Gusseted Pouches Market Size, Share, Trends and Forecast Analysis

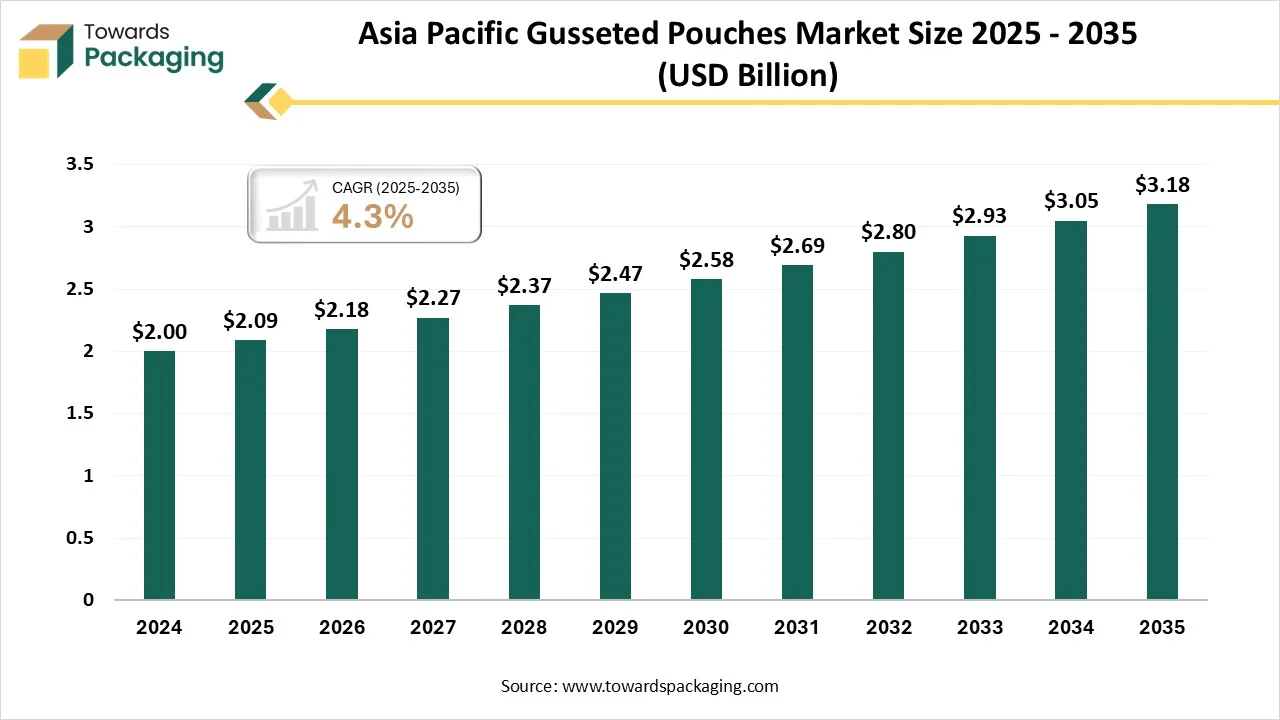

The gusseted pouches market is projected to grow from USD 4.78 billion in 2026 to USD 6.58 billion by 2035, expanding at a CAGR of 3.62%. Asia Pacific dominated the market in 2024 with a share of approximately 45%, while North America is expected to witness significant growth during the forecast period. This expansion is attributed to the increasing consumer demand for sustainable, convenient, and re-sealable packaging. The food and beverage sector, accounting for 50% of the market in 2024, remains a major driver. Additionally, innovations in materials, including biodegradable and compostable options, as well as eco-friendly laminates, are reshaping packaging solutions. By type, side gusseted pouches dominated with a 40% share in 2024, while flat-bottom gusseted pouches are expected to grow at the highest CAGR.

Key Highlights

- In terms of revenue, the market is valued at USD 4.61 Billion in 2025.

- The market is predicted to reach USD 6.58 Billion by the year 2035.

- Rapid growth at a CAGR of 3.62% will be officially experienced between 2025 and 2034.

- By region, Asia Pacific dominated the market with the biggest share of approximately 45% in 2024.

- By region, North America expected to rise at a notable CAGR between 2025 and 2034.

- By type, side gusseted pouches segment have contributed to the biggest share of approximately 40% in 2024.

- By type, flat-bottom gusseted pouches segment will grow at a notable CAGR between 2025 and 2034.

- By material type, plastic films segment will have the largest share of approximately 50% in 2024.

- By material type, biodegradable or compostable materials segment will rise at a notable CAGR between 2025 and 2034.

- By printing technology, rotogravure printing segment has the largest share of approximately 40% in 2024.

- With printing technology, the digital printing segment will rise at a notable CAGR between 2025 and 2034.

- By end-use industry, the food and beverages segment contributed to the biggest share of approximately 50% in 2024.

- By end-use industry, the personal care and cosmetics segment will grow at a notable CAGR between 2025 and 2034.

- By distribution channel, manufacturers segment have contributed the biggest share of approximately 60% in 2024.

- By distribution channel, e-commerce segment will rise at a notable CAGR between 2025 and 2034.

What Do You Mean By Packaging For The Gusseted Pouches Market?

The gusseted pouches market encompasses flexible packaging formats that feature expandable side or bottom panels (gussets) designed to increase storage capacity, enhance stability, and improve shelf presentation. These pouches are widely used across food and beverage, pharmaceuticals, personal care, pet food, and industrial packaging sectors due to their lightweight, customizable, and eco-friendly nature. They can be produced from multilayer laminates, paper, aluminium foil, or bio-based materials and are compatible with high-speed filling systems.

Gusseted Pouches Market Outlook

- Industry Growth Overview: Between the years 2025 and 2034, the market is witnessing rapid development, driven by growing consumer demand for sustainable, convenient, and portable packaging. Multiple market tracks project steady expansion through the early 2030s across main segments like retail, commerce, and food and beverages.

- Sustainability Trends: Gusseted pouches need less material in order to generate less waste compared to rigid packaging selections, such as metal and glass. Studies, like those by the Flexible Packaging Association, display that they can utilise 26-80% less material as compared to rigid containers for the same volume, which reduces the waste.

- Global Expansion: The overall industry for the gusseted pouches is witnessing major development, which is being driven by the growing urge for sustainable, convenient, cost-effective, and flexible packaging solutions. This growth is being fulfilled by the growing consumption of packaged foods and the fast development of e-commerce.

- Major Investors: Many organisations in the United States, China, and India are included in the gusseted pouch industry, including Berry Global Inc., Mondi Group, Sonoco Products Company, ProAmpac, Qingdao Dongfangjia Plastic Packaging, Shandong Qingzhou Hengchun Packaging Co., Ltd., Giriraj Impex, Gomati Ecopack, etc.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 4.61 Billion |

| Projected Market Size in 2035 |

USD 6.58 Billion |

| CAGR (2026 - 2035) |

3.62% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Type, By Material Type, By Printing Technology, By End-Use Industry, By Distribution Channel and By Region |

| Top Key Players |

Amcor plc, Mondi Group, Sealed Air Corporation, UFlex Ltd., Glenroy Inc., Printpack Inc., Goglio S.p.A., DaklaPack Europe B.V. |

Key Technological Shifts in the Gusseted Pouches Market

Artificial Intelligence is updating the path of packaging, which is being crafted. Generative design algorithms can quickly make hundreds of capable packaging patterns depending on specific parameters like material constraints, product dimensions, aesthetic choice, and cost targets, too. This significantly develops the design procedure that enables companies to discover a huge series of choices that would be possible with regular procedures.

AI algorithms can manage designs to lessen material waste, which leads to cost savings and reduced environmental impact. It can also encourage how a package will act under different conditions and pressure, assisting in tracking potential weakness and developing durability. Artificial Intelligence can be utilised to make tailored packaging designs depending on the customer choice or product demands.

Trade Analysis of Packaging for Gusseted Pouches Market: Import & Export Statistics

As per the worldwide import data, globe has imported 107 shipments of Food Packaging Pouch during the period April 2024 to March 2025 (TTM). These imports was being supplied by 30 exports to 35 Global buyers ,which marked a significant development rate of 91% as compared to the growing twelve months.

During this time, in March 2025, globe has imported 9 Food Packaging Pouch Shipments. This has checked an year-on-year development of 29% compared to March 2024,and a 124% sequential growth from Month February 2025.

Worldwide, the top three importers of Food Packaging Pouch are Chile, United States and Vietnam. United States is at the forefront in the world in terms of Food Packaging Pouch that has imported with 81 shipments ,followed by Chile with 25 shipments, and Vietnam taking the third position with 23 shipments.

Value Chain Analysis Of The Gusseted Pouches Market

- Material Processing and Conversion: Gusseted bags have a foiled space, either focused at the sides or base of the bag, that enables the packaging to stretch when filled. The fold expands out to make a flat surface for stable stacking. Side gusseted bags have inward folds along both vertical edges, and bottom gusseted bags include a flat, oval-shaped reinforced base.

- Package Design and Prototyping: One of the biggest benefits of gusseted pouches is their potential to double the storage. The stretchable design means we can fit more product into a minute package as compared to strong containers or flat bags. This is particularly advantageous for irregularly shaped food items, which could fit precisely in regular packaging. Apart from this, gusseted pouches are easy to carry and lightweight, which makes them a favorite among on-the-go users. If anyone is packaging snacks, for instance, their lightweight and flexible design enables them to fit neatly into lunchboxes, bags, and backpacks.

- Logistics and Distribution: Gusseted pouches streamline logistics and distribution by developing the storage potential, developing shipping efficiency, and ensuring robust product protection during transportation. Their lightweight, flexible design lowers the costs, minimizes the damage, and updates warehouse space, which makes them a selected choice over regular rigid packaging. They have huge bottoms or sides, which develop their volume. The type of gusset used encourages how the pouches are being shipped, stored, and showcased, too.

Pouch Packaging And Its Various Applications

| Industry |

Common Pouch Applications |

Suitable Pouch Types |

| Food and Beverage |

Confectionery, snacks, tea, coffee, spices, soups, pet food, frozen foods, and ready-to-eat meals |

Stand-up pouches, Gusseted pouches, Flat pouches, spouted pouches, and flat bottom pouches |

| Pharmaceuticals and Healthcare |

Pills, powdered medications, capsules, diagnostic strips, nutritional supplements, and wound dressings, too. |

Stand up pouches, flat pouches, shaped pouches and shaped pouches. |

| Cosmetics and Personal Care |

Shampoos, face masks, creams, lotions, body washes, travel-sized, sample sachets, and toiletries |

Flat pouches, child-resistant pouches, and zipper pouches. |

| Household and Cleaning |

Dish soaps, cleaning sprays, laundry detergents, air freshness, and pesticides. |

Spouted pouches, stand-up pouches, shaped pouches, and flat pouches. |

| Industrial and Chemical |

Sealants, adhesives, paints, lubricants, coatings, and agricultural chemicals |

Flat pouches, bag-in-box pouches, stand-up pouches, and spouted pouches |

| Electronics and Accessories |

Cables, chargers, small electronics, headphones, and screen protectors |

Zipper pouches, lay flat, and anti-static pouches |

| Promotional and Retail |

Promotional samples, gift items, and loyalty program rewards |

Four-sided pouches, shaped pouches, stand-up pouches, and zipper pouches |

Emerging Trends in the Gusseted Pouches Market

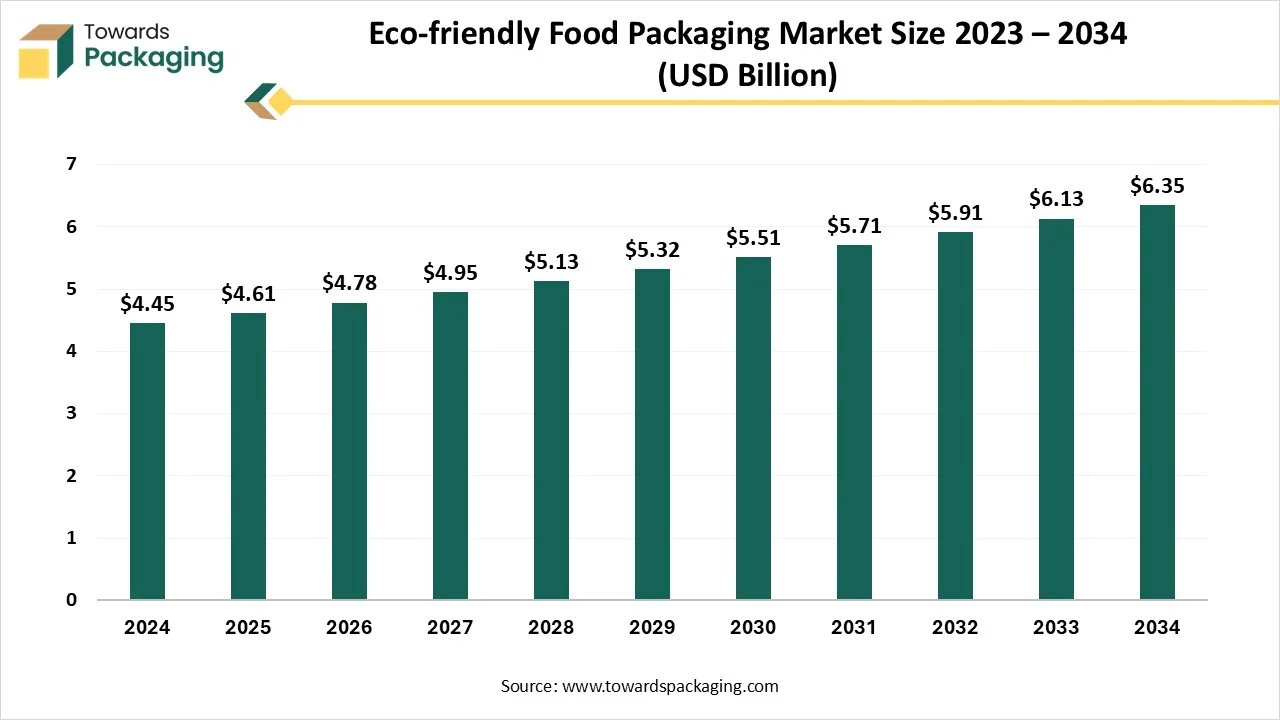

- Sustainable Materials: With growing worldwide consciousness towards surrounding sustainability, the usage of sustainable materials in pouch packaging is becoming a significant trend. More organizations are using recyclable, biodegradable, and compostable materials, such as plant-based and bioplastic materials.

- Single-serve pouches: Convenience and portion control: With communication to the increasing urge for on-the-go usage and portion-controlled servings, single-serve pouches are grabbing attention in 2024. They serve both portion control and convenience, which makes them a popular choice, particularly within the food and beverage field.

- Transparent Pouches: The clear choice: Transparency is not only a trending word, but it has fit into actual predictions in the pattern of transparent pouch packaging. Clear pouches or pouches with window designs are becoming popular as they allow users to visually check the product before making a buying decision.

- Innovative closures: Developing user experience: The globe of custom pouch packaging is experiencing a demand in the use of easy-to-open, inventive, and resealable closures. These high-level closure machines, which include sliders, zip-locks, and spouts, develop user convenience, ensure the product's freshness, and extend the shelf life.

- Stand-up Pouches: Functionality has met with visibility: Stand-up pouches are developing to be a go-to choice for several brands, given their exceptional functionality. These pouches provide perfect stability on retail shelves and update space utilisation. Their vertical beginning serves a huge room for product information, branding, and eye-catching design elements, which thus grows product visibility.

- Matte Finishes: Current Aesthetic and Tactile Experience: While polished finishes have regularly dominated the packaging sector, matte finishes are gaining huge growth in 2024. Matte finished pouches drip a modern and luxurious look, which serves with a different tangible experience that matches the current discerning users.

- Personalized Packaging: Personalization is a growing trend that permeates every kind of packaging, and pouches are no exception. Personalised packaging, which could include the user’s name, personalised message, and unique designs, is assisting brands to establish.

Market Dynamics

Market Opportunity

Cutting-edge possibilities in Gusseted Pouches Industry

The development of the gusseted pouches within the packaging sector is ready for growth and invention. With their in-depth efficiency and flexibility, they align with a variety of industries and products, which makes them an evergreen choice for further packaging demands. The currency growth in terms of material science, specifically in the space of recyclable and sustainable options, additionally develops the look of gusseted pouches, meeting the global encouragement towards environmentally-friendly packaging solutions.

This update is predicted to drive many brands towards accepting these pouches, not only for their regular advantage but also for their capability to mainly reduce the environmental impact of packaging.

Market Restraint

Top 5 Challenges of Gusseted Pouches

Gusseted pouches serve high potential but have particular restrictions, which include packaging instability, higher cost, challenges with storage and printing, and latest retail display issues too. They are more complicated to produce than simpler flat bags, which can develop manufacturing costs. This is because of the further material and more intricate selling procedure as required. One of the major drawbacks for several gusseted pouches is their insecurity, particularly for the side-gusseted types. They frequently cannot stand up on their own and become less rigid as the items are used. Despite being transported flat, gusseted pouches can still be heavier than flat bags when empty, displaying storage issues for organisations with limited warehouse area.

Type Insights

How Did The Side-Gusseted Pouched Segment Dominate The Gusseted Pouches Market?

The side-gusseted pouched segment has dominated the gusseted pouches market with approximately 40% share in 2024, as side-gusseted pouches have pleats or folds on the sides of the pouch, which are open in the outside direction when the pouch is being filled, thus developing the pouch’s potential without compulsorily developing the face width. This design is particularly utilised for packaging coffee beans and tea, as it is possible to pack a large quantity of the product in a narrow pouch, which is perfect for display on shelves. Side gusset pouches have a top-of-the-pouch seal and can be utilised with a flat bottom to improve stability.

The flat-bottom gusseted pouches segment is predicted to be the fastest in the market during the forecast period. These types of bags are often known as box pouches, which mix the attributes of both the stand-up pouches and the side gusset bag. The outcome pattern is one of the different stability, rearranging a box. These bags are classified by their flat base and the existence of gussets on all their sides. One of their characteristics is the potential to track an upright position, even when it is not filled. This structural benefit has guaranteed an optimal and leading display on store shelves, which develops their appeal and visibility. When we compare the box pouches to regular gusset bags, their upright stance mainly develops product presentation. The pattern significantly serves a bigger storage potential, which makes it an effective choice for packaging.

Material Insights

How Did The Plastic Films (PP And PET ) Segment Dominate The Gusseted Pouches Market?

The plastic films (PET and PP) segment has dominated the market with approximately 50% share in 2024, as polypropylene is the material that is classified for its clarity, which enables users to view the product inside, and its chemical resistance. Polypropylene bags also serve as a perfect barrier against moisture, which ensures the contents stay fresh for an extended time. Due to their higher melting point, PP bags are specifically perfect for products linked to heat during storage or packaging. On the other hand, flat bags with a gusset in metallic PET have a smaller size with a big storage capacity. With these gusseted bags, which can also be accepted in some cases for 3D geometry, we can display your products or keep them taking complete benefit of the available space.

The biodegradable or compostable materials segment is expected to be the fastest in the market during the forecast period. Several organizations serve compostable and biodegradable gusseted bags, which serve as eco-friendly alternatives for packaging snacks, goods, coffee, and more. They are available from producers and retailers like The Pure Option, CarePac, and Swisspac. Many of the plant-based materials, created from materials like corn starch and cellulose, were created. A main difference between compostable and biodegradable bags is that they are crafted to break down completely into non-toxic and natural elements, which are generally suitable for home composting conditions and industrial composting.

Printing Technology Insights

How Did The Rotogravure Printing Segment Dominate The Gusseted Pouches Market?

The rotogravure printing segment has dominated the market with approximately 40% share in 2024 as gusseted pouches are a famous packaging solution for a wide range of products, which include personal care items, food, and beverages. Rotogravure printing is a selected method for tailoring stand-up pouches because of many main advantages, such as this printing being well-known for its potential to generate high-resolution images with minute details, vibrant colours, and smooth gradients too. This quality is important for custom-printed stand-up pouches, as it assists brands in making eye-catching patterns that attract users. The accuracy of rotogravure ensures that even the minute text or intricate designs are printed precisely.

The digital printing segment is predicted to be the fastest in the market during the forecast period. The digitally printed Taylor pouches serve an accurate mix of durability, style, and functionality too. They have matte finish and glossy too, which are being crafted to make sure a perfect balance of functional values and aesthetics. The digitally printed layer has a glossy look which captures buyers' attention. From snacks to tea, digitally printed pouches are suitable for different products. They are available in various textures, as these pouches showcase a less vibrant vibe.

End-Use Industry Insights

How Did The Food And Beverage Segment Dominate The Gusseted Pouches Market?

The food and beverage industry segment dominated the market with a 50% market share in 2024, as in the food sector, gusseted bags are specifically beneficial. They serve as a perfect packaging solution for snacks, coffee, and grains. Their potential to stand upright develops the product visibility on shelves, which makes them a selected choice for consumers and retailers alike. They are mainly used in the food and beverage industry for packaging items like snacks, coffee, and dry fruits. Side gusset pouches are ideal when a huge fill capacity is needed. This is why they are often tilled for such products as tea, coffee, baked goods, and pet food, too. As they can stand vertically just like stand-up pouches, they serve perfect space updation.

The personal care and cosmetics segment is predicted to be the fastest-growing in the market during the forecast period. Gusseted pouches for beauty and health products serve many advantages, including product protection, convenience, and branding possibilities. Gusseted pouches are lightweight and convenient to carry, which makes them perfect for on-the-go usage and travel purposes too. They also serve with perfect barrier properties, which protect the products and pollutants, light, and moisture. Whether we have liquid formulations, salt granules, serums, or solid crams, there are such options available that can smoothly seal and protect any product. Pouches can be crafted with reusable characteristics, such as spouts and zippers. These features enable users to conveniently open and close the pouches, which track the freshness and longevity of the products.

Distribution channel Insights

How Did The Manufacturers (B2B) Segment Dominate The Gusseted Pouches Market?

The manufacturers segment has dominated the market with approximately 60% share in the year 2024, as manufacturers can sell gusseted pouches with the assistance of integration of direct B2B sales, as it is a network of online channels and distributors. The method often relies on the manufacturer's size, which is targeted at the industry, and the degree of personalization being served. For manufacturers that want to deliver tailored service and track the complete client relationship, a direct sales team is the smoothest procedure. This team works with customers to check their accurate specifications.

The e-commerce segment is predicted to be the fastest in the market during the forecast period. Transporting is a direct function of space and weight. Pouches weigh extremely less than regular rigid packages, thus lowering freight costs. Their reliability also enables more products to be packed into delivery boxes or containers, which maximizes the logistics. Pouches are designed with ease, such as resealable zippers, spouts that make them a breeze to utilise and store on hand. For online shoppers, simplicity is important, and pouch packaging is the answer.

Regional Insights

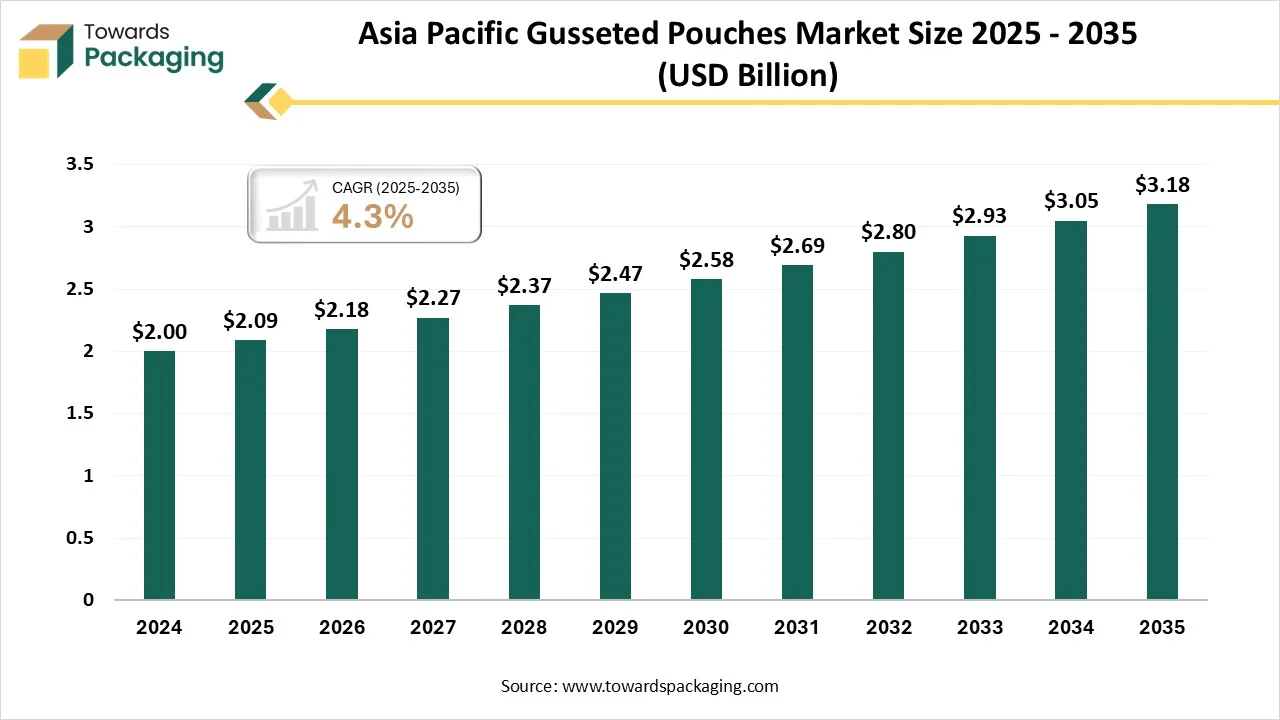

How Did The Asia Pacific Region Dominate The Gusseted Pouches Market?

Asia Pacific dominated the market with approximately 45% share in 2024 as the urge for gusseted pouches in the Asia Pacific region is witnessing main growth, driven by main factors like fast urbanization, the rising e-commerce sector, and developing user demand for packaged and convenience food. Asia Pacific is the biggest and fastest-developing market for flexible packaging, which includes gusseted pouches. The fast expansion of e-commerce in the Asia-Pacific region is specifically in India and China, which has made high demand for cost-effective and lightweight durable packaging. Gusseted pouches are perfectly suited for e-commerce due to their low shipping cost and space efficiency. On the other hand, the food and beverage industry is the biggest end-user for flexible packaging in the area. The developing demand for ready-to-eat meals, other packaged food, and snacks is being driven by busier lifestyles and urbanisation, which is a major catalyst for gusseted pouches.

Top India Insights for the Gusseted Pouches Market

The urge for gusseted pouches in India is witnessing rapid development, fueled by the booming food and beverage sector, the growth of e-commerce, and developing consumer demand for sustainable packaging and convenience. Indian users are increasingly finding user-friendly packaging features like easy-open mechanisms and resealable closures, too. Gusseted pouches serve this functionality, which makes them greatly attention-grabbing for on-the-go lifestyles.

North America region is expected to be the fastest-growing in the market during the forecast period. The urge for the gusseted pouches in North America is being driven by several main factors, such as the surging trend towards sustainability and ease, the main development of the e-commerce sector, and great acceptance in the food and beverage industry. While the Asia Pacific region initially dominates the worldwide industry, North America is a main contributor and is predicted to experience main development in the future years.

Top Canada Insights for the Gusseted Pouches Market

Initiatives like Extended Producer Responsibility 9EPR) programs in Canada are developing state-level recycled content, which compels U.S brand owners to accept more eco-friendly and recyclable packaging.

The urge for gusseted pouches in Canada is strong and developing, which is being driven by the complete rise of the flexible packaging market. Both users and the government are encouraging more eco-friendly packaging. In Canada, this has pointed to a growing urge for gusseted pouches made from sustainable materials like bioplastics, paper, and recyclable mono-materials.

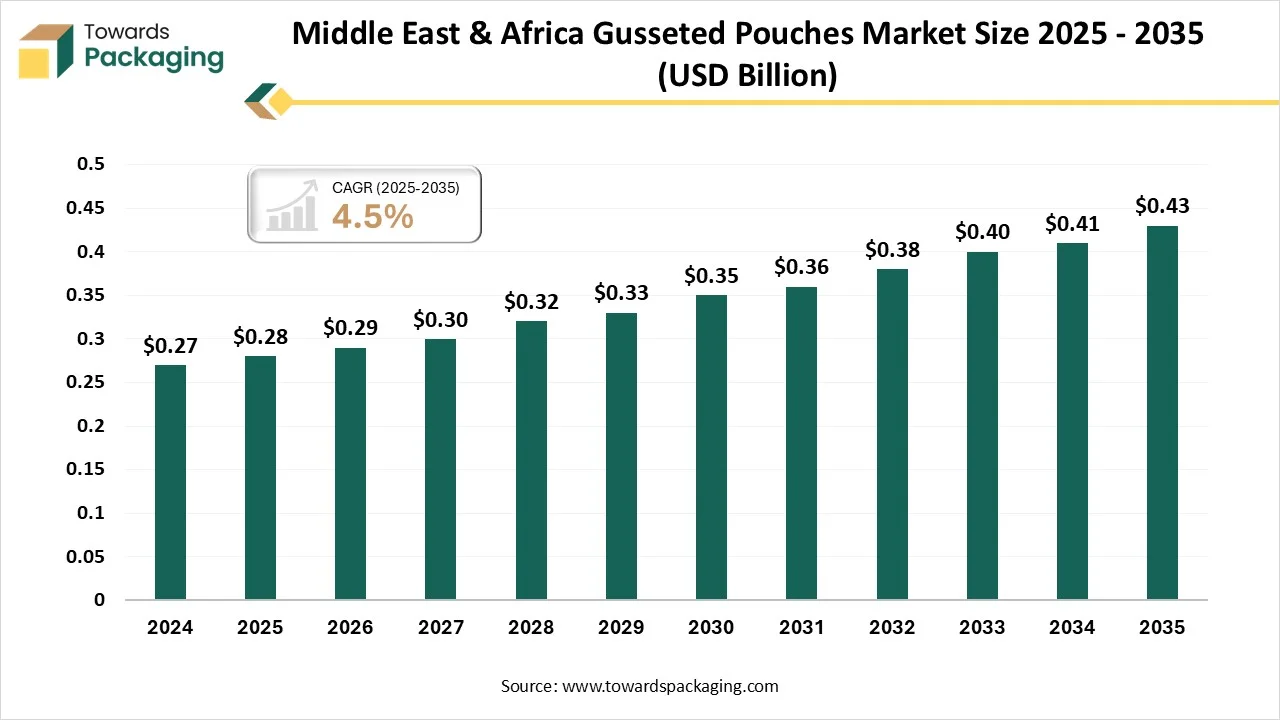

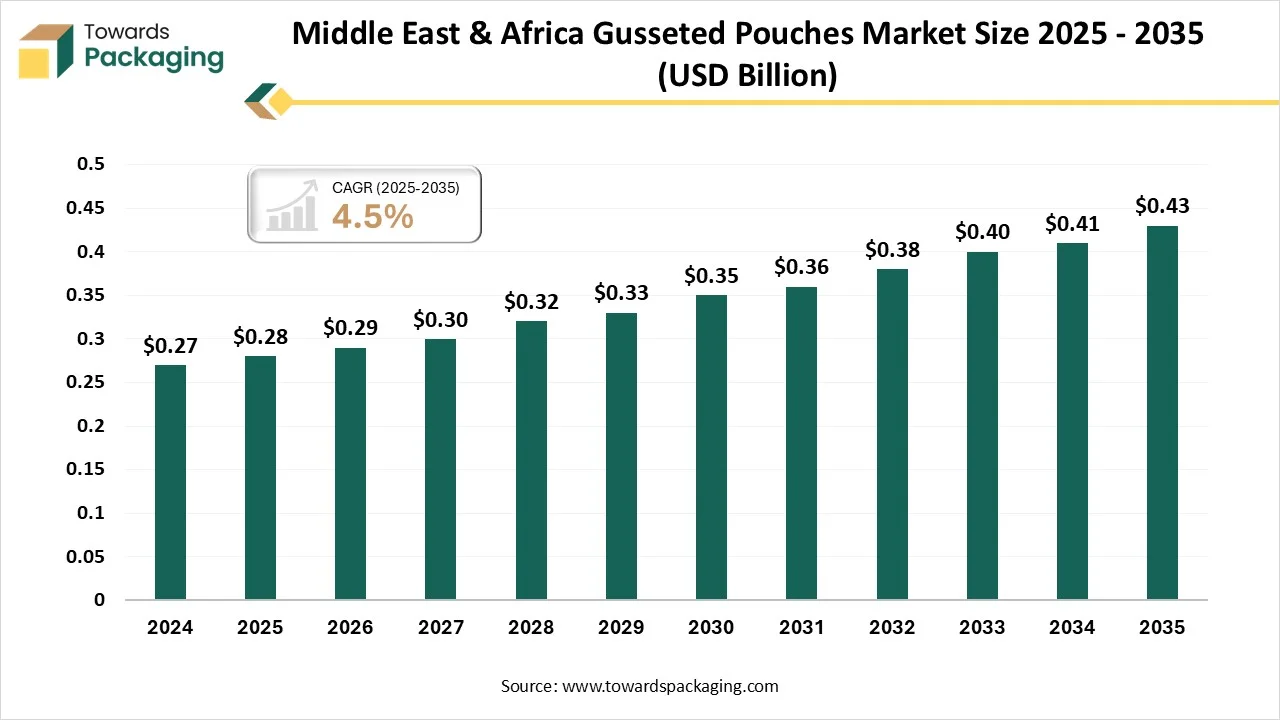

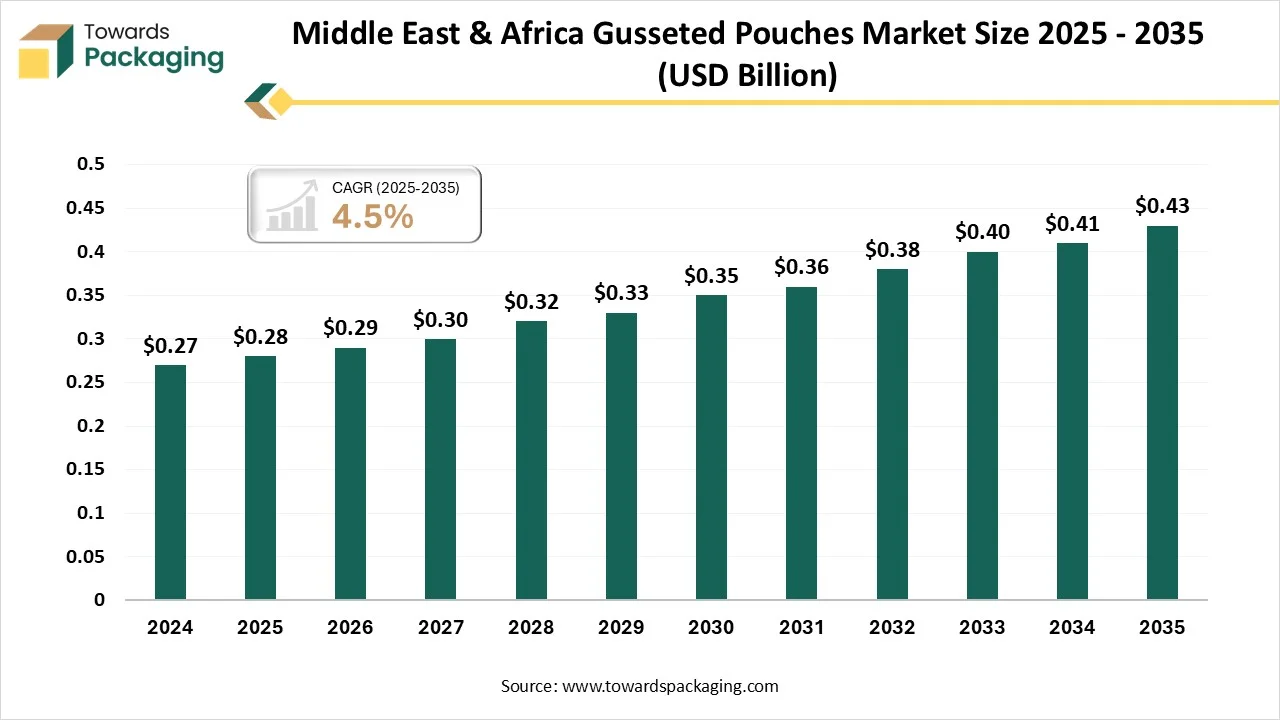

Middle East & Africa Gusseted Pouches Market Size 2025 - 2035 (USD Billion)

Country-Level Investments & Funding Trends for Gusseted Pouches Market

-

- Thailand: Growth is fueled by its developing tourism sector and the growing urge for environmentally friendly packaging solutions for local delicacies and souvenirs. Government initiatives have also assisted this trend by marketing sustainable tourism.

- United States: Investment is driven by the fast growth and development of the packaging industry, specifically in e-commerce, and the demand for smooth packaging for transportation and shipping too.

- United Kingdom: The industry is developing due to the importance of lowering plastic waste and a development in food delivery, online retail, and pharmacies too.

- The stretching of food and beverages, the pharmaceutical sector, and online delivery are mainly drivers for the gusseted bag market. The demand for packaging ensures product quality and extends the shelf life, which contributes to the acceptance of these pouches.

- Another trend driving the investment is branding and customization, as the bags provide a huge space for branding, which allows organizations to create a different brand identity through printing logos and product information.

Recent Developments

-

- In March 2025, Amcor revealed its AmFiber Performance Paper stand-up pouch, which is a refill pack that is personalized for quick coffee and other dry beverage items. At the beginning, when it was introduced across the Middle East, Europe, and Africa regions, this latest product became a part of Amcor’s huge range of AmbFiber Performance paper range that includes the recyclable paper-based packaging for dry beverage products.

- In October, Strong Roots, which is a veg-forward frozen food, has revamped a brand new product series into their line-up of plant-based and healthy foods. The inventive new Air Bites have been created particularly for the air fryer, which enables users to make crispy, veg-packed bites in minutes.

Top Vendors in the Gusseted Pouches Market and their offerings

-

- C-Pac Packaging Systems: It is a successful family-owned organisation in its second generation. It has more than 50 years of experience in the manufacturing of net packaging machines that are created in collaboration with top mechanical engineering companies in the market and a relevant partner when it comes to net packaging.

- Swiss Pack Pvt. Ltd.: At SwissPack, we use worldwide analyzed certifications and big data to make materials that can create a difference for different products and packaging demands. Its materials invention business has a huge selection of materials to select from.

- Eagle Flexible Packaging: At Eagle Flexible Packaging, its dedication to invention begins in-house. From sterile high-barrier medical packaging to FDA-compliant food pouches, we can make the current technology align with strict standards with efficiency and speed.

- Shako Flexipack Pvt. Ltd.: Shako Flexipack Pvt Ltd has been the top manufacturer in the Flexible Packaging sector. Shakoflex also serves package design solutions and technical services to a huge array of sectors and end-user applications.

- Qingdao Huahong Packaging Co., Ltd. Qingdao Huakang Plastic Packaging is a professional producer of flexible packaging, including compounding, printing, bag making, and cutting. It was officially developed in 2012, which is officially located in Hetao Export Processing Zone of Hongdao Economic Zone, and was further developed in 2021.

Gusseted Pouches Market Key Players

Tier 1

-

- Amcor plc

- Mondi Group

- Sealed Air Corporation

- Smurfit Kappa Group

- Huhtamaki Oyj

- Constantia Flexibles Group

- Berry Global Inc.

- Sonoco Products Company

- ProAmpac Holdings LLC

- Coveris Holdings S.A.

Tier 2

-

- UFlex Ltd.

- Glenroy Inc.

- Printpack Inc.

- Interflex Group

- Pouch Direct Europe

- Clondalkin Group Holdings B.V.

- American Packaging Corporation (APC)

- Winpak Ltd.

- Transcontinental Inc. (TC Transcontinental Packaging)

- Bemis Company, Inc. (now part of Amcor but with standalone brand influence)

Tier 3

-

- Goglio S.p.A.

- DaklaPack Europe B.V.

- Polypouch UK Ltd.

- Swiss Pac Pvt. Ltd.

- Flexipol Packaging Ltd.

- ABC Packaging Ltd.

- Logos Pack

- EPL Limited (Essel Propack)

- Technipaq Inc.

- Bischof + Klein SE & Co. KG

Market Segmentation of Gusseted Pouches Market

By Type

-

- Side Gusseted Pouches

- Bottom Gusseted Pouches

- Quad-Seal Gusseted Pouches

- Flat Bottom Gusseted Pouches

- Block Bottom Pouches

- Others

By Material Type

-

- Plastic Films

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyamide (PA) / Nylon

- Paper

- Aluminium Foil

- Biodegradable / Compostable Materials

- Multilayer Laminates

By Printing Technology

-

- Flexography

- Rotogravure

- Digital Printing

- Offset Printing

- Screen Printing

By End-Use Industry

-

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Pet Food

- Industrial / Chemical

- Agriculture

- Others

By Distribution Channel

-

- Manufacturers (B2B)

- Retail (Offline / Supermarkets)

- E-Commerce (Direct-to-Consumer)

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait