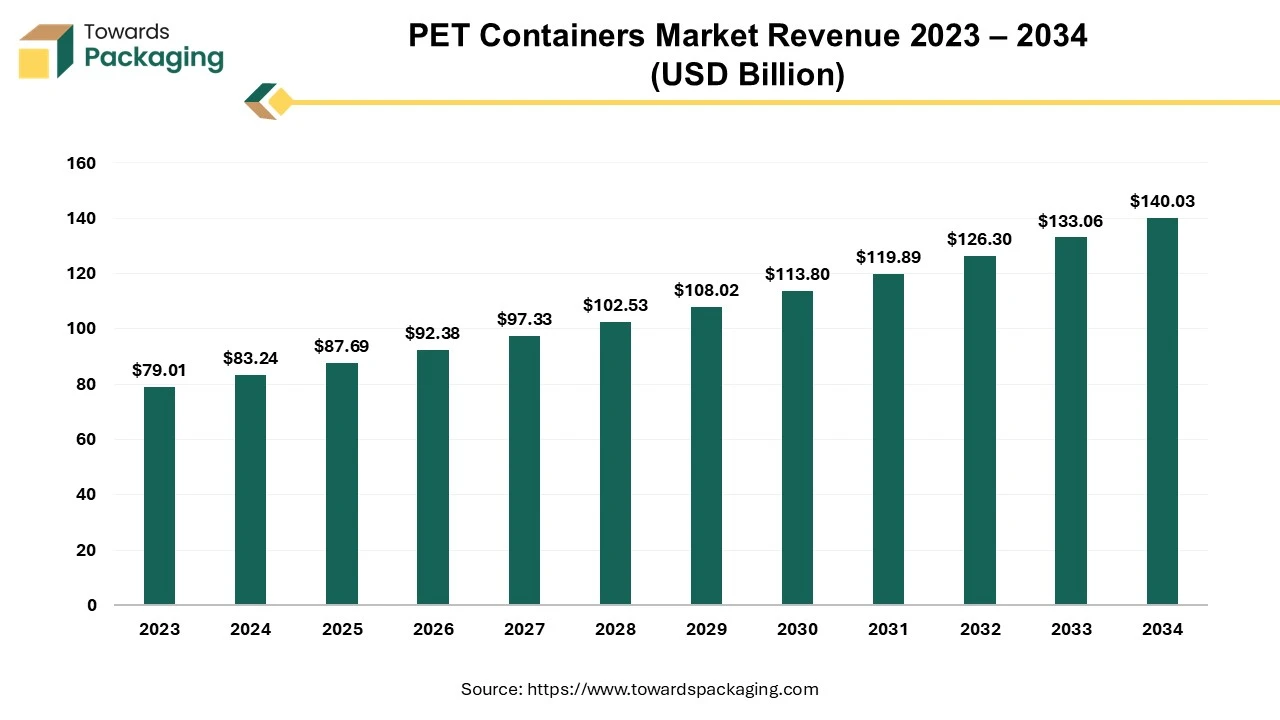

The PET containers market is forecasted to expand from USD 92.38 billion in 2026 to USD 147.68 billion by 2035, growing at a CAGR of 5.35% from 2026 to 2035. It provides detailed segmentation by type (bottles, jars, pails, crates, clamshells, trays, bowls & cups, others), technology (stretch blow molding, injection molding, extrusion blow molding, thermoforming, others) and end use (food & beverages, home & personal care, healthcare & pharmaceuticals, electrical & electronics, chemicals & petrochemicals, others).

The study includes regional data for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting Asia Pacific’s dominance in 2024 and the fastest growth expected in North America, along with country-level coverage such as the U.S., Canada, Germany, UK, France, China, India, Japan, Brazil, Mexico, South Africa, UAE, and Saudi Arabia. It also profiles leading companies including Amcor, Berry Global, Sonoco, Gerresheimer, ALPLA, Indorama Ventures, Esterform, Resilux and others, with competitive analysis, value chain mapping from terephthalic acid and ethylene glycol through converters to brand owners, trade data, and manufacturer and supplier positioning across key regions.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing PET containers which is estimated to drive the global PET containers market over the forecast period.

Terephthalic acid and ethylene glycol are combined via poly-condensation to create the white yet blue resin known as polyethylene terephthalate (PET), a linear thermoplastic long-chain polymer composed of repeating units. Plastic PET is a crucial raw ingredient for synthetic textiles. PET is a type of polyester used for blow-molded bottles and jars, fiber, and injection-molded components. Specific grades with the necessary characteristics for the various applications are provided. Polyethylene Terephthalate (PET) is utilized in the production of synthetic fibers, food and beverage containers, and other thermoforming applications. It may exist as an amorphous (transparent) or semi-crystalline (opaque and white) material, depending on its processing and thermal history.

2025 Regulations for Use of PET Containers

| Metric | Details |

| Market Size in 2025 | USD 87.69 Billion |

| Projected Market Size in 2035 | USD 147.68 Billion |

| CAGR (2025 - 2035) | 5.35% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Type, By Technology Type, By End Use and By Region |

| Top Key Players | Amcor Ltd., Aaron Packaging Inc., Sonoco Products Company, Berry Global Inc., Alpha Packaging Inc., Gerresheimer AG |

Increase of online shopping has raised demand for lightweight, durable, and tamper-proof packaging, especially for food and beverage products. PET containers are often chosen for their ability to withstand the rigors of shipping and handling. Due to the busy lifestyle and increasing working population the online ordering of food has risen which grown the demand for the PET containers packaging, which is estimated to drive the growth of the PET containers market over the forecast period. Furthermore, increasing launch of the food delivery app has risen the demand for the PET containers which has been estimated to drive the growth of the PET containers market in the near future.

Zomato's food delivery gross order value (GOV) is predicted by ICICI Securities to increase 22.9% year over year during the June quarter. It predicts that the average order value (AV) for food will stay level sequentially and increase by 2% year over year.

Zomato Ltd.'s stock increased 3% on 4th of November 2024, after it was reported that the online meal delivery service and unlisted Swiggy increased the platform charge from Rs 5 per order to Rs 6 in major regions including Bengaluru and Delhi. Zomato increased their platform charge from Rs 4 per order in Bengaluru, Hyderabad, Mumbai, Lucknow, and the National Capital Region to Rs 5 per order in April, 2024. Such immense increase in e-commerce as well as

There is a rising demand for packaging made from recycled PET (rPET) as consumers and businesses alike become more eco-conscious. Industries and small scale Companies are willingly incorporating rPET into their products to meet sustainability goals and adhere to regulatory pressures. This trend is driven by both consumer demand for environmentally friendly packaging and government regulations promoting recycling and reducing plastic waste.

Circular Economy ModelsMany companies are adopting circular economy models, in aim to minimize waste and reusing materials. The utilization of rPET assists to close the loop by enabling the recycling of PET containers into new bottles and packaging products.

Manufacturers are continually optimizing PET container designs to utilized less material while maintaining strength and functionality. Lightweighting helps reduce production costs, transportation costs, and environmental impact, making it an ongoing trend in the packaging industry.

Minimalist PackagingAlongside lightweighting, there is also a trend towards minimalist packaging design that uses fewer resources while still delivering high-quality, functional products.

Companies are increasingly investing in unique and customizable PET container designs to differentiate their products in the marketplace. Advances in injection molding and blow molding technology allow for more intricate shapes, sizes, and labeling options, giving brands greater flexibility in terms of packaging aesthetics.

Enhanced Graphics and LabelsPET containers are also becoming more attractive in terms of their visual appeal, with advanced printing techniques and high-quality graphics that enhance branding and consumer appeal.

Various governments are implementing stricter regulations on single-use plastics, encouraging the adoption of reusable packaging. For example, bans or taxes on single-use plastics have prompted companies to seek alternatives like reusable PET containers. Companies are increasingly marketing their eco-friendly initiatives, and offering reusable containers can be a selling point for environmentally-conscious consumers. The key players operating in the market are focused on adopting in organic growth strategies like partnership and collaboration to develop reusable PET bottle for cosmetic products, which is estimated to create lucrative opportunity to drive the growth of the PET containers market in the near future.

AI integration can enhance the PET containers market in various ways, improving efficiency, sustainability, and consumer satisfaction.

By optimizing production and manufacturing processes the AI integration helps the PET containers industry. AI can predict equipment failures and maintenance needs in PET container manufacturing, reducing downtime and ensuring more efficient production. AI-powered vision systems can inspect PET containers for defects more accurately and quickly than human inspectors, ensuring consistent product quality and reducing waste. AI can optimize the production process, adjusting variables like pressure, temperature, and material flow to improve the quality and reduce energy consumption.

The key players operating in the market are facing issue in selecting accurate technology for manufacturing PET containers as well as regulatory pressure, which is estimated to limit the growth of the PET containers market in the near future. Governments around the world are introducing stricter regulations regarding plastic use and waste management. These include bans on single-use plastics, extended producer responsibility (EPR) regulations, and mandates for higher recycled content in PET packaging, which increase operational costs for manufacturers.

Asia Pacific region dominated the global PET containers market in 2024. Due to rising environmental awareness in countries like China, India, and Japan, the demand for the recyclable PET containers are in demand. Due to the growing middle class income in the Asia Pacific region, the people are able to afford the recyclable PET containers. Due to rapid urbanization and busy work life in the Asia Pacific region the demand for the packaged and processed food products has risen the demand for the PET containers. Increasing launch of the new food delivery app in Asia Pacific region has risen the demand for the PET containers, which has been estimated to drive the growth of the PET containers market in the Asia Pacific region over the forecast period.

Over 3,000 eateries have joined WAAYU since its May 2023 launch in key Indian cities like Hyderabad, Bengaluru, Pune, Jaipur, and Mumbai. Following its launch on ONDC, WAAYU has also been collaborating strategically with TATA Neu and OLA, two of the network's most well-known buyer apps, to create a channel that will increase order volumes. All restaurant partners will benefit greatly from this partnership since it will increase customer satisfaction and provide a consistent flow of orders with no commission on delivery.

North America region is anticipated to grow at the fastest rate in the PET containers market during the forecast period. The North American market for PET containers is driven by the demand for packaged beverages and strong recycling programs. The U.S. and Canada have well-established recycling infrastructure, and regulatory pressures are encouraging brands to increase the use of recycled materials. North America has one of the highest per capita consumption rates of packaged beverages, such as bottled water, soft drinks, juices, and ready-to-drink tea. The demand for convenient, single-serve beverages in PET containers is driven by busy lifestyles, urbanization, and changing consumer preferences.

Additionally, the food and beverage sector remains the largest end-user of PET packaging, which is lightweight, durable, and provides excellent product protection. North American consumers highly value the portability and ease of use provided by PET containers, particularly for beverages and on-the-go foods. This convenience is a major driver for PET container adoption.

Europe is expected to experience considerable growth in the PET containers market in the upcoming period. This growth stems from strict regulations promoting recyclable materials, robust infrastructure for production and recycling, and the expanding e-commerce sector driving demand. Additionally, Europe boasts a well-established recycling infrastructure and high consumer awareness regarding sustainable packaging, which further contributes to the growth of recycled PET. Western Europe, particularly countries like Germany, France, and the Netherlands, is significantly influenced by regulations and sustainability initiatives, while Nordic countries and Central and Eastern Europe are also witnessing substantial growth in recycled PET adoption.

In January 2024, Bormioli Pharma and Loop Industries, Inc. accelerated a circular plastics economy by manufacturing 100% recycled polyethylene terephthalate plastic and polyester fiber. They announced that an innovative pharmaceutical packaging bottle made with 100% recycled virgin quality Loop™ PET resin will be unveiled within the Bormioli booth at Pharmapack, in recognition of the importance of adopting sustainable practices and materials to reduce environmental impact.

Latin America plays a distinctive role in the PET containers market, particularly in the beverage and food sectors. The region's PET market is experiencing remarkable growth due to rising bottled water demand, e-commerce expansion, and a shift toward sustainable packaging. Furthermore, governments and industries are actively promoting recycling, leading to increased PET recycling rates and greater adoption of recycled PET. Consumers are increasingly choosing products with minimal environmental impact, prompting manufacturers to adopt sustainable packaging solutions and incorporate recycled PET. The growing demand for bottled water, including mineral water, is driving the market for PET bottles. The availability of low-cost labor in the region makes recycled plastic from Latin America competitive even in the global market.

Bottles segment held a dominant presence in the PET containers market in 2024. PET bottles are lightweight, making them easy to transport, handle, and store. This is especially important in the food and beverage industry, where transportation fees and product handling efficiency are important. Their light weight minimizing shipping costs and carbon footprint compared to heavier packaging alternatives like glass.

PET bottles are highly durable and resistant to impact. Unlike glass, PET bottles do not break easily, which minimizes product loss during handling and shipping. This makes them especially suitable for beverages, personal care products, and household chemicals. PET bottles are central to the concept of a circular economy, where materials are reused and recycled rather than disposed of as waste. The ability to recycle PET bottles multiple times without compromising quality is a significant factor in their ongoing demand.

The jars segment is segment is expected to grow at the fastest rate in the PET containers market during the forecast period of 2024 to 2034. The demand for reusable PET jars is driven by a combination of sustainability trends, consumer preferences for environment-friendly packaging, affordable, and the versatility of PET as a material. As consumers become more environmentally conscious, they increasingly favour products with recyclable, reusable, or sustainable packaging.

PET jars, with their durability, ease of use, and reusability, offer an ideal solution to meet these demands. Additionally, businesses benefit from adopting reusable PET jars as part of their sustainability efforts, improving brand loyalty and meeting regulatory requirements. With the growing focus on reducing plastic waste, reusable PET jars are expected to continue gaining traction across various sectors, from food and beverage to personal care and beyond.

The stretch blow molding segment accounted for a considerable share of the PET containers market in 2024. Stretch blow molding is a highly popular technique for manufacturing PET (Polyethylene Terephthalate) containers due to a combination of factors that optimize production efficiency, cost-effectiveness, material properties, and product quality. Stretch blow molding can produce PET containers in an extensive variety of shapes and sizes, from simple round bottles to more complex and custom-designed containers with unique shapes and features (such as ergonomic handles or narrow necks). This flexibility allows manufacturers to meet specific consumer preferences, brand requirements, and functional needs. Stretch blow molded PET containers are particularly well-suited for holding carbonated beverages or pressurized liquids. The technique ensures that the containers are capable of withstanding the internal pressure from carbonation without deforming or rupturing. This is essential for beverage packaging, where pressure resistance is critical.

Stretch blow molding is the preferred technique for manufacturing PET containers due to its numerous advantages, including excellent material properties (strength, durability, and barrier performance), cost-effectiveness, design flexibility, and high production speed.

The food & beverages segment registered its dominance over the global PET containers market in 2024. The PET (Polyethylene Terephthalate) is lightweight material, that makes shipping of the food products more efficient and budget friendly. PET is clear, allowing consumers to see the beverages and food product inside, which is important for marketing and consumer trust. Despite being light, PET is resistant and strong to impacts, ensuring that food and beverages are protected during handling and transport. PET has good resistance to moisture, gases (like oxygen), and odors, which helps to extend the shelf life of food and beverages by protecting them from external elements.

By Type

By Technology Type

By End Use

By Region

February 2026

January 2026

January 2026

January 2026