Cement Packaging Market Demand, Size and Growth Rate Forecast

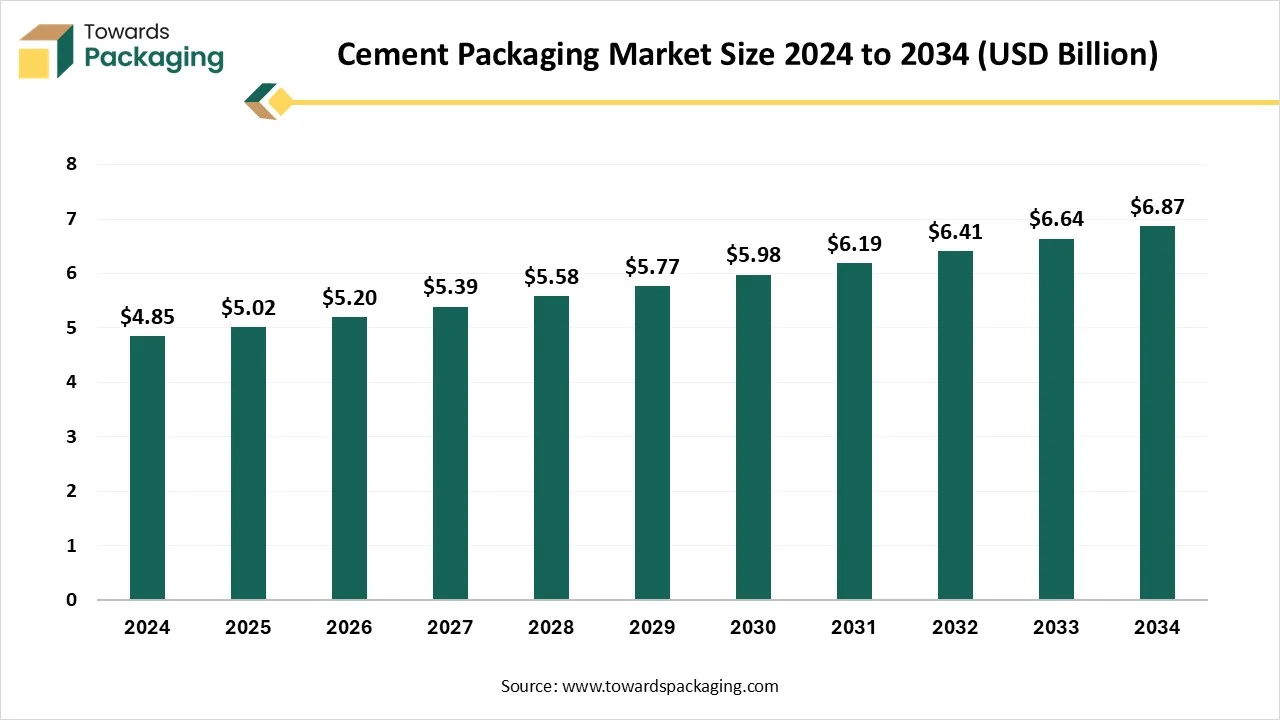

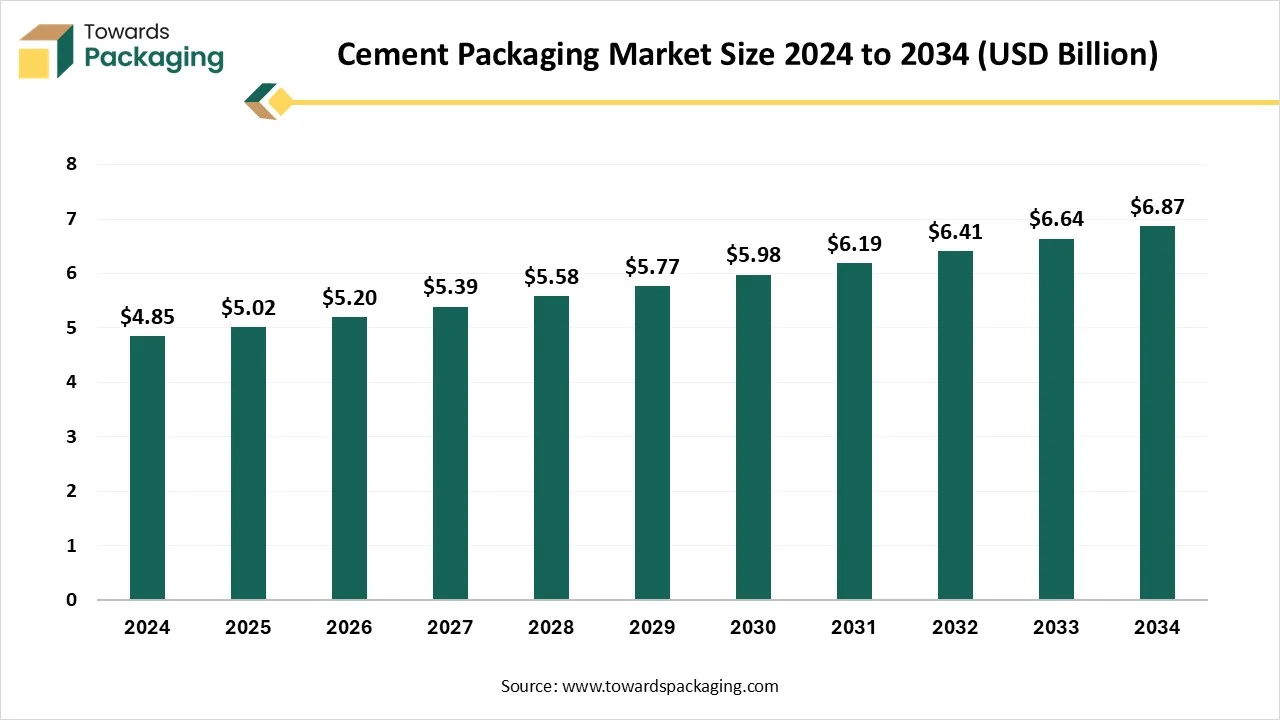

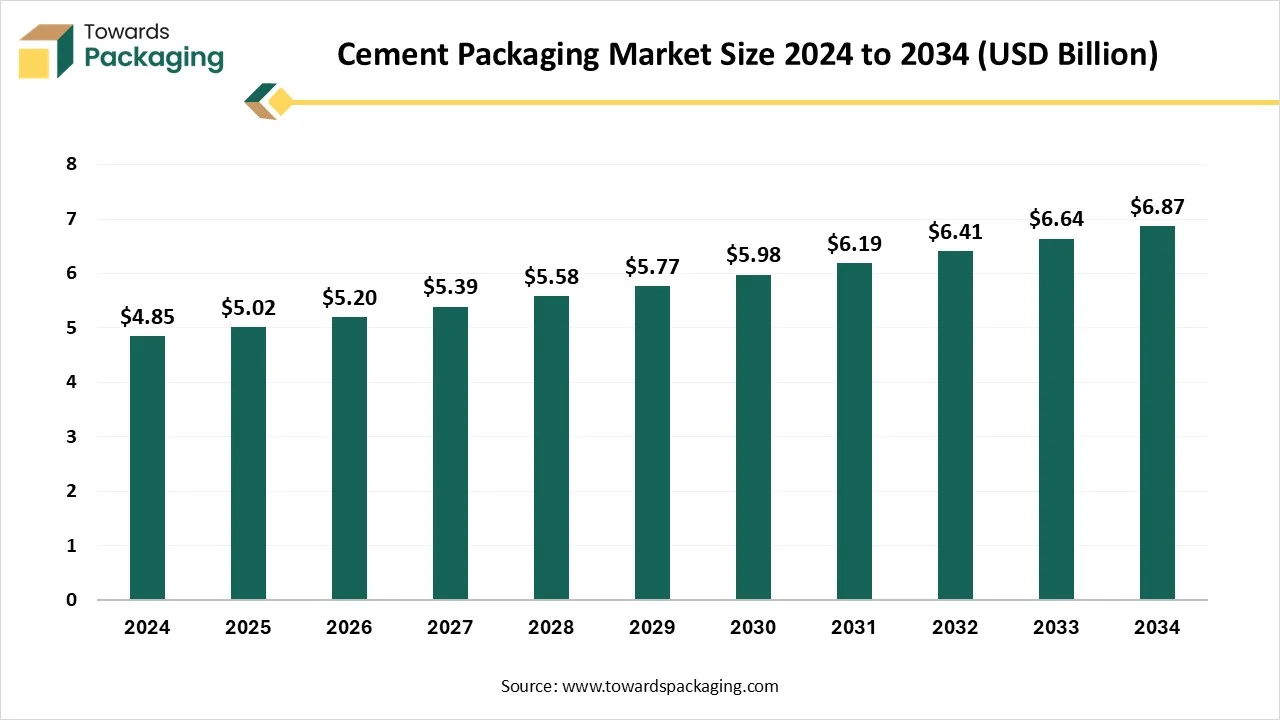

The cement packaging market is forecasted to grow from USD 5.02 billion in 2025 to USD 7.11 billion by 2035, expanding at a CAGR of 3.55%. The demand is driven by a rapidly developing construction sector in emerging economies, focusing on the need for product protection, sustainability, and technological advancements. The market is categorized by material types such as plastics, paper, and jute, with plastics dominating in 2024. By capacity, the 21kg to 50kg segment led in 2024, while the 6kg to 20kg segment is expected to grow fastest. Regional growth is led by Asia Pacific, with North America projected to experience significant growth during the forecast period.

Key Takeaways

- In terms of revenue, the market is valued at USD 5.02 Billion in 2025.

- The market is predicted to reach USD 7.11 Billion by the year 2035.

- Rapid growth at a CAGR of 3.55% will be officially experienced between 2025 and 2034.

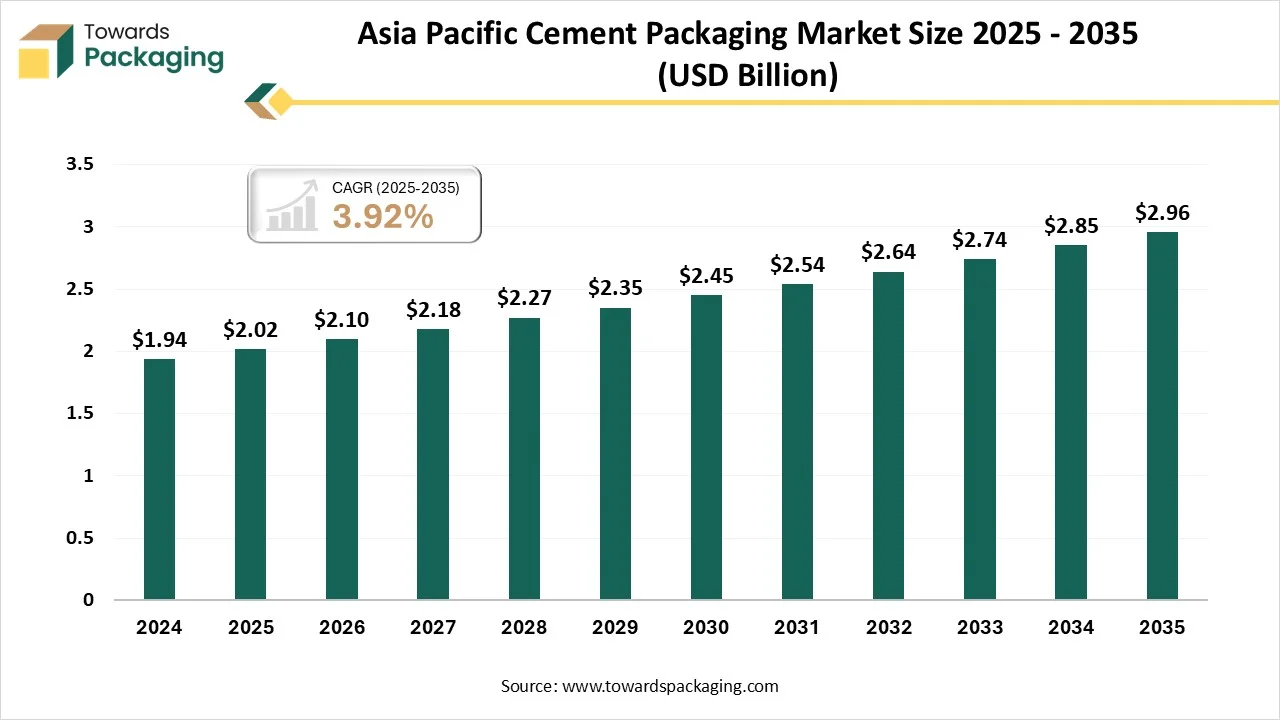

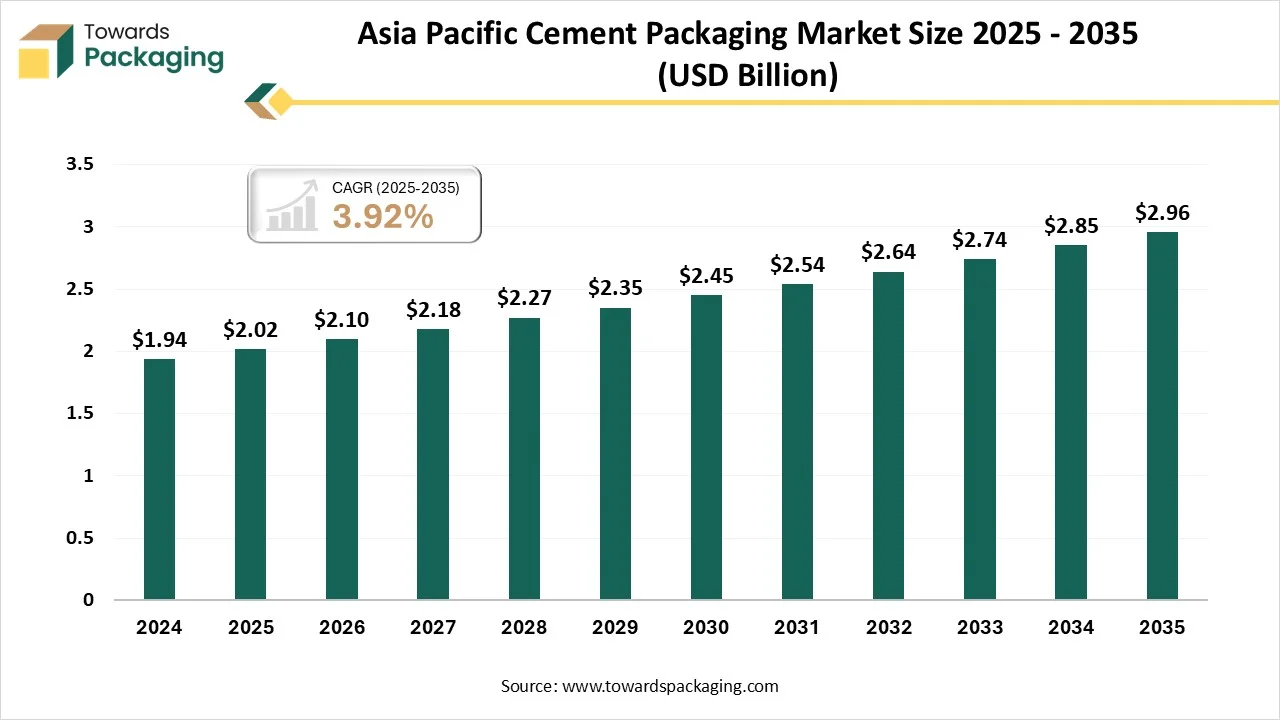

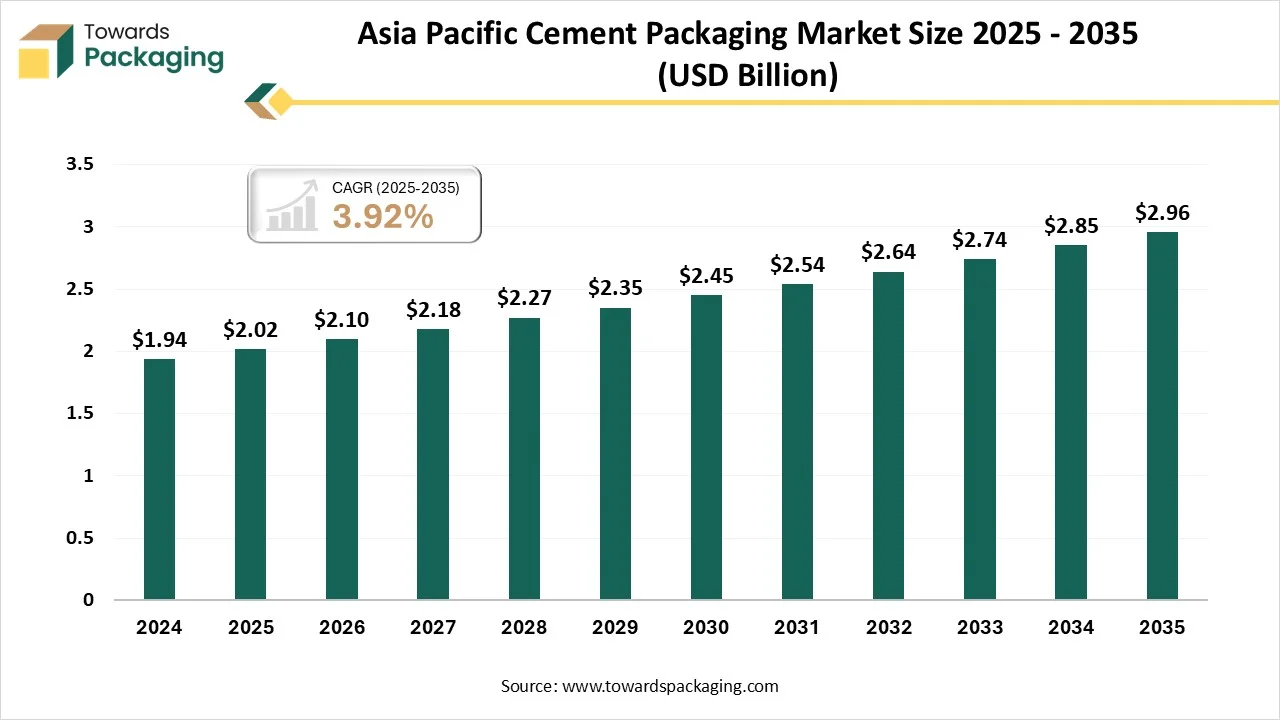

- By region, Asia Pacific dominated the region, having the biggest share in 2024.

- By region, North America is expected to rise at a notable CAGR between 2025 and 2034.

- By Material type, the plastics segment has contributed the largest share in 2024.

- By material type, the paper segment will rise at a notable CAGR between 2025 and 2034.

- By Capacity, the 21kg to 50kg segment has invested the biggest share in the year 2024.

- By capacity, the 6kg to 20kg segment will grow at a notable CAGR between 2025 and 2034.

- By product type, the cement bags segment has contributed the largest share in 2024.

- By product type, the sacks segment will develop at a notable CAGR between 2025 and 2034.

What Do You Mean By The Cement Packaging Market?

Cement is a fine powder that, when mixed with water, makes a paste that hardens over time. This hardened paste is the main ingredient in concrete. The history of cement dates to ancient times, with the Romans utilising the kind of lime-based mortar to build their huge structures. However, the current Portland cement, which is the most widely used type currently, was invented in the early 19th century by Joseph Aspdin.

Cement’s initial use is an element for the factual, which is used globally in terms of construction projects, from necessary services such as hospitals and schools to main infrastructure that includes bridges, airports, and motorways.

Cement Packaging Market Outlook

- Industry Growth Overview: The cement packaging market is developing due to developing construction activity, which is being driven by population development and urbanisation, specifically in regions like the Asia Pacific. Main drivers count the demand for moisture-resistant packaging, a trend towards sustainable materials like paper, and the invention of smart solutions and packaging design, too.

- Sustainability Trends: Green cement, a flashlight of hope, champions items that are less carbon-intensive than traditional manufacturing. This can point to applying new technologies or mixing industrial by-products into the cement-creating procedure. Beyond cutting-edge procedures, sustainability urges a comprehensive strategy. Selecting durable materials, updating processes for local surroundings, and using a circular economy are pressing.

- Global Expansion: The overall expansion of the cement packaging is being driven by the developing construction activities in growing nations, an expanding concentration on sustainability, and advancements in terms of packaging technology.

- Major Investors: Major investors and main players in the cement packaging sector include packaging companies like Smurfil Kappa, Mondi Group, along with major cement producers like Adani Group and UltraTech Cement.

Key Technological Shifts in the Cement Packaging Market

- Robotic technologies have become an important part of current cement plants. High-level robotic systems are now capable of performing repetitive and toxic tasks, right from kiln cleaning to material handling, without human involvement. Automated robotic arms can mainly lower the downtime by performing main tasks faster and with accuracy.

- Artificial Intelligence is updating automation, having the ability to track huge amounts of data, optimize in real-time, and predict system behaviors. AI-powered automation tools can significantly track important machine signals when maintenance is needed, which prevents costly breakdowns.

- Cement manufacturing is one of the biggest contributors for the greenhouse gas emissions, having around 7% of worldwide CO2 emissions which contributed to the sector. Penetrating carbon and generating technology, by acquiring CO2 emissions from the toxic gases made during the cement production, plants can mainly reduce their environmental impact.

- Outstanding development counts the growth of carbon capture and storage systems, which have trapped CO2 and keep it underground or transform it for other commercial uses.

- The motion plastics specialist igus has disclosed its primary humanoid robot, Iggy Rob, which has been crafted in order to assist industrial production, transport tasks, and service environments. The robot, served at an industry-disruptive price of approximately USD 54,500, serves as a cost-effective penetration point into humanoid robotics for organisations finding automation solutions.

Trade Analysis of Packaging for Cement Packaging Market: Import and Export

There are in total 3,251 Cement packaging suppliers in the globe that exports to 3,205 buyers worldwide. In the time from June 2024 to May 2025, 1,299 suppliers were very active, having the HU BEI MING XIANG TECHNOLOGY Co. Ltd and WEST INTERNATIONAL SUPPLY HCIAN LTD.

HU BEI MING XIANG TECHNOLOGY CO LTD is the top cement packaging supplier in the globe, which constitutes 40% of the total with 1,159 shipments. It is following closely LLC Bodomzor Cement with approximately 16% share of the total and same to 452 shipments.

Value Chain Analysis of the Cement Packaging Market

Material Processing and Conversion: A cement plant operation is an industrial facility that manufactures cement by mixing raw materials like clay, limestone, and iron ore, followed by heating them in a kiln at high temperatures in order to generate clinker. The Clinker is then excellently ground by using the gypsy and other additives in order to make the outcome cement, which is necessary for the construction projects globally.

Package Design and Prototyping: Package design for the cement gives importance to moisture, durability, and efficiency, which also increasingly concentrates on branding and sustainability. Prototyping enables producers to test and change these designs before full-scale production. A regular, recyclable, and cost-effective option. They are often covered with an inner plastic layer in order to protect against moisture and improve durability.

- Logistics and Distribution: The initial role of packaging in cement logistics is to protect the product from external elements, like dust, moisture, and physical damage. High-quality packaging tracks the cement’s honesty during storage and transit, which protects against product loss and ensures quality, too.

Types of Cement and Their Uses

| Type of Cement |

Composition /Features |

Initial Setting Time |

Compressive Strength |

Main Uses |

| Ordinary Portland Cement |

Great in lime, silicates (C3S and C2S) |

-30 minutes |

43,33, or 53 Mpa (28 days) |

General making buildings, pavements |

| Rapid Pozzolana Cement (PPC) |

High C3S cement, fireproof ground |

-30 minutes |

Big early strength (OPC 7 days in 3 days ) |

Road repairs, precast elements, fast-track projects |

| Poland Pozzolana Cement (PPC) |

OPC+ 15.35% pozzolanic materials (fly ash, etc.) |

-30 minutes |

High early strength (OPC 7 days in 3 days) |

Road repairs, precast elements, fast-track projects |

| Quick Setting Cement |

Lower don gypsum content is being added to the aluminum sulphate |

1 minutes |

Similar to OPC |

Underwater works emergency repair jobs |

| Low-heat cement |

Low C3S, high C2S, lessen tricalcium aluminate |

60 minute |

Slower gain, but durable |

Large dams, mass concrete foundations with essential cracks. |

| Sulphate Resisting Cement |

Low C3A elements (max-56 ) |

-30 minutes |

Similar to OPC |

Sewage systems, which are founded in sulphate |

| White cement |

Plastering, mass concreting, and water-retaining structures |

100 minutes |

-33MPa |

Complete finishes the wall putty having the title grout. |

| Colored Cement |

White cement + +mineral pigments |

-100 minutes |

Same as white cement |

Decorative flooring, facades pathways |

| Hydrophobic cement |

OPC+ water repairing additive |

-3 minutes |

Same as OPC |

Long-distance transport and storage |

Emerging Trends in the Cement Packaging Market

- Eco-friendly Packaging Materials: Several manufacturers are now discovering alterations like biodegradable packaging made from renewable resources such as sugarcane, cornstarch, and hemp, too. These materials are not only environmentally friendly but also serve the same kind of protective qualities as regular packaging. Further to that, there is a rising interest in utilising recycled content for cement packaging. Many organizations are starting to include plastic and recycled paper in their packaging, which lowers the demand for virgin materials.

- Smart Packaging for Supply Chain Transparency: One of the most exciting updates in cement packaging is the usage of smart packaging technology. This counts inventions like RFID tags, QR codes, and sensors, which assist in tracking products through the supply chain. By using smart packaging, cement manufacturers can ensure perfect inventory management and protect counterfeit products from penetrating the market.

- Energy-efficient manufacturing: The cement industry itself is energy-intensive, and it includes mainly greenhouse gas emissions. To solve this problem, several manufacturers are working on generating low-carbon cement. Along with this, packaging processes are also becoming more energy-oriented.

- Bulk Cement Packaging: Bulk Cement packaging is becoming more prevalent for big construction projects as it serves several advantages. For example, bulk cement can be shifted in bigger containers like silos, bulk sacks, and big bags, which reduces the demand for smaller individual packages.

- Personalized Packaging designs: As the urge for branded items develops, more producers are investing in tailored packaging designs that showcase their uniqueness. Tailored packaging assists cement manufacturers in developing their brand recognition. Whether with the help of different logos, designs, or messaging, packaging is now seen as a machine for constructing a stronger link with consumers.

- Flexible Packaging: While big packaging is perfect for big-scale projects, flexible packaging solutions are also developing in popularity, particularly for minute construction projects. Flexible intermediate bulk containers serve a more evergreen solution for packaging cement, as they can carry a large amount of material while still being lighter and convenient to handle smaller projects.

- Returnable and reusable packaging: A promising strategy in order to reduce waste is the acceptance of returnable and reusable packaging. Packaging that can be used several times assists in decreasing the demand for single-use materials, which mainly reduces the waste. Some organizations are witnessing the use of returnable packaging, in which the bags or containers are sent back to the producer after usage, reused, and cleaned for future shipments.

- Recycling programs and Circular Economy Initiatives: Cement producers are also experiencing recycling programs to make sure that packaging materials are recycled or reused. These programs push users to return to recycling for packaging, which keeps the materials in circulation and avoids the urge for new resources.

Material Insights

How Did The Plastic Segment Dominate The Cement Packaging Market?

The plastic segment has dominated the market in 2024 as current plastic cement bags are made from polypropylene (PP) OR high-density polyethylene because of their durability, strength, and perfect moisture resistance as compared to regular paper bags. These plastics are utilised to create different types of bags, which are often developed with extra characteristics like lamination for regular protection. Polypropylene is the most prevalent kind of cement packaging material as it is created from weaving thin strips of polypropylene plastic in a design to make a rigid, tear-resistant fabric.

The paper segment is predicted to be the fastest-growing during the forecast period. As the urge for cement developed and the construction sector developed, the demand for perfect packaging solutions developed. Paper bags, while smooth, were not always the perfect option in terms of reliability, particularly in challenging conditions. For example, paper bags could conveniently tear, and the cement inside could be exposed to moisture, which could affect their quality.

Paper was somewhat inexpensive and widely available, which makes it an accessible option for cement packaging. The paper bag design was effective, simple, and could be conveniently packed using a variety of procedures, such as heat-sealing or sewing. Mondi has revealed the Spanish Launch of its SolmixBag in partnership with Cemex. SolmixBag is a one-ply paper bag created from 100% kraft paper that transports and stores dry cement, coarse pre-mixes, and screed, too.

Capacity Insights

How Did The 21kg To 50kg Capacity Segment Dominate The Cement Packaging Market?

The 21kg to 50kg capacity segment has dominated the market in 2024 as its sophisticated and highly urgent series for cement packages in the construction sector. It completes various project demands with a flexible size for uses such as foundations, slabs, plastering, and bricklaying too. Its capacity restricts the unwanted loss of cement during storage, manufacturing, and transportation, which decreases the surrounding effect, develops working conditions for operators on the cement filling lines, and makes a smoother cement handling.

The 6kg to 20 kg segment is expected to be the fastest-growing in the market during the forecast period. The pouches and bags having this potential prevent the quality of the cement from pollutants and moisture, which makes a simple distribution and packaging procedure for producers. It is generally utilised for renovation, retail, and construction usage. These minute packs meet with small contractors, individual users, and do-it-yourself applications. Bags are often created from polypropylene material to ensure that moisture protection and product durability are important.

Product Insights

How Did The Cement Bags Segment Dominate the Cement Packaging Market?

The cement bags segment has dominated the market in 2024 as FIBC bags, which are often referred to as big bags, bulk bags, and jumbo bags, are made from woven polypropylene fabric and are focused on the bulk transportation and storage of flowable and dry goods. Their versatility is famous as they can handle anything from sugar and cement to grains, chemicals, and minerals, too.

The making of FIBC products enables them to handle weights that range from 500 kg to over 2000 kg. These bags are tailored in terms of coating liners, size, filling, and discharge options, and secure factors, which makes them perfect for a huge range of industrial uses.

- Ultracem cement Guatemala has revealed its current invention, the 6500 PSI structural cement bag, the most innovative product in the local industry, whose goal is to provide the maximum safety, projects, and technical backing too.

The sacks segment is expected to be the fastest-growing in the market during the forecast period. Juke was utilised to create a sack in the past. Hence, seasonal differentiations may be reflected in the jute result. As a result, there have been examples when there was a limitation of jute needed to make packaging bags. Hence, polypropylene polymer is greatly used and accessible every year. The supply chain will also be durable, which is affected by this. The introduction of the polypropylene plastic material will assist the supply chain so that it doesn’t get disturbed, and hence, track the stability of the supply of cement bags.

Regional Insights

How has the Asia Pacific Dominated the Cement Packaging Market?

Asia Pacific dominated the cement packaging market in 2024 as it is backed by vast industrialization, stretching digital ecosystems, and developing government investments in technology and infrastructure. The region’s energetic demographics. Counting a young population and the fastest developing middle class, which has further assisted demand for Cement Packaging Bag solutions across every industrial application and consumer too.

Digital updation in the Asia Pacific is developing the acceptance of cloud-based cement packaging bag solutions, with small and medium companies heavily experiencing digital tools for expansion.

Top India Insights for Cement Packaging Market

The urge for cement packaging in India is constantly high and predicted to develop significantly, which is being driven by the country's developing infrastructure and construction sectors. Market intelligence firms foretell substantial development in the Indian Cement market. Producers are increasingly accepting eco-friendly raw materials, such as bags made from recycled polypropylene. While some organizations are discovering inventive biodegradable materials like water-soluble water bags that totally dissolve during the cement integration procedure, which eliminates construction site waste.

Top China Insights for Cement Packaging Market

In the current year, the urge for cement packaging in China is being defined by the decline, but still huge, domestic cement industry that is linked with a strong government-led encouragement for sustainability and automation, and low-carbon packaging. The development rate for the bulk ration in China has developed mainly over the last two decades, which is being driven by the large-scale design projects and the developing usage of ready-mix concrete. Bulk transport is often more economical and less subject to moisture damage. Notwithstanding the growth of bulk transport, bagged cement remains substantial, specifically for decentralized, minute, and temporary construction projects, as well as reliable housing and urban growth.

North America expected to be the fastest-growing in the market during the forecast period. This region is developing due to the growing focus on sustainability and the circular economy within the construction industry. Producers are heavily accepting biodegradable materials and including additives that develop cement packaging durability while lowering the environmental footprint. Market players are also discovering automation and digitalization in manufacturing procedures to develop efficiency and align with the rising volume demands.

Top Canada Insights For The Cement Packaging Market

The urge for cement packaging in Canada is developing due to growing construction activity, specifically in housing and infrastructure projects. Efficiency, sustainability, and security are updating the market, with main trends counting the usage of eco-friendly materials, ergonomic designs, and bulk packaging too. Governments' investments and urbanisation in infrastructure projects like bridges and roads are the main factors that fuel the urge for cement and initially its packaging too.

Europe is expected to grow at a notable rate during the forecast period. The initial trend in European cement packaging is a rigid shift towards sustainability, which is being driven by the stringent regulations and environmental awareness. This has established regulations and surrounding awareness in order to reduce environmental impact. Inventions like Mondi, in partnership with Cemex, are growing high-level water-soluble bags created from kraft paper. These bags get dissolved completely during the integration procedure, which avoids waste on the construction website.

Middle East & Africa Cement Packaging Market Size 2025 - 2035 (USD Billion)

Country-Level Investments & Funding Trends for Cement Packaging Market

- In March 2025, Ethiopia’s Chinese-built Lemi National Cement Factory, which is the biggest of its type in the region, having the daily manufacturing potential of 10,000 tonnes, has won acclaim for updating the East African Country sector, which updates technology transfer, economic growth, and capacity-building too.

- In March 2025, Turkiye’s Sabanci Holding subsidiary, construction material generator Cimsa, had grown its U.S dollar-based market value sevenfold over the past five years, reaching the USD 1.4 billion.

- In April 2025, Ghacem Limited has once again completed its commitment of assisting deprived communities in the region with free cement bags for their educational and health infrastructure, with the start of the 2024 and 2025 Ghacem Cement Foundation donation ceremonies.

Recent Developments

- In August 2025, Ramco Cements, which is headquartered in Chennai, is eyeing an significant share in the construction chemicals segment, which has disclosed a new product line, Barbed Hard Worker. The series features 20 tailored products that include waterproofing solutions, adhesives, bonding agents, and repair mortars too.

- In June 2025, Star Cement Limited, a top name in the cement sector, has launched Star AAC (Autoclaved Aerated Concrete)Blocks and Star Block Jointing Mortar, which marks an major step towards innovative and sustainable construction solutions.

- In September 2025, Adani Cement had recently revealed the launch of “Adani Cement FutureX", which is a global academia-industry engagement programme crafted to connect classrooms with actual-world infrastructure and sustainability issues.

- In July 2025, Container Corporation of India (CONCOR) took a major step towards sustainable logistics by developing new tank containers that are crafted for bulk cement transport. This cutting-edge move is part of the company’s huge green logistics initiative, whose goal is to reduce the environmental impact of freight transportation.

- In August 2025, Lafarge Africa Plc, a top inventive and sustainable building solutions company, has changed its focus to the production of good-quality building solutions that count comments, has disclosed the launch of its latest product into the market, EcoCrete, Nigeria’s first low-carbon ready-mix concrete.

Top Vendors in the Cement Packaging Market and their Offerings

- Mondi: Mondi is an MNC packaging and paper group. The company is based in Weybridge, England. It has listings on the Johannesburg Stock Exchange and the London Stock Exchange as an constituent of the FTSE 100 Index.

- Smurfit Kappa: Smurfit Kappa is a top leader in terms of sustainable paper and packaging, that runs in 40 countries with over 100,000 employees working across 500+ packaging updating runs and 62 paper mills.

- Berry Global: Berry Global is a leading producer of plastic packaging and crafted materials, which is headquartered in Indiana. The company grows, designs, and generates a huge series of products for sectors like personal care, healthcare, and food and beverage.

- ProAmpac LLC: ProAmpac is a top manufacturer of flexible oil, film, and fiber packaging solutions that are constructed on the material science. It serves innovative packaging solutions, award-winning inventions, and industry-leading customer service to a different global marketplace.

- LC Packaging International BV: Royal LC Packaging is a family-owned distributor and producer of flexible transportation packaging, founded in 1923. With production locations, offices, and warehouses in 15 different countries in Asia, Africa, North America, and Europe the number is always approximately.

Cement Packaging Market Key Players

Tier 1

Tier 2

- United Bags

- Taurus Packaging

- NNZ Group

- ToolAsia Polysacks Pvt. Ltd

- TolAsian Polysacks Pvt. Ltd

- Gulf Paper Manufacturing Co.

- Storsack Group

- Rosenflex UK Ltd

- Asia Packaging Industries Ltd

- Fujian Henglong Plastic Industry Co., Ltd

Tier 3

- Unisun Packaging

- Elsepack

- Shalimar Pack

- Flexipol Packaging Ltd

- Orient Sacks Pvt. Ltd

- BulkSack India Pvt. Ltd

- Packwell Industries

- Taurus Polymers Pvt. Ltd

- Qingdao BagKing Packaging Co., Ltd

Cement Packaging Market Segmentation

By Material

By Capacity

- Up To 5kg

- 6kg To 20kg

- 21kg To 50kg

- Above 50kg

By Product Type

- Bags

- Pouches

- Sacks

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait