The PET blow molder market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally. Rising demand for recyclable, lightweight, and durable packaging from several sectors has influenced the growth of the market. The major factors driving this market to expand rapidly are increasing packaged food consumption, technological advancement, and food & beverage market. The growing concern for sustainability and efficiency in the production process has boosted the advancement in this market. This market is dominating in Asia Pacific due to rapid shift towards urban areas.

| Future Demand Driver | Description/Impact |

| Rising beverage consumption | Growing demand for bottled water, soft drinks, juices, and ready-to-drink beverages increases the need for PET bottles and blow moulding machines. |

| Expansion in non-beverage segments | Personal care, pharmaceuticals, and household products are increasingly packaged in PET, broadening market demand. |

| Sustainability & recyclability | Regulatory pressure and consumer preference for eco-friendly packaging drive the adoption of recyclable, lightweight PET bottles. |

| Technological innovations | Faster, automated, energy-efficient blow moulding machines help manufacturers meet higher production and cost-efficiency requirements. |

| Customization & flexible formats | Demand for different bottle shapes, sizes, and volumes encourages flexible blow moulding solutions. |

| Urbanization & changing lifestyles | Busy lifestyles and higher disposable income increase demand for convenient, packaged liquids, boosting PET packaging needs. |

The PET blow molder refers to a machine which is used to manufacture hollow PET containers like jars and bottles. It works by heating system the PET operator and then by means of high-pressure air to expand it to the form of a mould. It is widely used in the beverage bottles, household products containers, medical and pharmaceutical bottles, cosmetic containers, jars, and several other complex shapes. These machines are made up of components such as a heating system, preform feeder, cooling system, the blowing station itself, and molds. It is used in generating versatile and durable plastic containers for several consumer products.

| Metric | Details |

| Market Drivers | Rising demand for lightweight & recyclable packaging, growth in food & beverages, pharma packaging, sustainability regulations, technological advancements (Industry 4.0, robotics, AI). |

| Leading Region | Asia Pacific |

| Market Segmentation | By Machine Type, By Technology, By End-User Industry, By Material Type, By Application and By Region |

| Top Key Players | Amcor plc, Plastipak Packaging, Sidel Group, Krones AG, KHS GmbH, Nissei ASB Machine Co., SIPA S.p.A., Kautex Maschinenbau GmbH, Sacmi Group |

The PET blow moulding market is increasingly influenced by sustainability and regulatory requirements. Manufacturers are shifting to lightweight recyclable PET bottles in an effort to meet circular economy objectives and lessen their impact on the environment. Companies are being forced to use eco-friendly designs and materials by regulations such as requirements for recycled content and limitations on non-recyclable plastics.

Production methods are also covered by compliance, with an emphasis on automated energy-efficient devices that reduce operational waste and carbon emissions. To ensure that packaging satisfies both legal requirements and consumer expectations for environmentally friendly products, brands are also implementing certifications and traceability systems to validate sustainability claims. Companies are also exploring chemical recycling and biodegradable additives to further enhance the sustainability of PET packaging. Growing consumer awareness about plastic waste is encouraging faster adoption of greener PET blow moulding solutions across industries.

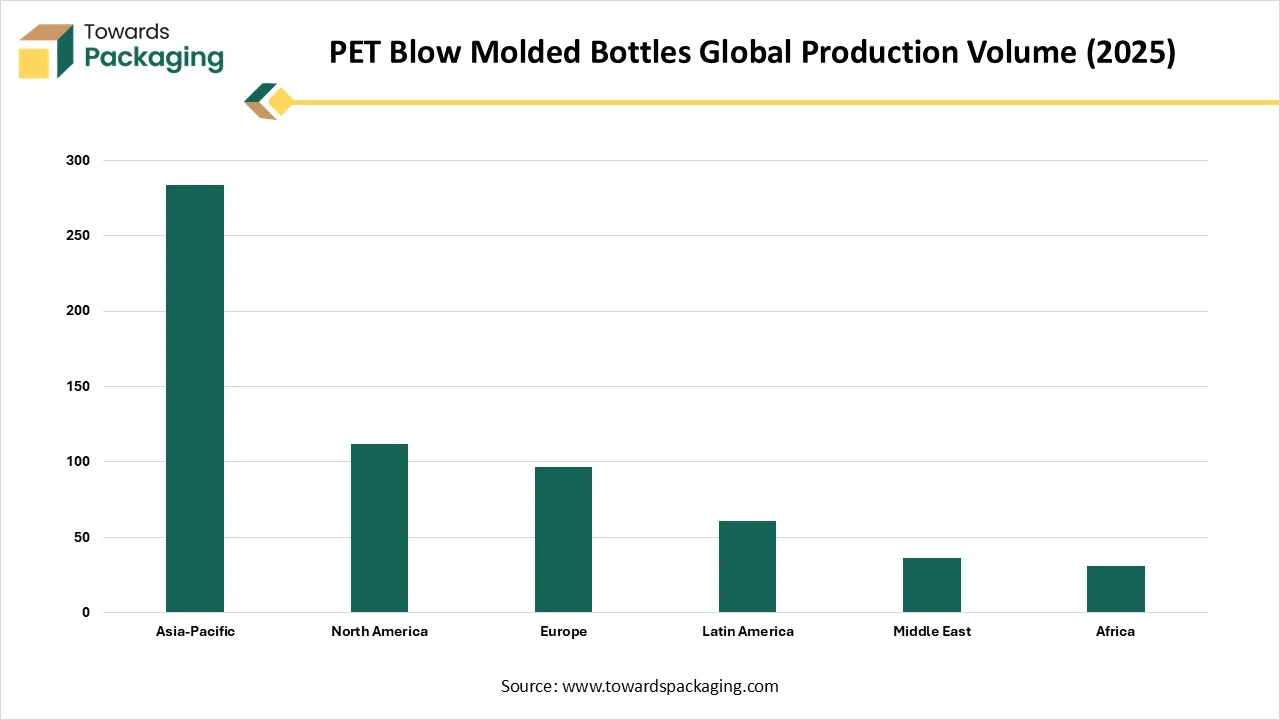

| Region | Billion Units / Year |

| Asia-Pacific | 284 |

| North America | 112 |

| Europe | 97 |

| Latin America | 61 |

| Middle East | 36 |

| Africa | 31 |

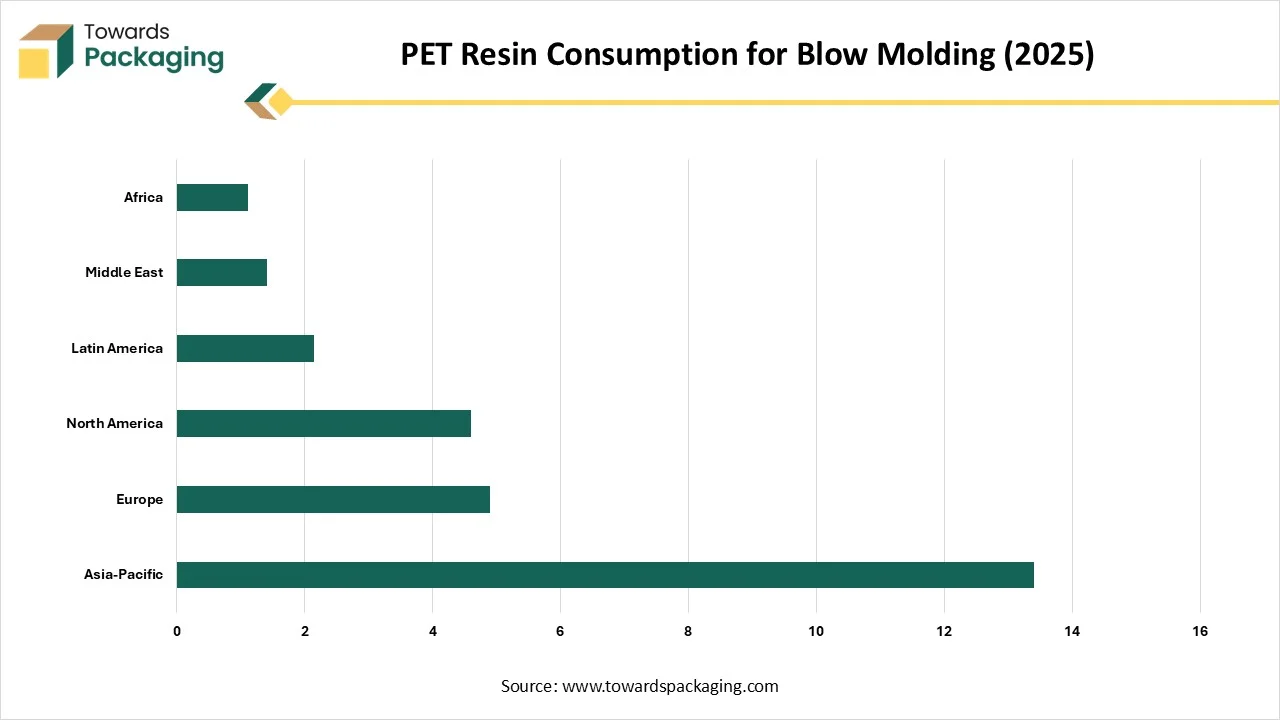

| Region | Adjusted Million Tonnes / Year |

| Asia-Pacific | 13.4 |

| Europe | 4.9 |

| North America | 4.6 |

| Latin America | 2.15 |

| Middle East | 1.42 |

| Africa | 1.12 |

The integration of AI technology in the PET blow molder market plays an important role in bringing innovation by enhancing automation, provide advantages such as error detection, predictive maintenance, and real-time procedure optimizing. This digital transformation has improved productivity, support in manufacturing process, and reduce operational charges. Such technological incorporation enhances sustainability goals among major market players and attracts a huge customer-base towards this market. AI technology ensures high-quality production of the bottles and increase the reliability of the brands.

Rising Demand for Lightweight and Recyclable Packaging

The rising demand for lightweight and recyclable packaging has influenced the demand for the PET blow molder market. This market plays a significant role in the personal care, pharmaceutical, and food & beverage industry. Continuous expansion in the food & beverages industry in introducing PET bottles for juices, carbonated soft drinks, and water has raised the usage of blow molder. Increasing consumer demand for eco-friendly products due to strict packaging guidelines and rising awareness regarding packaging pollution has pushed this market to grow rapidly.

High Charges Associated with Production Process

High charge of the production process of due to huge maintenance required for molder machines has hindered the PET blow molder market. There is a huge investment required in this market which limit its expansion. Changing ecological guidelines has affected the growth of the market. Huge competition associated with this market due to presence of several major market players hindered the growth of the market.

High Strength and Recyclability

High strength of the PET bottles and recyclability potential of the has raised the opportunities for the PET blow molder market. Continuous innovation in the sustainable packaging has raised the demand for this market. Rising demand for consumer demand for products packaging and increasing urbanization has enhanced the scope of the development of this market. With the increasing innovation of automation and energy-efficient bottles production has boosted this market to grow rapidly.

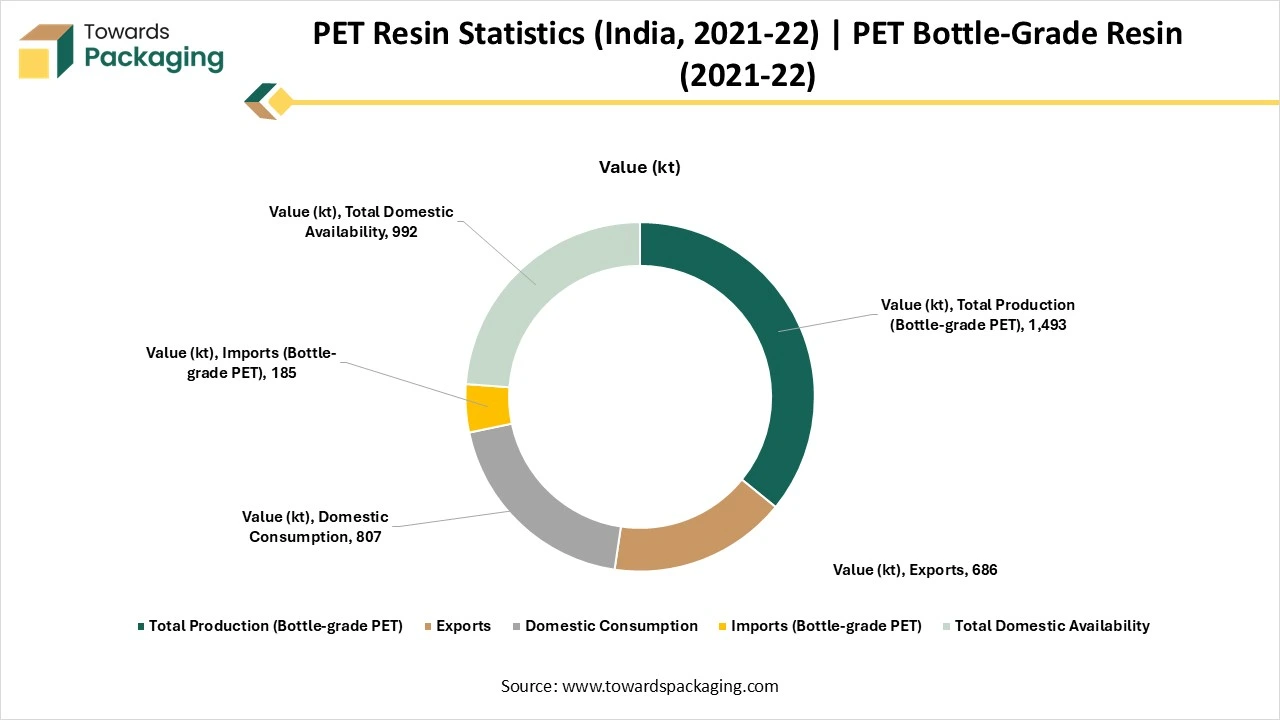

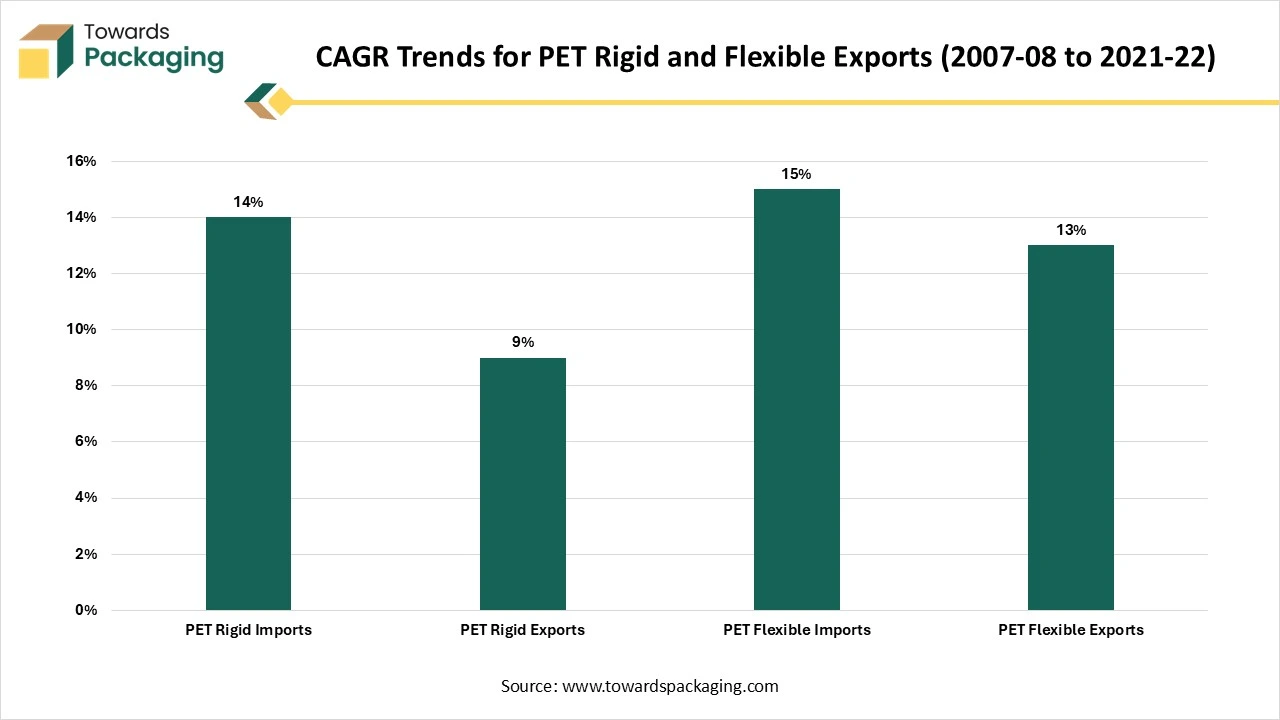

India’s PET resin industry has shown strong long-term growth. Production, imports, and exports of PET increased steadily from 2007-08 until the dip caused by COVID-19 in 2020-21, when lockdowns disrupted manufacturing. After the pandemic, demand for packaged food and beverages surged, helping the sector rebound to pre-COVID levels.

The automatic segment dominated the market in 2024 due to huge demand for high volume packaging. Large-scale producers in the personal care products, pharmaceutical, and food & beverages industries. Continuous innovation in this sector has influenced the demand for such machines in the packaging market. It helps in maintaining high-transparency and high-strength PET bottles.

The semi-automatic segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to the preform heating system and stretching potential. These machines are majorly used for small-batch, specialized bottles, and high-variety. The demand for these machines is increasing majorly because of its suitability, low equipment charges, and high flexibility.

The stretch blow molding segment held the largest share of the market in 2024 due to its high-efficiency and flexible designing. The major focus of this technology is to create durable and lightweight PET containers by the process of stretching and air blowing into it. This process helps to enhance the mechanical properties of the materials which enhance the demand of this segment. The increasing demand for recyclable packaging has raised the demand for this segment.

The extrusion blow molding segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to increasing demand for sustainable packaging. It is majorly used for several resins such as HDPE. These are considered as cost-effective solution for large containers mainly in beverage and packaging market. This technology is mainly utilized for premium packaging of the products.

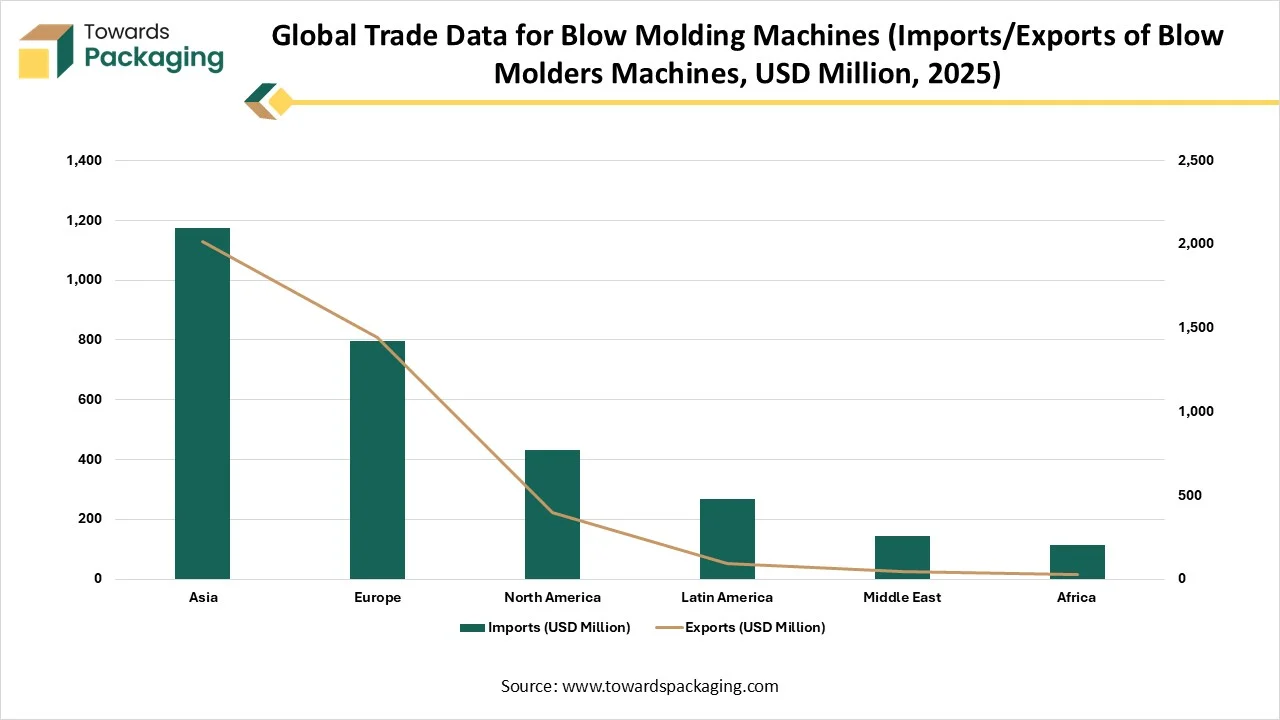

| Region | Imports (USD Million) | Exports (USD Million) |

| Asia | 1,175 | 2,015 |

| Europe | 795 | 1,445 |

| North America | 432 | 398 |

| Latin America | 268 | 92 |

| Middle East | 145 | 42 |

| Africa | 114 | 27 |

The food & beverages segment held the largest share of the market in 2024 due to huge demand for cost-effective, durable, and lightweight bottles. Rising demand for consumption of dairy products, edible oil, water, and carbonated drinks has pushed innovation in this market. This segment is benefitted from speciality and custom designed bottles and increasing demand for eco-friendly and recyclable packaging solutions. It attracts high-volume packaging process at an affordable range.

The pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to increasing demand for sterilizable, safe, and inert packaging. This type of packaging is widely used to protect the integrity of the products. The increasing number of aged population and people with chronic diseases increase the demand for pharmaceutical products.

The virgin PET segment held the largest share of the market in 2024 due to its high purity and clarity. The presence of excellent mechanical properties support in the production of high-barrier and thermal stability. It ensures the high-quality standard instructed by the regulatory guidelines. These materials are extremely used in creating packages of the industries such as food & beverages and pharmaceutical. Technological advancement in this segment has promoted its demand.

The recycled PET (rPET) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to sustainability and regulatory guidelines. Huge investment towards recycling infrastructures has influence the growth of this sector. Increasing demand for eco-friendly packaging among consumers has driven the growth of this segment.

The packaging segment held the largest share of the market in 2024 due to its sustainability and versatility. Process such as hot filling generate new opportunities for growth in this segment. This segment is developing rapidly due to huge demand in industries such as household & personal care, food & beverages, and pharmaceuticals. The rising demand for lightweight designs has influenced the growth of this segment. Packaging for disinfectants, sanitizers, edible oils, water, soft drinks, and several other products are preferably packaged under this market.

The automotive components segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its potential of corrosion-resistant, lightweight, and durability. It decreases emissions in vehicles and enhances fuel efficiency. Rising Recycling infrastructure is evolving to fulfil the requirement of the industry.

Asia Pacific held the largest share of the market in 2024, due to rapid industrialization and rising demand for packaged food products. The increasing demand for low-cost packaging from several industries has raised the demand for this market in countries like India, China, Japan, South Korea, and several others. The expansion of e-commerce sector and awareness among people towards eco-friendly packaging has boosted the demand for this packaging industry. Continuous innovation in this field has pushed the adoption of such packaging in various industries.

Increasing Domestic Packaging Demand Promote the PET Blow Molder Market in China

Increasing domestic packaging demand has raised the expansion of the market in China. Huge investment for the development of recycling infrastructure has raised the demand for this market to grow. Stringent push in the direction of automation has enhanced the usage of PET blow molder packaging. Advancement in AI technology lower charges and enhance efficiency.

Trend of PET Blow Molder in India

Depending on India’s growing economy, a big consumer base, and rising emphasis on sustainable practices, the PET blow molder trend is witnessing rapid development. The sector is moving towards higher automation, high-speed production, and greater automation too, to align with the developing demand for packaged goods in the food, beverage, and personal care sectors.

The future of India’s PET blow molder looks very promising. As the urge for easy, cost-effective, and sustainable packaging continues to develop, the sector will be developed by current technological innovations and a greater focus on circular economy practices, too. Collaborations and joint ventures, such as the one between Loop sectors and Easter Industries, also show a loyalty to advanced PET recycling that will further expand the sector.

Latin America expects the significant growth in the market during the forecast period. This market is growing due to increasing demand for carbonated drinks. There is a trending growing rapidly for using biodegradable and r-PET packaging due to increasing ecological pollution through packaging. There is huge demand for smart packaging of the products such as integration of anti-counterfeit and QR codes.

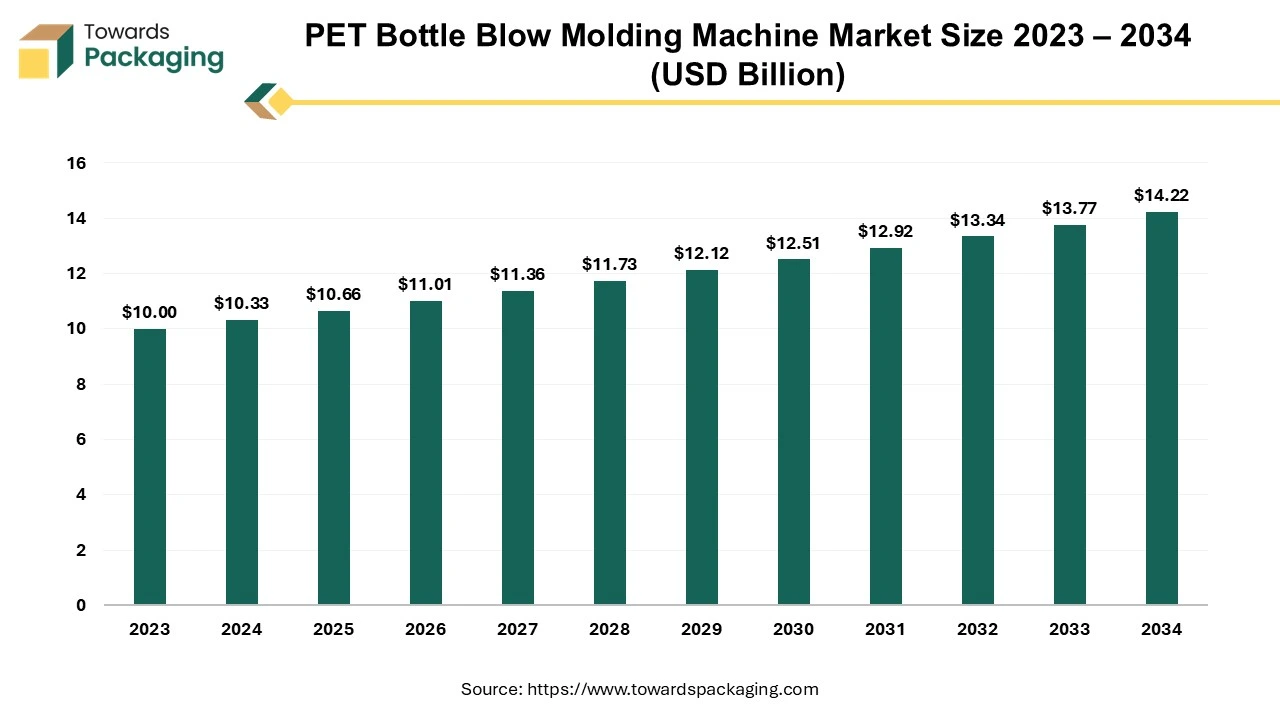

The global PET bottle blow molding machine market was valued at USD 10.33 billion in 2024 and is projected to reach USD 14.22 billion by 2034, expanding at a CAGR of 3.25% from 2025 to 2034.

The PET bottle blow molding machine market is a critical segment in the packaging industry and plays an important role in sectors like beverages, pharmaceuticals, personal care, and household products. The machines are essential in shaping PET into bottles of various sizes and designs, offering manufacturers high-speed production, flexibility in designs, and cost efficiency. The growing consumer demand for lightweight, durable, and recyclable packaging is driving the market is grow rapidly with the advancement in automation, energy efficiency, and smart manufacturing technologies.

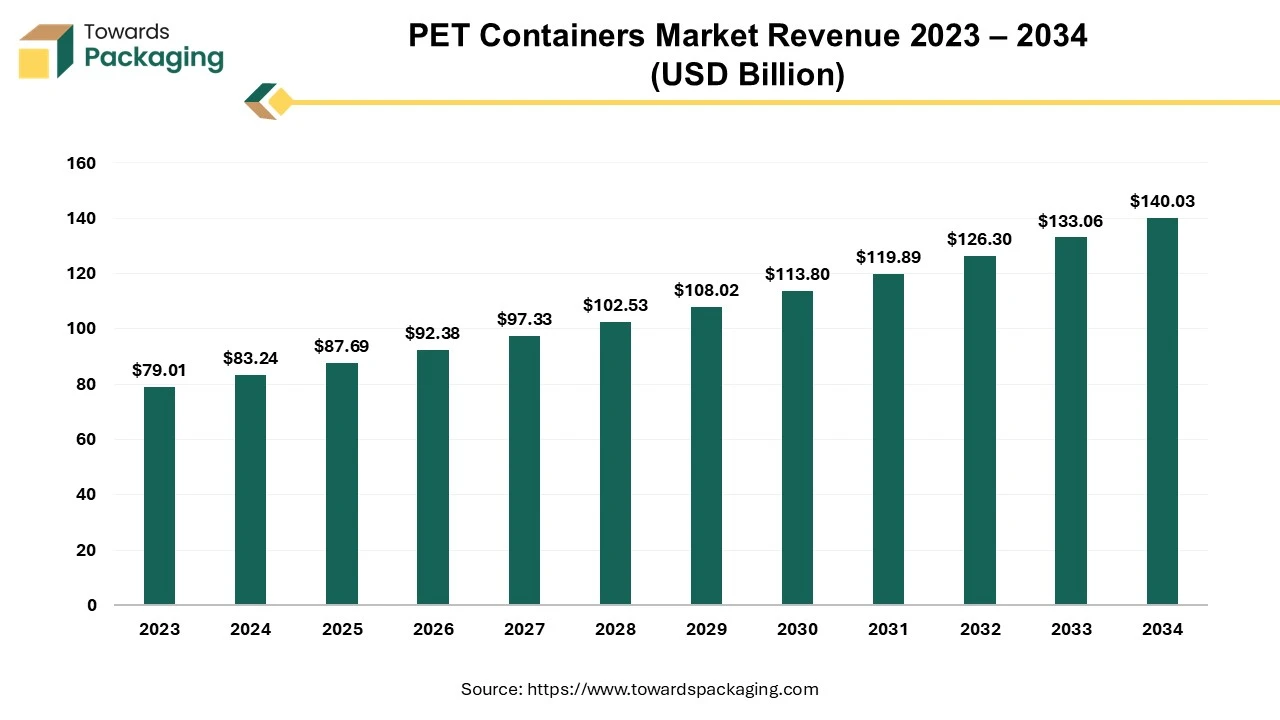

The PET containers market is forecast to grow from USD 87.69 billion in 2025 to USD 140.03 billion by 2034, driven by a CAGR of 5.35% from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing PET containers which is estimated to drive the global PET containers market over the forecast period.

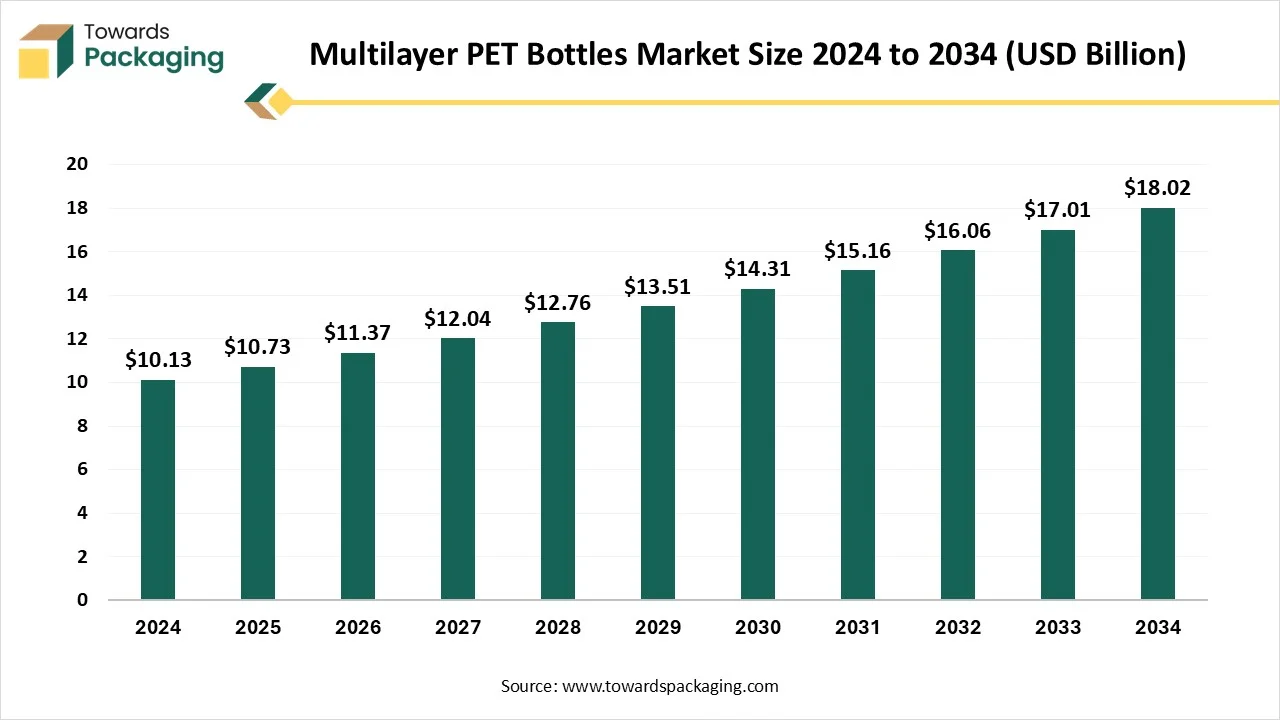

The multilayer PET bottles market is forecast to grow from USD 10.73 billion in 2025 to USD 18.02 billion by 2034, driven by a CAGR of 5.93% from 2025 to 2034. The rising food and beverages sector and continuous advancement in its packaging have influenced the growth of the market. The rapid shift of the market towards sustainable and eco-friendly packaging has boosted the development of this market. This market is dominating in the Asia Pacific due to its ability to decrease product wastage.

The major raw materials utilized in this market is polyethylene terephthalate (PET) resin.

The major components used in this market are PET preform, blow molding machine, mold, and high-pressure air.

This segment plays role in transportation and distribution of raw resources.

Tier 1

Tier 2

Tier 3

By Machine Type

By Technology

By End-User Industry

By Material Type

By Application

By Region

January 2026

January 2026

January 2026

January 2026