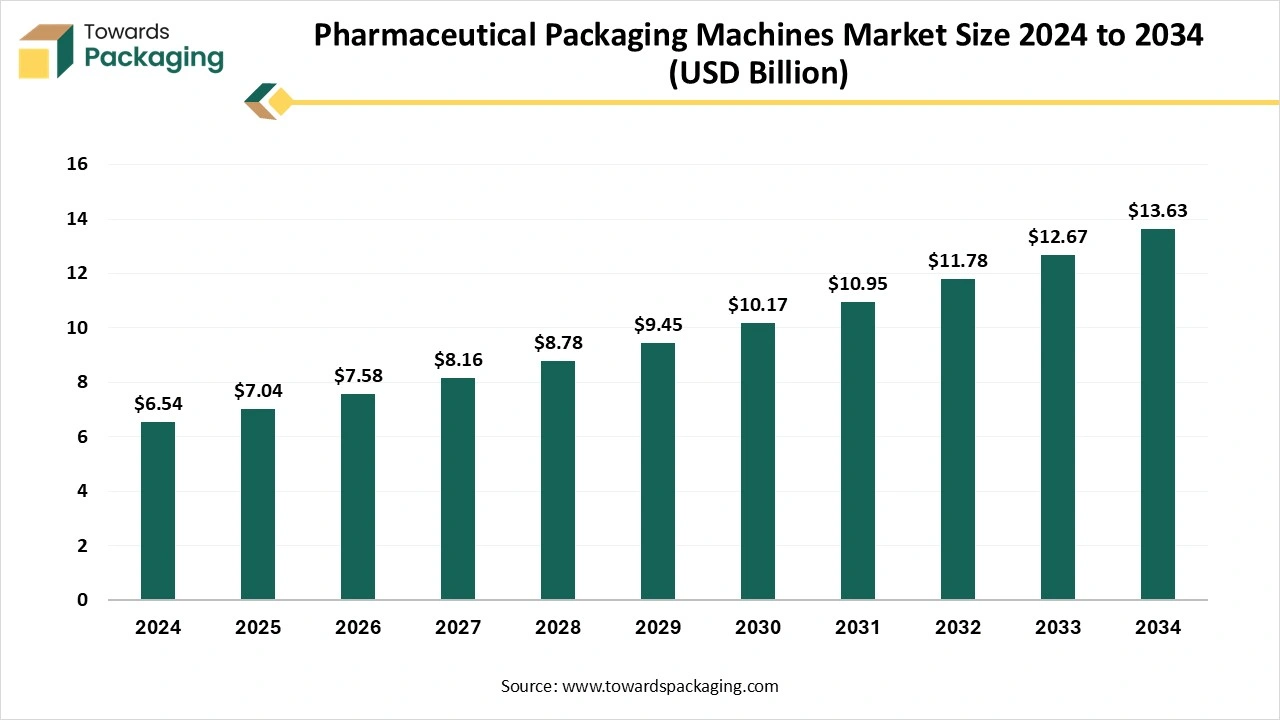

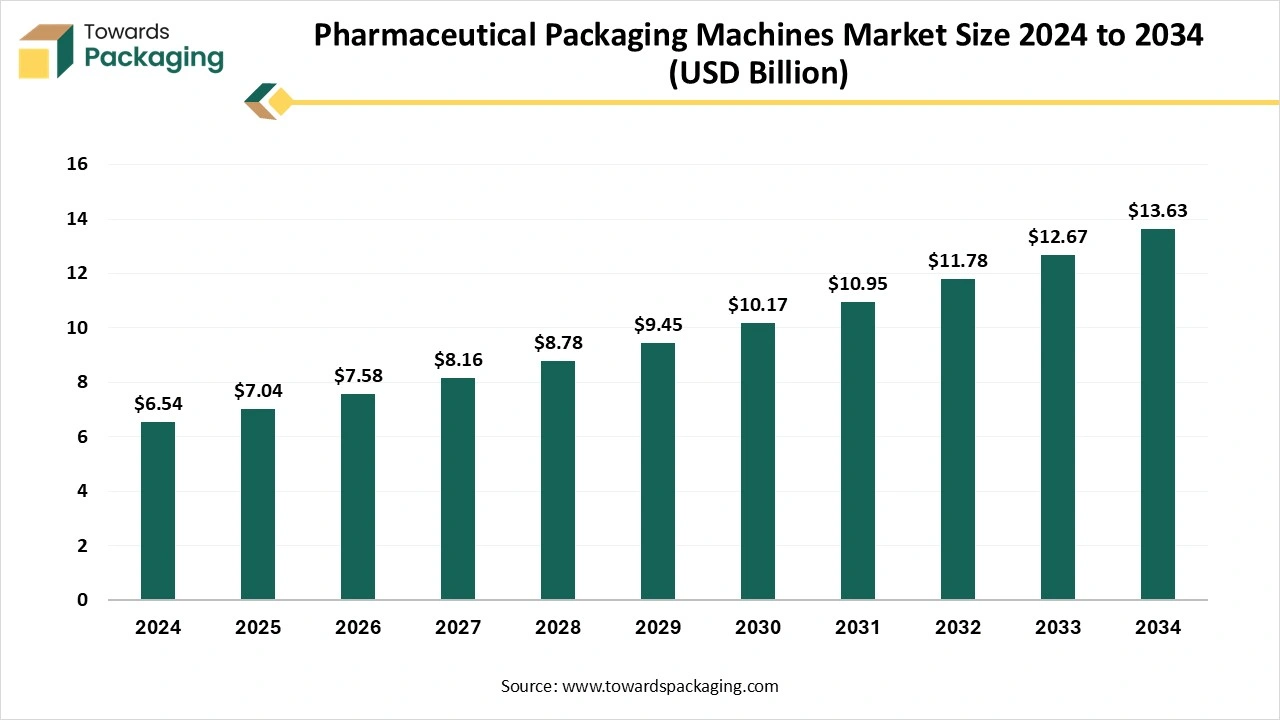

The pharmaceutical packaging machines market covers complete insights on global market size valued at USD 7.04 billion in 2025 and projected to reach USD 13.63 billion by 2034 at a CAGR of 7.63% along with evolving trends such as AI-enabled quality inspection, rising demand for single-dose packaging, and strict regulatory compliance. This coverage includes detailed segmentation by machine type (filling, labeling, form-fill-seal, cartoning, wrapping, palletizing, cleaning), regional analysis across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, plus competitive intelligence on major companies like Syntegon, Romaco, Optima, Marchesini, IMA, MULTIVAC, Uhlmann, and others. The report also explores value chain structure, raw material supply, trade flows, manufacturing capabilities, and global supplier networks.

Key Takeaways

- In terms of revenue, the pharmaceutical packaging machines market is valued at USD 7.04 billion in 2025.

- The market is projected to reach USD 13.63 billion by 2034.

- Rapid growth at a CAGR of 7.63% will be observed in the period between 2025 and 2034.

- Asia Pacific led the market with the highest share in 2024.

- Europe is expected to witness the highest CAGR during the forecast period.

- By machine, the filling machine segment dominated the market in 2024.

- By machine, the wrapping machines segment is expected to grow at a significant CAGR.

Market Overview

Pharmaceutical packaging machinery is the equipment that offers efficient solutions for preparing a wide range of pharmaceutical and nutraceutical products for treating various chronic diseases. Pharmaceutical packaging equipment can include case packers, label applicators, sealers, hand packing stations, and hard film over wrappers. These machines also provide customizable solutions that are tailored for different container sizes and product types. The well-equipped pharmaceutical packaging machinery ensures reliability and smooth integration with manufacturing operations. Pharmaceutical packaging machinery is required to meet regulatory standards and offers precision & high-speed automation that enhances production output without compromising quality.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2024 |

USD 6.54 Billion |

| Projected Market Size in 2034 |

USD 13.63 Billion |

| CAGR (2025 - 2034) |

7.63% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Machine and By Region |

| Top Key Players |

Syntegon Technology GmbH, Romaco Holding GmbH, Optima Packaging Group GmbH, Marchesini Group SPA, Mesoblast Limited. |

How is AI Integrated in the Pharmaceutical Packaging Machines Market?

As technology continues to grow, the integration of Artificial Intelligence (AI) in pharmaceutical packaging machines is positively impacting the growth of the pharmaceutical packaging machines market by improving quality control, predictive maintenance, and compliance with stringent global regulations. AI-powered systems can effectively automate inspection processes, identifying potential defects or failures, and ensure consistent product quality. Artificial intelligence (AI) can monitor machine performance and optimize packaging processes for efficiency.

Market Dynamics

Driver

Rapid expansion of the pharmaceutical industry

The rising demand for advanced packaging machinery for the pharma industry is expected to boost the growth of the pharmaceutical packaging machines market. Pharmaceutical packaging machines are specialized in medicine, sachet, and pouch packaging machines for the pharma industry. Pharma packaging is a complex process that requires efficient and high-precision machinery for sealing, filling, capping, bundling, labeling, and tracking. Pharmaceutical packaging plays a crucial role in ensuring the accuracy, safety, and compliance of medicines before reaching consumers. With stringent global regulations, the packaging of pharmaceuticals is increasingly becoming more efficient, precise, and tamper-proof.

Restraint

High cost

High initial investment

The high initial investment cost associated with the installation of pharmaceutical packaging equipment is anticipated to hamper the market's growth. The installation of pharmaceutical packaging equipment requires an adequate amount, which often acts as a barrier and results in slow adoption in several low and middle-income countries.

Opportunity

How are the Safety Standards and Regulations of the Government Impacting the Pharmaceutical Industry?

The presence of safety standards and regulations in the pharmaceutical industry is projected to offer lucrative growth opportunities to the pharmaceutical packaging machines market during the forecast period. Pharmaceutical packaging machines assist in automating every step of the process and high-precision filling, capping, and labeling for liquid, powder, and solid dosage forms, which must adhere to government safety standards and regulations. Moreover, the rising investment in advanced pharma packaging machines assists prominent key pharma players to ensure compliance, boost efficiency, and enhance product safety.

Segmental Insights

By Machine

Filling machines dominated the pharmaceutical packaging machines market in 2024.

Filling machines play a crucial role in the pharmaceutical industry by ensuring the precise and sterile dispensing of pharmaceutical products into various shapes and sizes of containers such as bottles, vials, and syringes. In addition, the filling equipment is the advanced technologies that handle a diverse range of solid, liquid, and powder medications. These pharmaceutical packaging machines feature automated controls and monitoring systems to reduce human error, enhance production, and improve efficiency, as well as ensure compliance with strict pharmaceutical quality standards.

On the other hand, the wrapping machines segment is expected to grow at the fastest CAGR. Wrapping machines serve the vital function in the pharma industry by precisely and securely packaging pharmaceutical products for protection from the external environment. These machines are specifically designed to handle packaging materials, including blister packs, strip packs, and sachets.

Regional Insights

North America is Expected to Dominate the Market in 2024

Asia Pacific dominated the pharmaceutical packaging machines market due to a huge population and growing urbanization, which is leading to an increase in the packaged food items market. The technology has enabled cost-effective and highly efficient packaging solutions in the pharmaceutical packaging machine, which has made it highly accessible in the region. This region is facing challenges and is also working actively towards solutions for waste management of the film packaging.

Sustainable solutions are being adopted, and emphasis on recycling the mono-material plastic is highly preferred in the region. China and India, containing almost half the population of the world, will continue the dominance the pharmaceutical packaging machines market in the upcoming years.

What Causes the Growth in the European Pharmaceutical Packaging Machines Market?

The European market is expected to show considerable growth due to increased consumption of packaged food items in this region. The rising urbanization and customer inclination towards packaged food items are the main driving factors in this region. The technological advancement is also ensuring a reduction in the cost of packaging and high quality in pharmaceutical packaging machine solutions. The most crucial thing in this region is the demand for sustainable packaging solutions. Continuous innovation is going on for biodegradable materials and recyclable plastic materials. The effective waste management strategies by using different innovative solutions are being implemented on a huge scale throughout the region.

- In April 2024, the United Kingdom announced the launch of the Circularity in Primary Pharmaceutical Packaging Accelerator (CiPPPA) initiative to develop and implement strategies for end-of-use recycling of medicinal devices and pharmaceutical packaging. CiPPPA is a collaborative non-profit initiative connecting stakeholders from across the pharmaceutical supply chain.

Europe is another main region for the pharmaceutical packaging machines market, in which regulatory policies have adjusted to high standards for release reduction, which drives the urge for effective and eco-friendly products. The European region is experiencing acceptance in industries like healthcare, automotive, and energy. Furthermore, the move towards renewable energy and green technologies in countries like the UK and Germany has led to the development of the Pharmaceutical Packaging Machines Market. The region’s importance in sustainability is expected to continue to shape industry trends in the coming years.

Latin America and the Middle East

Latin America is also experiencing constant growth in the pharmaceutical packaging machine market because of the growth in infrastructure development and industrialization, specifically in countries like Saudi Arabia, Brazil, and the UAE. The Middle East’s importance in sustainability in energy generation and Latin America’s rising automotive industry are boosting demand in the Pharmaceutical Packaging Machines Market. Hence, the Middle East’s loyalty to classify its economy, linked with Latin America’s efforts to update its industries, is expected to drive the main market expansion in these regions.

Pharmaceutical Packaging Machines Market Key Playres

Latest Announcements by Market Leaders

- In February 2025, Hanmi Pharmaceutical announced the launch of Countmate, a fully automated vial dispensing machine designed to meet the specific needs of the Canadian and US pharmaceutical markets. This strategic move is aimed at expanding the company’s footprint in North America and driving global sales growth. The machine represents a diversification of JVM’s product range, which previously focused on pouch-type dispensing equipment.

Recent Development

- On 4 December 2024, ACG inspection revealed its cutting-edge Life Sciences cloud, an overall end-to-end analytical and traceability solution whose goal is to serve production quality, manufacturing effectiveness, and transformational supply chain traceability, which gives energy to users to make a healthier world. (Source: Business Standard)

- On 14 July 2025, a Philadelphia-based pharmaceutical services company received a huge investment from two major private equity firms, accelerating its valuation to USD 10 billion.(Source: Philadelphia Business Journal)

- On 15 April 2025, Packaging solution server Syntegon revealed its current MLD Advanced filling machine, personalized for ready-to-use nested syringes. This latest serving is crafted to align with the demands of pharmaceutical producers for high output linked with 100% in-process control (IPC), ensuring accurate filling. (Source: Packaging Gateway)

- On 26 June 2025, Pratham’s pharmaceutical leaflet folding machine (inserts and outserts) will fold the medicines packaging. (Source: printweek)

- In February 2024, Aptar CSP Technologies collaborated with ProAmpac, a material science and flexible packaging provider, to develop and launch ProActive Intelligence Moisture Protect (MP-1000). This next-generation platform technology combines Aptar CSP’s 3-Phase Activ-Polymer technology with ProAmpac’s flexible blown film technology to deliver a moisture adsorbing flexible packaging solution.

- In May 2025, Antares Vision Group, a provider of track-and-trace systems for several fields, including the life sciences, unveiled precision labeling equipment. The company is collaborating with Siempharma, a manufacturer of packaging machines, by welcoming the ETF-300. The ETF-300 Labeler can adapt to multiple types of printing tech, such as thermal ink jet, thermal transfer, and laser.

Pharmaceutical Packaging Machines Market Segments

By Machine

- Filling

- Labelling

- Form Fill & Seal

- Cartoning

- Wrapping

- Palletizing

- Cleaning

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)