Flexible Packaging Adhesive Market Forecast, Technology & Chemistry Segmentation, Regional Production

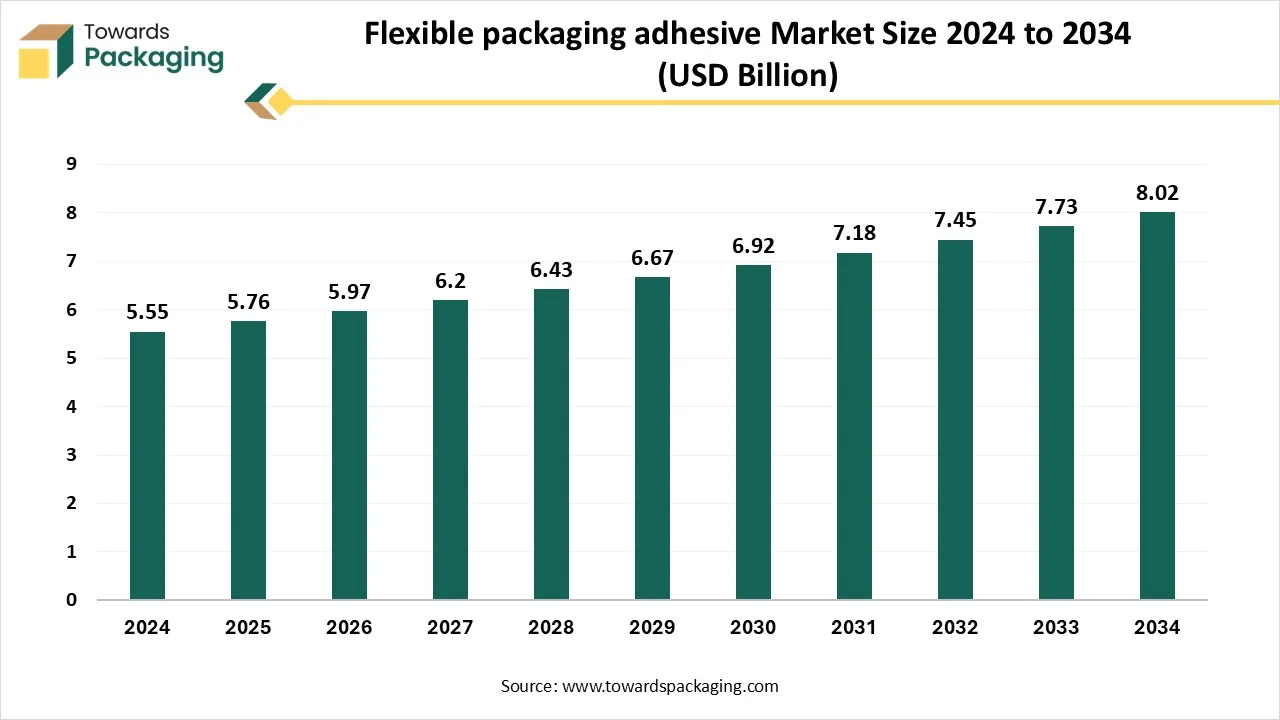

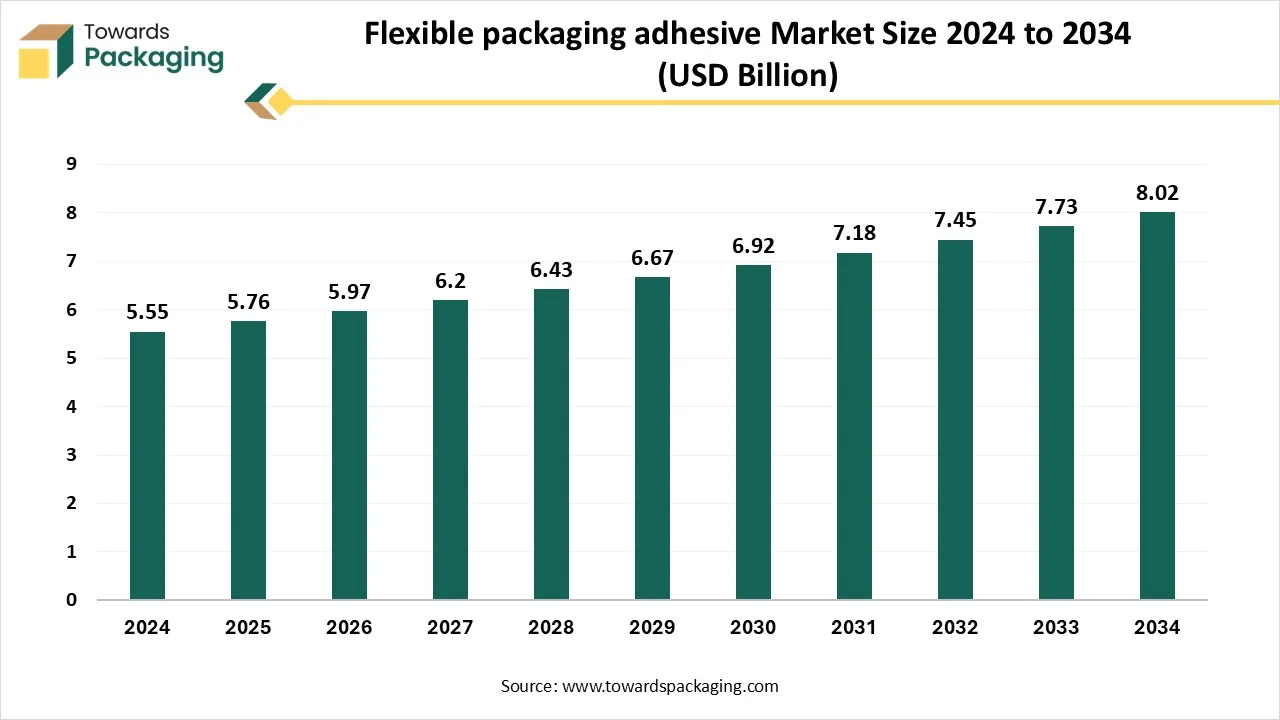

The flexible packaging adhesive market is forecasted to expand from USD 5.97 billion in 2026 to USD 8.32 billion by 2035, growing at a CAGR of 3.75% from 2026 to 2035. It covers detailed segmentation by technology (solvent-based, water-based, solvent-free, hot-melt, reactive), chemistry (PU, acrylic, epoxy, VAE, others), substrate, application, and end-use industry with all supporting statistics, shares, and growth rates. Regional and country-level data span North America, Europe, Asia Pacific, Latin America, and MEA, including production and consumption analysis, trade figures, and key opportunities.

The study also profiles leading companies, maps the value chain from raw material suppliers to converters and end users, and includes competitive benchmarking, recent developments, and strategic moves such as M&A and product launches.

Key Insights

- In terms of revenue, the market is valued at USD 5.76 billion in 2025.

- The market is projected to reach USD 8.32 billion by 2035.

- Rapid growth at a CAGR of 3.75% will be observed in the period between 2025 and 2034.

- Asia Pacific held the largest share in 2024 and is seen to grow at the fastest rate during the forecast period.

- The North American market is expected to grow at a notable CAGR in the foreseeable future.

- By technology, the solvent-based adhesives segment dominated the market with the largest share in 2024.

- By technology, the solvent-free adhesives segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By chemistry, the polyurethane (PU) segment dominated the market in 2024.

- By chemistry, the acrylic segment is expected to grow at the fastest CAGR in the forecast period.

- By substrate, the plastic–plastic segment dominated the market with the largest share in 2024.

- By substrate, the plastic–metal Foil segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By application, the food packaging segment dominated the market in 2024.

- By application, the pharmaceuticals segment is expected to grow at the fastest CAGR in the forecast period.

- By end-use industry, the packaging converters segment dominated the market with the largest share in 2024.

- By end-use industry, the pharmaceutical manufacturers segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

Adhesive Market Overview

Flexible packaging adhesives are specialized bonding agents used to join multiple layers of flexible materials such as plastic films, aluminum foil, and paper to create durable, multi-layered packaging structures. These adhesives ensure the layers remain securely bonded while maintaining flexibility, allowing the packaging to bend or fold without damage. Adhesives play a vital role in enhancing the packaging’s barrier properties, mechanical strength, heat resistance, and visual appeal. There are several types of adhesives used in flexible packaging.

Solvent-based adhesives offer strong bonding and fast drying, making them ideal for demanding applications, but they release volatile organic compounds (VOCs), posing environmental and health risks. Water-based adhesives are eco-friendly but may have limited resistance to moisture and require longer drying times. Hot-melt adhesives, applied in molten form, solidify quickly and are suited for low-barrier or heat-sealable applications. Each type of adhesive is chosen based on the specific performance, regulatory, and sustainability requirements of the packaging.

What Are the Latest Trends in the Flexible Packaging Adhesive Market?

Sustainability & Eco‑Friendly Adhesives

- Manufacturers are strongly shifting toward water-based, solvent‑free, and bio‑based adhesives to reduce volatile organic compounds (VOCs) and align with regulatory mandates and consumer demands for eco-conscious products. Product lines now include biodegradable, compostable formulations and adhesives designed for mono‑material recycling systems that support circular economy goals.

Smart & Functional Adhesives

- Advanced adhesive technologies are emerging with stimuli-responsive and pressure- or temperature-sensitive formulations. These adhesives unlock new capabilities in smart packaging, such as tamper-evident seals, conductive films for electronics, or labels that change behaviour under specific triggers.

Advanced Performance & Safety

- In response to stricter food-safety regulations and sterilization requirements, new adhesive formulations minimize non-migrating chemicals and maintain integrity under autoclaving, microwave use, or cold-chain conditions. This ensures minimal migration into packaged food or pharmaceuticals.

E-Commerce, Retail & Convenience-Led Growth

- With booming e‑commerce and fast delivery services, packaging adhesives are being engineered for high-speed automated lines, resilience during transit, and tamper-proof bonding. These use cases drive demand for adhesives that deliver consistent, durable seals for shipping and logistics applications.

Innovative Chemistries & Dual-Network Systems

- Sophisticated technologies such as dual-network, solvent-free adhesives with high strength and stretchability (e.g., triblock copolymer systems) are emerging. These offer ideal performance for flexible substrates while maintaining eco credentials by eliminating solvents.

How Can AI Improve the Flexible Packaging Adhesive Industry?

AI integration can significantly enhance the flexible packaging adhesives industry by optimizing production processes, improving quality control, and accelerating innovation. Through predictive analytics, AI can forecast demand trends and raw material requirements, minimize waste, and reduce operational costs. In manufacturing, AI-driven sensors and machine learning algorithms enable real-time monitoring of adhesive formulations, ensuring consistent viscosity, bond strength, and curing times. This enhances product quality while reducing errors and downtime.

AI aids in research and development by analyzing vast datasets to identify new sustainable adhesive formulations and optimize material compatibility. It also supports smart automation in lamination and coating processes, improving efficiency and reducing manual labor. Furthermore, AI-based vision systems can detect micro-defects or inconsistencies during application, ensuring higher precision and reducing rejection rates. As sustainability becomes a priority, AI helps align adhesive solutions with eco-friendly goals by simulating environmental impact and enabling life-cycle assessments, ultimately driving smarter, cleaner, and more agile production systems.

Market Dynamics

Driver

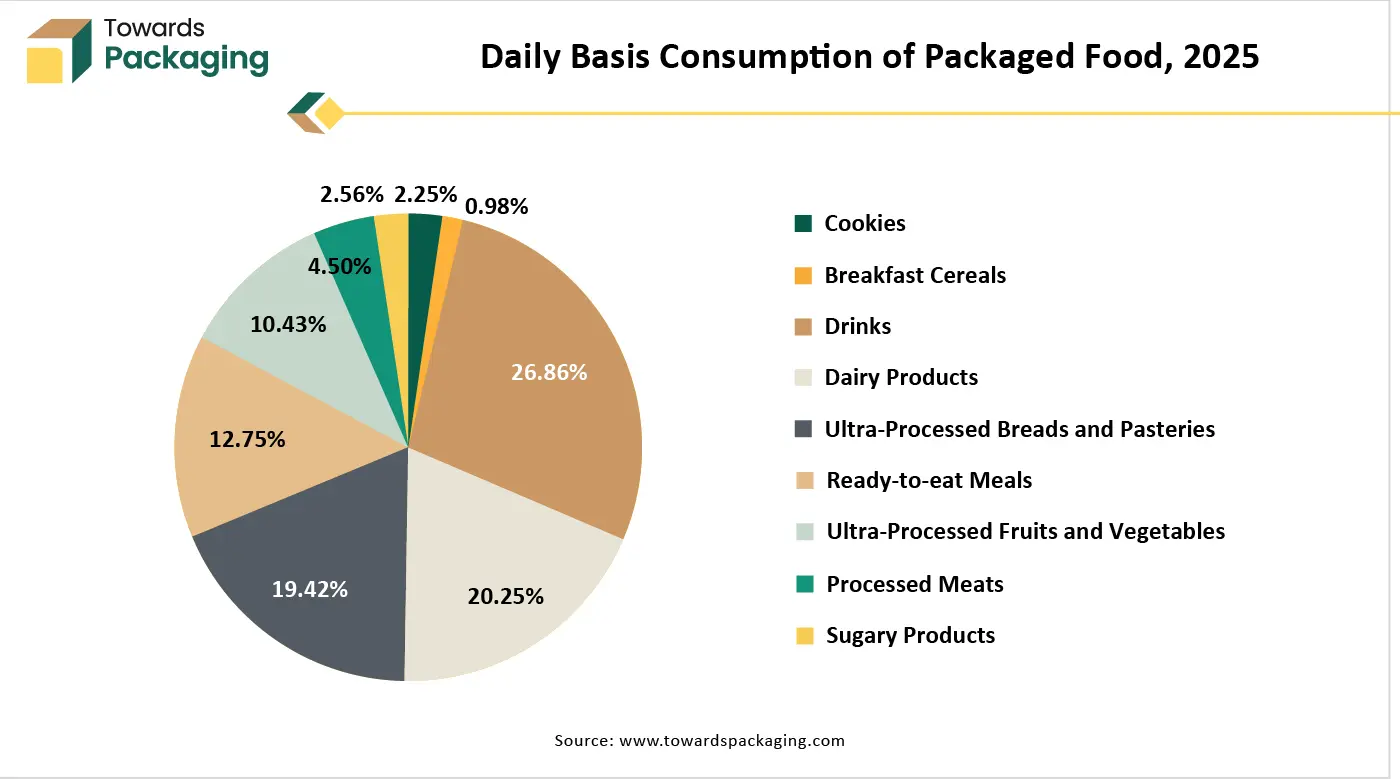

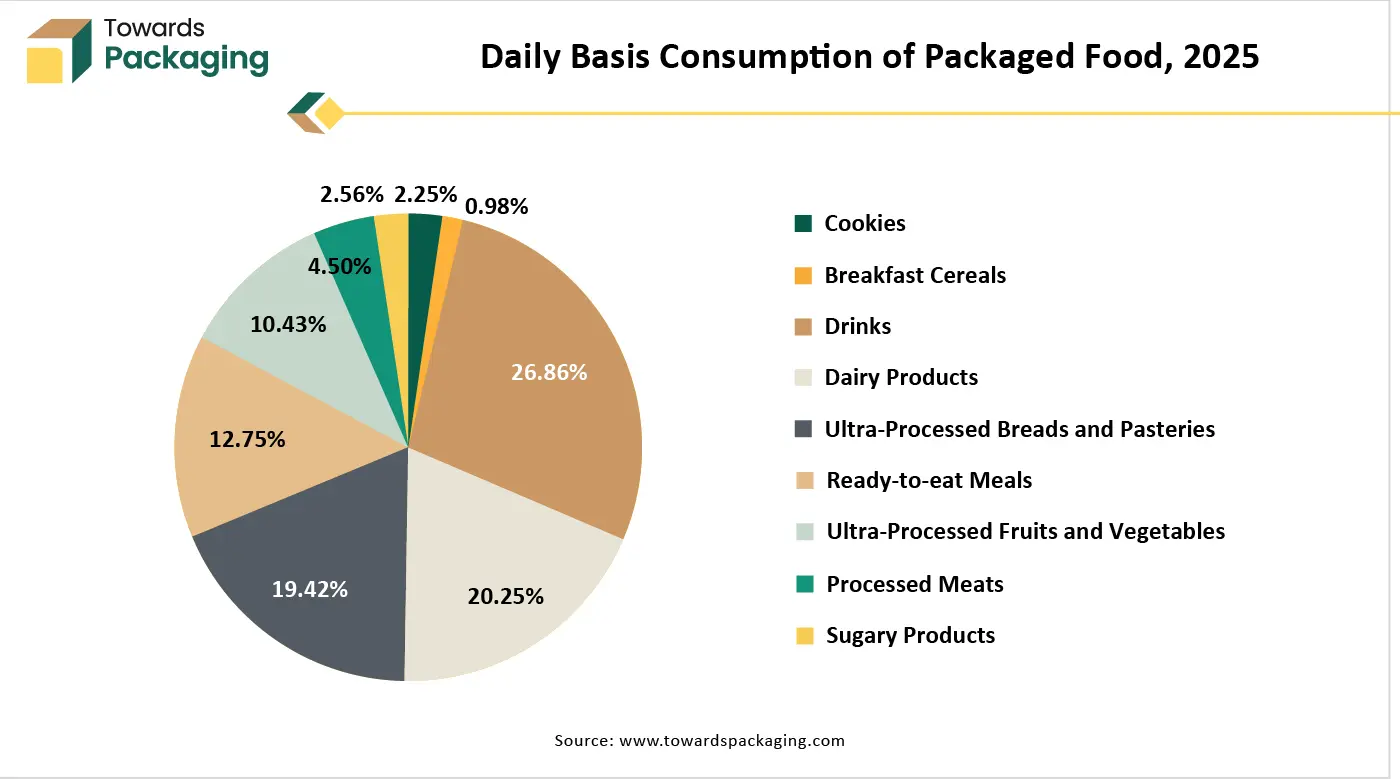

Rising Demand for Packaged and Processed Food

Increasing urbanization and busy lifestyles are boosting the demand for convenient, ready-to-eat, and single-serve packaged food, which heavily relies on flexible packaging adhesives for lamination and sealing. The growth of e-commerce and home delivery services requires durable, lightweight, and tamper-evident packaging, fueling the need for advanced adhesive technologies in flexible packaging.

Restraint

Stringent Environmental Regulations & Recyclability Challenges

The key players operating in the market are facing issues due to stringent environmental regulations and recyclability challenges, which are estimated to restrict the growth of the flexible packaging adhesive market. Fluctuating costs and limited availability of resins, solvents, and additives affect manufacturing stability and profitability. Restrictions on VOC emissions, especially from solvent-based adhesives, create compliance burdens and limit usage. Multi-layer laminated structures are hard to recycle, conflicting with growing sustainability and circular economy goals. UV-curable, solvent-free, and bio-based adhesives often have higher costs, limiting adoption by small manufacturers. Sustainable formulations may offer lower bond strength, barrier properties, or durability in demanding applications.

What are the Opportunities for the Growth of the Flexible Packaging Adhesive Market?

Sustainability & Eco‑Friendly Adhesives

- The expanding demand for recyclable, compostable, and bio‑based packaging fuels innovation in water‑based and solvent‑free adhesives to support circular economy goals.

Smart & Functional Adhesives

- Integration of sensors, QR codes, antimicrobial or temperature-sensitive behaviour in adhesives enables smart packaging applications, enhancing traceability and consumer engagement.

Advanced Adhesive Technologies

- Emerging formulations using nanotechnology, high-performance polymers, and dual‑network systems offer stronger bonding, stretchability, and resistance to moisture or oxygen.

Circular Economy & Regulatory Momentum

- Regulations requiring recyclability and biodegradable packaging create opportunities for adhesives compatible with mono-material recycling systems and compostable packaging.

Segmental Insights

Why does the Solvent-Based Adhesive Segment Dominate the Flexible Packaging Adhesive Market?

The solvent-based adhesive segment dominates the flexible packaging adhesive market due to its strong bonding capabilities, fast curing time, and excellent performance across diverse substrates, including plastic films, metal foils, and paper. These adhesives provide superior resistance to heat, moisture, and chemicals, making them ideal for demanding applications such as food, pharmaceuticals, and industrial packaging. Their high versatility and durability ensure long-term adhesion, even under harsh environmental conditions. Additionally, well-established manufacturing infrastructure and widespread industry familiarity contribute to their continued dominance. Despite environmental concerns, their unmatched performance in high-speed and high-performance laminating operations sustains their leading position in the market.

Solvent‑free adhesive technology has emerged as the fastest‑growing segment within the flexible packaging adhesives market, driven by several compelling factors. Firstly, stringent environmental regulations and growing sustainability concerns are pushing brands and manufacturers toward adhesives that eliminate VOC emissions and reduce carbon footprints, making solvent-free formulations a preferred choice. Secondly, continuous advancements in adhesive chemistry notably one‑component and two‑component solvent-free systems now deliver fast curing, high bond strength, and excellent performance across multilayer substrates, rivaling traditional solvent-based solutions. Moreover, increases in food, pharmaceutical, and e-commerce packaging create demand for adhesive systems that meet both functional and eco-friendly standards. Solvent-free adhesives offer non-toxic adhesion ideal for food-grade and medical packaging, enhancing safety and compliance. Finally, energy-efficient production benefits such as reduced drying times and lower application temperatures make solvent-free adhesives especially attractive for high-speed, automated packaging lines.

Which Chemistry Dominated the Flexible Packaging Adhesive Market in 2024?

The polyurethane chemistry segment dominates the flexible packaging adhesive market due to its exceptional bonding strength, versatility, and compatibility with a wide range of substrates such as plastic films, foils, and paper. Polyurethane adhesives offer superior flexibility, chemical resistance, and durability, making them ideal for demanding applications like food, pharmaceutical, and industrial packaging. They perform well under varying temperatures and humidity conditions, ensuring long-lasting adhesion. Additionally, polyurethane systems are available in both solvent-based and solvent-free forms, allowing manufacturers to meet environmental regulations while maintaining performance. Their adaptability and proven reliability make polyurethane the preferred choice in high-performance flexible packaging solutions.

The acrylic chemistry segment is driven by several powerful factors. Acrylic adhesives deliver exceptional bonding performance, including high peel and shear strength, excellent adhesion to diverse substrates, fast curing at ambient conditions, and resistance to chemicals, temperature changes, and yellowing, attributes highly valued in packaging applications such as pouches, labels, tapes, and cartons. Demand from flexible packaging and e‑commerce-driven industries is rising sharply, fueling the adoption of acrylic adhesives for their durability and reliability on automated production lines. Sustainability trends also favour water‑based acrylics, which comply with low-VOC regulations and support recyclable and repulpable packaging systems. Moreover, continuous R&D and innovation are introducing advanced acrylic formulations such as UV-curable, hybrid, and smart adhesives, boosting growth further in high-demand end-use sectors.

Why does the Plastic Substrate Segment Dominate the Flexible Packaging Adhesive Market?

The plastic-plastic substrate segment dominates the flexible packaging adhesive market due to its widespread use, cost-effectiveness, and versatile performance across various packaging applications. Plastics such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) offer excellent flexibility, lightweight properties, and barrier resistance to moisture, oxygen, and contaminants. These attributes make plastic substrates ideal for food, beverage, pharmaceutical, and personal care packaging. Additionally, their compatibility with multiple adhesive chemistries, especially polyurethane and acrylic, ensures strong bonding and durability. The ease of printing and lamination on plastic films also enhances branding opportunities. As industries prioritize efficiency and convenience, plastic substrates remain the preferred choice in flexible packaging.

The plastic–metal–foil substrate segment is the fastest-growing substrate category in the flexible packaging adhesives market, driven by its superior functionality and evolving packaging demand. These composite structures typically plastic films metallized or laminated with aluminum foil deliver outstanding barrier protection against moisture, oxygen, and light, preserving product freshness and extending shelf life, especially for food, pharmaceuticals, and confectionery. The metallic layer adds visual appeal, enhancing shelf presence in retail and e‑commerce settings. As e‑commerce and ready‑to‑eat lifestyles surge globally, packaging that is both lightweight and high-performing has become essential. Metalized film laminates meet this need while enabling conventional adhesive chemistries like polyurethane and acrylic to perform optimally on these complex substrates. Innovations toward recyclable metallized films and sustainable adhesive options are further fueling adoption, ensuring strong future growth for this technology segment.

Why does the Food Packaging Segment Dominate the Flexible Packaging Adhesive Market?

The food packaging application segment dominates the flexible packaging adhesives market due to its overwhelming volume and stringent performance requirements. Food industry adhesives must ensure safe, durable seals to extend shelf life, prevent contamination, and preserve freshness across products like pouches, labels, wrappers, and cartons. Consumer demand for convenience foods and on‑the‑go packaging has significantly increased flexible formats, boosting adhesive use. Adhesive formulations in this segment frequently meet food-safety regulations, such as low migration and non-toxic chemistries (e.g., water-based, solvent-free), ensuring compliance with strict standards. Additionally, continuous innovations in adhesive performance, heat resistance, bonding strength, and barrier compatibility support food industry needs and drive this application segment's leadership.

The pharmaceutical application segment is the fastest‑growing in the flexible packaging adhesives market due to several compelling factors. First, increased global pharmaceutical production, propelled by aging populations, chronic diseases, and a rise in generic and biologic drugs, drives demand for reliable packaging adhesives tailored for sensitive products. Second, strict regulatory standards (FDA, EMA) require adhesives with low migration, sterilization resistance, and food/drug contact safety, spurring innovation in compliant adhesive chemistries. Third, the rise of unit-dose, blister, and cold-seal packaging formats, which rely on precise bonding performance to ensure dosage integrity, favors advanced adhesive systems like waterborne, pressure-sensitive, and UV-curable types. Finally, demand for smart and active packaging, integrating tamper-evidence, sensors, or antimicrobial features, further accelerates the adoption of specialized adhesive solutions.

Which End-Use Industry Dominated the Flexible Packaging Adhesive Market in 2024?

Packaging converters represent the dominant end-use industry segment in the flexible packaging adhesives market due to their critical role in transforming raw materials into finished packaging products across diverse applications. These converters operate as key intermediaries between adhesive manufacturers and consumer brands, handling processes such as lamination, coating, and printing. Their demand for high-performance adhesives, especially solvent-free, water-based, and polyurethane types, is driven by the need for fast processing speeds, consistent quality, and regulatory compliance. As converters cater to major sectors like food, pharmaceuticals, and personal care, they require versatile, high-strength adhesives that ensure product integrity and packaging durability, solidifying their market dominance.

The pharmaceutical manufacturer segment is the fastest-growing end-use industry segment in the flexible packaging adhesives market due to several compelling drivers. Rapid expansion in pharmaceutical production, spurred by aging populations, chronic disease prevalence, and developments in biologics and generics, demands increasing volumes of sterile, unit-dose, and cold-seal packaging formats that rely on precision adhesive performance. Strict regulatory requirements from bodies like the FDA and EMA mandate adhesives with low migration, sterilization resistance, and drug-contact safety, prompting manufacturers to adopt specialized adhesive formulations. The push for smart and tamper-evident packaging, incorporating features such as sensors, RFID, and QR codes, further accelerates the adoption of advanced adhesive technologies. Growing demand for pharmaceutical products in home health and over-the-counter applications likewise increases reliance on flexible packaging with reliable adhesive systems tailored to pharmaceutical manufacturing needs.

Which Region Dominated the Flexible Packaging Adhesive Market in 2024?

Asia-Pacific is the dominant region in the flexible packaging adhesives market due to a combination of strong industrial growth, expanding consumer markets, and supportive government policies. Rapid urbanization and rising disposable incomes in countries like China, India, Indonesia, and Vietnam have driven higher consumption of packaged food, beverages, and personal care productssectors that heavily rely on flexible packaging. The region is also home to a vast manufacturing base, which supports large-scale production of flexible packaging materials and adhesives at competitive costs.

The growing e-commerce activity and the shift toward convenience-driven lifestyles have amplified the demand for durable, lightweight, and tamper-evident packaging solutions. Government initiatives promoting sustainable packaging and local production, along with increased foreign investments in the packaging and chemical sectors, further fuel market expansion. Additionally, the presence of key players and continuous technological advancements in adhesive formulations tailored for regional needs solidify Asia-Pacific's leadership in the global flexible packaging adhesives market.

China Market Trends

China leads the region due to its massive packaging industry, growing consumer base, and strong manufacturing infrastructure. The rise in packaged food, pharmaceuticals, and e-commerce has boosted demand for high-performance adhesives. Government policies promoting green and recyclable packaging are also encouraging innovations in eco-friendly adhesive solutions.

India Market Trends

India is witnessing rapid growth driven by urbanization, expanding FMCG and pharmaceutical sectors, and rising demand for convenient and affordable packaging. The government’s “Make in India” initiative and increasing investment in packaging R&D are further strengthening the flexible packaging adhesives market.

Japan Market Trends

Japan has a mature but innovation-driven market. The focus is on high-quality, safe, and sustainable adhesives, particularly for food and healthcare products. Advanced technology and strict regulations support demand for solvent-free and recyclable adhesive solutions.

South Korea Market Trends

South Korea’s advanced chemical and electronics industries foster the development of smart and functional adhesives. Growth in cosmetics, pharmaceuticals, and export-driven packaging creates strong domestic demand.

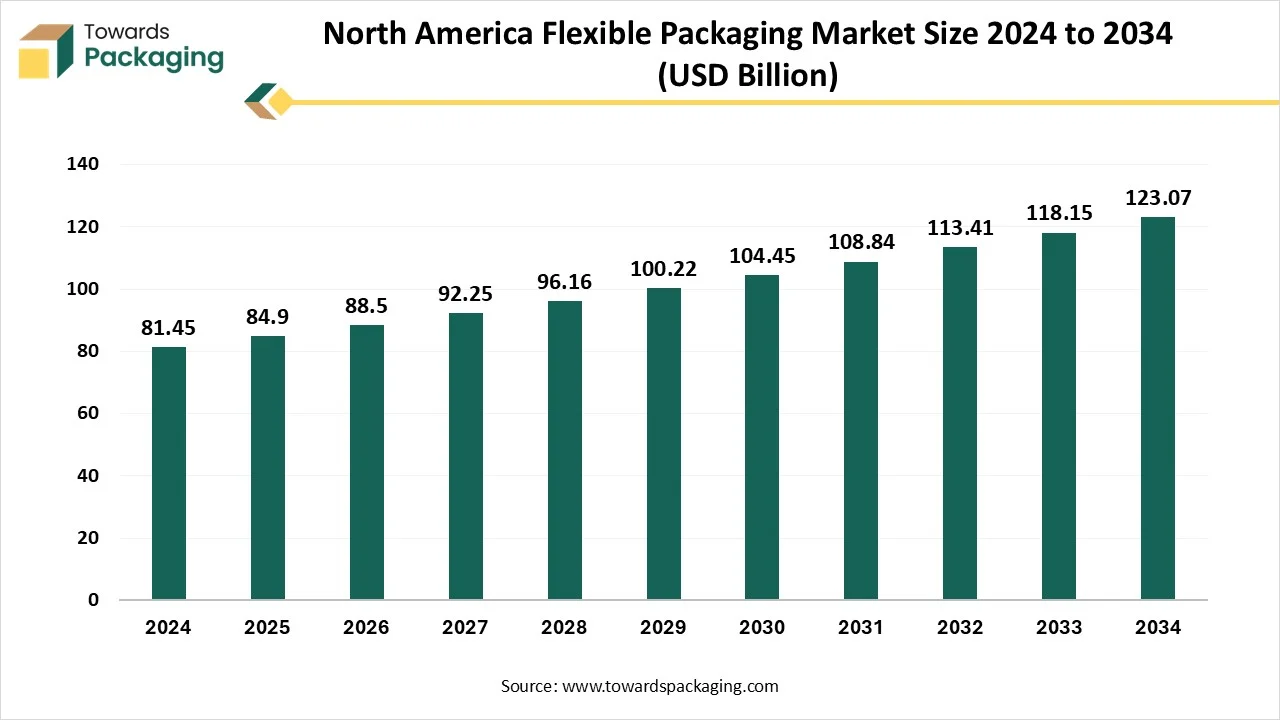

North America’s High Consumption of Packed Food to Project Steady Growth

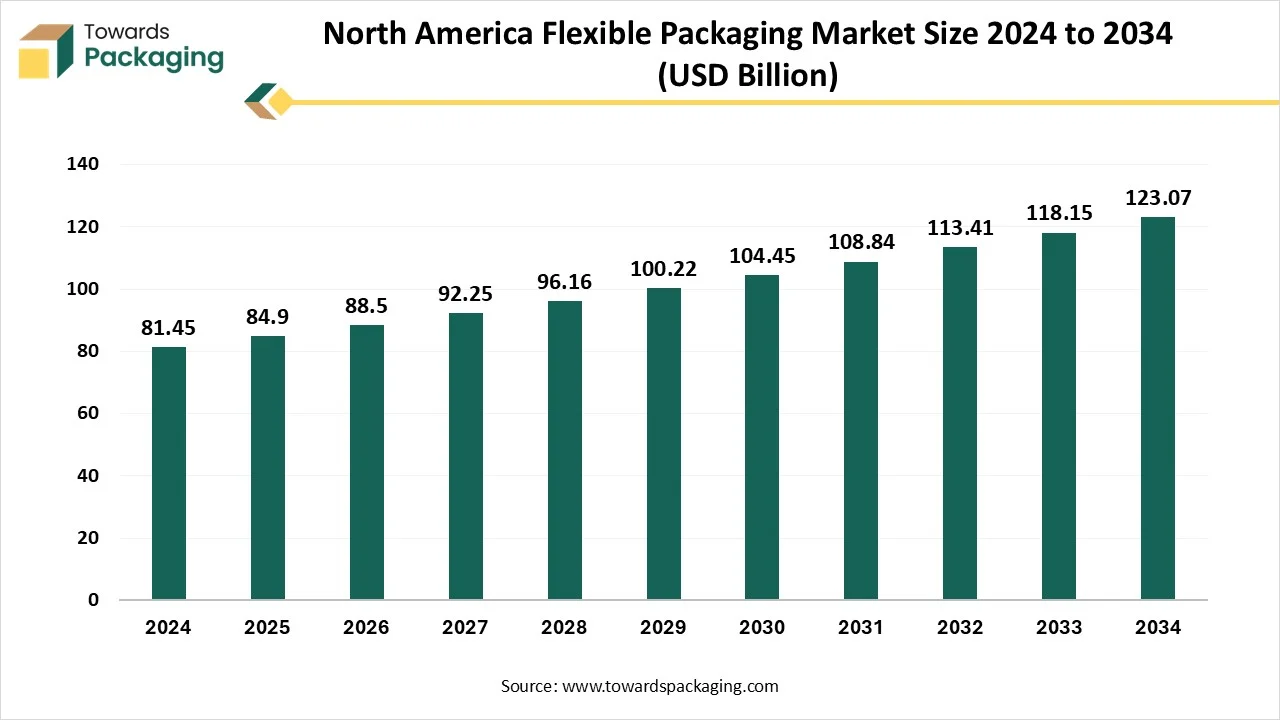

North America is experiencing notable growth in the flexible packaging adhesives market due to strong demand from established industries such as food and beverages, pharmaceuticals, and personal care. The region’s focus on high-quality, functional, and sustainable packaging solutions has driven the adoption of advanced adhesive technologies, including solvent-free, water-based, and bio-based formulations. Increasing consumer preference for convenience, single-serve, and ready-to-eat products further fuels demand for flexible packaging, which relies heavily on reliable adhesive systems.

The growth of e-commerce and the need for secure, tamper-evident packaging support the use of high-performance adhesives. Regulatory pressure from bodies like the FDA and EPA has encouraged innovation in low-VOC and recyclable adhesive solutions. The presence of major adhesive and packaging manufacturers, along with investments in R&D and automation, also enhances the region’s competitive advantage. Moreover, strong sustainability commitments from brands and retailers are pushing for greener adhesive technologies, contributing to consistent market expansion in North America.

Future of Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Future of North America Flexible Packaging Market

The North America flexible packaging market is expected to increase from USD 84.9 billion in 2025 to USD 123.07 billion by 2034, growing at a CAGR of 4.23% throughout the forecast period from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing flexible packaging which is estimated to drive the North America flexible packaging market over the forecast period. The North America flexible packaging market is experiencing steady growth, driven by rising consumer demand for convenience, sustainability, and innovation in packaging solutions.

Flexible packaging is widely used in the food and beverage sector, which remains the dominant end-user due to its cost-effectiveness and extended shelf life benefits. Technological advancements, such as recyclable mono-materials and high-barrier films, are supporting eco-friendly trends. Additionally, the rapid expansion of e-commerce and regulatory emphasis on sustainable practices continue to shape the future of this dynamic industry.

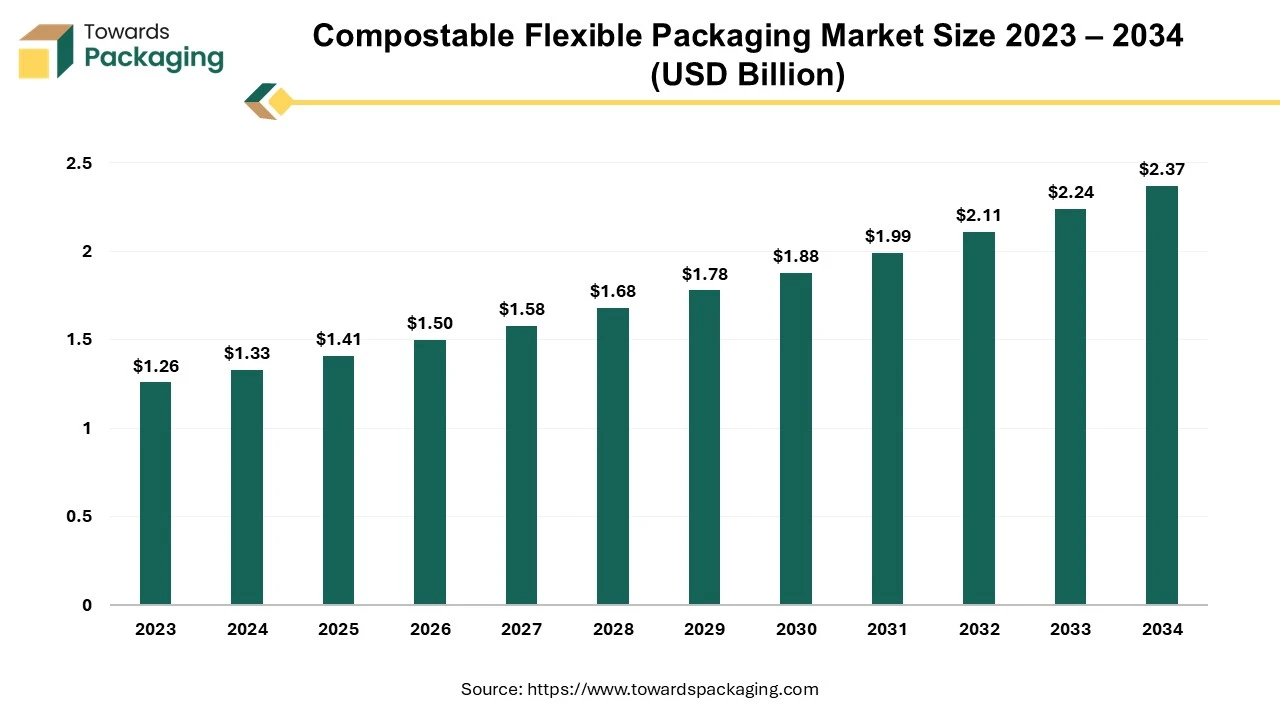

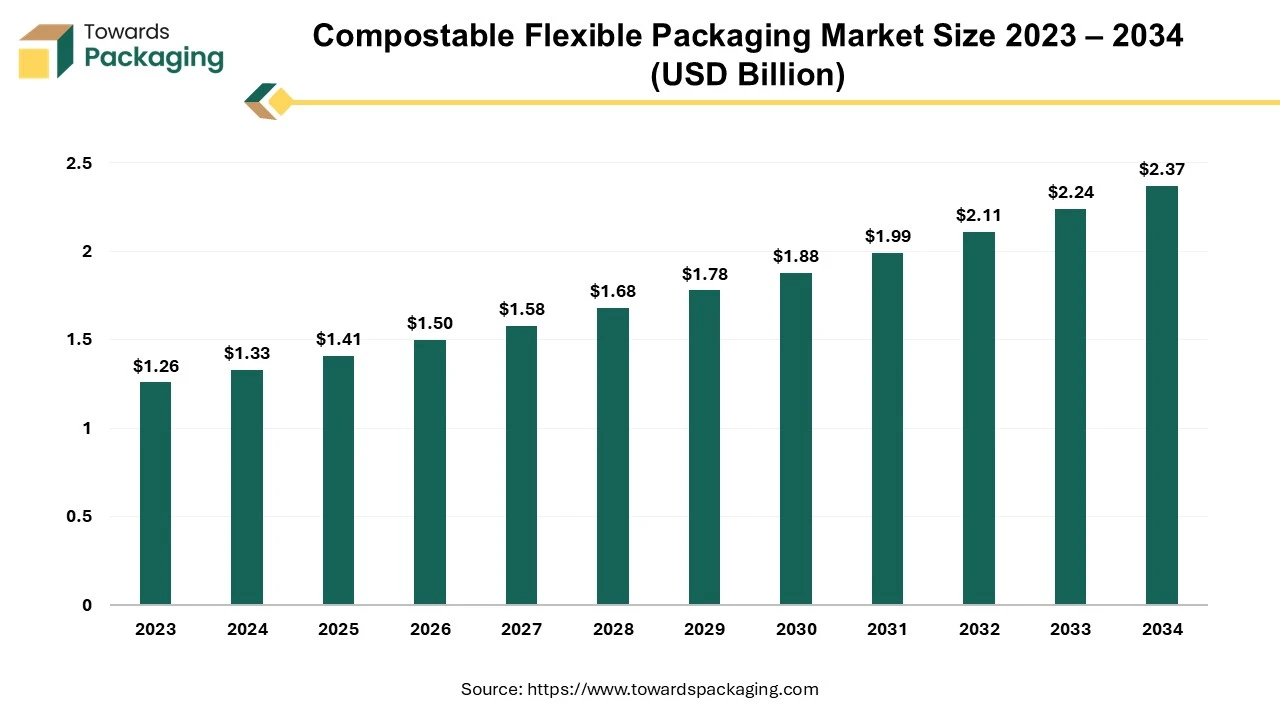

Future of Compostable Flexible Packaging Market

The compostable flexible packaging market is expected to increase from USD 1.41 billion in 2025 to USD 2.37 billion by 2034, growing at a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

Compostable flexible packaging is generated from various recycled and plant-based components, such as wood pulp and potato starch, making it an environmentally beneficial choice. Unlike some non-compostable rivals, natural components in compostable flexible packaging do not emit harmful pollutants when disposed of, helping to create healthier soil. An evolution in compostable flexible packaging has led to bioplastic, a plant-based alternative with qualities similar to less sustainable equivalents. Bioplastic, suitable for applications such as smoothie cups and fruit juices, is economically compostable because it is made from renewable sources and is also recyclable and reusable. It is well known that flexible packaging has reductions in each of these areas.

Top Flexible Packaging Adhesive Market Players

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Arkema Group (Bostik)

- 3M Company

- Sika AG

- Avery Dennison Corporation

- Dow Inc.

- Ashland Global Holdings Inc.

- Toyo-Morton Ltd. (Toyochem)

- DIC Corporation

- Paramelt B.V.

- Morchem S.A.

- Pidilite Industries Limited

- Ash & Lacy Construction

- Coim Group

- Flint Group

- Jubilant Agri and Consumer Products Ltd

- Bondzil Silicone

- Huntsman Corporation

- AkzoNobel N.V.

Latest Announcements by Industry Leaders

- The market strategy manager for flexible packaging at Henkel, Cagri Turkmen, states that by introducing Loctite Liofol LA 7837/LA 6265, a solvent-free solution that offers exceptional performance and enhanced sustainability, the Henkel company is extending the line of high-performance adhesives for retort applications. With this innovation, the Henkel company allows its customers to meet current market requirements, reduce CO2 emissions, and enjoy economic advantages due to higher production efficiency. (Source: Henkel)

New Advancements in the Market

- In July 2025, Henkel Adhesive Technologies is introducing Loctite Liofol LA 7837/LA 6265, an aliphatic adhesive system without solvent that is designed for high-temperature applications, such as pet food retort packaging. The technology eliminates the need for an energy-intensive drying stage, which is necessary for products containing solvents, and lowers material usage, combining the greatest degree of food safety with dependable processing to help reduce CO2 emissions. (Source: Henkel)

- In February 2025, Power Adhesives, a global leader in hot melt adhesive solutions with its headquarters in the UK, will present its most recent invention, the Vactac positioning adhesive system, at the premier international composites show, JEC World 2025, in Paris. Attendees will have the chance to witness live demonstrations of Vactac, a state-of-the-art substitute for traditional solvent-based spray adhesives used to position reinforcement layers during the vacuum infusion procedure.(Source: Power Adhesives)

Global Flexible Packaging Adhesive Market Segments

By Technology

- Solvent-Based Adhesives

- Water-Based Adhesives

- Solvent-Free Adhesives

- Hot Melt Adhesives

- Reactive Adhesives

By Chemistry

- Polyurethane (PU)

- Acrylic

- Epoxy

- Vinyl Acetate (VAE)

- Others (Rubber-based, Silicone, etc.)

By Substrate

- Plastic–Plastic

- Plastic–Metal Foil

- Plastic–Paper

- Metal Foil–Paper

By Application

- Food Packaging

- Pharmaceuticals

- Personal Care & Cosmetics

- Industrial Packaging

- Consumer Goods

By End-Use Industry

- Packaging Converters

- Food & Beverage Companies

- Pharmaceutical Manufacturers

- Retail & Private Label Brands

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- Kuwait

List of Figures

- Figure 1. Global Flexible Packaging Adhesive Market Size (USD Billion), 2025–2034

- Figure 2. Market Share by Region, 2024 – Asia Pacific 40%, North America 25%, Europe 20%, Latin America 8%, Middle East & Africa 7%

- Figure 3. Market Share by Technology, 2024 – Solvent-Based 40%, Water-Based 20%, Solvent-Free 20%, Hot-Melt 10%, Reactive 10%

- Figure 4. CAGR Growth by Technology, 2025–2034 – Fastest: Solvent-Free Adhesives

- Figure 5. Market Share by Chemistry, 2024 – Polyurethane (PU) 45%, Acrylic 20%, Epoxy 15%, Vinyl Acetate (VAE) 10%, Others 10%

- Figure 6. CAGR Growth by Chemistry, 2025–2034 – Fastest: Acrylic Adhesives

- Figure 7. Market Share by Substrate, 2024 – Plastic–Plastic 50%, Plastic–Metal Foil 25%, Plastic–Paper 15%, Metal Foil–Paper 10%

- Figure 8. CAGR Growth by Substrate, 2025–2034 – Fastest: Plastic–Metal Foil

- Figure 9. Market Share by Application, 2024 – Food Packaging 45%, Pharmaceuticals 20%, Personal Care & Cosmetics 15%, Industrial Packaging 12%, Consumer Goods 8%

- Figure 10. CAGR Growth by Application, 2025–2034 – Fastest: Pharmaceuticals

- Figure 11. Market Share by End-use Industry, 2024 – Packaging Converters 40%, Food & Beverage Companies 25%, Pharmaceutical Manufacturers 20%, Retail & Private Label Brands 15%

- Figure 12. CAGR Growth by End-use Industry, 2025–2034 – Fastest: Pharmaceutical Manufacturers

- Figure 13. Regional Production Analysis – Asia Pacific 40%, North America 25%, Europe 20%, Latin America 8%, Middle East & Africa 7%

- Figure 14. Country-Level Production Insights – China 18%, India 10%, Japan 5%, South Korea 4%, Rest of Asia Pacific 3% (example allocation)

- Figure 15. Competitive Landscape of Top Players in Flexible Packaging Adhesive Market

List of Tables

- Table 1. Global Flexible Packaging Adhesive Market Size (USD Billion), 2025–2034

- Table 2. Regional Market Share, 2024 – Asia Pacific 40%, North America 25%, Europe 20%, Latin America 8%, Middle East & Africa 7%

- Table 3. Technology Market Share, 2024 – Solvent-Based 40%, Water-Based 20%, Solvent-Free 20%, Hot-Melt 10%, Reactive 10%

- Table 4. Chemistry Market Share, 2024 – Polyurethane (PU) 45%, Acrylic 20%, Epoxy 15%, Vinyl Acetate (VAE) 10%, Others 10%

- Table 5. Substrate Market Share, 2024 – Plastic–Plastic 50%, Plastic–Metal Foil 25%, Plastic–Paper 15%, Metal Foil–Paper 10%

- Table 6. Application Market Share, 2024 – Food Packaging 45%, Pharmaceuticals 20%, Personal Care & Cosmetics 15%, Industrial Packaging 12%, Consumer Goods 8%

- Table 7. End-use Industry Market Share, 2024 – Packaging Converters 40%, Food & Beverage Companies 25%, Pharmaceutical Manufacturers 20%, Retail & Private Label Brands 15%

- Table 8. Regional Production Analysis by Key Countries – China 18%, India 10%, Japan 5%, South Korea 4%, Rest of Asia Pacific 3%; U.S. 15%, Canada 10%; Germany 6%, UK 4%, France 3%, Italy 2%, Spain 2%, Nordics 3%; Brazil 4%, Mexico 3%, Argentina 1%; UAE 2%, Saudi Arabia 3%, South Africa 2%

- Table 9. Key Market Drivers, Restraints, and Opportunities

- Table 10. Emerging Trends in Flexible Packaging Adhesives (Sustainability, Smart Adhesives, Dual-Network Systems)

- Table 11. AI in Flexible Packaging Adhesive Industry – Use Cases in Production, Quality Control, and R&D

- Table 12. Regional & Country-Level Market Opportunities and Government Regulations

- Table 13. Competitive Landscape – Market Share Analysis of Top Players

- Table 14. Recent Product Launches & Strategic Announcements (2024–2025)

Tags

FAQ's

Select User License to Buy

Figures (6)