is a demand for good machines in the packaging industry due to which this market is showing significant growth globally. Continuous innovative ideas generated by market players incline packaging companies towards automation in packaging where there is low labour cost required with the help of machines.

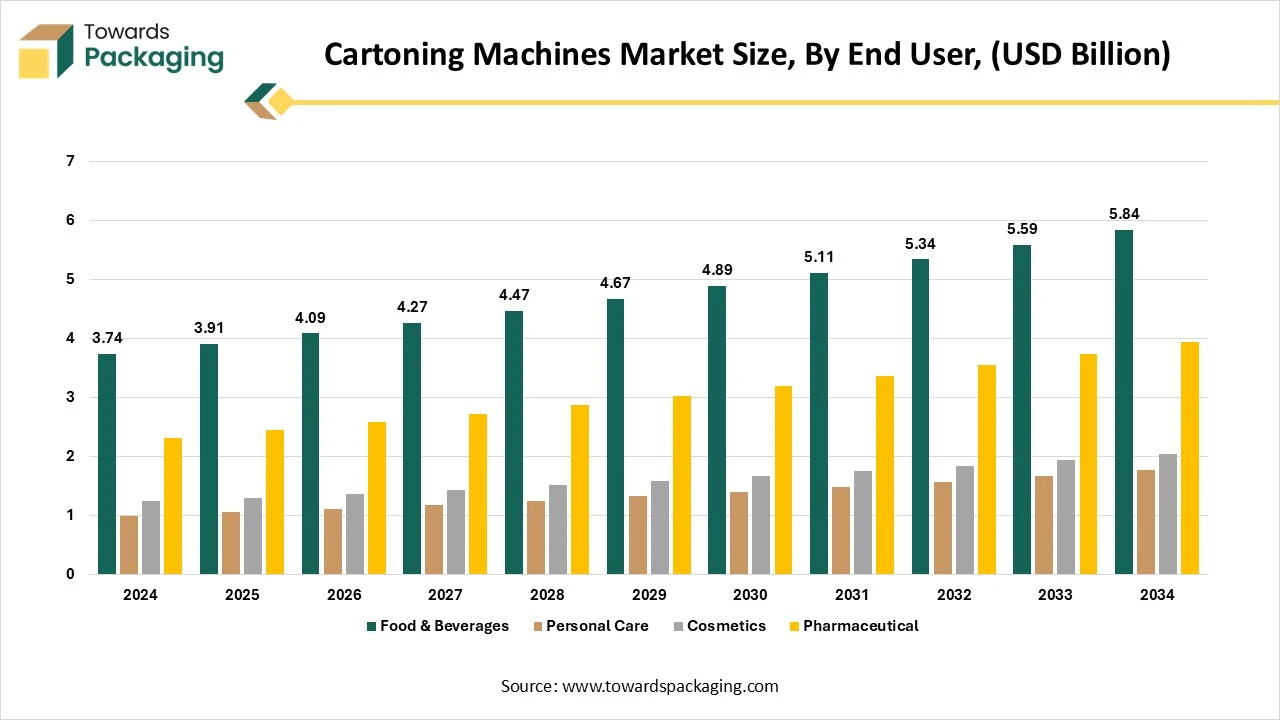

The growing fast-moving consumer goods sector driving the cartoning machine market due to efficient and secure packaging service. This sector comprises a wide sector of products such as personal care, household products, and food & beverages which require bulk production of carton packaging as a result contributing to the development of the cartoning machine that helps to produce large quantities at a cheaper rate.

There is a significant role in changing lifestyle preferences of people in the growth of this industry as the new generation is seeking convenience in everything and shifting from one place to another that requires packaging of products. These machines are the ultimate solution to high-speed packaging demand for products with fewer chances of error which develops the reliability of customers. As with the growing demand for packaging, there is a rising demand for enhancement of the quality of products which can be developed with the help of machines.

The rising demand from several sectors resulted in the growth of opportunities in this cartoning machine market. With the growth of industries such as the food & beverages sector, pharmaceutical sector, and various other e-commerce industries. The rising number of customers worldwide for a variety of products requires packaging with modification to enhance the market growth. The rising import-export business globally enhances the growth packaging market due to which there is a high demand for cartoning machines.

The growing demand for sustainable solutions in every aspect raised the paperboard carton demand in the market and to fulfil such bulk orders. The developing e-commerce industry increasing the demand for the packaging of products with complete safety this growing demand for an affordable solution boosts the cartoning machine industry. With the incorporation of automatic machines, it becomes easy for the packaging industry to generate cartons of various shapes and sizes.

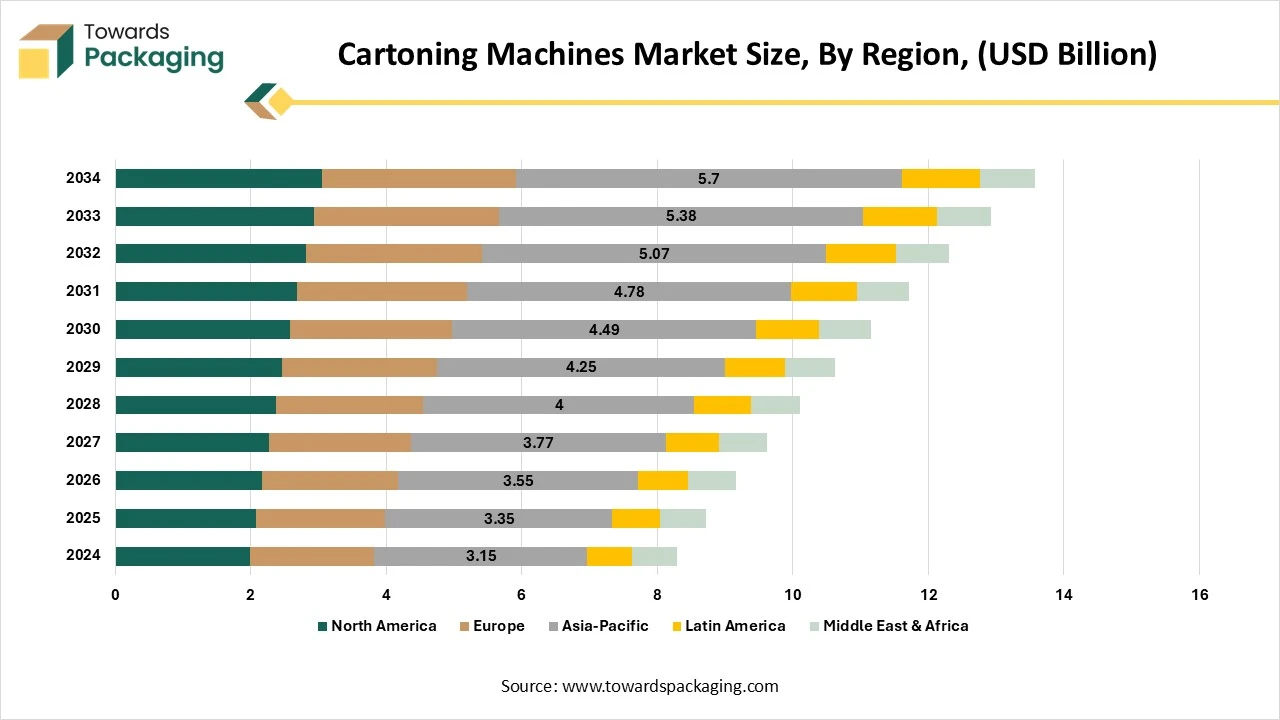

Asia Pacific witnessed the highest revenue share for the year 2024 this growth is due to the rising industrialization and increasing demand of customers for enhanced goods packaging. The adoption of automatic cartooning machines due to the heavy requirement of packaging mainly in the pharmaceutical and food sector supports focus precisely on the demand of the customers. There is a huge contribution of market players in the innovation and development of cartoning machines such as Jet Pack Machines Pvt. Ltd., NICHROME INDIA LTD, Durva Machinery, J-Pack Engineers Pvt. Ltd., Lodha International LLP, Pactech Machinery, Soham Machines, and various others. The rising industries in countries like India, Japan, China, Thailand, and South Korea facing a huge demand for the production of carton packaging boxes of different materials at a low charge.

Europe is estimated to grow at the fastest rate over the forecast period. The rising demand for the incorporation of advanced technology in the packaging field enhances the cartoning machine market. With the development of business in various fields a huge rise in demand for the packaging patterns of the products has influenced this market significantly. The increasing awareness activities and government funding on environmental issues also raise concerns about eco-friendly packaging. There is a huge trade rise in countries such as Germany, the UK, France, Italy, Spain, Sweden, Denmark, Norway and various others supplying packaged seafood and various other products to several countries. This export-import business needs proper packaging to avoid leakage of products which led to the rising demand for carton packaging that enhances the demand for cartoning machines.

In addition, this project is aimed at creating awareness around environmental cleanliness, especially in industry-forward areas. Siegwerk India's CSR team would closely monitor the progress of the project to meet the projected purpose and help open an avenue for more projects in the future.”

By Machine Type

By Packaging Material

By End User

By Region

February 2026

January 2026

January 2026

January 2026