Europe Transfer Molded Pulp Packaging Market Size, Share, Trends and Forecast Analysis

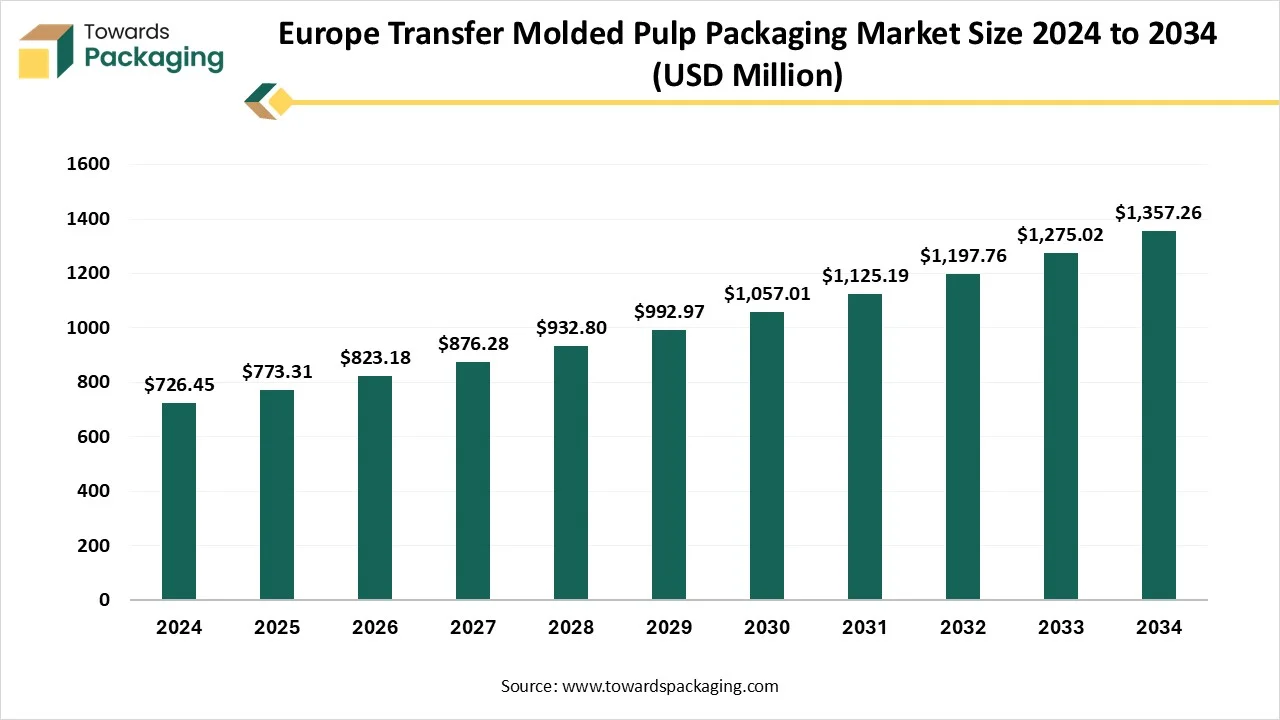

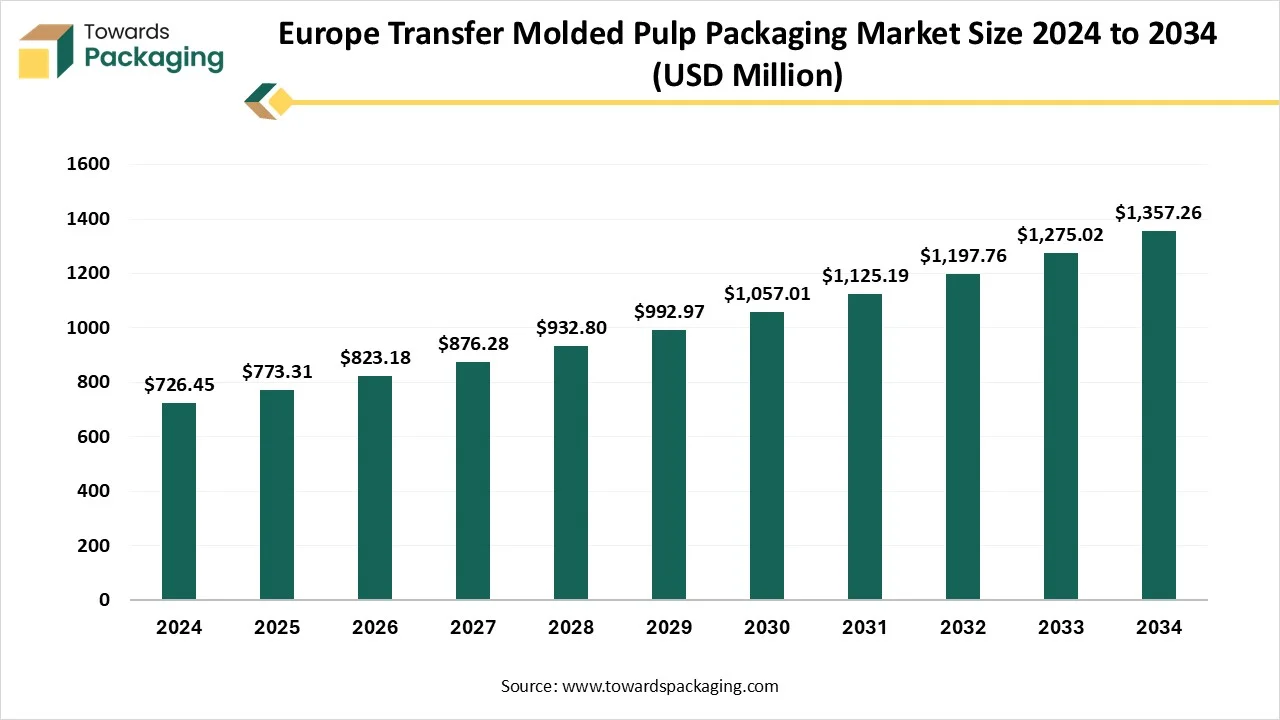

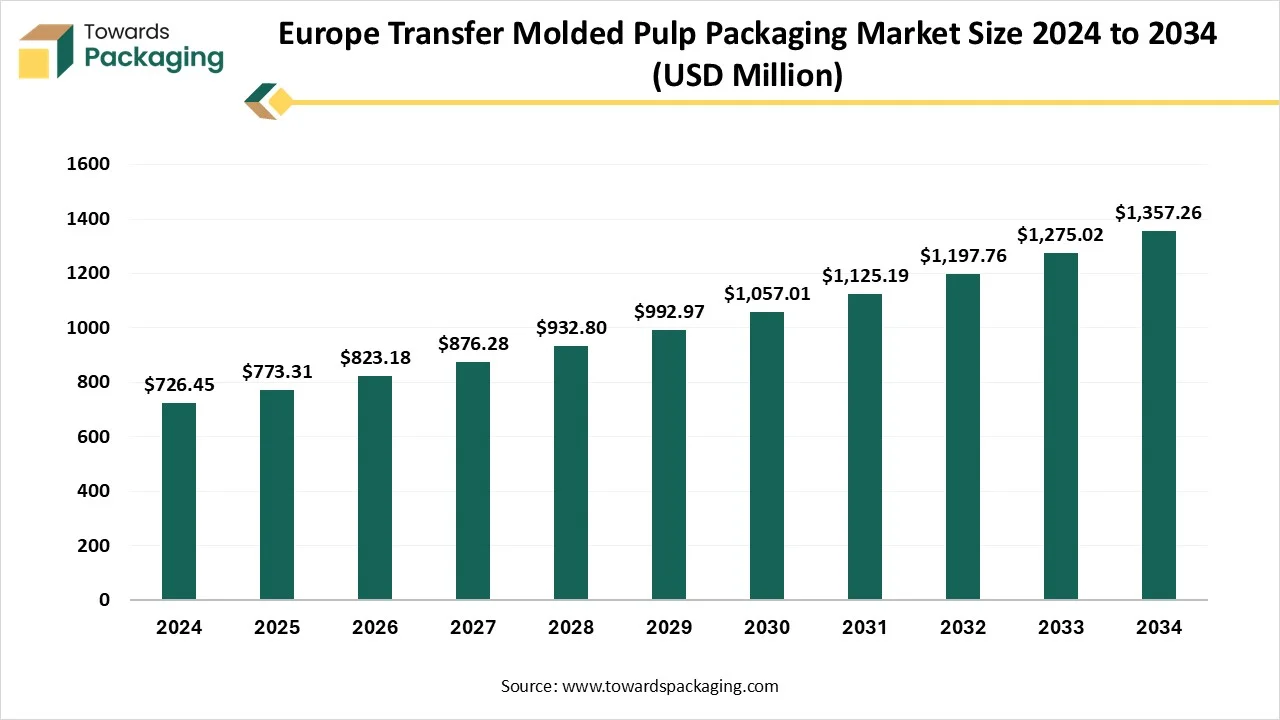

The Europe transfer molded pulp packaging market is forecasted to expand from USD 823.18 billion in 2026 to USD 1,444.80 billion by 2035, growing at a CAGR of 6.45% from 2026 to 2035. This market covers various segments including food, healthcare, and electronics packaging, with a significant share held by wood pulp-based packaging. Western Europe is leading due to high egg consumption and expansion in the poultry sector. The market's value chain encompasses raw material sourcing, component manufacturing, and logistics, with key players such as Brødrene Hartmann A/S, Huhtamaki, and PAPACKS Sales GmbH.

Major Key Insights of the Europe Transfer Molded Pulp Packaging Market

- In terms of revenue, the market is valued at USD 773.31billion in 2025.

- The market is projected to reach USD 1,444.80 billion by 2035.

- Rapid growth at a CAGR of 6.45% will be observed in the period between 2025 and 2034.

- By application, the food packaging segment contributed the biggest market share in 2024.

- By application, the healthcare segment will be expanding at a significant CAGR in between 2025 and 2034.

- By source/ raw material type, wood pulp segment contributed the biggest market share in 2024.

- By source/ material type, nonwood pulp segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By molded type, the transfer molded segment contributed the biggest market share in 2024.

- By molded type, the thermoformed segment is expanding at a significant CAGR in between 2025 and 2034.

- By product type, the trays segment contributed the biggest market share in 2024.

- By product type, clamshells / containers segment is expanding at a significant CAGR in between 2025 and 2034.

- By end-use sector, the eggs & egg cartons / fruit trays segment contributed the biggest market share in 2024.

- By end-use sector, the ready‑to‑eat meals / snacks / take‑away food service segment is expanding at a significant CAGR in between 2025 and 2034.

What is Europe Transfer Molded Pulp Packaging?

Europe transfer molded pulp packaging refers eco-friendly and sustainable packaging which is manufactured through a transfer molding technique where pulp is first vaccum-formed, dewatered, and then shifted to another mold to dry which result in smooth inner surface. This technique generates shock-absorbent and durable packaging which is utilized in various industries such as medical, electronics, and food industries.

Europe Transfer Molded Pulp Packaging Market Outlook

- Eco-friendly Packaging: Increasing regulatory guidelines and consumer preference has enhanced the demand for eco-friendly packaging of the products in this region.

- Strategic Expansion: Major companies are expanding due to expansion of cosmetic and healthcare industries.

- Digitalization: The significant advancement such as printable surface, thermoformed fiber, and water-resistance coating are enhancing the appeal and functionality of molded pulp packaging.

- Startup Ecosystem: The major emphasis of the startup industries are increasing eco-friendly packaging concern and e-commerce sector enhancement.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 773.31 Billion |

| Projected Market Size in 2035 |

USD 1,444.80 Billion |

| CAGR (2026 - 2035) |

6.45% |

| Market Segmentation |

By Application, By Source / Raw Material Type, By Molded Type, By Product Type and By End‑use / Sector |

| Top Key Players |

Brødrene Hartmann A/S, Omni-Pac Group, Huhtamaki, PAPACKS Sales GmbH, KIEFEL GmbH, James Cropper plc, TRIDAS, TART, Pulp-Tec Limited, Goerner Formpack GmbH, buhl-paperform GmbH |

Key Technological Shifts in Europe Transfer Molded Pulp Packaging Market

The Europe transfer molded pulp packaging market is experiencing major technological shift due to enhanced product durability and aesthetics, continuous innovation in the raw materials, improved production efficacy, and wider adoption in applications. Advancement in technology help in enhancing strength and allow it to expand profoundly. Major manufacturers are focusing towards development of cellulosic molded pulp for eco-friendly packaging.

Trade Analysis of Europe Transfer Molded Pulp Packaging Market: Import & Export Statistics

- France: The estimated export value of paper pulp filter blocks $8.01M in 2023, it is 8th largest exporter out of 108 worldwide. And imported values is approximately $12.3M and become 6th largest importer worldwide.

- Germany: It is estimated to export paper pulp of worth 102,175.23 USD and as per quantity it is approximately 28,101,700 kg.

- Italy: It is estimated to export paper pulp of worth 13,840.19 USD and as per quantity it is approximately 2,493,940 kg.

Europe Transfer Molded Pulp Packaging Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are wood pulp and non-wood pulp.

- Key Players: Huhtamaki, Goerner Formpack GmbH

Component Manufacturing

The major components used in this market are pulp, additives, molds.

- Key Players: Cullen packaging, PulPac

Logistics and Distribution

This segment is highly focused in combining manufacturers to consumers as well as special logistics providers.

- Key Players: Mondi Group, DS Smith Plc

Market Opportunity

Rapid Expansion of Pharmaceuticals and Healthcare Sector

The rapid expansion of pharmaceuticals and healthcare sector has enhanced the innovation process resulting in the rising opportunities in the Europe transfer molded pulp packaging market. The healthcare industry, conventionally dependent on plastic for its protective and sterile properties which is progressively discovering sustainable packing resolutions. Transfer molded pulp can offer protective and sterile packaging for pharmaceuticals, medical devices, and several other healthcare goods, decreasing ecological impact without negotiating safety. The versatility and cost-efficacy of molded pulp, accompanied by its product shield, influence its acceptance in businesses like cosmetics, food, and electronics.

Market Challenges And Restraints

Fluctuation in the Raw Material Charges

Fluctuation in the raw material charges has restricted the expansion of the market. This fluctuation can directly influence the production charges and profit limitations for producers of the transfer molded pulp packaging sector.

Application Insights

Why Food Packaging Segment Dominated the Europe Transfer Molded Pulp Packaging Market In 2024?

The food packaging segment dominated the market with highest share in 2024 due to increasing consumption of eggs among people in this region. Rising concern towards health and increasing protein consumption has enhanced safe storage containers for eggs. The rising production as well as consumption of eggs in Europe are predicted to influence the demand of molded egg trays and cartons, which is predicted to help the segment to grow. Moreover, growing utilization of transfer molded champagne or wine shippers to protect wine bottles from damage and breaking at the time of transit is likely to upsurge the development of the segment.

The healthcare segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its sustainability, cost-efficiency, and bio-degradability. Molded pulps are used for manufacturing several medical trays such as dental procedure, medical devices, and surgical instruments. These are cost effective and reusable resources which are widely adopted as it can be easily sterilized and cleaned.

Source / Raw Material Insights

Why Wood Pulp Segment Dominated the Europe Transfer Molded Pulp Packaging Market In 2024?

The wood pulp segment dominated the market with highest share in 2024 due to its superior fibre quality and its abundant availability. Wood pulp is derived majorly from sustainably handles areas in Europe which provide a steady and consistent raw resource supply for producers. The enhanced technology for handing out wood pulp into transfer molded methods also confirms effectual scalability and construction. Its essential moldability and strength make it extremely appropriate for a wide variety of protective packing applications, from industrial inserts to egg cartons, thus cementing its important place in the market.

The nonwood pulp segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rising ecological consciousness and the trend for huge resource variation. Non-wood pulp is extracted from agricultural deposits such as bamboo, bagasse, and wheat straw, provides a more supportable substitute to outdated wood pulp by exploiting waste flows. The increasing demand for circular budget resolutions and the wish to decrease dependance on virgin wood fibres are major aspects pushing the quick acceptance and technological progressions in non-wood pulp mold packing in Europe.

Molded Type Insights

Why Transfer Molded Segment Dominated the Europe Transfer Molded Pulp Packaging Market In 2024?

The transfer molded segment dominated the market with highest share in 2024 due to its cost-effectiveness and versatility. This molding method permits for the construction of moderately exact and smooth-textured molded pulp goods appropriate for products necessitating reasonable moderating and a clean appealing. Its extensive acceptance is apparent across several businesses in Europe, from electronic inserts to egg packaging. The well-known substructure and technical proficiency for transfer mold additionally subsidize to its position.

The thermoformed segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its capacity to create aesthetically excellent packaging, highly precise, and smooth packaging resolution. The progressive molding technology permit premium finish, finer details, and thinner walls. The increasing demand for sustainable packaging in segment such as consumer electronics and cosmetics.

Product Type Insights

Why Trays Segment Dominated the Europe Transfer Molded Pulp Packaging Market In 2024?

The trays segment dominated the market with highest share in 2024 due to their global usage across various industries for organizational and protective resolutions. Their modest, functional pattern makes them suitable for packaging vegetables, eggs, fruits, and several industrial mechanisms. The extensive acceptance of trays is extremely entrenched in the European distribution chain for farming goods. Their cost-efficiency, stickability, and protecting potentials solidify their important situation across Europe.

The clamshells / containers segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rising demand for recyclable and sustainable packaging. Strict guidelines of European countries have promoted the usage of this segment. The rising consumers preference for recyclability and sustainability packaging with premium and appealing package.

Enduse / Sector Insights

Why Eggs & Egg Cartons / Fruit Trays Segment Dominated the Europe Transfer Molded Pulp Packaging Market In 2024?

The Eggs & egg cartons / fruit trays segment dominated the market with highest share in 2024 due to increasing product protection. It has capacity to absorb shock, manage moisture, and shield against breakage. These trays maintain an excellent balance between affordability and performance. This type of packaging is preferred for the storage of large-scale products. Major companies are adopting recyclable and reusable packaging due to rising concern of consumers towards ecological effect.

The readytoeat meals / snacks / takeaway food service segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its sustainability and convenience in packaging. The increasing demand for on-the-go and ready-to-eat food products has boosted this type of packaging which protect food products and easy to manage. The rising demand for hygiene and safety of the products has influenced the demand of this packaging sector.

Country Insights

Western Europe held the largest share in the Europe transfer molded pulp packaging market in 2024, due to huge consumption of eggs. Such bulk demand has raised the concern for safe transportation for distribution as well as storage of products enhanced the production of these packaging. The enhanced manufacturing capacity is also a major factor behind the growth of this sector as it meets the demand of the consumers at an affordable range. The growing e-commerce industry and online order of electronics and cosmetic products has also influenced the demand for safe packaging that absorb shocks and protect fragile products. Its lightweight characteristic and affordability have enhanced the adoption of such packaging in this sector.

Eastern Europe’s expanding Poultry Sector

Eastern Europe expects the significant growth in the market during the forecast period. This market is growing due to rapid expansion of poultry industry. Increasing adoption of reusable and recyclable packaging in various sectors has promoted this market significantly. Increasing consumption of wine has also enhanced the necessity for safe storage boost the production of these packaging. Rising circular economy in this sector has also played an important role in the innovation of the market.

Recent Developments

- In June 2025, Ineos Olefins & Polymers Europe announced the launch of new grades precisely planned to satisfy strict EU regulatory necessities for challenging applications, comprising closures and caps, water pipes and milk bottles.

- In October 2024, Stora Enso announced the launch of Dry Molded Fiber Production Unit in Skene, Sweden. It has used PulPac’s technology for the making of fiber products like cup lids which have reduced CO2 footprint comparatively single-use plastics.

Top Companies in the Europe Transfer Molded Pulp Packaging Market

- Brødrene Hartmann A/S (Denmark): It is a major manufacturer of egg and fruits molded fiber packaging.

- Omni-Pac Group: It produce recyclable and sustainable paperboard and molded fibre packaging.

- Huhtamaki: It is a global sustainable packaging provider that comprises molded fiber and various other fiber.

- PAPACKS Sales GmbH: It produces plastic-free sustainable and renewable packaging.

- KIEFEL GmbH: It offers wide range of customized packaging and also support machine demonstration and sample generation.

- Others: James Cropper plc, TRIDAS, TART, Pulp-Tec Limited, Goerner Formpack GmbH, buhl-paperform GmbH

Europe Transfer Molded Pulp Packaging Market Segments Covered

By Application

- Food Packaging

- Electronics

- Healthcare

- Industrial

- Others

By Source / Raw Material Type

By Molded Type

- Transfer Molded

- Thick Wall

- Thermoformed

- Processed pulp

By Product Type

- Trays

- Bowls & Cups

- End Caps

- Clamshells / Containers

By End‑use / Sector

- Eggs & egg cartons / fruit trays

- Wine / beverage packaging (wine shippers, bottle dividers)

- Ready‑to‑eat meals / snacks / take‑away food service

- Medical / healthcare devices / hospital disposables