Commercial Printing Market Outlook 2025-2035 Technology, Application, Service, Print Medium, End-User Segments with Value Chain

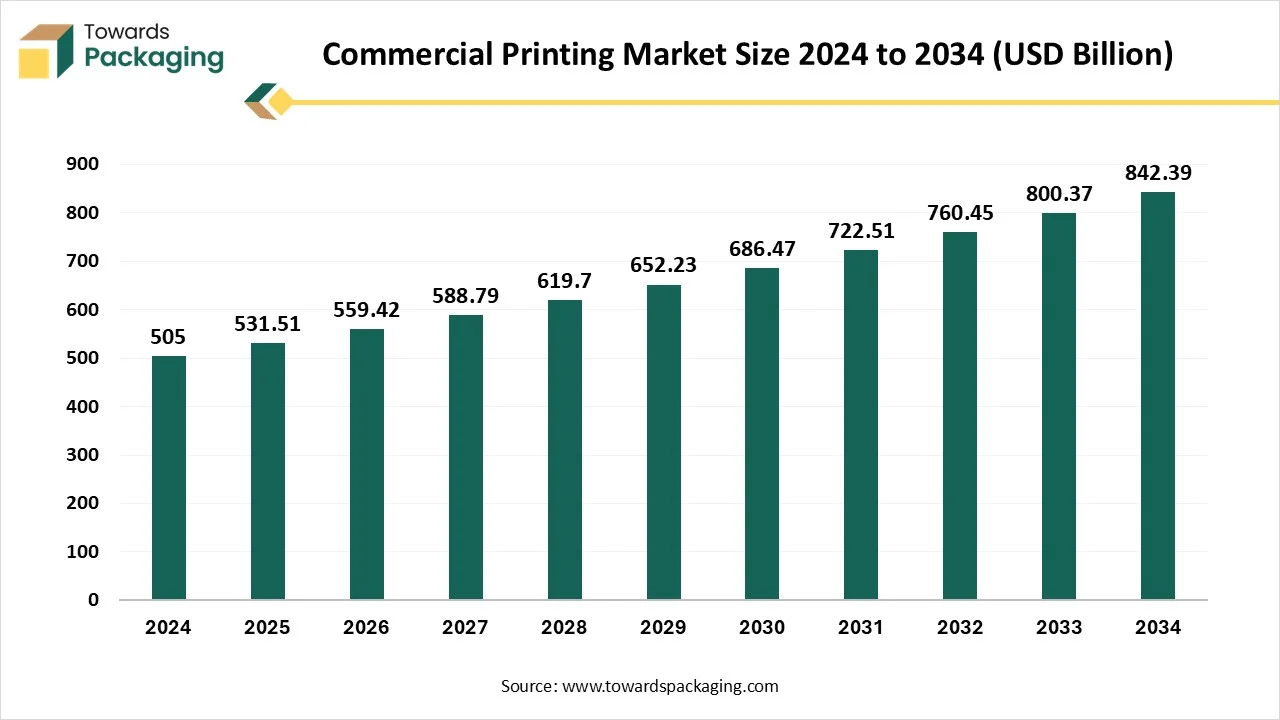

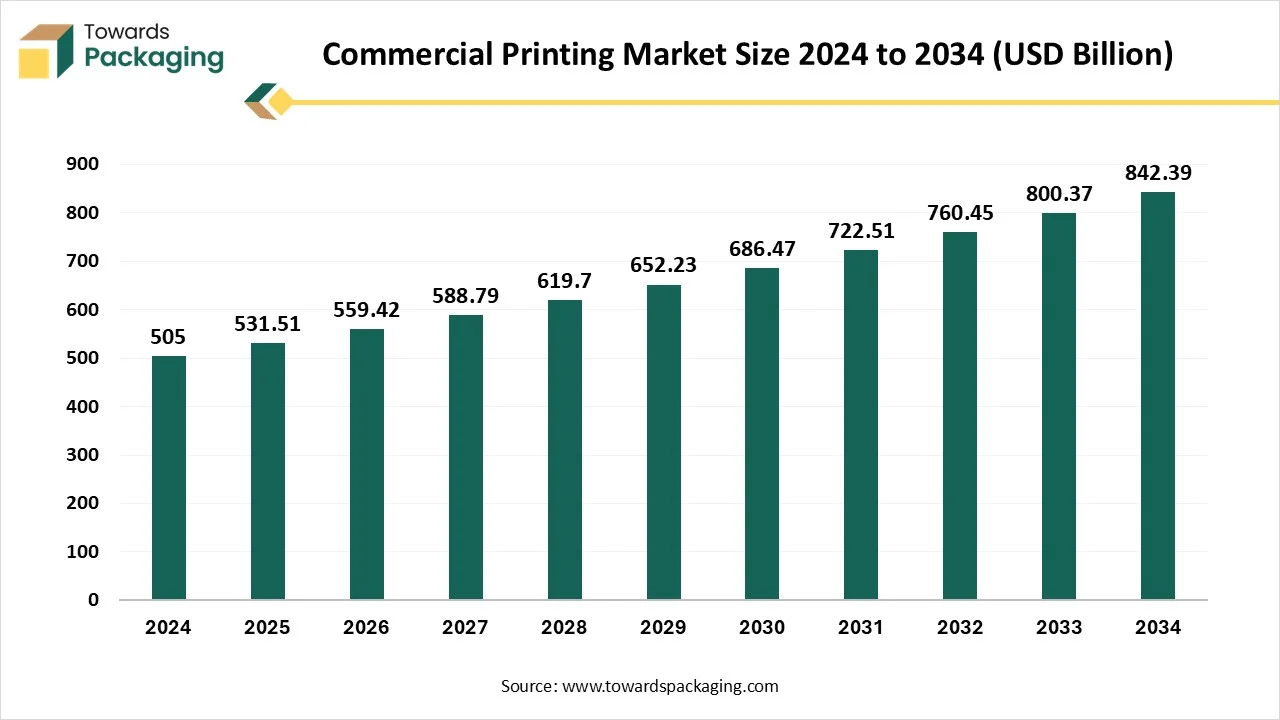

The commercial printing market is forecasted to expand from USD 559.42 billion in 2026 to USD 886.61 billion by 2035, growing at a CAGR of 5.25% from 2026 to 2035. This report covers the full market size history and forecast, along with detailed segment data by printing technology (including offset lithography with around 35% revenue share in 2024, fast-growing digital, inkjet, laser, flexographic, gravure, screen, letterpress, and 3D printing), application (with packaging as the leading segment in 2024 and strong growth in advertising and marketing collateral), services (printing services holding about 60% share in 2024 and high growth in finishing/post-press), print medium (paper with ~70% share in 2024 and fast-rising fabric/textile), and end-user industries (including retail & e-commerce at about 25% share in 2024 and rapidly expanding healthcare & pharmaceuticals).

Key Takeaways

- In terms of revenue, the market is valued at USD 531.51 billion in 2025.

- The market is projected to reach USD 886.61 billion by 2035.

- Rapid growth at a CAGR of 5.25% will be observed in the period between 2025 and 2035.

- Asia Pacific dominated the market with the largest revenue share in 2024.

- By printing technology, the offset lithography segment contributed the biggest revenue share of 35% in 2024.

- By printing technology, the digital printing segment will expand at a significant CAGR between 2025 and 2035.

- By application, the packaging segment contributed 524% revenue share in 2024.

- By application, the advertising and marketing collateral segment will expand at a significant CAGR between 2025 and 2034.

- By services, the printing segment contributed 60% revenue share in 2024.

- By services, the finishing or pot-press segment will expand at a significant CAGR between 2025 and 2035.

- By print medium, the paper segment dominated the market with a share of 70% in the year 2024.

- By print medium, the fabric /Textile segment is expected to grow significantly over the studied period.

- By end-user industry, the retail and e-commerce segment contributed the biggest revenue share of 25 % in 2024.

- By end-user industry, the healthcare and pharmaceuticals segment will expand at a significant CAGR between 2025 and 2034.

Market Overview:

The global commercial printing market encompasses services that offer printing solutions for businesses, institutions, and individuals, excluding personal/home printers. This includes offset, digital, flexographic, screen, and gravure printing used for packaging, advertising, publishing, transactional printing, and other commercial applications. The market also covers pre-press, press, and post-press services, including design, layout, and finishing activities.

Commercial printing is a huge and multifaceted sector that plays an important role in distributing information, marketing products, and communicating ideas. Worth over USD300 Million, it includes the manufacturing of a huge range of printed materials, from business cards and brochures to large-format posters and packaging too. As environmental issues grow, the printing sector is increasingly accepting sustainable practices. This counts on utilizing eco-friendly inks, recycling paper waste, and updating the procedure to lower energy consumption. Several commercial printing companies are finding certifications like the Forest Stewardship Council (FSC) to showcase their loyalty to sustainability.

What are the News Trends Commercial Printing Market?

- Print on-demand: Print on-demand is the name of the game changer, serving top-quality prints in the blink of an eye. Printers are accepting the demand for speed, serving fast turnaround services that deliver quality outcomes in record time. Printers are now capable of serving top-quality prints in a couple of days, meeting the modern expectation of quick service.

- Eco-friendly printing innovations: With climate change issues at the forefront, printing businesses are heavily accepting eco-friendly practices to lower their environmental footprint. Using recycled paper and materials lowers waste and protects natural resources, meeting with circular economy rules. Implementing energy-effective printing procedures and equipment to lower carbon emissions and operational costs, too.

- Personalization: Personalization will be the leading force in the digital printing sector, allowing businesses to make tailored backgrounds and connect with customers on a huge level. Personalization enables businesses to cut through the clutter by serving messages that resonate with personal interests, choices, and buying behaviours to make more meaningful and engaging experiences for their user in today's highly competitive industry. Variable data printing enables businesses to tailor print materials with personalised text and images, developing relevance and engagement too.

- Smart factor technologies: Smart factory technologies are transforming the digital printing sector, driving scalability, efficiency, and agility in print production procedures, too. Robotics and automated systems simplify printing workflows, lower manual labor, and develop production throughput. Internet of Things (IoT) tracks equipment performance and collects real-time data, allowing predictive maintenance and updating resource utilization.

- Digital printing: Digital printing remains a foundation for the printing industry, offering speed, versatility, and quality that the regular printing procedure lacks. It also eliminates the demand for a time-consuming setup procedure, allowing fast turnaround times and on-demand printing potential.

- Data Analytics and decision-making: Data analytics tools manage main performance metrics such as costs, production output, and customer satisfaction, serving actionable insights for performance improvement. Examining current trends and user behaviour assists businesses in identifying opportunities for product invention and market expansion, too.

How does AI Integration Impact the Commercial Printing Market?

With the capability of AI, businesses can serve highly tailored print solutions to their customers. AI-powered design tools now serve features like automatic layout indication, design element recommendations, and smart font pairings, too. This makes it convenient for even beginners to make professional-quality designs for packaging labels, posters, and business cards, right from the web to print. Color accuracy is important in printing, and AI can analyze and adjust colors to ensure consistent outcomes across various materials and substrates, too. This helps customers achieve the exact color they envision for their brand, ensuring a polished and professional appearance for every printed product. This level of personalization enhances the customer experience, fosters brand loyalty, and increases printing orders as well. With the AI-chatbots and automated messaging, customer receive immediate feedback on their issues, design tips, and order updates. This actual-time support makes sure they are never stuck or frustrated, resulting in a smoother and more satisfying experience.

Market Dynamics

Driver

The development of digital printing technology is one of the most changing trends in the sector. Like regular offset printing, digital printing serves quick turnaround times, high-quality results, and the potential to print on demand, making it perfect for shorter runs and tailored projects. High-speed inkjet and laser printing systems are constantly developing, improving color precision and allowing businesses to print a huge variety of marketing materials -from brochures and business cards to direct mail campaigns and tailored catalogs -at half the time and cost of regular methods. Consumers can now receive focused, tailored materials that showcase their different preferences and selections, which can develop engagement and improve conversion rates, too.

Restraint

The urge to serve competitive pricing while protecting profit margins is a continuous struggle. Organizations are often forced to accept cost-saving measures without compromising the quality of their results. Customer selections are continuously developing, making it important for businesses to stay responsive and agile too. This counts everything from adopting innovative printing technology to serving more tailored and customized solutions. Inflation and economic ambiguity can importantly affect operational costs. To stay adaptable, businesses must seek innovative ways to streamline their procedure, adjust to better terms with suppliers, and update resource allocation.

Opportunity

One of the fastest and visible effects of automation in the commercial printing sector is the developed efficiency of the production procedure. Automated machines run at higher speeds and with greater accuracy, leading to shorter production times and lower costs. Also, the benefit of printing machines is their flexibility. These machines are highly acceptable and can easily adjust to various printing procedures and materials.

Whether it's printing on various paper materials, sizes, or carrying different finishing options, automated printers can quickly shift between tasks without the demand for extensive manual modifications. This flexibility enables printing organizations to take on a huge range of projects. Remote tracking of printing machines enables faster problem detection and resolution, lowering downtime and the resources specifically linked with on-site maintenance and repair. This strategy lowers the carbon footprint linked with technician travel and the resources needed for on-site servicing.

Segmental Insights

How did Offset Lithography Dominate the Commercial Printing Market in 2024?

Offset printing or offset lithography is a kind of printing press technique that shifts ink from a plate to a rubber roller (or blanket) and then to different substrates to generate high-quality images and designs specifically for mass production, such as printing huge quantities of brochures, newspapers, stationery, and magazines, too. It runs using a range of rotating cylinders and specially made plates. The procedure starts by shifting an image onto an aluminium plate. The plate is fixed on the plate cylinder and treated so that only the image area attacks ink while non-image areas resist it using water.

Digital printing is a current procedure in which digital-based images are directly printed into various media. Like regular techniques, it vanishes the urge for printing plates, allowing faster setup and reduced costs. This technology enables good-quality, tailored outputs and screen printing on materials like canvas, glass, paper, and metal, which makes it perfect for short runs and detailed projects. This technology constantly grows, serving superior print quality and operational efficiency. Including these technologies can simplify the manufacturing of the complete printing process, lower costs, and enhance the complete procedure, making it a main area of focus for next-thinking companies.

How did Packaging dominate the Ccommercial Printing Market in 2024?

Tactile, colorful cereal boxes and overstated labels, and specialized flexible packaging with different fitments have become more widely available than before. Offset and flexographic printing allow brands to target more niche markets at smaller volumes or serve customizable designs and patterns. The print and packaging sector is truly different and has the potential to more precisely focus on the demands and tastes of particular demographics and consumer bases. Unbelievable growth in printing technology has allowed brands to have more control over the way they market their products, even as packaging serves greater protection.

Advertising and marketing collateral are main segments in the commercial printing industry, covering materials like flyers, brochures, catalogs, banners, posters, and point-of-sale displays. These printed products assist businesses in marketing brands, assist sales campaigns, and develop customer engagement. With growing demand for tailored and targeted marketing, organizations increasingly use digital printing to make high-quality, customized collateral in shorter runs. The transformation toward sustainable inks and recycled papers is also encouraging how marketing materials are manufactured.

How did the Printing Service dominate the Commercial Printing Market in 2024?

Printing service completely dominated the commercial printing industry by serving prepress, design, printing, finishing, and distribution. Businesses depend heavily on these services for generating marketing materials, labels, packaging, business documents, and publications. Their potential to serve cost-effective, high-volume, and good-quality prints using advanced technologies like digital, offset, and large-format printing has solidified their leadership. Furthermore, printing service providers often offer personalization, quick turnaround times, and sustainable printing options, which makes them the backbone of the commercial printing sector.

Finishing and post-press are important stages in the commercial printing sector, changing printed sheets into polished final products. This phase involves procedures like folding, cutting, laminating, varnishing, binding, embossing, foiling, and die-cutting to enhance the look, functionality, and durability. Finishing not only improves visual appeal but also adds value and protection that makes materials like catalogs, packaging, brochures, and marketing collateral stand out. With rising demand for customized, premium, and eco-friendly finishes, advanced post-press technologies have become a main differentiator for commercial printers aiming to serve high-effect outcomes.

How did the Paper Print Medium dominate the Commercial Printing Market in 2024?

Paper remains the primary material in the printing industry. Many commercial printers have implemented recycling practices for paper waste generated during production. Recycling paper conserves trees and reduces energy and water use in the paper manufacturing process. Although paper can typically be recycled 5-7 times before its fibers degrade, advancements in recycling technology have extended this lifespan. In printing, selecting the right paper is crucial for achieving high-quality results that satisfy both personal and professional needs. The choice of paper affects not only appearance and quality but also sustainability and the intended purpose of the printed materials.

Digital textile printing and 3D software for fashion sampling are a perfect fit. As the fashion designer looks for viable and sustainable production, designers and producers are heavily shifting to digital textile printing and 3D product simulation software to serve the aesthetic and practical background for their creations. Aesthetic, as in digital printing, there are no limitations or frontiers for creativity. Available colours are enumerated in the millions, and there are no practical limits to range. Digital printing can, for instance, faithfully regenerate the several and subtle hues of a rose leaf, at any size or scale from small to large and in any volume.

How did the Retail and E-commerce dominate the Commercial Printing Market in 2024?

Commercial printing in retail and e-commerce plays an important role in packaging, branding, and customer engagement. Retailers and online sellers depend on high-quality printed custom boxes, labels, hang tags, inserts, catalogs, and promotional materials to boost product visibility and create a memorable unboxing experience., With growing competition, brands are re-investing in tailored, sustainable printing and short-run solutions to link with consumers, assist marketing campaigns, and reinforce trust both in-store and online.

- In the healthcare and pharmaceutical sector, it is important for safety, compliance, and clear communication. Companies depend on tailored printing for dosage instructions, medicine labels, blister packs, patient information leaflets, tamper-evident seals, and regulatory inserts that meet strict FDA and international standards. High-quality printing ensures legibility of critical details, counterfeit protection, and traceability, while customized packaging and labelling assist in building trust and protecting health across pharmacies, hospitals, and clinics.

By Region

How does the Asia Pacific Region dominate the Commercial Printing Market?

Asia Pacific dominated the market in 2024, and the region is expected to sustain this position during the forecast period. The market is experiencing constant growth, driven by the fast expansion of e-commerce, retail, and packaging sectors across countries like India, China, Japan, and Southeast Asia. As brands increasingly focus on good-quality labels, personalized marketing materials, and folding cartons, the demand for digital and sustainable printing solutions has grown.

The region accounts for a major share of global packaging print volumes, with packaging uses showing the largest segment. Acceptance of digital printing technologies such as inkjet and laser printing is growing due to their cost-effectiveness and suitability for short-run and customized jobs. Overall, Asia Pacific remains a dynamic and competitive hub for commercial printing, assisted by rigid consumer markets and constant technological growth.

North America

According to the regional analysis, North America remains one of the fastest-growing and constant markets in the worldwide commercial printing market. The region benefits from a developed base of heavy print providers, rigid demand from industries like packaging, retail, and education, and a rising move towards sustainability and automation. The area is also developing a strong acceptance of digital and AI-powered print technologies in order to develop turnaround times and personalization.

The United States carries the biggest market share in the industry due to its huge commercial, e-commerce, and retail sectors. The country carries industry big companies like RR Donnelly and Quad, and its leading organizations in mixing the digital and AI-driven solutions into print workflows.

Main urge areas include the promotional materials, packaging, and photo books. Sustainability is also a rising focus, with the developed of recyclable materials and energy-efficient presses.

Canada

According to the current space in Canada, Canada’s commercial printing industry is minute but constantly developing, assisted by demand in packaging, small business marketing, and education. Canadian printers are experiencing web-to-print services, environmentally friendly ink levels, and short-run digital printing in order to align with the demands of local publishers and retailers. Government Incentives for clean technology and sustainability are also developing innovations in the sector.

Top Companies in the Commercial Printing Market

- RR Donnelley & Sons Company

- Deluxe Corporation (USA)

- Cimpress plc (Ireland)

- Quad/Graphics, Inc. (USA)

- Transcontinental Inc. (Canada)

- ACME Printing

- Taylor Corporation (USA)

- Vistaprint (Netherlands/USA)

- Toppan Inc. (Japan)

- Dai Nippon Printing Co., Ltd. (Japan)

- Canon Solutions America, Inc. (USA)

- Xerox Corporation (USA)

- HP Inc. (USA)

- Eastman Kodak Company (USA)

- Ricoh Company, Ltd. (Japan)

- Landa Corporation (Israel)

- Printful (USA)

- CEWE Stiftung & Co. KGaA (Germany)

- Shutterfly, LLC (USA)

- ARC Document Solutions, Inc. (USA)

Industry Leader Announcement in the Industry

- On 15 August 2024, Xerox revealed that it has been named a Leader in Quicirca's 2024 print security landscape report. This annual report serves as a snapshot of the positioning of the vendors in the Global Print Security industry and recognizes the print industry vendors who offer security solutions as part of their profile.

- On 22 February 2025, the Kerala Master Printers Association's Print and Beyond conference in Kochi 22 February 2025 contain an engaging panel discussion on the rising dynamics of the print and packaging sectors.

- On 25 February 2025, the development of inkjet printing has been assisted tremendously by sector top leaders in a huge range of expertise. If an organization produces printers, software, inks, and printheads, for instance, these systems are likely to succeed in the field

Recent Developments

- In September 2025, MS Printing Solutions and JK Group, which is a part of Dover, recently revealed that the disclosure of five multimass printers crafted to expand the performance standards in terms of digital textile printing.

- In July 2025, Gallus revealed the commercial launch of its MatteJet technology, which enables the UV InkJet press to print matte by changing the surface pattern of the printed dot. This kind of growth is predicted to open up industry for UV inkjet in the luxury food and drinks industry, and specifically for short-run premium spirits and wine, in which standard matte finish is regularly expected.

- On 30 June 2025, HP India recently revealed the current large-format printing solutions, the HP Latex 730 and 830 printer series. Crafted for small and medium-sized print service providers, these new printers are crafted to streamline operations, boost productivity, and constantly deliver high-quality press releases and high-value output, too.

- On 7 July 2025, Agfa, a top leader in inkjet printing solutions, was happy to announce it has secured three prestigious awards: the 2025 Pinnacle Product Award, presented by PRINTING United Alliance.

- On 9 July 2025, WOL3D began as " World of Lilliputs," producing miniature human figures, and then took up 3D Printing for consumer products. The company produces additive materials for 3D printing in India and distributes four international brands as well as many 3D printing machines.

- On 15 January 2025, Konica Minolta, a top leader in Imaging and Business solutions, discloses its participation in PrintPack 2025, in which it launches its revolutionary AccurioPress 14 010S and presents an exclusive profile of digital printing solutions designed to shift the commercial printing, packaging, and label industries too.

Segmentation of the Commercial Printing Market

By Printing Technology

- Offset Lithography

- Digital Printing

- Inkjet

- Laser

- Flexographic Printing

- Gravure Printing

- Screen Printing

- Letterpress

- 3D Printing (Commercial Applications)

By Services

- Design & Pre-Press

- Layout

- Graphic Design

- Proofing

- Printing

- High-volume Printing

- On-Demand Printing

- Finishing / post-press

- Binding

- Lamination

- Die-Cutting

- Foil Stamping

By Print Medium

- Paper

- Plastic

- Fabric/Textile

- Glass

- Metal

- Others (Wood, Ceramics)

By Application

- Packaging

- Labels

- Folding Cartons

- Corrugated Boxes

- Flexible Packaging

- Advertising

- Brochures

- Banners & Signage

- Flyers

- Direct Mail

- Publishing

- Books

- Magazines

- Newspapers

- Transactional

- Bills & Statements

- Invoices

- Checks

- Others

- Textile Printing

- Security Printing (tickets, ID cards, etc.)

By End-User Industry

- Retail & E-commerce

- Food & Beverage

- Healthcare

- Education

- Banking & Financial Services

- Media & Entertainment

- Consumer Goods

- Logistics & Transport

- Government & Public Sector

- Others

By Print Format

- Large Format

- Small Format

- Variable Data Printing (VDP)

By Business Model

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Web-to-Print Services

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (2)