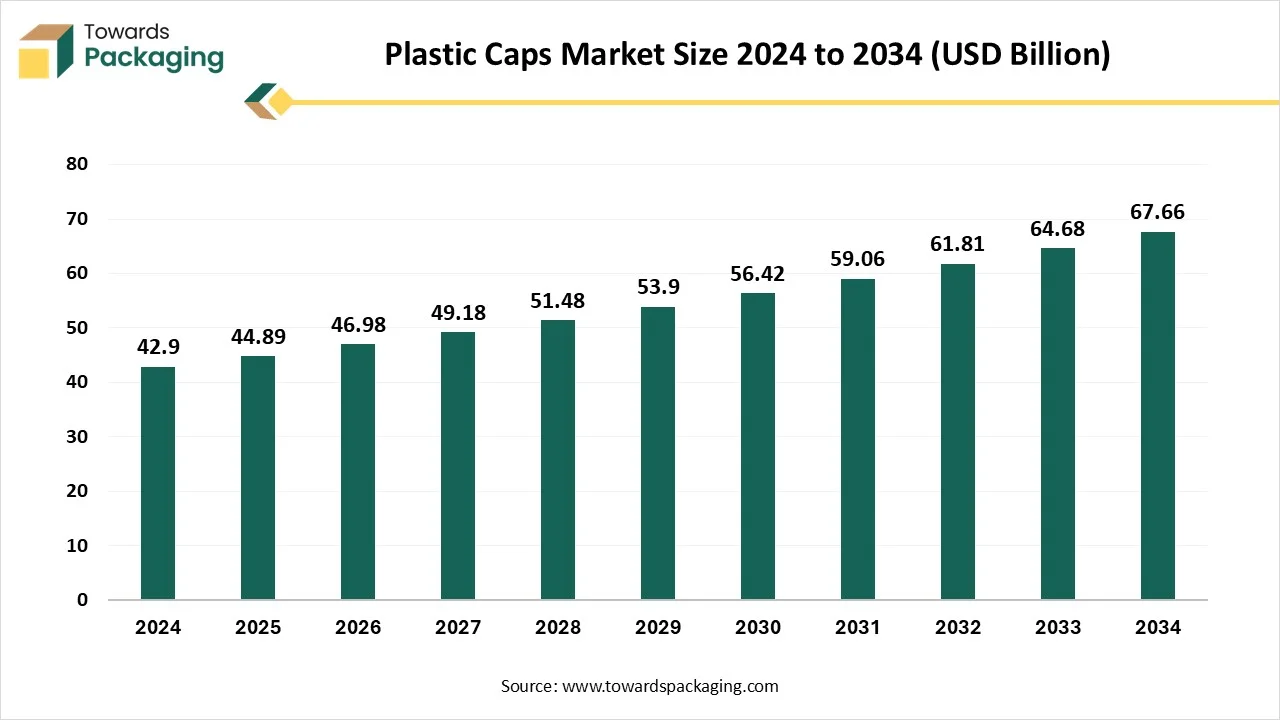

The plastic caps market is forecasted to expand from USD 46.97 billion in 2026 to USD 70.65 billion by 2035, growing at a CAGR of 4.64% from 2026 to 2035. This report covers complete market size evaluation, CAGR analysis of 4.64 percent, detailed segmentation by material, product, packaging type and applications, and full regional coverage across North America, Europe, Asia Pacific, Latin America and the Middle East and Africa.

The key players operating in the market are focused on adopting sustainable materials. Manufacturers are increasingly using monomaterial caps, such as polyethylene terephthalate (PET) and polypropylene (PP), to improve recyclability and reduce greenhouse gas emissions. In addition, the market is expanding exponentially in various developing and developed regions, particularly Asia Pacific, fuelled by the availability of raw materials and surging demand from multiple industries.

In the packaging industry, plastic caps offer protection, safety, and durability to various products from a wide range of industries. Plastic caps are crucial for sealing jars, bottles, tubes, and drums to ensure product safety and secure sealing while preventing leaks and contamination. The basic functions of plastic caps offer sealing and preservation, dispensing control, tamper-evidence, and convenience. Plastic caps are widely used in cold drink bottles, water bottles, jam jars, cosmetics bottles, medicine bottles, pickle jars, and others. Plastic caps ensure safety and freshness and enhance the shelf life of the product.

| Metric | Details |

| Market Size in 2025 | USD 44.89 Billion |

| Projected Market Size in 2035 | USD 70.65 Billion |

| CAGR (2025 - 2035) | 4.64% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Product, By Packaging Type, By Application and By Region |

| Top Key Players | Berry Global, Crown Holding, AptarGroup, Amcor plc, BERICAP, Silgan Holdings, RPC Group, United Caps |

As technology continues to evolve, the integration of artificial intelligence is significantly reshaping the landscape of the plastic caps market by enabling predictive maintenance, minimizing wastage, and optimizing production processes. By leveraging Artificial Intelligence (AI) and Machine Learning (ML) technologies, companies can effectively innovate and improve the efficiency of their operations through advanced data analysis and rapid automation. Artificial Intelligence can analyze vast volumes of data based on the properties and formulations of plastic materials to predict their properties. Several leading players are increasingly focusing on advancing plastic caps with AI-powered production and sustainable materials.

Rising Consumer Demand for Convenience and Low-cost Packaging

The growing demand for convenience and low-cost packaging from multiple end-user industries is expected to boost the market’s revenue during the forecast period. Plastic caps are cost-effective, lightweight, and durable, making them an ideal choice for making it a preferred choice for various applications, particularly in the food and beverage industry, personal care, chemicals, household care, cosmetics, pharmaceuticals, and other industries. Plastic caps ensure product integrity, preventing contamination and enhancing convenience for consumers. Their lightweight nature assists in reducing fuel consumption during shipping, and their durability ensures leak-proofness or breakage during transit, minimizing product waste and loss. Moreover, the integration of child-resistant and tamper-evident features plays a vital role, particularly in the pharmaceutical and food and beverage sectors. Therefore, increasing consumer demand for convenience and low-cost packaging fuels the adoption of advanced caps such as tamper-evident (TE) and dispensing caps.

Fluctuations in the Price of Raw Materials

The price volatility is anticipated to hinder the market's growth. The fluctuation in the price of raw materials such as polymer-based materials, which are widely used in the production of plastic caps, has led to an increasing manufacturing cost of advanced plastic caps, adversely impacting the profit margins of manufacturers. Moreover, the stringent environmental regulations regarding the usage of traditional plastic may hinder the growth of the global plastic caps market during the forecast period.

How is the Increasing Focus on Sustainability Impacting the Market Expansion?

The increasing focus on sustainability and eco-friendly products is projected to offer lucrative growth opportunities to the plastic caps market in the coming years. Sustainability has become a key focus in almost every industry, and plastic packaging is no exception. Several manufacturers are shifting towards monomaterial caps, widely using polyethylene terephthalate (PET) or polypropylene (PP), to improve the quality of recycled materials and enhance recyclability. Sustainable packaging offers several environmental benefits, ranging from reducing carbon emissions to promoting recycling initiatives, helping to pave the way for a greener future. Eco-friendly plastic caps can seal and protect the contents to ensure freshness, preventing contamination, and minimizing waste that is generated due to spoilage. Plastic caps offer significant compatibility with recycling processes. Plastic caps can be easily separated from the bottle, which makes the recycling process more efficient.

The screw-on caps segment held a dominant presence in the plastic caps market in 2024. Screw-on caps are the most common type of plastic caps. The segment’s growth is mainly driven by the increasing demand for soda containers, water bottles, and a wide variety of other liquid items. These caps are twisted onto the neck of a bottle, creating a secure and tight seal for protecting the product from contamination, maintaining freshness, and offering convenience as they are easy to open and close. For instance, bottled water consumption is expected to increase by a further 23% to 72 billion liters by 2028 in China. On the other hand, the dispensing caps segment is expected to grow at a significant rate, owing to the growing demand for convenient and precise dispensing solutions of liquid or semi-liquid products from various industries pharmaceuticals, food and beverage, cosmetics, and personal care, and others.

The polypropylene (PP) segment dominated the market with the largest share in 2024. Plastic caps are widely used owing to their strength, lightweight, cost-effectiveness, ease of mass production, ease of use, and adaptability across multiple industries. Several manufacturers widely prefer plastic material to reduce production costs while ensuring product freshness, protecting against contamination, and maintaining integrity. Moreover, the rapid advancements in plastic recycling technologies and the increasing trend of sustainability significantly enhance the production of eco-friendly plastic caps. The incorporation of post-consumer recycled (PCR) plastics in cap production. Reprocessing waste plastic into new caps can significantly lower dependency on virgin materials. On the other hand, the high-density polyethylene (HDPE) segment is growing at the fastest CAGR, owing to its high durability and strength. These plastic caps are often utilised in industrial and household products.

The bottles segment is expected to experience rapid growth over the global plastic caps market, owing to the increasing consumer spending on water bottles and beverages. The rapid expansion of e-commerce platforms allows manufacturers to reach a broader customer base and offer various plastic caps products directly to consumers. Bottles are widely used for storing liquids like beverages, water, and various other liquid products. In bottles, plastic caps assist in creating a tight seal, preventing leaks and maintaining the quality of the contents. Several manufacturers are embracing eco-friendly caps materials, efficient production, and responsible sourcing.

The food and beverages sector accounted for a significant share of the plastic caps market in 2024, owing to the rapid urbanization and rising consumer spending on packaged food and beverage products, particularly in developed and developing countries. In the food and beverage industry, plastic caps are widely used to offer convenience, safety, and assist in reducing product waste. In addition, the increasing consumption of carbonated and non-carbonated drinks is likely to strengthen the manufacturing capabilities of lightweight and durable plastic caps. The rapid advancements in material science and recycling technologies are expected to accelerate the adoption of sustainable plastic caps, making them an even more attractive option for businesses and consumers. On the other hand, the pharmaceuticals sector segment is expected to witness remarkable growth during the forecast period, owing to increasing demand for sealing bottles and cans of drugs, saline bottles, supplements, vaccine vials, and others.

Asia Pacific dominance is driven by rising consumer preferences for convenience, rapid urbanization, growing consumer demand for safety and hygiene plastic packaging products, rise in disposable income, rapid technological advancements in manufacturing, and increasing urbanization. Factors such as high consumer spending power, increasing consumption of carbonated and non-carbonated drinks, growing consumer demand for convenience and safety, the rising popularity of eco-friendly plastics, and increasing awareness about hygiene and contamination-free products. The increasing investment by key players in plastic caps innovation and in the development of recyclable and sustainable caps is anticipated to drive the market’s growth in the region.

In Asia Pacific, China, Japan, and India are the major contributors to the plastic caps market. The regions have the presence of robust manufacturing capabilities, along with a surge in middle-class population and rising consumer expenses on personal care and household products as well as increasing consumption of bottled beverages, expansion of pharmaceutical industry, and the surge in number of modern online retails are significantly contributing to the market dominance in the region. Sustainability trends are gaining immense attention in the region, with rising awareness of recyclable and lightweight materials like polypropylene (PP) and Polyethylene Terephthalate (PET), to improve the quality of recycled materials. Several manufacturers are adopting eco-friendly practices, responding to the evolving demand for environmentally responsible packaging and regulatory pressures.

North America represents considerable potential for the plastic caps market, owing to the presence of well-established industries such as cosmetics and personal care, pharmaceuticals, household cleaning products, food and beverages, and chemicals. Several key market players are increasingly investing in the recycling of plastic material to align with the sustainability trends. For instance, in October 2024, Vaseline is integrating a new recyclable pump into its Intensive Care lotions in the US and Canada. Learn how this is supporting Unilever’s goal to ensure 100% of our rigid plastic packaging is reusable, recyclable, or compostable by 2030.

As a part of broader sustainability initiatives, recycled plastic caps are gaining immense popularity to reduce plastic waste and meet the evolving demand of environmentally conscious consumers. Several manufacturers are actively focusing on designing lighter caps that require significantly less plastic without compromising functionality or strength. This innovation lowers the material costs and reduces carbon emissions during transportation, accelerating the adoption of sustainable packaging. Furthermore, the rapid technological advancements in manufacturing, such as digital printing and injection molding, enhance the efficiency in the production process and customization options for plastic caps.

By Material

By Product

By Packaging Type

By Application

By Region

February 2026

January 2026

January 2026

January 2026