Commercial Packaging Market Forecast 2025-2035 Growth Trends, Detailed Segments, Regional Insights, Key Companies & Supply Chain Mapping

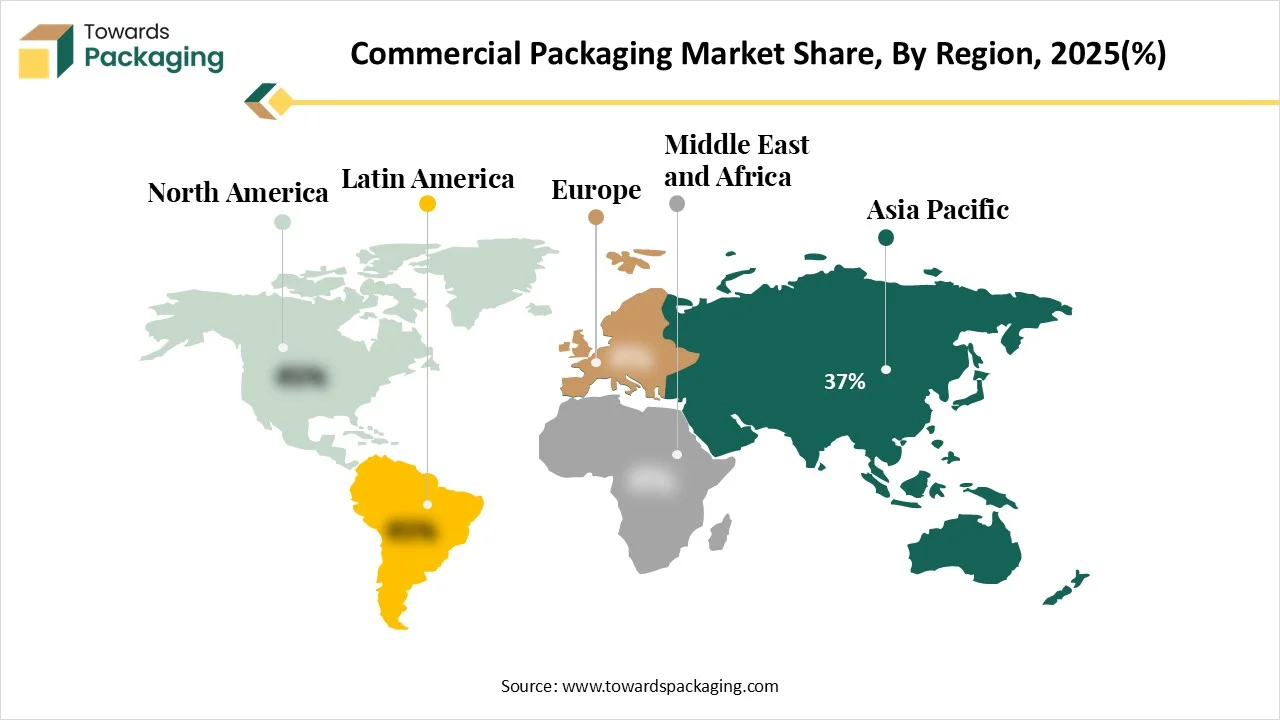

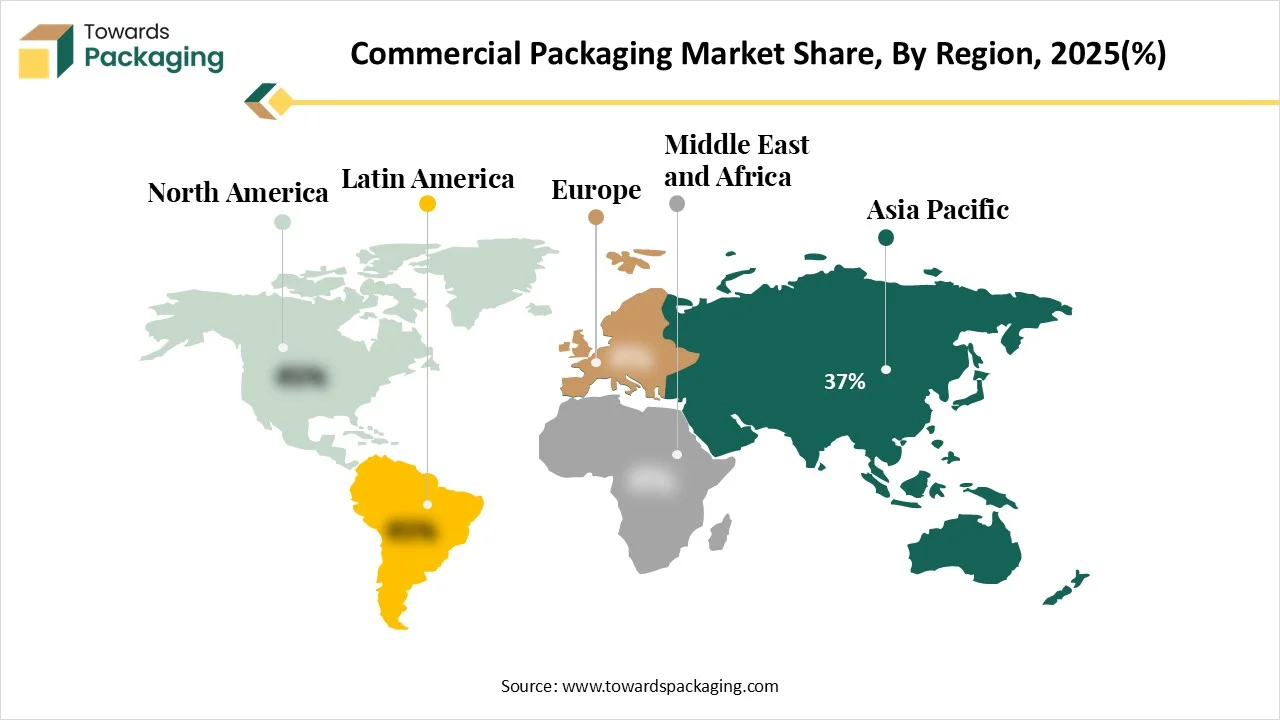

The commercial packaging market is witnessing strong expansion, driven by rising demand across food & beverages, pharmaceuticals, e-commerce, and industrial sectors. The market is dominated by Asia Pacific with over 37% share in 2024, followed by North America and Europe. Corrugated boxes held the largest 35% share among packaging types, while paper & paperboard accounted for 38% of material demand. Secondary packaging led with 45% share, and flexography printing contributed 32% of printing revenues.

The market is supported by leading players such as Amcor, WestRock, DS Smith, International Paper, Mondi, Smurfit Kappa, and others. The report covers full value chain mapping, global and regional trade flow, manufacturer and supplier data, and competition profiling, along with key growth trends such as sustainability, smart packaging, AI integration, and e-commerce expansion.

Key Insights

- Asia Pacific dominated the global market by holding more than 37% of the market share in 2024.

- Asia Pacific dominated the global market with the largest share in 2024.

- North America is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the corrugated boxes segment contributed the biggest market share of 35% in 2024.

- By packaging type, the flexible packaging segment is expected to expand at a significant CAGR between 2025 and 2034.

- By material, the paper & paperboard segment contributed the biggest market share of 38% in 2024.

- By material, the biodegradable/compostable materials segment will be expanding at a significant CAGR between 2025 and 2034.

- By function, the secondary packaging segment contributed the biggest market share of 45% in 2024.

- By function, the tertiary packaging segment is expanding at a significant CAGR between 2025 and 2034.

- By printing technology, the flexography segment contributed the biggest market share of 32% in 2024.

- By printing technology, the digital printing segment will be expanding at a significant CAGR between 2025 and 2034.

- By end-use industry, the food & beverages segment held the major market share of 40% in 2024.

- By end-use industry, the e-commerce & retail segment is projected to grow at a CAGR between 2025 and 2034.

Market Overview

The global commercial packaging market encompasses the production and distribution of packaging solutions designed to protect, transport, and promote goods across industries such as retail, industrial, food and beverage, electronics, healthcare, and e-commerce. This market is shaped by factors like branding needs, product differentiation, sustainability regulations, supply chain optimization, and the booming online retail sector. Innovations in smart packaging, lightweight materials, and eco-friendly formats are further transforming the industry.

Key Trends

What are the New Trends in the Global Commercial Packaging Market?

Rising demand for reliable packaging

- Increasing customer demand to enhance the integrity and shelf life of products has influenced the demand for this packaging.

Growing e-commerce sector

- The growing e-commerce sector has influenced the rise in demand for commercial packaging for the safe delivery of products.

Smart packaging adoption

- The increasing demand for smart packaging in the industries has boosted the development of commercial packaging to provide ease to consumers with tracking facilities.

How Can AI Improve the Global Commercial Packaging Market?

The incorporation of AI in the global commercial packaging market plays an important role in adding smart technology such as sensors, QR codes, RFID tags, and several others. With the incorporation of AI, this market is exploring several designs, sustainability, customer engagement, production, and logistics enhancement. Continuous introduction of smart & sustainable packaging patterns has influenced the demand for this sector significantly. AI-influenced customers by providing customized packaging and meeting the demands of the consumers. It helps industries identify enhanced quality packaging materials.

Market Dynamics

Driver

Rising Demand for Enhanced Technology Packaging Solution

The continuous demand for enhanced technology, eco-friendly, and cost-effective packaging solutions in several industries has driven the development of the global commercial packaging market. The rapid extension of online retail, such as Flipkart, Amazon, and Shopify, has enhanced the demand for sustainable, secure, and branded packaging. The majority of consumers are seeking biodegradable and recyclable packaging that has no adverse effect on products. Continuous innovation in this market has boosted the development of the market by fulfilling consumers' expectations. The increasing demand for reducing waste generation, minimizing carbon footprints, and endorsing sustainability is conducive to market development.

Restraint

Ecological Concerns

The increasing ecological concern has hindered the development of the global commercial packaging market. The packaging waste is dumped into the ocean and soil, which is harming the ecology. The underdeveloped process for the biodegradability of materials has restricted the growth of the market.

Opportunity

Rising Manufacturing of Medicines Packaging

Rising innovation in the pharmaceutical sector has influenced the demand for packaging standards of medicines, which can maintain the integrity of the medicines has raising a huge number of opportunities in the global commercial packaging market. The growing demand for telemedicine has raised the concern for enhanced packaging of medicines in innovative ways. The execution of stringent government guidelines to order the acceptance of particular industrial packing to preserve the honesty of goods and safeguard the innocuous management of dangerous resources is offering a push to the market development.

Segmental Insights

Why Corrugated Boxes Segment Dominated the Market in 2024?

The corrugated boxes segment contributed a considerable share of the global commercial packaging market in 2024 due to the rising demand for versatile, sustainable, and cost-efficient packaging. These are manufactured mainly from recyclable paper-based resources and are extensively utilized across various industries like FMCG, e-commerce, electronics, and many others. The significant development of online retail services has also influenced the demand for such packaging materials. These boxes offer superior support, cushioning capacity, and personalization options.

The flexible packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is primarily in demand due to adaptability and cost-effectiveness. These are widely utilized for the packaging of home care and personal care products. It has the capacity to enhance the shelf life of the products and preserve freshness.

Why the Paper & Paperboard Segment Dominated the market in 2024?

The paper & paperboard segment is expected to have a considerable share of the global commercial packaging market in 2024 due to rising ecological concerns, consumer awareness, and regulatory pressure. This material comprises folding cartons, kraft paper, and boxboard, which are mainly utilized in the food & beverage industry. This segment is highly in demand due to its recyclability, biodegradability, and cost-efficacy. These are widely suitable for shelf-ready packaging and branding. Major brands are replacing plastic trays, wraps, and clamshells with laminated or molded fiber paperboard choices.

The biodegradable/compostable materials segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is dominating due to the evolving guidelines of the government towards the packaging industry. These biodegradable materials are derived from cellulose, sugarcane, cornstarch, and many such components. Several industries, such as e-commerce, personal care, and food & beverages, are boosting the development of this segment.

Why the Secondary Packaging Segment Dominated the Market in 2024?

The secondary packaging segment is expected to have a considerable share of the global commercial packaging market in 2024 due to its logistic efficacy and branding strategy enhancement capacity. It is the outer layer of packaging that groups every product for transportation, storage, and display. This segment comprises corrugated boxes, cartons, overwraps, shrink wraps, and trays. It protects goods from pollution, contamination, or any ecological adversities.

The tertiary packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The rising concern for right-sized boxes used for product packaging has influenced the development of this segment. These are highly versatile and high worth packaging. Innovation in this segment, such as the integration of barcodes and many such advancements, has raised the demand for such packaging significantly.

Why Flexography Segment Dominated the Market in 2024?

The flexography segment is expected to dominant over the global commercial packaging market in 2024 due to cost-efficacy, speed, and versatility. This segment is widely utilized for printing on several substrates such as corrugated cardboard, paper, plastic films, and metallic foils. This is an eco-friendly method of printing on the packages and improving branding patterns. The rising demand for personalized printing to attract a huge number of consumers towards this market has influenced the growth of this segment.

The digital printing segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The demand for designs that stand out in the competitive market and improve the brand value. Such a printing technique helps to create unique patterns in the packages. The growing demand for customization of packages has influenced the demand for this segment.

Why the Food & Beverages Segment Dominated the Market in 2024?

The food & beverages segment is expected to have a considerable share of the global commercial packaging market in 2024 due to the growing demand for protection and preservation of food products. The rising demand for packaged food due to the changing lifestyle of people has influenced the demand for this market. The requirement to protect food products from spoilage, UV radiation, and several such conditions has raised the demand for this segment. The rapid shift towards urban areas has upsurge the demand for this packaging market.

The e-commerce & retail segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Rapid digitalization, evolving consumer experience, and growing online shopping trends have raised the demand for this segment. This segment needs enhanced product safety during transportation, which increases the reliability of commercial packaging.

Regional Insights

Rising E-Commerce Industries in Asia Pacific Promote Dominance

Asia Pacific held the largest share of the global commercial packaging market in 2024, due to the rising e-commerce industry. The growing e-commerce industries enhance the demand for flexible and corrugated packaging of products. The growing sustainability regulations have enhanced the demand for the packaging industry in this region. This region is dominating due to the huge production of packaging, which is made up of plastics, paper, and several other materials. In countries such as China, Japan, Thailand, India, and others are advancing packaging technology is advancing.

North America’s Rising Packaging Concerns Support Growth

The North America region is estimated to grow at the fastest rate in the global commercial packaging market during the forecast period. The growing innovation in the packaging sector has influenced the demand for the packaging market. The rising investment of the major market players has influenced the growth of the market. Such advancement has influenced the development of the commercial packages, which meet the demand of the industries.

Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Top Companies in the Commercial Packaging Market

- Amcor Plc

- WestRock Company

- Berry Global Inc.

- Mondi Group

- Smurfit Kappa Group

- DS Smith Plc

- Sealed Air Corporation

- International Paper Company

- Huhtamaki Oyj

- Tetra Pak International S.A.

- Sonoco Products Company

- Ball Corporation

- Graphic Packaging Holding Company

- Stora Enso Oyj

- Crown Holdings Inc.

- Uflex Ltd.

- AR Packaging

- Reynolds Group Holdings

- Georgia-Pacific LLC

- RPC Group (Now part of Berry Global)

Latest Announcements by the Global Commercial Packaging Market

- In February 2025, International Paper Chairman and Chief Executive Officer, Andy Silvernail, expressed, "With a stronger portfolio of sustainable packaging solutions, the combination of International Paper and DS Smith enhances our offerings, increases innovation, and expands our geographic reach. We will bring together the capabilities and expertise of two experienced teams, with similar cultures, to create the global leader in sustainable packaging solutions." (Source: PR Newswire)

New Advancements in the Global Commercial Packaging Market

- In June 2025, Mondi, a global leader in sustainable packaging, partnered with Saga Nutrition, a French pet food manufacturer, to create recyclable packaging for Saga’s dry pet food range. (Source: Mondi)

- In February 2025, International Paper and DS Smith, two of the leading producers of sustainable packaging, containerboard, and pulp products, combined forces on January 31, 2025, to create a new global leader in sustainable packaging solutions, focused on the attractive North American and EMEA regions. (Source: PR Newswire)

Global Commercial Packaging Market Segments

By Packaging Type

- Corrugated Boxes

- Flexible Packaging

- Rigid Plastic Containers

- Folding Cartons

- Pallets & Crates

- Paper Bags & Envelopes

- Returnable/Reusable Packaging

By Material

- Paper & Paperboard

- Plastics

- Metal

- Glass

- Biodegradable/Compostable Materials

- Wood

By Function

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Printing Technology

- Flexography

- Digital Printing

- Gravure Printing

- Lithography

- Screen Printing

By End-Use Industry

- Food & Beverage

- E-commerce & Retail

- Healthcare & Pharmaceuticals

- Electronics

- Industrial Goods

- Personal Care & Cosmetics

- Automotive

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (3)