Petrochemical Packaging Market Size, Share, Trends and Forecast Analysis

The petrochemical packaging market is anticipated to grow from USD 1262.47 billion in 2026 to USD 2280.26 billion by 2035, with a compound annual growth rate (CAGR) of 6.85% during the forecast period from 2026 to 2035. Growth is driven by rising petrochemical production for plastics, automotive, and construction applications, alongside stricter regulations for hazardous goods handling.

Innovations such as lightweight high-strength plastics, sustainable recyclable solutions, and smart tracking-enabled packaging are reshaping the industry, while the Asia Pacific continues to dominate production and demand, creating large-scale opportunities for packaging providers.

Key Highlights

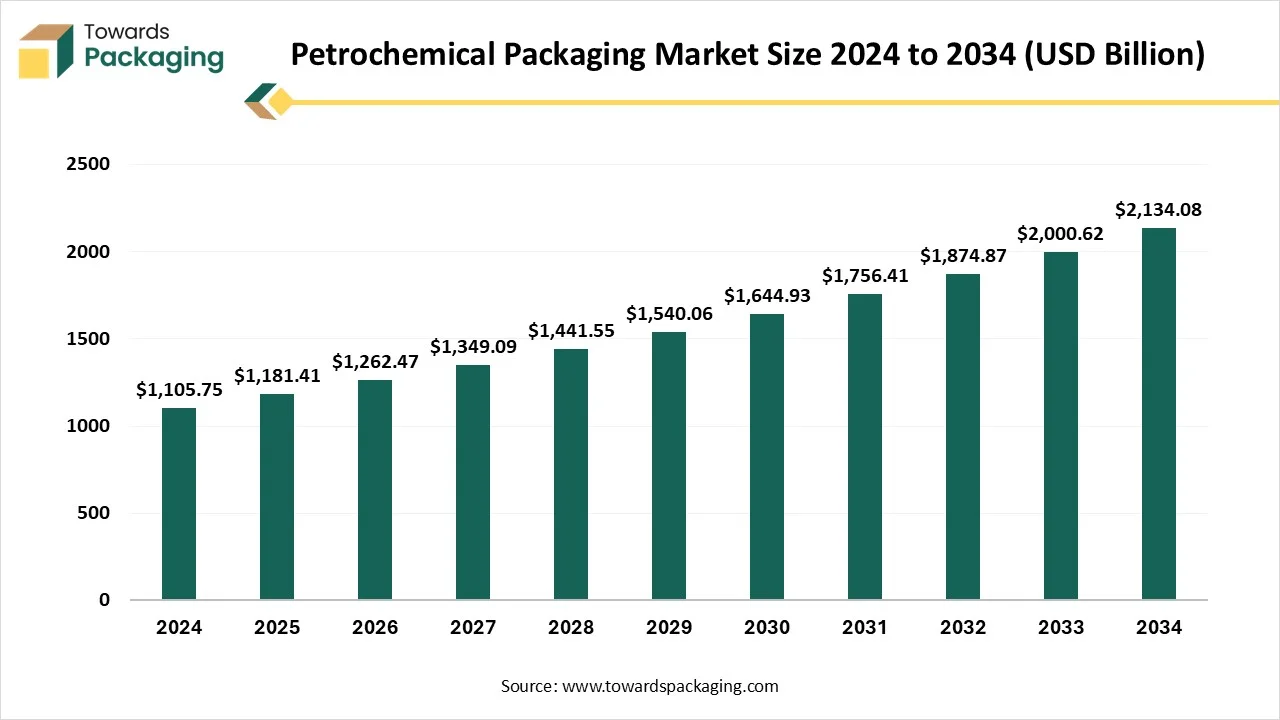

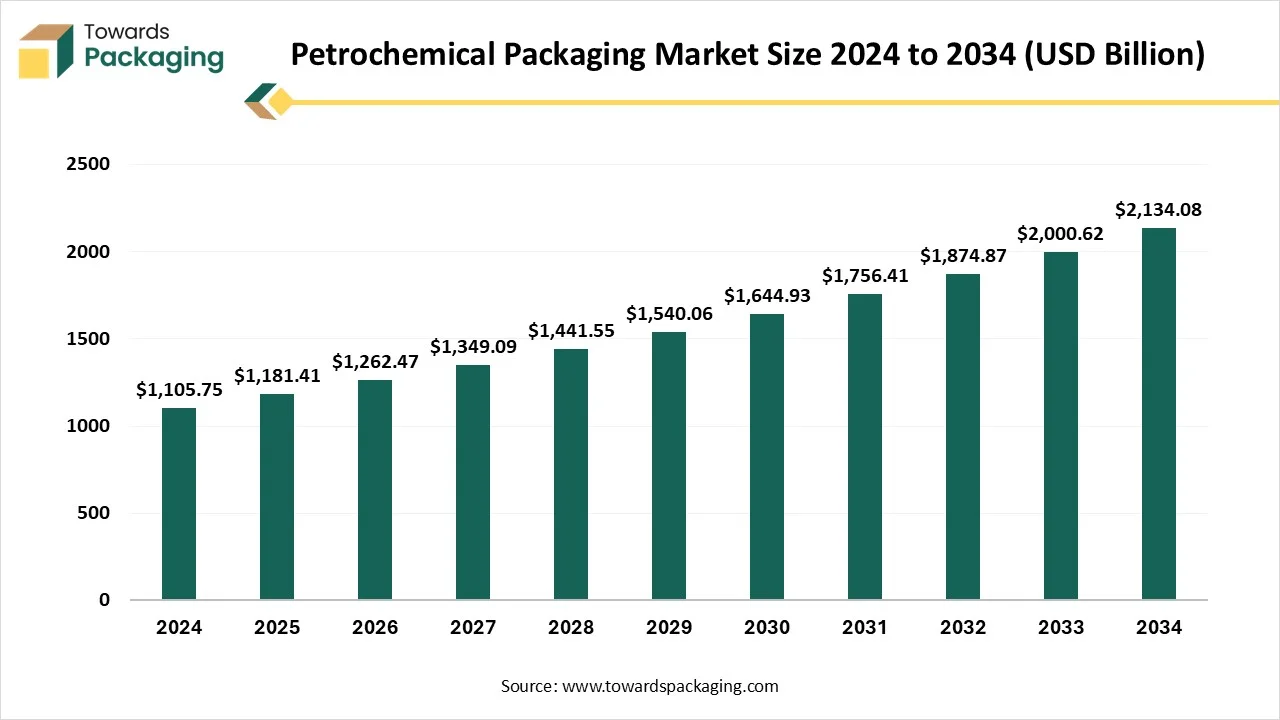

- In terms of revenue, the market is valued at USD 1105.75 Billion in 2024.

- The market is predicted to reach USD 2134.08 Billion by the year 2034.

- Rapid growth at a CAGR of 6.85% will be officially experienced between 2025 and 2034.

- By region, Asia Pacific held the largest share of approximately 45% in 2024.

- By region, North America expected to grow at a notable CAGR between 2025 and 2034.

- By packaging type, the drums segment has contributed to the largest share of approximately 30% in 2024.

- By packaging type, the Intermediate Bulk Containers (IBCs) segment will grow at a notable CAGR between 2025 and 2034.

- By material, the plastics segment has contributed to the largest share of approximately 40% in 2024.

- By material, the composite materials segment will grow at a notable CAGR between 2025 and 2034.

- By application, the polymers and resins segment has contributed to the largest share of approximately 35% in 2024.

- By application, specialty petrochemicals segment will grow at a notable CAGR between 2025 and 2034.

- By capacity, the 500-1000 litres capacity segment has contributed to the largest share of approximately 30% in 2024.

- By Capacity, above 1000 litres segment will grow at a notable CAGR between 2025 and 2034.

- By end-user, the petrochemical manufacturers segment has contributed to the largest share of approximately 45% in 2024.

- By end-user, the chemical distributors segment will grow at a notable CAGR between 2025 and 2034.

Market Overview

The petrochemical packaging market encompasses specialized materials and solutions designed to safely store, transport, and distribute petrochemicals, including polymers, resins, solvents, and industrial chemicals. Due to the hazardous and sensitive nature of these products, packaging must provide durability, chemical resistance, and compliance with international safety standards. Packaging types include drums, intermediate bulk containers (IBCs), sacks, flex tanks, and specialty containers tailored to liquid, solid, and gaseous petrochemicals.

Emerging Trends in the Petrochemical Packaging Market

- Shift toward sustainable materials: Petrochemicals packaging is shifting away from single-use plastics toward recyclable, biodegradable, and reusable solutions. Companies are experimenting with high-recycled content in plastics and paper-based alternatives to lower environmental impact. Governments are also enforcing strict regulations on plastic waste, making sustainability a central innovation driver.

- Growth of Hazardous Material Packaging: With growing global trade of dangerous petrochemicals, there is a greater need for UN-certified, tamper-proof, and leak-resistant packaging solutions. Inventions like anti-static coatings, corrosion-resistant linings, and multi-layer barriers are being integrated to ensure safety across long-distance shipments.

- Circular Economy Initiatives: Companies are increasingly adopting closed-loop packaging systems, in which drums, IBCs, and containers are collected, reconditioned, and reused. This lowers waste, develops cost efficiency, and meets global sustainability goals. Recycling partnerships and green supply chain practices are becoming the main competitive advantages.

- Smart Packaging Integration: The usage of IoT, RFID tags, and QR codes is changing petrochemical packaging into trackable and data-driven assets. These technologies enable real-time monitoring of toxic materials, develop inventory control, and ensure regulatory compliance during transport and storage.

- Lightweight and High-Strength Solutions: Demand is growing for packaging that balances low weight and high durability to update transportation. Advances in polymer mixes and crafted materials now enable lightweight containers with enhanced resistance to chemicals, moisture, and punctures, lowering logistics costs without adjusting safety.

- Adoption of Flexible Packaging: Flexible solutions such as FIBCs (Flexible Intermediate Bulk Containers ), heavy-duty sacks, and pouches are gaining attention over strong containers like metal drums. They reduce storage space, improve handling, and cut shipping costs, making them specifically popular in export-heavy petrochemical industries.

Market Dynamics

Market Driver

Economic Development Drives The Petrochemical Packaging

Economic development in petrochemical packaging is closely related to industrial development, trade expansion, and advancements in materials. As economies develop, the urge for petrochemical packaging rises in sectors such as Chemicals, pharmaceuticals, food, and consumer goods, driving investment in manufacturing facilities, recycling infrastructure, and high-level packaging technologies. This creates new business opportunities, assists job creation, and fosters innovation in sustainable materials like bio-based plastics and composites.

Market Restraint

Surrounding Toxic Causes Issues

The environmental effects of petrochemical products, including greenhouse gas emissions and plastic pollution, have created huge pressure on the sector. As grown countries, they implement strict regulations, and as users become more environmentally conscious, they are urging a reduction in the use of single-use plastics and a move to more sustainable materials. These transformations could push organisations in terms of research and development to generate recyclable and biodegradable materials. Furthermore, climate change is another challenge experienced by the overall industries, including the petrochemical industry. Growing global warming and public's urge to lower greenhouse gas emissions are great reasons for pollution.

International institutions and several countries have set carbon emission reduction goals that will directly affect the petrochemical sector.

Market Opportunity

Crucial Elements Of Petrochemical Packaging

The chemical sector’s products and solutions invest crucial features for a huge array of products, such as pigments and colors for decorative paints, packaging that protects food, active ingredients for pharmaceuticals, materials, and antiviral disinfectants for wind turbine blades. But some industries use more chemicals, such as construction or automotive. Each industry depends on chemical services in its production procedure as the main ingredient in its solutions and products.

Furthermore, the chemical industry experiences a huge opportunity to capitalize on the rising demand for sustainability-linked products and solutions. As users increasingly select and pay for more eco-friendly products, sectors are reducing their greenhouse gas emissions, driving the demand for sustainability-linked chemical solutions.

How Has Artificial Intelligence Benefited The Petrochemical Packaging Market?

Artificial Intelligence is increasingly transforming petrochemical packaging by developing safety, efficiency, and sustainability across the value chain. AI is used in material selection and design. The predictive algorithms analyze chemical properties to suggest the most suitable packaging materials with optimal barrier performance and durability. In manufacturing, AI-driven automation and robotics enhance precision in molding, sealing, and filling, lowering defects and material waste. For quality control, AI-powered vision systems detect micro-cracks, leaks, and inconsistencies in packaging at high speed.

Packaging Type Insights

How Did The Drums Segment Dominate The Petrochemical Packaging Market?

The drums segment dominated the petrochemical packaging market in 2024 as drums play a crucial role in the safe storage and transport of bulk liquids, powders, and hazardous materials. They are being valued for their strength, durability, and compliance with international safety standards, making them perfect for handling chemicals, solvents, and refined petroleum products. Both steel and high-density polyethylene drums are widely used, resisting corrosion, leakage, and impact during long-distance shipping. Their reusability and compatibility with closed-loop systems also align with growing sustainability initiatives, making drums a reliable and eco-conscious choice for petrochemical packaging.

The Intermediate Bulk Containers (IBCs) segment is predicted to be the fastest in the market during the forecast period. They are widely used for the efficient storage and transport of large volumes of semi-solids, liquids, and toxic chemicals. They serve a balance between drums and bulk tanks, with potential typically ranging from a few hundred to over a thousand liters. IBCs are favored for their space efficiency, stackability, and reusability, which assist in lowering logistics costs and handling time. It is made from materials like high-density polyethylene with steel or composite reinforcements, which serve as strong opposition to corrosion, chemical reactions, and leakage.

Material Insights

How Has The Plastics Segment Dominated The Petrochemical Packaging Market?

Plastics segment dominated the petrochemical packaging market in 2024 as they are among the most used because of their chemical resistance, strength, and lightweight properties, making them perfect for containers, drums, bottles, and flexible packs. Materials like HDPE and PP are selected for safe handling of both hazardous and non-hazardous chemicals while reducing transport costs. Their versatility in design and cost-effectiveness support large-scale use, and with growing focus on sustainability, the sector is increasingly turning to recycled and bio-based plastics for eco-friendly packaging solutions.

Composite materials segment predicted to be the fastest-growing in the market during the forecast period. They are gaining attention due to their potential to integrate the power of metals or rigid plastics with the lightweight and chemical resistance of polymers. Commonly used in drums, IBCs, and specialty containers, composites serve enhanced durability, leak resistance, and protection against corrosion, making them perfect for transporting hazardous or high-value petrochemicals. Their multi-layer structure also develops barrier properties, ensuring product safety during long-distance shipping

Application Insights

How Did The Polymers And Resins Segment Dominate The Petrochemical Packaging Market?

The polymers and resins segment dominated the petrochemical packaging market in 2024 as they offer high power, flexibility, and resistance to chemicals and moisture. Materials such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) are widely used to generate containers, films, and bulk packaging solutions. These materials ensure the safe carrying of toxic and non-toxic petrochemicals while being effective and lightweight. Advances in resin formulation also enable the development of barrier characteristics and recyclability, assisting both product safety and the sector’s shift toward sustainable packaging practices.

Speciality petrochemicals segment is expected to be the fastest-growing segment in the market during the forecast period. This type demands highly personalised solutions due to their fragile, reactive, or high-value nature. Packaging for these products focuses on enhanced barrier protection, chemical opposition, and compliance with strict safety standards to prevent contamination or leakage. Materials such as HDPE, multilayer composites, and coated polymers are often used to develop durability and compatibility with specialty chemicals.

Capacity Insights

How Did The 500-1000 Litres Capacity Segment Dominate The Petrochemical Packaging Market?

The 500-1000 litres capacity segment dominated the market in 2024 because in petrochemical packaging, containers with a 500-1000 litres capacity are prevalently used for storing and transporting bulk liquids, semi-solids, and toxic chemicals. This potential range is specifically met by Intermediate Bulk Containers and large composites or HDPE tanks, which serve stackability, space efficiency, and durability. They are crafted to comply with UN-certified safety standards, ensuring handling during long-distance shipments.

The above 1000 litres segment is predicted to be the fastest during the forecast period. Containers with a capacity of 1000 litres are mainly used for the storage and bulk transport of large volumes of chemicals, oils, and hazardous liquids. These include large industrial tanks, jumbo Intermediate Bulk Containers, and flexitanks, which serve high efficiency in long-distance and cross-border shipments. Designed with reinforced plastics, composites, or steel, they serve superior strength, chemical resistance, and leak prevention.

End-User Insights

How Did The Petrochemical Manufacturers Segment Dominate The Petrochemical Packaging Market?

The petrochemical manufacturers segment dominated the market in 2024, as they play an important role in the petrochemical packaging sector, as they are the initial producers of raw materials such as resin, plastics, polymers, and specialty chemicals used in the packaging solutions. They ensure the durability, quality, and chemical compatibility of packaging materials to safely store and transport hazardous and sensitive products.

The chemical distributors segment is expected to be the fastest in the market during the forecast period. These are important in the petrochemical packaging industry as they act as the connection between end-users and manufacturers, making sure safe and smooth delivery of chemicals in accurate packaging formats. They play an important role in choosing suitable packaging materials -such as drums, IBCs, or composite containers -that align with regulatory and safety standards for toxic and non-hazardous chemicals. Distributors also help maintain supply chain efficiency, reduce handling risks, and serve customised packaging solutions to meet client-specific demands. Their role demands compliance, waste management, and sustainability practices, making them integral to the overall petrochemical packaging ecosystem.

Regional Insights

How Did The Asia Pacific Dominate The Petrochemical Packaging Market?

Asia Pacific dominated the petrochemical packaging market in 2024 as the urge for petrochemical packaging is robust and fastly growing, propelled by accelerated industrialization, urbanization, and infrastructural expansion -specifically in China, India, and Southeast Asia. These developments fuel the developed consumption of petrochemical-derived packaging materials, particularly for sectors like food and beverage, consumer goods, and healthcare. The region carries a dominant share of the overall market -including more than 40% of global revenue in this space-with strong demand punctuated by government initiatives focused on sustainable packaging.

North America is expected to be the fastest-growing in the market during the forecast period. The urge for petrochemical packaging in the North American region is strong due to the region’s well-established chemical, pharmaceutical, and food processing solutions. Structural safety regulations drive the use of durable and compliant packaging formats such as drums, IBCs, and specialty containers. Additionally, the growth of sustainable practices is pushing manufacturers to accept recyclable and eco-friendly materials, while technological advancements like smart tracking solutions are further boosting demand.

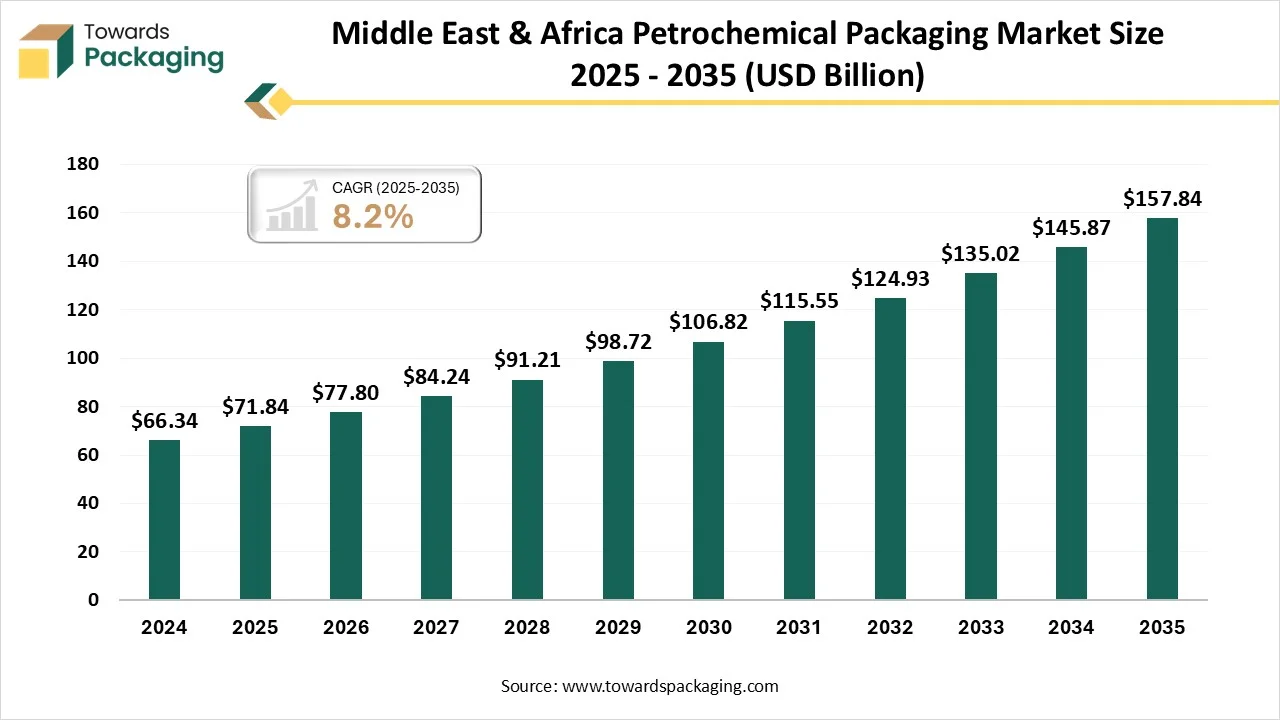

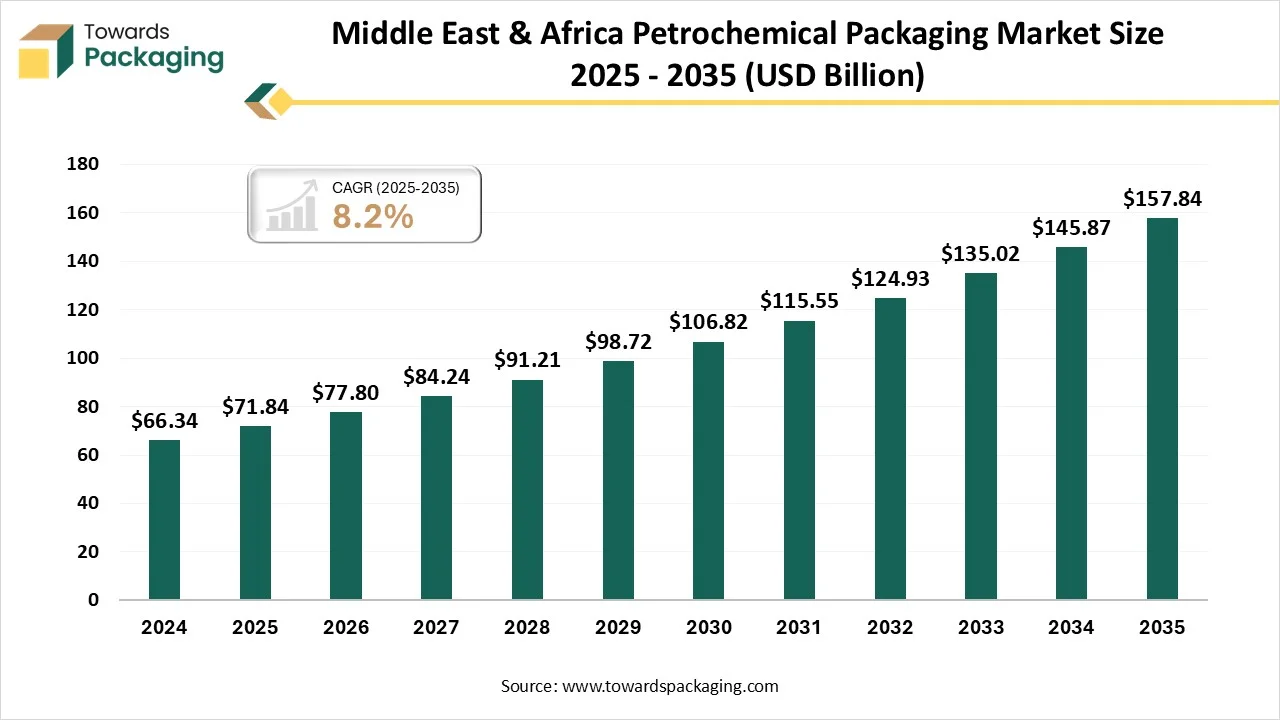

Middle East & Africa Petrochemical Packaging Market Size 2025 - 2035 (USD Billion)

Petrochemical Packaging Market - Value Chain Analysis

- Material Processing and Conversion: They refer to steps in which raw material, such as polymers, resins, or composites, are changed into usable packaging products like drums, containers, films, and multilayer sheets. This procedure includes refining, extrusion, molding, and lamination techniques to achieve the needed strength, chemical resistance, and barrier properties. Conversion makes sure that packaging meets industry standards for durability, safety, and performance while assisting innovations like lightweight structures, recyclable formats, and high-level coatings.

- Package Design and Prototyping: Package design and prototyping in petrochemical packaging is the stage in which concepts are transformed into testable, practical solutions before mass production. It includes creating functional designs that balance power, chemical compatibility, cost-efficiency, and sustainability while aligning with regulatory standards. Prototyping uses digital modelling, 3D printing, or pilot-scale manufacturing to evaluate the performance of packaging under real-world conditions, such as extreme climates, chemical exposure, and transportation.

- Logistics and Distribution: Logistics and distribution in petrochemical packaging play a crucial role in making sure that chemicals and linked products are transported safely, effectively, and in compliance with International regulations. Packaging solutions like drums, IBCs, and composite containers are crafted to withstand long-distance shipping, rough handling, and environmental stress during transit and storage.

Petrochemical Packaging Market Top Companies

Latest Announcements By Industry Leader

- In September 2025, Plastic Energy revealed the manufacturing of its first batch of TACOIL with its joint merger plan with SABIC in Gelen, Netherlands. This marks a main achievement on the path to complete commercial operations.

- In June 2025, leading multinational flexible packaging and solutions company, Uflex, introduced the FSSAI-Compliant single-pellet solution to implement the recycled PET in the food and beverage packaging solution.

Recent Developments

- In January 2025, Polycycl, which is a circular economy technology startup established in Chandigarh, revealed its patented Cantiflow Cracker generation IV chemical recycling pyrolysis technology. This complete native invention solves India’s escalating plastic waste issue by allowing the transformation of hard-to-recycle plastics.

- In July 2025, Oil and petrochemical company, Mitsubishi Technologies and ENEOS revealed the facility that utilises Mura Technology’s water-based recycling procedure to transform end-of-plastic waste into oil for generating the latest chemicals and plastic products.

- In June 2025, Borouge Plc, which is a top petrochemicals company that serves inventive and classified polyolefins solutions, is partnering with Honeywell to have a proof of concept for AI-powered autonomous uses, which has the capability to change Borouge’s UAE plant operations.

Segmentation of Petrochemical Packaging Market

By Packaging Type

- Drums

- Steel Drums

- Plastic Drums

- Intermediate Bulk Containers (IBCs)

- Sacks & Bags

- Polyethylene (PE) Bags

- Polypropylene (PP) Bags

- Multi-layer Sacks

- Flexitanks

- Bulk Containers

- Bottles & Cans

- Specialty Containers

- Others

By Material

- Plastics

- HDPE

- LDPE

- Polypropylene

- PET

- Metals

- Paper & Paperboard

- Composite Materials

- Others

By Application

- Polymers & Resins

- Solvents

- Olefins & Aromatics

- Fertilizers & Chemicals

- Specialty Petrochemicals

- Others

By Capacity

- Below 50 Liters

- 50–500 Liters

- 500–1,000 Liters

- Above 1,000 Liters

By End User

- Petrochemical Manufacturers

- Chemical Distributors

- Oil & Gas Companies

- Contract Packers

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait